New Bubble or New Trend: Do You Really Understand Tokenized Stocks?

TechFlow Selected TechFlow Selected

New Bubble or New Trend: Do You Really Understand Tokenized Stocks?

There is currently a bubble and hype chain: "stablecoin compliance → funds entering crypto → speculative炒作 of unregulated derivatives or meme coins."

By: SIMA Cong, AI Channel

The Fundamental Purpose

First of all, I must say that most of the information you’ve seen about tokenized stocks is inaccurate — many don’t even clearly explain what tokenized stocks actually are.

I’ll answer all your questions at once.

There currently exists a bubble and hype chain: "Stablecoin compliance → Funds enter crypto → Speculative trading of unregulated derivatives or meme coins."

Let me be clear: customers are betting against Robinhood on stock price movements — they are not participating in public market trading.

Is the Future Here, or Is This Just Overhyped?

On June 30, U.S. online broker Robinhood announced the launch of tokenized U.S. stock services on the same day as major crypto exchanges Bybit and Kraken, offering users 7×24 uninterrupted stock trading experiences.

According to Reuters, Robinhood launched its stock token trading service for EU users on the Arbitrum network, supporting over 200 U.S. stocks and ETFs — including Nvidia, Apple, and Microsoft. On the same day, Bybit and Kraken launched “xStocks” (tokenized stocks), powered by Swiss-regulated asset tokenization platform Backed Finance, covering around 60 stocks and ETF tokens.

Fueled by this news, Robinhood’s stock hit an all-time high, rising nearly 10%. Company executives also revealed plans to launch tokens linked to private company shares, starting with Sam Altman’s OpenAI and Elon Musk’s SpaceX.

Robinhood plans to launch tokens tied to private company shares.

Is this the beginning of a “crypto IPO” market bypassing traditional securities markets?

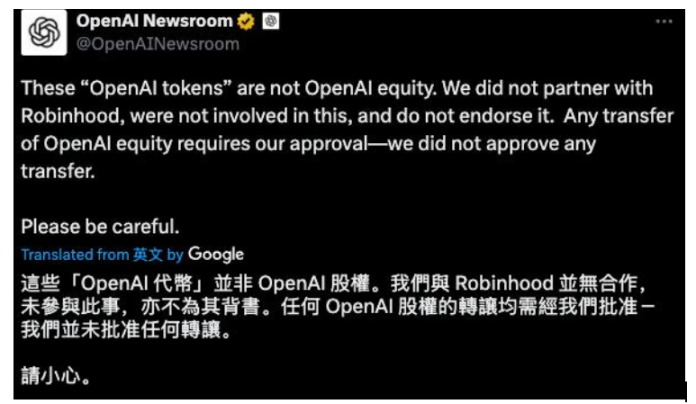

On July 3, OpenAI issued an emergency statement: “These ‘OpenAI tokens’ are not equity in OpenAI. We have not partnered with Robinhood, nor are we involved in this initiative, and we do not endorse it. Any transfer of OpenAI equity requires our approval — and no such approvals have been granted.”

A trade association representing financial firms is urging the U.S. Securities and Exchange Commission (SEC) to reject requests from digital asset firms seeking exemptions to offer tokenized stocks, instead advocating for a more transparent regulatory process.

In a letter sent this week to the SEC’s crypto task force, the Securities Industry and Financial Markets Association (SIFMA) said its members “have been watching closely” reports showing digital asset firms attempting to offer tokenized stocks and submitting no-action or exemption requests. A no-action letter means SEC staff would not recommend enforcement action if the firm launches these products.

“Therefore, SIFMA urges the SEC to deny these requests for no-action or exemption relief, and instead establish a robust public process that allows for meaningful public feedback before the agency makes any decisions regarding new trading and issuance models — particularly as these relate to potential policy actions arising from the SEC’s response to the RFI [Request for Information],” the association stated.

First, understand what it really is:

-

Imagine a stock’s total circulating shares as a cake. Robinhood buys a slice from the traditional market, then digitizes the price movement of that slice onto a blockchain. By lowering the entry barrier (as low as €1), it packages the expectation of that slice’s price increase or decrease into a blockchain token, which is then bought and sold.

-

This benefits Robinhood by increasing user numbers, which in turn boosts revenue potential and strengthens its own financial product ecosystem.

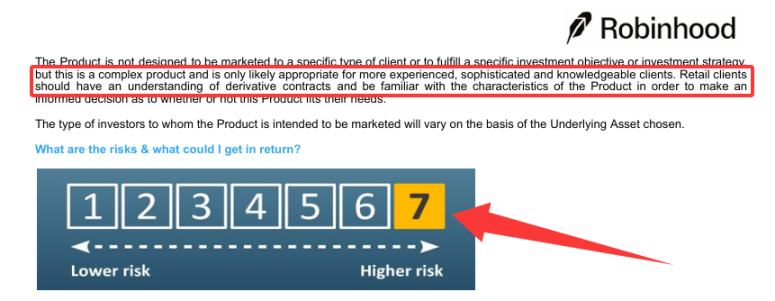

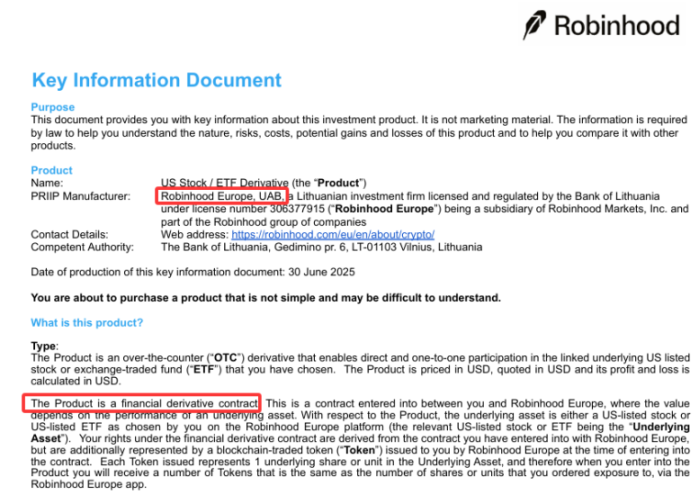

According to Robinhood’s key information document provided to customers before registration:

The product’s price adjusts dynamically based on the real-time value of the underlying asset provided by NASDAQ.

Holding this product does not mean you own any shares or units, nor do you have the right to receive the underlying asset’s shares or units. The product cannot be redeemed for the underlying asset’s shares or units, or in any other form, and does not grant rights associated with direct ownership of the underlying asset (e.g., voting rights at shareholder meetings).

This is a financial derivative product with the highest risk level of 7.

The product is not covered by investor compensation or deposit insurance schemes. Robinhood Europe is the sole counterparty for all payment claims related to the product against the underlying assets.

Robinhood Europe may suspend or close positions under specific circumstances, such as unexpected market volatility, requests made outside U.S. trading hours, temporary announcements, or other conditions that make pricing difficult.

Hedging orders using limit orders will be priced within ±0.5% of the last reported trade price of the underlying asset on Nasdaq exchanges (Nasdaq Stock Market, Nasdaq OMX BX, or Nasdaq OMX PHLX), and within ±0.5% of the foreign exchange rate.

Perpetual contracts use limit orders restricted to prices no more than ±1% above or below the last quoted trading price on the applicable perpetual contract exchange.

Refer to Robinhood’s official website for the definitive explanation.

Buying and Selling Stock Tokens

Before You Buy a Stock Token

Before purchasing your first stock token, you must register and get approved for trading. This includes:

-

Providing necessary information, such as your Tax Identification Number (TIN). If you have multiple TINs, the system may require you to add all of them.

-

Answering questions about your investor profile to help assess your financial situation and investment goals.

-

Completing a knowledge check questionnaire to ensure you understand stock tokens and their risks.

-

Reviewing and agreeing to required agreements, including terms of use.

Searching for Stock Tokens

You can find available stock tokens in Explore (magnifying glass icon). Use the search bar to look up tokens by stock symbol or name.

Placing Your Buy Order

-

After finding the stock token you want to buy, click on it to go to the Stock Token Detail Page (STDP).

-

On the STDP, select Buy.

-

We currently support buy orders in quantity or EUR value, including whole tokens and fractions.

-

Review estimated price and FX details. All stock tokens are displayed in USD, but you will purchase in EUR. Foreign exchange conversion happens automatically when you trade, with Robinhood charging only a 0.10% FX fee — no added spread.

-

Once confirmed, your buy order is placed.

Selling Stock Tokens

-

After finding the stock token you want to sell, click on it to go to the Stock Token Detail Page (STDP).

-

On the STDP, select Sell.

-

We currently support sell orders in quantity or EUR value, including whole tokens and fractions.

-

Review order details on the confirmation screen and confirm. Once confirmed, your sell order is placed.

Review and Confirm

After entering your order details, carefully review the information on the confirmation screen. If the market is closed, the confirmation screen will indicate your order has been queued for the next market open.

Using Funds After Sale

When your sell order executes, proceeds are immediately deposited into your account, but there are important details about how you can use them:

-

Funds are immediately available for trading. This means you can instantly use the EUR proceeds from your sale to buy other stock tokens or supported assets.

-

Withdrawals are paused until the next business day (T+1). While you can trade immediately, you cannot withdraw EUR proceeds to your bank account until the next business day after settlement.

This withdrawal hold specifically applies to EUR proceeds from selling stock tokens.

The withdrawal hold will be automatically lifted on the next business day.

If you make multiple sales on different days, each sale’s proceeds will become withdrawable on the next business day following that specific sale.

You can check your fund status under Transfers → Withdrawable to see current available balances versus those pending settlement.

Key Trading Details

-

Trading Hours: You can trade stock tokens from 2 AM CET/CEST Monday to 2 AM Saturday. You can also queue buy/sell orders outside these hours; they will be executed when the market reopens. The order confirmation screen will show whether your order was successfully queued.

-

Corporate Actions: Corporate actions affecting the underlying stock (such as splits or mergers) will impact your stock token. Trading may be suspended during processing. Banners and/or notifications in the app will inform you of corporate actions and trading suspensions. See Stock Token Corporate Actions for more details.

Market Data: Charts and fundamentals are displayed in USD.

Costs

FX Fee: We convert your EUR using the current exchange rate plus a small 0.10% FX fee.

Estimated Total Cost includes:

-

Converted token price (in EUR)

-

0.1% FX fee

-

A small buffer accounting for volatility

-

To help prevent extreme price fluctuations during order execution, the executed price for buy orders may be equal to or lower than:

-

0.5% above the last traded stock price and 0.5% above the current EUR/USD exchange rate.

-

Likewise, the executed price for sell orders may be equal to or higher than:

-

0.5% below the last traded price and 0.5% below the current EUR/USD exchange rate.

Trading Suspended During Corporate Actions

During the processing of corporate actions, we will temporarily block trading of affected stock tokens.

New orders generally cannot be placed during processing. In most cases, trading becomes unavailable around 2 AM CET/CEST on the effective date and resumes after processing is complete — typically around 3:30 PM CET/CEST, coinciding with the start of the U.S. market session.

All open orders for the affected stock token will be canceled during a corporate action.

In rare cases — such as delisting or liquidation — we may only allow sell orders for that specific stock token. Buy orders are prohibited, and any pending orders will be canceled.

How Are Stock Tokens Different From Traditional Stocks?

Stock tokens offer many of the same benefits as traditional stocks, but since you don’t own the underlying stock, you won’t have certain shareholder rights like voting. Additionally, unlike stocks, when you buy a stock token, you’re entering into a derivatives contract with Robinhood Europe.

How Do Stock Tokens Work?

When you buy a stock token, you’re not buying actual stock — you’re purchasing a tokenized contract that tracks its price, recorded on a blockchain.

You can buy, sell, or hold stock tokens, but currently cannot send them to external wallets or platforms.

What Are the Benefits of Trading Robinhood Stock Tokens?

Trading Robinhood stock tokens offers several potential advantages:

-

No commissions or hidden spreads: Only a flat 0.1% FX fee covers everything. No hidden costs ever.

-

Start from €1: Access the market on your terms — and earn dividends when eligible.

-

24-hour market access: Buy and sell stock tokens anytime Monday through Friday.

-

Invest with confidence: Robinhood stock tokens are offered as derivatives under MiFID II. Underlying assets are securely held by U.S.-licensed institutions.

In one sentence: What do current tokenized stocks look like?

A derivative contract requiring KYC/AML (providing your tax ID itself is KYC), lacking basic shareholder rights of traditional stocks (e.g., no voting rights, and you don’t even hold the underlying stock), non-transferable on-chain or across wallets/platforms (can only be traded within Robinhood’s stock token app), traded via limit orders (±0.5%), settled T+1. Most importantly, tokenized stocks cannot be traded during sensitive periods for the underlying company (e.g., during material information disclosures).

This is a derivative product disguised as a stock.

What Is a Stock?

A stock (also called "equity" or "share") is a financial instrument that grants shareholders an ownership stake in a company's equity.

It is a negotiable security through which a joint-stock company allocates ownership. To raise long-term capital, companies issue stocks to investors as certificates representing partial ownership, allowing shareholders to receive dividends (stock or cash) and share in profits from company growth or market fluctuations — while also bearing the risks of operational failures.

The world’s first stock was issued by the Dutch East India Company in the 17th century.

The essence of a stock is ownership in a company. By purchasing shares, investors become shareholders, sharing both profits and risks.

What Is a Derivatives Contract?

A derivatives contract is a financial agreement between two parties whose value is based on (or “derived from”) the price of something else — such as stocks, bonds, commodities, currencies, interest rates, or even market indices. You don’t own the physical asset (like a barrel of oil or company shares), but instead speculate on how its price will move.

These contracts bind Robinhood, as the counterparty, to pay customers based on the performance of U.S. stocks or ETFs. If the value increases from contract initiation to closure, Robinhood pays the profit. If the value decreases, Robinhood retains the difference. In cases of stock splits or buybacks, the derivative contract is adjusted and the token is rebalanced.

What Is Tokenization?

When a new U.S. stock derivative contract is signed, Robinhood simultaneously issues (mints) a new fungible token on the blockchain. This token represents the customer’s right to the U.S. stock derivative. The token is non-transferable.

When the U.S. stock derivative is closed out, Robinhood deletes the tokenized contract from the blockchain. The blockchain updates in real time, rendering the token invalid and unusable in any wallet or blockchain transaction.

U.S. stock derivatives are considered complex financial instruments. They are not traded on regulated markets or multilateral trading facilities. Although Robinhood hedges its obligations by purchasing U.S. stocks or ETFs in a 1:1 ratio for every derivative issued, customers should understand the inherent counterparty risk and evaluate Robinhood’s creditworthiness before trading.

What Is a Perpetual Futures Contract?

A futures contract is a derivative that obligates the buyer or seller to transact an asset at a fixed price on a future date, regardless of the market value at that time. A perpetual futures contract (or “perp”) has no expiration date. With no expiry, physical delivery is unnecessary — the sole purpose is speculative price prediction. These contracts allow speculation that future prices will be lower (short position) or higher (long position) than current prices.

What Is a Crypto Perpetual Futures Contract (“Crypto Perp”)?

A crypto perp is a perpetual futures contract referencing a crypto asset. The crypto perps offered by Robinhood refer to the crypto assets listed in the Key Information Document.

This isn't even tokenized stock — it’s tokenized financial derivatives

The so-called tokenized stocks issued by Robinhood Europe are fundamentally not actual stock ownership. They are derivatives. Robinhood explicitly states: “You do not own the underlying stock, nor can you redeem it for stock.” What you're trading is a private contract between you and Robinhood — not a blockchain-mapped stock registry. This is essentially a repackaged Contract for Difference (CFD), not a tokenized security.

Robinhood merely packages CFD/contract trading rights into a blockchain-visible token. But: it’s non-transferable, can only be closed within Robinhood’s system, and only the “trade receipt” is on-chain — not the stock ownership rights.

One core advantage of tokenized assets is usually transferability (on-chain). “Non-transferable” means this token is just a record within Robinhood’s internal system — not a freely tradable, decentralized blockchain asset. It’s merely a digital voucher tracking your “claim,” and this voucher cannot leave Robinhood’s ecosystem.

Traditional securities trading is strictly regulated by bodies like the SEC, ESMA, and FINRA. Robinhood’s model in Europe treats these as complex financial products — falling under “looser” regulation, even bypassing securities market compliance frameworks entirely.

Bubble Chain: “Stablecoin compliance → Funds enter crypto → Speculative trading of unregulated derivatives or meme coins.”

Robinhood’s business model is exactly the “speculative trading” link in this chain.

Fund safety relies entirely on Robinhood Europe’s solvency and creditworthiness. If Robinhood Europe faces financial trouble, your investment could be wiped out — with no investor compensation mechanism like those protecting customers of regulated financial institutions. This is a fundamental difference from traditional exchanges and brokers.

Role of Blockchain: In this case, blockchain acts more like an internal ledger and technical gimmick — used to issue non-transferable tokens to track customers’ derivative positions, rather than granting decentralized, transparent, freely tradable properties. It fails to deliver the promised vision of “tokenized stocks”: disintermediation, enhanced liquidity, lower barriers, and free on-chain trading.

John Cabriat, Robinhood’s Head of Crypto: “We’re solving historic investment inequality — now anyone can invest in these companies.”

This is a blatant and nakedly misleading marketing slogan.

Why Does Robinhood Buy the Underlying Stock 1:1?

Answer: To hedge its own market risk as the market maker (counterparty).

Robinhood is effectively the “other side” of your trade — when you win, they lose; when you lose, they win. It’s similar to a casino dealer and player relationship.

What Two Risks Are Being Hedged?

A. Market Price Risk

If unhedged, rising underlying stock prices would cause losses for Robinhood (since they owe customers the gain).

By buying the actual stock, Robinhood offsets its contract loss with gains from the rising stock price.

B. Currency Risk (for certain products)

If the token is denominated in EUR while the stock is in USD, Robinhood must also hedge exchange rate fluctuations.

But the primary risk hedged is the first: market price risk.

This is Robinhood’s self-designed centralized “trading loop.” Users don’t own stocks — they hold a liability contract issued by Robinhood. Robinhood hedges its market risk via spot stock markets, but users still bear Robinhood’s credit risk.

Robinhood Europe is not a traditional exchange. It doesn’t match buyers and sellers. It operates more like an Over-the-Counter (OTC) market maker.

As the sole counterparty, Robinhood Europe theoretically has incentives that may conflict with customer interests. For example, it might manipulate quotes under certain market conditions or make unfavorable settlement decisions. While compliant firms usually have internal controls, the risk remains.

This Is Regulatory Arbitrage

-

If mature securities markets already exist, why do we need tokenized stocks? What’s the point?

-

If tokenized stocks are pegged to real stocks with publicly listed underlying assets, shouldn’t they face the same regulations?

-

Given that crypto/DeFi regulation is significantly looser than traditional securities markets, is this “regulatory arbitrage”?

-

Is this model a bubble? Will it collapse as regulations like stablecoin bills tighten?

Under the principle of “same asset, same risk, same regulation,” Robinhood’s model constitutes regulatory arbitrage.

Traditional stocks are regulated by the SEC and FINRA; tokenized stocks on Robinhood are not bound by these, relying instead on European regulation (e.g., MiFID II), creating a regulatory gap. The 2025 GENIUS Act regulates stablecoins but leaves tokenized derivatives undefined — a gray area.

Tokenized stocks’ 24/7 trading and low entry barriers attract speculators, but lack investor protections (like SIPIC insurance), potentially creating unfair competition.

Same underlying asset, different legal structures, different regulatory rigor — this is a textbook case of regulatory arbitrage. Not technology-driven financial innovation, but speculation-driven arbitrage innovation.

-

Underlying asset: public company stock — same fundamental risk as traditional securities;

-

Investors face identical price volatility, corporate governance risks, and information asymmetry;

-

Without unified regulation, regulatory arbitrage emerges: same asset, different platforms, different oversight.

What Impact Does This Have on Altcoins?

First, it must be acknowledged: over the past century, U.S. securities regulation has largely been considered successful — deeper markets, more rational valuations, less fraud — thanks to mandatory disclosure by public companies.

Some market views suggest that tokenized traditional quality assets — backed by clear business models, compliant regulatory frameworks, and stable real earnings — are becoming the new favorites of on-chain capital, creating a siphoning effect on altcoin markets. Especially for tokens lacking real revenue models, immature products, and relying solely on narratives, liquidity is drying up and survival pressure is mounting.

Others argue altcoins won’t disappear entirely, but will become harder to survive. Every new high-quality asset introduced into the crypto market undermines assets whose prices rely purely on consensus. The only path forward for altcoins is generating real application value — especially income-generating utility. All tokens without real-world use, surviving only on narratives, will gradually enter a death spiral. Altseason may return, but the era of broad-based rallies across thousands of coins is gone. Simple speculation is outdated.

First, let’s define altcoins:

An altcoin refers to any cryptocurrency launched after Bitcoin. The term comes from “alternative coin” or “altcoin.” Simply put, it’s a catch-all term for all digital assets designed as alternatives to Bitcoin.

“Altcoin” originates from the Chinese term “shanzhai,” implying imitation or parody. Since Bitcoin was the world’s first cryptocurrency, many subsequent coins mimicking its technology earned the label “altcoin.”

But in the real crypto market, altcoins typically mean:

-

Lacking technical originality or real-world use cases

-

No clear business model or genuine demand

-

Cryptographic assets created for short-term hype, pump-and-dump schemes

They often mimic mainstream cryptocurrencies (like Bitcoin or Ethereum) in architecture but lack substantive innovation or value backing.

These projects often brand themselves with slogans like “decentralization,” “blockchain finance,” or “Web3 revolution,” but in reality, they’re just repackaged speculative tools.

They promise the illusion of “getting rich overnight,” attracting countless gambler-like speculators.

The end result: a few early participants cash out, leaving retail investors stranded at peak prices — ultimately losing everything.

Altcoins, meme coins, and vaporware attract speculators because they appear to offer life-changing wealth. Investors rush in like gamblers chasing near-zero odds — and often lose everything. Only unverifiable legends of riches persist, continuing to lure new speculators.

Market “wealth myths” (like Dogecoin or Shiba Inu’s surge) are amplified and spread endlessly, while countless loss stories are ignored. This information asymmetry, combined with human gambling instincts and FOMO (fear of missing out), draws investors into a casino-like environment — chasing improbable big wins — only to end up losing.

Yet, speculators selectively ignore risks and have short memories. Getting rich overnight is their sole focus and goal.

So the conclusion is clear:

Regardless of whether tokenized stocks require KYC — a built-in regulatory feature — their structure, pegged to real stocks, simply doesn’t align with the desires of altcoin speculators. Altcoins and even meme coins will continue to draw speculative interest.

Are so-called “tokenized stocks” part of a new bubble?

From multiple perspectives, yes:

Regulation Is Still Unclear

Stablecoin legislation, MiCA, and other regulations are not yet fully implemented — existing in a gray zone.

Limited Technological Innovation

Blockchain is only used for record-keeping and settlement — no real improvement in financial efficiency.

Driven by Market Sentiment

Investors chase the “blockchain finance” concept, ignoring the product’s true nature.

Heavy Speculative Atmosphere

Low barriers, small denominations, and easy trading attract large numbers of retail investors.

Potential Systemic Risk

If Robinhood or similar platforms default, it could severely impact millions of retail investors.

Against the backdrop of gradually tightening stablecoin regulations, market attention on “compliance” and “tokenization” is extremely high. Robinhood may be leveraging this sentiment to repackage its high-risk derivative products as the trendy concept of “tokenized stocks,” attracting investors eager to engage with crypto under a compliant framework.

Robinhood’s tokenized stocks are, at their core, price betting agreements — tools designed to cater to speculators.

After launching on July 1, 2025, trading volume surged 200%, with clear signs of speculative frenzy.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News