From Ethereum Foundation to community foundation: Is community an end or a means?

TechFlow Selected TechFlow Selected

From Ethereum Foundation to community foundation: Is community an end or a means?

The crypto world is full of ups and downs. We've seen too many cycles, where transparent commitments often turn out to be mere slogans, and communities are merely pawns driven by price-driven ambitions.

July 1, Cannes, France.

On stage at the ongoing EthCC conference, Ethereum developer Zak Cole delivered a striking declaration:

"ETH to $10k isn't a meme, it's a requirement!"

In other words, ETH reaching $10,000 is not just a joke—it’s a necessity.

Immediately after, he announced the formation of the Ethereum Community Foundation (ECF), a self-proclaimed community-driven foundation committed to propelling ETH to new heights.

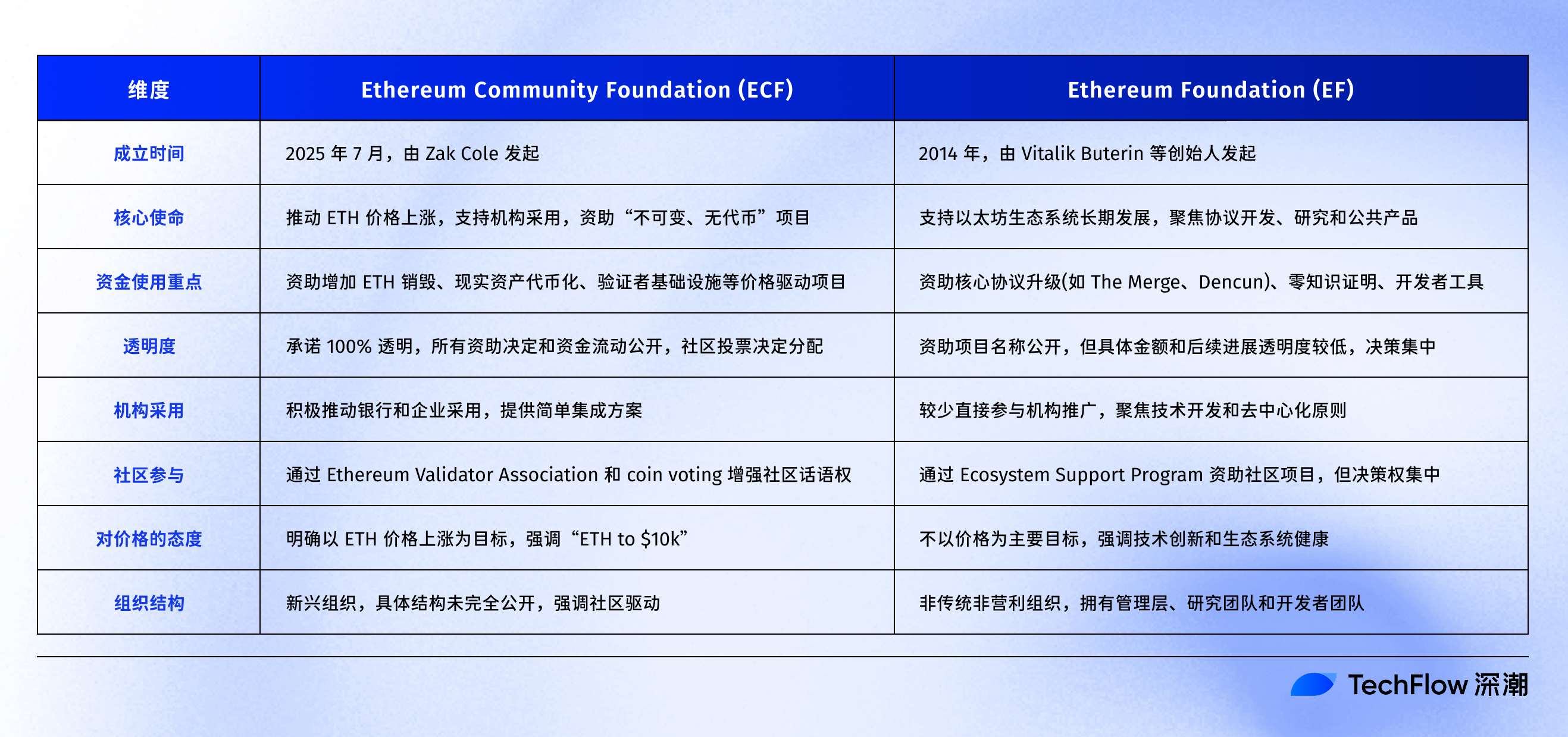

The name of this newly formed organization closely resembles that of the more official-sounding Ethereum Foundation (EF), differing by just one word.

Later in his speech, Zak Cole stated:

"We say what the Ethereum Foundation (hereinafter EF) won’t say, and do what they won’t do. We serve ETH holders because you deserve better. Our North Star, our ticker symbol, is ETH."

Cheers and skepticism erupted simultaneously on X: some hailed it as a sign of community awakening, while others mocked it as yet another speculative gimmick.

Ethereum—the king that gave rise to DeFi, NFTs, and Layer 2 innovation—is currently facing price stagnation and growing competition from rivals like Solana.

The Ethereum Foundation (EF), now 11 years old, has driven major technical upgrades such as The Merge and Dencun, but has also drawn criticism for high spending and alienating the community.

In this context, ECF’s rallying cry of serving the community and ETH holders is timely. But saying and doing are two entirely different things.

How exactly does ECF plan to push ETH to $10,000? And how does it differ from EF?

Transparency and Empowerment

Judging from the presentation, ECF’s goals are clear and aggressive: drive up ETH price, accelerate institutional adoption, and empower the community.

In broad terms, ECF aims to increase ETH burns and reduce circulating supply by funding high-volume projects—such as tokenized real-world assets—to push ETH toward $10,000.

Secondly, ECF plans to provide banks and enterprises with easy integration solutions to promote Ethereum as a global settlement layer and attract traditional finance. Finally, it promises to give validators and the broader community greater influence over protocol development and grant allocation through the Ethereum Validator Association (EVA) and coin-based voting mechanisms.

On a tactical level, ECF will focus on funding “immutable, no-token” projects.

Priority will be given to high-ETH-consumption applications such as on-chain financial derivatives and real estate tokenization, maximizing the impact of EIP-1559’s burn mechanism.

To attract institutions, ECF intends to collaborate with regulators to develop compliant on-chain solutions, while investing in validator infrastructure—such as staking tools and node optimization—to enhance network security.

Beyond all else, transparency is its core selling point: all funding decisions will be made via community voting, and financial flows will be 100% public—setting itself apart from the so-called "black box operations" of the Ethereum Foundation (EF).

If They’re Unfit, Replace Them

In *Romance of the Three Kingdoms*, Liu Bei, on his deathbed at Baidi City, entrusts his son to Zhuge Liang: "If my son is capable, support him; if he is unfit, you may replace him yourself."

Meaning: if my heir proves incompetent, take his place.

In 2025, Ethereum stands at a similar historical crossroads.

The Ethereum Foundation (EF) resembles the incapable Liu Shan—a leader who couldn't live up to expectations. But will the Ethereum Community Foundation (ECF) be the loyal Zhuge Liang—or something else entirely?

With this full suite of initiatives, ECF is clearly targeting the official Ethereum Foundation. Zak Cole’s speech directly hit EF’s pain points: stagnant prices, disengaged community, and losing ground to competitors.

The Ethereum Foundation (EF) was once Ethereum’s guiding light. Yet today, negative discourse dominates. EF is deeply mired in internal and external crises—high expenditures, centralized decision-making, and market underperformance have sparked widespread discontent.

In 2023 alone, EF spent $134.9 million funding mainnet upgrades and zero-knowledge proof research, drawing criticism for lack of transparency.

The community has questioned the opacity of its Ecosystem Support Program, citing missing details on fund distribution and project progress. Centralized control by a small management team contradicts Ethereum’s decentralized ethos.

In 2024, EF researchers Justin Drake and Dankrad Feist resigned over controversies related to their advisory roles at EigenLayer, further exposing conflicts of interest. On X, cries of “EF out of control” grew louder by the day.

Internal reorganizations and layoffs further highlighted management struggles.

In 2024, Ethereum’s mainnet revenue dropped sharply. Layer 2 chains like Arbitrum and Optimism siphoned off transaction volume, weakening the effect of EIP-1559 ETH burns due to reduced mainnet activity.

During the 2024–2025 bull market, ETH failed to outperform Solana, which holds advantages in transaction speed and low fees. Binance Smart Chain also diverted part of the DeFi traffic.

On institutional adoption, EF’s neutral stance has slowed Ethereum’s expansion into traditional finance, lagging far behind Solana’s enterprise partnerships.

Community disillusionment has thus paved the way for ECF’s dramatic entrance.

Zak, the Serial Entrepreneur

Man proposes, God disposes. Whether ECF can truly drive ETH to $10,000 ultimately depends on the people behind it.

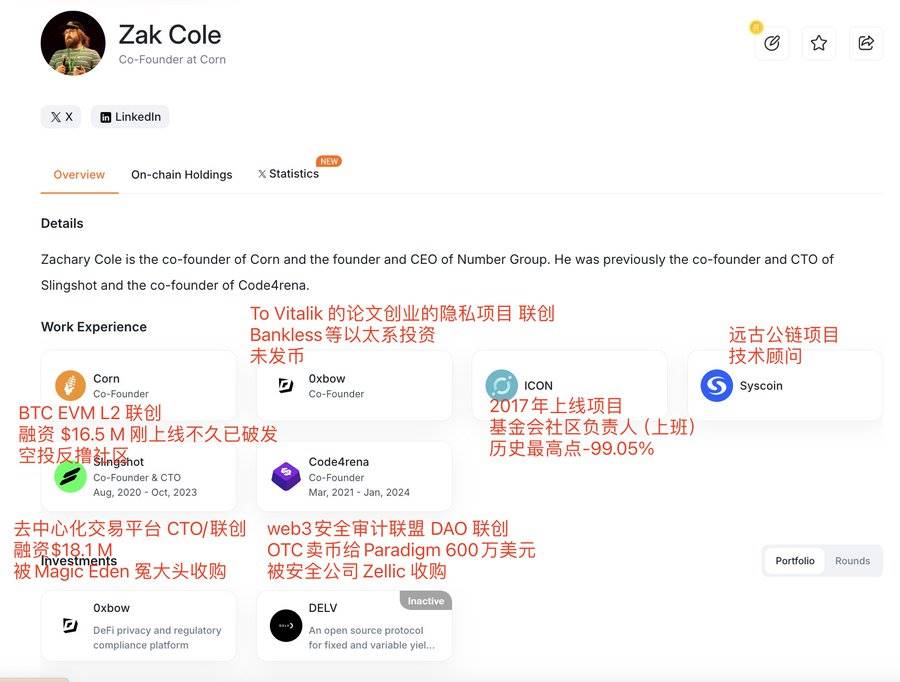

Yet Zak Cole, the central figure, is a double-edged sword—his track record adds both luster to his ambitions and shadows over ECF’s credibility.

He is a well-known serial entrepreneur in the space, having served as co-founder of multiple projects. But the outcomes of these ventures seem at odds with his current message of empowering the Ethereum community.

The community often ends up as the harmed bagholder.

According to crypto whistleblower CryptoBrave on X, several major projects Zak has been involved in have performed poorly in the market.

Take Corn, a BTC L2 project—heavy losses followed shortly after launch, and its airdrop strategy reportedly drained the community. His involvement in the ancient 2017 project ICON saw the token nearly go to zero.

(Image source: X user CryptoBrave @cryptobraveHQ)

Of course, poor market conditions, debunked narratives, and failed projects play a role. But it's hard to trust that someone who repeatedly starts anew will invest lasting commitment into the Ethereum community.

Thus, ECF’s bold “ETH to $10k” ambition remains questionable.

Its price-driven strategies—like funding high-burn projects and institutional adoption plans (e.g., bank partnerships)—may temporarily boost ETH value, but also carry risks of speculation and centralization.

After all, how can we be sure the next project won’t just be a rebranded rug pull?

The crypto world rises and falls constantly. We’ve seen too many cycles. Often, promises of transparency remain slogans, and the community becomes nothing more than pawns in a price-grabbing game.

This time—will it be different?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News