Stablecoin with High Winning Probability: Opportunities Extend Beyond the Platform

TechFlow Selected TechFlow Selected

Stablecoin with High Winning Probability: Opportunities Extend Beyond the Platform

Stablecoins are not just another payment rail—they are a platform for building entirely new financial products.

Author: Simon Taylor

Translation: TechFlow

Trending This Week

"Banking-as-a-Service" (BaaS) transforms bank licenses into APIs, reducing work that once took years and millions of dollars to just weeks and tens of thousands of dollars. Stablecoins, meanwhile, allow anyone to build financial products through new licensed entities (stablecoin issuers) with instant settlement. When foundational constraints are removed, previously impossible business models become inevitable.

This completely rewrites the economics of financial product development.

Example: Real-Time Lending Today’s credit card programs require pre-funding, deal with settlement delays, and involve cumbersome management processes. With stablecoins, when a customer swipes their card, funds can be instantly drawn from your credit line and settled immediately via Visa—fully automated.

In this article, we’ll explore:

-

Stablecoins as a platform

-

Who is impacted by the platform shift

-

The opportunities created by the platform

-

BaaS stack breakdown

-

Where money flows in the BaaS stack

-

Stablecoin stack breakdown

-

Where money flows in the stablecoin stack

-

Where your opportunity lies

Stablecoins Are a Platform

Any product that can be built on traditional finance can now be rebuilt using stablecoins and on-chain finance. More importantly, the immediacy and programmability of stablecoins enable entirely new economic models for innovative products and experiences.

Translation: TechFlow

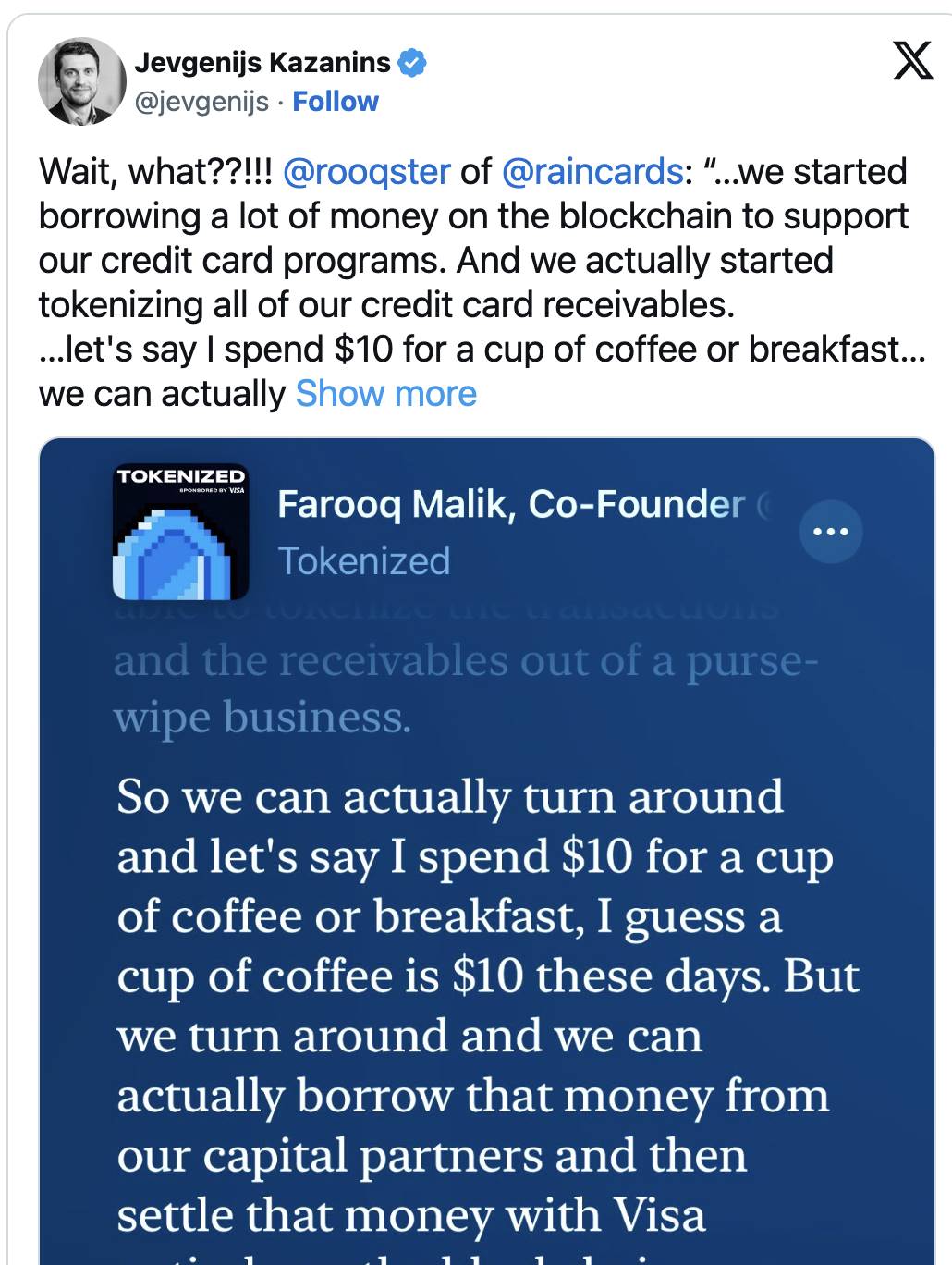

As a non-bank credit card program, you could let customers draw funds directly from your credit line at the point of sale and settle instantly through Visa. You could also directly link customer repayments to borrower repayments—entirely automated. As Rain's CEO recently explained on the Tokenized podcast:

This is a massive disruption to existing fintech:

-

Traditional Fintech: Requires pre-funding cash to back credit lines

-

Stablecoin World: Credit lines become real-time cash flow

This blew my mind—no more need to raise capital upfront for credit programs.

In payments, genuinely new things rarely emerge day-to-day. This is just one example. The entire world of non-bank lending is about to become 100x more efficient, yet few are paying attention. (By the way, Rain uses Fence Finance to enable this—worth checking out if you're in lending.)

If fintech changed how financial services are distributed, on-chain finance is transforming how they’re manufactured. You can now build entirely new business models without relying on legacy core ledgers or payment providers.

Everyone is strategizing for a world that may look drastically different within 12 months, trying to figure out what this means for them, their markets, and portfolios.

What Happens When Settlement Constraints Disappear?

This week I was invited to at least nine analyst calls (I attended only one—UBS’s Justin is truly legendary). Everyone wants to know who Circle’s soaring IPO will “kill.” Undoubtedly, stablecoins are disruptive, but our thinking around these questions remains overly simplistic.

-

Will credit cards die? No. Visa’s CEO had to personally go on CNBC to clarify after Walmart and Amazon announced they’re exploring stablecoins. We’re clearly at peak hype and fear around stablecoins.

-

Will card processors die? No. In the stablecoin era, card processors will evolve into roles similar to ISPs, providing secure user experiences—like linking stablecoin-backed cards in Apple Wallet.

-

Will banks die? No. While we no longer need banks to manufacture or distribute financial products, private credit and shadow banking will see massive opportunities. Specialized banks can become the best global on/off ramps—just as some excelled in the BaaS era, they may perform even better in the stablecoin era, serving more use cases and customer segments.

-

Who will die? Nobody truly “dies.” Legacy financial infrastructure never fully disappears—it just becomes less relevant. Meanwhile, new infrastructure can scale rapidly. The real market opportunity lies in new products, new businesses, and innovations that were previously too costly or risky to build.

The Real Opportunity in Stablecoins: Far More Than “Another Payment Rail”

If nobody dies, who wins?

This is worth pondering. Yes, banks can build products on stablecoins, distribute existing ones, and treat stablecoins as “another payment rail.” But if you view stablecoins merely as a new rail, you’ll miss the broader transformation. Stablecoins aren’t just rails—they’re global, 24/7, instant, and programmable. This enables entirely new products—and even new companies.

Banks often say: “Stablecoins are just another payment rail.” I understand the appeal of this framing, but it’s misleading.

This underestimates stablecoins’ potential. I get why banks want to make stablecoins seem “non-threatening,” comparing them to Zelle-like systems. But Zelle doesn’t have an ecosystem of financial products, trillions in asset class value, or active shadow banking players entering the space.

We are now experiencing the biggest regulatory shift in financial services since the 2010 Dodd-Frank Act.

This means real competition across all customer segments over who will dominate the manufacturing and distribution of financial products.

To understand this shift, let’s compare fintech and stablecoin products. First, recall the rise of fintech:

The Banking-as-a-Service (BaaS) Model

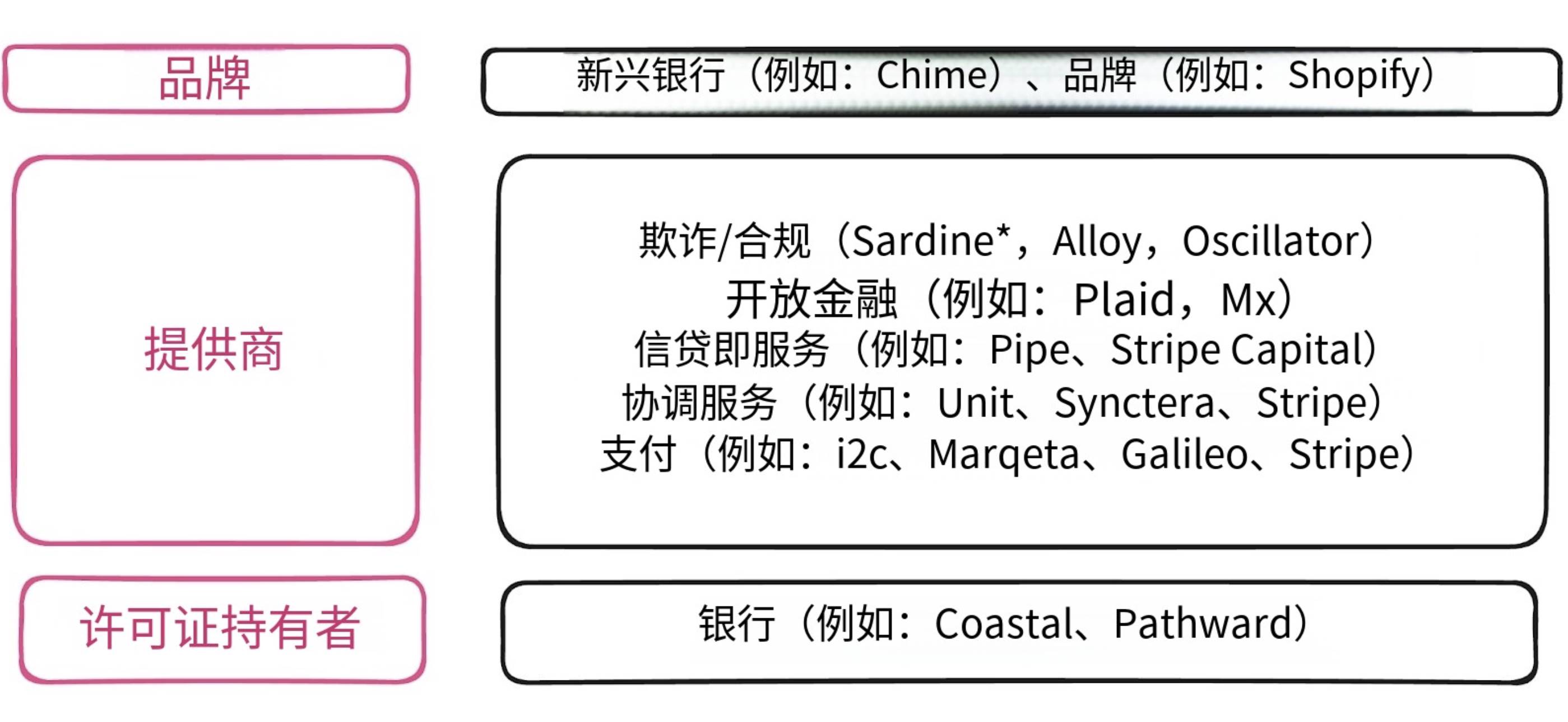

In the 2010s, Banking-as-a-Service made launching card programs and consumer accounts easier and cheaper than ever before. Work once reserved for banks became API-driven services that startups could quickly adopt and integrate at low cost.

Translation: TechFlow

Over the past decade, the BaaS stack has become mainstream in fintech, enabling more non-bank brands to enter the market. Co-branded cards have existed for decades. Yet the reality of airline reward cards is that they remain bank products—just branded with an airline logo (e.g., Delta or American Airlines) and hosted on bank websites and apps. This is closer to “whitelabeling” than “as-a-service.”

Still, access to banking “rails” like credit cards, ACH, and wire transfers is required. This created opportunities for smaller banks to “rent out” their licenses through partnerships with third parties like neobanks. These neobanks and non-bank firms then assemble customer-facing products via API providers.

BaaS removes licensing barriers—but keeps settlement constraints intact.

Where Does Money Live in the BaaS Model?

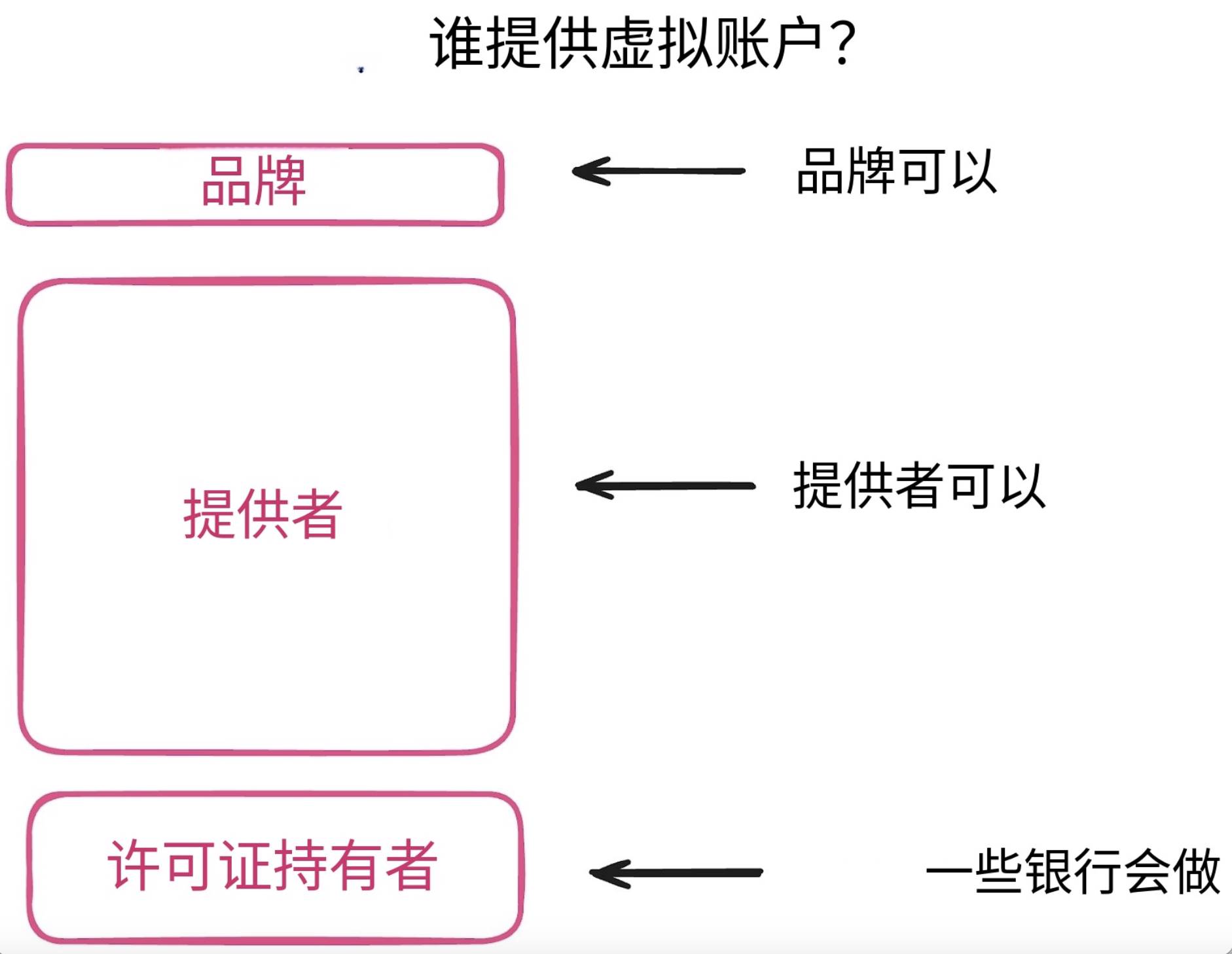

In BaaS, money lives in banks. In the U.S., this is typically structured as an FBO (“For Benefit Of”) account.

While many fintechs eventually obtain state money transmitter licenses (MTLs), FBO structures are often preferable—especially for non-financial brands. In Europe, many opt for e-money institution (EMI) licenses instead.

At a high level, FBO accounts let companies manage customer funds without facing expensive regulations tied to certain types of money movement. If you move money for customers, an FBO acts like one large pooled account. If you have funds from 1,000 customers, they’re all mixed together in one big pot.

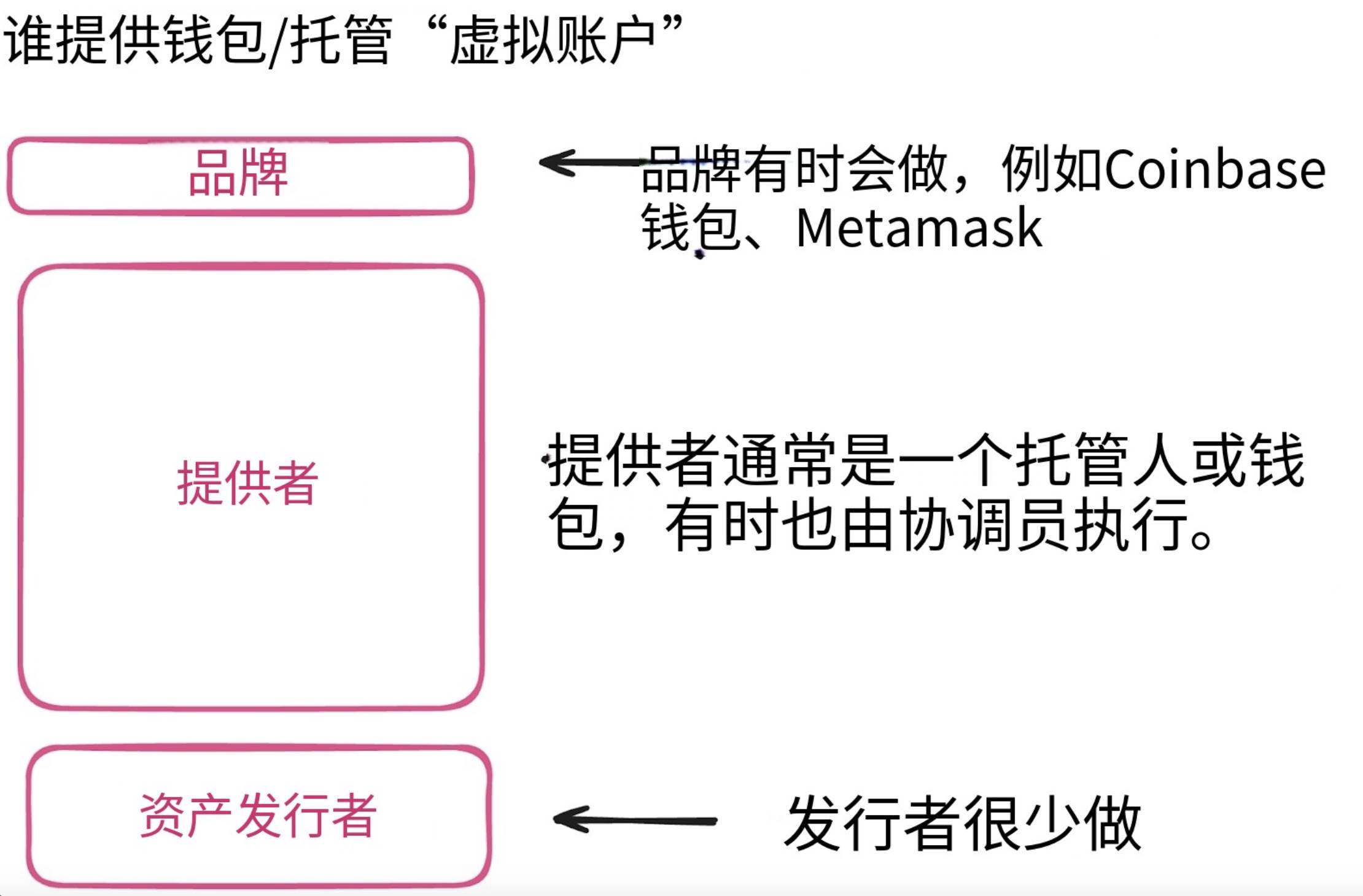

To address this, sub-ledgers or “virtual accounts” can split up the funds. These can be built by neobanks (like Chime), offered by payment providers, or sometimes provided as add-ons by banks.

Translation: TechFlow

In the BaaS model, responsibility for tracking customer funds isn't always clear.

Legally, money resides in the FBO account. But the entity managing the “virtual accounts” determines who owns each dollar.

This gets complicated—especially when the bank holding the FBO and the sub-ledger provider disagree on balances. That’s exactly what happened in the Synapse/Evolve collapse, leaving over 100,000 customers unable to access their funds.

Understanding where money is held and who is responsible is critical.

We’ve reached the limit of how much technology can modernize old infrastructure. Stablecoins and the GENIUS Act represent the biggest policy and regulatory development in financial services since Dodd-Frank in 2010.

You waited decades for fintech licenses—and got stablecoin legislation instead.

The Stablecoin Financial Product Stack

Stablecoins are to banking what the internet was to telecom—not just better, but an entirely different platform. While end-user stablecoin products may resemble neobanks, they operate on parallel infrastructure. WhatsApp’s core function is somewhat like SMS, but the experience is vastly superior.

(No analogy is perfect—bear with me.)

Translation: TechFlow

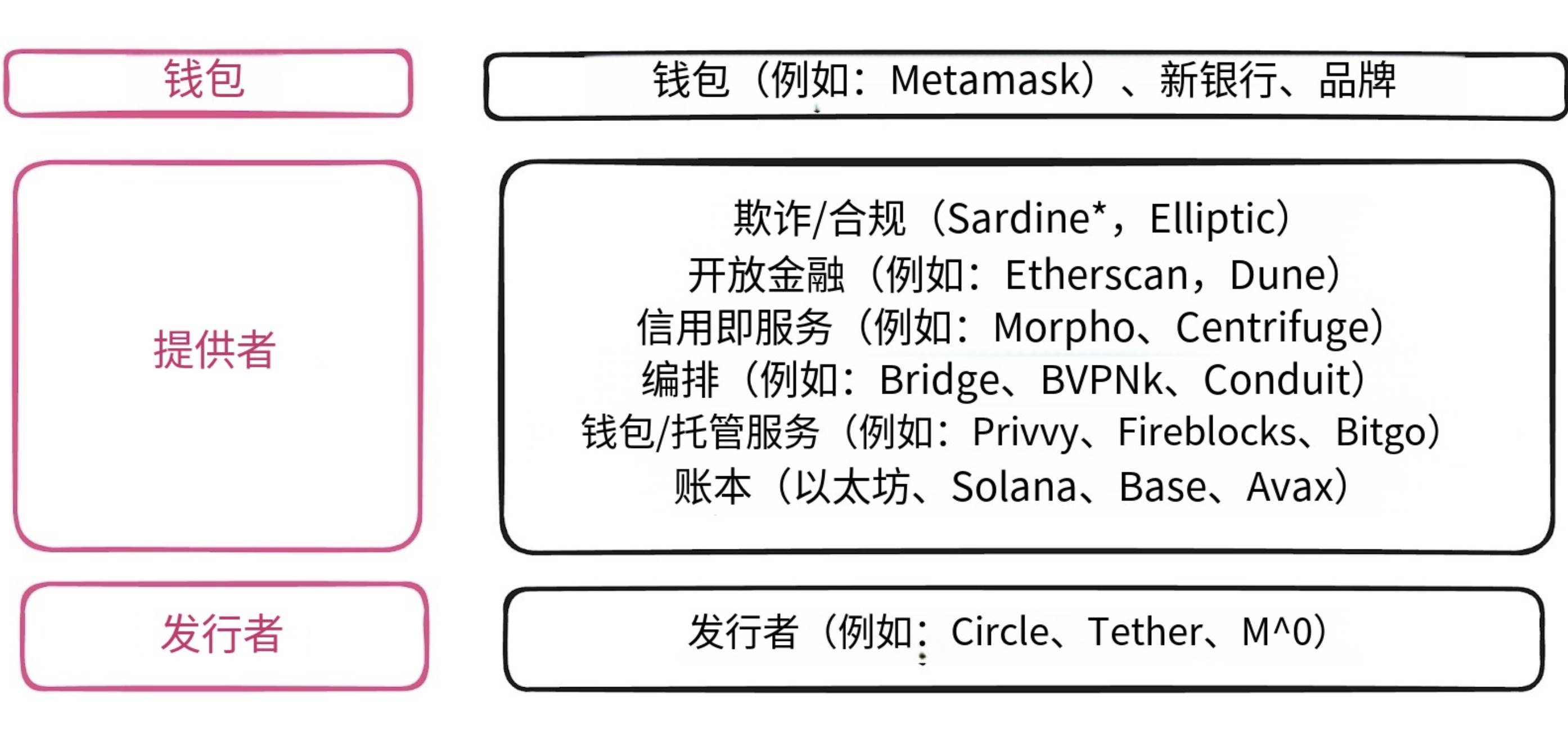

At the user experience layer, “wallets” can be direct-to-consumer apps or embedded within neobanks (like Revolut or Cash App).

At the provider layer, key differences emerge.

“Open finance” is different because most transactions occur on public networks.

The question is whether your app or interface lets you access the ledger with full native functionality (like Phantom or MetaMask), or offers a restricted experience (like neobanks might impose risk limits).

Credit-as-a-Service is fundamentally different because it’s private credit running entirely on DeFi rails.

This could become the most transformative part of the stack. Historically, DeFi meant over-collateralized loans—inefficient and limited. But that’s changing dramatically.

We’re entering the era of real-time lending. Today, a non-bank credit card program must secure a lender, pull funds for customer spending, and manage authorizations, legal docs, and multiple accounts for repayment. You pay higher fees, deal with settlement delays, and administrative overhead.

Orchestration hides enormous complexity

To run on stablecoin rails, you need connections to custody providers, wallets, multiple blockchains (Solana, Ethereum, Tron, Base), stablecoin issuers (USDC, USDe), exchanges, OTC desks, and the traditional finance (TradFi) ecosystem. This means integrating banks, payment firms, the entire TradFi stack, plus crypto and financial licenses. Compared to traditional fintech orchestrators solving “I don’t want an MTL or an FBO account,” stablecoin orchestrators tackle far more complex challenges—like enabling payroll platforms. Crypto is at least twice as complex as TradFi—for now.

Custody and wallets are the security engine of stablecoins

Custody and wallets form the security backbone of the stablecoin ecosystem. Self-custodial wallets let businesses or individuals manage their own stablecoins and assets. Solutions like Privvy or Fireblocks’ “Wallet-as-a-Service” are fascinating—they offer this capability as a headless service. As a business, you can hold stablecoins like cash, except your “vault” is hired via API. This lets you avoid direct involvement in crypto flows while users enjoy all the benefits of stablecoins—without even knowing they’re using them. However, in self-custody, you bear the risk of securing private keys.

Alternatively, custody providers can help manage these risks while embedding wallets into neobank or non-bank interfaces. Interestingly, custodians act somewhat like payment processors—they relay customer instructions to move assets via private keys to the underlying network.

Ledgers (like Solana, Ethereum) are like self-reconciling FBO accounts. Unlike traditional models where banks control accounts, blockchains don’t care who controls the wallet. For AML concerns: while blockchains are pseudonymous, stablecoin issuers (like Circle), custodians, orchestrators, and wallet providers typically comply with OFAC and FinCEN rules.

You can have a wallet holding funds for thousands of customers, then use a system to determine ownership (how many centralized exchanges operate). Or, you can add multi-wallet features to create “virtual accounts”:

-

Controlled by you for your customers;

-

Directly controlled by customers;

-

Or hybrid models—e.g., customers control funds, but you step in when balances exceed $10,000.

Wallets handle transaction instructions. In principle, this resembles FBO or MTL models—but in practice, it looks very different.

Where Does Money Live in the Stablecoin Model?

An excellent question. Assets live “on-chain,” while wallets hold the private keys to move them. In effect, each ledger can serve as a core ledger, FBO account, and sub-ledger—all depending on your wallet and custody setup.

Translation: TechFlow

Whoever holds the keys controls the money.

So funds are stored on-chain (e.g., Solana, Ethereum) but managed via wallets. There are many options for securing and managing wallets.

This sounds complex, right? The upside: perfect transparency. The downside: you’re responsible for your own security. Plus, managing multiple chains and stablecoins adds complexity. That’s why orchestrators like Bridge and BVNK are rising fast—they hide far more complexity than traditional fintech ever did.

Stablecoins: More Than Just a Payment Rail

Stablecoins aren’t just another payment rail—they’re a platform for building entirely new financial products.

-

With local stablecoin support, FX trading becomes much smoother.

-

Stablecoins enable 24/7 global real-time transactions.

-

Their programmability unlocks new tokenized assets and novel financial experiences.

When you can instantly draw from a private credit line for a credit card program, you’ve already crossed the efficiency frontier of traditional finance—a fact many still overlook.

Instead of focusing on stablecoins’ impact on card networks and consumer payment volume, focus on emerging players’ cost of goods sold (COGS), and who’s using stablecoins to disrupt FX and banking margins.

The real opportunity in stablecoins is building entirely new financial products.

-

For banks: Stop thinking “stablecoins are just another payment rail.” Ask: “What products become possible with instant settlement?” Your competitors are already building them.

-

For fintechs: All those products you couldn’t build due to settlement delays—now you can. The constraint is gone.

-

For investors: Look for companies solving problems that weren’t profitable before instant settlement. That’s where the real opportunity lies.

Past BaaS eliminated licensing barriers to spawn neobanks. Now, stablecoins eliminate settlement barriers to spawn entirely new categories of financial products. Companies rising in this unconstrained space won’t just improve existing products—they’ll create ones that were previously impossible.

Removing constraints fuels the innovation cycle forward.

The question isn’t who will be killed off—but what will become possible.

4 Fintech Companies to Watch 💸

1. Polar - Stripe-like billing for LLMs and modern SaaS

Polar offers checkout and complex billing (usage-based, subscriptions) with built-in customer management and global MOR capabilities. Its authorization engine grants access to license keys, GitHub repos, or Discord roles. Framework adapters let customers launch in under a minute.

If Stripe defined payments, Polar is redefining billing. It can auto-track AI agent token usage or precisely bill for execution time—solving complex metering problems and saving customers significant time and effort.

2. Nevermined - Billing solutions designed for AI agents

Nevermined offers three pricing models for AI agents: usage-based, outcome-based, and value-based. It manages metering and handles payments between humans and agents, or agent-to-agent. It integrates payments with identity management, logging every request, payment, or policy change for accurate billing and error reduction.

A fast path to monetization. While Stripe Billing covers much of this, Nevermined offers APIs tailored to this use case, with built-in metering and pricing models you’d likely need anyway. Stripe dominates, but this niche can still produce winners.

3. Ivy - Global banking payment aggregator

Ivy is building a unified API for bank payments across countries, aiming to make real-time payments the global default. Currently live in 28 countries, it offers a single API for payments and collections to crypto exchanges, marketplaces, and trading apps.

Someone has to build this. Bank payments are becoming standard in 60+ countries, but there’s no widely recognized aggregated API (though open finance providers have potential, they’re not seen as payment companies). Sometimes, defining a category is valuable in itself.

4. NaroIQ - White-label fund infrastructure

Naro helps small firms create their own ETFs, host other ETFs on their infrastructure, and provides full index solutions. Asset managers can launch funds at a fraction of manual costs and manage the entire ETF lifecycle—from creation to listing.

While BlackRock iShares, Vanguard, and Fidelity dominate ETFs, new entrants still have room. I’m curious about this team’s traction and what ETFs are being built on their platform.

These companies are pushing boundaries in their respective domains—worth watching!

Two Things You Need to Know

1. Kalshi Raises $185M at $2B Valuation: The Future of Prediction Markets?

Kalshi just closed an $185M round led by Paradigm, valuing the company at $2B—more than double Polymarket’s recent $1B valuation. Kalshi is a prediction market platform similar to Polymarket, letting users bet on outcomes from pop culture to politics. Bloomberg reported Polymarket is raising $200M at a $1B valuation. Notably, Polymarket is frequently cited in media, especially during elections.

-

Polymarket’s dilemma: Despite stronger brand awareness, Polymarket can’t reach U.S. users—the largest prediction market excluded from its biggest market. Kalshi, regulated by the CFTC, can legally serve U.S. customers. Recently increasing ad spend, Kalshi has seen strong user growth.

-

Investment rationale: Paradigm isn’t betting on gambling—it’s betting on predictive insurance, derivatives, and conditional payments. That’s the real thesis.

-

Strength of prediction markets: When other forecasting methods fail, prediction markets often get it right—making them powerful tools for accurate information.

-

Social reflection: While consumer gambling is controversial, younger generations gamble more due to distrust in traditional wealth paths. Prediction markets aren’t the root problem—they have real utility in financial markets.

-

Signal to watch: Paradigm’s Matt Huang said: “Prediction markets remind me of crypto 15 years ago—a new asset class on its way to trillions.” Matt was an early Bitcoin believer. When he speaks, listen.

2. Fiserv Announces Stablecoin for Its 10,000 Banks

Fiserv announced its own stablecoin, “FIUSD,” built on Paxos and Circle’s infrastructure, aiming for interoperability with other stablecoins and launching on Solana. Fiserv also plans to co-develop deposit tokens with banks.

Additional details from institutional blockchain sources: End users will see a separate FIUSD balance in their bank apps, reflecting different custody and operational assumptions. Behind the scenes, Fiserv uses Finxact tech to let banks subdivide stablecoin holdings per customer. Circle and Paxos play complementary roles: Circle provides deep USDC liquidity, Paxos enables PYUSD interoperability.

-

Stablecoins are mandatory: Every company needs a stablecoin narrative. Analysts are watching, stocks move—so announcing plans is smart PR.

-

The future of core ledgers: When you have stablecoins, do you still need core ledgers? Global assets still rely on legacy core systems. For stablecoins to be liquid, they must seamlessly connect to banking. Banks are becoming “ISPs” for on-chain finance.

-

Challenges of tech upgrades: Each bank needs new tech to work with legacy systems. Like not replacing both heart and brain in one surgery, swapping core ledgers is too risky.

-

Market potential of deposit tokens: On-chain finance needs diverse funding models. Just as sponsor banks thrived in BaaS, banks (and shadow banks) embracing stablecoins will gain huge opportunities.

-

Paxos and Circle’s delicate dynamic: Paxos is Circle’s main competitor, backed by the USDG alliance (Robinhood, Mastercard). Based in Singapore, it offers 4.1% yield.

-

Interoperability challenge: Compatibility with PYUSD highlights this issue. Interoperability is a major hurdle for stablecoins—can this solve it?

-

Peak stablecoin hype: SoFi launched global remittances, Visa’s CEO talked stablecoins on CNBC, Kraken released “Krak”—a wallet dedicated to stablecoins, competing with PayPal and Wise.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News