Level Two Revelation: The Art of War on the Plate

TechFlow Selected TechFlow Selected

Level Two Revelation: The Art of War on the Plate

Continue exploring in a thorough and accessible way to enrich our analytical toolkit.

By: Dave’s Market Perspective

Welcome to Chapter 2 of the "Behind the Scenes" series: The Art of the Chart. In the previous chapter, we clarified the concept of secondary markets and three major structural frameworks. This article dives deeper while remaining accessible, expanding our analytical toolkit. This piece will be intense—readers often dislike lukewarm content; they either want pure entertainment or hardcore insights. But don’t worry—I’ll explain logical derivations, highlight memorizable patterns, and include engaging stories along the way.

The *Art of War* by Sun Tzu, written during the Spring and Autumn period, consists of thirteen chapters, each focusing on different aspects of military strategy. Wang Anshi praised it as “profound in tactics, extending far beyond mere warfare.” Drawing inspiration from the ancients, I present the Chart Art of War, summarizing five common market patterns:

- Futures-Driven Markets

- American-Style Strong Hands

- Open-Cards Manipulation

- Wyckoff Development Model

- Miscellaneous Patterns

As stated in Sun Tzu’s *Mou Gong Pian*: “Know the enemy and know yourself; your victory will never be endangered.” Without further ado, generals, let the battle begin.

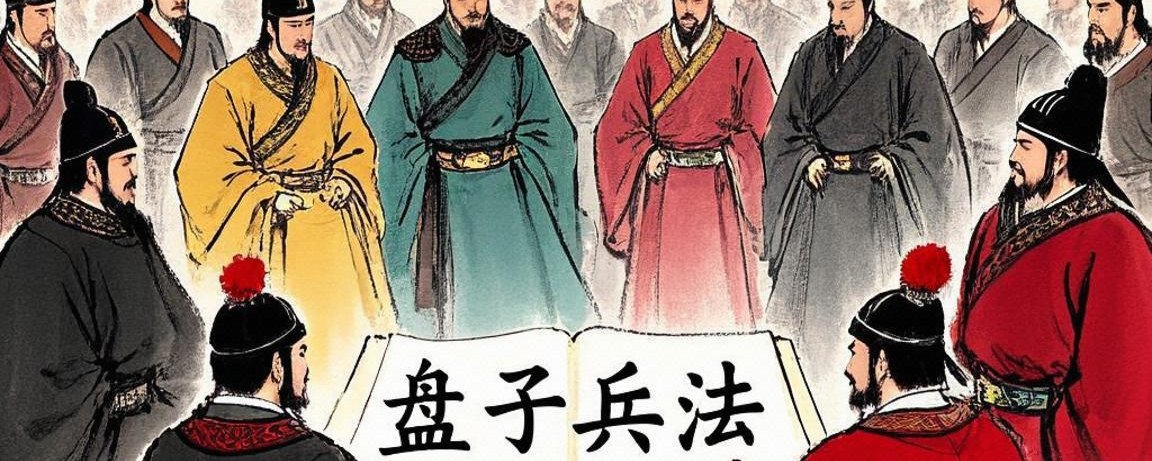

1. Futures-Driven Markets

Let’s fill in the gap left in Chapter 1 by explaining how traders profit through futures-spot interplay and what signals we can observe. First, two essential threads from experts detailing short squeeze mechanics:

https://x.com/wublockchain12/status/1805786970515537973

https://x.com/Michael_Liu93/status/1916131432193527842

Phase One: Accumulation and Launch

If you recall Chapter 1, I mentioned a key insight: the secret of manipulation lies in liquidity. For most manipulators, their profit model requires inflating prices—there must be a price-lifting phase. During this phase, chips must be consolidated; otherwise, excessive overhead supply increases risk and could lead to losses. Thus, every manipulated coin begins with accumulation—a foundational stage no scheme can skip.

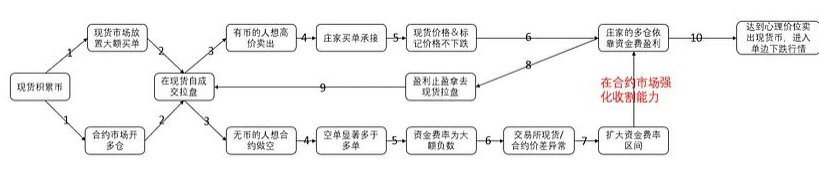

Let’s use UMA as an example since it recently caught my attention. From December 2024 to March 2025, UMA steadily declined—this was the prior operator exiting, leaving loose holdings. But starting late March, volume surged into sideways consolidation. After nearly three months of tight range-bound action forming a solid box pattern, accumulation completed.

What did the operator achieve in Phase One?

- Accumulate at low levels, control circulation

- Gather capital to gain control over order flow

- Test market sentiment repeatedly

Now the predator enters Phase Two: Establishing Long Futures Positions—the true start of operations. Here comes OI (Open Interest), a critical metric indicating open contracts. While I usually explain logic, this time I’ll give a direct takeaway: when OI spikes abnormally—especially sharply—it's a war signal. Compared to accumulation (which may take indefinite time and is hard to confirm), an OI surge is straightforward. Memorize this: for small or meme coins, a spike in OI + sufficient consolidation = incoming momentum.

Take UMA again—price rose shortly after OI spiked. Not strictly causal, but highly correlated. Why? Because building long positions is crucial for profits. So how exactly do they make money?

Phase Three: Funding Rates and Short Squeezes

To prevent perpetual contracts from deviating too far from spot prices, funding fees are exchanged every hour (formerly every 8 hours) between longs and shorts, aligning contract prices with spot. Since there are far more shorts in derivatives than holders in spot (as the manipulator controls most spot supply), funding rates turn negative—shorts pay longs. On small-cap coins, these fees become substantial income streams. Operators recycle this cash into spot buying, triggering liquidations of leveraged shorts. Meanwhile, their own longs gain value. And don’t forget—they also sell high what they bought cheap. Classic buy-low-sell-high remains king.

So we summarize the playbook:

Funding rate income, pump-induced short squeezes, and chip distribution

In practice, not all three elements are always used. When done, once inventory is cleared and longs unwound (OI drops), they abandon the asset like a cold general leaving a worthless city.

Look at ALGO (Alpaca Coin): after manipulation ended, scattered holdings allowed free fall. A thought exercise: what was the operational process and how did its ownership structure evolve? Discuss in comments.

That concludes Part 1 on futures-driven markets—feedback welcome from seasoned operators.

2. American-Style Strong Hand Markets

"American-style" often implies brute force aesthetics. I label such moves accordingly—not just due to violent pumps, but because operators frequently originate from North American groups. This is a critical pattern to master.

Key features:

- Strong bullish pressure with significant gains

- Extended duration—while most rallies last ~3 days, these avoid sharp dumps, often consolidating sideways or creeping up slowly

- No comfortable entry points—weak pullbacks, strong momentum, technical indicators ignored, forcing observers to miss out

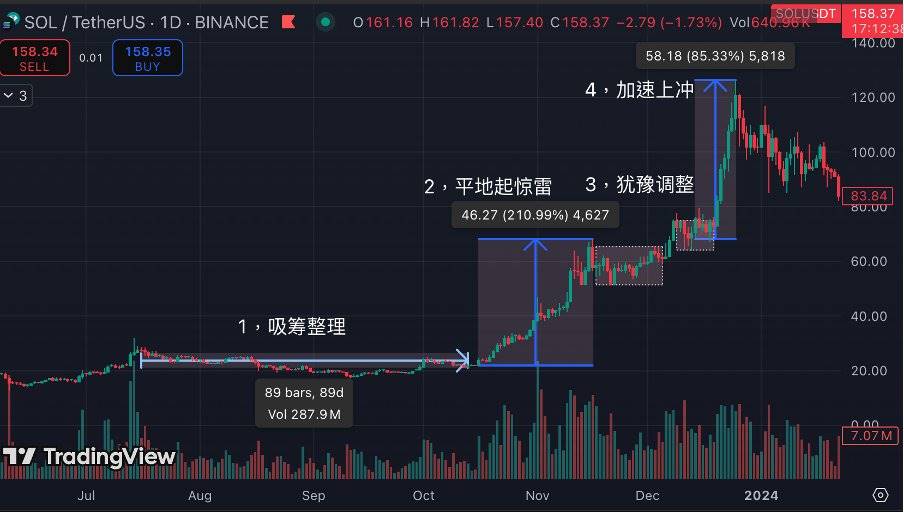

- Now let’s examine a real case: SOL

Solana’s first leg fits the American-style mold; later phases mix other dynamics as its ecosystem grew. Let’s break down the initial move.

Accumulation first—no trend escapes this phase, much like solving conic section problems in math exams—all require equation systems. A scoring trick: write equations regardless, earn partial credit. Early on, UMA saw gradual downtrend accumulation—ideal for shaking out impatient retail. The second retest clearly marked accumulation zone. Range spanned only ~30%, narrow but prolonged—only die-hard holders stayed.

Sudden explosion—American physique revealed. This is where you identify the chart type. As broader market turned, SOL surged violently ahead of peers. Candlestick patterns showed reversal signals—technically bearish—but price ignored them completely. Fundamentals unchanged, no decisive news, yet price gained 210%. Classic institutional move—e.g., a fund raising capital and launching a campaign.

During correction, two flat stages emerged—hardly any decline, just minor shakes. No downtrend visible. Especially the second base near previous highs—a clean horizontal hold. That’s golden confirmation: not a fakeout. No breakout without strength means the hand remains powerful. They may plan exits, but won’t execute an A-shaped dump. At this point, riding the bubble for one final leg becomes viable.

Finally, acceleration phase: final push aligned with macro trend—pure FOMO fuel, as high as sentiment carries.

From a trading perspective, Phase Two (the sudden breakout) defines this setup—not every coin delivers full three-wave structures. Ideally, catch it early. Look back—did you find a good entry? Probably not. That’s the essence of American-style: hesitation kills. https://x.com/0xDave852/status/1918142304105427063

This link leads to another deep dive on SUI—an American-style play. My entry was late in Phase Two. Whether Phase Three unfolds requires gambling.

SOL’s third phase gave us confidence to stay long.

I mentioned A-shaped dump earlier—let me show you what that looks like:

Layer:

Textbook American-style pump followed by A-shaped crash. You couldn’t get in during the steady grind upward—then the last candle drops 50%. But their cost basis is ultra-low. Anyone who’s run such plays knows their skill exceeds average projects. A slick combo move—watch out in battle.

A word of caution about Phase Three: paper trading seems easy, live trading likely causes losses—stop-hunted constantly.

How to trade it? Once identified as American-style strong hand:

- Best approach: catch the explosive breakout—don’t fear chasing. If logic eludes you and no one explains why—it’s working. Just go.

- Second method: research team and background—read my “Seventh Night” article analyzing potential beyond technicals and fundamentals.

- Last: focus on breakout trades. SOL’s third stage looked sweet—but Layer? Enter during consolidation and you’re dead. Would stop-loss help? Possibly—but choppy ranges trigger stops easily. Only veterans understand how many fakeouts occur here. Either buy near range bottom with tight stop, or wait for confirmed breakout.

Fun aside: the three coins discussed—SOL, SUI, Layer—all have teams/institutions rooted in North America. Hence, calling them “American-style” holds water.

This pattern appears widely, offers rich returns, and shows clear traits—worth mastering.

3. Open-Cards Manipulation

The term “open-cards” sounds contradictory—manipulators usually hide. This third model relies on off-chart clues or holistic judgment, using logic and tracing capital flows. It ties back to the “designated perspective” introduced in Chapter 1.

The premise: a known entity must pump a token for strategic reasons. Remember: price manipulation isn’t solely for profit; it can also “build faith,” generate buzz, etc.—all beneficial if cost-controlled.

These charts vary technically, but follow consistent logic. Two classic strategies:

- “One lifts a nest”: Pump one token to create wealth effect, lifting entire sector/ecosystem for long-term gain.

- “Arrow drawn, must shoot”: Failure to pump risks collapse elsewhere—e.g., MSTR. I closely watch this stock. Its upside multiplier exceeds BTC’s, yet downside resilience is notable—even at lows, MSTR shows strength. Likely because unchecked decline would trigger cascading liquidations, so forces intervene.

We’ll illustrate both. Admittedly, secondary market analysis gets qualitative here—less quantifiable than pure charting, yet this separates skilled traders. Let’s feel it through examples!

3.1 Building Faith: BGB

BGB is Bitget Exchange’s native token, traded only on Bitget & MEXC—jokingly called a “single-player coin.” From Oct to Dec 2024, BGB surged over 6x—an aggressive open-card pump.

Key signals identifying BGB opportunity:

1. Subjective Motivation: Stand Out Amid Fierce Competition. Late last year, exchange wars intensified—battles over existing users, stagnant new user growth. Hyper’s rise added pressure. Every CEX scrambled. Initiatives like BGB wealth generation became hot topics. Friends actually rode the full wave. At peak, even Xiaohongshu influencers posted: “My boyfriend made 800K from BGB.” Powerful fusion of primary narrative and secondary momentum pushed Bitget into mainstream awareness. Many held despite 40–50% drawdowns before exiting—proof of genuine belief at top.

2. Objective Reason: Reputation Recovery. On Oct 7, a whale dumped BGB, crashing price 50%. Though exchange reversed losses, concerns over depth and liquidity arose. Real trading volume and intrinsic value of BGB faced scrutiny. Despite solid PR recovery, facts matter—an incident reveals weakness. Doubts grew about platform token and overall trust. Pumping BGB served as reputation rehab—flooding narratives with irrational wealth stories to drown skepticism.

3. Structural Edge: Ideal Ownership Distribution. As a quasi-single-player coin, most BGB supply sits with exchange and affiliates—easy to control sell-side pressure. With controlled float, pumping becomes trivial. Also, success isn't measured purely by BGB profit—building faith and visibility matters. Market makers could go all-in. By endgame, people were essentially profiting from market cap expansion. Relative to restored credibility, the cost was negligible.

You’ve seen an offensive pump example—hopefully tasted my “off-chart” reasoning flavor. Clarification: this analysis carries no criticism toward Bitget. On Pizza Day, only @Yuanzhuo_labs, @TokenPocket_CN, @xiejiayinBitget, and @BitgetWalletCN sent me gifts amid Twitter chaos. Personally, regardless of opinions on BG, I’m grateful 😂. This event could enter history books as a textbook exchange marketing & token operation case.

3.2 Fight to Survive: TST

TST is BSC’s flagship meme coin—rose 100x amid dog coin frenzy—and one of few rallies I fully captured. Its journey was rocky, culminating in a forced pump—arrow drawn, must shoot. Let’s blend story and logic.

Feb 6, 2025: BNB Chain released tutorial video deploying TST test token. Amid meme hype, community assumed “official endorsement”—price rocketed. TST had already become BSC meme pioneer—capital markets always premium “first mover” status. Though early chaos meant unclear logic from team or market.

Feb 7: @cz_binance dropped a confusing post stating TST unrelated to Binance, urging against speculation. Understandable from a tech-focused founder—CZ values real utility. Whether creating BSC or investing, he dislikes meme nihilism. Standard NFA disclaimer. But big bro missed a cultural nuance: since 2017, the more elites deny something, the more authentic it feels. Projects once leveraged Vitalik’s denials for clout. CZ might’ve forgotten this habit. Result? After 70% crash post-denial, TST bizarrely V’d back up and stabilized. Worse—discussions peaked. Now core logic emerged:

Phase Two: Open-card pump—TST up 10x. I entered here. Why pump? Recall the second model: “Arrow drawn, must shoot.” All eyes on TST—it was priced as BSC meme leader. If Binance failed to lift it, trust would shatter—abandoning the whole meme space, even future of the chain.

Investment thesis simplified: bet on Binance’s capability. Online hate was loud—market share eroding, outdated, messy internal politics, corruption, near-death. But as old-timer, I trusted Binance deeply. Some faith needs no logic—I’ve seen @binancezh escape doom countless times. No need to act like angry youth betting on surrender. With that conviction plus open-hand pattern, I deployed confidently. What followed? Today Twitter swarms with Binance fans. @heyibinance proved every doubter wrong. Binance continues dominating exchanges.

Post-pump dip formed textbook flag pattern—then handed off to organic market action.

Binance’s “let the market speak” marketing philosophy is elegant and efficient. Compared to flashy Sun-style or mass-mobilization BG-style promotion, market-driven messaging is hardest yet most authentic.

After TST, BSC memes exploded. Binance Wallet soared. Even today’s alpha launch campaigns trace roots to TST’s boost—a perfect “one lifts a nest” execution. Another quick example: ORDI. Binance’s secondary pump signaled: OKX dominates inscription issuance, but real pricing power rests here. That wealth creation worked wonders—Binance listing wealth effects still linger today.

Didn’t expect Open-Cards section to run long—personal favorite remains American-Style from Ch.2, maybe because these stories add flavor. Lengthy, but hopefully readable. Now briefly cover classic Wyckoff model:

4. Wyckoff Market Pattern

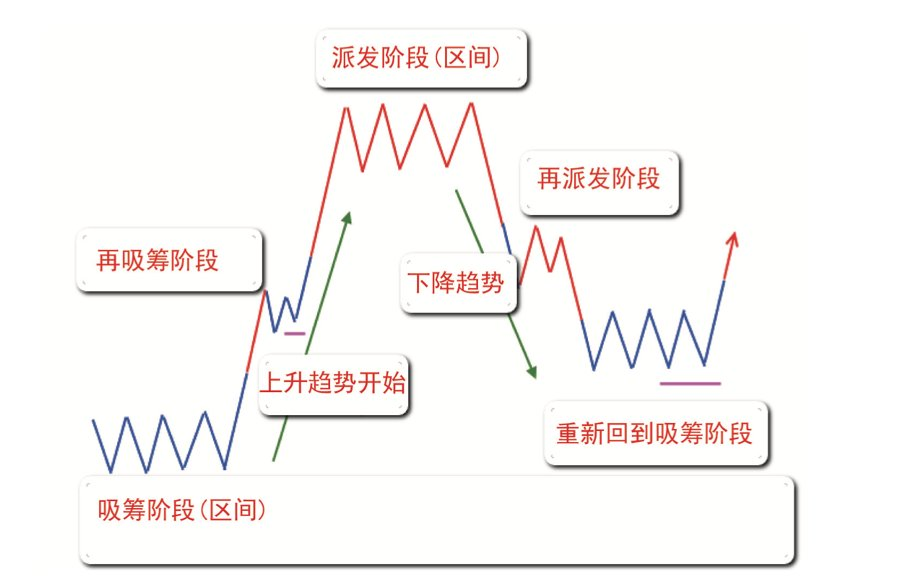

This section teaches technical analysis. Mastering Wyckoff requires reading multiple books—we’ll simplify macro structure.

“Since the early 20th century, major financial institutions derive core market principles from Dow Theory and Wyckoff Method—though they never admit it. They prefer retail traders rely on moving averages or MACD, knowing these superficial tools feed their profits.”

A complete cycle has four phases: Accumulation, Markup, Distribution, Markdown. See diagram:

- Accumulation: Smart money quietly buys at low levels, establishing position. Price moves sideways or in narrow range.

- Goal: Silently gather enough supply to prepare for markup.

- Markup: Price breaks above accumulation zone, uptrend begins. Smart money drives price higher for profit.

- Goal: Profit from rising prices while attracting public buying interest.

- Distribution: At high levels, smart money gradually sells to retail, shifting ownership. Price enters consolidation or chop.

- Goal: Exit positions at peak, preparing for downtrend.

- Markdown: Price breaks below distribution range, downtrend begins. Supply overwhelms demand, smart money mostly exited.

- Goal: Return price to lower levels, possibly restarting new accumulation cycle.

Ethereum’s 2017 bull run offers a classic example. Study the chart below—identify which segments match each phase.

Important notes: First, real-world Wyckoff patterns have endless variations. Perfect textbook cases almost never occur—remember: imitation brings death, understanding brings life. Flexibility after grasping logic is key. Second, smart money knows this framework—expect vicious traps and plenty of fake signals. This demands hands-on experience—nothing substitutes real combat. Lastly, NFA. DYOR.

5. Miscellaneous Patterns

Earlier models cover classics. Given infinite market complexity versus limited human insight, this summary barely scratches surface. Final thoughts on less-understood but potentially patterned behaviors. “Patterned” means underlying logic exists—mechanics drive outcomes. Pure retail noise or PvP? Unless you’re elite, better skip. Experts welcome discussion.

5.1 Money Laundering Markets

Scale and profitability of gray industries shocked me—far exceeding imagination. Crypto laundering-linked tokens often see explosive moves. Two categories worth studying:

- Black-market currencies: e.g., Bitcoin in 2013, Monero (XMR), HYPE, TRX—chains ideal for illicit settlements or wash trading. Post-Bitcoin era holds promise. Currently researching—may publish soon.

- Dedicated laundering vehicles: e.g., BOME spiking 5x overnight. Hackers often convert funds to ETH, then swap into memecoins via Ethereum for obfuscation. Chain forensics aren’t my strength, but clues likely exist.

5.2 VC Coins

Prime short targets. Why do Binance listings often dump immediately—becoming reliable free-money trades? Root cause: excessively loose supply structure. Pre-listing airdrops and Launchpad distributions flood retail with tokens. No incentive for whales to lift—everyone dumps simultaneously.

VC coins worsen this: large volumes of unissued tokens held by investors eager to exit. Plus, VC coins often suffer from inflated valuations—making it hard for new smart money to justify stepping in. Thus, low-quality VC coins offer excellent short opportunities.

5.3 Asian-Style Manipulation

Similar logic to American-style, but pace differs drastically. These tokens move extremely fast—sometimes compressing two-month American-style moves into three days. Strikingly, project teams, market makers, or institutions behind them are often Asian. Call them “Asian-style hands”—e.g., Trump and Milei coins. One operated by North Americans, the other Asians. Rumor says Argentine President Milei’s coin launched by a Shenzhen group—their ambition and收割 speed differ entirely.

Take TRX—apply American-style logic from Ch.2. Phases roughly align, but speed is insane. Suspect operators are hyper-aggressive Gen Z kids. We emotionally invested 04-born traders simply can’t compete with these kidney-driven young guns. In such fast-food markets, be a player, not a partner—be ruthless, not romantic.

Sigh—when will Asians learn endurance? Learn from Americans. Too fast—you blink and it’s over.

Many more secondary patterns exist—this covers current thoughts. Join discussion below.

Conclusion

From Sun Tzu’s *Void and Form*: “Military formation has no constant shape, like water.” This ~10,000-character piece aims to share logic and experience. Summarizing development models helps future secondary trading—even using this as a cheat sheet beats blind gambling. Yet as traders, remember: never mechanically apply templates, never armchair theorize. True knowledge emerges only through battlefield scars.

Markets are battlefields

End with Chairman Mao’s poem:

Reading June 30th People’s Daily report on Yujiang County eradicating schistosomiasis. Thoughts swirl, unable to sleep. Gentle breeze, morning sun at window, gazing south sky, penning joyfully.

Green hills and clear waters avail nothing, Even Hua Tuo helpless before tiny worm! Thousands of villages overgrown, people abandoned; Ten thousand homes desolate, ghosts singing sorrowful songs. Sitting still, travel eight thousand miles a day, Roaming skies, viewing ten thousand rivers. Cowherd asks after plague spirit— Same joys and sorrows drifting with passing waves.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News