Stock Market Tokenization from a "Conspiracy Theory" Perspective: A Mild Global "Dollar Harvest"?

TechFlow Selected TechFlow Selected

Stock Market Tokenization from a "Conspiracy Theory" Perspective: A Mild Global "Dollar Harvest"?

From dollar stablecoins to tokenized U.S. stocks, Crypto bless America might not be a joke after all.

Author: Tyler

Have you ever traded U.S. stocks on-chain?

Overnight, Kraken launched xStocks, supporting tokenized trading of 60 U.S. stocks; Bybit quickly followed with popular stock pairs like AAPL, TSLA, and NVDA; Robinhood also announced plans to support U.S. stock trading on blockchain and is developing its own proprietary chain.

Whether the wave of tokenization is just old wine in new bottles, one thing is clear: U.S. equities have suddenly become the "new darling" of the blockchain world.

Yet upon closer inspection, this emerging narrative—woven from dollar stablecoins, stock tokenization, and on-chain infrastructure—is pulling crypto deeper into financial narratives and geopolitical dynamics, inevitably reshaping its role.

Stock Tokenization Is Nothing New

Tokenizing U.S. stocks isn’t a novel idea.

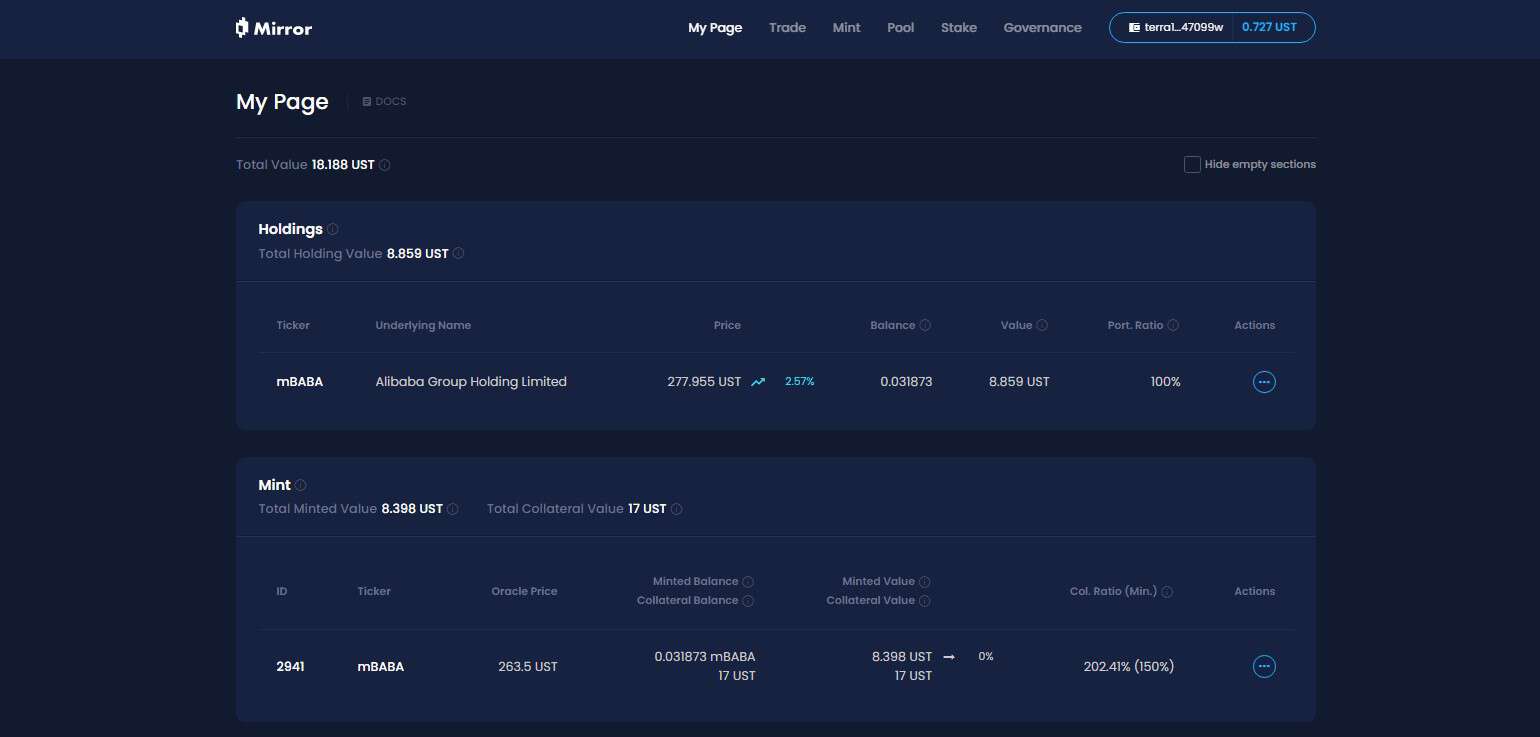

In the previous market cycle, projects like Synthetix and Mirror pioneered a full suite of synthetic asset mechanisms on-chain. This model allowed users to mint and trade “tokenized stocks” such as TSLA or AAPL by over-collateralizing assets (e.g., SNX, UST), and even extended coverage to fiat currencies, indices, gold, crude oil—essentially any tradable asset.

The mechanism works by tracking underlying assets: users lock up crypto collateral (e.g., $500 worth of SNX) at high ratios (e.g., 500%) to mint synthetic tokens (like mTSLA or sAAPL) that track real-world prices.

Since pricing relies on oracles and trades are executed via smart contracts without counterparties, the system theoretically offers infinite liquidity depth and zero slippage—a key advantage.

So why didn’t this synthetic asset model achieve mass adoption?

At its core, price pegging ≠ ownership. These tokenized stocks don’t confer actual equity ownership—they merely allow speculation on price movements. If oracles fail or collateral collapses (as Mirror did during the UST crash), the entire system risks liquidation imbalances, de-pegging, and loss of user confidence.

Another often-overlooked long-term issue: synthetic stock tokens remain niche within crypto. Capital circulates only within closed on-chain loops, with no institutional brokers involved. As a result, they stay “shadow assets”—unable to integrate into traditional finance, establish real capital conduits, or inspire derivative products, making it hard to attract structural inflows of new capital.

They had their moment—but ultimately failed to go mainstream.

A New Architecture for Channeling Global Capital into U.S. Stocks

This time around, stock tokenization has adopted a different approach.

Take Kraken, Bybit, and Robinhood’s latest offerings: instead of price pegs or on-chain simulations, these platforms use real stock custody, with funds flowing through licensed brokers into actual U.S. equities.

Objectively speaking, under this model, any user can simply download a crypto wallet, hold stablecoins, and buy U.S. stocks on a DEX—bypassing account opening requirements, KYC hurdles, time zones, and geographic restrictions. The process directly channels capital into U.S. markets via blockchain.

On a micro level, it enables greater global access to U.S. equities. But macroeconomically, it represents how the U.S. dollar and American capital markets are leveraging crypto—a low-cost, highly elastic, 24/7 channel—to attract incremental global capital. Notably, current implementations only allow long positions, with no shorting, leverage, or non-linear payoff structures (at least for now).

Imagine a non-crypto user in Brazil or Argentina discovering they can buy tokenized U.S. stocks on a CEX or DEX. With just a few clicks—downloading a wallet, converting local currency to USDC—they can invest in AAPL or NVDA.

This is framed as improved user experience, but in reality, it's a “low-risk, high-certainty” capital funnel into U.S. equities. For the first time, global hot money can flow frictionlessly across borders into American assets via crypto—enabling anyone, anywhere, anytime, to invest in U.S. stocks.

And as more L2s, exchanges, and wallets natively integrate these “stock trading modules,” the relationship between crypto, the U.S. dollar, and Nasdaq becomes increasingly seamless and entrenched.

From this vantage point, a series of “old and new” crypto narratives are being engineered into a distributed financial infrastructure tailored specifically for U.S. financial interests:

-

Treasury-backed stablecoins → Global dollar liquidity pool

-

Stock tokenization → Gateway to Nasdaq

-

On-chain trading infrastructure → Global relay station for U.S. brokerages

This may represent a subtle yet powerful form of global capital attraction. Regardless of whether it smells of conspiracy theory, one thing is certain: figures like Trump or future U.S. policymakers might well embrace this new narrative of stock tokenization.

How Should We Assess the Pros and Cons of Stock Tokenization?

If we view stock tokenization purely from within the crypto ecosystem, does it hold real appeal? And what impact could it have on the on-chain market cycle?

I believe we need a dialectical perspective.

For users lacking access to U.S. stock markets—especially crypto natives and retail investors in developing countries—stock tokenization opens an unprecedented low-barrier pathway. It amounts to “financial democratization,” breaking down systemic walls.

After all, the U.S. stock market—the home of Microsoft, Apple, Tesla, and NVIDIA—has long been celebrated for its historic bull run and remains one of the most attractive asset classes globally. Yet for most ordinary investors, participation has always come with high barriers: account setup, deposit/withdrawal complexity, KYC, regulatory constraints, and time zone differences—all of which deter countless would-be participants.

Now, all you need is a wallet and some stablecoins—even in Latin America, Southeast Asia, or Africa—and you can instantly buy Apple, NVIDIA, or Tesla shares. This brings dollar-denominated assets to the masses. Simply put, for regions where local assets underperform both U.S. equities and inflation, stock tokenization offers unprecedented accessibility.

Conversely, within the crypto community—particularly among Chinese-speaking, trading-focused users—the overlap with traditional stock investors is already significant. Most already have brokerage accounts and can easily access global markets via banks and international brokers like Interactive Brokers (my personal setup uses SafePal/Fiat24 + IBKR).

To these users, current stock tokenization feels half-baked: long-only, no derivatives, no options or short-selling—hardly a trader-friendly experience.

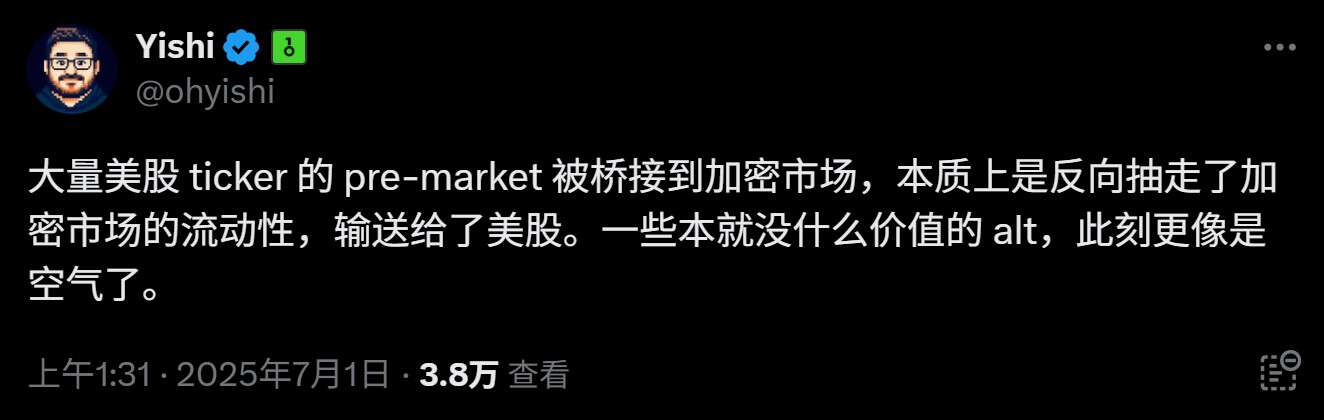

Could stock tokenization drain liquidity from the broader crypto market? Don’t dismiss the possibility too quickly. In fact, I see this as a potential window of opportunity—an inflection point for DeFi to rebuild after purging low-quality assets.

One of DeFi’s biggest challenges today is the lack of high-quality assets. Beyond BTC, ETH, and stablecoins, there are few tokens with strong value consensus. Many altcoins are volatile and fundamentally weak.

But if these newly custodied, on-chain U.S. stock tokens gradually integrate into DEXs, lending protocols, options markets, and derivatives systems, they could serve as foundational assets—diversifying portfolios and bringing more predictable value and narrative depth to DeFi.

Current stock tokenization products are essentially spot custody + price reflection, lacking leverage or complex payoffs. There’s a clear gap in advanced financial tooling. The real opportunity lies with those who can deliver composable, liquid products offering integrated “spot + shorting + leverage + hedging” experiences on-chain.

Imagine using these tokens as high-credit collateral in lending protocols, creating new hedging instruments in options platforms, or including them in composable baskets within stablecoin protocols. From this angle, whoever delivers a seamless on-chain experience combining spot, shorting, leverage, and hedging could build the next Robinhood or Interactive Brokers of the blockchain era.

And for DeFi, this might be the true turning point.

The question is—who will capture the product upside from this new narrative?

Final Thoughts

Since 2024, the debate over whether "crypto can still disrupt TradFi" has ceased to be meaningful.

Especially this year, bypassing geographic limitations of traditional finance through stablecoins—circumventing sovereign barriers, tax obstacles, and identity checks—has emerged as a central theme in recent narratives led by compliant dollar stablecoins.

"Crypto bless America" might not be a joke after all.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News