RWA Landscape Research: Who Are the Key Players in the Ecosystem?

TechFlow Selected TechFlow Selected

RWA Landscape Research: Who Are the Key Players in the Ecosystem?

If BTC/ETH ETFs serve as the "capital entry point" from off-chain to on-chain, then RWA is the "asset bridge" from on-chain finance to the mainstream world.

Author: @Laaaaacieee, Researcher at Bitget Wallet

1. Why Should We Focus on RWA Now?

RWA is emerging as one of the fastest-growing sectors in on-chain finance. As traditional financial institutions increasingly embrace blockchain technology and interest rate environments shift, more real-world assets—such as U.S. Treasuries, gold, stocks, and accounts receivable—are being mapped onto blockchains to enable more efficient trading, custody, and yield distribution.

If BTC/ETH ETFs serve as the "entry point" from off-chain to on-chain capital flows, then RWA acts as the "asset bridge" connecting on-chain finance with the mainstream world. Leading projects like Ondo Finance and Matrixdock have partnered with financial institutions such as Circle and BlackRock. Meanwhile, the trend of on-chain RWA products is accelerating beyond DeFi into end-user applications including wallets and exchanges.

2. Overview and Trends in the RWA Sector

2.1 Definition and Core Logic of RWA

RWA refers to valuable real-world assets that are converted into tokenized assets via issuance, mapping, staking, or fractionalization on a blockchain, enabling circulation and interaction within blockchain ecosystems. The core idea lies in leveraging smart contracts and open financial protocols to achieve more efficient, transparent, and composable asset utilization.

Common types of RWA include:

-

Bonds (e.g., U.S. Treasuries, private debt)

-

Commodities (e.g., gold, carbon credits)

-

Income-generating assets (e.g., accounts receivable, prepaid orders)

-

Real estate (ownership shares held as NFTs)

-

Equity & securities (mapping traditional corporate stocks or fund shares onto chains, often involving security token issuance)

The advantages of onboarding assets to the blockchain include enhanced liquidity, faster and more convenient cross-border clearing and settlement, greater transparency, reduced intermediaries, and lower issuance costs. Additionally, once RWA is tokenized, it can participate in various DeFi activities—making RWAfi a major advantage.

Moreover, some RWA products fulfill the vision of allowing users to access investments they couldn't previously buy off-chain due to eligibility restrictions:

-

Goldfinch’s Private Debt Fund-of-Funds product is underpinned by private debt offerings from mega funds like Ares; these TradFi private debt products typically have high investment thresholds, but on the platform, users can invest starting at $100

-

Products like USDY, backed by U.S. Treasuries, solve the problem for residents in many countries who lack compliant avenues to purchase U.S. Treasury bonds

2.2 Market Size and Growth Potential

2.2.1 Market Size & Growth Rate

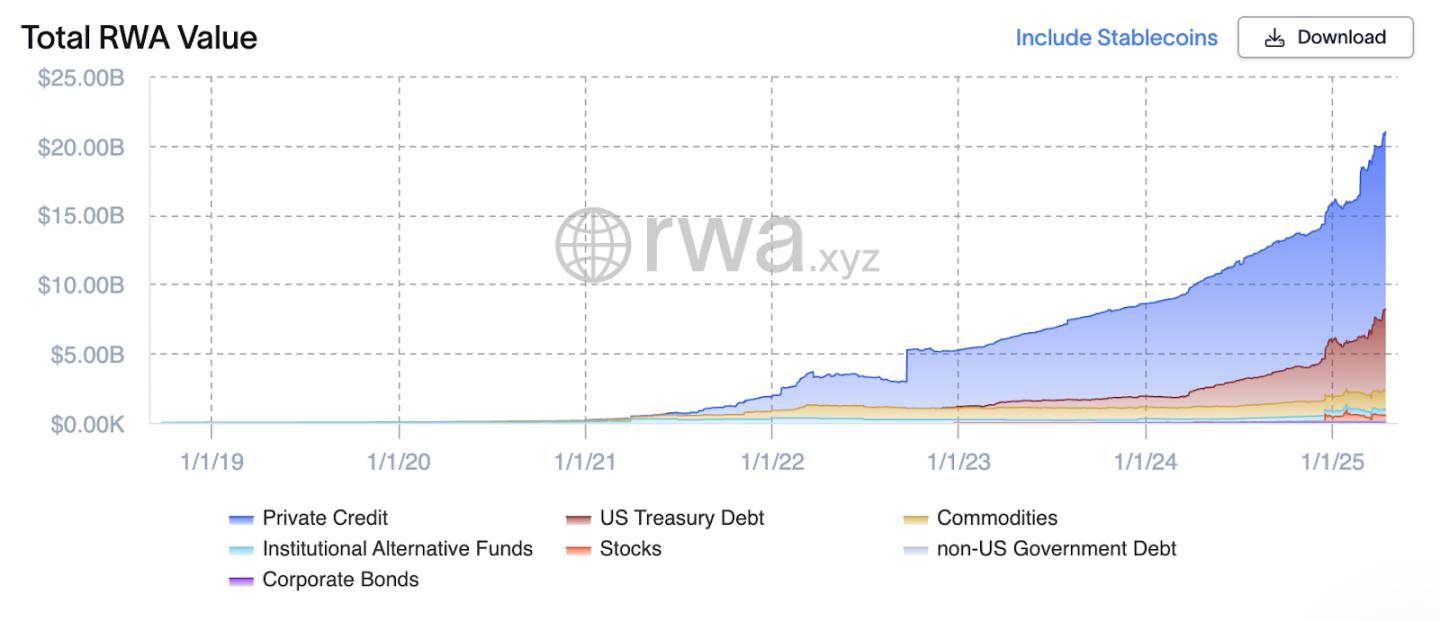

As of mid-April 2025, the global on-chain non-stablecoin RWA market was valued at approximately $21 billion, representing nearly 115% year-over-year growth and a three-year compound annual growth rate (CAGR) of ~120%. This expansion has been primarily driven by debt-based RWAs such as U.S. Treasury debt and private credit, which posted 3-Year CAGRs of 3590% and 135%, respectively.

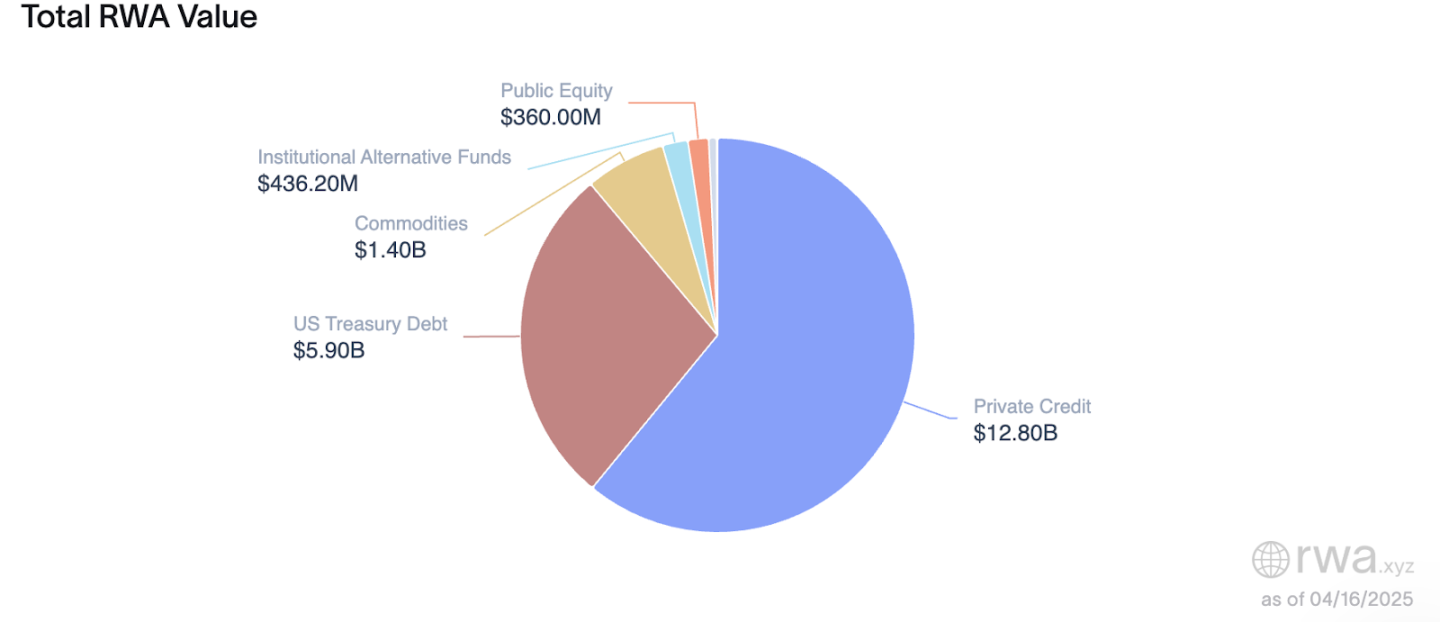

Within the global on-chain non-stablecoin RWA space, the top three categories are Private Credit, U.S. Treasury Debt, and Commodities, with on-chain values of $12.8 billion, $5.9 billion, and $1.4 billion, accounting for approximately 61%, 28%, and 7% of the total, respectively.

In terms of chain distribution, Ethereum remains the dominant RWA issuance platform, holding about 58.6% of the market share with $58.7 billion in assets under management (AUM). ZKsync Era ranks second with 17.4% share and $17.4 billion in AUM.

2.2.2 Future Growth Outlook

A joint report titled *Reimagining Asset Management* published in July 2022 by Boston Consulting Group (BCG) and digital securities platform ADDX forecasts that the global tokenized asset market could reach $16 trillion by 2030—a potential 760x increase from current levels—positioning RWA as a key component of on-chain assets.

An important comparison is with BTC/ETH ETFs. Based on closing data as of April 15, 2025, Bitcoin ETFs had a total AUM of $97.23 billion and Ethereum ETFs $8.29 billion, collectively five times larger than the non-stablecoin RWA market.

BTC/ETH ETFs are “capital entry points”; RWA is an “asset export channel”

-

ETFs: Packaging on-chain assets into traditional financial products → attracting traditional capital into crypto; significance: compliance pathways + public-market validation; limitation: limited to BTC/ETH, focused on speculation/hedging

-

RWA: Mapping off-chain assets onto-chain → building new on-chain financial markets; significance: enabling DeFi and wallets to carry real-world value; advantages: broader asset types (bonds, gold, real estate, credit…), stronger yield backing

RWA holds genuine potential for structural integration between TradFi and on-chain DeFi

-

ETFs represent more of an “asset repackaging” exercise—their essence remains a form of TradFi market expression

-

RWA breaks down TradFi’s underlying assets into components of smart contracts and on-chain account systems, deeply integrating with DeFi protocols (e.g., collateralized lending, yield aggregation, stablecoin backing, etc.)

-

RWA drives a structural revolution in asset supply—more challenging, yet vastly larger in scale, with far greater long-term implications and deeper ecosystem integration than ETFs

ETF vs RWA: Scale Potential

ETFs present opportunities for CEXs, asset managers, and exchanges

RWA is the core battleground for DeFi, wallets, and on-chain protocols

-

Wallets can offer asset management, portfolio display, wealth management gateways, KYC visibility layers

-

For example, wallets integrating products like Ondo, sUSDS, USDY can provide on-chain principal-protected wealth management features—an effective complement to CEX offerings

-

In contrast, ETFs are managed by firms like BlackRock, Charles Schwab, and Franklin Templeton and won’t drive revolutionary change within wallet products

2.3 Key Drivers of the Sector

2.3.1 Macro Interest Rate Environment Fuels Demand for “Real Yield” On-Chain

Since 2022, the global economy has entered a high-interest-rate cycle, particularly in the U.S., where the federal funds rate has remained above 5%, significantly increasing the appeal of traditional financial assets like U.S. Treasuries and money market funds.

Meanwhile, the traditional DeFi ecosystem faces declining on-chain risk-free rates and intensified competition in yield models amid bull-bear cycles, leading to rising demand from users for “stable, high-yield” asset allocation options.

RWA products effectively bridge this gap by bringing real-interest-bearing assets—such as U.S. Treasuries, bonds, and income notes—on-chain, offering users “low-volatility + real yield” investment alternatives.

2.3.2 Traditional Financial Institutions Are Actively Joining, Bringing Assets and Credibility

Starting in 2023, top-tier financial institutions including BlackRock, Franklin Templeton, WisdomTree, JPMorgan Chase, and Citibank have launched RWA-related initiatives.

These institutions are experimenting with native on-chain issuance of traditional financial assets—not just bridged mappings—through mechanisms such as on-chain fund tokens, tokenized Treasury products, and tokenized asset funds.

This move goes beyond mere asset expansion—it signifies the convergence of TradFi sovereign credit with blockchain settlement efficiency, greatly boosting market confidence in RWA.

Notable examples include:

-

Franklin Templeton issued BENJI Token, representing shares in its on-chain U.S. government money market fund, tradable on Polygon and Stellar;

-

BlackRock invested in tokenization platform Securitize and plans to launch a tokenized fund on Ethereum;

-

Citi announced a pilot program to settle certain custodied bonds on-chain.

2.3.3 Global Regulation Is Gradually Opening Up, Creating Legal Pathways

Unlike the "wild growth" era of ICOs, RWA involves heavily regulated assets such as securities, bonds, and funds, requiring compliance-driven development.

Currently, multiple countries and regions have established clear regulatory frameworks, laying legal foundations for asset tokenization, token issuance, and investor rights:

p.s. Reg A+ is a lighter securities issuance framework under U.S. law, allowing companies to issue stocks or tokens to general investors—not just accredited ones—without undergoing a traditional IPO, up to $75 million annually. Exodus Movement, INX, and tZERO have all used Reg A+ to issue assets.

Notable cases:

-

Sygnum Bank in Switzerland has issued tokenized corporate bonds, allowing investors to purchase financing products on-chain;

-

Hong Kong supported China Construction Bank in issuing a HK$200 million tokenized green bond on-chain—the first government-backed tokenized bond project in Asia.

2.4 Classification of Major Participants

The RWA ecosystem consists of four main participant types: asset issuers, infrastructure providers, application-layer platforms, and data/service providers.

Asset Issuers (Token Issuers)

Responsible for mapping real-world assets (e.g., U.S. Treasuries, gold, real estate) into tradable on-chain tokens, handling compliance structuring, yield distribution, custody, and regulatory oversight.

Infrastructure Providers (RWA Infra & Issuance Chains)

Offer asset custody, identity verification, regulatory compliance support, and asset issuance platforms—often Layer 1 or permissioned blockchains.

Application-Layer Platforms (Access Products & User Protocols)

Provide user interfaces, portfolio tools, and wealth management features, often integrated with DeFi modules to connect retail investors with on-chain RWA.

Data and Index Providers (Oracles & Indices)

Supply on-chain price feeds, volatility metrics, indices, and other data essential for linking off-chain information with on-chain protocols.

2.5 Development Constraints

Many companies evolve rapidly, with business models still in experimental phases—this is evident when press releases from six months ago no longer reflect current website content (e.g., Credix, which initially operated a credit platform but now shows no related info and has pivoted to PayFi).

In terms of liquidity, most RWA products currently only allow whitelisted trading, with only a few supporting open market circulation:

Most RWA products (e.g., private credit LP tokens, Treasury products) only permit transfers among whitelisted addresses. Only the following currently support full secondary market trading:

-

Commodity-backed products (e.g., gold)

-

Ondo Finance’s USDY, a U.S. Treasury product built on a compliant framework

Compliance risks and on-chain/off-chain asset alignment remain unresolved: RWA inherently connects on-chain smart contract systems with off-chain asset custody and contractual rights, creating natural compliance risks and misalignment issues. Most projects currently use hybrid architectures such as SPVs (Special Purpose Vehicles) or partnerships with regulated custodians—centralized sides require users to complete KYC and subscription reviews, while on-chain tokens (e.g., bTokens) function as standard ERC-20s with free transferability. However, due to inconsistent regulations across jurisdictions, divergent KYC policies, and difficulties verifying on-chain identities, several core challenges persist:

-

Regulatory gray zones are common: Many projects operate without explicit securities licenses, using structural designs to “avoid definitions” (regulatory arbitrage); tighter regulation could trigger delisting risks

-

Authenticity of asset custody is hard to verify: Whether on-chain tokens truly correspond to off-chain assets relies largely on custodian attestations or third-party audit reports, which lack standardization and enforceability

-

Liquidation and recovery processes lack transparency: When underlying assets face issues (e.g., default, early redemption, SPV bankruptcy), there's no standardized process for how token holders assert rights or participate in liquidation—smart contracts cannot autonomously resolve off-chain legal matters

-

Regulators struggle to define DeFi product compliance status: Especially when RWAs are embedded in DeFi (e.g., as collateral for lending or in AMM pools), their legal classification remains unclear, exposing both projects and users to potential “illegal securities issuance” or “cross-border transaction violations”

Representative cases:

-

Maple Finance faced LP redemption issues after borrower defaults—despite having on-chain logic, resolution ultimately required off-chain arbitration;

-

Backed Finance explicitly limits ownership to “compliant whitelisted users,” restricting liquidity but serving as a way to mitigate compliance risk;

-

RealT holders must pass KYC through a U.S. entity to claim property rights and yields—any failure in KYC renders on-chain rights fragile.

3. Key Players and Ecosystem Landscape

3.2.1 U.S. Treasuries Category

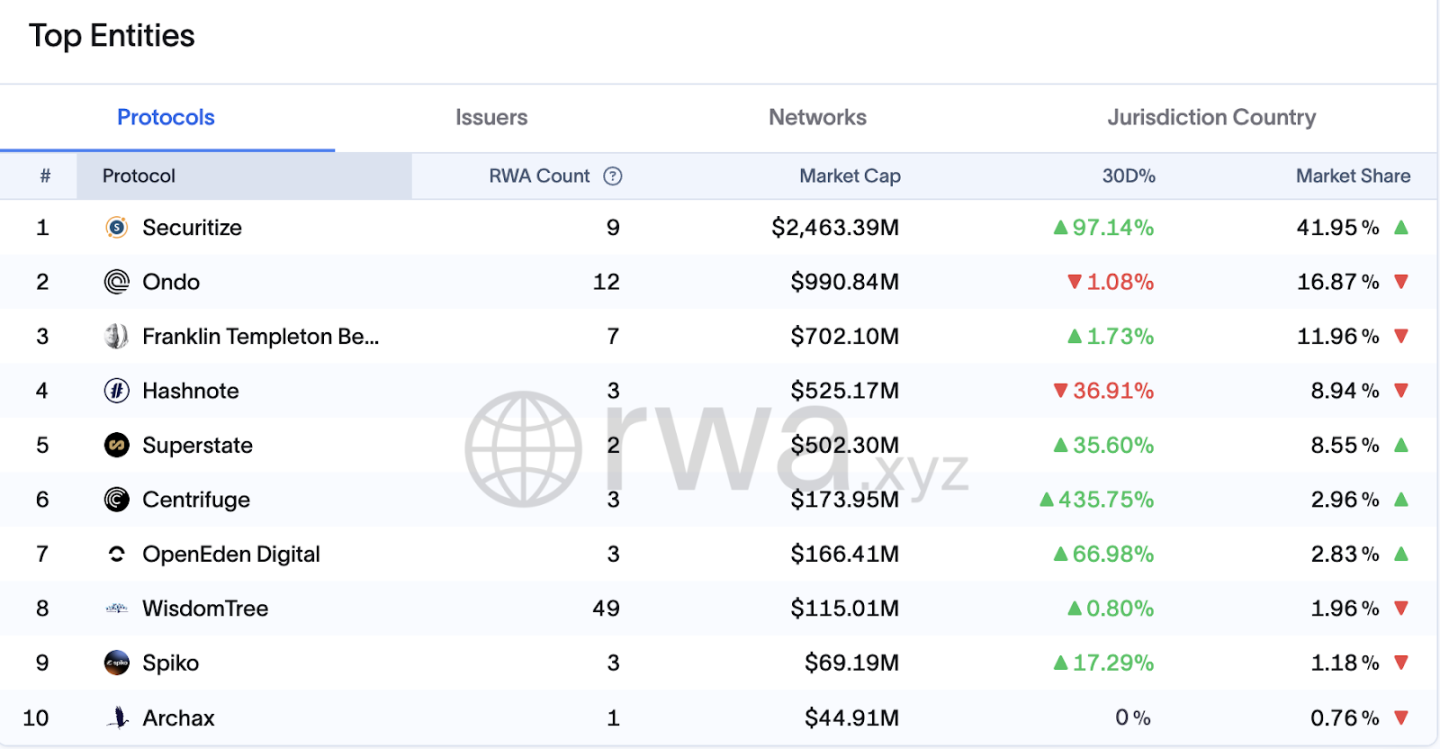

The top 5 projects currently hold 88% market share. Securitize and Franklin Templeton represent “TradFi-compliant issuance,” while Ondo and Superstate exemplify “Web3-native compliant yield platforms.”

Securitize

https://x.com/Securitize

Founded: 2017

Headquarters: San Francisco, USA

Founders: Carlos Domingo (former head of digital at Telefónica), Jamie Finn

Funding: Raised ~$100 million from investors including BlackRock, Morgan Stanley, Blockchain Capital, and Circle Ventures

Key Resources:

-

Registered broker-dealer and transfer agent with the U.S. SEC

-

Operates Securitize Markets, a compliant digital securities trading platform

-

Partnered with BlackRock as transfer agent for its first tokenized fund on public blockchain

Notable Products:

-

Provided equity tokenization services for companies like Exodus and Oddity

-

Supports tokenization of private equity, bonds, real estate, and other assets

Ondo Finance

https://x.com/OndoFinance

Founded: 2021

Headquarters: New York, USA

Founders: Nathan Allman (ex-Goldman Sachs), Pinku Surana

Funding: Multiple rounds backed by Founders Fund, Pantera Capital, and others

Key Resources:

-

Strategic partnerships with BlackRock, Mastercard, Aptos

-

Launched Flux Finance, enabling decentralized lending for assets including USDC and OUSG

Notable Products:

-

USDY: Stable-yield token backed by short-term U.S. Treasuries and bank deposits

-

OUSG: Token pegged to short-term U.S. government bonds

Franklin Templeton (Traditional Asset Management Giant)

https://x.com/FTI_Global

Founded: 1947

Headquarters: California, USA

Key Resources:

-

Over $1.6 trillion in global AUM

-

Launched BENJI tokens on multiple blockchains including Stellar, Ethereum, Polygon, Arbitrum, and Base

Notable Product:

-

BENJI: Token representing shares in Franklin OnChain U.S. Government Money Fund (FOBXX), with each token equivalent to one fund share

Hashnote

https://x.com/Hashnote_Labs

Founded: 2023

Headquarters: Chicago, USA

Founder: Leo Mizuhara

Funding: $5 million incubated by Cumberland Labs

Key Resources:

-

Acquired by Circle in 2025, integrated into its digital asset capital markets division

-

Launched USYC, one of the largest tokenized money market funds globally

Notable Product:

-

USYC: Tokenized money market fund backed by short-term U.S. Treasuries (primary and secondary trading restricted to KYC/AML-approved investors)

Superstate

https://x.com/superstatefunds

Founded: 2023

Headquarters: San Francisco, USA

Founders: Robert Leshner (founder of Compound), Dean Swennumson, Reid Cuming, Jim Hiltner

Funding: Raised $18.1 million from CoinFund, Distributed Global, Breyer Capital, Galaxy Digital, and others

Key Resources:

-

Launched USTB (short-term U.S. government securities fund) and USCC (crypto arbitrage fund)

-

Assets held by regulated third-party custodians to ensure compliance and security

Notable Products:

-

USTB: Provides on-chain access to short-term U.S. Treasuries

-

USCC: Combines crypto arbitrage and government securities yield strategies

3.2.2 Global Bonds Category

Spiko

https://x.com/Spiko_finance

Founded: 2023

Headquarters: Paris, France

Founders: Paul-Adrien Hyppolite and Antoine Michon, both with financial and regulatory backgrounds from French government and private sector roles

Funding: No public details disclosed

Key Resources:

-

Collaborates with the French Financial Markets Authority (AMF) to ensure compliance

-

Assets custodied by Crédit Agricole and CACEIS Bank (Santander subsidiary), ensuring security

Notable Products:

-

€MMF: Invests in short-term government debt from Eurozone countries, average maturity under 60 days, maximum asset maturity under 6 months

-

$MMF: Invests in U.S. Treasuries, structured similarly to €MMF

-

Deployed across multiple blockchains: Polygon, Arbitrum, Starknet, Etherlink

OpenTrade

https://x.com/opentrade_io

Founded: 2023

Headquarters: San Francisco, USA

Funding:

Seed round closed in April 2024, raising $3.2 million from a16z crypto CSX, CMCC Global, Draper Dragon, Plassa Capital, and Ryze Labs

Extended seed round closed in November 2024, raising $4 million from AlbionVC, a16z crypto CSX, and CMCC Global

Key Resources:

-

Partnerships with WOO X, Littio, Nest to offer RWA yield products

-

Assets held by regulated third-party custodians for security

Notable Product:

-

RWA Yield Vaults: Offer stable-yield products backed by real-world assets

3.2.3 Private Credit Category

Centrifuge

https://x.com/centrifuge

Founded: 2017

Headquarters: Berlin, Germany

Team Background: Founded by Lucas Vogelsang et al., team members bring extensive fintech and blockchain experience

Funding: Raised over $15 million across multiple rounds from Galaxy Digital, IOSG, BlueYard Capital, and others

Key Resources:

-

Collaborates with DeFi protocols like MakerDAO and Aave to advance on-chain RWA lending markets

-

Launched Centrifuge Credit Group to handle asset risk assessment and underwriting

Notable Products:

-

Tinlake: Open RWA investment platform enabling users to tokenize real-world assets and raise financing (KYC required)

-

Centrifuge Chain: Permissionless chain for RWA tokenization (KYB only)

-

Deployed on Ethereum and Polkadot

Figure

https://x.com/Figure

Founded: 2018

Headquarters: San Francisco, USA

Team Background: Founded by Mike Cagney, former CEO of SoFi, with team members experienced in finance and tech

Funding: Raised over $200 million from DST Global, RPM Ventures, DCG, and others

Key Resources:

-

Developed Provenance Blockchain, tailored for financial services applications

-

Partners with multiple financial institutions to promote digitization and on-chain trading of assets

Notable Products:

-

Figure Markets: Zero-fee crypto trading platform (KYC required)

-

Figure Lending: Offers home equity loans

Tradable

https://x.com/tradable_xyz

Founded: 2022

Headquarters: Singapore

Team Background: Composed of fintech and blockchain experts focused on asset digitization and on-chain trading

Funding: No public details disclosed

Key Resources:

-

Offers asset tokenization services across multiple asset classes

-

Collaborates with financial institutions to advance asset digitization and on-chain trading

Notable Product:

-

Tradable Platform: An asset tokenization and trading platform supporting multiple asset types

Maple Finance

https://x.com/maplefinanec

Founded: 2021

Headquarters: Sydney, Australia

Team Background: Founded by Sidney Powell and Joe Flanagan, with strong finance and tech expertise

Funding: Raised over $30 million from BlockTower, Maven 11, Framework Ventures, and others

Key Resources:

-

Provides institutional-grade decentralized credit markets, supports uncollateralized lending

-

Launched Syrup protocol, combining Maple’s lending infrastructure with DeFi openness

Notable Products:

-

Maple Direct: Direct loan channel for institutions

-

Syrup: Offers high-quality asset-backed loans to DeFi users

TrueFi

https://x.com/TrueFiDAO

Founded: 2020

Headquarters: San Francisco, USA

Team Background: Launched by TrustToken team, experienced in finance and tech

Funding: Raised over $30 million from a16z, BlockTower, Alameda Research, and others

Key Resources:

-

Uncollateralized decentralized credit market, supports loans across multiple asset types

-

Introduced a credit scoring system to assess borrower risk

Notable Products:

-

TrueFi Lending: Uncollateralized lending service (KYC required)

-

TrueFi Credit: Credit scoring and risk assessment service

Mercado Bitcoin

https://x.com/MercadoBitcoin

Founded: 2013

Headquarters: São Paulo, Brazil

Team Background: One of Latin America’s largest crypto exchanges, focused on financial innovation and digital asset growth

Funding: Raised $200 million in 2021 led by SoftBank

Key Resources:

-

Partnered with Polygon Labs to plan issuance of $200 million in RWA tokens by 2025

-

Collaborating with Plume Network to tokenize Brazilian assets including ABS, consumer credit, corporate debt, and accounts receivable

Notable Products:

-

MB Tokens: Over 340 tokenized products launched, totaling $180 million in tokenized assets

-

RWA Tokens: Include energy, oil, and real estate-related tokens offering stable yield distributions

Goldfinch

https://x.com/goldfinch_fi

Founded: 2020

Headquarters: San Francisco, USA

Team Background: Founded by ex-Coinbase engineers Blake West and Michael Sall, aiming to build a crypto-native credit market without crypto collateral

Funding: Raised $25 million in Series A in 2021 led by a16z, with participation from Coinbase Ventures, Variant, BlockTower

Key Resources:

-

Partners with top-tier private credit funds like Ares, Apollo, Golub to offer institutional private credit products

-

Launched Goldfinch Prime, enabling users to invest in multiple private credit funds for stable returns

Notable Products:

-

Goldfinch Prime: Stable-yield product backed by real-world assets, targeting 10–12% annualized returns

-

Callable Loans: Allow investors to withdraw funds before loan maturity

Credix

https://x.com/Credix_finance

Founded: 2021

Headquarters: Brussels, Belgium

Team Background: Founded by Thomas Bohner et al., team members bring fintech and blockchain expertise

Funding: Raised $11.5 million in Series A in 2022 led by Motive Partners and ParaFi Capital, with participation from Valor Capital, Circle Ventures, Voltage Capital

Key Resources:

-

Focused on on-chain credit markets in emerging economies, especially Latin America

-

Partners with fintech platforms to offer uncollateralized lending

Notable Product:

-

Credix Platform: A decentralized capital market ecosystem allowing asset originators to tokenize and finance assets

3.2.4 Commodities Category

RWA Gold Sector Comparison

Paxos Trust Company

https://x.com/Paxos

Founded: 2012 (formerly itBit)

Headquarters: New York, USA

Team Background: Founded by Charles Cascarilla and Rich Teo, team brings deep finance and tech experience. Paxos was the first blockchain company to receive a “limited-purpose trust company” charter from the New York State Department of Financial Services (NYDFS), focusing on regulated blockchain infrastructure.

Funding:

Raised over $540 million, valued at $2.4 billion

Investors include PayPal Ventures, Bank of America, Founders Fund, Oak HC/FT, Mithril Capital

Key Resources & Partnerships:

-

Provides crypto trading and stablecoin issuance services for PayPal (e.g., PYUSD)

-

Partners with Stripe to power its “Pay with Crypto” feature with stablecoin payment infrastructure

-

Collaborates with Credit Suisse, Société Générale, Revolut, and others to advance asset digitization and on-chain trading

Notable Products:

-

USDP (Pax Dollar): Regulated dollar-pegged stablecoin, backed 1:1 by USD

-

PAXG (Pax Gold): Regulated gold-backed token, each representing one troy ounce of physical gold

-

PYUSD (PayPal USD): Dollar-pegged stablecoin co-issued with PayPal

-

USDL (Lift Dollar): Yield-bearing stablecoin issued via UAE subsidiary, distributing daily returns

-

itBit Exchange: Regulated digital asset exchange supporting multiple cryptocurrencies

3.2.5 Stocks Category

Synthetix

https://x.com/synthetix_io

Founded: 2018 (formerly Havven)

Headquarters: Australia

Team Background: Founded by Kain Warwick, team members have strong finance and tech expertise

Funding: Multiple rounds backed by Framework Ventures, Paradigm, and others

Key Resources:

-

Originally an over-collateralized synthetic asset protocol, now evolved into a crypto-native derivatives platform, TVL $71.97M

-

Pioneered a debt pool model supporting multi-asset synthetics (stocks, commodities, forex), maintaining stability via high collateral ratios (400–600%)

Notable Products:

-

Synths: Synthetic assets tracking real-world asset prices

-

Synthetix Exchange: Decentralized exchange for trading Synths

Backed Finance

https://x.com/BackedFi

Founded: 2021

Headquarters: Zug, Switzerland

Team Background: Co-founded by Dr. Adam Levi, Roberto Klein, and Yehonatan Goldman, with strong finance and blockchain expertise

Funding: Raised $17.9 million by April 2024 from Gnosis, Coinbase Ventures, Semantic Ventures, Stratos Technologies, Blockchain Founders Fund, Stake Capital, 1kx, Nonce Classic, and others

Key Resources & Partnerships:

-

Issued under Swiss DLT Act, uses EU MiFID II passport to serve European retail investors; tokens represent real stocks held by SPVs (e.g., bCSPX tracks S&P 500 ETF)

-

Partnered with Chainlink, integrated Proof of Reserve (PoR) to ensure every bToken is 1:1 backed

-

Collaborates with INX to offer bNVDA (NVIDIA stock) trading to qualified non-U.S. users

-

Partners with eNor Securities to promote tokenized securities in Latin America

Notable Products:

-

bCSPX: Tokenized product tracking the S&P 500 index

-

bTSLA: Tokenized product tracking Tesla stock

-

bNVDA: Tokenized product tracking NVIDIA stock

-

bIB01: Tokenized product tracking iShares 0–1 Year Treasury ETF

-

bHIGH: Tokenized product tracking high-yield corporate bonds

Product Features:

-

All bTokens are ERC-20 tokens with free transferability and composability, deployed across multiple chains

-

Each bToken is 1:1 backed by real assets held by regulated third-party custodians

-

Complies with Swiss DLT Act, ensuring legality and security

-

Uses Gnosis Chain to reduce gas costs

Dinari

https://x.com/DinariGlobal

-

Founded: 2022

-

Headquarters: California, USA

-

Funding: Raised $17.5 million from Alchemy Ventures, 500 Global, Version One, and others

Key Resources & Partnerships:

-

Registered with the U.S. SEC as a transfer agent, compliantly issuing dShares (tokenized stocks), backed 1:1 by physical securities

-

dShares deployed on Arbitrum and Ethereum mainnet, supporting multi-chain circulation

-

Integrated with compliant platforms like Securitize and INX to ensure regulatory compliance of security tokens

Notable Products:

-

dAAPL: Tokenized product tracking Apple stock

-

dTSLA: Tokenized product tracking Tesla stock

-

dGOOGL: Tokenized product tracking Alphabet (Google) stock

Product Features:

-

All dShares are ERC-20 tokens, freely transferable on-chain (subject to whitelist), backed by real securities held by compliant custodians

-

Complies with U.S. securities laws, requires KYC/AML verification, primarily targeting accredited investors

Swarm X

https://x.com/SwarmMarkets

Founded: 2020

Headquarters: Berlin, Germany

Team Background: Co-founded by Philipp Pieper (co-founder of Swarm Fund) and Timo Lehes, team brings deep expertise in blockchain, financial markets, and regulatory compliance

Funding: Raised ~$5.5 million in seed round from Fenbushi Capital, Blockwall Capital, NEO Global Capital, and others

Key Resources & Partnerships:

-

Regulated by German Federal Financial Supervisory Authority (BaFin), holds Financial Services Provider (FSP) license for regulated digital asset trading

-

Launched Open dOTC, a permissionless RWA trading platform enabling on-chain trading without restrictions

Notable Products:

-

Tokenized US Treasuries

-

Tokenized AAPL

-

Tokenized EUR Bonds

Product Features:

-

All assets are ERC-20 tokens, 1:1 backed by physical assets, regulated by BaFin

-

Supports permissionless OTC trading, lowering barriers and enhancing liquidity

3.3 Key Chains, Yield Aggregators, and Infrastructure

Plume Network

https://x.com/plumenetwork

Positioning: Plume is the first modular Layer 1 blockchain designed specifically for Real-World Assets (RWA), aiming to efficiently and securely bring traditional assets on-chain.

Technical Features:

-

EVM-compatible, supports smart contract development

-

Built-in compliance and asset tokenization mechanisms simplify the RWA onboarding process

-

Supports cross-chain interoperability, deployed across 16 blockchain networks

Ecosystem Development:

-

Hosts over 180 protocols and 18 million unique addresses

-

Launched Plume Passport (RWAfi wallet) and pUSD (ecosystem stablecoin)

-

Backed by Haun Ventures, Galaxy, Superscrypt, and other institutions

Converge

Ethena and Securitize have launched a new public chain called Converge, scheduled to go live in Q2. Converge is a settlement network for traditional finance and digital dollars, driven by Ethena Labs and Securitize. Its vision is to provide the first settlement layer purpose-built for TradFi-DeFi convergence, centered around USDe and USDtb, secured by ENA. The blockchain is expected to serve two core use cases:

-

Settlement for permissionless spot and leveraged DeFi speculation;

-

Storage and settlement of stablecoins and tokenized assets.

-

Securitize will deploy its core future tokenized asset issuance layer on Converge, expanding beyond tokenized Treasuries and funds to cover all forms of securities. Ethena will launch its core products USDe, USDtb, and iUSDe natively on the chain.

-

Applications will be built on Converge to enable TradFi institutions to interact with iUSDe, USDe, and Securitize-backed assets on-chain.

Currently, five protocols have committed to building and distributing institutional-grade DeFi products on Converge:

-

Aave Labs’ Horizon: Bridges TradFi and DeFi via a market designed for Securitize tokenized assets (including Ethena’s institutional iUSDe);

-

Pendle Institutional: Provides rate speculation infrastructure for scalable institutional opportunities like iUSDe;

-

Morpho Labs: Offers modular money markets for Ethena and Securitize assets;

-

Maple Finance and Syrup: Build verifiable on-chain institutional yield and credit products based on USDe and RWA;

-

EtherealDEX: High-performance derivatives and spot trading powered by Ethena liquidity, using USDe as collateral.

Stellar

https://x.com/StellarOrg

Founded: 2014

Headquarters: San Francisco, USA

Team Background: Co-founded by Jed McCaleb and Joyce Kim. Jed McCaleb is also a co-founder of Ripple and Mt. Gox.

Funding: Supported technically, financially, and operationally by the Stellar Development Foundation (SDF) to grow the network and its applications.

Key Resources:

-

Uses Federated Byzantine Agreement (FBA) consensus for fast, low-cost transactions

-

Supports issuance and trading of multiple asset types, including fiat and crypto

-

Partners with IBM, MoneyGram, and others to advance global payment solutions

Notable Products:

-

Stellar Network: Mainnet supporting asset issuance, management, and trading

-

Lumens (XLM): Native token used for transaction fees and account activation

-

Soroban: Smart contract platform enabling developers to build dApps

Algorand

https://x.com/Algorand

Founded: 2017

Headquarters: Boston, USA

Team Background: Founded by Turing Award winner and MIT professor Silvio Micali, team brings deep expertise in cryptography and blockchain

Funding: Supported by Algorand Foundation to grow the ecosystem and applications

Key Resources:

-

Uses Pure Proof-of-Stake (PoS) consensus for rapid transaction finality

-

Supports smart contracts and creation/management of multiple asset types

-

Provides diverse developer tools and SDKs supporting multiple programming languages

Notable Products:

-

Algorand Network: Mainnet enabling efficient, low-cost transactions

-

Algorand Standard Assets (ASA): A Layer 1 feature allowing users to represent any asset on Algorand with the same security and usability as native ALGO

PolyTrade

https://x.com/Polytrade_fin

Founded: 2021

Headquarters: Dubai, UAE

Team Background: Founded by fintech expert Piyush Gupta, team includes professionals from SocGen, J.P. Morgan, HSBC, Polygon, PayU—bringing rich experience in asset management and on-chain finance

Funding: Raised $3.8 million in seed round in 2023 from Alpha Wave, Matrix Partners, Polygon Ventures, Singularity Ventures, GTM Ventures, and CoinSwitch Ventures

Key Resources:

-

Built an asset-agnostic RWA aggregation platform integrating multiple issuers and nine asset classes (e.g., credit, real estate, Treasuries, invoices)

-

Adopted ERC-6960 standard to support composition/splitting of RWA assets

-

Supports 70+ issuers and 7,000+ RWA assets, with a clear flow from asset discovery → investment → secondary market circulation

Notable Products:

-

Polytrade Marketplace: RWA aggregation platform offering asset discovery, trading, and portfolio capabilities

-

Polytrade Scan: On-chain asset explorer improving traceability and transparency

3.4 Notable Data, Research, and Outreach Channels

Data Websites:

RWA.XYZ: https://app.rwa.xyz/

DefiLlama RWA Module: https://defillama.com/protocols/rwa

Tokeny RWA Ecosystem Map: https://tokeny.com/real-world-asset-rwa-tokenization-ecosystem-map/

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News