Circle In-Depth Analysis: Opportunities and Challenges for the Stablecoin Giant

TechFlow Selected TechFlow Selected

Circle In-Depth Analysis: Opportunities and Challenges for the Stablecoin Giant

This article will provide an in-depth analysis of USDC's issuance mechanism, competitive advantages, and the investment value of Circle.

Author: dddd, Core Contributor of Biteye

Introduction

In the global digital currency market, stablecoins are playing an increasingly important role as a bridge between traditional finance and the cryptocurrency world. As the second-largest stablecoin by market share, USDC (USD Coin) and its issuer Circle have recently drawn significant market attention. Since Circle's IPO at $31 in early June, its stock price has surged to nearly $200 (peaking at $298.99). This remarkable performance not only reflects the growth trajectory of the stablecoin industry but also reveals the opportunities and challenges facing this emerging financial instrument. This article will provide an in-depth analysis of USDC’s issuance mechanism, revenue model, competitive advantages, and Circle’s financial condition and investment value.

USDC’s Issuance Mechanism and Revenue Model

Fund Safeguard System

USDC employs a strict fund safeguard mechanism. For every 1 USDC purchased, investors must deposit 1 USD as reserve capital. To ensure investor fund security, USDC implements a separation of ownership and control rights. Legally, Circle, as the issuer, holds ownership of the USDC reserves and manages these assets in a "trust" structure. However, USDC holders gain actual control over the reserves through token ownership, meaning Circle can only operate the reserves upon user instructions.

In terms of custody, USDC reserves are held by BNY Mellon Bank in New York and stored separately in dedicated accounts, ensuring fund safety and independence. Investment management is handled by BlackRock, a globally renowned asset management firm, primarily investing in its money market funds with U.S. Treasury securities as the main asset class, generating returns through interest rate spreads.

Risks and Limitations of the Revenue Model

While USDC’s revenue model is relatively stable, it faces clear risks and limitations. First, reserve income is entirely dependent on BlackRock’s money market fund performance—mainly invested in short-term Treasuries—leaving Circle with little active control over these returns. According to Circle’s 2024 financial report, interest income from USDC reserves was $1.661 billion, with a total issuance of $60 billion, resulting in an actual annualized yield of 2.77%. In contrast, the yield on six-month U.S. Treasury bills during the same period was 4.2%. This indicates that the money market fund managed by BlackRock underperformed direct Treasury investments, likely due to fund management fees, liquidity requirements (holding cash buffers), and portfolio diversification mandates.

Second, reserve income is highly sensitive to fluctuations in Treasury yields: profits rise when rates increase and fall when rates decline. This passivity makes Circle’s profitability heavily dependent on macroeconomic conditions and monetary policy shifts. The current Fed tightening cycle has created a favorable earnings environment for Circle, but once the central bank enters a rate-cutting phase, the company’s profitability will face substantial pressure.

More critically, Circle cannot fully capture all benefits generated by USDC. Due to historical partnership agreements, Circle must share USDC investment income with Coinbase. The specific arrangement is: all USDC earnings within the Coinbase platform belong exclusively to Coinbase, while off-platform USDC earnings are split equally between the two parties. Based on 2024 financial data, this structure means Circle receives only 38.5% of total USDC investment income, while Coinbase captures 61.5%.

Market Competition and Channel Expansion

To reduce reliance on Coinbase, Circle has actively expanded new distribution channels. The company partnered with Binance, paying $60.25 million plus monthly trading incentives, securing Binance’s support. This strategy proved highly effective—Binance has become the world’s largest USDC trading venue, accounting for 49% of total volume, significantly reducing Coinbase’s market share.

However, this competitive dynamic has introduced new challenges. Coinbase has designated USDC as the core settlement token on its Base chain, collaborated with Stripe to support USDC on Base, and offers up to 12% yield for users holding USDC in the Coinbase Advanced derivatives market, aiming to protect its market position and distribution revenue.

Competitive Analysis Between USDC and USDT

Market Share Comparison

In the stablecoin market, USDT still dominates. As of May 31, 2025, USDT’s market cap reached $153 billion, capturing 61.2% of the market, while USDC’s market cap stood at $61 billion, representing 24.4% share. USDT’s issuance growth rate continues to outpace USDC, demonstrating its strong market position.

USDC’s Competitive Advantages

Despite trailing USDT in market share, USDC holds distinct advantages across multiple dimensions.

Transparency and Audit Advantage: USDC adopts a “100% transparent pegging” model, with reserves consisting solely of cash (23%) and short-term U.S. Treasuries (77%). These assets are audited monthly by firms like Grant Thornton, with public reports issued regularly. By Q4 2024, reserve size reached $43 billion. This transparency has led institutions such as BlackRock and Goldman Sachs to adopt USDC for cross-border settlements, with institutional holdings reaching 38% in 2024.

In contrast, USDT faced regulatory scrutiny over reserve transparency and was embroiled in controversy from 2017–2019, eventually settling for $41 million. Although USDT improved its reserve composition after 2024, its “self-attestation” model remains less transparent.

Regulatory Compliance: USDC holds a New York BitLicense, EU MiCA authorization, and certification from Japan’s FSA, becoming the first globally recognized stablecoin approved for circulation in Japan. By participating in the U.S. GENIUS Act legislation, USDC aims to become a “benchmark” under regulatory frameworks and successfully attracted JPMorgan Chase and Citibank into its payment network in 2024.

USDT, however, operates via a “gray zone” strategy, headquartered in Hong Kong and incorporated in the British Virgin Islands, placing its operations in a regulatory gray area. The EU MiCA framework excluded USDT from its compliant list, causing its European market share to plummet from 12% at the beginning of 2024 to just 5%.

Investor Trust: During the 2023 Silicon Valley Bank crisis, USDC briefly dropped to $0.87, but Circle publicly verified its reserves the next day, restoring the price to $0.99 within 48 hours—showcasing the market resilience of its compliance model. BlackRock accepts only USDC as collateral in its on-chain fund products, reflecting high institutional trust.

Penetration into Traditional Finance: USDC collaborates with SWIFT to develop a “Digital Dollar Payment Gateway,” connecting 150 international banks in 2024, aiming to become the “blockchain version of SWIFT” for corporate cross-border settlements.

Impact of Regulatory Policies

The introduction of the *2025 U.S. Stablecoin Innovation Guidance and Establishment Act* (GENIUS Act) could reshape the stablecoin landscape. As the first federal regulatory framework for stablecoins in the U.S., the act may position USDC as the only compliant global stablecoin, attracting more institutions to include it in asset management products.

For USDT, if the law requires issuers to be federally chartered banks, its offshore registration could lead to a ban on U.S. operations, potentially causing it to lose 20% of its market share.

Circle Financial Analysis

Profitability Analysis

Circle’s financial profile exhibits some contradictions. In terms of profitability, the company’s gross margin is 24.00%, significantly below the industry median of 50.18% (the term “industry” here refers to banking and fintech companies such as PayPal, Visa, and Stripe). This is mainly because revenue comes from money market funds managed by BlackRock, whose returns are constrained by U.S. Treasury yields, limiting pricing power, and because Circle must pay channel fees.

However, Circle’s EBITDA margin stands at 11.43%, slightly above the industry median of 10.43%, indicating strong operational efficiency. More notably, the net profit margin reaches 9.09%, far exceeding the industry median of 3.57%, reflecting exceptional effectiveness in managing operating costs.

Low Asset Utilization

Circle performs poorly in asset utilization. Its asset turnover ratio is only 0.05x, far below the industry median of 0.59x, meaning each dollar of assets generates just five cents in revenue. Total asset return (ROA) is 0.28%, also significantly below the industry median of 2.05%.

The root cause lies in Circle’s large allocation to low-yield Treasury investments, which, while stable, result in low asset efficiency. Nevertheless, as long as Circle can continue accumulating deposits, the absolute profit generated remains substantial.

Cash Flow Position

Circle excels in cash flow management, with operating cash flow reaching $324 million, far surpassing the industry median of $113.92 million. This strength stems largely from regulatory requirements for stablecoin operations, which mandate high cash reserve levels.

Growth Prospects and Concerns

Circle demonstrates strong revenue growth, increasing by 15.57%, more than 2.6 times the industry median of 5.95%. However, profit growth has deteriorated significantly: EBITDA growth is -31.75%, EBIT growth is -32.57%, and EPS growth is -61.90%, creating a “growing revenues but shrinking profits” trend.

This situation primarily results from sharply rising costs during expansion. Distribution and transaction costs increased 71.3% quarter-on-quarter, marketing expenses reached $3.9 million, and employee compensation rose 23.7% year-on-year.

Valuation and Investment Perspective

Current Valuation Levels

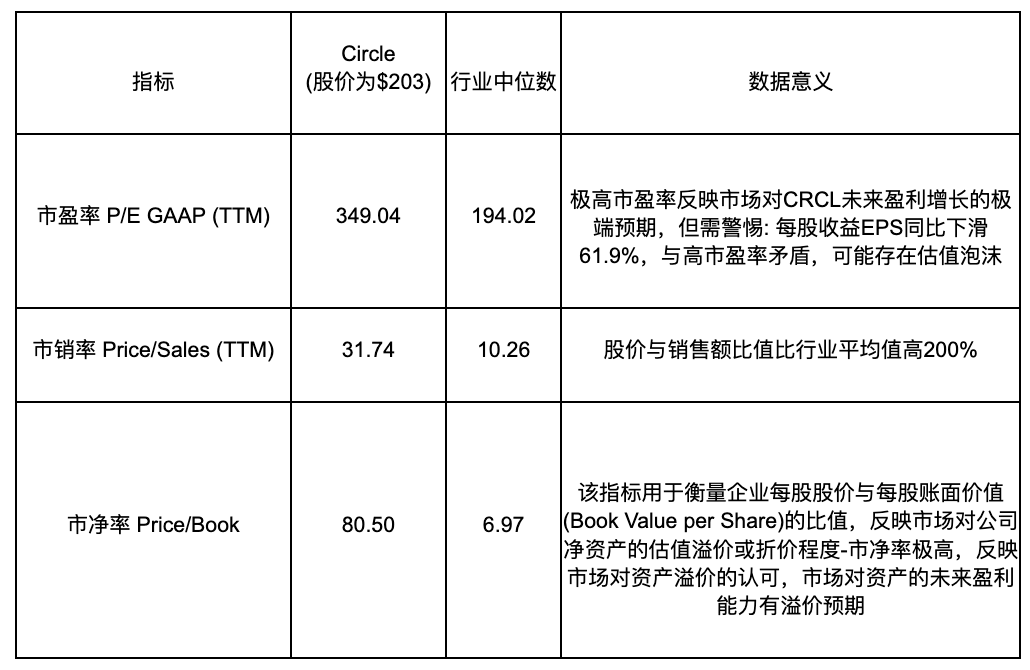

Circle’s P/E, P/S, P/CF, and P/B ratios all exceed industry medians, reflecting extremely high investor expectations for future performance. To justify these valuations, Circle must deliver strong growth in profitability, sales, and discretionary cash flow. Notably, future growth drivers may come from product diversification, particularly the rapid expansion of EURC, its euro-denominated stablecoin in Europe, and breakthroughs in its RWA tokenization product USYC in real-world asset digitization.

Ownership Structure Analysis

Circle’s ownership structure is unhealthy. Institutional ownership accounts for only 10%, compared to 30% for Coinbase. Senior management holds just 7.4%, a relatively low stake. Retail and other investors collectively hold 37%, exceeding both institutional and executive holdings. JPMorgan, Citi, and Goldman Sachs provided an IPO valuation range of $27–$28, signaling limited institutional confidence in Circle.

Investment Thesis

Bull Case:

-

Stablecoins solve inherent inefficiencies in traditional fiat systems, and the market is expanding

-

USDC holds a significant first-mover advantage in regulatory compliance within the stablecoin space

-

Gradually reducing reliance on Coinbase for distribution, enabling Circle to capture a larger share of investment income in the future

-

The GENIUS Act could force major competitor USDT to exit the U.S. market

Bear Case:

-

Valuation is disconnected from fundamentals, with declining profitability contradicting high multiples

-

Low return on assets undermines long-term value creation

-

Over 60% of USDC investment income goes to Coinbase, depriving Circle of full economic benefits (based on 2024 financial data)

-

Low institutional ownership and unbalanced equity structure indicate poor governance health

Conclusion and Outlook

Circle exhibits characteristics of “high market expectations, rapid growth, and elevated valuation.” On one hand, its stock price has risen over 540% since IPO, reflecting market recognition of its strengths in regulatory compliance and market expansion. As the most transparent stablecoin, USDC enjoys strong credibility among institutional investors, providing a solid competitive foundation. On the other hand, the company faces challenges including constrained profitability, low asset utilization, and the burden of justifying its high valuation.

In the short term, the sharp rise in Circle’s stock price has already priced in optimistic expectations, prompting investors to closely assess the alignment between valuation and fundamentals. In the long run, Circle’s ability to break through via product diversification will be critical. Growth drivers such as EURC’s expansion in Europe, innovative applications of the RWA tokenization product USYC, and reduced dependence on revenue sharing with Coinbase could provide new momentum.

With advancing regulations like the GENIUS Act and continued maturation of the stablecoin market, USDC’s regulatory first-mover advantage may translate into greater market share and enhanced profitability. When evaluating Circle, investors must balance its innovation potential against current valuation levels, monitoring whether the company can validate market expectations through diversified strategies and improved operational efficiency.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News