Tiger Research: Why Are CEXs Rushing into DeFi?

TechFlow Selected TechFlow Selected

Tiger Research: Why Are CEXs Rushing into DeFi?

CEX promoting the expansion of on-chain services is not merely a defensive strategy; it represents an active bet on the future of the crypto ecosystem.

Translation: TechFlow

This report by Tiger Research analyzes why major centralized exchanges (CEXs) such as Bybit, Binance, and Coinbase are entering the DeFi space—and their strategic approaches.

Summary

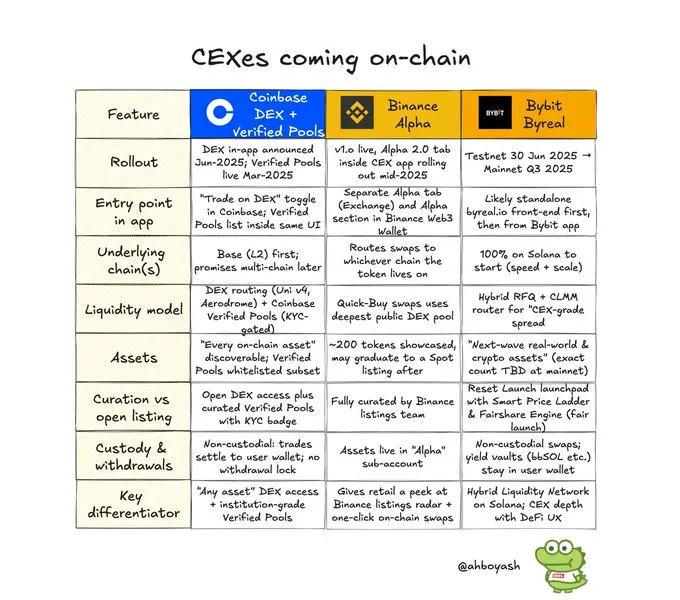

Strategic Differentiation: Binance offers retail-focused on-chain services aimed at lowering the Web3 entry barrier. Bybit has launched an independent platform, ByReal, to deliver CEX-grade liquidity on-chain. Coinbase adopts a dual-track model targeting both retail and institutional users.

Why CEXs Are Going On-Chain: As more early-stage tokens debut first on decentralized exchanges (DEXs), centralized exchanges face listing delays due to regulatory reviews—losing trading volume and revenue. On-chain services allow them to participate in early token liquidity and retain users without formal listings.

The Future of CeDeFi: Platform boundaries are blurring. Exchange tokens are evolving from fee-discount tools into core assets connecting centralized and decentralized ecosystems. Some DeFi protocols may be absorbed into larger CEX-dominated networks, accelerating the formation of an integrated hybrid market.

1. A Missed Opportunity No More: CEXs Move On-Chain

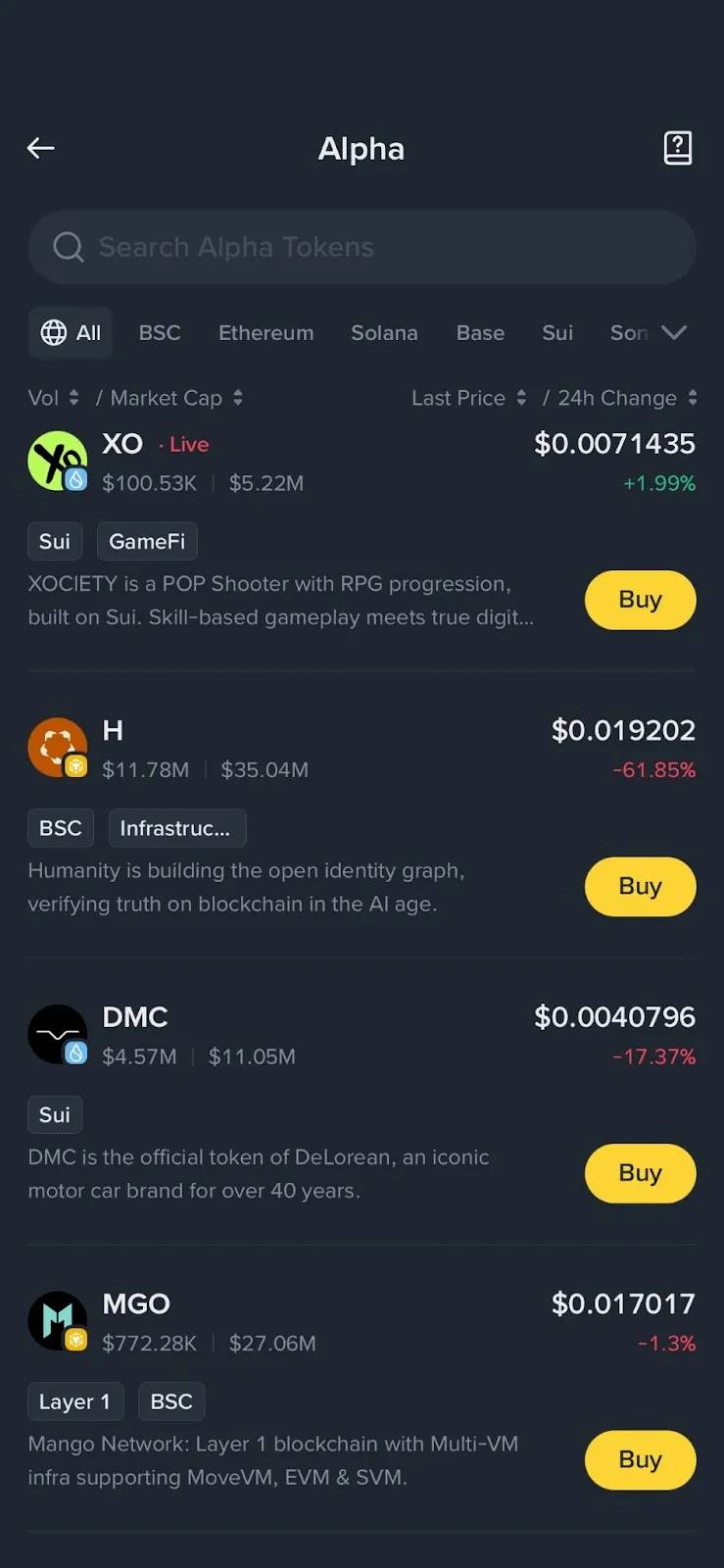

Binance’s recent initiative, Binance Alpha, has become a focal point in the market. Operated by the Binance team, Alpha functions as a DeFi-based listing platform that enables retail users to access early-stage tokens faster than through traditional exchange channels. This significantly enhances token accessibility and engagement, particularly via mechanisms like Alpha Points, which facilitate targeted airdrops to users.

However, the model is not without controversy. Several tokens listed through Alpha experienced sharp price drops shortly after launch, sparking debate over the program’s structure and intent. Despite mixed reactions, one trend is clear: centralized exchanges are no longer passive observers in the DeFi ecosystem—they are now active participants.

This shift isn’t limited to Binance. Other major platforms are also moving on-chain. For instance, Bybit recently announced ByReal, a Solana-based DeFi platform. Coinbase has revealed plans to integrate on-chain services directly into its app. These developments signal a broader structural transformation across the exchange industry.

The key question is: Why would centralized exchanges, long reliant on stable, revenue-generating business models, venture into the inherently volatile world of DeFi? This report examines the strategic rationale behind this shift and explores the market dynamics driving it.

2. The State of CEX Entry Into DeFi: What Are They Actually Building?

Before analyzing the strategic motivations for CEXs entering DeFi, it's essential to understand what they're actually building. While these efforts are often grouped under the broad trend of "CeDeFi" (Centralized-Decentralized Finance), their implementation varies significantly across platforms.

Bybit, Coinbase, and Binance each take distinct approaches—with notable differences in architecture, asset custody models, and user experience. Understanding these distinctions is crucial to assessing their respective strategies.

2.1 Bybit’s ByReal: Delivering CEX-Level Liquidity Through an Independent DEX

ByReal announcement. Source: @byreal_io

On June 14, Bybit announced ByReal as an on-chain extension of its exchange infrastructure. The primary goal is clear: replicate centralized exchange-level liquidity within an on-chain environment. To achieve this, Bybit employs a hybrid design combining a Request-for-Quote (RFQ) system with a Concentrated Liquidity Market Maker (CLMM) model.

The RFQ mechanism allows users to request quotes from multiple brokers before executing trades, enabling price optimization through professional market makers. The CLMM model concentrates liquidity around actively traded price ranges, improving capital efficiency and reducing slippage—both critical factors in approximating a CEX-like trading experience on-chain.

At the user level, ByReal remains decentralized. Assets are self-custodied via Web3 wallets like Phantom, and the platform includes a token launchpad for new projects. It also offers yield-generation features through its Revive Vault, including Solana staking products such as $bbSOL.

Bybit’s strategic intent with ByReal is to create a parallel liquidity layer for early-stage tokens that may not meet its main exchange’s listing standards but can thrive in a more open, community-driven environment. While structurally similar to Binance Alpha, ByReal distinguishes itself by integrating launchpad functionality and yield products into a more comprehensive service offering.

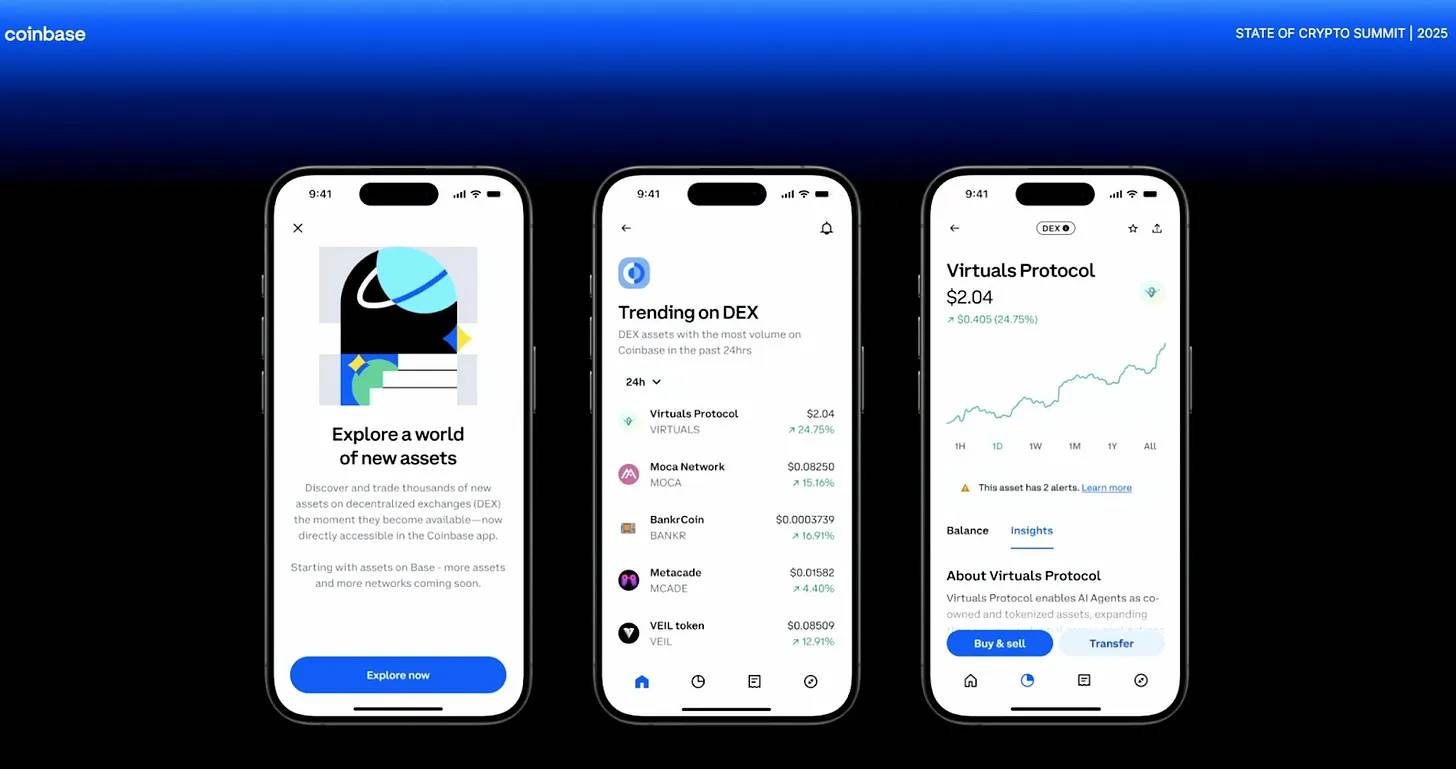

2.2 Coinbase: A Dual-Track Strategy Targeting Retail and Institutional Users

Source: Coinbase

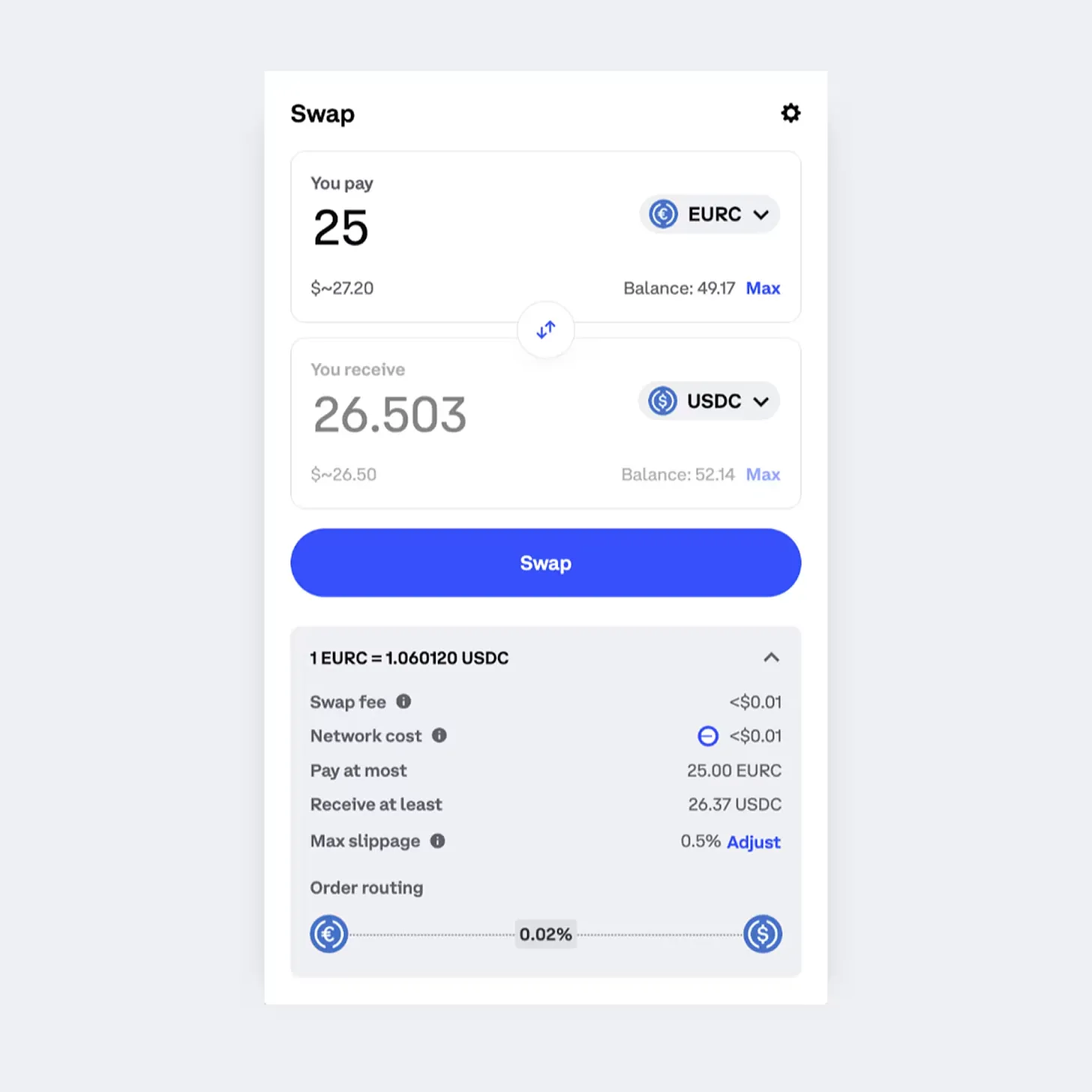

At its 2025 crypto conference, Coinbase announced plans to integrate DeFi trading directly into its main app rather than relying solely on a standalone wallet. The core of this strategy is seamless user experience. By enabling DEX trading within the primary app, users can access and trade thousands of tokens immediately upon minting—all without leaving the Coinbase interface.

Source: Coinbase

Although DeFi access is already possible through the standalone Coinbase Wallet, the company introduced a key differentiator: Verified Pools. These pools are exclusively accessible to institutional participants who have passed KYC (Know Your Customer) verification, providing regulated entities with a secure and compliant environment.

In effect, Coinbase has developed a sophisticated dual-track strategy: serving retail users with smooth, integrated on-chain access while offering institutions a regulated, high-assurance liquidity venue. This allows the company to serve both user segments while balancing usability with compliance.

2.3 Binance Alpha: A Retail-Focused Strategy to Lower the Web3 Barrier

Among the three major exchanges, Binance Alpha is the most retail-oriented product. Unlike others prioritizing decentralization, Binance emphasizes ease of use. Alpha is accessible via a tab within the Binance main app, allowing users to trade without ever leaving their familiar interface.

Even though all transactions are processed on-chain, users interact with Alpha through their existing Binance accounts—eliminating the need to set up separate wallets or manage seed phrases, drastically lowering the entry barrier for Web3 newcomers.

While all three platforms are converging toward CeDeFi models, their paths differ significantly. Bybit targets DeFi-native users with a fully decentralized architecture and advanced liquidity mechanisms; Coinbase pursues a dual-track approach, serving both retail and institutional clients through differentiated infrastructure; and Binance focuses on mass adoption by simplifying Web3 complexity.

Each exchange is navigating unique trade-offs in asset custody, product curation, and integration depth, collectively shaping diverse entry points into the evolving CeDeFi ecosystem.

3. Strategic Drivers Behind CEXs Entering DeFi

3.1 Capturing Early Token Opportunities and Mitigating Listing Risks

The first reason is straightforward: CEXs want early access to popular tokens but cannot list them fast enough.

Most new tokens now launch directly on decentralized exchanges (DEXs), where permissionless listing mechanisms and widespread attention drive rapid volume growth. However, due to legal scrutiny, risk management, or regional compliance constraints, even when CEXs clearly see user demand, they often cannot list these tokens immediately.

This delay incurs real opportunity costs. Trading volume flows to decentralized platforms like Uniswap, and CEXs lose listing fee revenue. More importantly, users begin associating token discovery and innovation with DEXs—not CEXs.

By launching their own on-chain products, CEXs create a compromise solution. Platforms like ByReal and Binance Alpha act as semi-sandboxed venues: tokens can be traded without going through formal listing channels, yet still within a controlled and brand-safe environment. This allows exchanges to monetize user activity early—through swap fees or token issuance mechanisms—while maintaining legal distance. They provide access, but do not directly custody or endorse the assets.

This structure gives CEXs a pathway to participate in token discovery while avoiding regulatory liability. They capture liquidity, generate revenue, and steer activity back into their ecosystems—all while waiting for formal listing reviews to catch up.

3.2 Keeping Users On-Chain to Prevent Churn

The second driver stems from user behavior. While DeFi leads in token innovation and capital efficiency, mainstream users still struggle with access. Most users are reluctant to manually bridge assets across chains, manage wallets, approve smart contracts, or pay unpredictable gas fees. Yet, the most attractive opportunities—such as new token launches and yield strategies—are increasingly happening on-chain.

CEXs recognize this gap and respond by embedding DeFi access directly into their platforms. All the CEX integrations mentioned above allow users to interact with on-chain liquidity through familiar CEX interfaces. In many cases, exchanges abstract away wallet management and gas costs entirely, enabling users to access DeFi as easily as using a Web2 app.

This approach achieves two goals. First, it prevents user churn. Traders who might otherwise migrate to DEXs can now engage with DeFi products while remaining within the CEX ecosystem. Second, it strengthens platform defensibility. By controlling the access layer—and gradually the liquidity layer—CEXs build network effects beyond spot trading.

Over time, this translates into user lock-in. As users mature, many seek cross-chain routing, yield products, and trading strategies. If a CEX operates its own DEX infrastructure, launchpad layer, or even a dedicated chain (like Coinbase’s Base), it ensures users, developers, and liquidity remain anchored within its ecosystem. User activity is tracked, monetized, and recycled—without leaking to third-party protocols.

In essence, going on-chain allows CEXs to control the full lifecycle of user funds—from fiat onramps, to DeFi exploration, to eventual token listings and exits—everything within a unified, revenue-generating system.

4. The Road Ahead for CeDeFi

The expansion of major centralized exchanges onto the blockchain marks a pivotal moment in the evolution of the crypto industry. CEXs no longer view DeFi as an external phenomenon but are now building their own infrastructure—or at least ensuring direct access to the user layer.

4.1 Blurring Boundaries: The Rise of a New Trading Paradigm

As CEXs integrate on-chain services, the line between “exchange” and “protocol” is becoming increasingly blurred from the user’s perspective. A user trading on-chain tokens via Bybit may not even realize whether they’re interacting with a decentralized protocol or a centralized interface. This convergence could significantly reshape the industry’s liquidity architecture, product design, and user flows.

Institutional behavior will also be a key indicator, although widespread capital inflows are unlikely in the short term. Institutions remain cautious due to unresolved risks: regulatory uncertainty, smart contract vulnerabilities, token price manipulation, and opaque governance mechanisms.

CEX-launched on-chain services do not eliminate these structural risks. In fact, some institutions may perceive exchange-mediated DeFi access as an additional layer of intermediary risk. Realistically, early adopters will likely be hedge funds and proprietary trading firms deploying small amounts of capital for experimentation. More conservative players—such as pension funds or insurers—are expected to remain on the sidelines for years. Even if they participate, allocations will likely be extremely cautious—typically no more than 1–3% of their portfolios.

Against this backdrop, predictions of “billions in capital inflows” appear overly optimistic. A more realistic outlook involves gradual testing in the hundreds of millions. Still, even modest capital inflows could enhance market depth and help mitigate volatility to some extent.

4.2 The Evolving Role of Exchange Tokens

As exchanges expand their on-chain offerings, the utility of native exchange tokens will evolve accordingly. Holding certain quantities of these tokens may grant users discounts on on-chain transaction fees or unlock yield opportunities through staking and liquidity incentives. These changes could introduce new utility—and new volatility—to exchange tokens.

Currently, Binance is the only major platform offering clear and sustained utility for its native token (BNB), which plays active roles across multiple services. Most other exchange tokens remain limited to basic fee discounts.

As CeDeFi infrastructure matures, this will change. When operating integrated on- and off-chain platforms, exchanges will use their native tokens as bridges between the two worlds. Users may need to hold exchange tokens to participate in staking, Launchpools, or gain priority access to early-stage projects—whether listed centrally or decentralized.

This functional expansion elevates exchange tokens beyond mere utility assets—they become core components of vertically integrated ecosystems. Exchanges with existing tokens may significantly enhance their utility, while those without may consider launching new tokens to support DeFi-related services, especially if they operate proprietary blockchains or differentiated DeFi layers.

In short, exchange tokens are evolving from simple fee tools into strategic assets that play critical roles in user retention, protocol integration, and cross-platform capital flow.

4.3 Convergence Underway: A New Competitive Landscape

CEX-driven expansion into on-chain services is not merely a defensive move—it represents an active bet on the future of the crypto ecosystem. Exchanges no longer see DeFi as a threat, but as an adjacent domain to integrate or even absorb.

The most likely scenario is convergence. Major exchanges will increasingly operate semi-decentralized networks, while independent DeFi protocols may find themselves dependent on—or even integrated into—these growing ecosystems. This could lead to a redistribution of power and liquidity, with CEX-dominated platforms becoming gravitational centers for DeFi activity.

This trend may foster a more unified market structure, enabling seamless liquidity flow between centralized and decentralized environments. Users will be able to choose combinations of trust, transparency, and convenience based on their preferences. The competitive landscape is shifting—and Bybit’s launch of ByReal may be an early signal of this hybrid future taking shape.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News