New Chair, Big Dovish Turn? Markets Are Very Aggressive in Their Expectations for the Fed Next Year

TechFlow Selected TechFlow Selected

New Chair, Big Dovish Turn? Markets Are Very Aggressive in Their Expectations for the Fed Next Year

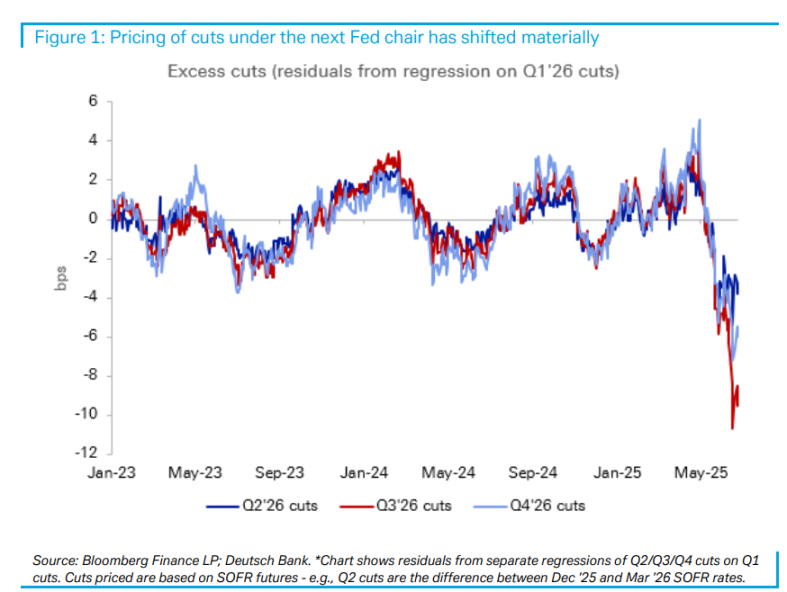

Deutsche Bank said that through statistical model analysis, it has identified a "new chair premium" phenomenon, with the market pricing in unusually accommodative policy during the incoming Fed chair's tenure, especially in the third quarter of 2026—coinciding with the new chair's term.

Author: Dong Jing, Wall Street Insights

A recent research report from Deutsche Bank shows that market expectations for the Federal Reserve's policy next year have shifted significantly, with anticipation growing that a new chair could drive continued monetary easing.

On June 26, according to Fengtou Trading Desk, Deutsche Bank stated in its latest report that financial markets have materially changed their outlook on Fed policy for next year—particularly exhibiting unusually aggressive expectations for rate cuts following the appointment of a new Fed chair.

The current Fed chair’s term expires in May next year. However, as noted in a Wall Street Insights article, Trump is considering announcing his nominee for the next Fed chair as early as this summer—well ahead of the traditional 3-4 month transition window. Sources indicate that Trump aims to use an early announcement to allow a "shadow chair" to begin influencing market expectations and shaping monetary policy direction even before Chair Powell’s term officially ends.

The report also notes that since dovish comments last week by Fed governors such as Christopher Waller, markets have priced in an additional ~10 basis points of rate cuts by year-end.

Statistical Model Reveals Anomalous Pricing for Next Year: The Emergence of a "New Chair Premium"

Deutsche Bank highlights that the most striking shift has occurred in expectations for rate cuts during the middle of next year.

The report suggests markets are increasingly pricing in the likelihood that once a new Fed chair takes office, monetary policy will remain accommodative. With Chair Powell’s term ending in May next year, this timing has become a focal point for market attention.

Using a regression model, Deutsche Bank identified a notable pattern: by regressing rate cut pricing for the second, third, and fourth quarters of next year against the first quarter, and analyzing residuals, they measured how “anomalous” forward rate cut expectations are relative to Q1.

The bank found that over the past month, these residuals have turned significantly negative—especially for the third quarter of 2026, which coincides with the likely start of a new chair’s tenure. This indicates that markets are pricing in an abnormally dovish policy stance under a new chair, a pattern that deviates from historical norms in recent years.

Note: Residuals refer to the difference between observed values and estimated (fitted) values. They contain important information about the validity of a model’s underlying assumptions. If the regression model is correctly specified, residuals can be viewed as observable proxies for errors.

Nonetheless, the report urges caution regarding this so-called "new chair premium." Monetary policy decisions require majority support from FOMC voting members, meaning any new Fed chair would need to persuade colleagues to follow a different policy path. This institutional constraint implies that policy discontinuities around a leadership change should be mild at most.

Notably, despite the divergence, market expectations for rate cuts in Q2, Q3, and Q4 of 2026 still remain lower than those for Q1—suggesting investors aren't anticipating a sharp policy pivot, but rather a longer-lasting period of accommodative policy under the new chair.

Recent Shifts in Market Pricing: Dovish Rhetoric Fuels Rate Cut Bets

As previously reported by Wall Street Insights, on Monday (June 23), Fed Governor Bowman said that if inflation pressures remain contained, he could support a rate cut as early as July.

Bowman cited rising risks in the labor market, while noting inflation appears to be stabilizing toward the Fed’s 2% target. On Friday last week, Fed Governor Christopher Waller said in a CNBC interview that he might support a rate cut at the next meeting due to concerns about excessive softness in the labor market.

Deutsche Bank pointed out in the report that since last Thursday, markets have added approximately 10 basis points of additional rate cuts by year-end—primarily driven by the dovish remarks from Governors Waller and Bowman. This shift reflects investors’ immediate reaction to signs of a softer Fed stance.

According to the latest data from FedWatch, the market now assigns a 20.7% probability to a rate cut in July—up from 12.5% a week earlier. Traders have already fully priced in an interest rate reduction by the September meeting.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News