New protocols are flooding the market—7 tools to help you find the next breakout star

TechFlow Selected TechFlow Selected

New protocols are flooding the market—7 tools to help you find the next breakout star

Access 7 key tools and evaluation dimensions to help you identify the next Aave-level potential project from on-chain data and mindshare.

Author: Ignas | DeFi Research

Translation: Saoirse, Foresight News

Is your enthusiasm for chasing hot new projects still high?

I’ve shared on X that my motivation to pursue new projects has dropped to its lowest level since I entered the crypto space in 2018. Even during bear markets, my mindset was better than it is now.

Am I the only one feeling this way? Maybe I’m just lazy… or perhaps burned out? But it doesn’t feel entirely like that either.

I’ve become more cautious than before—I no longer allocate large portions of my portfolio to new protocols.

During previous bull runs, capital flowed more freely and profits were easier to make. But we haven’t seen an altseason yet, so liquidity remains relatively tight.

The risk-reward dynamic has also shifted: while hacks and protocol vulnerabilities have decreased compared to the past, the vast majority of airdrop returns have significantly shrunk.

Capital is being diluted across a growing number of protocols, resulting in a lack of breakout, category-defining projects.

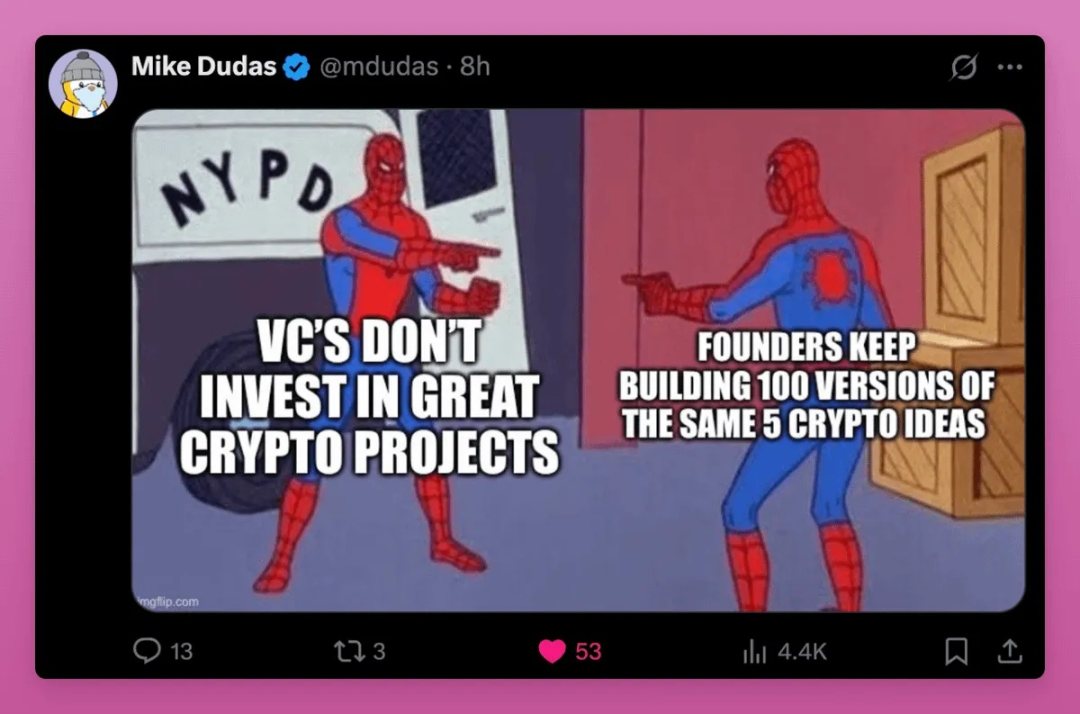

A more tangible observation is that many current new projects only offer incremental improvements, lacking true 0-to-1 breakthrough innovations. This view is echoed by Mike Dudas.

This phenomenon isn't limited to DeFi protocols—it's widespread across L1 blockchains and L2 scaling solutions as well.

Why should we care about Kraken’s Ink protocol or Soneium L2? Without genuine innovation that creates incremental value, all that remains are token incentives and liquidity mining number games.

In today’s information-overloaded environment, filtering for projects worth your time is increasingly difficult. If this sentiment is common across the market, it presents greater challenges for new projects—but also creates more opportunities for sharp-eyed crypto natives (degens).

Still, we must continue identifying potential candidates that could become the next Aave, Ethena, or Pendle.

The key questions are: How do you determine which protocols deserve your attention? And where should you look for them? In this article, I’ll share a set of tools, methods, and information sources to help you spot protocols already gaining early momentum. Evaluation dimensions include:

-

Mindshare (refers to the level of awareness and influence a protocol or project holds among industry participants such as investors, users, and developers)

-

Onchain adoption

-

Usage by smart accounts

Besides, I’ll list several projects I’m watching as reference cases, presented in the format of quoted statements.

Risk Warning: This article is for informational and educational purposes only and does not constitute any investment advice. Please conduct your own due diligence and make decisions cautiously based on your personal financial situation.

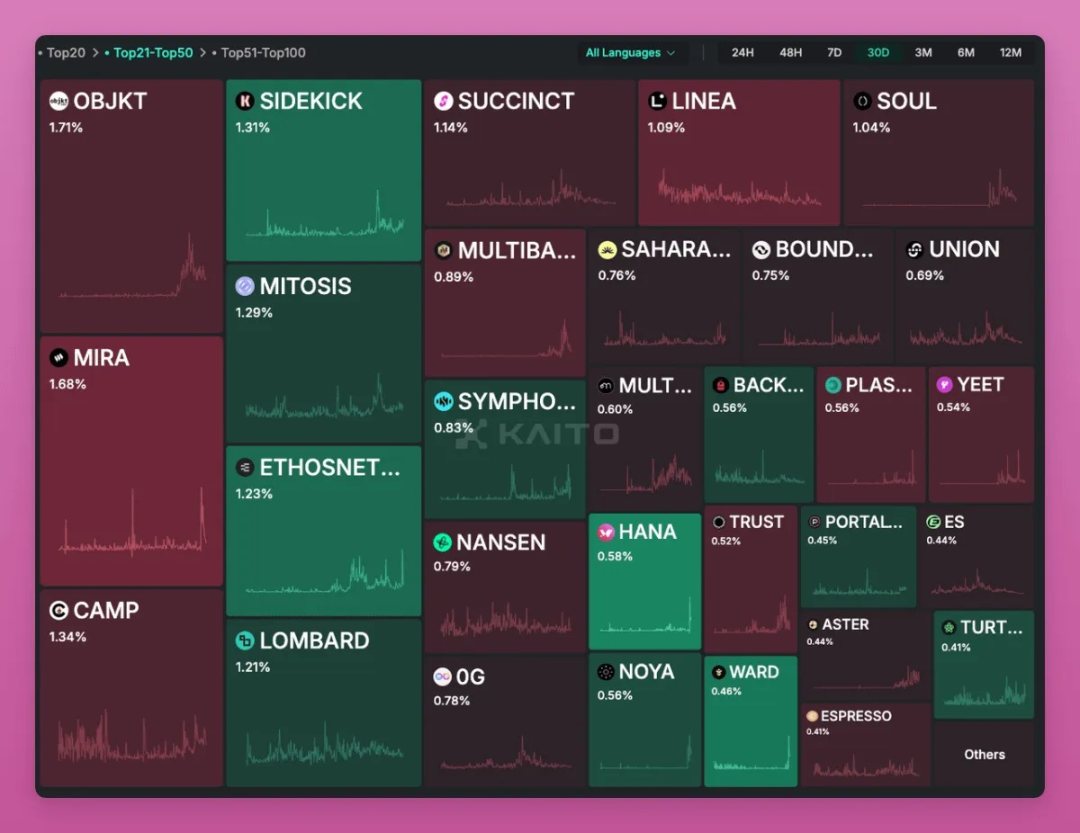

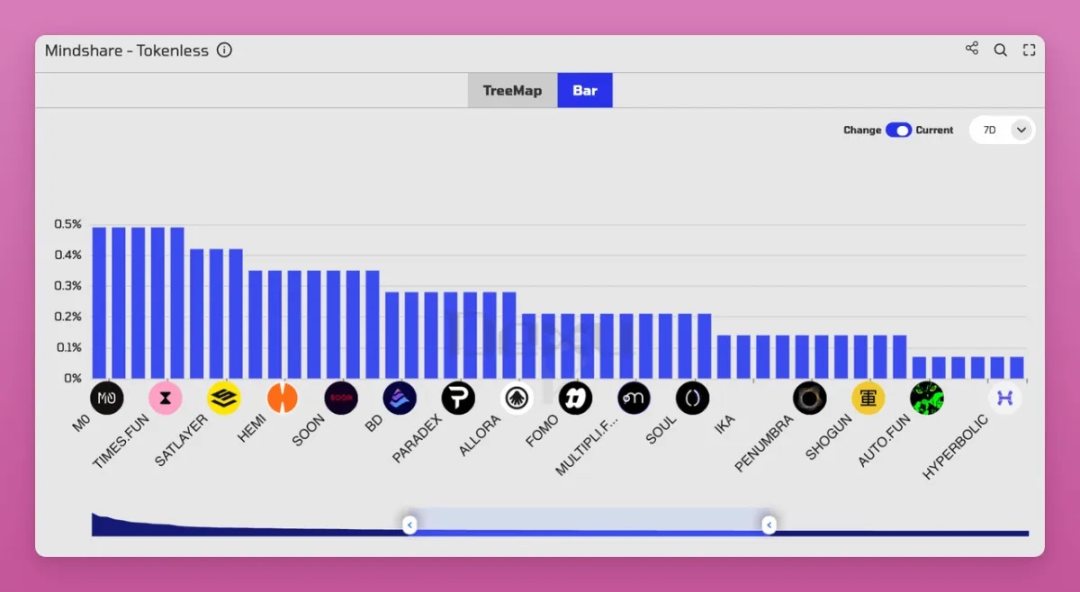

1. Kaito

Kaito’s flagship portal subscription costs $1,099/month (reduced to $750/month with a two-year plan).

Notably, Kaito offers a free data dashboard listing top non-tokenized projects by “mindshare.” While screenshots of the Top 20 frequently go viral, how many projects from positions 21–50 can you recognize?

You can explore potential projects of interest at yaps.kaito.ai.

Take Multipli as an example—a yield solution provider for native assets (e.g., BTC), stablecoins, and real-world assets (RWAs). Backed by top-tier VCs including Pantera, Sequoia Capital, and Spartan Group, it is expected to launch its token with a “low circulating supply + high FDV” model. Its current $70.3 million TVL sits in an ideal range—avoiding the risks associated with low-TVl projects while not facing severe dilution pressure despite being in its second incentive phase.

While Kaito is powerful, some in the industry question whether it distorts market perception, especially given frequent endorsements from KOLs. If you're skeptical, try the next tool, which uses a different algorithm to broaden your alpha discovery framework.

2. Dexu AI

"Gain multidimensional insights into mindshare, market sentiment, narrative strength, original tweet metrics, and CT (crypto Twitter) smart account indicators."

Here’s how to use Dexu to screen non-tokenized projects:

Method One:

-

Log into Dexu AI → Go to "Sector Analysis" → Select "Social"

-

Switch between analysis dimensions: Mindshare Index, sentiment heat, distribution of high-value followers on X, etc.

-

Customize time frames and adjust data granularity via slider

Method Two:

-

Click "Projects" → Navigate to "Top Project" page

-

Scroll down to "Projects Leaderboard - top 5000"

-

Lower the "Seniority" (project age) filter to uncover emerging projects; increase the "Network" (engagement level) threshold to filter out low-activity ones

For a video tutorial, check Dexu’s in-depth guide posted on X.

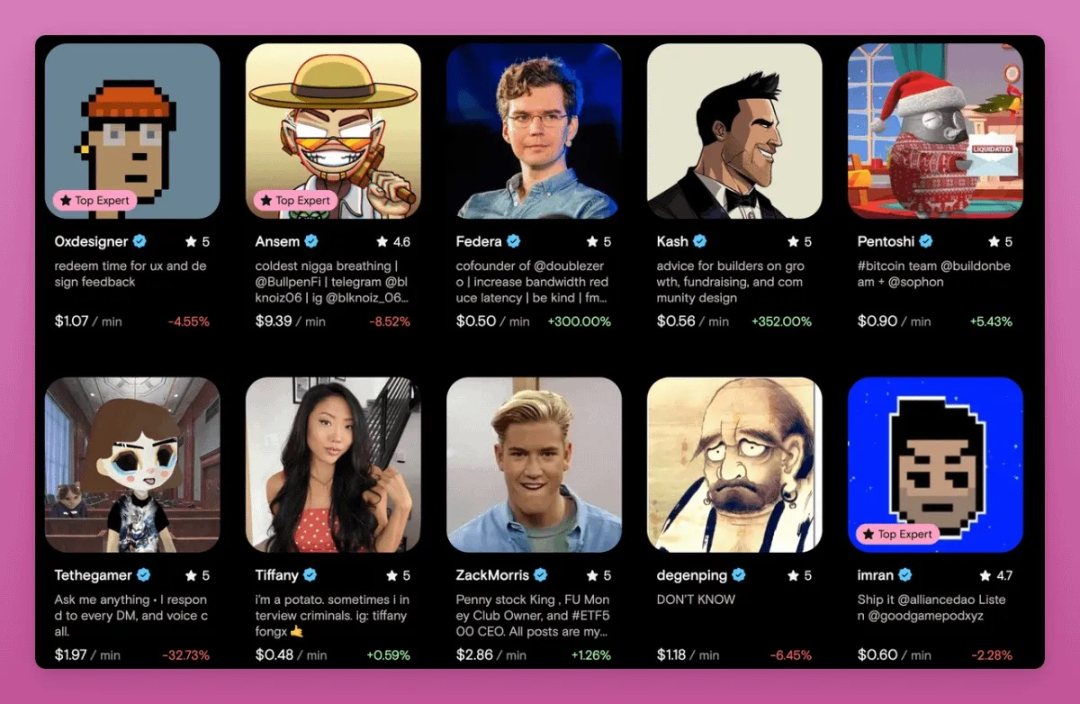

Project Example: Time.Fun—Two core use cases: 1. Paid direct access to crypto leaders: Pay to send DMs to founders and KOLs in crypto, significantly increasing response rates for high-value outreach. 2. Speculative demand forecasting: Bet on which figures will see surging DM demand.

Notably, Solana team members and core contributors are actively using and promoting the platform. Combined with strategic investments from Coinbase Ventures and Alliance DAO, its potential airdrop value is promising.

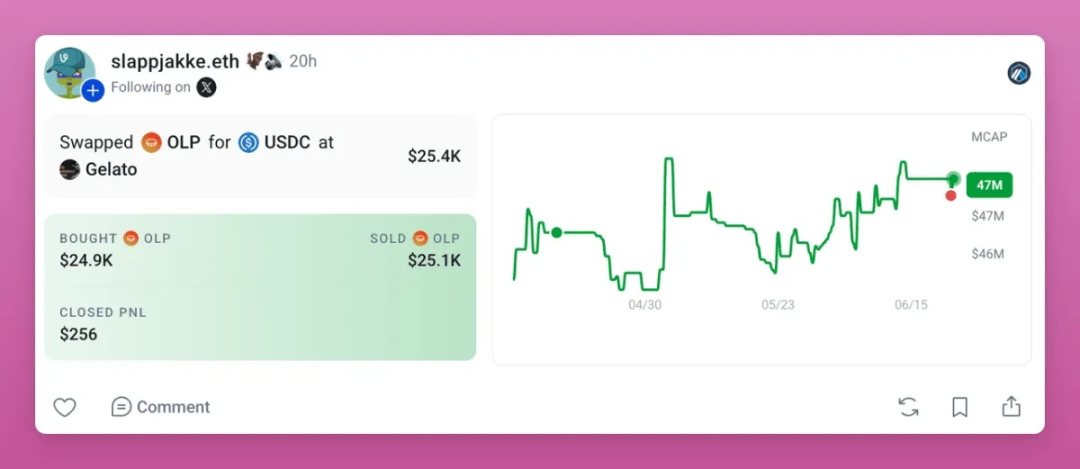

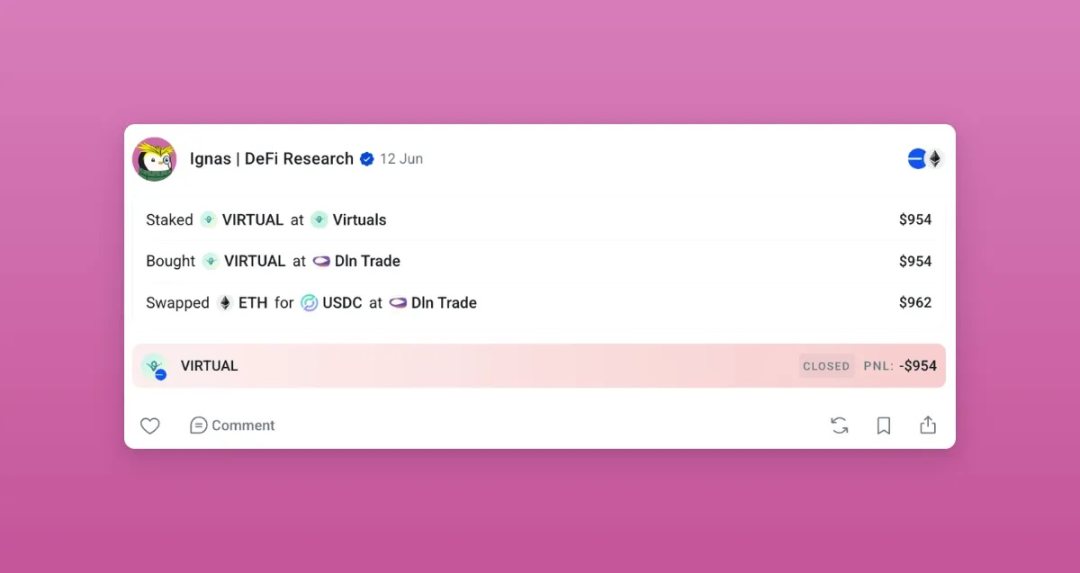

3. 0xPPL

0xPPL is one of my top-secret crypto tools, yet very few people truly know or use it.

It’s a social platform that defies convention. While it supports posting similar to X, its standout feature is displaying wallet activity from the accounts you follow on X.

While Kaito and Dexu focus on follower counts and social mindshare, 0xPPL cuts through the noise by revealing users’ actual onchain behavior.

Impressively, 0xPPL’s wallet linking system now accurately matches KOL accounts with their onchain addresses. You can see not only token trades but also critical actions like funding inflows into protocols.

Simply log in with your X account and connect a wallet with transaction history to sync the onchain footprints of those you follow. Each feed is unique, shaped by your personal following list.

If you follow many airdrop farmers, you’ll gain direct insight into the real protocols they’re deploying in—not just hype-driven discussions online.

Hats off to the team’s daily updates: from UI refinements to subtle optimizations, each iteration meaningfully improves user experience.

Though the team hasn’t announced a token plan yet, given the product’s maturity, it’s only a matter of time.

4. Nansen

Nansen’s versatility sets the industry benchmark. I previously shared a guide on discovering 100x gems using Nansen and other tools.

Beyond that, two features deserve special attention:

First, Nansen’s points incentive system. Points can be earned through:

-

Subscribing to Pioneer or Professional paid plans

-

Participating in staking/mining on the platform

-

Inviting friends to register

In the current InfoFi narrative boom, Nansen—as a leading player in this space—is worth watching.

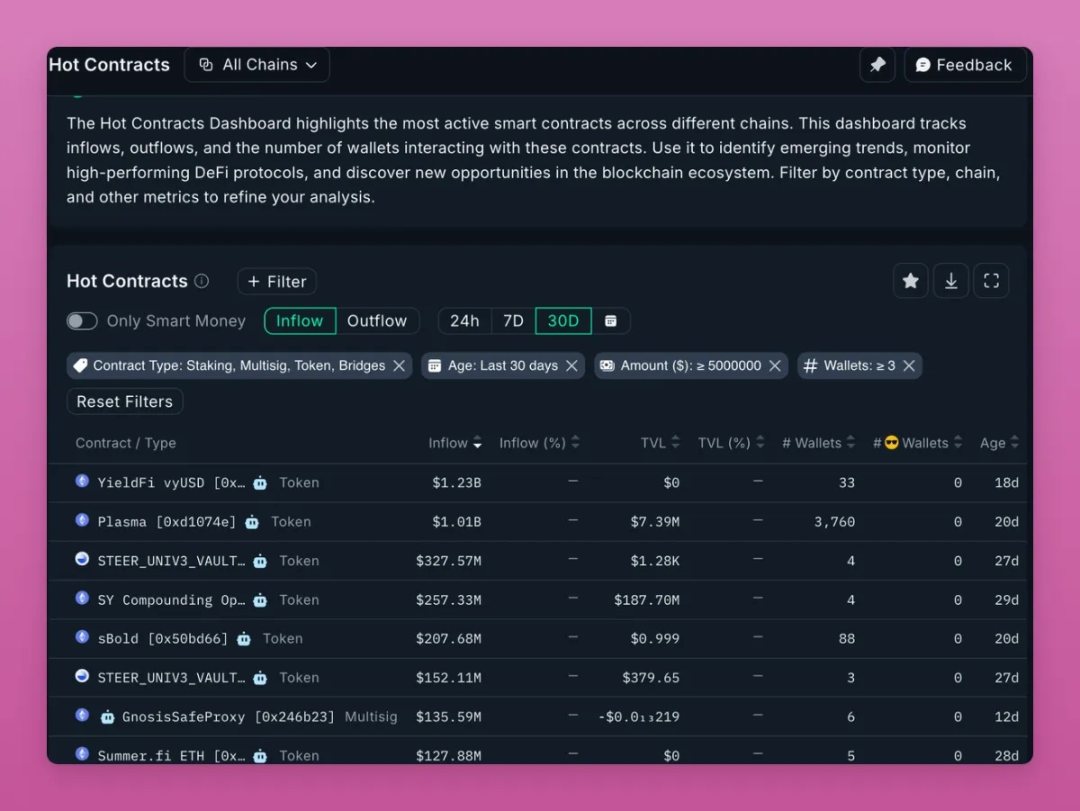

Second, tracking fund flows in popular contracts. Recommended approach: Use filters strategically

-

I typically exclude DEXs and liquidity pools (this is especially useful if you’re an active LP)

-

Set minimum TVL at $5 million

-

Limit contract creation date to within the last 30 days

Example filtered results:

- YielFi’s vyUSD stablecoin offers 16% APY (current TVL: $32M, assess with caution) - Plasma protocol surges in popularity but has paused deposits - Liquity’s newly launched BOLD stablecoin continues expanding (LQTY token rose逆势 during broader market downturn)

Also noteworthy: Steer Protocol—an automated multi-position liquidity management tool for DeFi, supporting 27+ blockchains and 32 DEXs (e.g., Quickswap, Camelot, Sushiswap). Key advantages: ✅ No manual management of concentrated liquidity ✅ Enhanced LP returns ✅ Built-in diverse market-making strategies. Funding: Raised $1.5M in seed round from Druid Ventures, Republic Capital, Big Brain Holdings, and others.

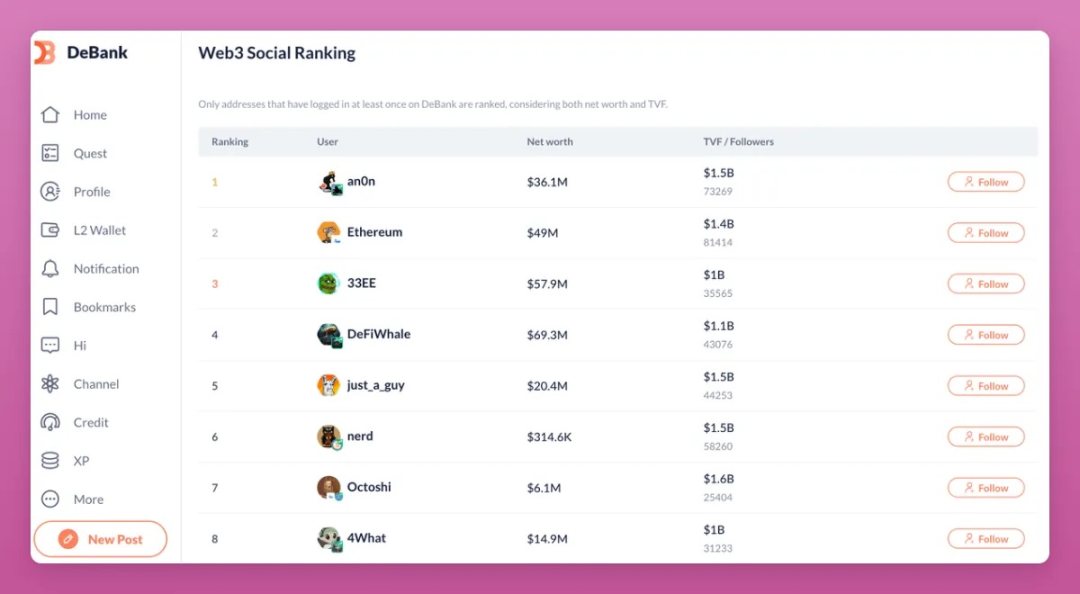

5. DeBank

Although DeBank’s flagship portfolio tracking feature has been integrated into Rabby Wallet, reducing its mindshare on X, its address-tracking function remains a rich source of alpha opportunities.

Steps:

-

Click “More” → Enter “Web3 Social Ranking”

-

Select target accounts and review their current airdrop participation

Finding airdroppers and protocols aligned with your investment style takes effort—but it’s absolutely worthwhile. Observing real capital movements is far more valuable than scrolling trending topics on X.

While writing this piece, I discovered the LAGOON protocol via DeBank: a vault strategy provider with $70M TVL offering 9% APY on ETH deposits. (Note: Please conduct your own due diligence!)

6. DeFiLlama

Given DeFiLlama’s widespread recognition, here are some advanced tips directly from Patrick Scott, DeFiLlama’s Growth Lead:

Strategy One: Precise Screening for Airdrop Candidates

-

Go to DeFiLlama.com → Click “Airdrops”

-

Check “Hide Forked Protocols”

-

(Optional) Add TVL filters

Then manually review each protocol and select those matching your criteria.

Strategy Two: Ride the Wave of Trending Chains

-

Identify currently trending chains (e.g., HyperEVM)

-

Sort all protocols on that chain by TVL

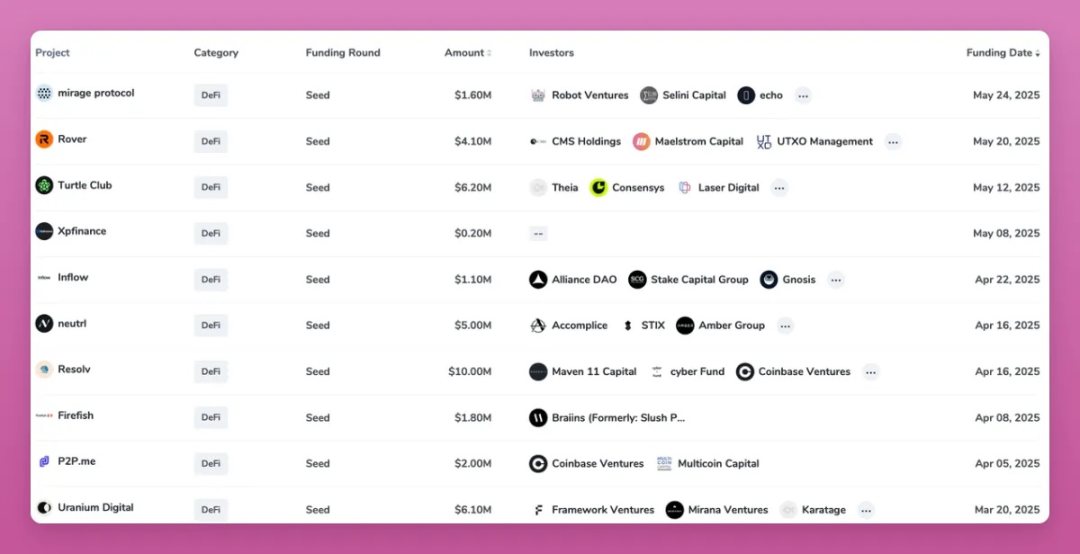

7. Coincarp – Tracking Funding Activity

Despite rising anti-VC sentiment in this market cycle, well-funded protocols remain prime targets for airdrop hunters.

I’ve long emphasized that tokens with “low circulating supply + high FDV” are ideal for airdrop farming—they possess the capital to provide initial liquidity at TGE.

Among funding trackers, Coincarp is my go-to: completely free and extremely simple to use.

My screening strategy:

-

Select sector: “DeFi”

-

Filter by funding stage: “Seed,” focusing on earliest-stage projects

Surprisingly, seed funding rounds in DeFi have sharply declined recently: only four in May, five in April. Fortunately, fewer projects mean it’s easier to study each one thoroughly 😉

Turtle Club Project Breakdown: A DeFi rewards platform that delivers extra yield through partnership agreements—essentially a “decentralized cashback program.” How it works: 1. Log in with wallet (no deposit required) 2. System automatically tracks your liquidity mining/staking activities on partner platforms 3. Earn additional rewards and TURTLE tokens Advantages: - Zero risk: Funds stay in your wallet - Yield stacking: Extra rewards on top of base yields - Early mover benefits: Higher returns for first users

Bonus: Crypto Bloggers to Follow

In this post, I wanted to share how I discover emerging trending protocols.

I didn’t mention randomly scrolling posts on X—everyone does that, and the signal-to-noise ratio is painfully low.

In contrast, crypto bloggers are excellent sources for spotting new protocols. Here are a few I recommend subscribing to:

-

Alpha Please: Shares 3 alpha-rich apps weekly. Subscribe on Substack

-

The DeFi Investor: Delivers updates on new project launches and developments. Substack subscription link

-

blockmates: Deep dives into trending projects. Website

-

The Daily Degen: Follow their “New Projects” section

-

The DeFi Edge: Newsletter regularly covers emerging hot projects and market trends

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News