Mining the Bull Market: A Detailed Guide to OKX's 7 Major CeFi Tools for Navigating Market Ups and Downs

TechFlow Selected TechFlow Selected

Mining the Bull Market: A Detailed Guide to OKX's 7 Major CeFi Tools for Navigating Market Ups and Downs

How to choose the right tools under different market conditions?

Although October is not a fixed month for gains in the crypto market, some years have indeed shown exceptional market performance. For example, in October 2020, Bitcoin rose approximately 28%, laying a solid foundation for the bull run that followed. In October 2021, Bitcoin surged even more dramatically, reaching an all-time high of around $66,900 on the 20th. This October, Bitcoin has once again gained momentum, breaking through $70,000. Many analysts point out that the fourth quarter often sees strong crypto market performance, likely due to increased trading activity and heightened market sentiment toward year-end.

Alongside Bitcoin's upward momentum, meme coins and "golden dog" narratives are flourishing—new stories emerge constantly, from goats to geese. VC-backed projects are also making strong comebacks, with major product launches from Worldcoin, Uniswap, ApeCoin, and others. Meanwhile, continuous capital inflows into Tether and Bitcoin ETFs are providing greater liquidity and volatility, enhancing overall market vitality. A series of positive market movements are setting the stage for new market trends.

However, regardless of which phase the market is in during a "Bitcoin bull run," what matters most is how users respond to different market conditions. It’s essential to understand which tools deliver steady returns, which suit all market types, which are better for short-cycle trading, which are designed for on-chain use, and which support instant redemption—rather than relying on intuition to predict market direction. To help users better understand and utilize these tools, this article outlines OKX’s top 10 CeFi products and their ideal market applications, enabling users to navigate changing market environments more flexibly and build their own toolkit.

1. Strategy Products

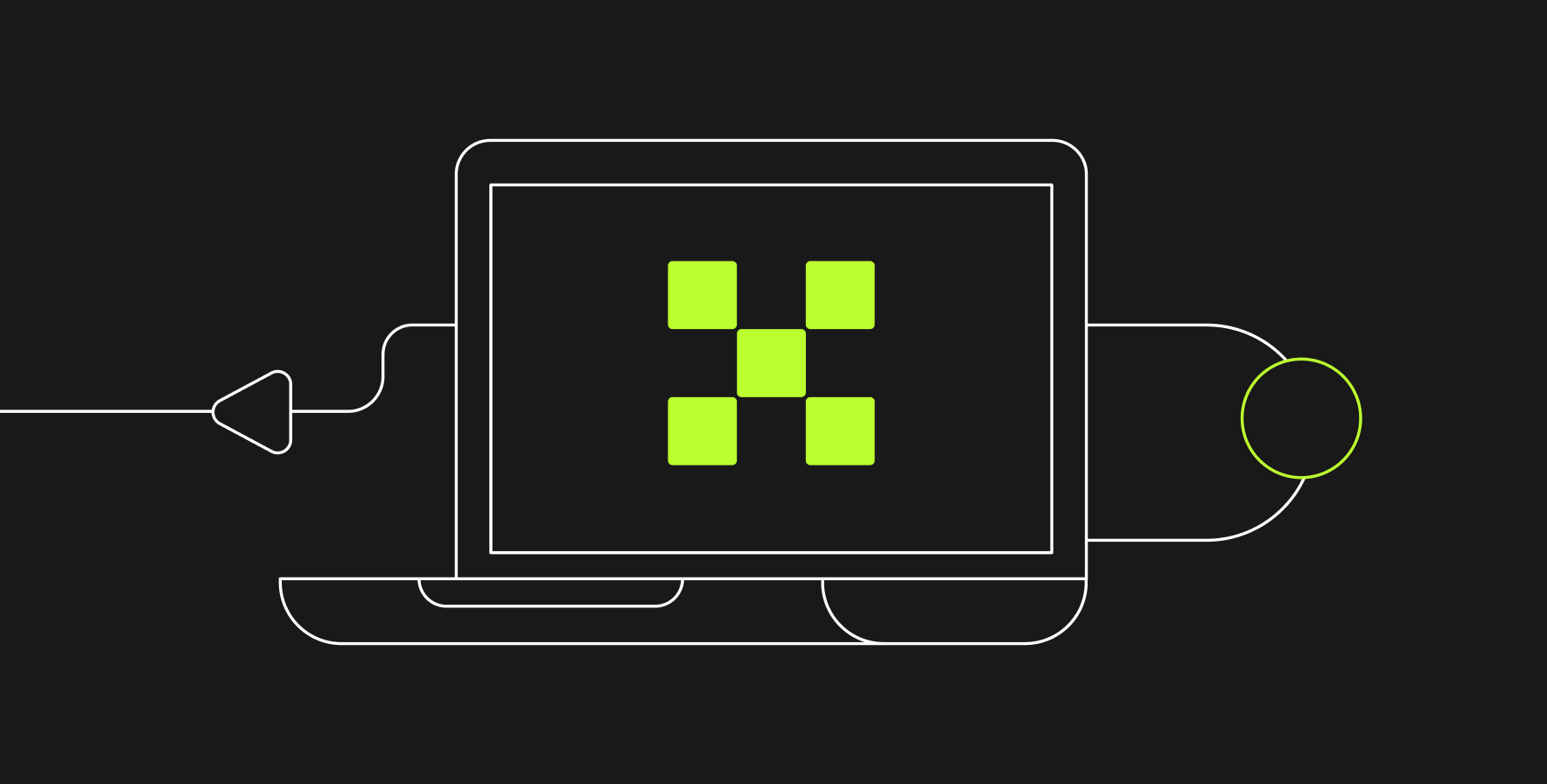

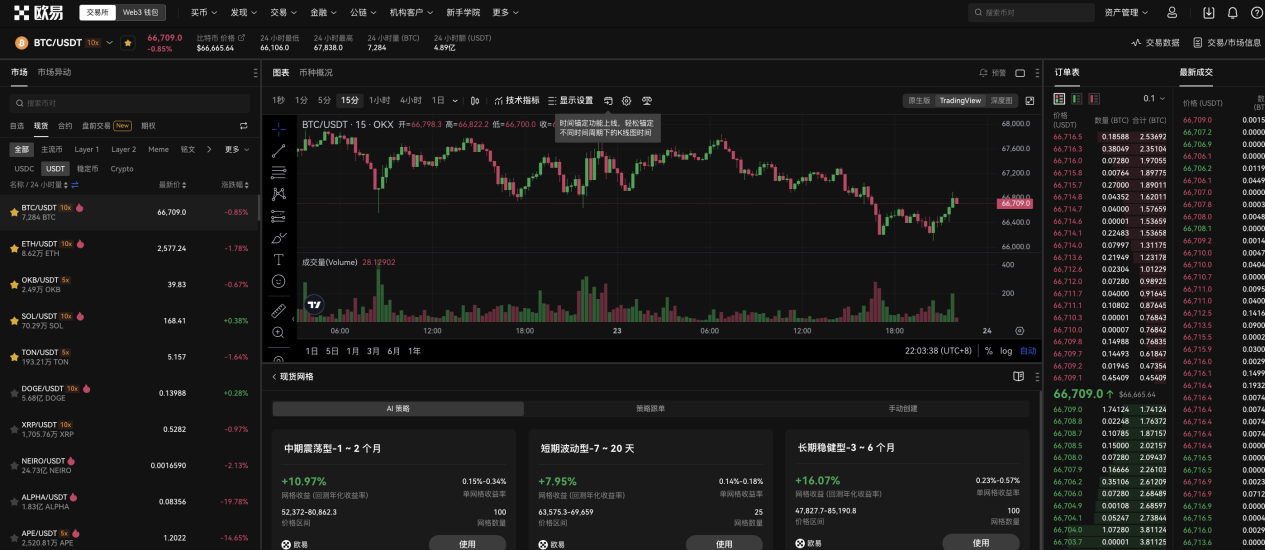

OKX trading strategy products are a suite of tools designed to enable automated and customized trading, suitable for various market conditions and trading needs. Their core advantage lies in reducing manual operations and improving trading efficiency, gradually becoming a favored trading model among users. OKX offers dozens of strategy products including grid trading, martingale, HODL Pool, Bottom-Finder, arbitrage orders, iceberg orders, and time-weighted orders, making it one of the most mature platforms offering multiple strategies, with low fees and user-friendly operations. Below, we briefly introduce several key strategies.

1. Spot Grid: Buy Low, Sell High Within a Specific Range – Ideal for Sideways or Slightly Rising Markets

Strategy Overview: The spot grid strategy is an automated trading tool that executes "buy low, sell high" operations within a predefined price range, helping users profit from market fluctuations. Users only need to set the highest and lowest prices of the range and choose the number of grids. The system divides the range into multiple smaller grids, automatically placing buy and sell orders within each. As the market fluctuates, the strategy continuously performs trades within the range, capturing profits from price swings. OKX offers both manual and smart setup modes: users can customize parameters or use system-recommended smart grid settings for quick deployment.

Best Use Cases: The core of the spot grid strategy is "selling high and buying low" to profit from sideways markets, making it especially suitable for ranging or slightly bullish conditions. In such environments, the strategy effectively captures small price movements and accumulates gains. However, in a strongly bearish market, the strategy may face losses due to continuous buying at lower prices, so caution is advised during downtrends.

Example: Suppose a user plans to use the BTC/USDT spot grid strategy on OKX.

1) Market Outlook: The user believes Bitcoin will trade between $25,000 and $30,000 over the coming period. Given the expected range-bound movement, they opt for a spot grid strategy to profit from volatility.

2) Parameter Setup:

• Trading Pair: BTC/USDT

• Price Range: Set minimum buy price at $25,000 and maximum sell price at $30,000.

• Number of Grids: Divide the range into 10 grids. Each grid spans ($30,000 - $25,000)/10 = $500. The system will place automatic buy/sell orders every $500.

• Investment Amount: Allocate 2 BTC as initial capital, partly used to buy BTC and partly to hold USDT for selling.

3) Strategy Execution:

• As Bitcoin fluctuates between $25,000 and $30,000, the system automatically buys BTC when prices drop below certain levels and sells when they rise. For instance, if BTC drops to $26,000, the system buys; if it rebounds to $27,000, the system sells, capturing spread profits.

4) Expected Outcome:

• If BTC continues oscillating within the range, the strategy repeatedly buys low and sells high, accumulating small profits across grids. For example, if BTC drops from $26,500 to $25,500 and rebounds to $28,000, the system executes multiple profitable trades across different grids.

5) Profit Withdrawal or Adjustment:

• Users can withdraw profits anytime during strategy execution or manually stop or adjust the strategy based on market changes. If a sustained downtrend begins, users may consider adjusting grid parameters or pausing the strategy to avoid losses.

Key Advantages: The spot grid strategy sensitively captures minor market fluctuations, reduces manual intervention, and allows automatic execution of trading plans. It supports both custom parameter settings and system-recommended smart configurations, catering to users of all experience levels.

How to Use: 1) Log in to OKX and go to the trading page. 2) Select "Spot Grid" under "Strategy Trading Mode." 3) Enter the highest and lowest prices, number of grids, or use smart recommendations, then confirm the amount and create the grid strategy. The invested funds will be isolated from your trading account and dedicated to this strategy. 4) After creation, manage the active grid strategy via the "Strategies" section below the trading interface. You can withdraw profits or stop the strategy at any time.

Direct Access:

https://www.okx.com/zh-hans/trade-spot-strategy/btc-usdt#ordtype=grid

2. Contract Grid: Better Suited for Volatile Bull Markets with Sharp Swings, Offering Greater Flexibility and Error Tolerance

Strategy Overview: The contract grid strategy automates "buy low, sell high" (or vice versa) trades within a defined price range, specifically designed for futures trading. Users set the upper and lower bounds and the number of grids; the system calculates entry and exit points and places orders automatically. As prices fluctuate, the strategy executes trades to capture profits from volatility.

Best Use Cases: The core of contract grid is volatility arbitrage, making it ideal for prolonged sideways markets. Additionally, users can tailor the strategy based on market bias: long-only grids execute long entries and exits, suitable for slightly bullish ranges; short-only grids handle short positions, fitting slightly bearish trends; neutral grids open shorts at higher levels and longs at lower levels, ideal when market direction is unclear.

Example: Refer to the spot grid example above for similar setup.

Notably, contract grids allow leverage, enabling larger exposure with less capital. This amplifies potential gains from small price moves but increases risk. Typically, contract grids require margin and carry liquidation risk—if prices move sharply, positions may be forcibly closed. Spot grids do not have this risk, as trades are fully backed by user assets and cannot be liquidated due to market swings.

Key Advantages: This strategy runs automatically without manual monitoring. Compared to spot grids, contract grids adapt well to rising, falling, or volatile markets by opportunistically buying low and selling high. Users can select directional strategies based on market views, making it more flexible and resilient—ideal for bull markets with large swings or frequent spikes. Spot grids, in contrast, are more conservative and better for users avoiding leverage risk.

How to Use: 1) Open OKX on PC or mobile and go to the "Trade" page. 2) Select "Contract Grid" under "Strategy Trading Mode." 3) Input parameters like high/low prices and number of grids, or use smart recommendations. Confirm amount and create. 4) Funds are isolated from your trading account for exclusive use in this strategy. 5) View, manage, withdraw profits, or stop the strategy via the "Strategies" tab below the trading interface.

Direct Access:

https://www.okx.com/zh-hans/trade-swap-strategy#ordtype=contract_grid

3. Smart Arbitrage: Best for Pairs with Long-Term Positive Funding Rates and High Liquidity, Low-Risk Funding Fee Earnings

Strategy Overview: Smart arbitrage is a method designed to generate stable returns by hedging against price volatility. Its core principle uses delta-neutral strategies—holding equal but opposite positions in spot and futures markets to hedge price risk. Profits primarily come from collecting funding fees (e.g., earnings when funding rates are positive). Once activated, the strategy steadily earns funding fees paid by longs to shorts. This strategy is particularly effective in bull markets. OKX offers two modes: 1) Custom mode, where users select high-yield strategies and set take-profit points manually; 2) Smart mode, where the system recommends optimal strategies and intelligently manages stop-loss, take-profit, and position adjustments (currently not yet live).

Best Use Cases: Smart arbitrage works best with major cryptocurrencies that maintain positive funding rates over the long term. Due to funding rate mechanisms, many leading coins often sustain positive rates, allowing users to earn consistent fee income. In custom mode, users should prioritize pairs with persistently positive funding rates and high liquidity to minimize slippage and maximize returns. Thus, this strategy suits users seeking stable returns in volatile markets, especially those lacking time or expertise for manual management.

Example: Suppose a user deploys the BTC smart arbitrage strategy on OKX—simply input the amount and start.

For illustration, using BTC: If a user invests $2,100 in basis trading, and BTC spot price is $65,000, the system does the following:

1) Invest $2,000 to buy BTC in the spot market (0.03077 BTC).

2) Allocate $100 to short BTC/USDT perpetual contracts (20x leverage).

Assuming a funding rate of 0.01% and BTC price at $65,000:

3) Funding fee collected every 8 hours (three times daily), annual total: $2,000 × 0.01% × 3 × 365 = $219.

4) Annualized return: $219 / $2,100 = 10.43%.

Key Advantages: Users can leverage smart arbitrage to hedge price risk while steadily earning funding fees. However, despite low long-term risk, potential risks include slippage during settlement, delta imbalance, and forced liquidation of contract short positions.

How to Use: 1) Log in to OKX, go to the trading page, and select "Strategy Trading Mode." 2) Choose "Smart Arbitrage." 3) Select the cryptocurrency and enter the amount, then click create. 4) Manage the active strategy via the "Strategies" section. You can stop the strategy anytime.

Direct Access:

https://www.okx.com/zh-hans/trade-swap-strategy#ordtype=smart_arbitrage

4. Bottom-Finder & Top-Exit: No Need to Monitor Markets Constantly, Ideal for Users Wanting to Buy Low or Sell High

Strategy Overview: Bottom-Finder guarantees purchasing a certain amount of cryptocurrency at a discounted price upon expiry. Users can choose system modes with high discount rates, short lock-up periods, and high guaranteed ratios—or customize their own. Top-Exit guarantees selling a portion at a premium price at expiry, with options for high premiums, short terms, and high guarantee ratios, or custom setups. Both strategies are fee-free, but funds are locked until expiry.

Best Use Cases: Top-Exit suits users anticipating a market peak, aiming to automatically sell at high prices to lock in profits and prevent asset depreciation. If the market price at expiry < Top-Exit price, the user sells only the guaranteed proportion, with the remainder returned. If market price ≥ Top-Exit price, the full quantity is sold at the set price. Bottom-Finder benefits users expecting a rebound, enabling automatic purchases at low levels for strategic accumulation. If expiry price > Bottom-Finder price, only the guaranteed portion is bought at the discount, with leftover funds returned. If expiry price ≤ Bottom-Finder price, the full amount is purchased at the discounted price.

Examples:

Top-Exit Example: Assume BTC is $20,000. A user selects a card to sell 1 BTC at $22,000, with 20% guaranteed ratio and 3-day term. At expiry:

• If BTC is $21,000, the user sells 0.2 BTC at $22,000; remaining funds returned.

• If BTC is $23,000, the user sells 1 BTC at $22,000.

Bottom-Finder Example: BTC at $20,000. A user chooses to buy 1 BTC at $19,000, 20% guaranteed, 3-day term. At expiry:

• If BTC is $21,000, the user buys 0.2 BTC at $19,000; excess funds returned.

• If BTC is $18,000, the user buys 1 BTC at $19,000.

Key Advantages: Top-Exit helps users automatically sell at preset highs, locking profits and avoiding drawdowns, without constant monitoring. Bottom-Finder enables automatic purchases at set lows, helping users catch bottom opportunities, accumulate assets, and benefit from rebounds—all without needing to watch the market.

How to Use: 1) Log in to OKX and go to the trading page. 2) Select "Bottom-Finder" or "Top-Exit" under "Strategy Trading Mode." 3) Choose cryptocurrency, strategy mode, and amount to complete setup.

Direct Access:

Bottom-Finder:

https://www.okx.com/zh-hans/trade-spot-strategy#ordtype=lvf_buy

Top-Exit:

https://www.okx.com/zh-hans/trade-spot-strategy#ordtype=lvf_sell

5. HODL Pool: Smart Rebalancing to Capture Opportunities from Rotating Market Trends

Strategy Overview: HODL Pool is an automated strategy that dynamically rebalances a user-selected portfolio of cryptocurrencies. Dynamic rebalancing maintains constant proportions among selected assets. Users can trigger rebalancing via two modes: fixed time intervals or percentage deviation thresholds—referred to as "Proportional Balance" and "Scheduled Balance."

Best Use Cases: Markets often see rotation between coins or sectors—some rise, then pull back, while others begin to climb. Holding static positions may cause users to miss profit-taking chances. By cashing in gains on rising assets and reallocating into emerging ones, users can lock profits and increase exposure to promising coins. Repeating this cycle generates additional returns from the portfolio.

Examples:

Proportional Balance Example: User selects this mode

1) Parameter Setup

• Portfolio: BTC 50%; ETH 30%; SOL 20%

• Balance Mode: Proportional Balance | 10%

• Investment: $10,000

2) Strategy Execution

• Stage 1 – Acquire Target Assets: $10,000 is used to buy $5,000 worth of BTC (at $1,000, i.e., 5 BTC), $3,000 of ETH (at $500, i.e., 6 ETH), and $2,000 of SOL (at $100, i.e., 20 SOL).

• Stage 2 – Trigger Rebalance: BTC rises to $1,500, others unchanged. New values: BTC 60%, ETH 24%, SOL 16%. BTC exceeds target by ≥10%, triggering rebalance. System sells 0.83334 BTC and buys 1.5 ETH and 5 SOL, restoring original ratios. Final holdings: 4.16666 BTC ($6,250), 7.5 ETH ($3,750), 25 SOL ($2,500).

Scheduled Balance Example: User selects this mode

1) Parameter Setup

• Portfolio: BTC 50%; ETH 30%; SOL 20%

• Balance Mode: Time-Based | Every 4 Hours

• Investment: $10,000

2) Strategy Execution

• Stage 1 – Acquire Assets: Same as above—5 BTC, 6 ETH, 20 SOL.

• Stage 2 – Trigger Rebalance: After 4 hours, BTC reaches $1,500. Values now: BTC 60%, ETH 24%, SOL 16%. Since BTC deviates by ≥3%, rebalance triggers. System sells 0.83334 BTC, buys 2.5 ETH and 5 SOL. Holdings: 4.16666 BTC ($6,250), 7.5 ETH ($3,750), 25 SOL ($2,500).

Key Advantages: Helps users capitalize on rotating market trends without being constrained by fixed allocations. The strategy leverages exchange rate fluctuations between coins to grow holdings.

How to Use: 1) On OKX Web or App, go to "Trade" page, select "Strategy Trading Mode," then "HODL Pool." 2) Enter parameters and confirm amount to create the pool. (Funds are isolated from trading account.) 3) Manage the strategy via the "Strategies" section below the trading interface.

Direct Access:

https://www.okx.com/zh-hans/trade-spot-strategy#ordtype=smart_portfolio

2. Earn Products

Earn is OKX’s one-stop platform helping users discover diverse holding-based earning opportunities, including Simple Earn, structured products, and on-chain earn options, offering rich product choices. Specifically: 1) Simple Earn is a low-barrier product for users with idle digital assets, offering flexible and fixed-term options. 2) Structured products include Dual Currency, Seagull, Shark Fin, Snowball, and HODL Snowball—innovative financial instruments derived from derivatives markets. Users can select based on current market conditions and risk appetite. All OKX structured products currently have zero fees. 3) OKX On-Chain Earn provides curated staking and DeFi protocols to earn on-chain rewards.

6. Dual Currency: Ideal for Users Uncertain About Market Direction But Seeking Returns

Product Overview: Dual Currency is a non-principal-guaranteed structured product that helps users earn extra returns while buying or selling digital currencies at target prices. Currently, OKX offers BTC- and ETH-denominated Dual Currency products, supporting BTC and ETH subscriptions for low-buy/high-sell strategies. Compared to USDT-denominated versions, it offers a new way to earn, zero-cost conversion between two major cryptos, continuous yield generation, and avoids missing market moves due to conversion to USDT—helping users hold assets worry-free.

Best Use Cases: Best suited for sideways or flat markets—when prices move within a range and future direction is uncertain. With Dual Currency, users lock in returns as long as the price doesn’t hit the trigger level by expiry, regardless of whether the asset price rises or falls.

Example: Suppose a user uses the BTC/ETH-denominated Dual Currency product on OKX. Its main advantage in a bull market is earning yield without fear of being "shaken out."

1) Market Outlook:

The user expects ETH/BTC to dip slightly short-term and wants to earn yield while increasing BTC exposure, but wishes to avoid losing ETH holdings due to market noise.

2) Product Selection: User chooses OKX’s denomination-based Dual Currency—Sell High ETH/BTC

• Current ETH price: 0.03 BTC

• Target price: 0.02 BTC

• Term: 1 day

• Expected return: ~21.40% APY

3) Two Possible Outcomes:

• Expiry price ≥ 0.02 BTC: If ETH/BTC doesn't fall below 0.02, user sells ETH at target price (0.02 BTC) and receives BTC, plus the yield.

• Expiry price < 0.02 BTC: If ETH/BTC drops below 0.02, user keeps ETH and receives yield in ETH (APY ~21.40%).

4) Outcome Analysis: The key advantage is stable yield regardless of ETH/BTC price movement. In a bull market, users don’t miss holding ETH—if price stays above target, they keep ETH and earn yield. If price hits or exceeds target, they convert ETH to more BTC. During expected dips or sideways movement, Dual Currency offers a low-risk way to earn while staying flexible and avoiding missed opportunities.

Key Advantages: OKX Dual Currency enables zero-slippage conversion between popular cryptocurrencies, ensuring price stability during swaps while generating annualized yield. Regardless of market movement, if the price hits the target, OKX ensures the agreed buy/sell, locking in gains. Users can also customize products—choosing coin pairs, terms, target prices—for personalized control and flexibility.

How to Use: 1) Log in to OKX, go to Finance. 2) Select Structured Products → Dual Currency. 3) Choose coin, term, target price, enter amount, and subscribe.

Direct Access:

https://www.okx.com/zh-hans/earn/dual

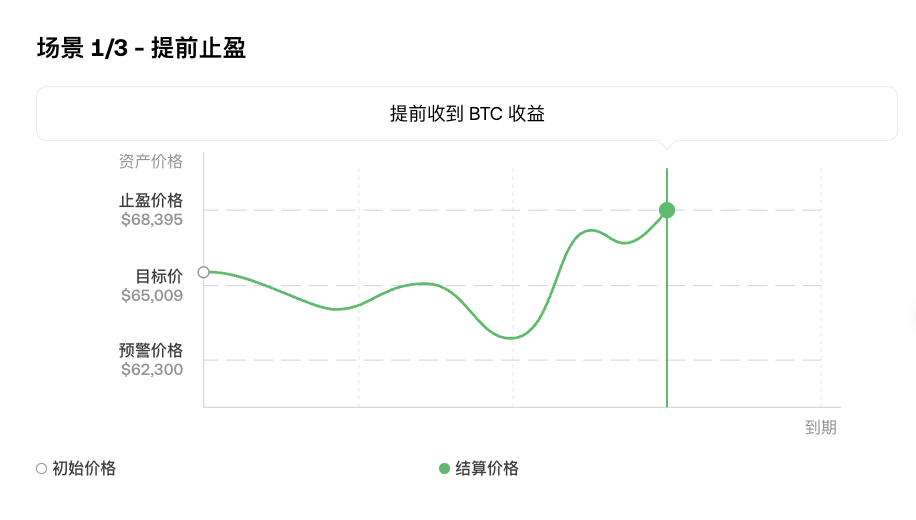

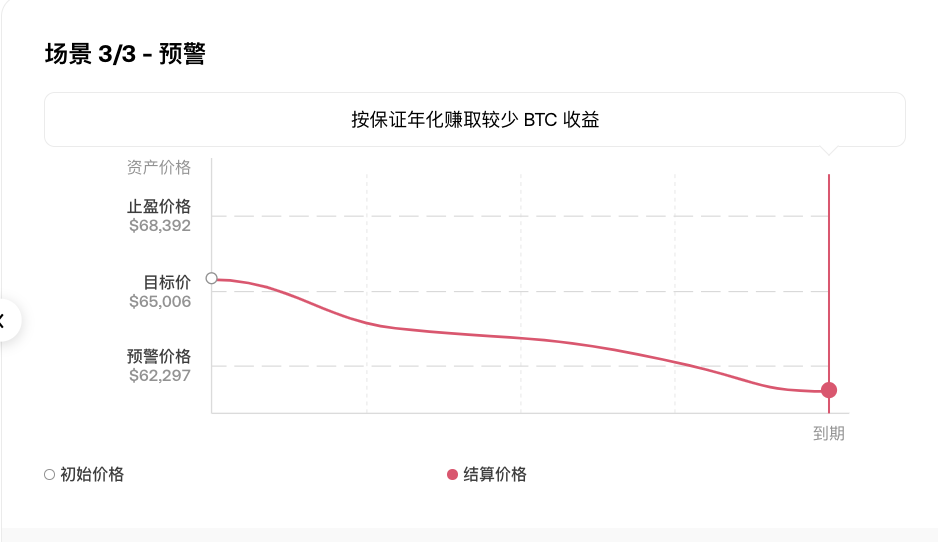

7. HODL Snowball: Best for Rising and Sideways Markets

Product Overview: HODL Snowball is a single-currency structured product that helps users trade their chosen cryptocurrency and earn returns during uptrends. There are three possible settlement scenarios: early profit-taking, maximum gain, or early settlement due to warning level breach—allowing portfolio growth with built-in risk protection.

Best Use Cases: OKX HODL Snowball suits medium-to-long-term holders, especially in sideways or steadily rising markets, helping secure gains while mitigating extreme downside risks.

Example:

1) Market Outlook: A user believes BTC will remain relatively stable in the coming days, likely trending up within a range.

2) Product Setup: User selects a 7-day HODL Snowball with 25.25% APY, initial price $64,997, target price $65,007, take-profit price $68,393, and warning price $62,300, then enters amount to participate.

3) Possible Outcomes:

Scenario 1: If price breaches take-profit level on any day, order settles early and user receives payout.

Payout = Subscription Amount × (1 + APY × Term / 365)

Scenario 2: If price stays between take-profit and warning levels, user earns max return and receives payout at maturity.

Payout = Subscription Amount × (1 + APY × Term / 365)

Scenario 3: If price drops below warning level, order settles early.

Payout = Subscription Amount × [(Settlement Price / Target Price) + (APY × Term / 365)]

Key Advantages: 1) No currency conversion: Users deposit BTC or ETH and receive the same currency back regardless of market moves—simplifying operations. 2) Guaranteed annualized return: Users earn yield in all scenarios, ensuring stable returns and reduced risk. 3) Daily early take-profit: Users can monitor daily and lock profits early if market hits target. 4) Downside protection: If price crashes below warning level, system auto-settles, adding safety. 5) Low threshold: Minimum investment is just 0.0004 BTC or 0.005 ETH—accessible to all. 6) Zero fees: No extra costs beyond principal, maximizing net returns.

How to Use: 1) Log in to OKX, go to Finance. 2) Select Structured Products → HODL Snowball. 3) Choose coin, term, target price, enter amount—simple and fast.

Direct Access:

https://www.okx.com/zh-hans/earn/snowball-hodl

The above highlights only selected CeFi products from OKX. Beyond strategy and earn products, OKX also offers diverse lending and copy-trading options, fully meeting varied user needs and helping them navigate market ups and downs flexibly. Download the OKX app: https://www.okx.com/zh-hans/download or visit the OKX website: https://www.okx.com/zh-hans to get started.

3. Disclaimer

This content is for informational purposes only and does not constitute and should not be construed as (i) investment advice or recommendation, (ii) an offer or solicitation to buy, sell, or hold digital assets, or (iii) financial, accounting, legal, or tax advice. We do not guarantee the accuracy, completeness, or usefulness of the information provided. Digital assets (including stablecoins and NFTs) are subject to market volatility, involve high risk, may depreciate, and could become worthless. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation and risk tolerance. Please consult your legal/tax/investment professional regarding your specific circumstances. Not all products are available in all regions. For more details, please refer to the OKX Terms of Service and Risk Disclosure & Disclaimer. OKX Web3 Mobile Wallet and its derivative services are governed by separate terms of service. You are solely responsible for understanding and complying with applicable local laws and regulations.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News