Tired of getting rekt? Here comes the ultimate beginner-friendly blockchain scanning tool guide!

TechFlow Selected TechFlow Selected

Tired of getting rekt? Here comes the ultimate beginner-friendly blockchain scanning tool guide!

A step-by-step guide to using the blockchain scanning tool.

Written by: TechFlow

As the go-to destination for striking it rich overnight, Pump.fun has maintained relentless popularity since its launch just a few months ago. The mania around meme coins hasn't cooled down—in fact, both the protocol revenue and number of newly issued assets on Pump.fun continue to climb.

Seeing how large the pie from this Pump protocol has become, other projects naturally feel envious. Beyond Solana, various Pump-style applications have emerged across different blockchains. Whether on Ethereum or TRON, these platforms have all had their moment in the spotlight, with users flooding onto every major and minor chain to try them out.

Yet beyond the tempting prospect of turning small stakes into big gains, a far more common reality on Pump platforms is that most people end uplosing money faster. Compared to mature secondary markets, the internal market trading (inner pool) makes player-versus-player (PvP) battles simpler and more brutal. Worse still, the one-click token launch mechanism enables countless "cartels" to sharpen their knives, targeting retail investors with carefully laid traps designed to extract maximum value.

Therefore, avoiding being rekt while trying to identify relatively trustworthy opportunities among countless Memecoins has made “chain scanning” an essential survival skill for experienced on-chain players aiming to improve their odds in this PvP battlefield.

“Chain scanning” refers to using various on-chain tools to monitor real-time developments such as new asset launches, large transactions, time-bound trading volume rankings, buy/sell activities of tracked addresses (so-called smart money), and familiar developers launching new projects.

Today, TechFlow brings you a comprehensive beginner-friendly guide to Pump chain scanning—helping players stay informed, act swiftly, survive the PvP arena, and remain at the table without falling victim to unexpected rug pulls.

PS: This article contains no sponsored content. All tools mentioned are personally tested by the author. For on-chain speculation, we recommend using a dedicated wallet and beware of phishing risks.

Chart Viewing Tools

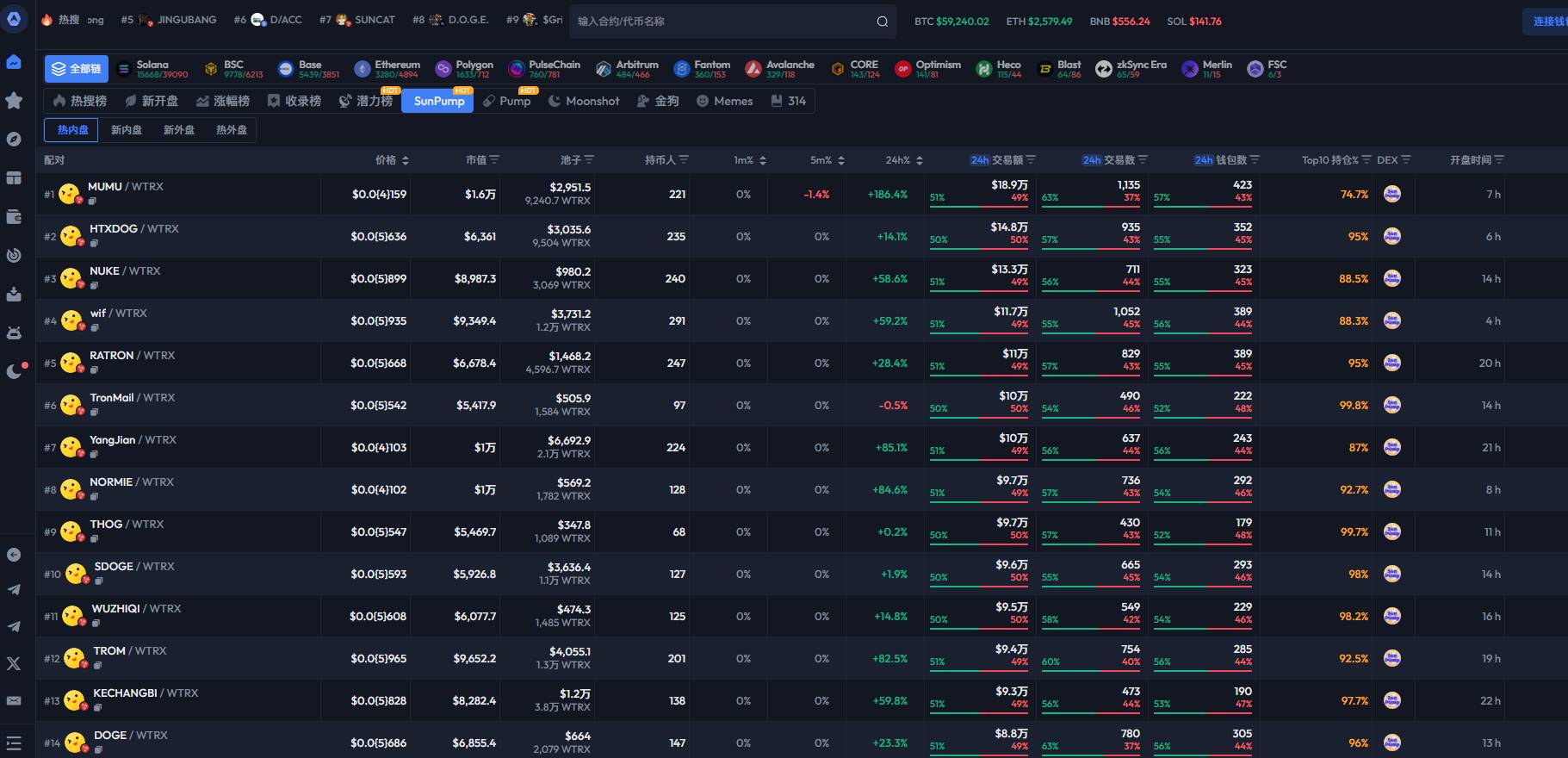

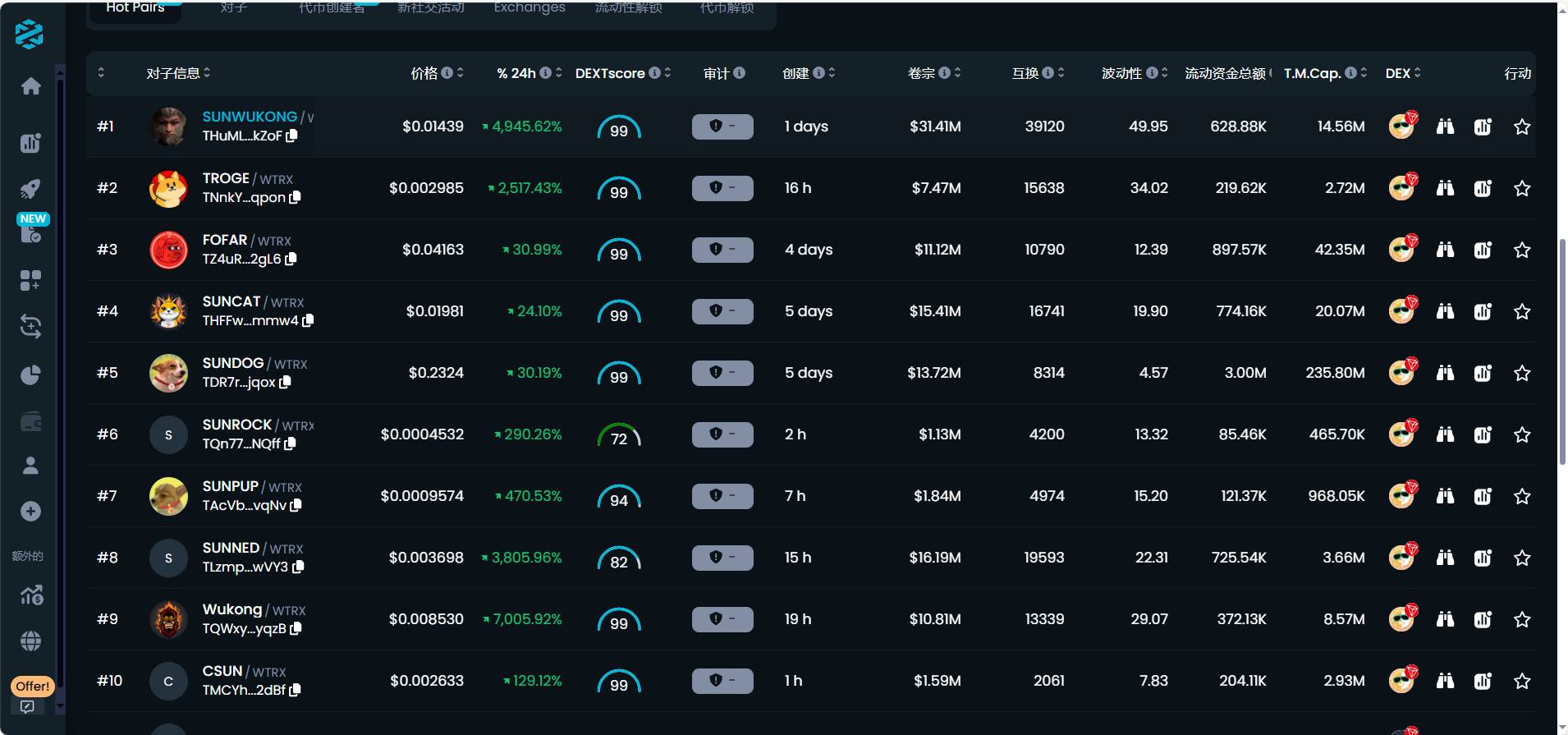

Chart viewing tools aren’t new—they’ve long been essentials even before recent Pump platforms rose to fame. However, Sunpump, which recently went viral, still suffers from minor bugs causing missing K-lines and trades within its interface. Third-party chart tools can help track price movements inside the pools more reliably.

The platform updates quickly on trending topics and already features dedicated sections for Sunpump and related metrics on its homepage. It supports entering contract addresses to view internal pool prices on Sunpump, though testing shows occasional delays of several minutes.

Dextools now also supports monitoring TRON-based assets, allowing timely access to internal pool prices across various Pump platforms, with a smooth overall user experience.

Monitoring Tools

When it comes to chain scanning, what matters most is having a comprehensive monitoring tool. While functionalities vary slightly, core features typically include tracking new token launches, short-term trading volume spikes, and tokens nearing full allocation. These tools usually come in the form of “web version + Telegram bot.” Popular options include GMGN.AI, BullX, and iCrypto. Since BullX currently requires an invitation code and iCrypto doesn't yet support Solana, here we focus on GMGN.AI, which is especially popular among Chinese-speaking users:

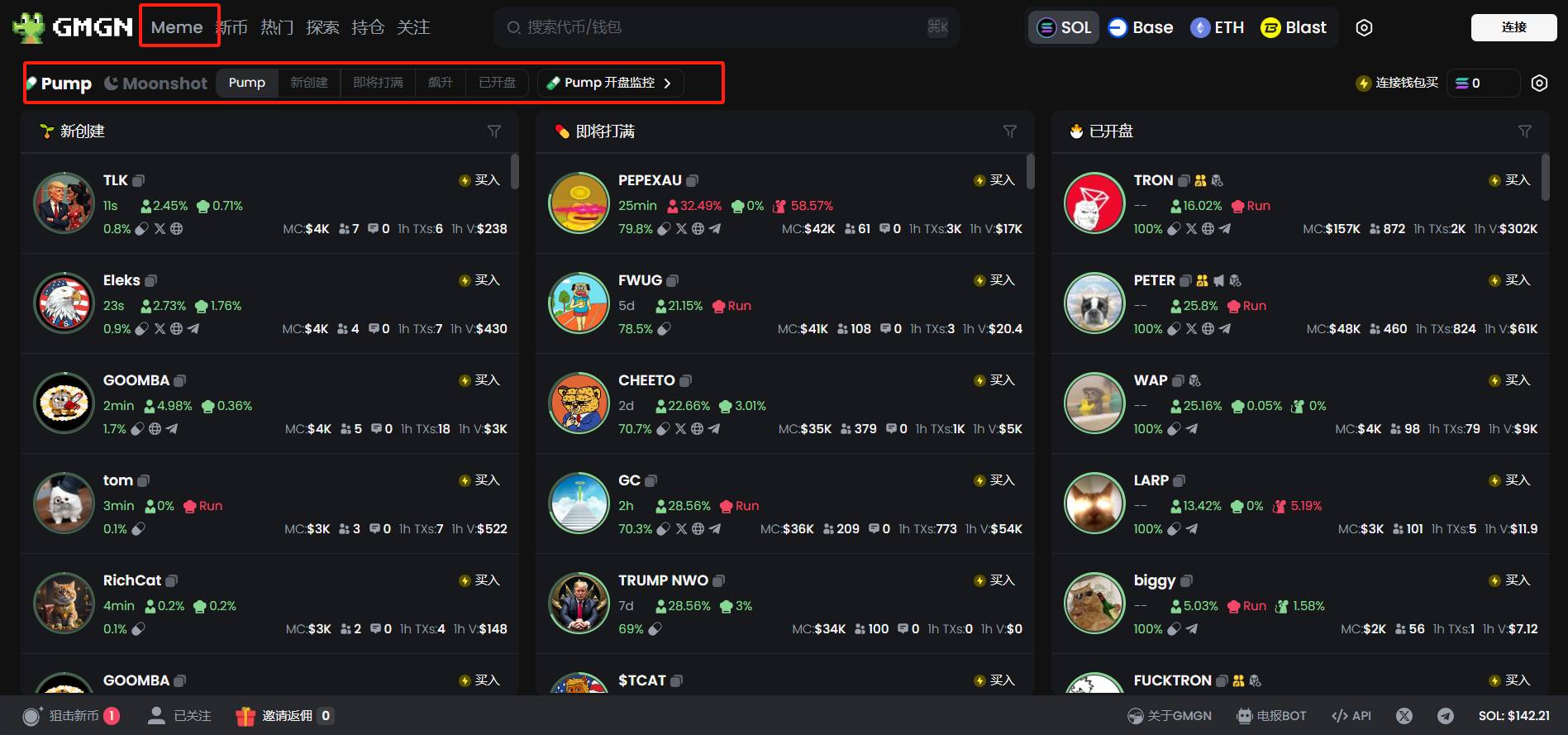

GMGN supports multi-chain asset monitoring and offers particularly robust coverage for Solana's Pump.fun ecosystem.

Its “Meme” section provides tailored support for Pump.fun users, including sub-features like “Newly Created Asset Monitoring,” “Near-Full Allocation Alerts,” “Short-Term Trading Volume Surge Detection,” and “Launched Token Tracking.”

Only the “Launched Token Monitoring” function requires connecting your Telegram account to receive instant alerts; all other functions are immediately usable via the web interface.

While these metrics may seem independent, based on personal experience, combining them flexibly allows you to filter out relatively reliable investment targets:

-

Newly Created Asset Monitoring: Focus on the developer’s token holdings, their past project history, and concentration levels among top 10 wallets for holistic evaluation.

-

Near-Full Allocation Monitoring: Pay attention to assets experiencing sudden surges in inner-pool trading volume, check whether smart money is participating heavily, and see if there's any activity on the project’s official Twitter.

-

Launched Token Monitoring: These tokens have already exited the inner pool. Here, examine whether the dev has dumped their holdings, assess potential entry points, observe whether notable players are engaging on Twitter, and gauge community buzz in Telegram groups.

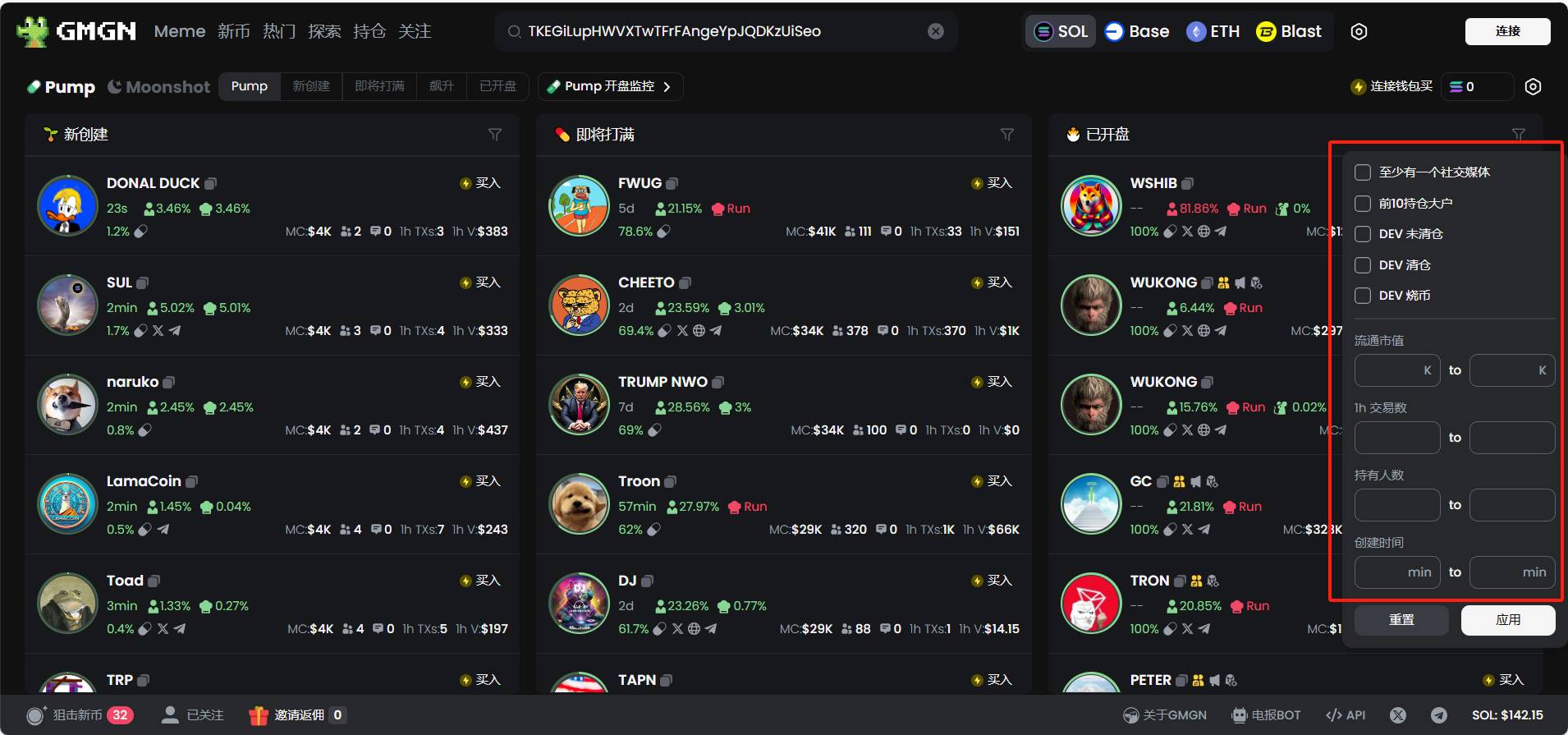

In addition, GMGN allows custom filtering based on social media presence, top address holdings, developer actions, trading volume, creation time, and more.

Unfortunately, GMGN currently focuses on ETH and Solana assets and does not yet support TRON asset monitoring.

Telegram Bots

As on-chain PvP grows fiercer, acting fast has become a key advantage. Telegram bots have surged in popularity and are now indispensable tools for on-chain traders.

Since most trading bots offer similar functionality, below are several Chinese-supported bots frequently used by the author, covering on-chain monitoring, trading execution, sniping, and more.

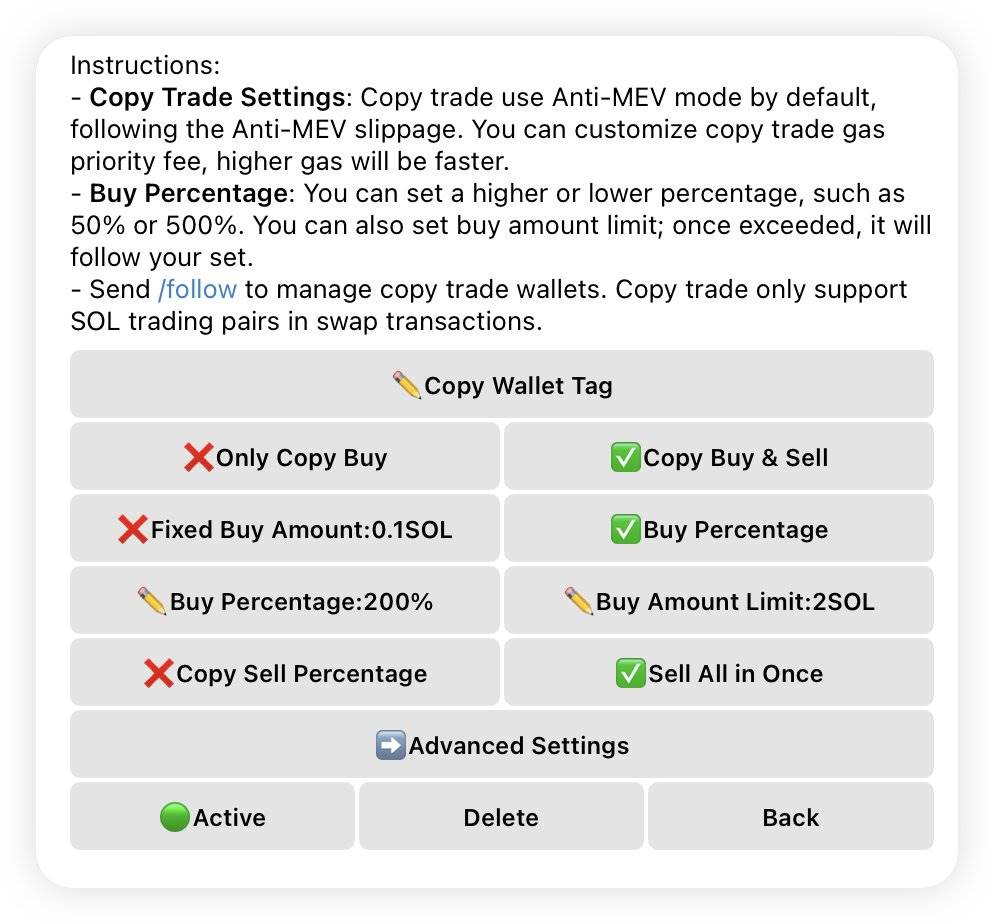

As previously mentioned, GMGN.AI operates through both a web interface and Telegram bot. Besides its practical website, its TG bot offers broad functionality, supporting various monitoring and trading modes, with full Chinese language support.

Developed by a Chinese team, Pepe Boost should be familiar to users in the Chinese-speaking community—it gained significant traction during the Meme coin boom earlier this year.

Pepe Boost supports multiple chains including Ethereum, Solana, and Base, offering practical features like copy-trading, sniping, and monitoring.

-

Sunpump Monitoring Bots

Currently, there isn't a reliable trading bot available for the trending Sunpump platform. Below are some useful Telegram bots focused on monitoring Sunpump on-chain activity—for reference only:

Bot monitoring KOL tweets recommending Sunpump assets: https://t.me/+Ff1coEzyIbYyYTg1

Monitor for Sunpump assets reaching 30% allocation: https://t.me/sunpump1

Sunpump discussion channel (with basic query functions): https://t.me/sunpumpcaode

Summary

Investing carries risk—participate with caution. Even the best tools are merely aids. The true winning strategy lies in mastering human nature: avoid FOMO, implement strict risk management, align knowledge with action, and restrain greed.

Wishing you smooth sailing on your on-chain journey.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News