How to track the market movements of crypto VC through tools?

TechFlow Selected TechFlow Selected

How to track the market movements of crypto VC through tools?

In the ever-evolving world of cryptocurrency investing, do you often feel left behind?

Written by: Rekt Fencer

Compiled by: TechFlow

In the ever-evolving world of cryptocurrency investing, do you often feel like you're falling behind? Are you struggling to keep up with the latest moves of venture capital (VC) firms in the market?

Well, fear not — there are various tools and resources available to help you stay informed and ahead of the curve. In this article, we'll explore some of the best tools for closely tracking what VCs are doing in the crypto market.

VC firms always stay ahead of retail investors:

• They define trends and narratives.

• They select the most promising projects.

• They monitor the current state of the market.

• They have access to a lot of insider information.

That's why you always learn about things later than they do.

Therefore, it's worth knowing which funds are the most successful and what they’re currently doing.

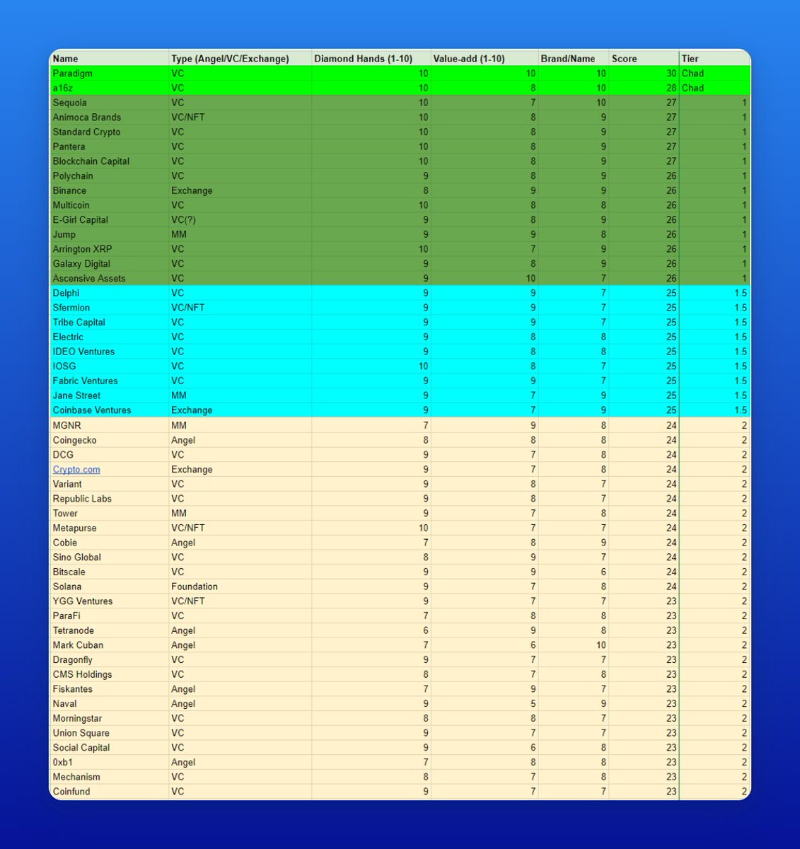

Currently, top-tier crypto VCs include Paradigm, a16z, Sequoia, and Binance Labs. Below, you can find a table listing all the VC rankings:

Of course, to track crypto funds as effectively and quickly as possible, you need to use different tools such as:

• CryptoRank;

• Crunchbase;

• Chain Broker;

Let’s go through them one by one.

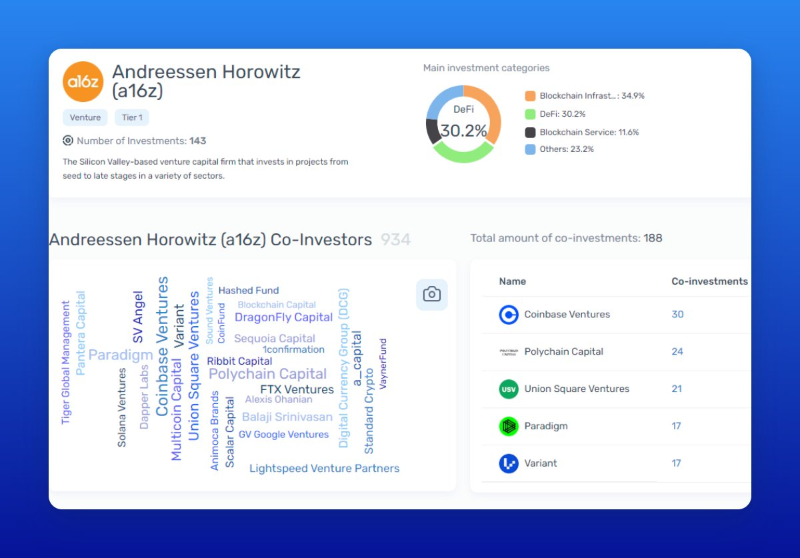

CryptoRank

CryptoRank is a market intelligence and analytics platform that recently added a dedicated section for cryptocurrency funds. Here, you can find extensive information about different funds:

• Total number of investments;

• Market share;

• Key investment categories;

• Their portfolio;

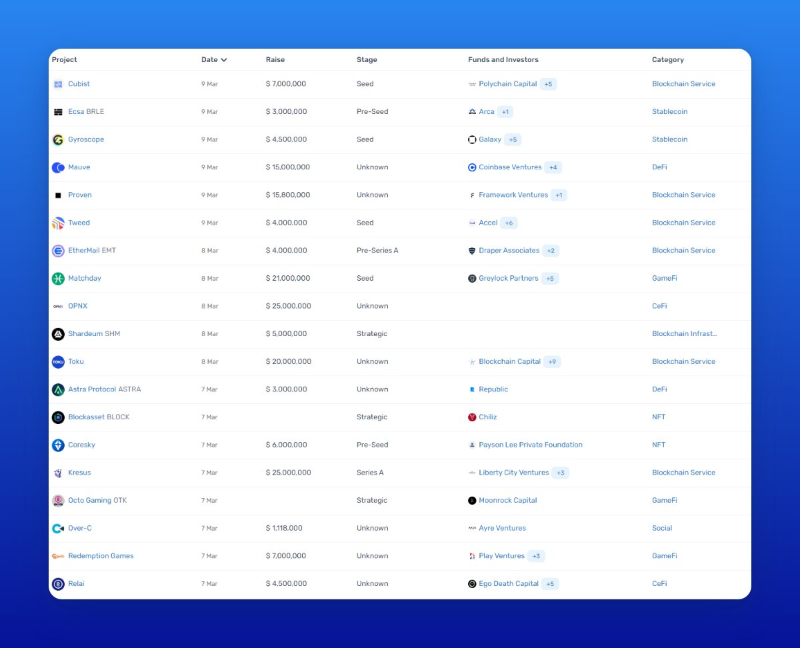

The platform also offers a funding round tracker tool where you can find:

• The amount of funding raised by a project;

• Investment stage;

• Which VCs participated in the investment;

• Project category;

They’ve also created a very convenient dashboard to analyze fund investments:

• Cryptocurrency fundraising trends;

• Most active funds;

• Types of projects preferred by VCs;

Crunchbase

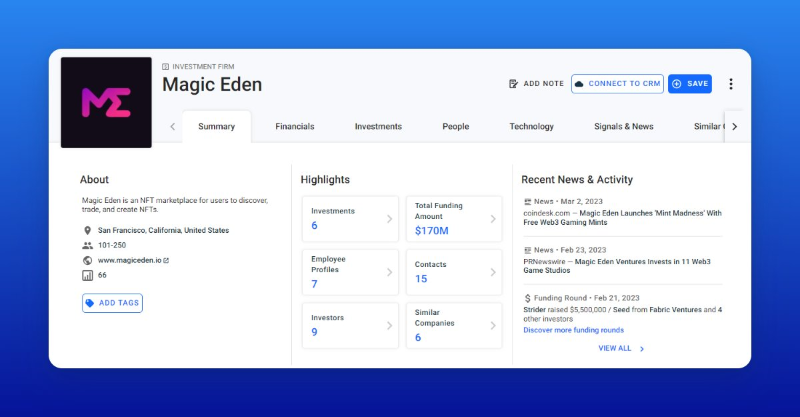

On Crunchbase, you can use multiple features to analyze a project, a fund, or even an individual employee. By visiting a project page, you can find:

• Total funding raised;

• Information on all funding rounds;

• Most active investors;

• Employee profiles;

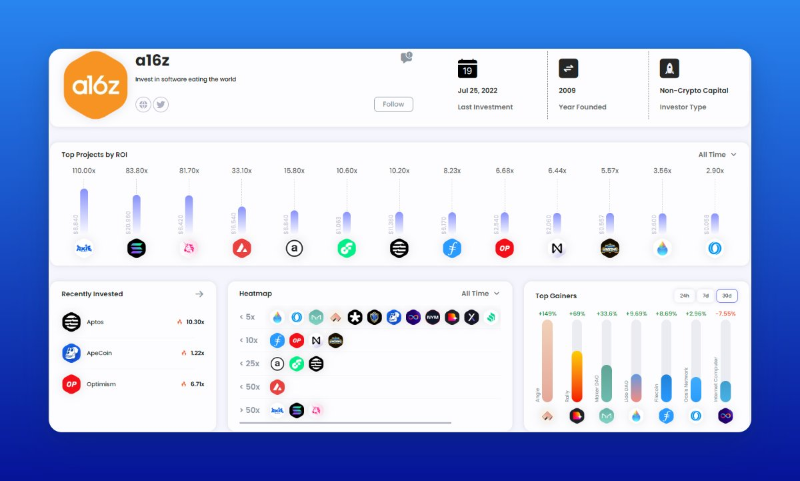

Chain Broker

Chain Broker allows you to track fund returns on investment. Here, you can find:

• The most profitable funds;

• Current ROI of investments;

• Recent investments;

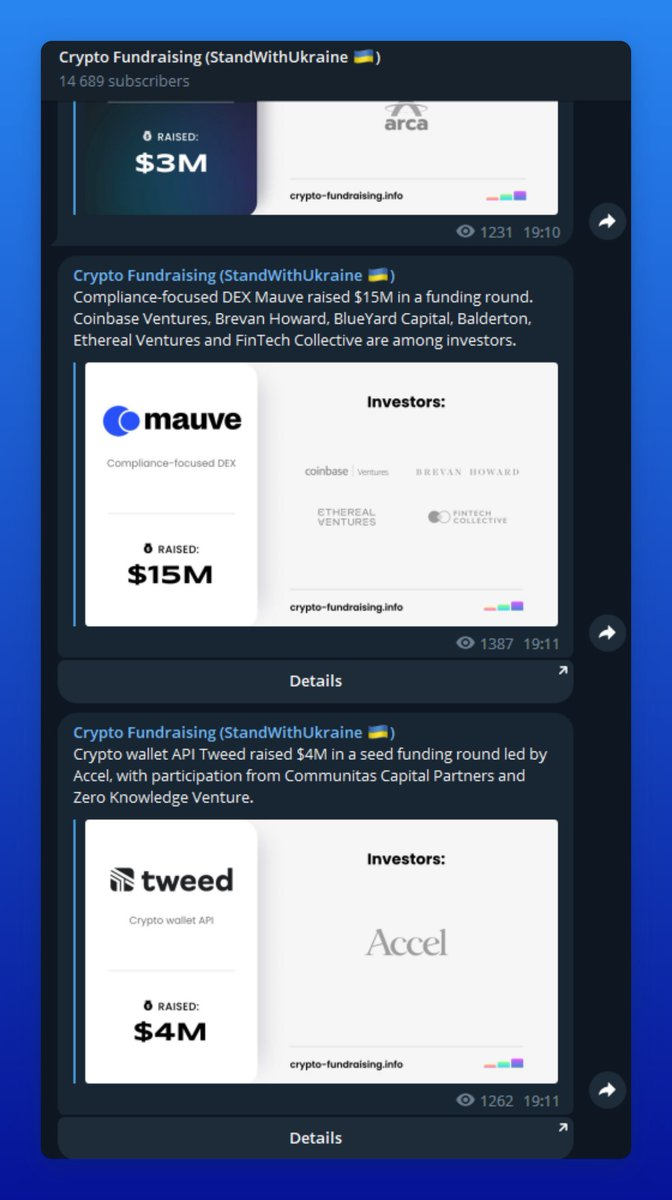

In addition, if you prefer something simpler, you can follow Telegram bots and channels dedicated to tracking VC activity — they post updates on all recent VC investments so you won't miss a thing.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News