How to Capture Price Surge Opportunities from the Korean Market? Practical Tools and Strategies Shared

TechFlow Selected TechFlow Selected

How to Capture Price Surge Opportunities from the Korean Market? Practical Tools and Strategies Shared

The South Korean market has always played a key role in the cryptocurrency market.

Written by: Miles Deutscher

Compiled by: TechFlow

The South Korean market has long played a pivotal role in the cryptocurrency space, known for its distinctive trait—nationwide retail participation in crypto trading—which has driven remarkable price surges for numerous tokens. Therefore, monitoring South Korea's crypto trading activity is crucial.

In this article, crypto researcher Miles Deutscher outlines several methods to help capture emerging trends in South Korea’s crypto market. Below is the original piece:

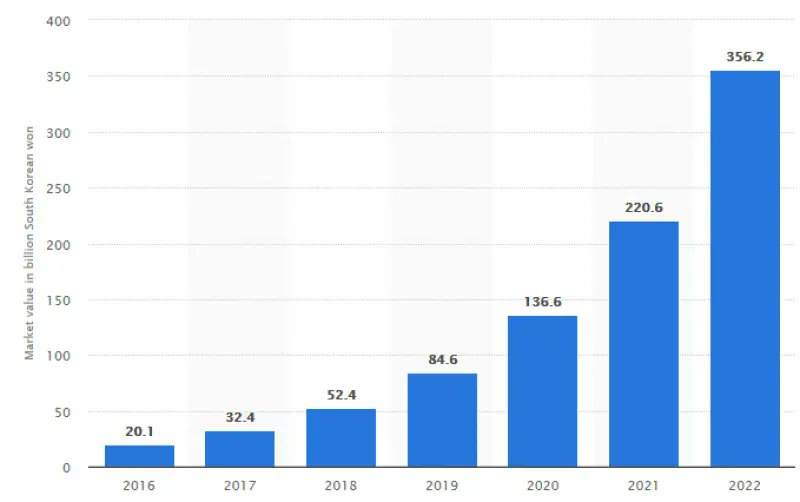

The value of South Korea’s crypto market is growing rapidly, with some of this year’s biggest rallies fueled by Korean retail investors—APT and ARB being recent examples. Support from authorities for Web3 development, a strong economy, and a cultural emphasis on technology and innovation are all contributing factors behind this trend.

As a result, South Korea has become one of the world’s major crypto hubs and currently ranks among the top four countries by trading volume.

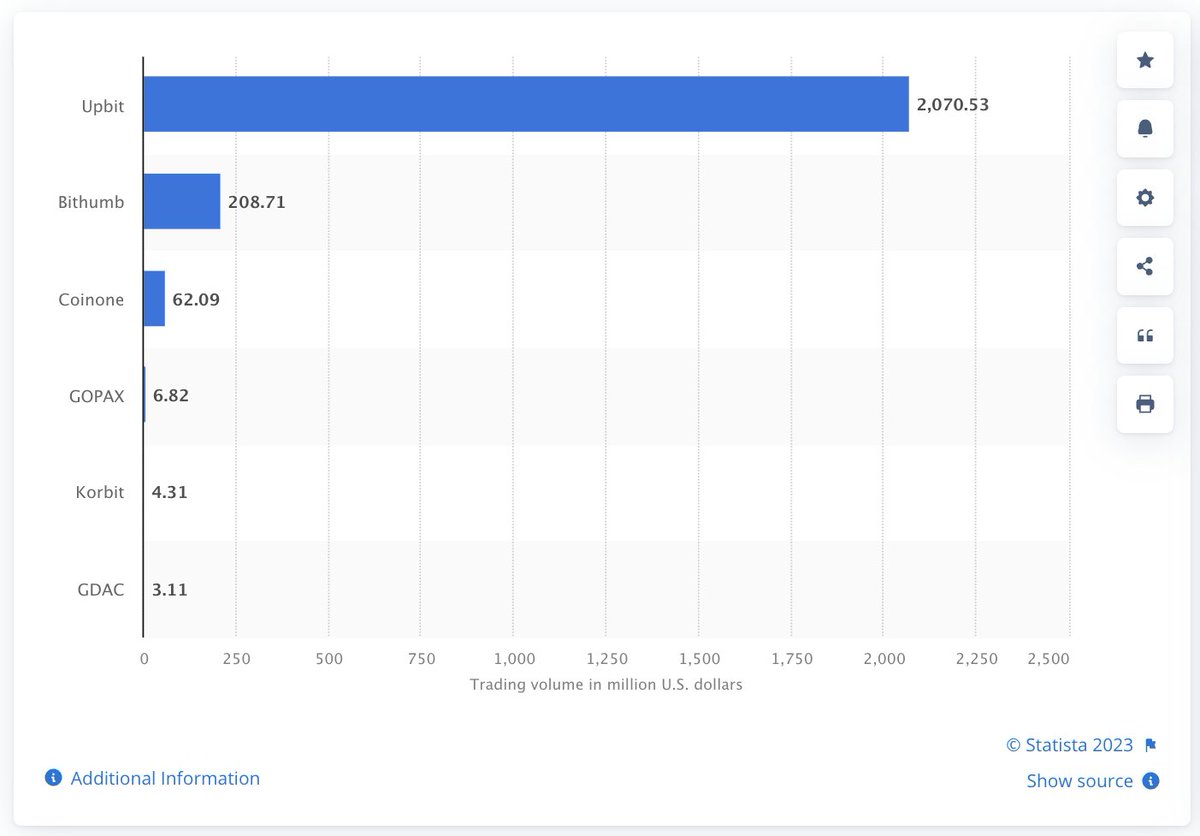

Upbit is currently South Korea’s largest cryptocurrency exchange, dominating the domestic market with a 76.6% share.

Due to its dominance, monitoring Upbit has become a fundamental method for tracking Korean trading movements.

Below are four steps that can help you catch the next surge in South Korea’s crypto market:

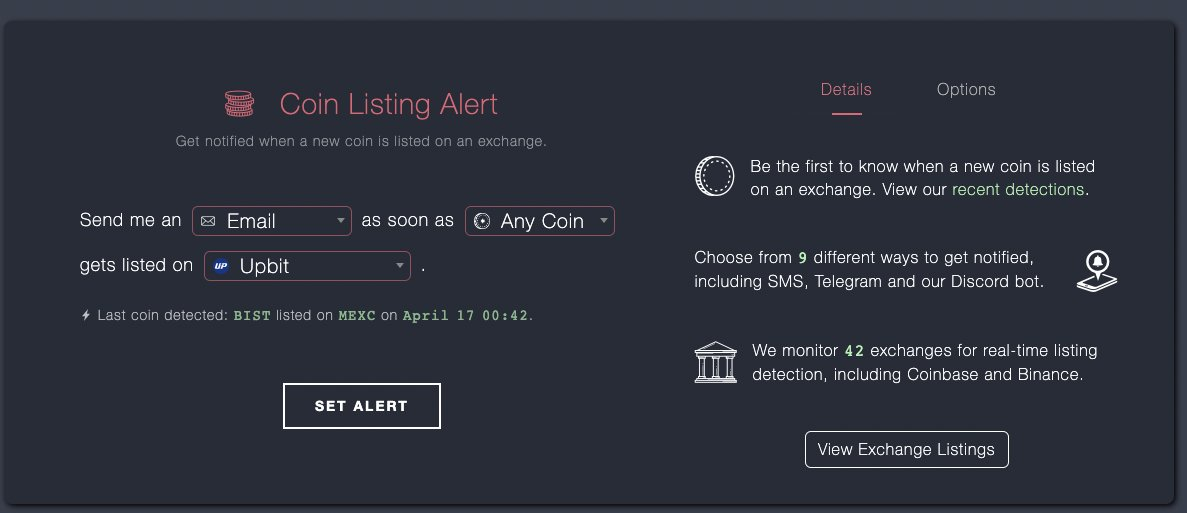

1. Monitor newly listed cryptocurrencies.

You can use websites like Crypto Exchange Listing Bot to send you alerts whenever a new cryptocurrency is listed on Upbit. This may help you catch "listing pumps."

Project Twitter: https://twitter.com/crypto_alerting

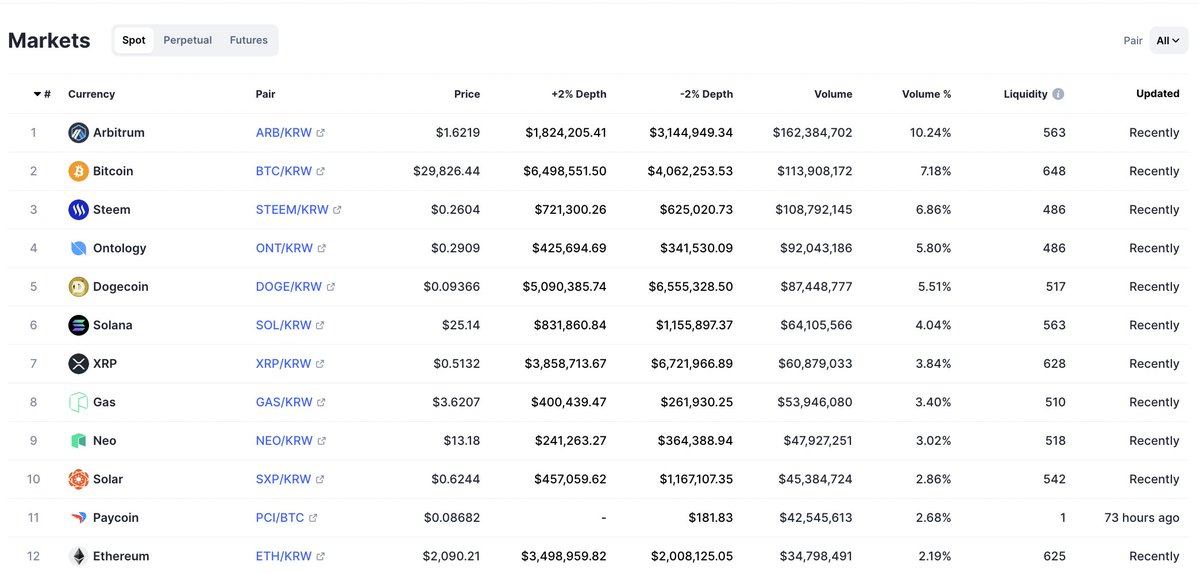

2. Use CoinMarketCap to monitor trading pair volumes.

This dashboard allows you to view the top cryptocurrencies by trading volume, along with other relevant metrics. It's useful for identifying which trading pairs are currently "hot."

Project Twitter: https://twitter.com/CoinMarketCap

3. Go further by using bots to automatically detect abnormal volume spikes.

These can serve as signals for deeper research. I use the Unusual Upbit Volume Bot, which compares Upbit data with corresponding Binance data.

On April 13, the bot detected a 102.9% increase in $ARB volume on Upbit. Later that day, $ARB began rising by 40%.

Project Twitter: https://twitter.com/UnusualUpbitVol

However, I don’t immediately go long just because volume spikes. I treat increased volume as a signal to conduct further research into the token and determine the drivers behind the price movement. I ask myself:

• Is this token being driven by the Korean community?

• Has the volume increase been sustained over a significant period?

• Are there other factors influencing the price move?

• What does the price chart look like? (Very important)

4. Look for cryptocurrencies with low circulating supply and high FDV.

A low circulating supply means that increases in trading volume can have a larger impact on price. Both $APT and $ARB were examples of this scenario, which partly explains their explosive rallies (especially the former).

As the South Korean market grows rapidly, keeping an eye on its developments makes sense. Of course, I also closely monitor other Asian markets such as Hong Kong and Japan. With regulatory uncertainty in the U.S. and increasing crypto adoption across Asia, we may be witnessing an interesting shift in market dynamics.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News