InfoFi's Light and Shadow: An Ecosystem Overview, Where Lies the Breakthrough Path?

TechFlow Selected TechFlow Selected

InfoFi's Light and Shadow: An Ecosystem Overview, Where Lies the Breakthrough Path?

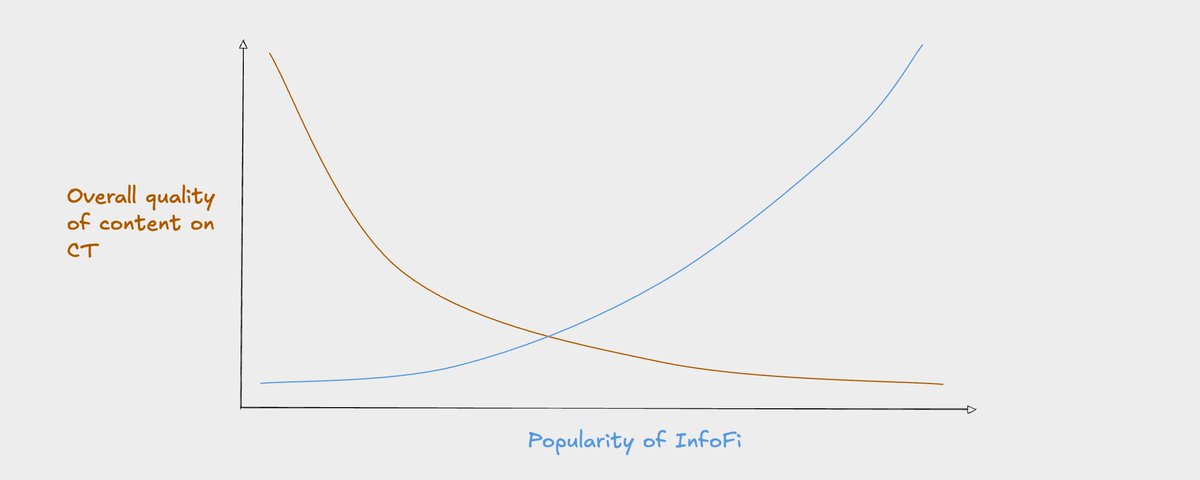

InfoFi Prisoner's Dilemma: The Game Theory Trap Under Matthew Effect-Driven Revenue Distribution, Between Information Mining and Noise Vortex.

Author: KarenZ, Foresight News

In 1971, psychologist and economist Herbert A. Simon first proposed the theory of attention economy, pointing out that in an information-overloaded world, human attention has become the scarcest resource.

Economist and USV managing partner Albert Wenger further reveals a fundamental shift in *The World After Capital*: human civilization is undergoing its third leap — from the "scarcity of capital" in the industrial era to the "scarcity of attention" in the knowledge age.

-

Agricultural Revolution: aimed at solving food scarcity, but triggered land competition;

-

Industrial Revolution: addressed land scarcity, shifting focus to resource competition and capital accumulation;

-

Digital Revolution: centers on competing for attention.

This transformation is driven by two key characteristics of digital technology: zero marginal cost of information replication and dissemination, and the universality of AI computing—while human attention remains non-replicable.

Whether it's Labubu's popularity in the designer toy market or top streamers' live commerce, both are essentially battles for users’ and viewers’ attention. However, in traditional attention economies, users, fans, and consumers act as "data fuel" contributing attention, while excessive profits are monopolized by platforms and scalpers. InfoFi in the Web3 world attempts to disrupt this model—by leveraging blockchain, token incentives, and AI technologies to make the production, distribution, and consumption of information transparent, aiming to return value to all participants.

This article will dive deep into InfoFi project classifications, challenges faced, and future trends.

What Is InfoFi?

InfoFi is a fusion of Information + Finance. Its core lies in transforming hard-to-quantify, abstract information into dynamic, measurable value carriers—not limited to traditional prediction markets, but also including attention, reputation, on-chain data or intelligence, personal insights, narrative activity, and other forms of information or abstract concepts that can be distributed, speculated upon, or traded.

The core advantages of InfoFi include:

-

Value Redistribution Mechanism: Returns value monopolized by platforms in traditional attention economies back to genuine contributors. Through smart contracts and incentive mechanisms, information creators, distributors, and consumers can share in the generated value.

-

Information Valuation Capability: Transforms abstract elements such as attention, insights, reputation, and narrative activity into tradable digital assets, creating markets for previously illiquid informational value.

-

Low-Barrier Participation: Users can participate in value distribution simply via social media accounts through content creation.

-

Innovative Incentive Mechanisms: Rewards not only content creation but also dissemination, interaction, verification, and more, enabling niche content and long-tail users to earn rewards. High-quality content receives greater compensation, encouraging continuous high-value output.

-

Cross-Domain Application Potential: For example, integrating AI offers benefits like content quality assessment and optimized prediction markets.

InfoFi Classifications

InfoFi encompasses various application scenarios and models, primarily categorized as follows:

Prediction Markets

Prediction markets are a core component of InfoFi—a mechanism leveraging collective wisdom to forecast outcomes of future events. Participants buy and sell "shares" tied to specific event outcomes to express expectations about future developments (e.g., elections, policy results, sports events, economic forecasts, price expectations, product launch timelines). Market prices reflect the crowd’s aggregated expectations. Polymarket is a representative application promoting the InfoFi concept.

Vitalik has long been a staunch supporter of prediction markets like Polymarket. In his November 2024 article “From Prediction Markets to Info Finance,” he stated: “Prediction markets have the potential to create better applications across social media, science, journalism, governance, and other fields. I call these types of markets info finance.” Vitalik also highlighted Polymarket’s dual nature: one side functions as a gambling site for participants; the other serves as a news platform for everyone else.

Within the InfoFi framework, prediction markets go beyond mere speculation—they serve as platforms to uncover and reveal truthful information through financial incentives. This mechanism leverages market efficiency, rewarding accurate predictions with economic gains and penalizing incorrect ones with losses. Elon Musk himself retweeted Polymarket data a month before the 2024 U.S. election showing Trump leading with 51% support, commenting: “Because real money is involved, this data is more accurate than traditional polls.”

Representative prediction market platforms include:

-

Polymarket: The largest decentralized prediction market, built on the Polygon network using USDC as the trading medium. Users can predict outcomes related to political elections, economics, entertainment, product launches, and more.

-

Kalshi: A fully CFTC-regulated prediction market platform in the United States. By partnering with Zero Hash, a crypto and stablecoin infrastructure provider, Kalshi accepts deposits in USDC, BTC, WLD, SOL, XRP, and RLUSD, though settlements occur in fiat currency. Kalshi focuses on Event Contracts, allowing users to trade outcomes of political, economic, and financial events. Its regulatory compliance gives Kalshi a unique advantage in the U.S. market.

Yap-to-Earn (Mouth-Farming) InfoFi

"Mouth-farming" ("嘴撸") is a playful term coined by Chinese crypto communities for Yap-to-Earn—earning rewards by sharing opinions and content. The core idea behind Yap-to-Earn is incentivizing users to post high-quality, crypto-related content or comments on social platforms. Most projects use AI algorithms to assess content volume, quality, engagement, and depth to distribute points or tokens. Unlike traditional on-chain activities (e.g., trading or staking), this model emphasizes users’ informational contributions and influence within communities.

Key features of Yap-to-Earn:

-

No need for on-chain transactions or large capital—just an X account is sufficient.

-

Rewards valuable discussions, boosting community activity around projects.

-

AI algorithms reduce human bias, filter bots and low-quality content, ensuring fairer reward distribution.

-

Points may convert into token airdrops or ecosystem privileges, offering early adopters potentially higher returns.

Mainstream Yap-to-Earn or Yap-supporting projects include:

Kaito AI: A leading Yap-to-Earn platform that partners with multiple projects. Using AI algorithms, Kaito evaluates the quantity, quality, engagement, and depth of users’ crypto-related posts on X, awarding Yap points used in leaderboards to compete for token airdrops.

Thus, creators can prove their influence and content value through Yaps, attracting targeted, high-quality followers; regular users can efficiently discover quality content and KOLs via the Yap system; meanwhile, projects achieve precise outreach and enhanced brand visibility—creating a virtuous, win-win ecosystem.

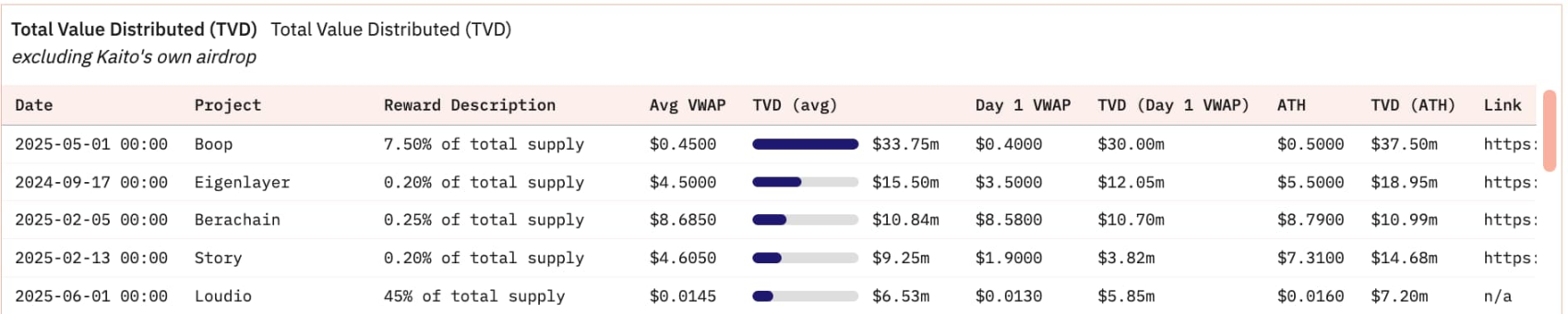

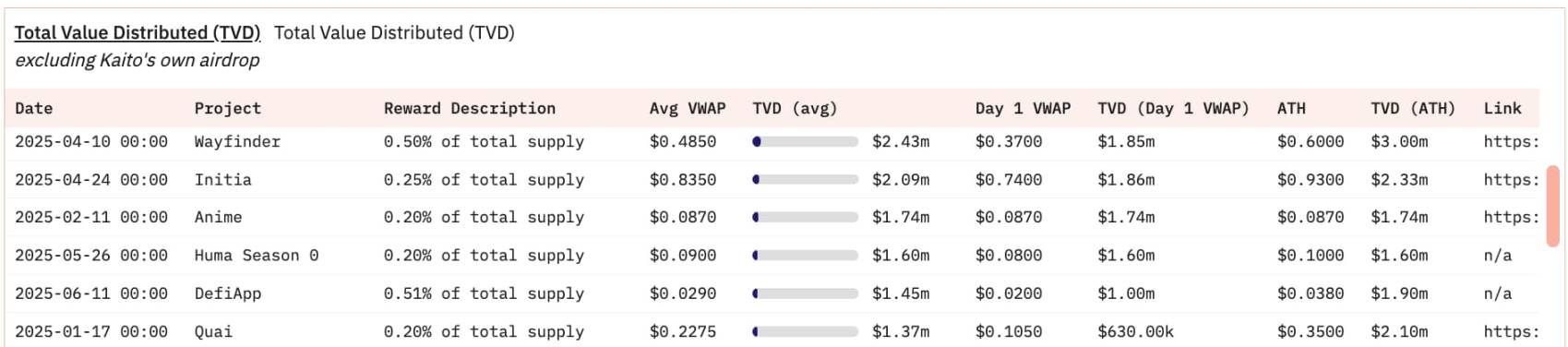

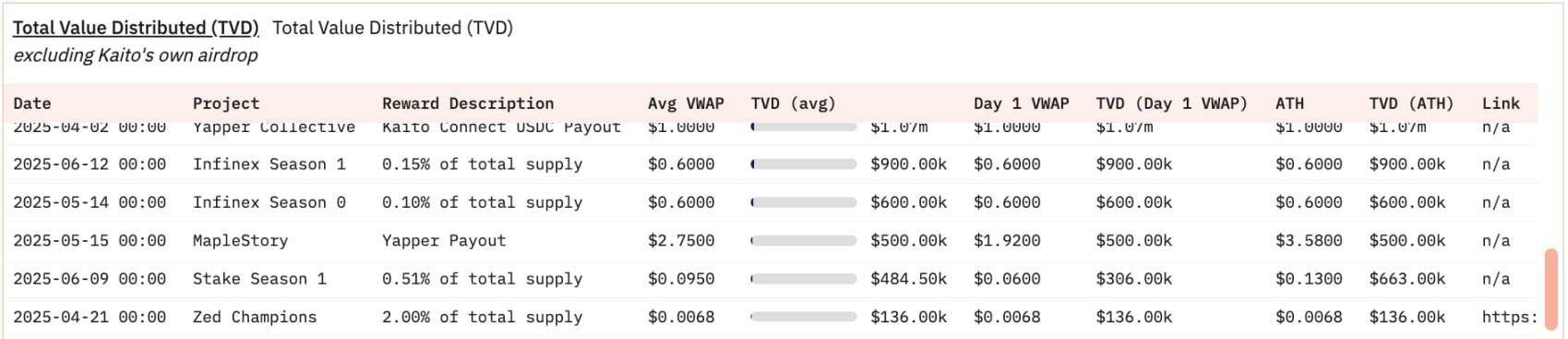

Kaito AI has distributed over $90 million worth of tokens to various communities (excluding Kaito’s own airdrop), with over 200,000 active Yappers monthly.

Source: https://dune.com/queries/5088750/8397899

Cookie.fun: Cookie tracks AI agents’ mindshare, engagement, and on-chain data to generate comprehensive market overviews, and monitors mindshare and sentiment toward crypto projects. Cookie Snaps includes a built-in rewards and airdrop system, rewarding creators who contribute attention to featured projects.

Cookie has collaborated with three projects on Snaps campaigns: Spark, Sapien, and OpenLedger. The Spark campaign attracted over 16,000 participants, while the latter two had 7,930 and 6,810 participants respectively.

Virtuals: While Virtuals itself isn't focused solely on Yap-to-Earn, it is an AI agent launchpad. In mid-April, it launched a new Genesis Launch mechanism on Base, where one way to earn allocation points involves Yap-to-Earn (powered by Kaito).

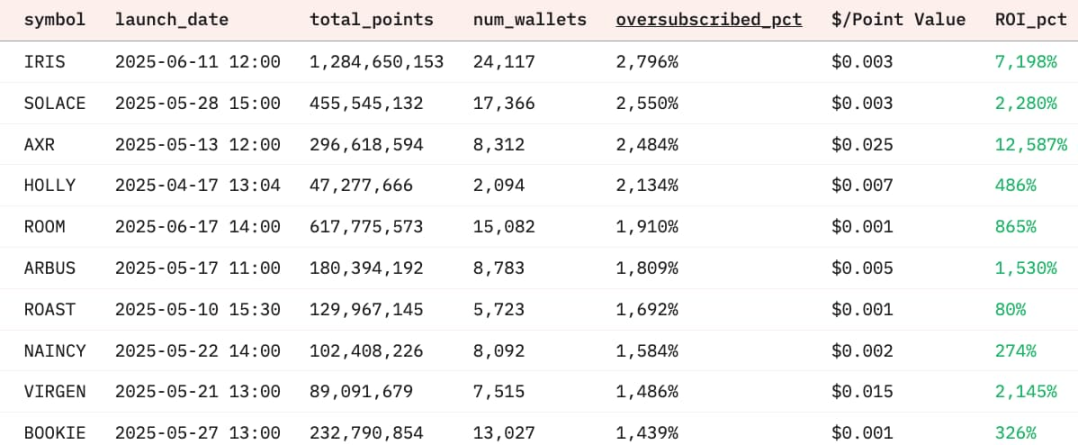

Top AI agent projects on Virtuals with high subscription rates. Source: https://dune.com/queries/5195678/8548951

Loud: As an “attention value experiment” within the Kaito AI ecosystem, Loud captured over 70% of Kaito’s attention leaderboard prior to its token launch via Initial Attention Offering (IAO) in late May 2025. LOUD’s mechanism revolves around the attention economy—post-launch transaction fees are primarily distributed in SOL to the top 25 users on the attention leaderboard.

Wallchain Quacks: Wallchain is a programmatic AttentionFi project based on Solana, backed by AllianceDAO. Wallchain X Score measures overall user influence, while Wallchain Quacks rewards high-quality content and meaningful interactions. Currently, Wallchain uses a custom LLM to evaluate creator content daily, rewarding insightful and valuable content with Quacks.

Yap-to-Earn + Tasks / On-Chain Activity / Verification: Multidimensional Contribution Valuation

Some projects combine content contribution with on-chain actions (e.g., trading, staking, NFT minting) or tasks to holistically assess multidimensional user contributions.

Galxe Starboard: Galxe is a Web3 growth platform. Its newly launched Galxe Starboard aims to reward authentic contributions both off-chain and on-chain. Projects can define multiple contribution layers—what matters isn’t just how many tweets were posted, but the overall value delivered, including post engagement, sentiment, virality, dApp interaction, token holding, NFT minting, or completing on-chain tasks.

Mirra: Mirra is a decentralized AI model trained on community-curated data, capable of learning from real-time contributions by Web3 users. Specifically, creators publish high-quality content on X, effectively submitting validation data for AI training; scouts identify valuable content on X and tag @MirraTerminal in replies to submit insights, guiding which content the AI learns from and shaping intelligent AI development.

Reputation-Based InfoFi

Ethos: A blockchain-based reputation protocol that relies entirely on open protocols and on-chain records, combined with Social Proof-of-Stake (Social PoS), generating credibility scores through decentralized mechanisms to ensure reliability, decentralization, and Sybil resistance. Ethos currently operates under a strict invitation-only model. Its core function is generating a Credibility Score—an index quantifying a user’s on-chain trustworthiness—based on activities such as comment systems (with cumulative utility) and endorsement mechanisms (staking ETH to vouch for others).

Ethos also launched a reputation market, allowing users to speculate on the reputation of individuals, companies, DAOs, or even AI entities by buying and selling “trust votes” and “distrust votes”—effectively going long or short on reputation.

GiveRep: Primarily built on Sui, GiveRep aims to transform users’ social influence and community participation on X into quantifiable on-chain reputation, incentivizing user engagement. Commenting on a creator’s post and mentioning @GiveRep official Twitter earns both commenter and creator one reputation point. To prevent abuse, GiveRep limits each user to three such mentions per day (inclusive), while creators can receive unlimited points. Mentions from Sui ecosystem projects and ambassadors earn extra points.

Attention Markets / Predictions

Noise: A trend discovery and trading platform built on MegaETH, currently accessible only via invite code. Users can go long or short on a project’s attention level.

Upside: A social prediction market (backed by investors including Arthur Hayes) that rewards discovering, sharing, and predicting valuable content and links. It creates dynamic markets via upvotes, with revenue shared proportionally among voters, creators, and curators. To prevent manipulation of prediction pools, vote weight decreases during the final five minutes of each round.

YAPYO: An attention market infrastructure in the Arbitrum ecosystem. YAPYO states that rewards within its coordination mechanism are not just income—they represent lasting influence.

Trends: Allows X posts to be tokenized as trends on a bonding curve (“Trend it”). Creators qualify for 20% of the trading fees generated from each trend’s bonding curve.

Token-Gated Content Access: Filtering Noise

Backroom: Enables creators to launch tokenized spaces offering curated content such as market insights, alpha, and analysis—no management required and no social pressure. Users unlock low-noise, high-value information by purchasing on-chain Keys tied to each creator’s space. Keys aren’t merely access passes—they’re tradable assets with dynamically priced demand-driven curves. Meanwhile, AI processes chat data and signals into actionable insights.

Xeet: A new protocol on the Abstract network, not yet fully launched, but already running a referral program that rewards KOLs with points. Xeet founder @Pons_ETH mocked that InfoFi has devolved into NoiseFi, stating, “It’s time to reduce noise and amplify signals.” Publicly known so far is that Xeet will integrate Ethos scores; beyond that, no further details have been disclosed.

Data Intelligence InfoFi

Arkham Intel Exchange: Arkham is a chain intelligence tool, intelligence trading platform, and exchange. Arkham Intel Exchange is a decentralized intelligence marketplace where “on-chain detectives” can earn bounties.

Challenges Facing InfoFi

Prediction Markets

-

Regulation and Compliance: Prediction markets may be viewed as binary options or gambling-like instruments, facing regulatory scrutiny. For instance, Polymarket was deemed illegally operating in the U.S. by the CFTC for failing to register as a Designated Contract Market (DCM) or Swap Execution Facility (SEF), resulting in a $1.4 million fine in 2022 and mandatory blocking of U.S. users. Investigations by the U.S. Department of Justice and FBI in 2024 further highlight ongoing regulatory challenges.

-

Insider Trading and Fairness: Markets may be distorted by insider information. Large capital holders could temporarily manipulate prices. Designing fair rules and mechanisms remains a critical challenge for InfoFi prediction markets.

-

Liquidity and Participation: The effectiveness of prediction markets depends on sufficient participants and liquidity. Niche topics often face the “long-tail liquidity problem,” where insufficient participation leads to unreliable market signals. AI agents may partially alleviate this, but further optimization is needed.

-

Oracle Design: Polymarket suffered an oracle manipulation attack, causing significant losses for users who bet correctly. In February 2025, UMA, Polymarket, and EigenLayer announced collaboration on building a prediction market oracle. Research directions include developing oracles supporting multiple dispute-resolution tokens, with additional features under exploration such as dynamic bonding, AI agent integration, and enhanced security against bribery attacks.

Yap-to-Earn

-

Increased information noise and proliferation of AI-generated ad accounts, drowning out authentic signals. Users struggle to extract value from vast content volumes, eroding community trust and reducing marketing efficacy for projects. According to KOL CryptoBrave (@cryptobraveHQ): “Several project founders have complained—paying $150K in service fees to run on Kaito, allocating 0.5%-1% of tokens for KOL mouth-farming—only to find most participants are AI-generated ad accounts. They want top-tier KOLs and ICTs involved, so they pay extra, then Kaito contacts them separately.”

-

Most Yap-to-Earn projects lack public explanations of their algorithms for evaluating content quality, engagement, and depth, raising concerns about fairness in point distribution. If algorithms favor certain accounts (e.g., influencers or coordinated networks), high-quality creators may leave. Kaito recently upgraded its algorithm based on community feedback, prioritizing quality over quantity by default, excluding posts lacking project insights or commentary from attention rewards, and strengthening defenses against interaction manipulation and coordinated inflation.

-

Matthew Effect in Reward Distribution: Typically, projects and KOLs benefit mutually, but long-tail creators and retail interactors still face low earnings and fierce competition. Kaito founder Yu Hu noted on June 8: “Of roughly 1 million registered users on Kaito, fewer than 30,000 have ever earned yaps—less than 3%. The next phase of network growth is maximizing conversion rates.” Poor airdrop expectation management can lead to community dissatisfaction. Magic Newton was a relatively successful Yap-to-Earn case on Kaito AI—the Kaito ecosystem recommended one-third of all Newton-verified agents, leaving mouth-farmers highly rewarded—but still faced criticism for being unfriendly to retail users. In contrast, Humanity was directly accused by the community of “betraying users” and “extreme anti-farming,” sparking a crisis of trust due to imbalanced distributions.

-

While Yap activities attract initial engagement, attention drops sharply after rewards are distributed, lacking sustainability. LOUD reached a market cap close to $30 million on its launch day, but now stands below $600,000.

-

Attention does not equal market share.

Reputation

-

Reputation-based InfoFi projects like Ethos use invitation-only models to maintain user quality and resist Sybil attacks. However, this raises entry barriers, limiting new user onboarding and hindering broad network effects.

-

Risk of malicious manipulation.

-

Interoperability issues in reputation scoring—different protocols’ scoring systems cannot easily communicate, creating information silos.

InfoFi Trends

Prediction Markets

-

Integration of AI and Prediction Markets: AI can significantly enhance market efficiency—for example, analyzing massive datasets to deliver more accurate predictions in complex scenarios, or deploying AI agents to address long-tail problems.

-

Convergence of Social Media and Prediction Markets: Prediction markets could become core infrastructure for the future information economy. On June 6, X officially announced a partnership with Polymarket, naming it the official prediction market partner. Polymarket CEO Shayne Coplan said: “Combining Polymarket’s accurate, impartial, real-time prediction probabilities with Grok’s analytics and X’s real-time insights will instantly provide contextual, data-driven understanding to millions of global users.”

-

Decentralized Governance: Prediction markets can apply to DAOs, corporations, or even societal governance—known as “Futarchy.” Proposed by economist Robin Hanson and supported by Vitalik since 2014, Futarchy’s core principle is “vote on values, bet on beliefs.” It works as follows: communities vote to define success metrics (e.g., GDP, stock price); for specific policy proposals, two prediction markets are created (e.g., pass vs. reject). Participants trade these tokens, with prices reflecting market expectations on whether the policy improves the target metric; the option with the higher average price is adopted, and token payouts settle based on actual outcomes. Advantages include reliance on data rather than propaganda, charisma, or marketing.

-

Content and news tools for everyone.

Yap-to-Earn + Reputation-Based InfoFi

-

Integrate social graphs and semantic understanding technologies to improve AI accuracy in assessing content value, ultimately favoring high-quality content.

-

Incentivize high-performing long-tail creators.

-

Add slashing or penalty mechanisms.

-

Launch Web3-native InfoFi LLMs.

-

Multidimensional evaluation of contributions.

-

Combine reputation-based InfoFi with DeFi—use reputation scores as credit basis for lending and staking.

-

Tokenization of abstract assets like attention, reputation, and trends will spawn new derivative types.

-

Expand beyond just the X social platform.

-

Integrate with more social platforms and news media to build universal tools for attention and alpha discovery.

Data Intelligence InfoFi

-

Combine data analytics charts with creator insights, adding incentives for creation and distribution.

-

Integrate data analytics charts with AI analysis.

Summary

The core conflict in the digital age is the disconnect between those who create attention and those who capture its value. This very gap is the driving force behind the Web3 InfoFi revolution.

The central contradiction in Yap-to-Earn lies in balancing information value with participation incentives—if unaddressed, it risks repeating SocialFi’s trajectory of “high start, low finish.” The key to InfoFi is establishing a balanced “trinity” mechanism—information discovery, user engagement, and value redistribution—to drive a better infrastructure for knowledge sharing and collective decision-making. This requires not only technical implementation of attention quantification but also mechanism design ensuring ordinary participants receive fair returns from information dissemination, avoiding severe skew in value distribution.

More importantly, the InfoFi revolution requires both top-down and bottom-up momentum to truly realize a fair and efficient attention economy. Otherwise, the Matthew effect in收益 pyramids will turn InfoFi into a gold rush for a few, betraying its original mission of democratizing attention value.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News