Kaito Founder: Riding the InfoFi Wave to Build a Fair Value Network

TechFlow Selected TechFlow Selected

Kaito Founder: Riding the InfoFi Wave to Build a Fair Value Network

The true value of attention depends on multidimensional variables such as user retention rate, strength of consensus, underlying product capabilities, and content quality.

Author: Yu Hu, Founder of Kaito

Translation: Saoirse, Foresight News

In the past few days, I’ve seen extensive discussions about the value of attention—whether in crypto or beyond—and whether it truly matters. Here are my thoughts, and where Kaito fits into this landscape:

Can Attention Drive Value?

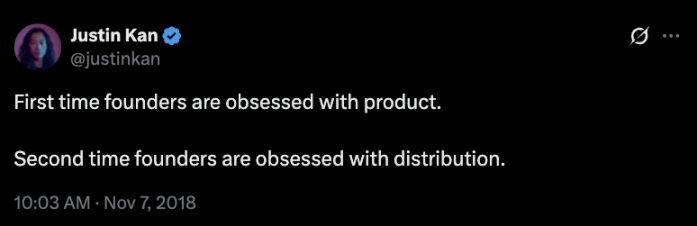

"First-time founders obsess over product; second-time founders obsess over distribution." — Justin Kan, Co-founder of Twitch

In modern consumer products, distribution is deeply tied to attention—measured by screen time or share of voice in the market.

The core value of attention extends far beyond crypto. There are countless examples where superior products underperform in adoption due to weak distribution, while mediocre ones thrive simply because they capture more attention.

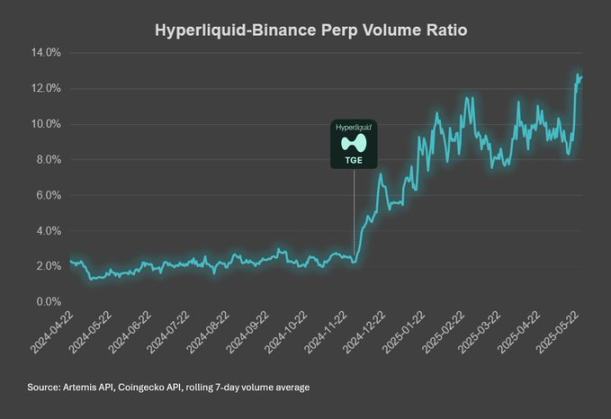

In crypto, even leading projects can accelerate growth significantly with strong attention—Hyperliquid’s explosive market share increase post-TGE is a prime example.

If Attention Drives Value, Can It Also Influence Valuation?

1. Non-Meme Projects: My analytical framework follows an indirect transmission chain (Note: liquidity purchases refer to buying assets that are easily tradable and liquid, such as cryptocurrencies):

-

Attention → User Adoption → Strengthened Fundamentals → Potential Liquidity Purchases

-

Attention → Investor Education → Potential Liquidity Purchases

This mirrors how traditional public companies operate:

-

Marketing teams focus on traffic acquisition → driving user conversion

-

Investor Relations (IR) teams focus on investor education

In crypto, attention holds even greater significance for two key reasons:

-

Users are often also token holders, enabling a dual conversion loop;

-

Speculative demand creates an “attention premium” effect.

2. Meme Coin Valuation: Traditional conversion chains break down here. Valuation logic simplifies to:

Attention × Narrative (Fundamentals × Multiplier Effect)

-

With equal attention, differences in narrative lead to valuation divergence;

-

Within the same narrative category, attention becomes the core competitive edge.

I won’t dive into specific launch projects, but in short: attention is critical—but not all attention is equally valuable.

The Significance of Attention Building for Projects Pre- and Post-TGE

Pre-TGE:

Given the typically high incentives at TGE, the unit value of attention lies in:

-

Distributing brand exposure and education to convert as many airdrop recipients as possible into genuine users;

-

Communicating investment theses to as many potential investors as possible.

Post-TGE:

-

Attention building delivers the highest value during new product launches and emerging narrative scenarios;

-

Top projects commonly adopt continuous attention management strategies—this is essential both for user lifecycle management and capital market relationship maintenance.

How Kaito Builds an Ecosystem of Attention Value

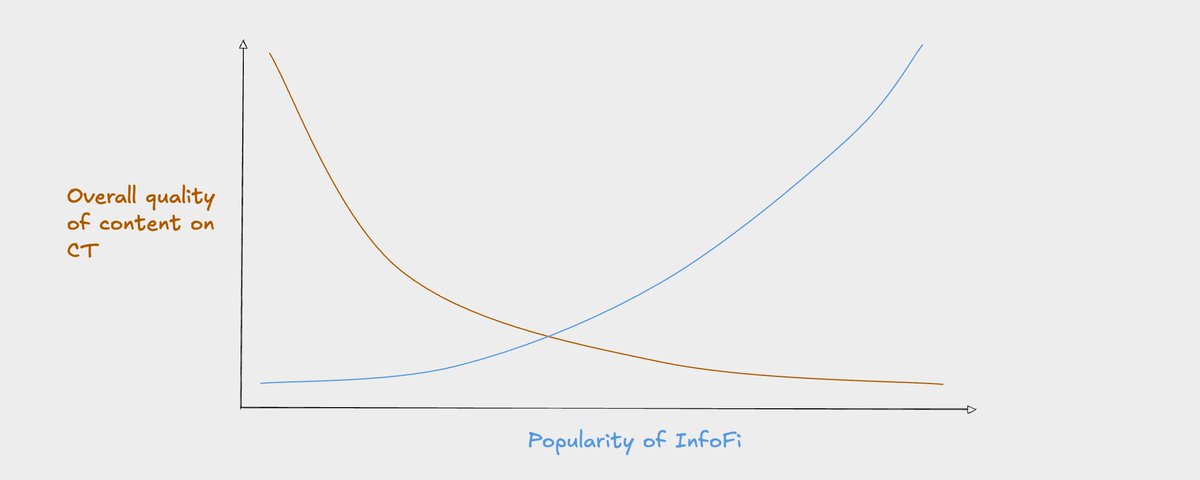

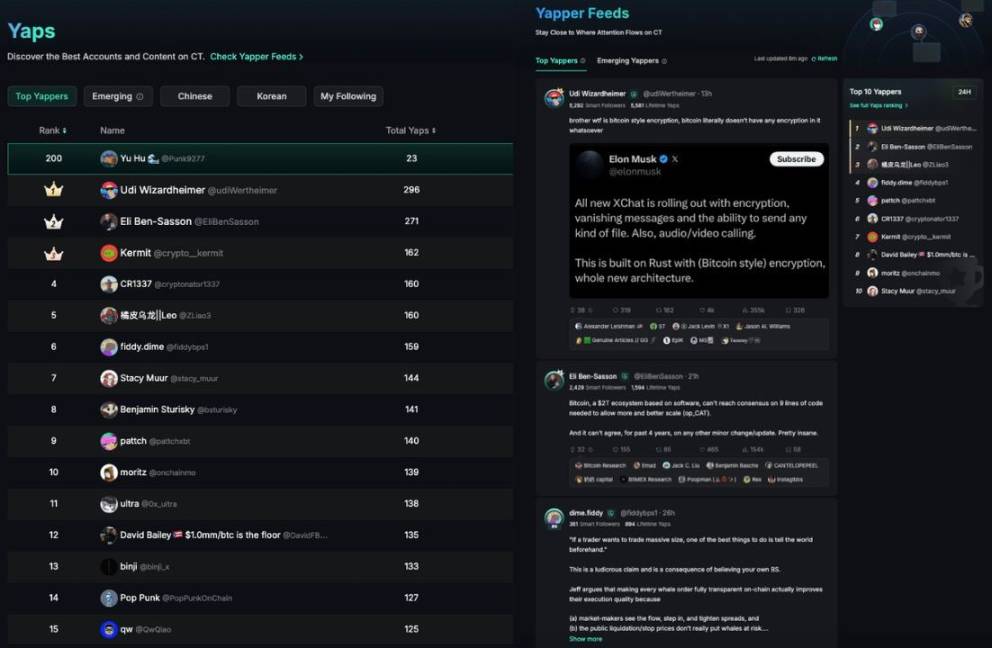

Some question whether Yaps might encourage noise or low-quality content, but real-time rankings tell a different story: Yaps consistently favors high-quality discussions. For instance, the top three trending posts over the last 24 hours (from the time of writing) include:

-

@udiWertheimer sparked a deep discussion on Musk’s crypto-related statements;

-

@EliBenSasson criticized Bitcoin’s inability to implement the OP_CAT function;

-

@fiddybps1 challenged Jeff.hl’s claim that “Hyperliquid’s transparent trading benefits crypto whales.”

Notably, each project’s Yapper leaderboard has its own customizable weighting mechanism—reward rules can be tailored based on insightfulness, emotional resonance, and other dimensions.

The key variable in attention value lies in differentiation of content creators and content formats.

-

Some projects prioritize maximizing brand visibility—Loudio’s operational strategy is a case in point—meaning their algorithms place less emphasis on content quality and depth;

-

In contrast, others focus on cultivating focused, in-depth discussions, especially around specific products. Infinex is a representative example of this model.

Kaito’s core value is providing customized solutions for diverse strategies, while using content curation to enhance user education and brand recognition—users can quickly build a mental map of a brand based on the type of content it incentivizes.

Kaito’s Attention-to-Value Conversion System

Kaito’s scope extends beyond attention generation. Beyond Yaps, we have built:

-

User Conversion: Bridging attention to real users via Kaito Earn;

-

Capital Formation: The Capital Launchpad will soon enable AI-driven fundraising matching;

-

Market Building: More innovative use cases coming soon.

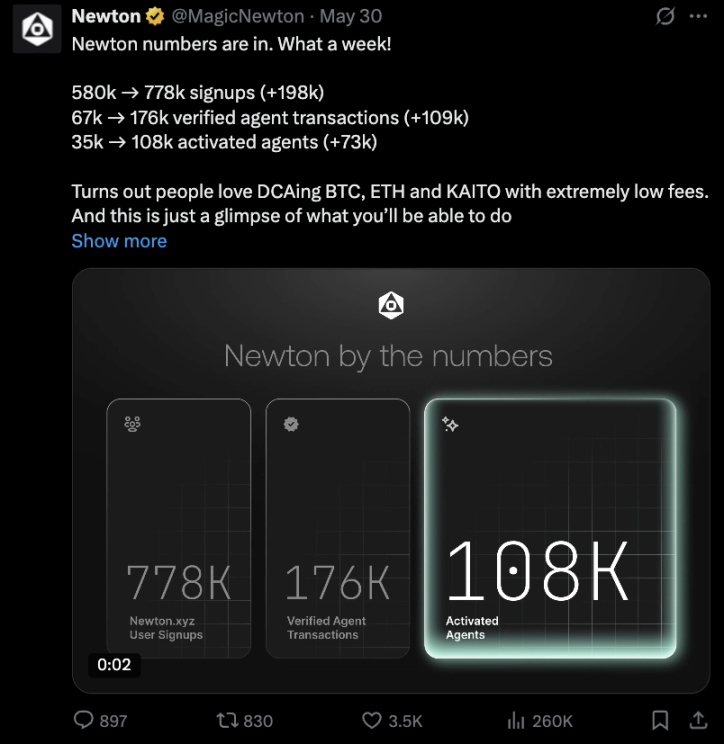

Since the launch of Kaito Earn in May, Kaito has deeply entered the user conversion space, leveraging our high-quality, highly engaged user base. Last week’s data shows Kaito activated 33,699 active agents whose trading volume accounted for approximately one-third of Newton’s total platform volume. These agents are actively investing, consistently dollar-cost averaging into assets like Bitcoin and KAITO, generating real transaction fees.

We’ve also launched similar collaboration programs with projects like Infinex.

With the upcoming launch of Capital Launchpad, Kaito will leverage AI analytics to fill technological gaps in capital formation, optimizing for long-term value alignment, value-add efficiency, and coverage breadth.

In terms of vertical expansion, Kaito is moving beyond the X ecosystem, breaking down industry information silos—stay tuned for more innovations.

Conclusion

In an era of attention scarcity, its intrinsic value no longer needs debate.

A deeper insight is that the true value of attention depends on multidimensional variables: user retention rate, strength of consensus, underlying product quality, and content standards. Industry trends are now clear:

-

Opinion leaders who control attention gateways will dominate commercial monetization;

-

Tech platforms capturing screen time will monopolize distribution channels and data assets.

This is precisely why brands (and founders) must establish a social presence. Rather than resist this global trend, our industry is uniquely positioned to build a fairer, more empowering network for everyone.

This is the foundational logic behind why brands (and entrepreneurs) must cultivate a social footprint. Instead of resisting this global shift, we should harness industry innovation to build a more equitable value network.

This is the vision of InfoFi: unlocking mass monetization potential by empowering three core pillars:

-

Data sovereignty and value extraction;

-

Markets as the most authentic measure of value;

-

Information markets as democratized platforms for expressing market views.

Let’s keep pushing boundaries.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News