Huobi Growth Academy | InfoFi In-Depth Research Report: The Attention Finance Experiment in the AI Era

TechFlow Selected TechFlow Selected

Huobi Growth Academy | InfoFi In-Depth Research Report: The Attention Finance Experiment in the AI Era

The revolution is not yet complete; optimism in InfoFi must remain cautious.

1. Introduction: From Information Scarcity to Attention Scarcity, InfoFi Emerges

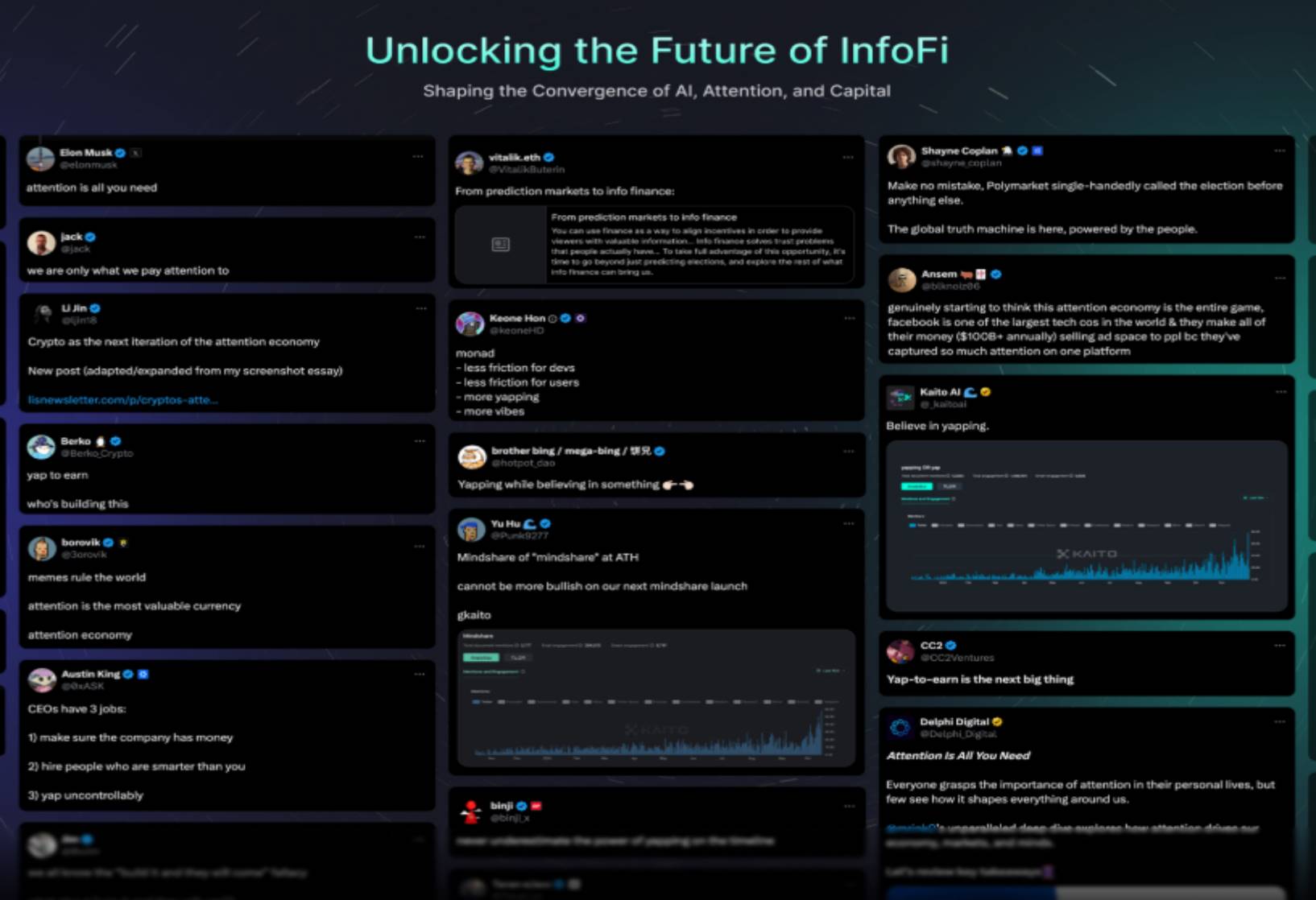

The information revolution of the 20th century brought explosive knowledge growth to human society, but also triggered a paradox: when accessing information incurs almost no cost, what becomes truly scarce is no longer the information itself, but our cognitive resources—attention—used to process it. As Nobel laureate Herbert Simon first proposed in 1971 with his concept of the "attention economy," "information overload leads to attention poverty," a condition modern society is deeply immersed in. Faced with relentless content flooding in from Weibo, X, YouTube, short videos, and news feeds, human cognitive boundaries are being continuously strained, making filtering, judgment, and valuation increasingly difficult.

This scarcity of attention has evolved in the digital age into a fierce battle for resources. In traditional Web2 models, platforms tightly control traffic gateways through algorithmic distribution, while the true creators of attention—users, content creators, and community advocates—are often reduced to "free fuel" within the platform’s profit logic. Dominant platforms and capital stakeholders repeatedly harvest value along the attention monetization chain, while ordinary individuals who drive information production and dissemination struggle to participate in value sharing. This structural divide has become a core contradiction in the evolution of digital civilization.

The rise of Information Financialization (InfoFi) occurs precisely against this backdrop. It is not an isolated new concept, but a foundational paradigm shift built on blockchain, token incentives, and AI empowerment, aiming to "redefine the value of attention." InfoFi seeks to transform unstructured cognitive behaviors—such as user opinions, information, reputation, social interactions, and trend discovery—into quantifiable, tradable asset forms. Through decentralized incentive mechanisms, every participant in the information ecosystem who creates, spreads, or evaluates information can share in the resulting value. This is not merely technological innovation, but an attempt at redistributing power over "who owns attention and who controls information."

Within the narrative framework of Web3, InfoFi serves as a critical bridge connecting social networks, content creation, market dynamics, and AI intelligence. It inherits DeFi's financial mechanism design, SocialFi’s social drivers, and GameFi’s incentive structures, while integrating AI capabilities in semantic analysis, signal recognition, and trend forecasting to build a novel market structure centered on the "financialization of cognitive resources." Its core is not simply content distribution or likes and tips, but an entire logic of value discovery and redistribution revolving around "information → trust → investment → return."

From agrarian societies where "land" was the scarce resource, to industrial eras driven by "capital," to today’s digital civilization where "attention" has become the core productive asset, humanity's focal point of value is undergoing a profound shift. InfoFi is the concrete expression of this macro-level paradigm transition within the on-chain world. It is not just a new frontier in crypto markets, but potentially the starting point for deep restructuring of governance models, intellectual property logic, and financial pricing mechanisms in the digital world.

Yet no paradigm shift is linear; all inevitably involve bubbles, hype, misunderstanding, and instability. Whether InfoFi can become a genuine user-centric attention revolution depends on whether it can achieve a dynamic balance among incentive design, value capture logic, and real demand. Otherwise, it risks becoming yet another illusion sliding from "inclusive narratives" back into "centralized harvesting."

2. The InfoFi Ecosystem: A Ternary Intersection of "Information × Finance × AI"

At its core, InfoFi constructs a complex market system embedded with financial logic, semantic computation, and game-theoretic mechanisms—a response to today’s network environment characterized by information overflow and elusive value capture. Its ecosystem architecture is not a single-dimensional "content platform" or "financial protocol," but rather the convergence point of three elements: information value discovery mechanisms, behavioral incentive systems, and intelligent distribution engines—forming a full-stack ecosystem integrating information trading, attention incentives, reputation scoring, and intelligent prediction.

At the foundational level, InfoFi represents an attempt to "financialize" information—transforming previously unpriced cognitive activities like content, opinions, trend judgments, and social interactions into measurable, tradable "quasi-assets" endowed with market prices. By introducing finance, information ceases to be fragmented, isolated "content fragments" during production, circulation, and consumption, instead becoming "cognitive products" possessing speculative attributes and value accumulation potential. This means a comment, a prediction, or a trend analysis may simultaneously express individual cognition and function as a speculative asset with risk exposure and future payoff rights. The popularity of prediction markets such as Polymarket and Kalshi exemplifies this logic applied to public discourse and market expectations.

However, financial mechanisms alone are insufficient to resolve the noise overload and adverse selection ("bad money drives out good") caused by information explosion. Thus, AI becomes the second pillar of InfoFi. AI plays two key roles: first, semantic filtering, acting as the "first line of defense" between signal and noise; second, behavior identification—modeling multidimensional data such as users’ social network behaviors, content interaction trajectories, and originality of views—to enable precise evaluation of information sources. Platforms like Kaito AI, Mirra, and Wallchain are typical examples that introduce AI into content assessment and user profiling, serving as algorithmic referees in Yap-to-Earn models to determine who receives token rewards and who should be muted or downgraded. In a sense, AI functions in InfoFi similarly to market makers and clearing mechanisms in exchanges—core components ensuring ecological stability and credibility.

Information itself remains the foundation. It is not only the object of trade but also the origin of market sentiment, social connections, and consensus formation. Unlike DeFi, where assets are anchored to on-chain hard assets like USDC or BTC, InfoFi’s underlying assets are more fluid, loosely structured, yet highly time-sensitive "cognitive assets"—opinions, trust, topics, trends, insights. This determines that InfoFi markets do not operate via linear stacking, but rely heavily on dynamic ecosystems built upon social graphs, semantic networks, and psychological expectations. Within this framework, content creators act as "market makers," offering viewpoints for others to assess their "price"; users are "investors," expressing value judgments through likes, shares, bets, and comments, pushing certain information up or down across the network; platforms and AI together serve as "referees + exchanges," ensuring fairness and efficiency throughout the market.

The synergistic operation of this ternary structure gives rise to a series of new species and mechanisms: prediction markets offer clear targets for speculation; Yap-to-Earn encourages knowledge mining and interaction-as-output; reputation protocols like Ethos convert personal on-chain history and social behavior into credit assets; attention markets like Noise and Trends attempt to capture "emotional fluctuations" spreading across chains; and token-gated content platforms like Backroom rebuild paid-information logic through permission economics. Together, they form a multi-layered InfoFi ecosystem encompassing value discovery tools, value distribution mechanisms, multidimensional identity systems, participation thresholds, and anti-Sybil safeguards.

It is precisely within this intersecting structure that InfoFi transcends being merely a market—it evolves into a complex information博弈 system. Using information as the medium of exchange, finance as the incentive engine, and AI as the governance center, its ultimate goal is to build a self-organizing, distributed, and adjustable platform for cognitive collaboration. In some ways, it aims to become a "cognitive financial infrastructure," not only for content distribution, but to provide the entire crypto society with more efficient mechanisms for information discovery and collective decision-making.

Nonetheless, such a system is inherently complex, diverse, and fragile. The subjectivity of information makes unified value assessment impossible; the speculative nature of finance increases risks of manipulation and herd effects; and the black-box nature of AI poses transparency challenges. The InfoFi ecosystem must constantly balance and self-correct amid these three tensions, or else easily slide toward its antithesis—becoming either disguised gambling or an "attention extraction field" under capital dominance.

Building the InfoFi ecosystem is not an isolated effort by any single protocol or platform, but a co-evolution of an entire socio-technical system—a deep exploration by Web3 into governing information rather than just managing assets. It will define how information is priced in the next era and may even construct more open and autonomous cognitive markets.

3. Core Mechanism: Innovation Incentives vs. Extraction Traps

Beneath the surface prosperity of the InfoFi ecosystem lies ultimately a game of incentive design. Whether it involves participation in prediction markets, output from yap-to-earn behaviors, construction of reputation assets, trading of attention, or mining of on-chain data, everything boils down to one central question: Who contributes? Who benefits? Who bears the risk?

From an external perspective, InfoFi appears to be a "relations-of-production revolution" as Web2 transitions to Web3: attempting to break the exploitative chain between "platform–creator–user" in traditional content platforms and returning value to original contributors of information. But internally, this value redistribution is not naturally fair—it rests on a delicate balance of incentives, verification, and博弈 mechanisms. Well-designed, InfoFi could become an innovative experimental ground for shared user gains; imbalanced, it easily devolves into a "retail investor extraction field" dominated by capital and algorithms.

First, we must examine the positive potential of "innovation incentives." The essential innovation across all InfoFi sub-sectors lies in endowing intangible assets—information—that were previously difficult to measure and impossible to financialize—with clear tradability, competitiveness, and settleability. This transformation relies on two key engines: blockchain’s traceability and AI’s assessability.

Prediction markets monetize cognitive consensus via market pricing; yap-to-earn ecosystems turn speech into economic activity; reputation systems create inheritable, pledgeable social capital; attention markets treat trending topics as tradable assets, redefining content value through the logic of "information discovery → signal betting → profit from price differences"; and AI-powered InfoFi applications aim to build a data- and algorithm-driven information finance network through large-scale semantic modeling, signal detection, and on-chain interaction analysis. These mechanisms give information cash-flow-like properties for the first time, turning "saying something, retweeting, endorsing someone" into genuine productive labor.

Yet the stronger the incentives, the greater the temptation for "gaming abuse." The biggest systemic risk facing InfoFi is precisely the distortion of incentive mechanisms and the proliferation of arbitrage chains.

Take Yap-to-Earn: on the surface, it uses AI algorithms to reward the value of user-generated content. But in practice, many projects attract a surge of creators initially, only to quickly fall into an "information fog"—bot armies spamming accounts, VIP insiders gaining early access, project teams manipulating interaction weights. A top-tier KOL bluntly stated: "You can’t even make the leaderboard now unless you farm volume—the AI is trained to detect keywords and chase trends." One project insider revealed: "We invested $150K in a Kaito yap-to-earn campaign, and 70% of the traffic turned out to be AI bots and fake accounts competing internally. Real KOLs didn’t join. We won’t do a second round."

Under opaque point systems and unclear token expectations, many users become "unpaid workers": posting tweets, interacting, logging in, building groups—only to be excluded from airdrops. Such "backstabbing" incentive designs not only damage platform reputations but also risk long-term collapse of the content ecosystem. The contrast between Magic Newton and Humanity is particularly telling: the former had transparent allocation mechanisms during the Kaito yap phase and delivered strong token returns; the latter suffered community trust crises and accusations of "anti-farming" due to unfair distribution and lack of transparency. This structural inequity under the Matthew effect drastically reduces participation enthusiasm among tail-end creators and ordinary users, even giving rise to the ironically named "algorithm-sacrificing yap players."

More importantly, financializing information does not equate to achieving value consensus. In attention or reputation markets, content, people, or trends that are "bought up" are not necessarily signals of lasting value. Without real demand or use-case support, once incentives fade or subsidies stop, these financialized "information assets" often collapse rapidly, creating a Ponzi-like dynamic of "short-term hype, long-term zero." The brief life of project LOUD epitomizes this logic: hitting a $30M market cap on launch day, it plummeted to under $600K just two weeks later—an InfoFi version of "hot potato."

Additionally, if oracle mechanisms in prediction markets lack transparency or fall prey to manipulation by well-funded actors, information pricing distortions easily occur. Polymarket has faced multiple user disputes over "unclear event settlements," and in 2025 experienced a major compensation crisis triggered by a vulnerability in oracle voting. This reminds us that even prediction mechanisms tied to "real-world information" must strike a better balance between technology and博弈.

In the end, whether InfoFi’s incentive mechanisms can transcend the adversarial narrative of "financial capital vs. retail attention" depends on whether they can establish a triple positive feedback loop: information production must be accurately identified → value distribution must be transparently executed → long-tail participants must be genuinely incentivized. This is not merely a technical challenge, but a test of institutional engineering and product philosophy.

In summary, InfoFi’s incentive mechanisms are both its greatest strength and its biggest source of risk. Every incentive design in this market could spark an information revolution—or trigger a collapse of trust. Only when incentive systems evolve beyond mere traffic and airdrop games into foundational structures capable of identifying real signals, rewarding quality contributions, and forming self-sustaining ecosystems can InfoFi truly leap from "hype economy" to "cognitive finance."

4. Analysis of Key Projects and Areas to Watch

The current InfoFi ecosystem exhibits a vibrant, fast-shifting landscape. Different projects have evolved distinct product paradigms and user growth strategies around the core path of "information → incentives → market." Some have already validated their business models, becoming anchor points in the InfoFi narrative; others remain in the proof-of-concept stage, still optimizing mechanisms and educating users. Amid this crowded field, we analyze five representative directions and highlight promising projects worth tracking.

1. Prediction Markets: Polymarket + Upside

Polymarket is one of the most mature and iconic projects in the InfoFi ecosystem. Its core model allows users to collectively price real-world events by buying and selling contract shares denominated in USDC. Vitalik dubbed it the "prototype of information finance" not only because of its clear trading logic and robust financial design, but also because it has begun to function as a media outlet—during the 2024 U.S. election, for instance, Polymarket’s projected outcome probabilities outperformed traditional polls multiple times, sparking discussions and retweets from figures including Elon Musk.

With Polymarket’s official integration with X, its user growth and data visibility have further increased, positioning it as a potential "super hub" merging social discourse with information pricing. However, challenges remain, including regulatory risks (CFTC scrutiny), oracle disputes, and low engagement on niche topics.

In contrast, Upside focuses on socialized prediction and is backed by prominent investors like Arthur Hayes. It attempts to democratize content prediction through a like-and-vote mechanism, allowing creators, readers, and voters to share in revenue. Emphasizing lightweight interaction, low barriers to entry, and de-financialized UX, Upside explores fusion models between InfoFi and content platforms. Its future performance in user retention and content quality maintenance will be crucial to watch.

2. Yap-to-Earn: Kaito AI + LOUD

Kaito AI is one of the most representative platforms in the Yap-to-Earn model and currently the largest in terms of InfoFi users, with over 1 million registered accounts and more than 200,000 active Yappers. Its innovation lies in using AI algorithms to evaluate the quality, engagement, and relevance of users’ posts on X (formerly Twitter), distributing Yaps (points) accordingly, and conducting token airdrops or rewards based on leaderboards and project partnerships.

The Kaito model creates a closed loop: projects incentivize community promotion with tokens, creators compete for attention with content, and the platform maintains order through data and AI models. However, rapid user growth has led to issues like signal pollution, bot proliferation, and controversies over point distribution. Kaito’s founder has recently begun iterating algorithms and optimizing community mechanisms to address these problems.

LOUD, meanwhile, was the first project to conduct an IAO (Initial Attention Offering) based on a Yap-to-Earn leaderboard, capturing 70% of Kaito’s attention prior to launch. While its airdrop strategy generated massive social buzz in the short term, the subsequent crash in token price led the community to label it a "hot-potato-style extraction." LOUD’s rise and fall illustrate that the Yap-to-Earn sector remains in its trial-and-error phase, with mechanisms requiring refinement in maturity and fairness.

3. Reputation Finance: Ethos + GiveRep

Ethos stands as the most systematic and decentralized effort in the reputation finance space. Its core idea is to build a verifiable on-chain "credit score," generating ratings not only from interaction records and comment systems, but also incorporating a "bonding mechanism": users can stake ETH to vouch for others, assuming risk to form a Web3-style trust network.

Another major innovation by Ethos is the introduction of a reputation speculation market, enabling users to "go long or short" on others’ reputations—creating a novel financial instrument where trust becomes tradable. This opens possibilities for integrating reputation scores with lending markets, DAO governance, and social identity verification. However, its invite-only model has slowed user growth, and lowering barriers while enhancing Sybil resistance will be key to future development.

Compared to Ethos, GiveRep is lighter and more community-focused. Its mechanism allows users to rate creators and commenters by mentioning the official account, with daily comment limits. Leveraging X’s active community, it has achieved notable traction on Sui. This model suits lightweight testing of social virality and reputation scoring, and could serve as a trust base for future governance weight allocation and project airdrops.

4. Attention Markets: Trends + Noise + Backroom

Trends explores the "assetization of content," allowing creators to mint their X posts as tradable "Trends" with custom pricing curves. Community members can buy and go long on post popularity, while creators earn fees from trades. It creatively turns "viral posts" into liquid assets—a quintessential example of "social financialization."

Noise is an attention futures platform built on MegaETH, where users bet on changes in topic or project热度. As a direct investment vehicle for attention finance, its early predictive models have shown market-discovery potential in invite-only tests. If integrated with AI for trend forecasting, it could emerge as a "leading indicator" tool in the InfoFi ecosystem.

Backroom represents an InfoFi product focused on "pay-to-unlock + high-value content curation." Creators set token thresholds to publish premium content; users buy Keys to access them. These Keys themselves are tradable and subject to price volatility, forming a closed loop of content finance. Amid the NoiseFi craze, this model emphasizes "noise reduction and signal filtering," gaining traction among knowledge creators.

5. Data Insights & AI Agent Platforms: Arkham + Xeet + Virtuals

Arkham Intel Exchange has become synonymous with financialized on-chain intelligence, allowing users to post bounties that incentivize "on-chain detectives" to reveal wallet ownership. Similar to traditional intelligence markets, it achieves decentralization and tradability for the first time. Despite controversy—privacy violations, witch hunts—it establishes the basic paradigm for insight-driven InfoFi.

Xeet, though not fully launched, has been described by founder Pons as an "anti-noise engine" for InfoFi. By integrating Ethos reputation, KOL recommendations, and private content feeds, it aims to create a more authentic, spam-free signal market—a direct rebuttal to Yap-to-Earn noise.

Virtuals innovates by treating AI agents as new InfoFi participants. Through task execution, evaluation, and interaction data generation, it introduces "non-human productivity" into the ecosystem. Its Genesis Launch phase, linked with Kaito’s Yap-to-Earn, reflects growing inter-project synergy in the InfoFi space.

5. Future Trends and Risks: Can Attention Become the "New Gold"?

In the deep waters of the digital economy, information is no longer scarce—but effective information and genuine attention are increasingly precious. Against this backdrop, many industry insiders call InfoFi the "next narrative engine" or even a potential "new gold." The logic is simple: in an age of abundant AI compute and near-zero content costs, what’s scarce isn’t content, but actionable "signals" and the real attention directed toward them. Whether InfoFi can evolve from concept to asset class—from short-term "yap incentives" to long-term "on-chain influence standards"—depends on the interplay of three trends and three risks.

First, deeper integration between AI and prediction markets will usher in the era of "reasoning capital." Polymarket’s integration with X and Grok has already demonstrated this model: real-time public opinion + AI analysis + real-money博弈 creates a flywheel between effectiveness, authenticity, and market feedback. Future InfoFi projects leveraging AI for event modeling, signal extraction, and dynamic pricing could greatly enhance the credibility of prediction markets in governance, news verification, and trading strategies. For example, futarchy-based DAOs might use AI + prediction markets to formulate policy.

Second, the convergence of reputation, attention, and financial attributes will spark an explosion in decentralized credit systems. Current reputation InfoFi projects (like Ethos and GiveRep) are building blockchain-based "credit scores" without third-party intermediaries. In the future, reputation scores could underpin DAO voting rights, DeFi collateral, and content distribution priority—becoming genuine "social capital" on-chain. If cross-platform recognition, Sybil resistance, and traceable credit histories are achieved, attention-reputation systems could rise from auxiliary metrics to core assets.

Third, the tokenization and derivatives of attention assets represent InfoFi’s ultimate form. Current Yap-to-Earn models remain at the stage of exchanging content and influence for points. Mature InfoFi should enable valuable content, a KOL’s "attention bond," or a set of on-chain signals to become tradable assets—allowing users to "go long," "short," or even "construct ETFs." This would birth an entirely new financial market—from narrative-driven Meme Tokens to derivative assets based on attention dynamics.

Yet, for InfoFi to achieve sustainability, it faces three structural risks.

First, flawed mechanism design leads to widespread "yap traps." Overemphasis on quantity over quality, opaque platform algorithms, and unrealistic airdrop expectations result in high initial热度 followed by cliff-like drops in attention—repeating the "airdrop peak" fate of SocialFi. For example, LOUD attracted users via Yap leaderboards, but saw its market cap and engagement collapse after token launch, revealing a lack of long-term ecological mechanisms.

Second, the "Matthew effect" intensifies, fragmenting the ecosystem. Data from most yap platforms already show: over 90% of rewards go to the top 1% of users. Long-tail participants gain little from interactions and cannot surpass the KOL tier, eventually exiting. Unless broken by mechanisms like reputation weighting and credit mobility, this structure will weaken user motivation, turning InfoFi into another "platform oligarchy."

Third, dual threats of regulation and information manipulation loom large. Emerging products like prediction markets, reputation trading, and attention speculation lack unified global regulatory frameworks. Once platforms touch gambling, insider trading, false advertising, or market manipulation, regulatory crackdowns become likely. Polymarket has faced dual scrutiny from the CFTC and FBI in the U.S., while Kalshi has differentiated itself through compliance. This means InfoFi projects must adopt "regulatory-friendly" designs from Day One to avoid operating on the legal edge.

In conclusion, InfoFi is not merely the next content distribution protocol, but a bold attempt to financialize attention, information, and influence. It challenges traditional models of platform value capture and conducts a collective experiment on the idea that "everyone can be an alpha discoverer." Whether InfoFi can become the "new gold" of the Web3 world hinges on finding the optimal balance among fair mechanisms, incentive design, and regulatory frameworks—transforming the "attention dividend" from a privilege of the few into an asset for the many.

6. Conclusion: The Revolution Is Not Complete—Cautious Optimism for InfoFi

InfoFi’s emergence marks another cognitive evolution in the Web3 world, following cycles of DeFi, NFTs, and GameFi. It attempts to answer a long-overlooked question: in an era of information overload, free content, and algorithmic saturation, what is truly scarce? The answer: human attention, real signals, and credible subjective judgment. These are exactly the elements InfoFi seeks to assign value, build incentives around, and embed within market structures.

In a way, InfoFi is a "counter-power revolution" against the traditional attention economy—not letting platforms, giants, and advertisers monopolize data and traffic dividends, but instead attempting to redistribute the value of attention to genuine creators, spreaders, and identifiers through blockchain, tokenization, and AI protocols. This structural redistribution gives InfoFi the potential to transform content industries, platform governance, knowledge collaboration, and even societal discourse mechanisms.

Yet potential does not equal reality. We must remain cautiously optimistic.

The revolution has not yet succeeded—but it has begun. InfoFi’s future will not be defined by any single platform or vertical, but co-shaped by all creators, observers, and signal detectors of attention. If DeFi was a revolution about value flow, then InfoFi is a revolution about value perception and distribution. On the long road toward decentralization and disintermediation, we should maintain clear judgment and prudent participation—while also recognizing its potential to grow a new forest of narratives from the soil of the next-generation Web3.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News