Which Web2 businesses are better suited for quickly adopting stablecoins?

TechFlow Selected TechFlow Selected

Which Web2 businesses are better suited for quickly adopting stablecoins?

Understanding "why stablecoins are needed" is easy, but few people have thought about "how to use stablecoins."

Author: Josh Solesbury (Partner at ParaFi)

Translation: Azuma, Odaily Planet Daily

Headlines related to stablecoins have exploded over the past six months, catalyzed by Stripe’s acquisition of Bridge and progress on the GENIUS Act. From CEOs of major banks to product managers at payment firms and senior government officials, key decision-makers are increasingly mentioning stablecoins and highlighting their benefits.

Stablecoins are built on four core pillars:

-

Instant settlement (T+0, significantly reducing working capital needs);

-

Extremely low transaction costs (especially compared to SWIFT);

-

Global accessibility (available 24/7 with just an internet connection);

-

Programmability (enabling money driven by embedded code logic).

These pillars perfectly explain the advantages of stablecoins touted in headlines, blog posts, and interviews. As such, the argument for *why* stablecoins are needed is easy to grasp—but the question of *how* to apply them is far more complex. Currently, there is little concrete guidance—whether for fintech product managers or bank CEOs—on how to integrate stablecoins into existing business models.

With this gap in mind, we’ve written this high-level guide to help non-crypto businesses explore stablecoin use cases. The following sections are divided into four distinct business models. Each will detail where stablecoins create value, the implementation roadmap, and a diagram of the transformed product architecture.

Ultimately, while headlines matter, our real goal is widespread stablecoin adoption—scaling stablecoins into real-world business applications. We hope this article serves as a small foundation toward that vision. Now, let’s dive into how non-crypto enterprises can use stablecoins today.

To-C Fintech Banks

For consumer-facing (To-C) digital banks, enhancing enterprise value hinges on optimizing three key levers: user scale, average revenue per user (ARPU), and churn rate. Stablecoins directly support the first two. By integrating partner infrastructure, digital banks can launch stablecoin-based remittance services—reaching new customer segments and adding new revenue streams for existing users.

In an era defined by digital connectivity and globalization, many fintech target markets are inherently cross-border. Some digital banks position cross-border financial services as a core offering (e.g., Revolut or DolarApp), while others treat it as an ARPU-boosting feature (e.g., Nubank or Lemon). For fintech startups targeting diasporas or specific ethnic communities (such as Felix Pago or Abound), remittances are a market necessity. All these types of digital banks are already—or will soon—benefit from stablecoin-powered remittances.

Compared to traditional remittance services (like Western Union), stablecoins offer faster settlement (instant vs. 2–5+ days) and lower fees (as low as 30 basis points vs. over 300 bps). For example, DolarApp charges only $3 to send USD to Mexico with instant delivery. This explains why stablecoin payments have already achieved 10–20% penetration in certain corridors (e.g., U.S.-Mexico), with growth accelerating.

Beyond generating new revenue, stablecoins also improve cost efficiency and user experience when used as internal settlement tools. Many operators face the well-known pain point of weekend settlement delays: banking closures halt settlements for two days. Digital banks committed to real-time service must bridge this gap using working capital loans—an approach that incurs opportunity costs (especially burdensome in today’s interest-rate environment) and may require additional fundraising. Stablecoins eliminate this issue entirely with instant, global settlement. Robinhood, one of the world’s largest fintech platforms, exemplifies this shift. In its Q2 2025 earnings call, CEO Vlad Tenev stated: “We’re using stablecoins to settle a significant volume of weekend transactions, and this usage continues to grow.”

Given these benefits, it’s no surprise that To-C fintechs like Revolut and Robinhood are embracing stablecoins. So, if you work at a consumer bank or fintech company, how should you leverage stablecoins?

Here’s how to implement them in this business model:

Real-Time, 24/7 Settlement

Use stablecoins like USDC, USDT, or USDG for instant settlement—including holidays;

Integrate wallet providers/coordinators (e.g., Fireblocks or Bridge) to connect your banking system with dollar/stablecoin flows on-chain;

In targeted regions, partner with fiat off-ramp providers (e.g., Yellow Card in Africa) for B2B/B2B2C stablecoin-to-fiat conversion;

Filling Fiat Settlement Gaps

Use stablecoins as temporary substitutes for fiat during weekends, reconciling once banking systems resume;

Collaborate with providers like Paxos to build internal stablecoin settlement loops between customer accounts and corporate entities;

Instant Counterparty Funding

Use the above solutions or liquidity partners to bypass ACH/wire transfers, enabling rapid fund deployment to exchanges/partners;

Automated Cross-Border Treasury Rebalancing

When fiat channels are closed, transfer funds between business units/subsidiaries via on-chain stablecoins;

Enable headquarters to build an automated, scalable global treasury management system;

Beyond these foundational capabilities, one can envision a new generation of banks fully built around the principles of “always-on, instant, composable finance.” Remittances and settlements are just the beginning—future applications include programmable payments, cross-border wealth management, and tokenized equities. These institutions will win through superior user experience, richer product offerings, and lower cost structures.

Commercial Banking & Enterprise Services (B2B)

Today, entrepreneurs in countries like Nigeria, Indonesia, and Brazil face significant hurdles when trying to open U.S. dollar accounts at local banks. Typically, only high-volume traders or those with special connections qualify—and even then, only if the bank has sufficient USD liquidity. Local currency accounts expose business owners to both bank risk and sovereign credit risk, forcing them to constantly monitor exchange rates to maintain working capital. When paying overseas suppliers, they incur high fees for converting local currency into major currencies like USD.

Stablecoins can dramatically reduce these frictions, and forward-thinking commercial banks will play a pivotal role in their adoption. Through compliant, bank-hosted digital dollar platforms (e.g., USDC or USDG), businesses can achieve:

-

Hold balances in multiple currencies without establishing multiple banking relationships;

-

Settle cross-border invoices in seconds—bypassing traditional correspondent banking networks;

-

Earn yield on stablecoin deposits;

Banks can thus upgrade basic checking accounts into global multi-currency treasury solutions—offering speed, transparency, and financial resilience unmatched by traditional accounts.

Here’s how to implement stablecoins in this business model:

Global USD / Multi-Currency Account Services

Banks host stablecoins for businesses via partners like Fireblocks or Stripe-Bridge;

Reduce startup and operational costs (e.g., fewer licenses required, no need for FBO accounts);

High-Yield Products Backed by High-Quality U.S. Treasuries

Offer yields near the federal funds rate (~4%) with significantly lower credit risk than local banks (regulated U.S. money market funds vs. domestic banks);

Integrate with interest-bearing stablecoin providers (e.g., Paxos) or tokenized Treasury partners (e.g., Superstate/Securitize);

Real-Time, 24/7 Settlement

See consumer fintech section above.

Promising Global Use Cases (Solvable via Stablecoin Platforms / Commercial Banks)

Importers pay USD invoices in seconds; overseas exporters release goods immediately;

Treasurers move funds across countries in real time, eliminating correspondent banking delays—making banks viable partners for large multinationals;

Business owners in high-inflation countries anchor their balance sheets to USD via stablecoins.

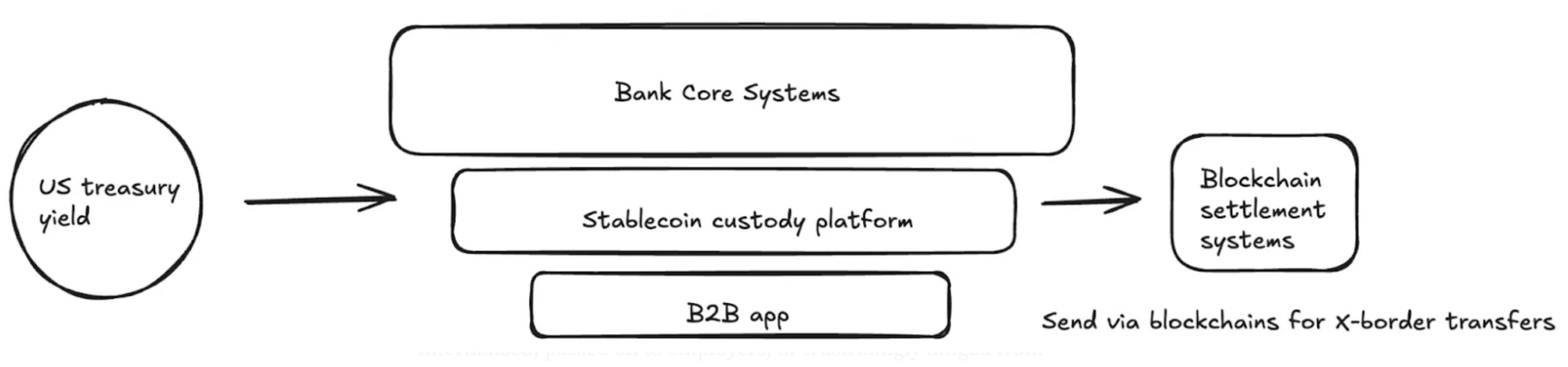

Product Architecture Example (Stablecoin-Powered Commercial Banking)

Payroll Providers

For payroll platforms, the greatest value of stablecoins lies in serving employers who need to pay workers in emerging markets. Cross-border payments—or payments in countries with underdeveloped financial infrastructure—impose significant costs on payroll platforms. These costs are either absorbed by the platform, passed on to employers, or deducted from contractor pay. The easiest opportunity for payroll providers is to add stablecoin payout rails.

As discussed earlier, transferring stablecoins cross-border from the U.S. financial system to a contractor’s digital wallet is nearly free and instantaneous (depending on fiat on-ramp configuration). While contractors may still incur fees to convert to local currency, they receive payments instantly in a globally strong, USD-pegged asset. Evidence shows surging demand for stablecoins in emerging markets:

-

Users are willing to pay an average premium of ~4.7% to obtain USD stablecoins;

-

In countries like Argentina, this premium can reach 30%;

-

Stablecoins are gaining popularity among contractors and freelancers in regions like Latin America;

-

Dedicated freelance platforms like Airtm are seeing exponential growth in stablecoin usage and user acquisition;

-

Most importantly, a user base already exists: over 250 million digital wallets actively used stablecoins in the past 12 months, and growing numbers are open to receiving stablecoin payments.

Beyond speed and end-user cost savings, stablecoins offer significant benefits to the enterprise customers who pay for payroll services. First, stablecoins are far more transparent and customizable. According to a recent fintech survey, 66% of payroll professionals lack tools to understand their actual costs with banks and payment partners. Fees are often opaque, and processes confusing. Second, today’s payroll execution involves substantial manual work, consuming finance team resources. Beyond payment execution, there are numerous downstream tasks—from accounting to tax reporting to bank reconciliation. Stablecoins, being programmable and equipped with a native ledger (blockchain), greatly enhance automation (e.g., batch scheduled payments) and accounting capabilities (e.g., automatic smart contract calculations, withholding, and recordkeeping).

So how should payroll platforms enable stablecoin payouts?

Real-Time, 24/7 Settlement

Covered previously.

Closed-Loop Payments

Partner with stablecoin card issuance platforms (e.g., Rain) to allow end-users to spend stablecoins directly—fully preserving speed and cost advantages;

Collaborate with wallet providers to offer stablecoin savings and yield opportunities.

Accounting & Tax Reconciliation

Leverage blockchain’s immutable ledger to automatically sync transaction records via API into accounting and tax systems—automating withholding, bookkeeping, and reconciliation.

Programmable Payments & Embedded Finance

Use smart contracts to automate batch payouts and conditional payments (e.g., bonuses). Can partner with platforms like Airtm or deploy smart contracts directly.

Integrate with DeFi base protocols to offer affordable, globally accessible wage-based financing. In some jurisdictions, this bypasses typically cumbersome, closed, and expensive local bank partnerships. Apps like Glim (and indirectly Lemon) are actively building these features.

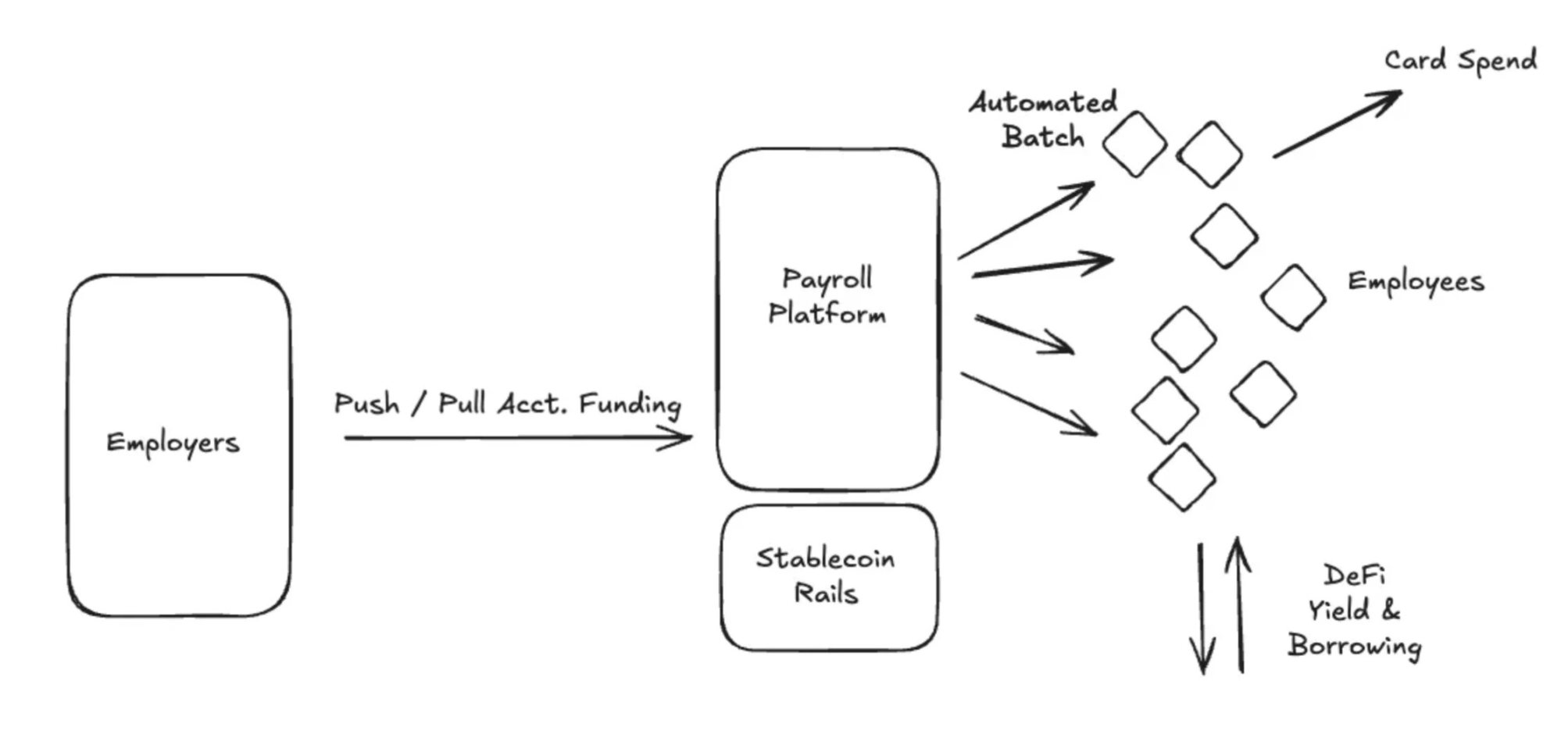

Building on these approaches, here’s how such a system could be implemented:

A stablecoin-enabled payroll processing platform partners with U.S. fiat on-ramps (e.g., Bridge, Circle, Beam) to link bank accounts with stablecoins. Before payday, funds are moved from the client’s corporate account to on-chain stablecoin accounts (hosted by the aforementioned providers or custodians like Fireblocks). Payments are fully automated and broadcast in bulk to all global contractors. Contractors receive USD stablecoins instantly, which they can spend via Visa cards supporting stablecoins (e.g., Rain) or save in on-chain accounts (e.g., USTB or BUIDL) earning yield through tokenized Treasuries. With this new architecture, overall system costs drop significantly, contractor coverage expands dramatically, and automation reaches new levels.

Card Issuers

Many companies today derive core revenue from card issuance. Chime, which went public on June 12, generates over $1 billion annually in the U.S. alone from interchange fees. Despite its massive domestic success, Chime’s partnership structure with Visa, its banking relationships, and technical setup offer little support for international expansion.

Traditional card issuance requires obtaining direct licenses from Visa per country—or partnering with local banks. This cumbersome process severely limits geographic scalability. Take publicly traded Nubank: after more than a decade in operation, it began international expansion only in the past three years.

Additionally, card issuers must post collateral to Visa and other card networks to mitigate default risk. This allows networks to guarantee merchants (like Walmart) that cardholder payments will be honored—even if the issuing bank or fintech fails. Networks assess the issuer’s transaction volume over the prior 4–7 days to determine required collateral. This creates a heavy burden for banks and fintechs, forming a significant industry entry barrier.

Stablecoins are transforming the possibilities for card issuance. First, they are enabling a new class of card platforms like Rain, which leverage primary membership with Visa to offer global issuance powered by stablecoins. Examples include fintechs issuing cards simultaneously in Colombia, Mexico, the U.S., Bolivia, and many other countries. Moreover, because stablecoins enable 24/7 settlement, a new class of card partners can now settle over weekends. Weekend settlement drastically reduces counterparty risk, effectively lowering collateral requirements and freeing up capital. Finally, the on-chain verifiability and composability of stablecoins enable a more efficient collateral management system—reducing working capital needs for issuers.

Here’s how to implement stablecoins in this business model:

Partner with Visa and card issuers to launch a USD-denominated global card program;

1. Flexible card network settlement options;

2. Settle directly in stablecoins (enabling weekend and overnight settlement);

-

Card networks generate daily settlement reports listing bank accounts and routing numbers—now replaced with stablecoin addresses;

-

Alternatively, convert stablecoins back to fiat before settling with the card network;

-

Reduce collateral requirements thanks to 24/7 settlement capability.

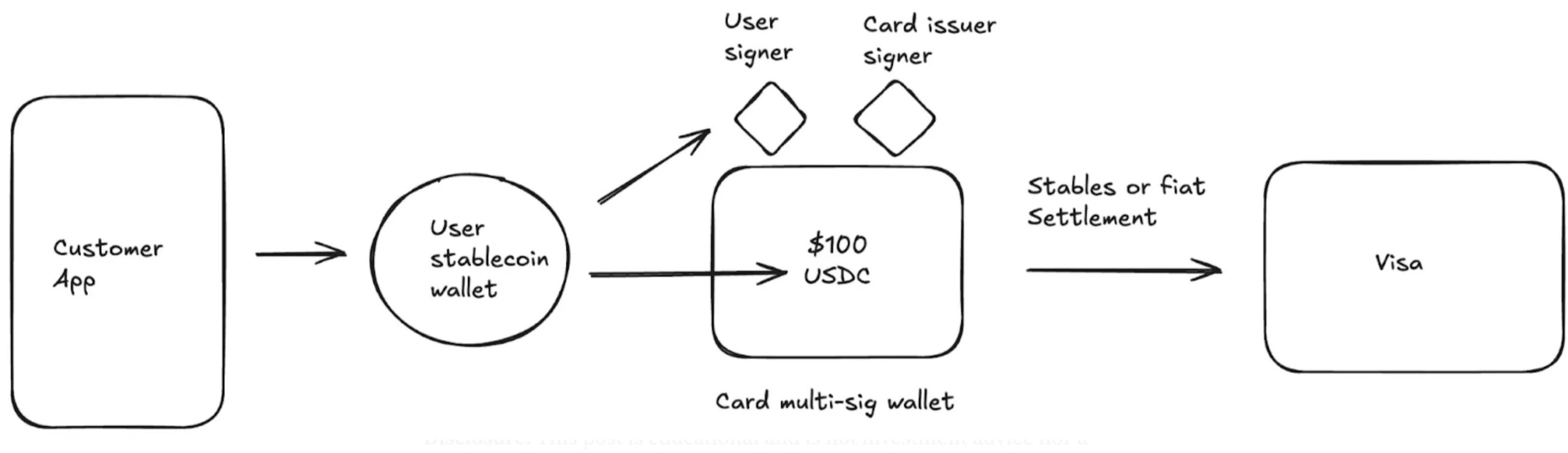

3. Example workflow for a stablecoin-enabled global card product:

Conclusion

Stablecoins are no longer a futuristic promise requiring imagination—they are now practical tools experiencing exponential usage growth. The question is no longer *if* to adopt them, but *when* and *how*. From banks to fintechs to payment processors, developing a stablecoin strategy has become imperative.

Enterprises that move beyond proof-of-concept and genuinely integrate and deploy stablecoin solutions will outperform competitors in cost savings, revenue growth, and market expansion. Notably, these tangible benefits are supported by an expanding ecosystem of integration partners and upcoming regulatory clarity—both of which significantly reduce execution risk. Now is the optimal time to build stablecoin solutions.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News