Scene is King: Restructuring the Stablecoin Competitive Landscape and Shifting Value Focus

TechFlow Selected TechFlow Selected

Scene is King: Restructuring the Stablecoin Competitive Landscape and Shifting Value Focus

The value creation center of stablecoins is shifting from the mere "issuance" phase toward "creating, empowering, and deeply cultivating application scenarios."

By Aiying Compliance

With Circle's successful Nasdaq listing, the stablecoin market is undergoing a structural transformation. While attention focuses on Circle’s $5 billion valuation and its stablecoin business model, a deeper shift is taking place: the center of value creation in stablecoins is moving beyond mere "issuance" toward “creating, empowering, and cultivating real-world applications.” This is not just a tactical adjustment—it represents a fundamental restructuring of the industry’s entire value logic. By analyzing the driving forces, market dynamics, and development trajectories behind this shift, we will see that the future of stablecoin competition no longer lies in “who can issue more coins,” but in “who can create and control more valuable application scenarios.”

1. Shift in Value Focus: From Issuance Dominance to Scenario Competition

Examining the evolution of the stablecoin industry reveals a clear pattern: the sector is transitioning from being “issuance-centric” to “scenario-centric.” This transformation is not accidental but driven by five structural forces.

Pressure on the issuance layer. Circle’s IPO filings reveal a critical reality: even as the second-largest issuer, it must pay 50% of its net interest income (NII) to Coinbase as distribution subsidies. Such costly distribution models expose shrinking profit margins in the issuance segment. As excess profits diminish, market participants are pushed to explore other parts of the value chain—especially application scenarios.

Network effects in issuance have solidified. As a medium of exchange, a stablecoin’s utility heavily depends on adoption—the more people use it, the more valuable it becomes. These network effects have entrenched USDT with 76% market share, while USDC holds a fragile 16%, and all others split the remaining 8%. This structure is now highly rigid; new entrants cannot disrupt the status quo simply by launching another stablecoin.

Fundamental regulatory shifts. Global stablecoin regulation is evolving from “risk prevention” to “innovation promotion and application focus.” The U.S. GENIUS Act clearly distinguishes “payment stablecoins” from other types, establishing dedicated compliance pathways for the former. Hong Kong officially passed and implemented its Stablecoin Issuers Bill on May 21, 2024, regulating issuance while providing a clear legal framework for stablecoin-based innovations. The Monetary Authority of Singapore (MAS) further categorizes stablecoins into “single-currency stablecoins” (SCS) and others, applying differentiated oversight based on use cases. Together, these trends signal a common direction: the value of stablecoins will increasingly depend on their performance in real-world applications—not just issuance scale.

Qualitative changes in user demand. Market maturity is marked by users shifting from merely holding stablecoins to using them to solve specific problems. Early adopters may have been satisfied with a “digital version of the dollar,” but mature users now expect tangible utility beyond speculation. This shift compels market players to move focus from “minting more tokens” to “creating more use cases.”

Sustainability of business models. As competition intensifies, relying solely on seigniorage and issuance volume faces long-term sustainability challenges. Competitive pressure will drive up yields on reserve assets, squeezing margins. In contrast, developing application scenarios unlocks diversified revenue streams—transaction fees, value-added services, revenue sharing from financial products—offering a more sustainable model for ecosystem participants.

These five forces collectively propel the stablecoin industry from an “issuance war” into an era of “scenario competition.” Looking at the industry’s trajectory, we can identify three distinct phases:

-

Concept Validation (2014–2018): Stablecoins gained market acceptance, primarily serving liquidity needs in crypto trading

-

Medium of Exchange (2018–2023): Stablecoins solidified their role in transactional use cases, with explosive growth in minting volume

-

Utility & Value Creation (2024–present): The focus shifts from issuance scale to building and monetizing real-world applications

We are at the beginning of the third phase, where core competition centers on “who can build more valuable application scenarios.” For market participants, understanding this shift is essential—it redefines what success means and how value is distributed.

2. Deepening Scenarios: The Gold Mine of Stablecoin Applications

To grasp the deeper logic of “scenarios rule,” we must go beyond surface-level technical narratives and analyze how stablecoins generate value within specific use cases. This requires unpacking each scenario’s complexity, existing pain points, and the transformative potential of stablecoin technology.

1. B2B Cross-Border Payments & Trade Finance: Beyond Simple Fund Transfers

The challenges in B2B cross-border payments are far more complex than they appear. Conventional discussions often emphasize speed and cost, but the real issues lie in the fragmentation and uncertainty across the entire cross-border payment and trade finance ecosystem.

When an Asian company pays a European supplier, it faces multiple challenges:

-

Currency risk management: Exchange rate fluctuations during the lag between payment initiation and settlement can erode 1–3% of value

-

Liquidity fragmentation: Corporate cash pools across different markets are siloed, preventing efficient consolidation

-

Uncertain settlement timing: Variable arrival times in traditional systems complicate supply chain planning and cash flow forecasting

-

Compliance complexity: Cross-border transactions involve multiple regulatory regimes, leading to high costs and risks

-

Disconnection between finance and payments: Payment systems lack integration with trade finance tools like letters of credit, factoring, or supply chain financing

The value of stablecoins here extends well beyond faster fund transfers. Through smart contracts and blockchain, they enable a comprehensive value system:

-

Programmable payment conditions: Payments can be automatically linked to trade events (e.g., shipment confirmation, quality inspection), enabling procedural control over trade workflows

-

Real-time FX handling: Smart routing across multi-currency stablecoin pools minimizes currency volatility exposure

-

Liquidity aggregation: Funds across markets and currencies can be managed on a unified infrastructure, greatly improving capital efficiency

-

Automated trade finance: Traditional instruments like letters of credit or receivables financing can be transformed into self-executing blockchain smart contracts, streamlining execution and risk management

This holistic improvement goes far beyond efficiency gains—it fundamentally restructures how B2B cross-border payments and trade finance operate. Achieving this vision, however, demands solving practical hurdles: legal recognition of smart contracts across jurisdictions, integration with legacy systems (ERP, core banking), and cross-chain interoperability.

2. Real-World Asset Tokenization (RWA): Building a New Value Internet

RWA is another transformative application for stablecoins, though its complexity is often underestimated.

In traditional finance, real-world assets (e.g., real estate, commodities, private equity) suffer from illiquidity discounts due to high transaction costs, limited market participation, and inefficient price discovery. RWA promises to reduce this discount via blockchain, but realizing this promise requires a full ecosystem—with stablecoins serving as foundational infrastructure.

Stablecoins play three pivotal roles in the RWA ecosystem:

-

Value bridge: Connecting tokenized on-chain assets with fiat money in traditional finance

-

Transaction medium: Providing liquidity and counterparties for trading tokenized assets

-

Distribution channel: Automating payouts such as rental income or bond coupons to token holders

Take real estate tokenization: investors could buy fractional ownership via stablecoins, receive rent distributions instantly in stablecoins, use tokens as collateral on lending platforms for liquidity—all automated via smart contracts without intermediaries.

Yet, major challenges remain:

-

On-chain/off-chain legal linkage: Ensuring enforceable legal ties between digital tokens and physical assets

-

Trustworthy data input: Reliably bringing off-chain asset data onto-chain (the oracle problem)

-

Regulatory complexity: Tokenized assets may fall under securities, commodities, and payment regulations simultaneously

In this context, stablecoin issuers focusing only on price stability will struggle to capture value. Instead, those offering integrated solutions—stablecoin payments, asset tokenization, trading, and compliance—will dominate this space.

3. Cross-Ecosystem Connector: Bridging DeFi and Traditional Finance

Today’s financial landscape features two parallel ecosystems: decentralized finance (DeFi) and traditional finance (TradFi). Each has strengths: DeFi offers permissionless access, programmability, and high capital efficiency; TradFi provides regulatory clarity, deep liquidity, and broad user trust. Long-term value maximization will come not from replacement, but from connection.

Stablecoins are emerging as the key bridge—they possess attributes of both worlds: they are blockchain-native tokens compatible with smart contracts, yet represent fiat-backed value acceptable in traditional finance. This duality makes them the natural medium for inter-ecosystem value transfer.

Key application scenarios include:

-

Hybrid treasury management: Corporations manage daily operations in traditional banks while deploying surplus liquidity via stablecoins in DeFi protocols for yield

-

Cross-ecosystem capital optimization: Intelligent systems dynamically allocate funds between TradFi and DeFi based on market conditions

-

Compliant DeFi access: Regulated stablecoin providers offer institutional investors compliant gateways to DeFi services

Aiying has found in conversations with treasury teams across Asia-Pacific that this “day-night capital management” model is gaining traction—even traditional firms now recognize that allocating part of their liquidity to DeFi via stablecoins generates incremental returns while maintaining risk controls.

However, building such scenarios requires overcoming key hurdles: regulatory complexity (especially for regulated institutions), risk isolation mechanisms (to prevent DeFi risks from spilling over), and simplified UX (to make it accessible to non-crypto experts). Success demands innovation across technology, regulation, and user experience.

Through this analysis of three core scenarios, it’s clear: stablecoin value creation has moved far beyond the idea of a “digital dollar.” It is now about building complex, multi-dimensional application ecosystems. In this landscape, issuance capability alone is insufficient—success requires deep scenario understanding, ecosystem orchestration, and frictionless user experiences.

3. Diverging Regulatory Landscapes: Forward-Looking Strategies in Hong Kong and Singapore

Regulation shapes—and reflects—the direction of market evolution. Analyzing the stablecoin strategies of two key Asia-Pacific financial hubs—Hong Kong and Singapore—clarifies the trend toward scenario-driven value creation.

Hong Kong: From Sandbox to Mature Framework

On May 21, 2024, Hong Kong’s Legislative Council passed the Stablecoin Issuers Bill, marking a transition from experimental sandboxes to a mature regulatory framework. Key features include:

-

Layered regulatory architecture: Differentiated rules for different stablecoin types, prioritizing single-fiat-backed stablecoins used for payments

-

End-to-end risk management: Oversight spans issuance, custody, trading, and payment processing

-

Scenario-oriented incentives: Regulatory facilitation and policy support for stablecoin applications serving the real economy

From HKMA policy documents and industry engagement, it’s evident that Hong Kong’s strategic focus has shifted from “attracting stablecoin issuers” to “cultivating innovative application ecosystems.” This is reflected in policies such as clarifying regulations for corporate use of stablecoins in cross-border trade settlements, issuing guidance for financial institutions on stablecoin custody and exchange, and supporting interoperability between stablecoin and traditional payment systems.

This strategy aligns with Hong Kong’s unique positioning as a gateway between mainland China and global markets. By fostering stablecoin application ecosystems, Hong Kong aims to strengthen its role in offshore RMB services, Greater Bay Area cross-border finance, and Asian international asset management.

Singapore: A Fine-Grained, Risk-Proportionate Approach

Compared to Hong Kong, the MAS adopts a more granular, risk-proportionate regulatory model. Its framework classifies stablecoins into categories with tailored standards:

-

Single-Currency Stablecoins (SCS): Pegged to one fiat currency, primarily for payments, subject to strict reserve and risk controls

-

Non-SCS Stablecoins: Backed by baskets of currencies or other assets, facing differentiated requirements

-

Use-case-adaptive regulation: Adjusting oversight intensity based on application (retail vs. wholesale payments, trading, etc.)

Notably, MAS emphasizes stablecoins’ value in cross-border payments, trade finance, and capital markets. It has launched several pilot projects: Ubin+ (cross-border stablecoin settlement), Guardian (tokenization and trading of sustainable finance assets), and Project Orchid (retail stablecoin payments). All point to the same conclusion: the value of stablecoins lies not in issuance, but in the applications they enable.

This direction aligns with Singapore’s identity as a global trade and financial hub—leveraging stablecoins in real commercial use cases strengthens its strategic role in connecting global trade and capital flows.

Common Trends and Implications

Comparing Hong Kong and Singapore reveals key convergences:

-

From risk aversion to innovation promotion: Both regulators have shifted from caution to actively guiding innovation

-

Focus on application value: Stablecoins are seen as financial infrastructure, not just products, with emphasis on real-world impact

-

Targeted allocation of regulatory resources: Priority given to use cases that serve the real economy and solve real problems

These regulatory trends confirm the central thesis: value in the stablecoin ecosystem is migrating from issuance to applications. Regulators recognize this shift and are shaping policy to accelerate it.

For market participants, this means: strategies focused solely on issuance will face growing limitations. Those innovating in applications and solving real problems will gain greater policy support and market opportunities.

4. Enabling Infrastructure: From Distribution to Value Creation

If application scenarios are the gold mine of the stablecoin ecosystem, then payment infrastructure is the essential tool for mining it. As the market shifts from “who issues” to “who enables compelling use cases,” a crucial question arises: what kind of infrastructure truly empowers diverse applications?

Through in-depth interviews and needs analysis with dozens of enterprise clients, Aiying finds that corporate demands for stablecoin payment infrastructure go far beyond simple “send and receive” functionality. Enterprises need integrated solutions addressing five core challenges:

Five Core Challenges in Enterprise Stablecoin Payments

-

Complex multi-currency and multi-channel management: Multinational firms handle 5–10 fiat currencies and multiple stablecoins. They need a unified interface—not separate processes for each currency

-

Opaque FX conversion costs: Hidden FX fees in cross-border transactions often reach 2–3% or higher. Firms need tools to monitor and optimize these costs in real time

-

Multi-layered compliance and risk controls: Transactions across regions and sizes face varying regulatory demands. Solutions must meet compliance without excessive operational burden

-

Integration barriers with legacy systems: Any new payment solution must seamlessly connect with existing ERP, finance, and accounting systems—otherwise adoption costs are prohibitive

-

Lack of programmable payment capabilities: Modern enterprises require conditional payments, multi-level revenue splits, event-triggered automation—not just basic fund transfers

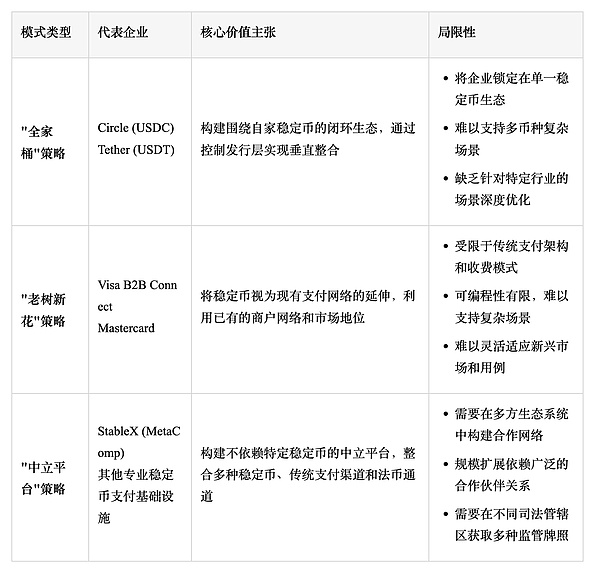

In response, three distinct infrastructure models have emerged, each reflecting a different strategic positioning:

Deep Comparison of Three Stablecoin Payment Infrastructure Models

Analyzing these models, we find the “neutral platform” approach holds unique advantages in enabling diverse applications—particularly in three areas:

-

Multiecosystem integration: No single stablecoin or payment channel meets all needs. Neutral platforms integrate multiple stablecoins, channels, and fiat rails, giving enterprises maximum flexibility to choose optimal combinations per use case—free from ecosystem lock-in

-

Intelligent cross-scenario optimization: True value isn’t just offering options, but intelligently recommending the best path. For example, a Singapore-to-Brazil payment might optimally route via USDC on one exchange at time A, USDT via another channel at time B, or even revert to traditional banking under certain conditions. This dynamic optimization is core to scenario value

-

Compliance enablement: As stablecoin use expands beyond trading into broader commerce, compliance complexity rises. Neutral platforms reduce the cost and difficulty of compliance by integrating KYB, transaction monitoring, SAR filing, and other tools—enabling innovation within regulatory guardrails

Looking ahead, we anticipate further specialization in stablecoin payment infrastructure, forming a clear layered architecture: stablecoin issuers focus on price stability and reserve management; neutral infrastructure providers connect ecosystems, optimize routes, and ensure compliance; vertical solution builders concentrate on deep application in specific industries. This division of labor will significantly boost ecosystem efficiency and innovation capacity.

5. Future Outlook: The Convergence of Payments and Finance

Looking forward, the evolution of stablecoin applications follows a clear trajectory: from standalone payment tools to comprehensive financial infrastructure. This transformation will unfold in three stages, each representing a qualitative leap in value creation.

Three Stages of Stablecoin Application Evolution

Stage One: Payment Optimization (2023–2025)

We are currently in the first stage, where the primary value proposition is solving basic payment inefficiencies—especially in cross-border contexts. Key characteristics:

-

Accelerated settlement (from 3–5 days to real-time or near-real-time)

-

Reduced explicit costs (from ~7% to 0.1%–1%)

-

Greater transparency (real-time transaction tracking)

-

Improved FX handling (minimizing losses from currency volatility)

In this phase, stablecoins act primarily as a transmission medium, supplementing or replacing traditional payment rails. Competition centers on who offers faster, cheaper, and more reliable payments.

Stage Two: Embedded Financial Services (2025–2027)

As basic payments improve, stablecoin applications enter the second stage—deep integration of financial services into payment flows. This phase will feature:

-

Seamless link between payments and trade finance (e.g., automatic receivables financing based on payment history)

-

Integrated liquidity management (smart pooling, idle cash yield optimization)

-

Programmable multi-party collaboration (automated coordination among buyers, sellers, and financiers in supply chains)

-

Real-time balance sheet management (corporate treasury functions shift from delayed reporting to live oversight)

Here, stablecoins evolve from payment tools to foundational financial architecture. Competition shifts from raw speed to delivering intelligent, integrated financial solutions.

Stage Three: Programmable Finance (2027 and beyond)

Ultimately, stablecoin applications will reach the third stage: programmable finance. Enterprises will use APIs and smart contracts to customize complex financial workflows based on business logic. Examples include:

-

Business rules directly translated into financial terms (e.g., sales terms auto-converted into payment conditions)

-

Dynamic capital optimization (funds automatically routed across channels and instruments based on real-time conditions)

-

Automated cross-organizational finance (financial systems of upstream and downstream firms coordinated programmatically)

-

Democratized financial innovation (enterprises build custom financial tools at low cost)

In this final stage, stablecoins become truly “programmable money,” with finance no longer a standalone function but deeply embedded in core business operations. Competition centers on who offers the most powerful and flexible financial programming capabilities.

6. Emergence of a New Division of Labor

This three-stage evolution will drive a more specialized division of labor within the stablecoin ecosystem, visible across three layers:

-

Infrastructure Layer: Stablecoin issuers focus on price stability, reserve management, and regulatory compliance—providing a reliable foundation. This layer faces standardization and commoditization pressures, limiting differentiation.

-

Application Platform Layer: Neutral payment infrastructure providers connect stablecoins, optimize routes, ensure compliance, and deliver core functionalities. Differentiation occurs through technology, UX, and ecosystem integration.

-

Scenario Solution Layer: Vertical-specific vendors deliver deeply customized solutions for particular industries. Their edge comes from deep domain expertise and targeted problem-solving.

As specialization deepens, value distribution will shift: the infrastructure layer sees margin compression, while the application and scenario layers capture increasing value share. This mirrors the internet’s evolution—from infrastructure battles to platform wars, and finally to application dominance.

Conclusion: Whoever Creates the Applications, Owns the Future of Stablecoins

The stablecoin market is undergoing a profound value reconstruction—from “who issues the coin” to “who creates and amplifies real-world applications.” This is not a minor business adjustment, but a complete redefinition of how value is created in the industry.

Reviewing the history of payment technologies, a recurring pattern emerges: every payment revolution progresses from infrastructure buildout, to product standardization, and finally to explosion of scenario-based value. Credit cards took decades to evolve from simple payment tools into foundations for consumer finance ecosystems. Mobile payments similarly evolved from cash substitutes to deeply integrated lifestyle platforms. Stablecoins are following the same path, and we are now at the pivotal turning point—from standardization to scenario-driven value creation.

In this new era, success no longer depends on who has the largest issuance volume or strongest capital base, but on who best understands and solves real problems in specific domains. Specifically, market participants need three core capabilities:

-

Scenario insight: Identifying and deeply understanding underlying pain points and needs in specific sectors

-

Integration and orchestration: Connecting and coordinating multiple stakeholders to build end-to-end solutions

-

User empowerment: Abstracting and simplifying complex technology to make it accessible and usable

For participants in the stablecoin ecosystem, this value migration demands a strategic pivot: from chasing scale and speed to cultivating vertical scenarios and user value. Those who embrace specialized roles, build open ecosystems, and focus on application innovation will emerge as leaders in reshaping the global financial infrastructure.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News