AI Investment Overview for the First Half of 2025: 58% of Global Venture Capital Flows into AI

TechFlow Selected TechFlow Selected

AI Investment Overview for the First Half of 2025: 58% of Global Venture Capital Flows into AI

AI remains the most attractive frontier in venture capital, though funding flows are becoming more cautious.

Author: Catalaize

Translation: Felix, PANews

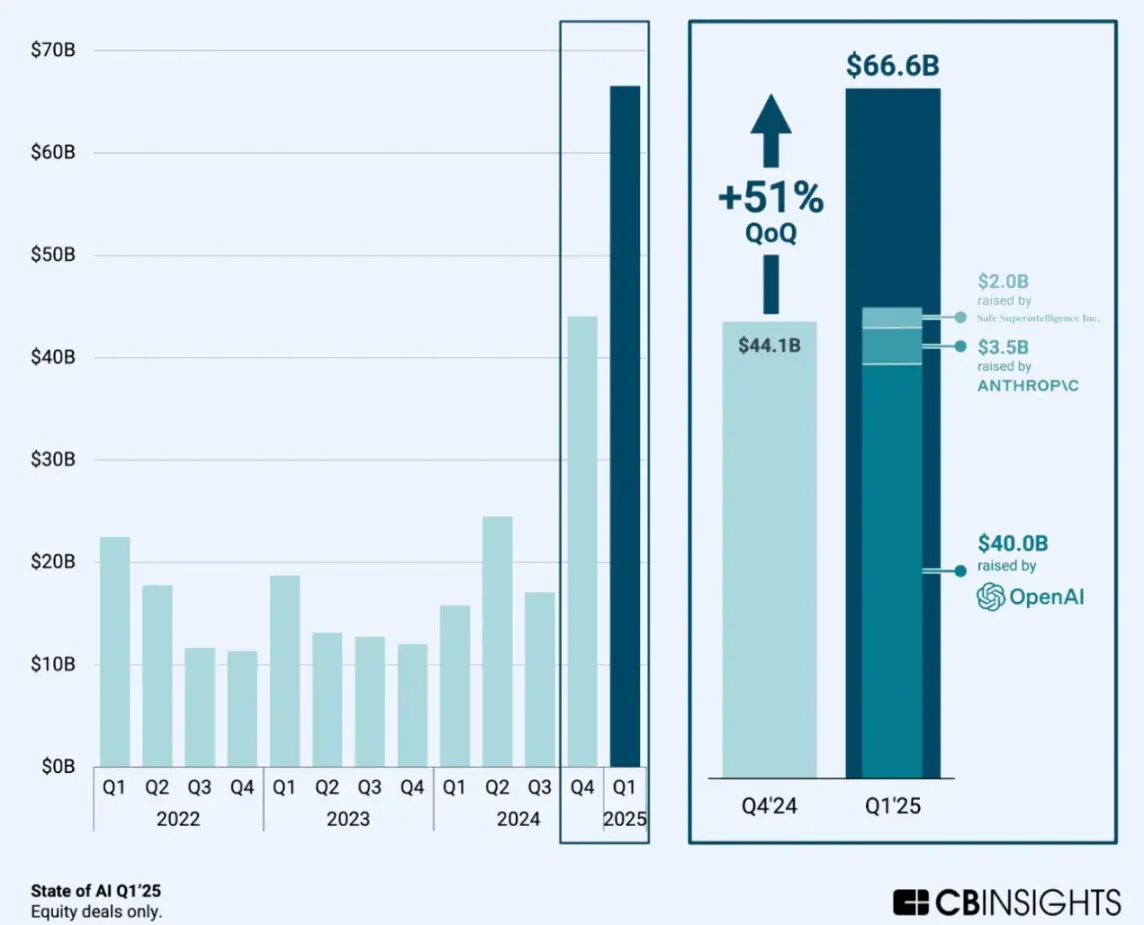

Between January and June 2025, global investment in AI startups significantly surpassed the first half of 2024. In Q1 2025 alone, approximately $60–73 billion flowed into the sector—exceeding half of the total investment for all of 2024—and marking over 100% year-on-year growth. During the first quarter, venture capital funding directed toward AI companies accounted for about 58% of the total, compared to roughly 28% a year earlier. This clearly reflects investor "AI FOMO."

This means: Capital is concentrating into AI at an unprecedented scale, with major institutions doubling down on companies perceived as likely winners, potentially reshaping capital allocation for the rest of the year.

Massive Funding Led by a Few Giants

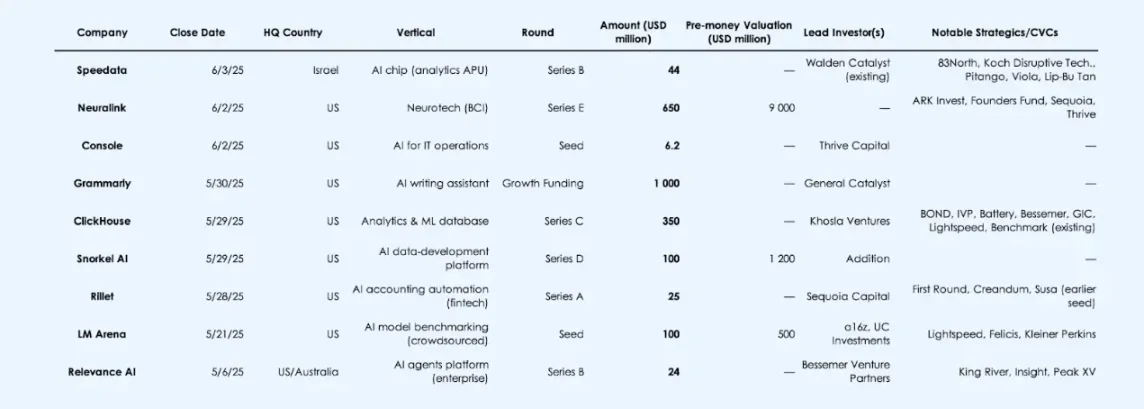

Dominant players led the wave of ultra-large late-stage funding rounds during this period. In March, OpenAI raised $40 billion—the largest private funding round in history—valuing the company at $300 billion. Anthropic secured $3.5 billion in its Series E round, reaching a $61.5 billion valuation. Other notable deals, such as Safe Superintelligence’s $2 billion raise and Neuralink’s $650 million Series E, further inflated the totals.

This means: A "winner-takes-all" dynamic is concentrating most capital into a tiny number of firms, crowding out potential funding for early-stage or smaller ventures.

Funding Size Polarization: The Barbell Effect

Besides headline-grabbing mega-rounds, mid-sized deals surged while seed funding remained selective. The median seed round size in AI reached around $15 million (average ~$41 million), while Series A rounds had a median of $75–80 million—far exceeding historical averages (the global median Series A across sectors was ~$10 million in 2022). Growth-stage C and D rounds had median sizes between $250 million and $300 million, with averages skewed even higher due to outliers like OpenAI.

This means: Swelling deal sizes reflect fierce competition for leading players. Investors unable to write nine-figure checks may shift focus to niche areas or earlier stages, while any startup claiming an AI narrative can secure larger funding and higher valuations.

Industry and Geographic Concentration

Participants in generative AI and core model/infrastructure domains attracted over $45 billion in the first half, accounting for more than 95% of disclosed funding. Application-focused verticals were comparatively starved: healthcare/biotech received ~$700 million; fintech/enterprise sectors ~$2–3 billion. Geographically, the U.S.—especially Silicon Valley—dominated: over 99% of global AI funding in the first half went to U.S.-headquartered companies. Asia and Europe lagged behind. China's largest single round (Zhipu AI) amounted to $247 million; Europe saw only a few mid-sized raises (e.g., UK-based Latent Labs raised $50 million).

This means: This boom is centered in the U.S. and driven by a handful of large firms. Governments and investors outside the U.S. are expected to respond in the second half by launching national AI funds, offering incentives, or pursuing cross-border investments to avoid falling behind.

Outlook for H2: High Enthusiasm, Growing Caution

Despite record capital inflows, investor prudence is returning. Many H1 funding rounds featured strategic or corporate investors (cloud providers, chipmakers, defense firms), signaling preference for projects with real-world use cases and strategic synergies. In the second half, investors will closely monitor how well-funded startups deliver products, generate revenue, and navigate regulation—especially amid intensifying competition.

This means: Capital in H2 may favor companies demonstrating efficiency and genuine market traction—particularly “picks and shovels” enablers (tools, chips, enterprise software)—raising barriers for new entrants and reinforcing incumbents’ advantages.

Significance

The first half of 2025 has been a pivotal moment for AI investment. The massive influx of capital—and its concentration among a few players and regions—will shape innovation and competition for years to come. For investors, understanding where money is flowing and why is crucial for navigating the second half of 2025. Can the winners justify their valuations, or will we see corrections and renewed focus? H1 data offers early signals for portfolio strategy, policy considerations (e.g., antitrust, national security), and founders’ fundraising prospects over the next six months.

Most notable AI funding rounds from the past month

Macro and Trend Analysis

1. Funding Momentum: Unprecedented Year-on-Year Surge

In H1 2025, VC investment in AI startups far exceeded the same period in 2024. Reliable estimates indicate that around $70 billion flowed into AI companies in Q1 alone—more than half of the total AI funding for all of 2024. This implies that H1 2025 funding was more than double that of H1 2024 in dollar terms.

In Q1 2025, AI captured 53–58% of global VC activity, up from 25–30% a year earlier—meaning more than half of all global venture capital is now going into AI.

Key driver: A small number of massive funding rounds; without them, overall VC flows would be roughly flat year-on-year.

Implication for H2 2025: Overall VC metrics may hinge on AI deal flow; any cooling in AI enthusiasm could drag down broader funding levels.

2. Funding Stage: Late-Stage Dominance, Mixed Early-Stage Trends

Data shows a barbell-shaped distribution of deal sizes in AI.

Late-stage (Series C+) dominates: Total late-stage funding across all industries reached $81 billion in Q1 2025, a ~147% increase year-on-year, with AI as the main driver.

Average D and E round sizes range from $300 million to $950 million (median ~$250–450 million).

Early-stage: Deal counts declined (global early-stage deals down ~19% YoY), but round sizes increased sharply.

Median seed funding for AI startups in H1 2025 was ~$15 million; Lila’s $200 million seed round was an outlier.

Series A median: ~$75–80 million.

Takeaway: Investors are placing fewer, larger bets—confident in specific AI themes but cautious elsewhere. This polarization is expected to persist through H2.

3. Sector Allocation: Focus on Foundational Models and Infrastructure

Over 95% of AI funding chased developers of generative AI models and their infrastructure (cloud, chips, development platforms). OpenAI and Anthropic alone absorbed about 60% of all AI funding in H1.

In contrast, vertical applications appear negligible:

-

Healthcare/Biotech AI: ~$700 million (e.g., Hippocratic AI raised $141 million, Insilico raised $110 million).

-

Financial services and enterprise productivity: collectively just a few billion dollars.

-

Robotics/Defense AI: niche but notable (e.g., Shield AI raised $240 million).

Investor rationale: Control the "AI stack." Vertical applications risk commoditization or face longer go-to-market cycles.

4. Geographic Distribution: U.S. Dominance, Bay Area Claims Half

In Q1, 71–73% of global VC funding flowed to North America; in value terms, AI funding was ~99% concentrated in the U.S. The San Francisco Bay Area (including OpenAI) alone captured nearly half of all global venture capital.

EMEA: Only a few mid-sized AI deals (Latent Labs raised $50 million, Speedata raised $44 million).

APAC: Raised just $1.8 billion for AI in Q1 2025 (down 50% YoY); China’s largest round was Zhipu AI’s $247 million.

In short: The U.S. holds a decisive edge in the "AI arms race" when it comes to capital deployment.

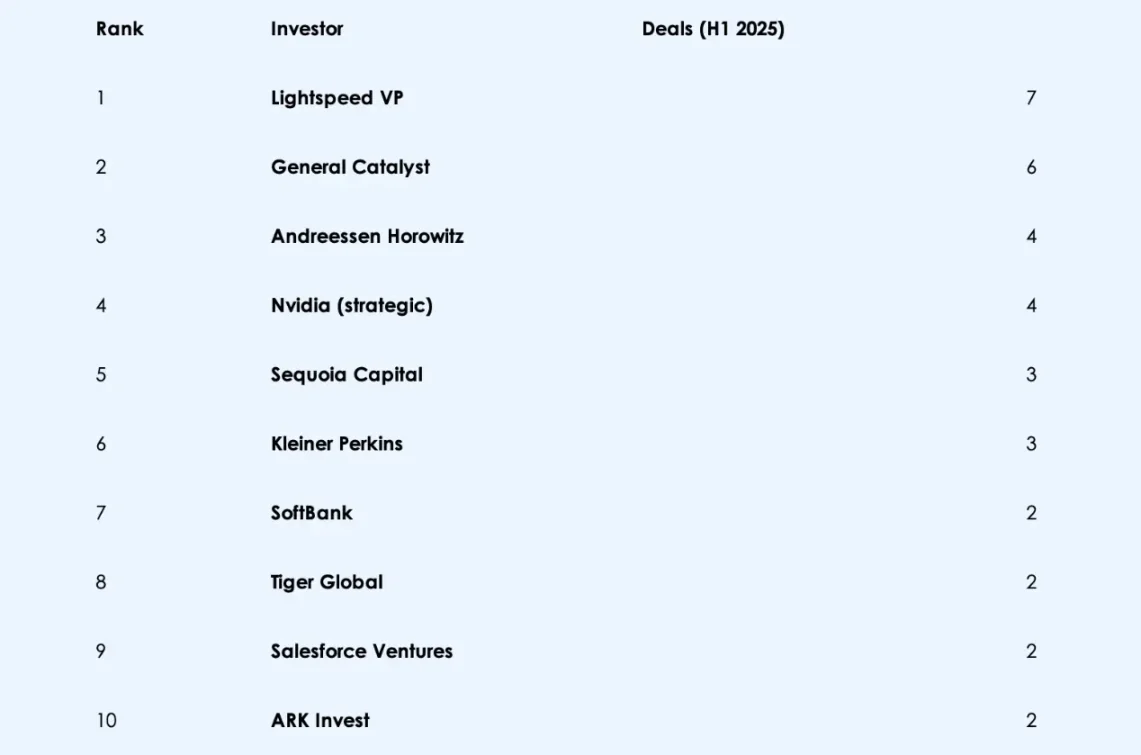

5. Investor Landscape:

Sovereign wealth and crossover funds (Saudi Arabia’s Prosperity7, Malaysia’s Khazanah, Thrive Capital) led multiple rounds.

Corporate VC arms of major tech firms (Microsoft, Salesforce, Google) were highly active.

Net effect: Capital from diverse sources is flooding in.

Forward-Looking Outlook for H2:

Regulatory Milestones

Governments are still figuring out how to regulate AI. In the EU, the AI Act is expected to be finalized by end-2025. In H2, lobbying efforts by startups are anticipated, along with early signs of compliance. In the U.S., executive orders on AI and congressional actions—such as hearings or proposed legislation—will be critical. New rules on data usage, model transparency, or chip export controls could reshape startup economics and investor confidence.

Positive outlook: Clearer, business-friendly guidelines could legitimize AI adoption across industries.

Negative outlook: Harsh regulations (e.g., liability for AI errors) could deter startups and investors.

Additionally, watch U.S. government AI procurement—rumors of a multi-billion-dollar initiative could signal strong demand for enterprise-focused AI firms.

IPO Pipeline and Exit Opportunities

Despite surging private funding in 2025, no breakthrough AI IPO has emerged yet. This could change in H2. Companies like Databricks, Stripe (AI-related), or even OpenAI may become IPO candidates.

A successful IPO could reprice the market, unlock liquidity for late-stage investors, and provide benchmark valuations.

Prolonged IPO stagnation may erode investor confidence in exit timelines for AI startups.

In the meantime, M&A activity could heat up. Big Tech—Google, Microsoft, or NVIDIA—might acquire smaller AI teams or core infrastructure providers. A major AI acquisition could reshape competitive dynamics and deliver returns to VCs.

Technical Breakthroughs and Product Launches

Anticipate major announcements: possibly OpenAI’s next-generation model, or hardware from Sam Altman and Jony Ive.

Any significant leap in capability (e.g., reasoning models or 10x cost reduction) could validate high valuations and spark another wave of capital.

Watch enterprise traction—API sales, SaaS adoption, and revenue generation. But risks remain: security breaches or public misuse could trigger regulatory backlash and dampen market sentiment.

In short, H2’s technical and commercial execution will determine whether the optimism of H1 can endure.

Regulatory and Ethical Backlash

If governments or the public perceive AI as out of control, swift interventions may follow: licensing requirements, GDPR-style fines, or strict limits on certain models.

Ethical resistance: Scandals, mass automation-driven layoffs, or AI-generated misinformation could rapidly shift market sentiment, making fundraising harder.

Compute and Talent Constraints

AI’s lifeblood—GPUs and elite engineers—remains scarce.

GPU bottlenecks may force underfunded teams out, while well-capitalized firms hoard compute resources.

The talent war intensifies, with OpenAI and Google aggressively recruiting top researchers.

Burn rates are soaring: Some startups spend over $100 million annually on cloud services without shipping products quickly. If the gap between spending and output widens, expect down rounds and harsh market resets.

Model Commoditization

Ironically, the LLM race is accelerating commoditization. Open-source releases (Meta’s LLaMA, Mistral, etc.) blur differentiation.

Moats are shifting toward data quality, distribution, or vertical integration.

If OpenAI starts losing to lean open-source players or in-house enterprise models, VCs may reassess what “defensibility” truly means.

H2 might sound the alarm: Not every finely tuned wrapper deserves a $1 billion valuation.

Forecast for H2 2025

Funding volumes slow but remain high

After the H1 frenzy, deal pace will moderate. No more $40 billion rounds expected, but quarterly AI funding will still be double 2024 levels. The boom continues—just more sustainably.

Major liquidity events arrive

At least one $10+ billion exit is expected: either an IPO (e.g., Databricks) or an acquisition by a traditional firm seeking relevance.

This will influence investor sentiment and reset pricing expectations.

Clear stratification of the startup ecosystem by Q4:

-

The top 5–10 AI companies (well-funded, strong momentum) will pull ahead and may begin acquiring talent via acquihires.

-

Mid-tier or overhyped startups lacking product-market fit? Many will pivot, face down rounds, or fade away.

-

Investors will reward revenue-generating execution—not just research roadmaps or GPU spending.

Final Conclusion

The next six months will stress-test the AI narrative. Will 2025 mark the beginning of sustained transformation—or a bubble needing correction?

Some froth will burst, but the core thesis remains intact. AI is still the most compelling frontier in venture capital—just with more discerning capital flows.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News