Stablecoin Series Report (1): Are Stablecoins Bigger Than Web3?

TechFlow Selected TechFlow Selected

Stablecoin Series Report (1): Are Stablecoins Bigger Than Web3?

The growth in stablecoin scale means a significant increase in the supply of on-chain DeFi asset-side assets.

Author: XinGPT

For those in the Web3 industry, stablecoins are a term so familiar it's almost second nature. From day one of crypto trading, depositing funds to buy stablecoins has been standard practice.

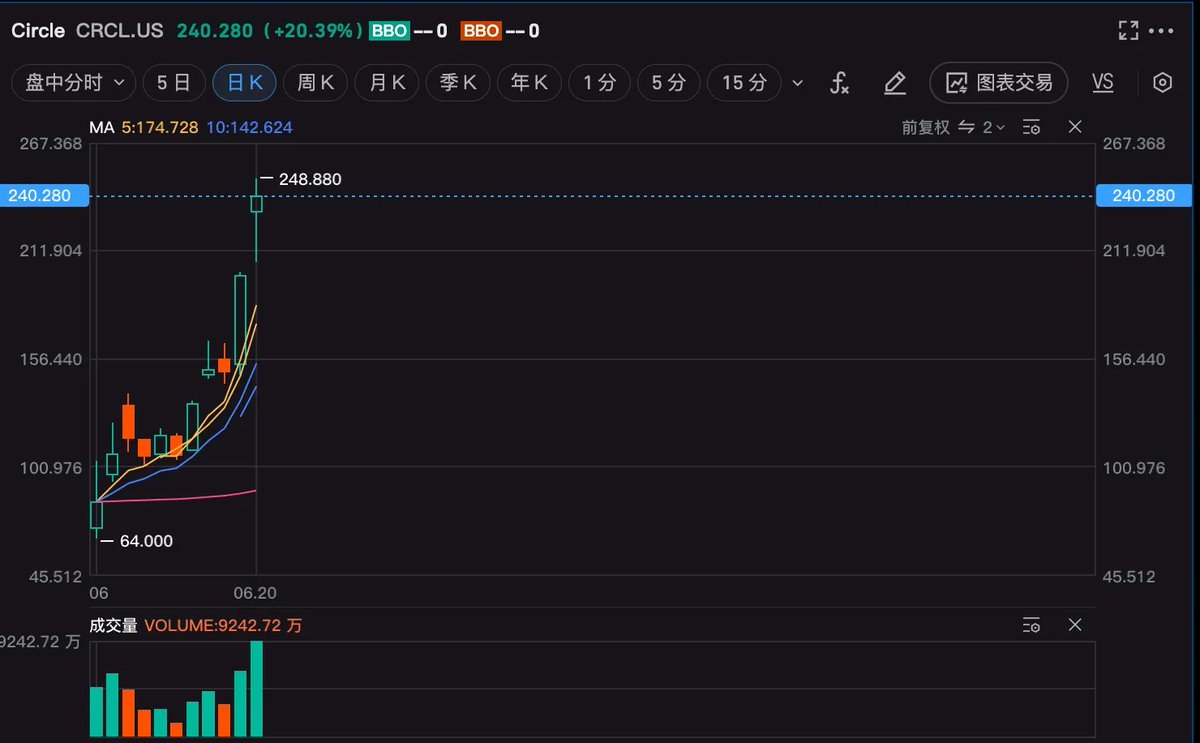

So why did Circle, often seen as the first publicly listed stablecoin company, achieve an astonishing threefold surge within just two weeks of its上市?

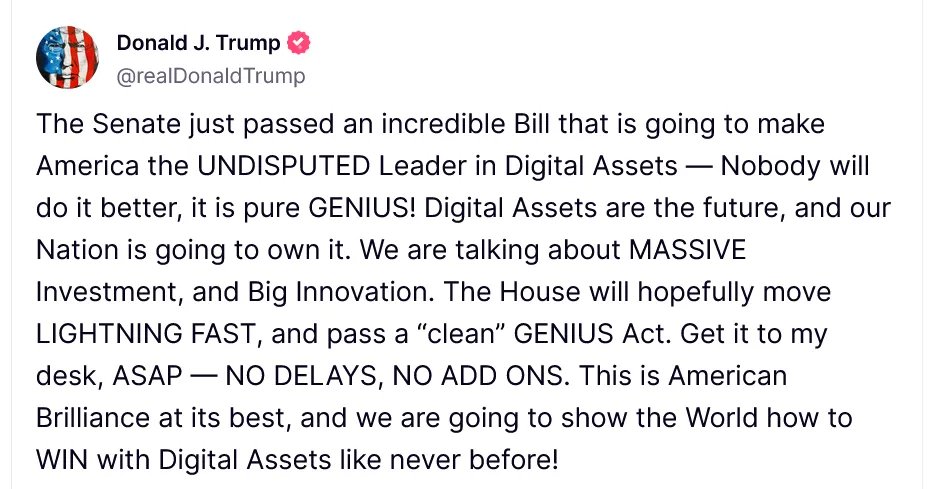

The key catalyst was the U.S. Senate’s passage on June 17 of the GENIUS stablecoin bill. Below, we analyze what this legislation entails and why it gained Senate approval with strong likelihood of becoming law.

The core regulatory elements of the stablecoin bill are as follows:

-

Dual Regulatory Framework: The GENIUS Act establishes a "dual-track" federal and state regulatory system, setting clear operational rules for the stablecoin market. Issuers must choose either federal or state oversight based on scale. Large-scale issuers (with over $10 billion in outstanding issuance) fall under federal regulation to ensure compliance and transparency.

-

1:1 Reserve Requirement: All stablecoins must maintain full 1:1 reserves composed exclusively of high-liquidity, safe assets. Permitted reserve assets include: U.S. dollar cash, insured bank demand deposits, U.S. Treasury securities maturing within 93 days, repurchase/reverse repurchase agreements, government money market funds investing solely in the above assets, and tokenized forms of these legally compliant assets. Issuers may not use cryptocurrencies or other high-risk assets as reserves.

-

Disclosure and Audit Mechanisms: To enhance market transparency, stablecoin issuers must publish monthly reserve reports and undergo independent audits. This aims to strengthen public trust in the stablecoin system and mitigate run risks.

-

Licensing and Compliance: Issuers must obtain licenses from regulators and comply with banking regulations. A transition period of 18 months is provided, during which existing stablecoins must adjust to meet compliance requirements.

-

Anti-Money Laundering and Sanctions Compliance: Stablecoin issuers must adhere to the Bank Secrecy Act (BSA) and anti-money laundering (AML) regulations, implementing Know Your Customer (KYC) procedures and transaction monitoring systems to prevent illicit financial flows.

-

Consumer Protection: In the event of an issuer’s bankruptcy, token holders have priority claims on reserve assets, ensuring their funds cannot be misappropriated.

Item two reveals a crucial insight—and likely the primary reason the stablecoin bill gained significant traction under a potential Trump administration: debt management.

The vision articulated by Senator Bill Hagerty of “strengthening dollar dominance” is now being rapidly capitalized upon. Standard Chartered estimates that if the bill passes, global stablecoin market capitalization could soar to $2 trillion by 2028—effectively creating a massive new buyer focused exclusively on short-term U.S. Treasuries. Even more striking, Tether and Circle already collectively hold $166 billion in U.S. Treasuries. Wall Street analysts predict that in coming years, stablecoin issuers will surpass hedge funds to become the third-largest holders of U.S. debt, trailing only the Federal Reserve and foreign central banks. Treasury Secretary Scott Bessent calculated that if stablecoin markets reach several trillion dollars by the end of the decade, private-sector demand for Treasuries could reduce government borrowing costs by several basis points—effectively leveraging crypto liquidity to subsidize U.S. fiscal financing. More subtly, this demand channels global capital into U.S. debt, reinforcing the dollar’s status as the world’s reserve currency through the conduit of stablecoins. No wonder Trump reportedly said of the bill: “Get it to my desk—fast.”

Although the bill still requires approval by the House of Representatives before reaching the president, market expectations suggest its eventual enactment is all but certain.

How Will the Stablecoin Bill Impact Investment?

Let’s start with Circle. With a current market cap of approximately $50 billion, Circle earned $160 million in profit in 2024. Based on optimistic projections from its Q1 2025 earnings, full-year 2025 profits could reach $490 million—implying a price-to-earnings ratio exceeding 100x. This projection assumes USDC issuance nearly triples from 2024 levels to $120 billion by year-end, doubling from the $60 billion mark reached in June 2025. Given that Tether’s USDT is currently issued at around $150 billion, such growth represents an extremely ambitious target for Circle.

Yet the market isn’t irrational—why assign such a high premium to Circle?

Arthur Hayes, founder of BitMEX and investor in Ethena stablecoin, puts it this way:

“U.S. Treasury officials believe assets under custody (AUC) managed via stablecoins could grow to $2 trillion. They also see dollar-backed stablecoins as a spearhead—not only to advance or sustain dollar hegemony but also to act as buyers indifferent to Treasury price volatility. This is an absolutely critical macro tailwind.”

The “price-to-dream” valuation reflects how stablecoins are increasingly framed as a financial lever for Trump to reinforce dollar dominance, boost Treasury appeal, and even support future Fed rate cuts. In that context, is a $50 billion valuation for the leading player in this space really expensive? At $100 billion, you still couldn’t call it overpriced.

What Other Investment Opportunities Exist in the Broader Stablecoin Ecosystem?

If we view stablecoins as cars, the value chain resembles automotive manufacturing: automakers (issuers), dealerships (distribution), parts suppliers (infrastructure), maintenance, and service providers. Similarly, the stablecoin ecosystem includes issuers, distribution channels, application-specific services, and technical infrastructure components.

Stablecoin issuance is already an elite-dominated arena. Tether controls much of the underground dollar market (gray/black economy) and is actively working toward legitimacy. Circle leads the compliant sector but faces rising competition. Payment giants like PayPal and Stripe, with established user bases, can distribute stablecoins at less than half the cost (see my prior analysis on Circle’s cost structure: https://x.com/xingpt/status/1930305013404053909). Meanwhile, USD1—a project backed by a team linked to Trump—is aligning itself with major exchanges, aiming to capture a slice of the pie from both Tether and Circle.

Other issuers are better understood as extensions of distribution channels. For multinational logistics or e-commerce firms, launching proprietary stablecoins may offer lower returns compared to simply using mainstream stablecoins and earning referral revenue.

For startups, I see greater potential in niche-service providers—akin to Square in traditional payments—offering stablecoin-based merchant acquiring solutions tailored to specific verticals. Simply telling merchants, “My processing fees are 90% lower than credit cards,” is far more persuasive than trying to educate them about accepting a new payment method like USDC.

Among niche applications, I believe small-value cross-border payments represent a major pain point. Traditional SWIFT remittances cost $10–30 for transfers that take 1–3 business days. By contrast, stablecoins offer near-instant settlement with negligible fees—delivering over a 10x improvement in user experience. A provider that successfully captures this segment could emerge as the PayPal of the stablecoin era.

As for technical infrastructure providers—custodians, RegTech platforms, etc.—I view these as relatively low ROI ventures due to high compliance burdens, heavy operations, and thin margins. However, they offer stable, counter-cyclical cash flows, making them suitable for defensive entrepreneurs seeking predictable income—or internal incubation projects within large firms like Ceffu or CB Custody.

Beyond Circle: What Are the Other Public Market Plays in the Stablecoin Narrative?

Circle’s rising valuation directly benefits Coinbase. Before the so-called “unequal treaty” expires, Coinbase collects 50% of Circle’s distribution revenue as a channel fee—a lucrative arrangement.

Newly listed stablecoin-related companies may also experience Coinbase-style rallies. Additionally, traditional brokers, payment processors, and card networks will gain exposure depending on their progress integrating with stablecoin networks:

Within crypto, growth in stablecoin supply significantly increases available capital in DeFi lending markets, benefiting leaders like Aave and Morpho. It also strongly advantages yield-focused protocols such as Ondo and Maple Finance—especially those tokenizing U.S. Treasuries on-chain, who stand to gain the most direct upside.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News