How do U.S. state governments select public blockchains for stablecoin issuance?

TechFlow Selected TechFlow Selected

How do U.S. state governments select public blockchains for stablecoin issuance?

Rate the public blockchains.

Last night I came across a news story: the U.S. state of Wyoming, in selecting a public blockchain for its upcoming stablecoin WYST, conducted an open scoring process. Ultimately, 11 chains made the shortlist, with Aptos and Solana tied for first place at 32 points, followed closely by Sei at 30. Ethereum and various Layer 2s scored only 26 or lower—quite different from their perceived ecosystem activity levels and token prices. How exactly were these scores determined? Curious, I studied it together with my teacher GPT.

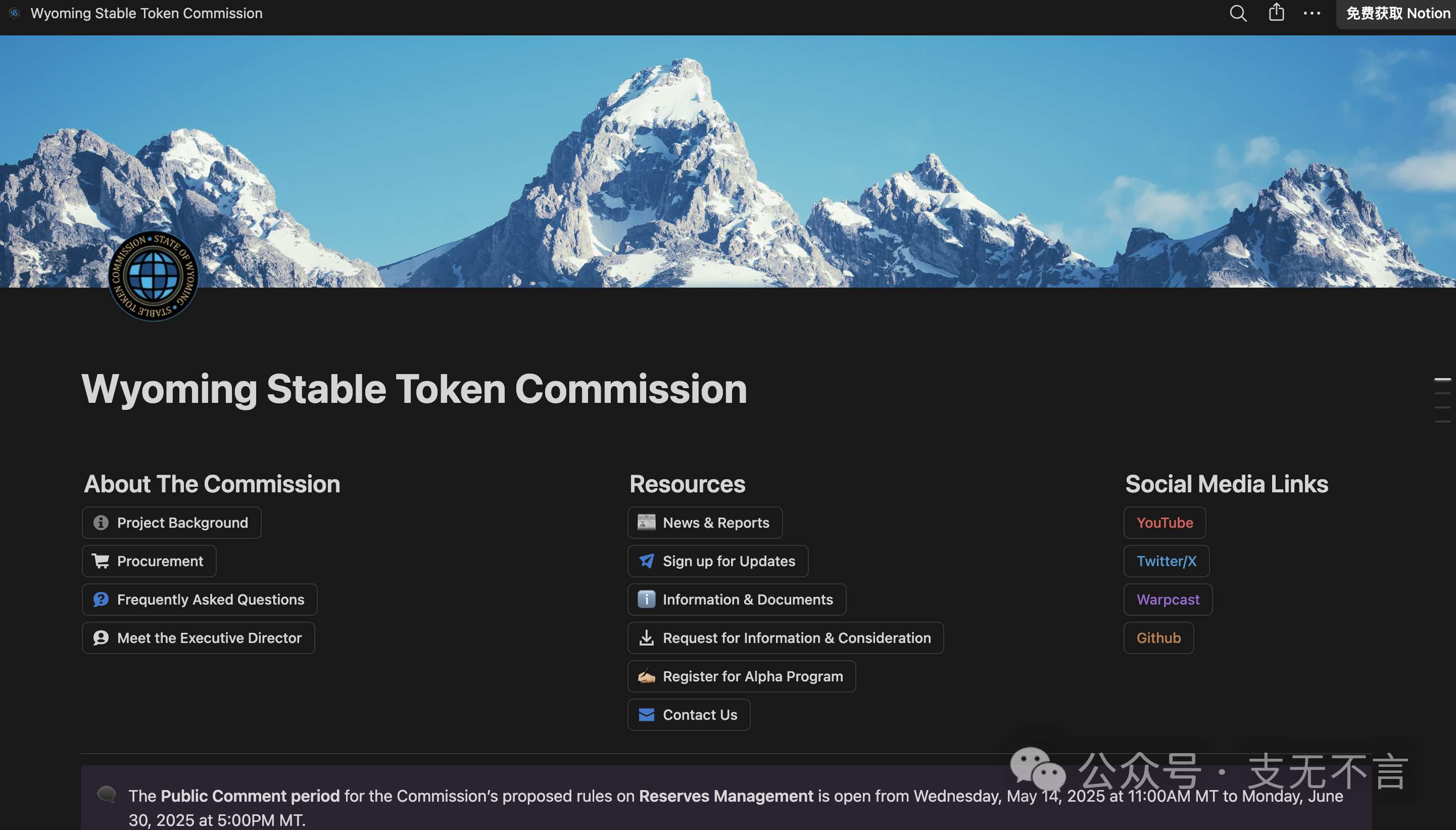

1/ First, kudos to this U.S. state government for building in public. The Wyoming Stable Token Committee, behind the WYST stablecoin, was established in March 2023 under the state's Stable Token Act. The committee maintains a public Notion page containing project overview, meeting calendars and records, scoring criteria and results, memos, Q&A, contact information, and links to its own YouTube channel, X account, Warpcast profile, and GitHub repository—more transparent and diligent than many half-hearted crypto projects today.

You can check it out directly here:

https://stabletoken.notion.site/

2/ In Q4 2024, the committee initially screened 28 blockchains. First, 14 were eliminated based on four yes/no criteria: permissionless access, supply transparency, on-chain analytics support, and ability to freeze transactions. Then, the remaining chains were scored across nine metrics (each worth up to 3 points): network stability, number of active users, TVL, stablecoin market cap, TPS, transaction fees, transaction finality time, block time, and whether registered in Wyoming. Additional points were awarded through five bonus advantages (2 points each): privacy, interoperability, smart contract/programmability, use cases, and partnerships. Six risk factors could each deduct 2 points: entity-level illegal activities, team-level illegal activities, history of security vulnerabilities, poor network availability, lack of bug bounty programs, and lack of code maintenance.

The final recommendation included five Layer 1 chains: Solana (32), Avalanche (26), Ethereum (26), Stellar (24), Sui (26); and four qualifying Layer 2 chains: Arbitrum (26), Base (25), Optimism (19), Polygon (26)—all added to the “Candidate Blockchains” list.

3/ Aptos and SEI were actually newly added in Q1 this year. During that quarter, the committee updated its evaluation framework. A new yes/no criterion—"vendor support"—was introduced, requiring that "the blockchain must have development, auditing, and infrastructure deployment supported by vendors approved by the committee. Foundation-led support is acceptable if approved."

Another updated requirement: "The chain must be fully indexed and supported by the committee’s partnered on-chain analysis platforms (e.g., Chainalysis, TRM Labs)."

Two new bonus advantage categories were also added, each worth 2 points:

- Emerging Market Trends: hosting projects in emerging sectors such as AI, DePIN, virtual reality, gaming assets, etc.

- Foundation Support: whether the foundation supports one or more of technical development, WYST liquidity, or marketing promotion

In this round of scoring, Aptos and SEI received 32 and 30 points respectively, earning them inclusion into the candidate list.

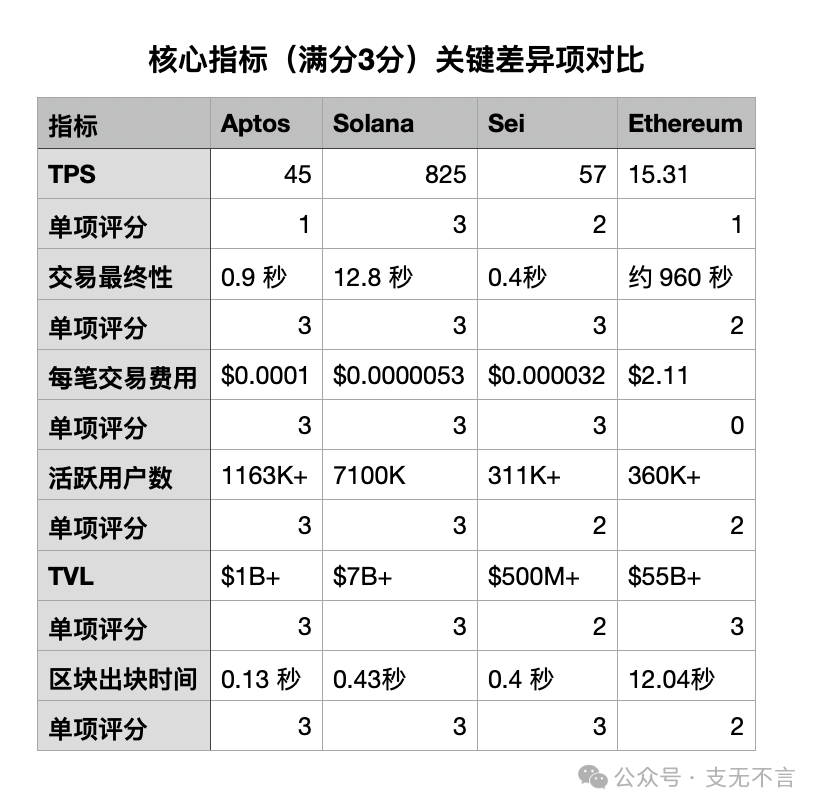

4/ So how did these score differences arise? I created a comparative chart focusing on key metric variations. Note that since the re-evaluation did not re-score the nine previously selected chains, some data reflects end-of-2024 figures rather than current ones.

As shown, Ethereum leads drastically in TVL, but lags significantly in performance metrics like transactions per second (TPS), transaction finality duration, cost per transaction, and block interval. This also explains why, due to Layer 2 rollups diverting activity, Ethereum’s mainnet active user count ranks at the same level as SEI, far behind Aptos and Solana.

But how did Aptos manage to tie with Solana for top score? Upon review, I found two reasons: first, Aptos performs well across the board—strong compliance, high speed, low cost, and stable network; second, the new bonus categories helped boost its score, while Solana did not participate in this latest round of re-scoring. If we exclude those two new bonus items, Solana would still hold the highest actual score.

5/ Ethereum supporters should take note: although Ethereum often positions itself as the ideal platform for real-world asset tokenization, when it comes to governmental technology selection, features like permissionless access are treated merely as pass/fail thresholds. Network stability counts for only one of several core metrics. Lack of technical barriers and insufficient network availability are penalized, but even incidents like Solana going offline resulted in only minor deductions (1 point each), with limited overall impact. Decentralization degree isn’t scored at all. Instead, the state prioritizes capabilities like freezing addresses and having a legal entity registered in Wyoming. Most core metrics focus on performance, cost, and scale.

That said, the state-level stablecoin initiative has always emphasized “multi-chain support” and “technology neutrality.” Rules will continue to evolve, feedback will be collected, and chains not yet selected are welcome to submit applications. Therefore, both listed candidates and unlisted chains theoretically retain future opportunities.

6/ Beyond blockchain selection, Wyoming’s state-level stablecoin project deserves attention. As the first U.S. state planning to issue a stablecoin, WYST originally aimed for a July 4 launch. However, during a late-May meeting, the timeline was pushed back to Q3 2025, with a proposed new date of August 20. Upcoming tasks include public consultation on reserve management rules, final approvals, establishing dedicated general ledger/accounting charts, setting up trust and liquidity fund accounts with third-party custodians, and engaging licensed service providers—including centralized exchanges, payment platforms, digital wallets, and market makers—for WYST purchase and resale operations.

Ultimately, the stablecoin’s reserves will be managed by Franklin Templeton, with Chainalysis handling on-chain analytics, and integrations carried out via LayerZero and Fireblocks. A decentralized validation network and official website will go live, WYST contracts deployed on mainnet before August 20, followed by a public announcement at the Wyoming Blockchain Symposium marking the official launch.

Beyond Wyoming, Nebraska has passed its “Financial Innovation Act,” authorizing an entity called Telcoin to issue a state-backed stablecoin tentatively named eUSD. Tinian Island, part of the Northern Mariana Islands—a U.S. territory—proposed launching the Marianas US Dollar (MUSD) stablecoin. Though vetoed by the governor in April, the Senate overturned the veto in May.

This wave of U.S. states and major corporations preparing to launch their own stablecoins echoes America’s Free Banking Era from 1837 to 1866. At that time, banks, railroads, construction firms, stores, restaurants, churches, and even individuals issued thousands of private currencies—around 8,000 types by 1860—with no uniform standards. The image accompanying this article shows a $1 private note issued between 1836–1841 by the Delaware Bridge Company of New Jersey.

7/ Recently, discussions around RMB-backed stablecoins have intensified, with several large companies showing interest. After resolving whether such a stablecoin should exist, the next question becomes: which blockchain will host it? Will a dedicated chain be built? Will corporate consortium chains like AntChain or JD Chain be used? Or will international public chains be adopted, or domestic ones like Hashkey Chain and Conflux? This dilemma faces governments and enterprises not just in China and the U.S., but worldwide. While Wyoming’s scoring and disclosure system may not be perfect, it sets a valuable precedent. We can expect to see more innovative governance models emerge in the future.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News