Stablecoin Shockwave: Restructuring Payment Channels and Fees?

TechFlow Selected TechFlow Selected

Stablecoin Shockwave: Restructuring Payment Channels and Fees?

Stablecoin legislation + retail terminal adoption pulls the "decade-long threat" into a 24-36 month valuation window, with the market using stock prices to front-run the repricing of the "net fee rate curve."

Author: Beauty of Bayes

On June 13, the entire U.S. payments sector—including Visa and Mastercard, which have some of the deepest business model moats—suffered sharp share price declines. Why did the "stablecoin expectation" instantly rupture the payments segment?

On June 11, the U.S. Senate passed a procedural vote on the GENIUS Act by a wide margin of 68–30, making a national stablecoin license "almost certain," significantly reducing regulatory uncertainty and dramatically lowering the barrier to issuance.

On June 12, Shopify and Coinbase announced a pilot program on the Base chain for USDC settlements, with initial merchants going live that day—indicating small and medium-sized businesses can now bypass card networks entirely to receive on-chain dollar-denominated payments.

On June 13, The Wall Street Journal reported Walmart and Amazon are evaluating the issuance of their own stablecoins; multiple media outlets followed up the same day.

For Visa and Mastercard, such corporate defections represent the first direct threat to their "fee-based moat," triggering panic-driven institutional selling and causing significant intraday stock volatility.

The payment industry's reaction shows this decline was not due to "market beta" but rather "business model delta."

-

Visa: Transaction assessment fees plus interchange revenue ≈ 55% of total revenue;

-

Mastercard: Business structure similar to Visa, but with higher leverage;

-

PayPal (leading the S&P payments sector sell-off): Branded Checkout fees at 2.9%+, facing the greatest substitution risk;

-

Shopify: Merchant Solutions (including Shopify Payments) ≈ two-thirds of gross profit;

Compared to the S&P 500’s intra-day pullback of –1.1%, payment stocks fell 2–6 times more sharply.

So, exactly which revenue curve did the "stablecoin shockwave" hit?

Why is this the first real threat to the 200 basis point (bp) fee moat?

When news broke Friday about Amazon and Walmart potentially issuing stablecoins, the entire payments sector plunged. Their combined scale and bargaining power are immense—Amazon, Walmart, and Shopify together account for over 40% of U.S. online GMV. If they collectively steer users toward using their "own coins," they could overcome cold-start challenges in one move. Unlike earlier attempts at "crypto payments," today’s on-chain cost-performance curve is now comparable to traditional card networks (Base chain TPS >1,200, transaction cost < $0.01).

① The core remains the fee differential: 2.5% (traditional card model) → 0.2% (stablecoin model)

The average U.S. merchant cost for card transactions is ~2.1–2.7% (swipe fee + assessment fee). In contrast, settling via USDC/Layer-2 stablecoins reduces total costs—including gas and on/off-ramp fees—to under 0.25%. This order-of-magnitude improvement in merchant economics immediately enhances their negotiating power.

② Inversion of capital utilization income

Stablecoin issuers must hold 1:1 Treasury bills (T-Bills), whose yields can be partially or fully passed through to merchants or users. Traditional card clearing, however, operates on T+1/2 settlement cycles without interest sharing—resulting in a double blow to revenue (compressed fees + loss of liquidity income).

③ Shift in barriers: Card networks’ global acceptance infrastructure and risk frameworks are built on decades of “multi-sided network effects.” But smart contracts and international settlement systems are replacing “physical terminal networks” with “public chain consensus layers” and “offshore dollar reserves,” enabling rapid migration of network externalities. The entry of Walmart and Amazon solves the “cold start” problem at once.

Company-level sensitivity analysis?

Visa / Mastercard: Every 1 bp change in fees ≈ 3–4% EPS impact;

For PayPal, transaction margins are already under pressure. If stablecoins accelerate Braintree (low-cost gateway) adoption, Branded Checkout gross profits will be diluted;

For Shopify, its Merchant Solutions take-rate (2.42%) includes card fees. A shift to on-chain settlement would require repricing Shop Pay commissions;

In the short term, both Visa and Mastercard are testing proprietary tokenized deposits and Visa-USDC settlements, but these currently represent less than 0.1% of TPV;

PayPal has already issued PYUSD, positioning itself to benefit as an issuer—but at the cost of sacrificing high-margin businesses;

Shopify is transforming into a “multi-channel payment platform,” potentially passing on lower fees while retaining volume, though increasing GMV burden;

Long-term moat considerations

Visa and Mastercard still maintain hard barriers in fraud detection, brand trust, and acceptance interfaces across 200+ countries—their moat remains the deepest in the payments stack;

PayPal’s 430 million active accounts and BNPL/wallet ecosystem continue to provide lock-in effects, but the company must undergo deep transformation;

Shopify’s SaaS integration, OMS, and logistics ecosystem make payments merely an entry point—profits can be shifted to SaaS ARPU by securing the front-end.

Scenario modeling: What does 10% traffic diversion mean?

Assumption: $1.2 trillion U.S. e-commerce GMV in 2026, 10% stablecoin penetration, 200 bp fee gap.

Visa + Mastercard: Potential annual revenue reduction ≈ $1.2T × 10% × 200 bp × 55% revenue share ≈ $1.3B → translates to ~–6% EPS impact.

PayPal: If 15% of branded TPV migrates away, operating profit may decline by 8–10%.

Shopify: Assuming only 20% GMV shifts and take-rate drops by 40 bp, gross margin compression ≈ 150 bp.

More importantly, the low fees of stablecoins exert downward pressure across the entire payment stack. Even if only 10% is replaced, the total revenue pool available to the payment ecosystem faces clear fee pressure.

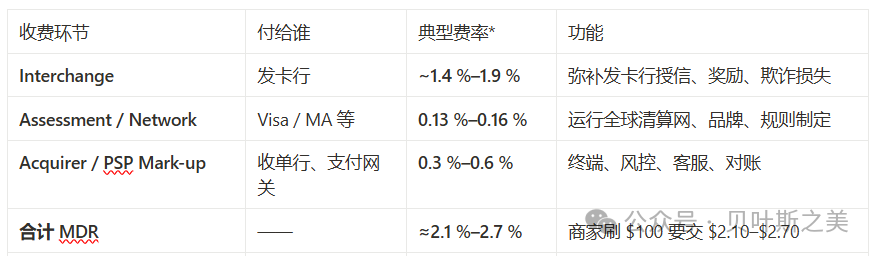

Detailed breakdown: The U.S. merchant payment stack

Average total fees for most North American merchants range between 2.0%–3.2%; the example used here is 2.34% (1.80% + 0.14% + 0.40%). Let’s unpack the leap from “2.5% → 0.2%”—which specific fee layers are being reduced to mere fractions?

1. Traditional card path: 2%–3% “three-tier revenue split”

Interchange = the “cake” for issuing banks (covering credit extension, rewards, fraud risk).

Assessment / Network & Processing fee = the “cake” for Visa and Mastercard (~0.13%–0.15% domestic base rate), plus a few cents per transaction processing fee.

Card networks do not set interchange fees directly; instead, they charge independent network fees to acquiring banks, who pass them to merchants—this constitutes the core revenue line in Visa/Mastercard annual reports.

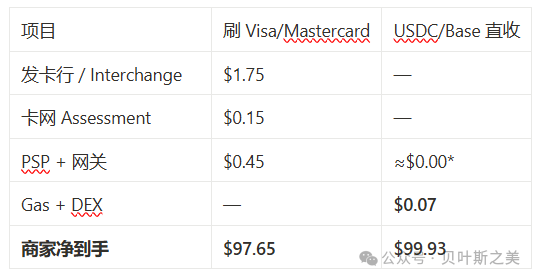

2. Stablecoin path: Reducing “tier-by-tier tolls” to single decimal points

Scenario: A Shopify merchant receives a $100 order paid in USDC (on Base chain). The merchant chooses to retain USDC rather than immediately converting it to fiat.

If the merchant insists on cashing out, Coinbase Commerce offers a 1% off-ramp—total cost ~1.07%, still well below 2%. However, long-tail merchants often keep USDC to pay suppliers or ad costs, effectively skipping the “withdrawal” step altogether.

Why can it be so cheap (< 0.25%)?

First, Interchange is completely eliminated—no issuing bank, no credit risk → the largest slice (~1.5%+) vanishes.

Second, Network costs are drastically compressed—public chain consensus (gas) is priced in fixed cents, negligible for transaction values between $100–$1,000.

Third, acquirer/gateway services become commoditized. Coinbase, Circle, and Stripe compete aggressively with “zero-to-fractional” fees to gain market share, greatly increasing merchant bargaining power—the biggest pressure falls on aggregated payment platforms.

Additionally, reverse subsidies emerge: Shopify offers 1% USDC cashback to consumers, essentially using “interest income + marketing budget” to offset residual fees and lock traffic back into its ecosystem.

3. Comparative invoice ($100 transaction)

In the Shopify pilot, the acquiring fee is subsidized to zero; using Coinbase Commerce incurs a $1.00 fee.

4. What other “invisible revenues” are being eroded?

Thus, the drop from 2.5% to 0.2% is not just rhetoric—it transforms Interchange, Network, and Acquirer commissions into “Gas + DEX + ultra-thin gateway” components, shrinking the cost base by two orders of magnitude.

The defection of giants like Shopify and Amazon gives zero- or even negative-fee models access to meaningful GMV for the first time, prompting markets to reprice the fee moats of payment incumbents.

The immediate impact on Visa and Mastercard remains limited. Based on Visa’s latest full fiscal year data (FY 2024, ended September 2024), we calculate the “platform Take Rate”—net revenue ÷ payment volume:

Visa net revenue: $35.9B, Payment volume: $13.2T → 35.9 ÷ 13,200 ≈ 0.00272

≈ 0.27% (≈ 27 bp). Using “payment + cash withdrawal volume,” the total reaches $16T

35.9 ÷ 16,000 ≈ 0.00224 ≈ 0.22% (≈ 22 bp)

Payment Volume (PV) is Visa’s standard benchmark, excluding ATM withdrawals. Hence, 0.27% is the more commonly cited Take Rate. Including ATM/cash withdrawals increases the denominator, diluting the rate to ~0.22%. This Take Rate includes all of Visa’s revenues (service fees, data processing, cross-border fees, etc.), but excludes Interchange collected by issuing banks—which is not Visa’s income.

Further breaking down FY 2024 revenue: Service fees $16.1B → ~12 bp against PV; Data processing fees $17.7B and cross-border fees $12.7B are primarily volume- or transaction-based, not easily expressed as simple percentages of payment volume.

Therefore, per Visa’s FY 2024 reporting, the standard “net revenue Take Rate” is ~0.27% (27 bp); including cash withdrawals brings it to ~0.22%. This is broadly comparable to Chinese payment channels—WeChat Pay and Alipay typically charge 0.6%, with service providers offering rates as low as 0.38%/0.2% (promotions, SME discounts). The key difference lies in the much higher Interchange fees in the U.S.

Two key metrics to watch next:

— Merchant adoption speed post-legislation: Penetration of 10% GMV alone could erode Visa/MA EPS by 5%+;

— Whether card networks can re-integrate on-chain settlement into their “pipeline”: If they can reclaim 0.1%–0.2% in clearing fees, stock prices may revert to the mean.

Once the fee moat narrows, the denominator in valuation models changes—that was the fundamental reason payment stocks were dumped by institutions last week.

What “high-frequency signals” should we monitor going forward?

-

Senate final vote on June 17 and House scheduling in July (pace of legislative progress).

-

Amazon / Walmart whitepapers or patent filings (to assess genuine intent vs. negotiation tactics).

-

Shopify-USDC TPV KPI: Monthly volume exceeding $1B would validate merchant feasibility.

-

Visa/MA stablecoin clearing network test rates: Can they absorb “on-chain settlement” into their own pipeline?

-

Reserve scale of Circle, Tether, etc.: If T-Bill holdings grow >25% YoY, it indicates real capital outflow.

Hence, the sector-wide adjustment isn't just "news炒作"—it reflects a fundamental rewrite of valuation assumptions. Concerns have emerged, and the entire U.S. traditional payment infrastructure and fee structure face disruption. While short-term impact is limited, the trajectory of stablecoin development must be closely watched.

Stablecoin regulation + retail adoption has pulled a "threat from ten years ahead" into a 24–36 month valuation window—markets are front-running the repricing of "net fee curves."

Payment giants aren’t passive: Network-as-a-Service, custodial settlement layers, and Tokenized Deposits could rebuild defenses, but this requires time and capital investment.

In the short term, the sell-off reflects the "most pessimistic fee compression–EPS sensitivity" scenario. If final legislation tightens, or card networks successfully re-channel on-chain payments, stock prices may experience beta-mean reversion.

In the medium to long term, investors should evaluate payment companies' true moat erosion using second-order derivatives (changes in gross profit structure) rather than first-order ones (transaction volume growth).

Stablecoins represent a parallel clearing network offering “zero fees + interest rebates.” When the strongest buyers (Walmart/Amazon) and most inclusive sellers (Shopify merchants) embrace it simultaneously, the myth of a uniform 200 bp fee becomes unsustainable—the stock market has sounded the warning before revenue impacts materialize.

End of article.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News