The battle for profits has begun: how can emerging stablecoins challenge USDT and USDC's monopoly on billions in revenue?

TechFlow Selected TechFlow Selected

The battle for profits has begun: how can emerging stablecoins challenge USDT and USDC's monopoly on billions in revenue?

This article introduces three new stablecoin protocols vying for a billion-dollar monopolistic market with yields ranging from 4% to 16%.

Author: Duo Nine

Translation: Tim, PANews

The stablecoin market is changing. USDT and USDC do not return the yields they generate to users; instead, they keep it all for themselves.

This creates an opportunity for other stablecoin competitors.

Now let’s look at three such projects—more are on the way.

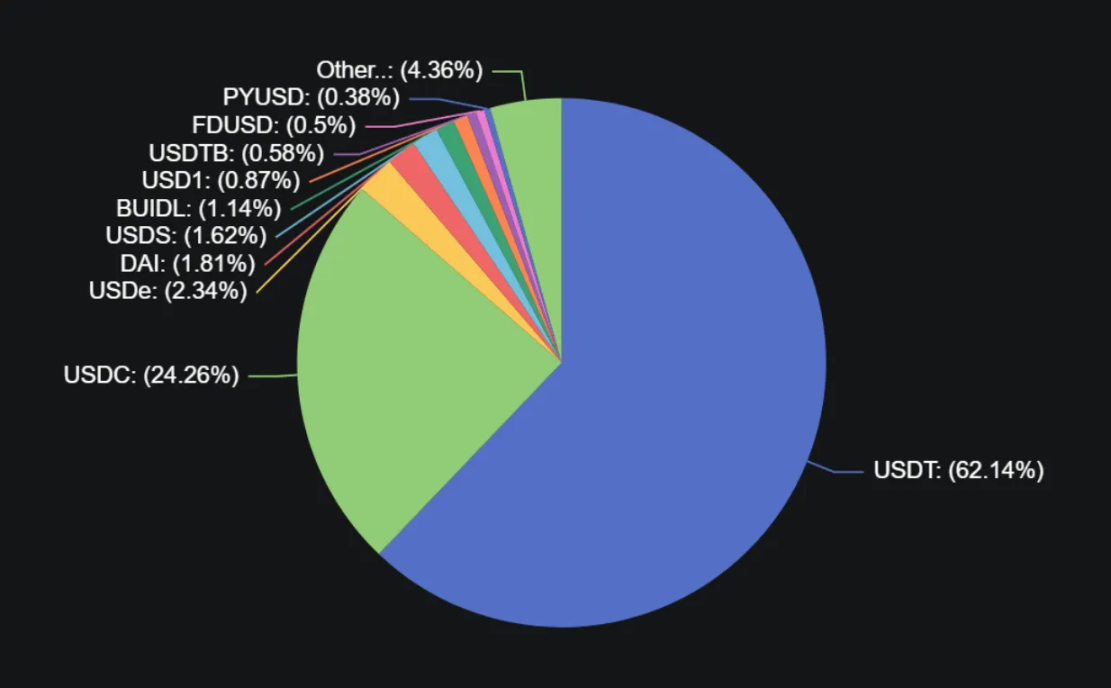

The current stablecoin market size is approximately $250 billion, with USDT accounting for 62% and USDC for 24%. Together, they control 86% of the total stablecoin market cap.

What's the problem?

Neither USDT nor USDC pays any yield to holders. All dollar-denominated collateral assets are invested in U.S. Treasuries, which currently generate around a 4% annualized return—all of which goes entirely to Tether and Circle, not to users.

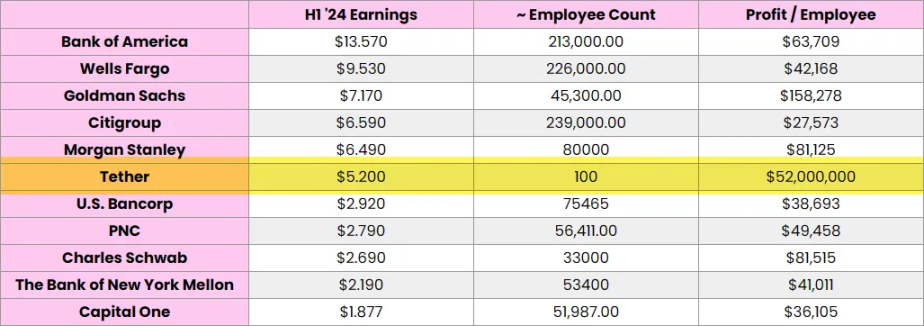

You might imagine that in 2024, Tether became the world’s most profitable company, generating over $50 million in profit per employee. By 2025, this figure had approached $60 million. This makes Tether the most profitable bank in existence.

But this also represents a clear vulnerability.

Holders receive no returns and will inevitably demand a share of these profits. For alternative stablecoins aiming to share yields with users, this presents a perfect entry point. The following three cases illustrate this trend.

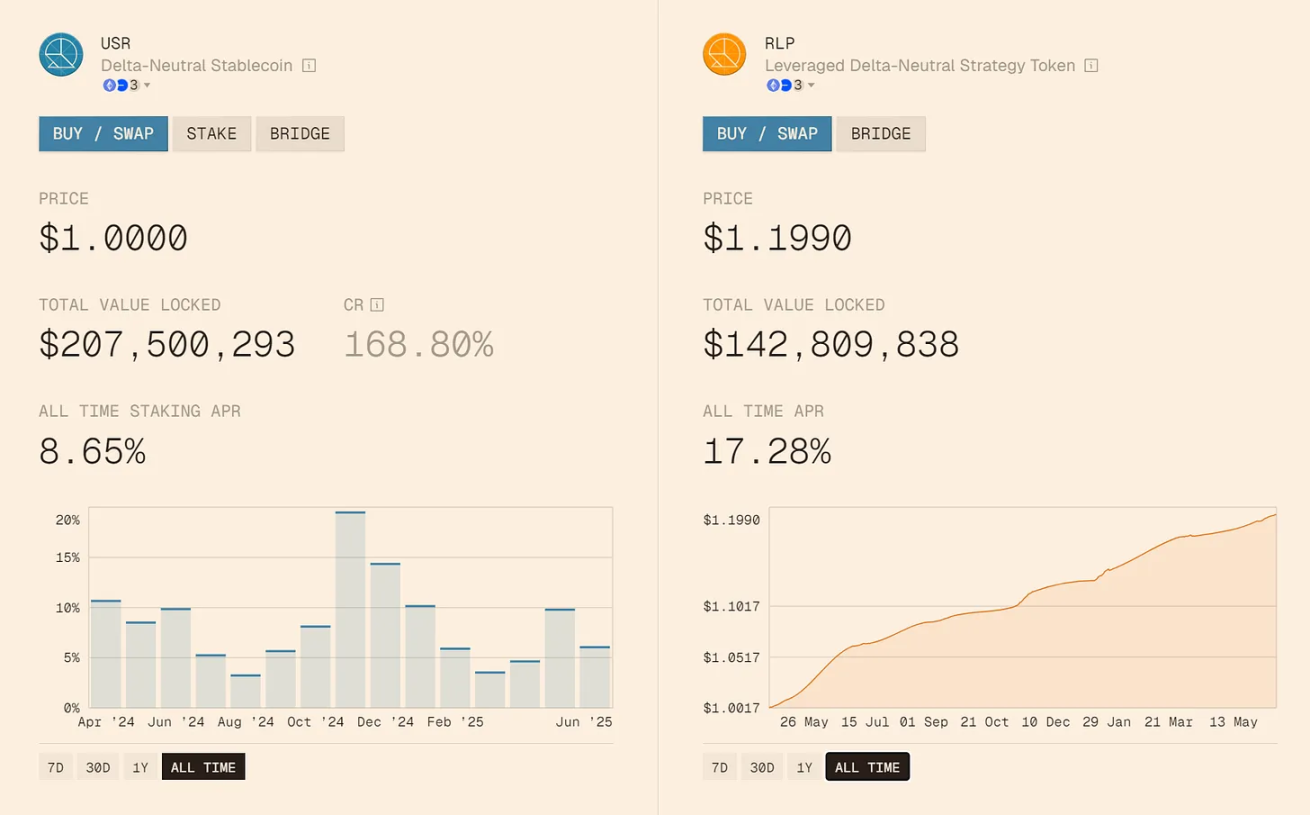

1. Resolv, USR – 8.6% Annual Yield

Resolv has two key products:

-

USR: A stablecoin fully backed 1:1 by Bitcoin and Ethereum

-

RLP: Resolve Liquidity Pool token

An annualized yield can be generated through hedged Bitcoin and Ethereum positions as shown below:

USR is secured by 168% overcollateralization, making its risk extremely low. Its main risk lies in potentially losing its dollar peg, though this has never happened so far. With an average annual yield of 8.65%, it outperforms AAVE by double—a performance worth watching.

RLP is a token whose value accumulates through yield and increases in price over time. Its returns come from leveraged deployment of excess collateral into identical market-neutral strategies. RLP carries higher risk—if market conditions turn unfavorable, the token price may decline.

RLP acts as a buffer and protection layer for USR. RLP depositors take on greater risk in exchange for higher rewards, while USR users are shielded. This design mechanism is fair.

Advantages of USR

-

Higher yield than AAVE

-

Fully backed by BTC and ETH

-

High transparency

-

Protected by the RLP mechanism during adverse market conditions

-

No minting or redemption fees

-

Instant staking and unstaking without lock-up periods

Disadvantages of USR

-

Service only available on Ethereum network, potentially leading to higher gas fees

-

Users must stake USR tokens to earn yield

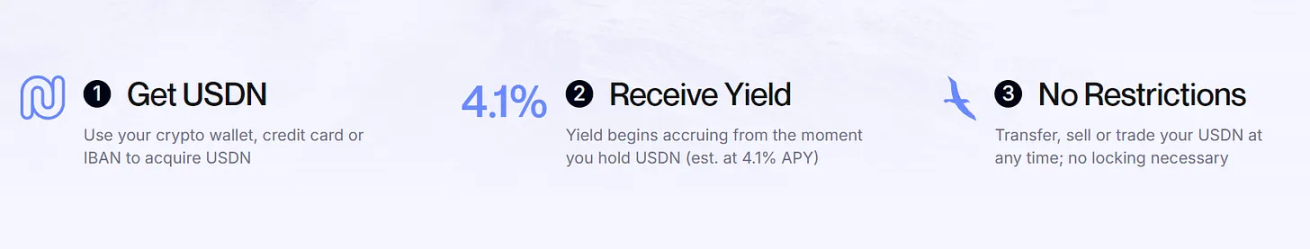

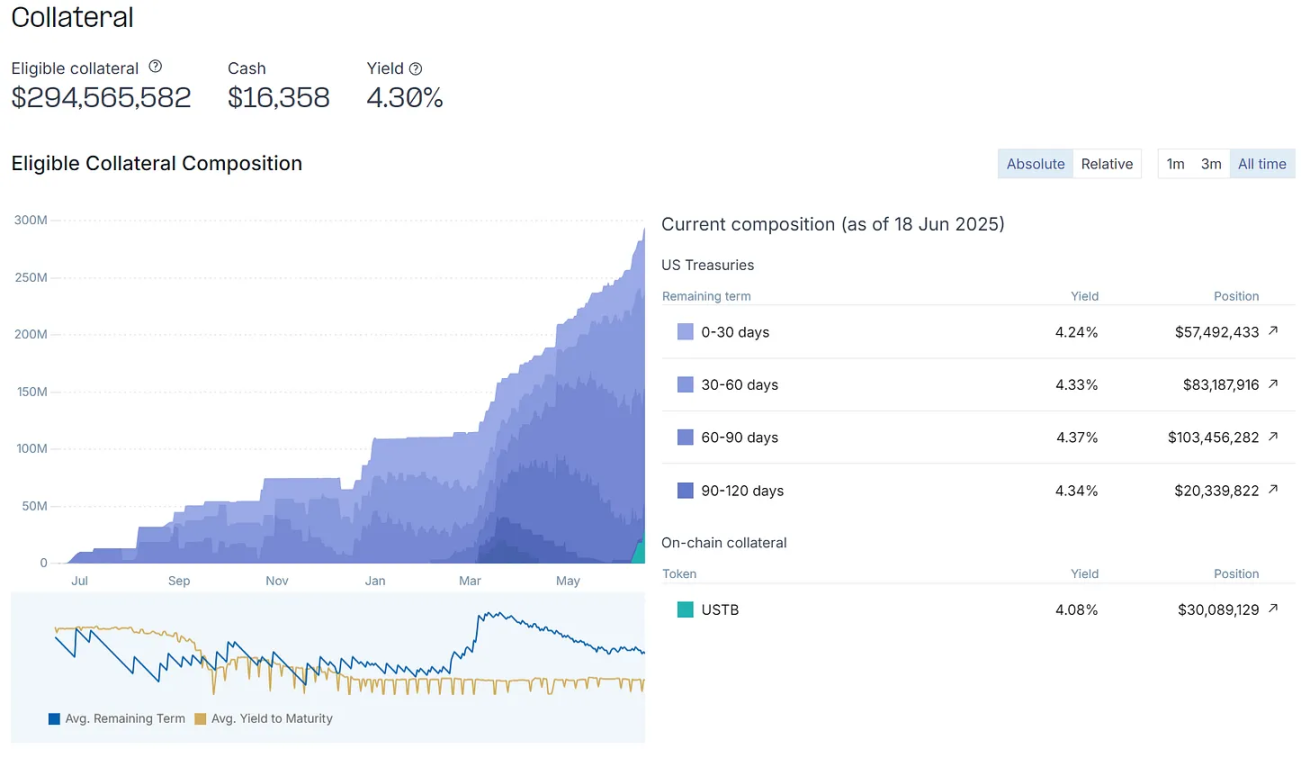

2. Noble Dollar, USDN – 4.1% Annual Yield

Noble Dollar is a product launched by m0. Its core feature: users earn 4.1% annual yield from U.S. Treasuries daily based on their USDN holdings—no locking or staking required. In short, extra USDN automatically appears in users’ wallets every day, akin to free airdrops.

Although USDN currently has limited use cases, it will soon be supported across multiple chains including Ethereum and Layer 2 networks. Imagine staking USDN on AAVE: users could earn both the base 4% yield plus an additional 4–5% incentive yield from AAVE.

The potential applications of this digital dollar are endless. If this model succeeds in the future, USDT and USDC could face disruption.

Advantages of USDN

-

Attractive yield backed by U.S. Treasuries

-

High transparency

-

No staking required

-

Daily yield settlement

-

Can be purchased with fiat directly on their website

-

Native cross-chain bridge enables easy transfer of USDC

Disadvantages of USDN

-

Limited current use cases (to be improved)

-

Lower yield compared to competitors like Resolv

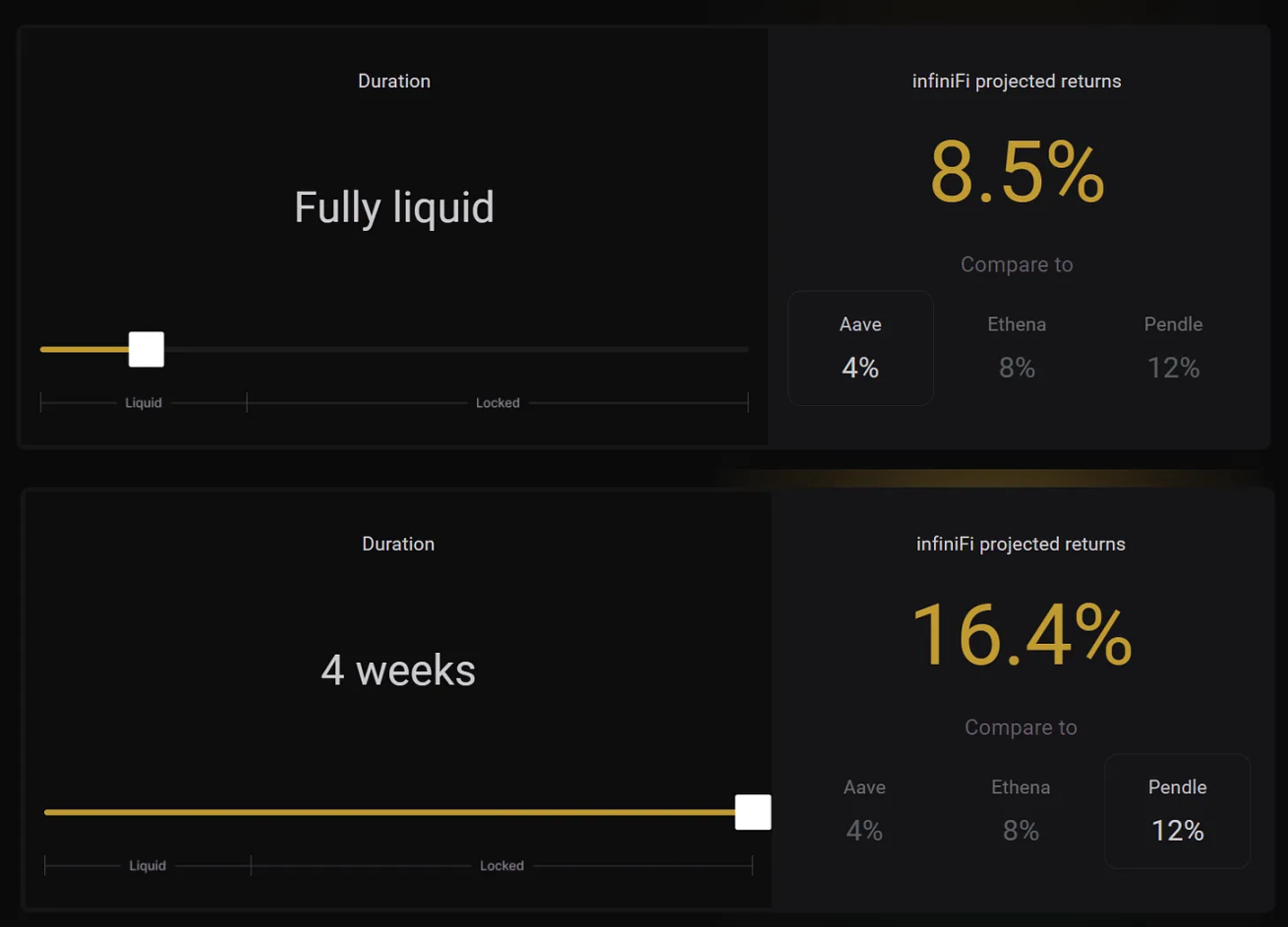

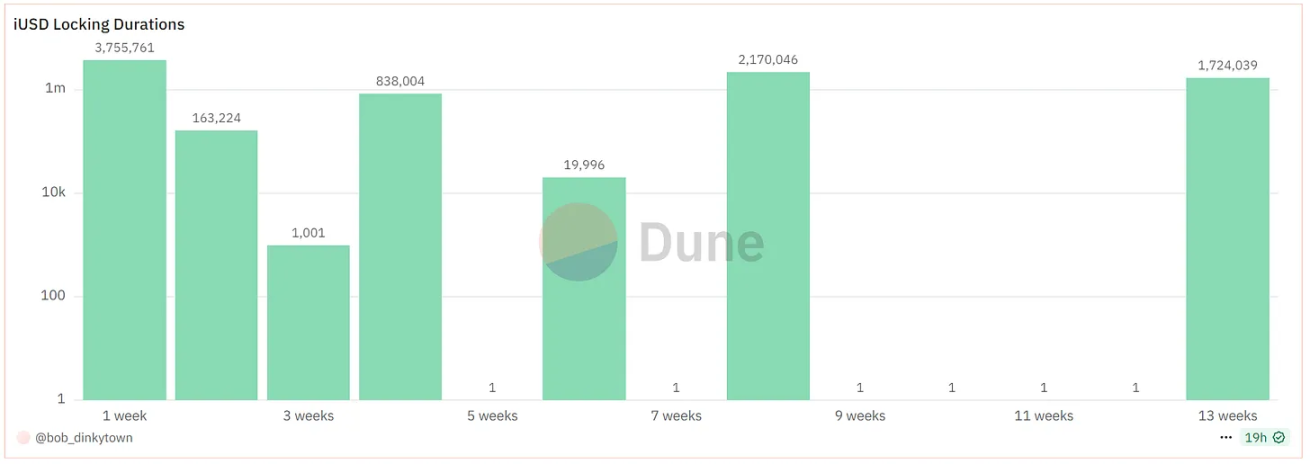

3. infiniFi, iUSD – 8.5% to 16% Annual Yield

InfiniFi belongs to a new generation of "stablecoins" offering varying yields based on user preferences and risk tolerance. To obtain 1 iUSD, a user deposits 1 USDC, which is then deployed into diversified yield-generating strategies.

If a user wants instant liquidity and the ability to withdraw USDC at any time, the yield will be lower. However, if they agree to lock up iUSD for longer periods, the protocol can employ more advanced USDC strategies to achieve higher returns. While risk increases, the higher yield may justify it.

The current yield with no lock-up period is about 8.5%. But if users are willing to lock their iUSD for four weeks or longer, yields can reach up to 16.4%.

Overall, I don’t recommend locking funds for several weeks. If something goes wrong, you’ll be stuck. Still, within the context of stablecoin investing, this approach is reasonable—it’s somewhat similar to short-term bank deposits.

The iUSD mechanism works like this: users who lock iUSD for one or more weeks provide protection for those keeping iUSD liquid (unlocked). In case of system issues, users earning the highest yields bear losses first. This resembles how Resolv’s RLP users protect USR holders. Why is this mechanism crucial?

Imagine a scenario where all iUSD holders want to withdraw and reclaim their USDC. Only when sufficient liquidity exists can holders of liquid (unlocked) iUSD exit first.

If liquidity is insufficient (because much of the USDC is locked in long-term strategies), iUSD may lose its 1:1 peg with USDC or incur losses. This is because prematurely exiting an 8-week locked USDC strategy may incur additional costs.

These losses are borne first by users with the longest lock-up periods. In principle, this mechanism helps maintain iUSD’s peg and protects liquid iUSD holders. However, if liquidation is too slow, black swan events could still cause iUSD to depeg.

Generally speaking, as long as InfiniFi doesn’t hold large amounts of USDC or suffer major losses in its strategies, the risk remains low. But if the DeFi protocols used in its long-term strategies (such as Ethena) are hacked or drained, risks escalate. In such cases, iUSD users using lock-up mechanisms could suffer severe losses—even principal loss.

Advantages of iUSD

-

Extremely high yields

-

High transparency

-

Immediate liquidity available even at the lowest yield tier

-

High-yield tiers backstop lower-yield tiers

-

Suitable for users with different risk appetites

Disadvantages of iUSD

-

It is not a true stablecoin but rather a receipt for deposited USDC

-

Liquidity risk—insufficient USDC available to meet redemption requests

-

iUSD may depeg if liquidity dries up

-

High-risk strategies may underperform or result in principal loss

-

Exposed to risks inherent in all DeFi platforms used for yield generation

When investing in such new protocols, I suggest starting with small amounts and waiting until after the bear market before committing larger sums. These new protocols need stress-testing to prove their viability. Take InfiniFi, for example—its operational model resembles a hedge fund that collects user capital for investment.

On the other hand, closely monitoring developments in this emerging sector is critical. The combination of various protocols not only offers diverse options but also allows users with different risk tolerances to build portfolio strategies that achieve targeted returns at their preferred risk levels.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News