Traditional payment models on the verge of collapse—will a trillion-dollar stablecoin financial firm emerge?

TechFlow Selected TechFlow Selected

Traditional payment models on the verge of collapse—will a trillion-dollar stablecoin financial firm emerge?

The Collapse of Stablecoins and Traditional Payment Models.

Author: Rob Hadick, Partner at Dragonfly

Translation: AididiaoJP, Foresight News

Stablecoins are not meant to enhance existing payment networks—they are designed to completely disrupt them. Stablecoins enable businesses to bypass traditional payment rails entirely, meaning these conventional systems could one day be fully replaced.

When payments are built on stablecoins, every transaction is simply a digital entry on a ledger. Today, many emerging companies are already driving the reconfiguration of how money moves.

Recently, much discussion has centered around stablecoins becoming Bank-as-a-Service (BaaS) platforms—connecting existing payment rails from issuing banks to merchant acceptance and everything in between. While I agree with this view, when I consider how businesses and protocols will create and capture value under new paradigms, viewing stablecoins merely as connectors within legacy infrastructure significantly underestimates their true potential. Stablecoin payments represent not just incremental improvement but a fundamental reimagining of payment rails from the ground up.

To understand where we’re headed, we must look back at history—because history reveals the obvious evolutionary path.

The Evolution of Modern Payment Rails

The origins of modern payment systems trace back to the early 1950s. Diners Club, founded by Frank McNamara, introduced the first multipurpose charge card. This card established a closed-loop credit model, with Diners Club acting as the intermediary between merchants and cardholders. Before Diners Club, nearly all transactions were conducted via cash or proprietary bilateral credit agreements directly between merchants and customers.

After Diners Club's success, Bank of America (BofA) saw an opportunity to expand its lending business and reach a broader customer base, launching the first mass-market consumer credit card. BofA mailed over two million unsolicited, pre-approved cards to middle-class consumers, usable at more than 20,000 merchants across California. Due to regulatory constraints, BofA began licensing its technology to other U.S. banks and eventually expanded internationally, forming the first credit card payment network. However, this rapid expansion brought massive operational challenges and severe credit risk, with delinquency rates soaring above 20%. Rampant fraud further threatened the entire project, bringing it close to collapse.

It became clear that only through a true cooperative organization—establishing rules and providing shared infrastructure—could the chaos and challenges across bank networks be resolved. Members could compete on product pricing but needed to adhere to common standards. This organization later evolved into what we now know as Visa. Another group formed by California banks to compete with BofA eventually became Mastercard. This marked the birth of our modern global payment model, which has since become the dominant structure in the global payments industry.

From the 1960s to the early 2000s, nearly all innovation in payments focused on enhancing, supplementing, and digitizing this existing global framework. After the internet boom of the 1990s, much of the innovation shifted toward software development.

E-commerce emerged in the early 1990s—the purchase of a Sting CD on NetMarket was the first online transaction. Soon after, PizzaNet became the first national retailer to accept online payments. Major e-commerce players like Amazon, eBay, Rakuten, and Alibaba were founded in the following years. The rise of e-commerce gave birth to numerous early independent payment gateways and processors. Most notably, Confinity and X.com—founded in late 1998 and early 1999 respectively—merged to become today’s PayPal.

Digital payments led to the creation of many well-known, multi-billion-dollar companies. These firms connected offline merchants with online retail, including Payment Service Providers (PSPs) and PayFacs such as Stripe, Adyen, Checkout.com, and Square. They solved merchant-side problems by bundling gateways, processing, reconciliation, fraud compliance tools, merchant accounts, and other value-added software and services. Yet clearly, they did not fundamentally disrupt the traditional financial payment network.

Although some startups aimed to disrupt traditional banking payment networks and card issuance infrastructure, prominent companies like Marqeta, Galileo, Lithic, and Synapse primarily focused on integrating new businesses into existing banking networks and infrastructures rather than replacing them. Many companies discovered that simply adding a software layer atop legacy infrastructure did not lead to explosive growth.

Some companies recognized the limitations of traditional payment methods and foresaw building payment solutions based on internet-native currencies—completely independent of traditional banking infrastructure. PayPal was among the most famous examples. In the early 2000s, many startups focused on digital wallets, peer-to-peer transactions, and alternative payment networks. By fully bypassing banks and card associations, giving end users greater monetary autonomy, companies like PayPal, Alipay, M-Pesa, Venmo, Wise, Airwallex, Affirm, and Klarna emerged.

Initially targeting underserved populations with better user experiences, product offerings, and cheaper transactions, these companies gradually captured increasing market share. Traditional financial payment providers felt the threat from Alternative Payment Methods (APMs), prompting Visa and Mastercard to launch Visa Direct and Mastercard Send—real-time P2P payment services. Although these represented major improvements, they still suffered from limitations imposed by legacy infrastructure. These systems still required pre-funded balances or involved foreign exchange/credit risk, necessitating internal hedging of liquidity pools without achieving instant, transparent settlement.

Essentially, the evolution of modern payments follows this path: Closed-loop + Trusted Intermediary → Open-loop + Trusted Intermediary → Open-loop + Partial Personal Autonomy. Yet opacity and complexity remain dominant, resulting in poorer user experiences and rent extraction at multiple points across the network.

The Evolution of Merchant Payments

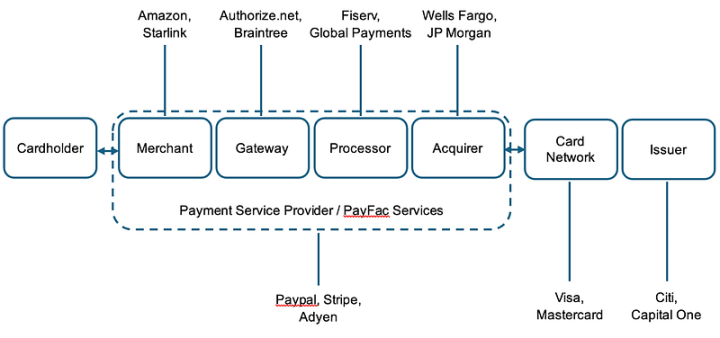

Businesses can use stablecoins to bypass part or all of the technical infrastructure of traditional payment networks. The diagram below illustrates a simplified merchant payment flow:

And here is the breakdown of responsibilities within a stablecoin-based payment network:

Today, Stripe already handles much of the merchant-side workflow, even offering merchant accounts and various software for operating businesses and accepting payments. But it does not operate its own card network or issue payment cards.

Now imagine a world where Stripe becomes a central bank, issuing its own stablecoin backed by collateral approved under the GENIUS Act. The stablecoin enables atomic settlement between consumer and merchant wallets via a transparent, open-source ledger (blockchain). You no longer need issuing banks or acquiring banks—Stripe (or any issuer) only needs one (or a few) banks to hold the reserve backing its stablecoin. Transactions occur directly on-chain through wallets, or via minting/redeeming requests sent to Stripe (the issuer / central bank), settled on-chain. Clearing and settlement happen through smart contracts that can manage refunds and disputes (see Circle’s refund protocol). Payment routing and even conversion into other currencies/products can be programmatically executed. With stablecoins and blockchain technology, data transfer standards from banks to gateways, processors, and networks become simpler. Greater transparency and fewer stakeholders make fees and accounting far more straightforward.

In this world, Stripe appears to have almost entirely replaced the current payment model—owning full infrastructure, offering accounts, card issuance, credit, payment services, and network—all built on superior technology that reduces intermediaries and gives wallet holders near-total control over fund flows.

Simon Taylor: “If you build on stablecoins, every transaction is just a number moving on a ledger. Merchants, gateways, PSPs, and banks previously had to reconcile different ledger entries. With stablecoins, anyone operating with stablecoins becomes simultaneously the gateway, PSP, and acquirer—every transaction is just a number moving on a ledger.”

This sounds like science fiction. Are there real-world issues today around fraud, compliance, stablecoin availability, liquidity/cost? Will there be incremental steps between today and this potential future? Even Real-Time Payments (RTPs) have limitations—programmability and interoperability in cross-border remittances are problems RTPs cannot solve.

Regardless, the future is arriving step by step, and some companies are preparing. Leading issuers like Circle, Paxos, and withausd are expanding their products. Payment-focused blockchains like Codex, Sphere, and PlasmaFDN are moving closer to serving end consumers and enterprises. Future payment networks will drastically reduce intermediaries while increasing autonomy, transparency, interoperability, and customer value.

Cross-Border Payments

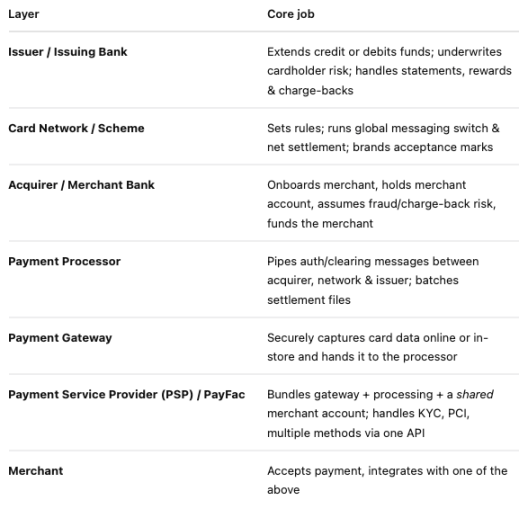

B2B cross-border payments are one of the areas where stablecoin adoption is growing rapidly.

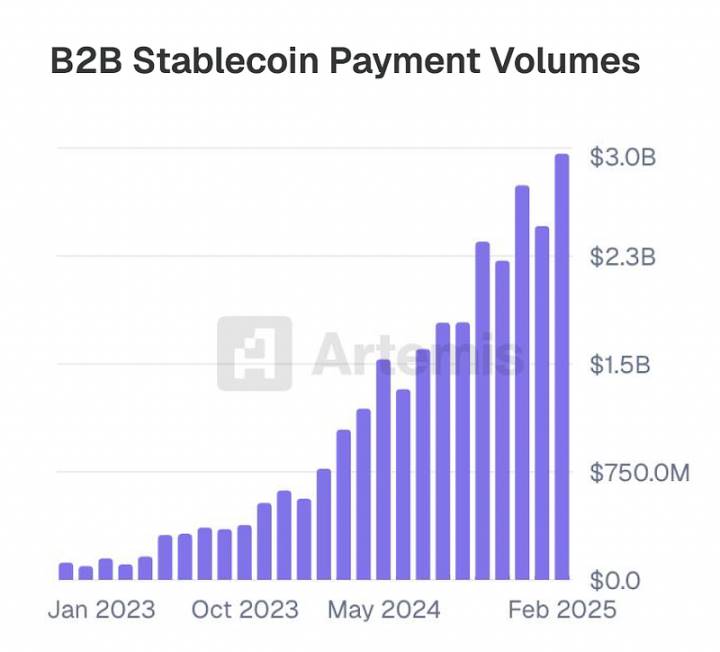

Matt Brown wrote an article last year about cross-border payments, illustrated by this chart:

In many cases, cross-border transactions involve multiple banks using SWIFT for messaging. While SWIFT itself isn’t the problem, the back-and-forth communication between banks adds significant time delays. Settlement often takes 7–14 days, introducing substantial risk and cost, with extremely low transparency. For example, JPMorgan Chase frequently experienced situations where millions of dollars were effectively “lost” for extended periods when transferring funds from its U.S. parent to foreign subsidiaries. Additionally, multiple counterparties expose participants to foreign exchange risk, raising average transaction costs by 6.6%. Moreover, corporate funds generate little to no yield while in transit across borders.

Therefore, it’s no surprise that Stripe recently announced financial accounts powered by stablecoins. This allows businesses to access USD-denominated financial accounts backed by stablecoins, mint/redeem stablecoins directly via Bridge, and transfer funds to other wallet addresses through the Stripe dashboard. Using the Bridge API for fiat on/off-ramps, issue payment cards backed by stablecoin balances (depending on region, currently using Lead Bank), convert into other currencies, and ultimately move directly into interest-bearing products for treasury management. While many features still rely on traditional systems as interim solutions, sending, receiving, issuing, and exchanging stablecoins and tokenized assets do not depend on legacy rails. Fiat on/off-ramp solutions resemble today’s APMs—companies like Wise and Airwallex have essentially built their own banking networks to hold funds locally in different countries and net settle at day’s end. Airwallex co-founder Jack Zhang pointed this out correctly last week, though he didn’t consider how the world would change if fiat on/off-ramps were no longer needed.

If you only use stablecoins to buy tokenized assets without converting to fiat, you completely bypass the traditional correspondent banking model. This greatly reduces reliance on third parties to actually hold and transmit assets, allowing customers to capture more value and lowering payment costs for everyone. Startups like Squads Protocol, Rain Cards, and Stablesea are working to enable direct buying and selling of tokenized assets via stablecoins. Every company operating in this space will eventually scale across the entire network.

But if you want to convert stablecoins into fiat for spending, Conduit Pay partners directly with the largest FX banks in local markets to enable seamless, low-cost, and near-instant cross-border transactions on-chain. Wallets become accounts, tokenized assets become products, and blockchains become the network—greatly improving user experience. If fiat on/off-ramps aren’t required, costs can be even lower. All of this is achievable through better technology, delivering simpler reconciliation, greater autonomy, higher transparency, faster speed, stronger interoperability, and lower costs.

What Does This Mean?

It means a native, on-chain world built on stablecoins—where every transaction is simply a number moving on a ledger—is arriving. It won’t just connect current payment models—it will gradually replace them. This is why we will soon see the emergence of the first trillion-dollar fintech company built on stablecoins.

I know this article will invite many valid criticisms—for example, that I haven’t addressed certain practical concerns. But please understand that myself and many entrepreneurs in this space are already aware of these issues and actively working to solve them. Innovation works this way: incremental building atop old systems will never produce truly new systems, because entrenched interests will always resist change.

Closed-loop + Trusted Intermediary → Open-loop + Trusted Intermediary → Open-loop + Partial Personal Autonomy → Truly Open, Digital-Native System, where anyone can compete across the entire payment network, and customers exercise sovereignty through open networks.

The views expressed in this article are solely those of the author and do not necessarily reflect the opinions of Dragonfly or its affiliated entities. Dragonfly may have invested in some of the protocols or cryptocurrencies mentioned herein.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News