Israel Inflicts Heavy Blow on Ethereum, Are Geopolitical Crises Creating Volatility-Driven Opportunities for the Crypto Market?

TechFlow Selected TechFlow Selected

Israel Inflicts Heavy Blow on Ethereum, Are Geopolitical Crises Creating Volatility-Driven Opportunities for the Crypto Market?

My wallet: Please stop fighting. Institutions: Aggressively "buy the dip" on ETH.

Author: Dingdang, Odaily Planet Daily

This morning, a sudden "black swan" event shattered the financial market's brief calm.

As news broke of Israel launching airstrikes against Iran, the cryptocurrency market plunged. According to OKX data, BTC price dropped below 103,000 USD, down 3.3% in 24 hours; ETH, which had recently shown strength, fell below 2,450 USD with a 9.2% decline; SOL, buoyed by ETF optimism, dropped to around 140 USD, losing 9.5%.

The derivatives market was devastated. Coinglass data shows that total liquidations across all markets reached 1.159 billion USD in the past 24 hours, with long positions accounting for the vast majority—1.084 billion USD. By asset, BTC liquidations amounted to 458 million USD and ETH to 287 million USD.

Markets shifted from recovery to collapse overnight.

Escalating Israel-Iran Tensions: The Trigger

This downturn wasn't driven by technical factors but by a classic geopolitical shock.

Israel launched airstrikes on Iran, reportedly killing Quds Force commander General Soleimani. According to Jinshi News, several high-ranking Iranian officials were targeted, including Armed Forces Chief of Staff Mohammad Bagheri. Israeli Defense Minister Katz warned that missile and drone attacks targeting Israel and its civilians are expected soon. Israel has now conducted five rounds of airstrikes on Iran.

Iran’s official media relayed a statement from the Armed Forces Chief of Staff, vowing that Israel and the U.S. would "pay a very heavy price," and promising "severe retaliation" against both nations. Saudi media, citing Israeli reports, said Tel Aviv was attacked, including strikes on ten nuclear facilities.

Insiders revealed that Trump and his top foreign policy advisors discussed at Camp David over the weekend how to reach a nuclear deal with Iran without escalating tensions. The Iran issue was one of several diplomatic topics discussed during the transition period. Officials appeared determined to pursue diplomacy ahead of the Israeli strikes.

U.S. Middle East envoy Witkoff had planned to travel to Oman for a sixth round of talks, but the airstrikes have cast doubt on the negotiation prospects. Trump posted on Truth Social: "We remain committed to resolving the Iranian nuclear issue through diplomacy! My entire administration has been instructed to negotiate with Iran. They can become a great nation, but they must first fully abandon hopes of obtaining nuclear weapons."

Senator Chris Murphy stated the attack on Iran "clearly aims to sabotage the Trump administration's negotiations with Iran" and "risks triggering a regional war with catastrophic consequences for the United States."

This geopolitical storm has not only intensified Middle East tensions but also hammered global risk assets. U.S. stock index futures extended losses, with Nasdaq futures down 2%. The crypto market’s recent rebound has been erased, while safe-haven assets surged. Spot gold prices broke above 3,400 USD per ounce today, rising 55 USD with a peak intraday gain exceeding 1.65%, and gold-related assets rallied collectively.

Data Watch: Is ETH a Buying Opportunity?

Despite ongoing turmoil in the crypto market, ETH has quietly become a focal point for counter-trend capital inflows. On-chain data reveals institutions and whales are stepping in to accumulate.

On-chain analyst Yujin reported that a whale who previously timed two successful ETH trades spent 174.1 million USD to buy 65,325 ETH after today’s dip, averaging 2,665 USD per ETH. The position is currently underwater.

Lookonchain data shows an address possibly linked to ConsenSys bought 2,825 ETH (7.48 million USD) over-the-counter four hours ago. Over the past two weeks, this address has accumulated over 160,000 ETH (worth 421 million USD).

Some whales are even using leverage. According to The Data Nerd, an address starting with 0x109 borrowed 5 million USDT from Aave to purchase 1,844 ETH (~4.6 million USD). It then deposited all these ETH back into Aave, bringing its total AETHWETH holdings to 23,786.

These moves appear less like speculative bets on a bounce and more like a clear signal of convergence between on-chain activity and real-world sentiment: large capital is re-embracing ETH.

Why ETH? Why Now?

There are clues behind ETH’s counter-trend accumulation.

Since early 2025, the Ethereum Foundation has initiated rare reforms—streamlining operations and restructuring teams—to improve efficiency. Markets interpret this as a sign that the Ethereum ecosystem is maturing toward sustainable development.

Following MicroStrategy’s move to add BTC to its balance sheet, ETH is emerging as a new corporate treasury favorite. U.S.-listed company SharpLink Gaming recently announced it will include ETH in its asset allocation. Bloomberg reports at least three Nasdaq-listed firms are evaluating ETH as a long-term investment, aiming to replicate MicroStrategy’s "growth flywheel" model. This trend signals growing institutional acceptance of ETH in traditional finance.

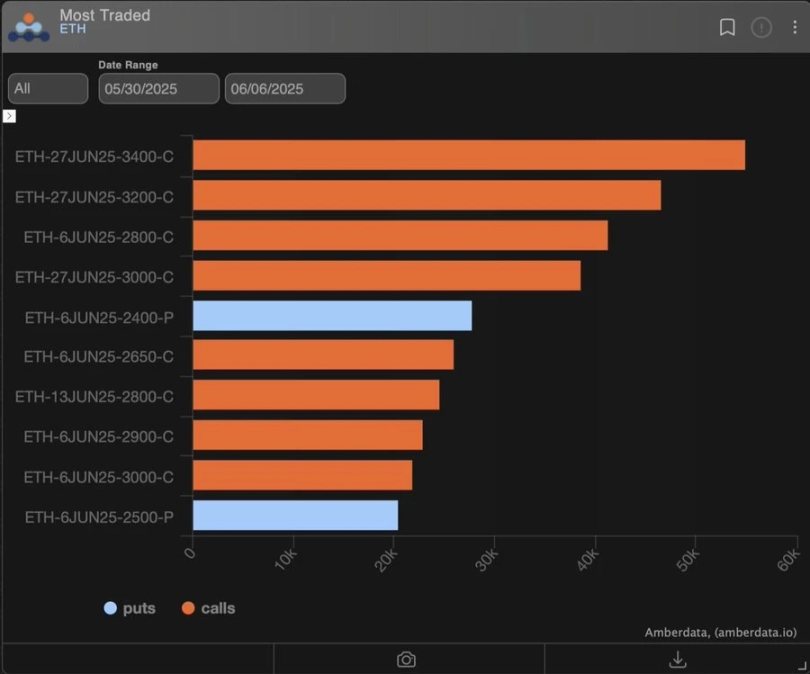

Deribit data shows ETH call option volume has steadily risen since June, indicating increasing market expectations for a near-term ETH rebound.

Image via @Amberdataio

Who’s Rallying the ETH Bulls?

On June 11, a wallet likely linked to Cumberland withdrew 10,200 ETH (~28.54 million USD) from Binance. Twenty hours earlier, this address deposited 30 million USDC into Binance to begin accumulation when ETH was trading around 2,790 USD.

The most vocal proponent of ETH longs lately—especially in Chinese-speaking communities—is Trend Research. The firm has been buying ETH continuously since the 1,400 USD level and now holds 142,000 ETH. Founder Jack Yi publicly holds 100,000 long ETH options contracts.

In a twist, ETH has even become a hacker’s investment vehicle: In April 2023, hackers stole various tokens worth 23 million USD from Bitrue exchange, converted them into ETH, then sold 4,207 ETH at 3,885 USD each for 16.345 million DAI.

On June 12, the hacker transferred 5,111.5 ETH and 16.345 million DAI to a new address, used the DAI to buy 5,917.8 ETH at 2,762 USD, and then funneled all 11,029.3 ETH (worth 30.46 million USD) through Tornado Cash.

In other words, the 23 million USD stolen from Bitrue was ultimately converted into 12,079 ETH and laundered via Tornado Cash, now valued at 32.36 million USD—a profit of 9.36 million USD.

Market Outlook: Where Will BTC Bottom? Can ETH Break Out?

Karoline Mauren, co-founder of crypto derivatives liquidity provider Orbit Markets, commented: "Cryptocurrencies reacted negatively to news of Israel's strike on Iran, consistent with broader risk assets. We expect BTC to find technical support around 101,000 USD, but in the short term, geopolitical developments will remain the dominant driver of price action."

Middle East tensions remain highly uncertain, making a near-term recovery for risk assets unlikely. However, the counter-trend accumulation in ETH sends a clear message: the market continues searching for assets perceived as relatively stable, and ETH may be breaking away from the broader altcoin correlation.

In contrast, altcoins face bleak conditions. Rui, investment manager at HashKey Capital, noted that altcoin liquidity has frozen. Order books lack depth, positive news fails to attract buyers, new listings drop within thirty seconds, and everything is trending downward gradually.

Still, there’s some good news. Recently, SEC Chair Paul Atkins said the commission is developing an "innovation exemption" policy for DeFi platforms. Atkins instructed staff to explore regulatory modifications that would grant exemptions for on-chain financial systems, allowing SEC-regulated entities to rapidly launch blockchain-based products. If implemented, this would ease DeFi regulation and directly benefit the expansion of the Ethereum ecosystem, enhancing ETH’s intrinsic value.

Yet this raises a critical question: Does ETH’s rise signal a return of "alt season"? The answer may be no. Currently, ETH’s ability to attract capital relies heavily on institutional buying. If even ETH requires institutional support, what hope remains for other altcoins?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News