All You Need to Know About the GENIUS Act | As Regulation Begins, Who Will Walk the Compliance Red Carpet?

TechFlow Selected TechFlow Selected

All You Need to Know About the GENIUS Act | As Regulation Begins, Who Will Walk the Compliance Red Carpet?

Every upheaval in the stablecoin arena is a necessary step toward the industry's maturity.

The stablecoin landscape is once again in flux. As stablecoins solidify their position within the cryptocurrency market, major regulatory bodies are rolling out new rules aimed at balancing financial stability with innovation.

BlockSec has partnered with Grandway Law Offices to examine the U.S. Senate's proposed "Guiding and Establishing National Innovation for U.S. Stablecoins Act" (GENIUS Act), analyzing the compliance challenges Web3 projects may face under this framework and offering practical, targeted solutions.

1 GENIUS Act: Legislative Progress and Key Provisions

1.1 Key Milestones in the Legislative Process

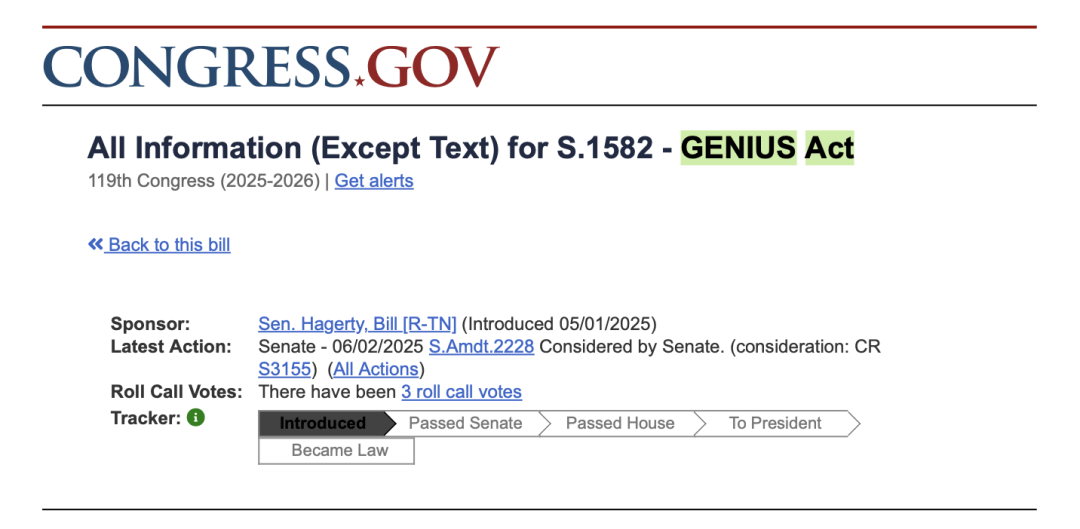

§ February 4, 2025: Bill Introduced

Senators Bill Hagerty, Tim Scott, Kirsten Gillibrand, and Cynthia Lummis jointly introduced the GENIUS Act draft in the Senate.

§ March 13, 2025: Passed by Senate Banking Committee

The Senate Banking Committee approved the GENIUS Act with bipartisan support (18 votes in favor, 6 opposed), forwarding it to the full Senate. Starting March 2025, the bill underwent multiple rounds of revision.

§ May 8, 2025: First Cloture Motion Vote in the Senate

The first cloture motion vote failed in the Senate, with 48 votes in favor and 49 opposed—falling short of the required 60 votes. All Democrats opposed the motion. Key points of contention included:

-

Regulatory loopholes concerning foreign issuers (e.g., risks of sanctions evasion by Iran or North Korea);

-

Lack of restrictions on financial gains by the Trump family through the USD1 stablecoin;

-

Ambiguity regarding准入 rules for tech giants.

§ May 15–19, 2025: Bill Amendments

Bipartisan negotiations led to urgent revisions, including but not limited to:

-

Removing direct restrictions targeting Trump-affiliated crypto projects, shifting focus toward stronger consumer protection;

-

Requiring foreign issuers to have transaction freezing capabilities.

§ May 20, 2025: Second Cloture Motion Vote in the Senate

The second cloture motion passed with 66 votes in favor and 32 opposed. This critical step brought the U.S. one step closer to establishing its first federal-level stablecoin regulatory framework. Although the GENIUS Act had not yet completed final legislative procedures, this vote cleared a significant procedural hurdle.

§ June 11, 2025: Third Cloture Motion Vote in the Senate

The third cloture motion on the GENIUS Act and its latest amendments passed with 68 votes in favor and 30 opposed. This advancement further signaled that the U.S. is nearing the establishment of a federal stablecoin regulatory framework. Despite not having completed final passage, the bill has overcome a major phase of legislative resistance.

§ Next Steps: Full Senate Debate and Amendment Process

Once entering the full Senate debate and amendment process, the bill only requires a simple majority (51 votes) to pass its final version.

§ Next Steps: House of Representatives Review

Following Senate approval, the bill will be sent to the House of Representatives. In the House, a simple majority (218 votes) is sufficient for passage. Given the current Republican narrow majority (220:215), the likelihood of the GENIUS Act passing the House is high.

§ Next Steps: Presidential Approval

After House passage, the bill will go to the President for signature. Considering Trump’s prior commitment to establish a stablecoin regulatory framework by August 2025, direct signing appears likely. However, if the final version includes a clause prohibiting the President or immediate family members from holding equity in stablecoin issuers, Trump may veto or delay the bill due to political or public pressure.

1.2 Key Adjustments in the Revised Version

Compared to the initial GENIUS Act draft introduced on February 4, 2025, the latest version includes the following key changes:

Beyond these details, we recommend particular attention to two areas: enhanced oversight of foreign payment stablecoin issuers and strengthened anti-money laundering (AML) regulations.

New Oversight of Foreign Payment Stablecoin Issuers

The GENIUS Act establishes a regulatory framework for foreign payment stablecoin issuers incorporated outside the U.S. or in U.S. territories (e.g., Puerto Rico, Guam, American Samoa, U.S. Virgin Islands). The core mechanisms are “registration” and “regulatory equivalence recognition.” Under the “registration” requirement, foreign issuers must register with the Office of the Comptroller of the Currency (OCC) and meet strict compliance standards before they can offer or sell payment stablecoins in the U.S. via U.S. digital asset service providers. “Regulatory equivalence recognition” means that after submitting a registration application, the OCC will evaluate the issuer based on several factors: Treasury Department assessment of whether the home jurisdiction’s regulatory regime is comparable to U.S. standards; the issuer’s financial and managerial capacity in the U.S.; transparency of submitted materials; potential risks to U.S. financial stability; and the likelihood of involvement in illegal activities.

Additionally, foreign payment stablecoin issuers must maintain adequate reserves to meet U.S. user redemption demands. If the Treasury determines their home country’s regulatory system is equivalent to the U.S. and there is a reciprocal agreement, reserve requirements in the U.S. may be waived—but technical regulatory capabilities must still be demonstrated.

Strengthened Anti-Money Laundering (AML) Regulation

The GENIUS Act introduces two new provisions—“AML Protection” and “AML Innovation”—to enhance AML oversight.

-

AML Protection

Compared to the original version, which only briefly referenced international reciprocity for AML compliance by foreign issuers, the revised bill provides detailed AML compliance requirements, penalties for non-compliance, and exemption mechanisms.

- Compliance Requirements for Foreign Issuers

Foreign payment stablecoin issuers seeking to publicly offer, sell, or trade their stablecoins in the U.S. must demonstrate both technical capability and willingness to comply with U.S. “lawful orders,” such as freezing, seizing, or blocking specific stablecoin transfers.

- Determination of Non-Compliance and Penalties

The Treasury Department may designate and publish a list of non-compliant foreign issuers, and prohibit digital asset service providers from offering secondary market trading services for their stablecoins. Digital asset providers violating this rule face fines up to $100,000 per day, while non-compliant foreign issuers may face daily fines up to $1 million and could be banned from U.S. financial transactions. Furthermore, the GENIUS Act grants the Treasury the right to bring civil actions against non-compliant issuers to collect fines, seek injunctions to block their access to U.S. financial systems, and require digital asset platforms to delist their payment stablecoins.

These requirements mean foreign issuers must invest more resources to meet U.S. technical and compliance standards, potentially driving smaller players out of the U.S. market. This could lead to industry consolidation, leaving only large, compliant platforms viable.

- Exemptions and Exceptions

The U.S. Treasury may grant exemptions to certain entities or transactions under special circumstances, including national security needs, intelligence or law enforcement operations, or when a foreign issuer is taking substantial steps to correct non-compliance.

-

AML Innovation

The AML Innovation section focuses on leveraging emerging technologies to improve detection and prevention of illicit digital asset activities, including money laundering. Specific measures include:

- Public Comment Solicitation and Research

Within 30 days of the GENIUS Act’s enactment, the Treasury will launch a 60-day public comment period to identify innovative methods, technologies, or strategies currently used or potentially adoptable by regulated financial institutions to detect and prevent digital asset-related illegal activities. These may include application programming interfaces (APIs), artificial intelligence (AI), digital identity verification, and blockchain monitoring tools.

The adoption of APIs, AI, and blockchain monitoring will help shift regulators from manual review to automated supervision, significantly improving AML efficiency.

- Research and Evaluation

After the public comment period, the Treasury will conduct research based on received input. The Financial Crimes Enforcement Network (FinCEN) will assess the innovative methods mentioned, comparing them with existing approaches to evaluate improvements in regulatory effectiveness, cost, privacy risk, operational efficiency, and cybersecurity impact. Based on this evaluation, FinCEN will develop specific requirements for regulated institutions adopting these innovations to detect illicit digital asset activities, establish operational guidelines for payment stablecoin issuers to identify and report illegal activities involving their tokens, and set best practices for monitoring blockchain transaction systems.

- Risk Assessment and National Strategy

The Treasury must incorporate the national counterterrorism and anti-illicit financing strategy mandated by the Countering America’s Adversaries Through Sanctions Act (CAATSA) into its oversight of digital asset illicit activities, focusing particularly on how digital assets are used for money laundering, sanctions evasion, and high-risk behaviors in foreign jurisdictions that facilitate illegal activities through fiat conversion.

- Congressional Reporting

The Treasury will regularly submit reports to Congress detailing research findings on innovative detection technologies, progress in technology implementation, and recommendations for future legislation.

2 Compliance Challenges for Different Types of Projects

The GENIUS Act has broad implications, but different types of Web3 projects face varying degrees of compliance challenges. Below, we analyze the specific challenges faced by various project categories, ordered from most to least affected.

2.1 Direct Impact: Stablecoin Issuers

Mainstream stablecoin issuers, as primary targets of the GENIUS Act, face the strictest compliance requirements and highest implementation costs. These projects must obtain federal or state licenses within 120 days, establish a 100% reserve backing system, implement monthly public disclosures, and possess real-time asset freezing capabilities. For issuers with market capitalization exceeding $50 billion, annual audits and enhanced reporting obligations are also required. Initial compliance investments are estimated between $8 million and $20 million, with ongoing annual operating costs ranging from $3 million to $10 million.

Algorithmic and decentralized stablecoin projects may not be directly subject to traditional reserve requirements but face uncertainty in regulatory classification. These projects must reassess their governance structures, technical designs, and compliance strategies to determine whether their models need adjustment to meet regulatory expectations. In particular, stablecoin mechanisms involving yield generation may be classified as securities, bringing them under SEC oversight.

2.2 Severe Impact: Core DeFi Protocols

DeFi lending protocols face fundamental business model adjustments. The prohibition of yield-bearing stablecoins will force these protocols to redesign their product architectures. They must remove or restructure yield-based stablecoin strategies, adjust interest rate models, and ensure all integrated stablecoins come from compliant issuers. These projects must also implement enhanced transaction monitoring and reporting mechanisms to meet AML requirements.

DeFi yield protocols are hit hardest, as their core business model—providing yield on stablecoins—may be classified as securities issuance. These protocols must completely reconfigure their product offerings, eliminate strategies relying on non-compliant stablecoins, or explore new operational models within the regulatory framework.

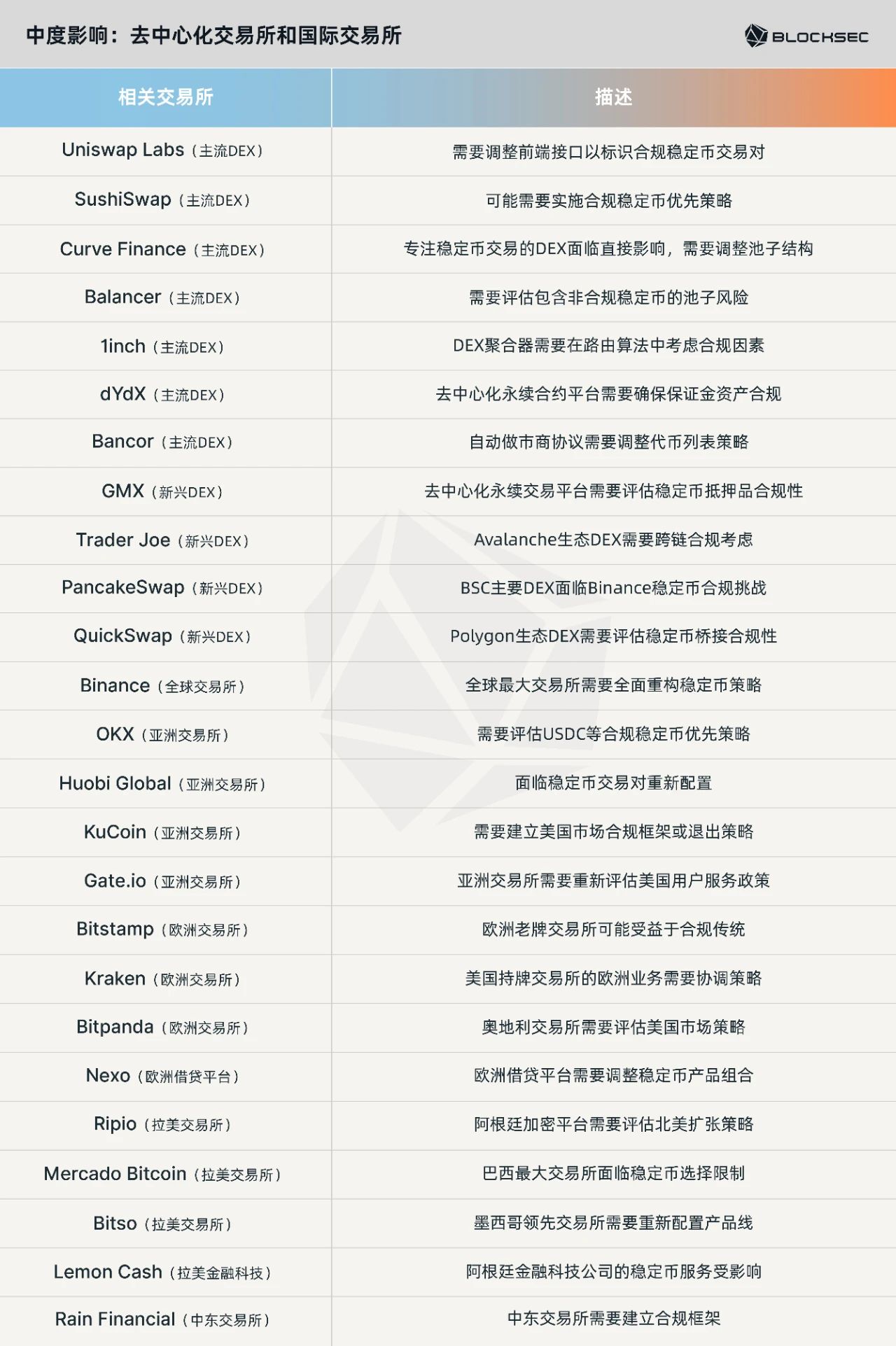

2.3 Moderate Impact: Decentralized Exchanges and International Exchanges

Decentralized exchanges (DEXs) benefit relatively from regulatory asymmetry, as the GENIUS Act primarily targets issuers rather than trading platforms. Nevertheless, these platforms must modify their frontends to label compliant stablecoins, possibly prioritize compliant ones, and factor compliance into routing algorithms. DEXs focused on stablecoin trading (e.g., Curve) face more direct impacts and may need to reconfigure their liquidity pool structures.

International exchanges face a binary choice: build a comprehensive U.S. compliance framework or exit the U.S. market. These platforms must reconfigure stablecoin trading pairs, promote compliant stablecoins, and may need to restrict services to U.S. users. Rising compliance costs and complexity will compel them to reassess global market strategies.

2.4 Moderate Impact: Wallet Service Providers

Custodial wallet providers face regulatory requirements similar to money transmitters, including fund segregation and enhanced consumer protections. These companies must separate customer funds from operational assets, establish user protection mechanisms in case of issuer bankruptcy, and may need to obtain relevant financial service licenses.

Non-custodial (self-custody) wallet providers remain relatively independent but must implement UI features showing stablecoin compliance status, provide user education, and make strategic decisions regarding handling compliant vs. non-compliant stablecoins. The impact here is mainly functional rather than regulatory.

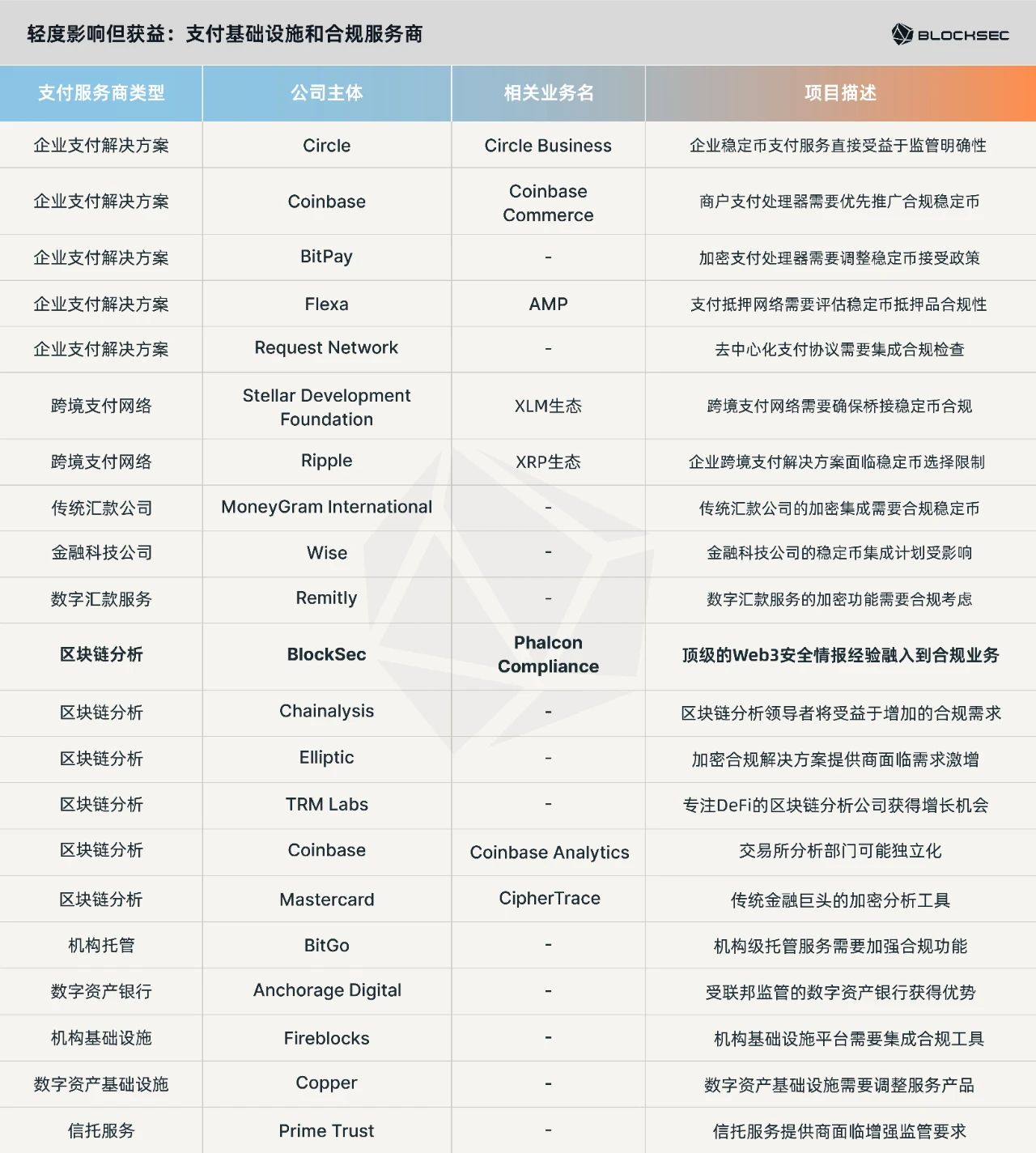

2.5 Mild Impact but Beneficiaries: Payment Infrastructure and Compliance Service Providers

Payment infrastructure providers stand to benefit from the GENIUS Act, as regulatory clarity encourages collaboration with traditional financial institutions and enterprise adoption. These companies need only adapt products to prioritize compliant stablecoins and will generally gain from increased market confidence and expanded customer bases.

Compliance infrastructure providers face significant market opportunities, as demand across the Web3 industry for blockchain analytics, transaction monitoring, custody services, and compliance consulting will surge. These firms must rapidly scale their service offerings to meet growing demand.

2.6 Common Characteristics of Compliance Challenges

From the above analysis, we identify several common compliance challenges posed by the GENIUS Act:

2.6.1 Need for Technical Architecture Adjustments

Almost all Web3 projects involved with stablecoins in the U.S. market will need technical modifications. Stablecoin issuers must build real-time transaction monitoring and asset freezing capabilities; DeFi protocols must redesign smart contracts to distinguish compliant from non-compliant stablecoins; DEX platforms must integrate compliance status indicators into their frontends; wallet providers must implement user education and risk warnings. The complexity and cost vary by project type, but all require substantial development effort.

2.6.2 Pressure to Establish Regulatory Relationships

For most Web3 projects, building and maintaining relationships with regulators is a new challenge. Directly regulated entities (e.g., stablecoin issuers, custodial wallets) must establish direct links with the OCC, state regulators, and FinCEN. Indirectly affected entities (e.g., DeFi protocols, DEXs) must work through legal counsel to build compliance frameworks. International projects must evaluate whether to establish U.S. subsidiaries or seek regulatory exemptions. Building these relationships requires significant legal and compliance investment and long-term maintenance.

2.6.3 Requirement for Operational Model Restructuring

The GENIUS Act presents an opportunity for Web3 projects to rethink their core operations. Yield-generating stablecoin projects must fundamentally restructure their value propositions. Decentralized projects must balance decentralization with compliance. Cross-chain projects must navigate multi-jurisdictional complexities. Algorithm-driven projects must introduce more human oversight and intervention. Such restructuring may require redefining a project’s competitive advantage and market positioning.

3 BlockSec’s Compliance Solutions

The GENIUS Act provides a clear regulatory framework for U.S. stablecoin issuance. Clearer compliance requirements help reduce industry risks, attract more users, and unlock new growth opportunities. Increasingly, organizations no longer view regulation as a barrier but actively embrace compliance—implementing KYC, identifying and recording suspicious behaviors related to money laundering and terrorist financing, tracking sanctioned entities, conducting due diligence on large transactions, promptly reporting suspicious activities, and taking action to block, freeze, or reject related transactions—thereby enhancing their compliance capabilities.

However, blockchain’s anonymity and the complexity of on-chain interactions—especially cross-chain transactions—pose significant challenges for institutions in risk assessment, team coordination, and responding to regulatory scrutiny. To address this, BlockSec has formed a deep partnership with Grandway Law Offices, combining technology and legal expertise to deliver comprehensive compliance support.

3.1 Phalcon Compliance APP: Effortless Identification and Management of Compliance Risks

To meet growing global compliance demands, BlockSec has launched the Phalcon Compliance APP—a powerful tool for VASPs to meet anti-money laundering (AML) and counter-terrorism financing (CFT) regulatory standards, enabling precise identification and management of address- and fund-related risks.

3.1.1 Precise Detection of Illicit Activities 📍

-

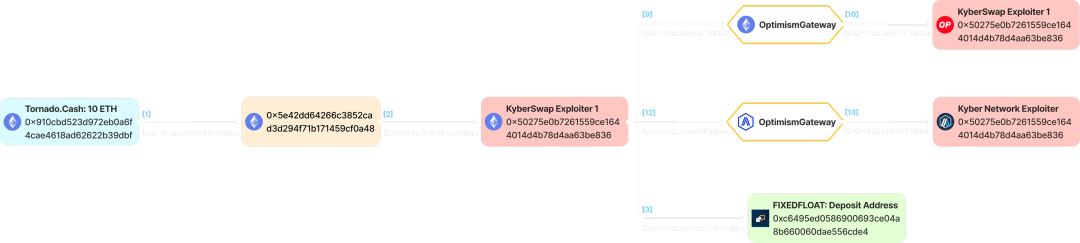

Risk Exposure Tracking: Leveraging a massive database of over 400 million labeled addresses with real-time updates, the system accurately identifies high-risk entities (e.g., sanctioned parties) and supports unlimited-hop transaction tracing to quickly uncover suspicious addresses linked to risky counterparts.

-

Transaction Behavior Analysis: Real-time monitoring of on-chain transactions powered by an AI-driven behavioral analytics engine, capable of processing over 500 transactions per second in parallel. By analyzing behavioral patterns, it precisely detects suspicious activities such as money laundering and structuring.

3.1.2 Predefined + Customizable Risk Engine 🌐

-

Predefined Risk Engine: Built-in risk engine compliant with FATF standards, covering key risk types such as entity risk, interaction risk, high-frequency transfers, large-value transfers, and intermediary addresses—helping institutions align easily with international compliance benchmarks.

-

Customizable Risk Engine: Institutions can define their own risk rules based on jurisdiction and business model to meet unique compliance needs.

3.1.3 Continuous Screening and Risk Alerts 🚨

Users can schedule periodic address risk screenings or trigger a full network scan instantly to monitor risk status in real time. Upon detecting potential threats or changes in risk levels, the system delivers alerts through seven channels—including Telegram, email, and Lark—ensuring rapid awareness and response.

3.1.4 Address and Customer Management 👥

Users can view an address’s risk level and historical alert records to understand its overall risk profile. The system allows grouping multiple addresses under a single entity, enabling comprehensive customer risk analysis and more effective risk management.

Integrated fund-tracking investigation tool: MetaSleuth

3.1.5 Efficient Team Collaboration 🤝

The system supports task delegation, commenting, blacklisting, and other collaborative features, enabling seamless teamwork across roles to respond swiftly to risk alerts. Additionally, BlockSec has engaged Grandway Law Offices as external advisors to provide legal guidance on specific compliance issues.

3.1.6 One-Click STR/SAR Report Export ✅

Users can select their jurisdiction—such as the U.S., Hong Kong, or Singapore—and generate corresponding Suspicious Transaction Reports (STR) or Suspicious Activity Reports (SAR) with a single click. Through close collaboration with Grandway, BlockSec ensures reports meet local regulatory standards, empowering institutions to confidently navigate complex compliance environments.

In the face of evolving regulations and increasingly sophisticated illicit actors, the Phalcon Compliance APP offers VASPs a comprehensive, end-to-end compliance solution—from real-time monitoring to report generation—building dynamic risk control barriers to precisely prevent money laundering, terrorist financing, and other threats, ensuring efficient and effective compliance.

3.2 Get Started Today

The launch of the Compliance APP marks BlockSec Phalcon’s evolution from an attack monitoring and automatic blocking platform into a dual-module solution encompassing Security APP (threat defense) and Compliance APP (compliance risk management), delivering a seamless “offense-defense一体, worry-free regulation” experience.

The platform now supports over 30 major blockchain networks, including Ethereum, BSC, Solana, Base, Tron, Arbitrum, Avalanche, Optimism, Manta, Merlin, Mantle, Sei, Bitlayer, Core, BoB, Story, Sonic, Gnosis, and Berachain.

Visit our website for more information, or click “Read More” in the lower-left corner of this article to book a product demo and experience its features firsthand.

🔗 Phalcon Compliance APP:

https://blocksec.com/phalcon/compliance

🔗 Phalcon Security APP:

https://blocksec.com/phalcon/security

🔗 Book a Demo:

https://blocksec.com/book-demo

Conclusion

Every upheaval in the stablecoin ecosystem is a necessary step toward industry maturity. The advancement of the GENIUS Act, the release of Hong Kong’s Stablecoin Bill, and the UK FCA’s proposals on stablecoin and crypto asset regulation all signal a complete reshaping of the industry landscape. While the short term may bring rising compliance costs, market consolidation, constrained innovation, and increased global regulatory friction, in the long run, regulatory clarity lays the institutional foundation for sustainable Web3 development. Amidst this dual transformation of markets and rules, only those who proactively adapt and embrace change will seize new opportunities. BlockSec and Grandway will continue to walk alongside you, empowering every Web3 team committed to compliance and innovation to ride the waves in this new era.

About Grandway

As a full-service law firm, Grandway’s Web3 team has built extensive experience in offshore Web3 project structuring, Web3投融资, Web3 fund formation and operations, and domestic and international Web3 compliance.

One of China’s earliest legal teams dedicated to Web3, Grandway has been actively involved since 2013 in legal matters across blockchain applications, infrastructure projects, crypto asset management, securities compliance, DeFi (decentralized finance), RWA (real-world assets), GameFi (blockchain gaming), and NFTs (digital collectibles). The team supports project growth within compliance frameworks and delivers tailored legal solutions for leading players across sectors. Passionate about blockchain technology and the Web3 industry, the team stays closely aligned with industrial developments and regulatory trends, continuously exploring new business opportunities.

Website: https://www.grandwaylaw.com

About BlockSec

BlockSec is a globally leading blockchain security company founded in 2021 by renowned industry experts. Dedicated to enhancing the security and usability of the Web3 world, BlockSec offers one-stop security services, including smart contract audits, the BlockSec Phalcon security and compliance management platform, and the fund-tracking investigation platform MetaSleuth.

To date, BlockSec has served over 500 clients worldwide, including top Web3 companies such as Coinbase, Cobo, Uniswap, Compound, MetaMask, Bybit, Mantle, Puffer, FBTC, Manta, Merlin, and PancakeSwap, as well as authoritative regulatory and consulting agencies like the United Nations, FBI, SFC, PwC, and FTI Consulting.

Website: https://blocksec.com

Twitter: https://twitter.com/BlockSecTeam

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News