Yang Ge Gary: GENIUS Act and On-Chain Shadow Money

TechFlow Selected TechFlow Selected

Yang Ge Gary: GENIUS Act and On-Chain Shadow Money

The nominal and substantive purposes of the GENIUS Act are clearly different: internally, it is nominally about compliance regulation; externally, it is actually about showcasing and propaganda.

Author: Yang Ge Gary

During 25Q2, coinciding with several major crypto conferences in North America, the U.S. Senate passed the procedural advancement of the GENIUS Act (Guiding and Establishing National Innovation Using Stablecoins Act) on May 19 by a vote of 66 in favor and 32 opposed. Within less than a week, financial and crypto institutions rapidly iterated and interacted with each other—putting it simply, as one friend said, the entire market became restless.

The significance of this bill lies in its profound impact on both short-term and long-term global financial economics, unfolding across multiple layers like a powerful earthquake close to the surface. If successfully implemented, the GENIUS Act will skillfully neutralize crypto’s disruptive threat to the existing status of the U.S. dollar and Treasury bonds, while instead enabling the dollar to benefit from the growth in value and liquidity within the crypto market. At its core, this represents leveraging the dollar's current advantage as a price anchor to secure its long-term dominance as a value anchor. Calling it "Genius" is truly well-deserved.

Building upon discussions at last week’s New York conference, I have summarized the following key points:

TL;DR

1. The fundamental reasons behind the declining control of traditional dollars;

2. Understanding trade-offs and strategic retreats amid crypto-driven transformation of the global monetary system;

3. The nominal versus actual purposes of the GENIUS Act;

4. Insights for fiat systems from DeFi restaking and the money multiplier effect of shadow currencies;

5. Gold, the U.S. dollar, and crypto stablecoins;

6. Global market reactions post-legislation and dramatic shifts in financial transactions and assets;

1. The Fundamental Reasons Behind the Declining Control of Traditional Dollars

The decline in the dollar’s global economic influence stems from multiple factors. From a long-cycle perspective, resource dividends accumulated since the Age of Exploration through WWII have been largely exhausted. In the short term, policy tools for economic regulation are increasingly ineffective. However, four key factors fundamentally explain the current situation:

i) Rapid rise in global economies and national capabilities has reduced the necessity of using the dollar as the sole medium for international trade and financial settlement. More countries and regions are building independent trading and monetary systems outside the dollar;

ii) During the COVID-19 period (2020–2022), the U.S. expanded its money supply by over 44%, increasing M2 from $15.2 trillion to $21.9 trillion (Federal Reserve data), triggering an irreversible erosion of dollar credibility post-pandemic;

iii) Internal rigidity and entropy within the Federal system's monetary and fiscal policy mechanisms have led to inefficient capital allocation and highly asymmetric wealth distribution, ill-suited to the needs of digitalization and AI-driven economic growth;

iv) The rapid emergence of decentralized crypto-based financial systems, amplified by the above conditions, is disruptively overturning the Bretton Woods-era paradigm built on nation-state credit foundations.

Notably, established financial figures such as Ray Dalio and certain politicians have fallen into dogmatic inertia when assessing the Thucydides Trap under these circumstances. For the past decade, many have insisted that the Thucydides Trap remains imminent or already active between China and the U.S., even basing lobbying or investment strategies on this idea. In reality, both nations face identical challenges—they belong on the same side of the Thucydides Trap, while the opposing side consists of the crypto financial system and decentralized production relations in the digital age. How to navigate this inevitable transition defines the upgraded version of the Thucydides Trap in the new era. Clearly, the GENIUS Act gets the point.

2. Recognizing Trade-offs and Strategic Retreats Amid Crypto-Driven Transformation of the Global Monetary System

In essence, the GENIUS Act reflects a calculated trade-off—a bold strategic retreat to advance later. It marks the Federal government’s acknowledgment of the declining influence of the traditional dollar within legacy financial systems, and actively further decentralizes authority over dollar issuance and settlement (note: most offshore fiat dollars already originate from off-balance-sheet credit expansion by offshore banks, forming shadow money whose issuance and clearing authenticity relies on access systems and compliance networks, backed and filtered for redemption by sovereign central banks). Facing the inevitable trend of crypto finance development, the act adopts a countermove strategy—drawing inspiration from advanced DeFi restaking models combined with prior experience of extending offshore dollar credit via foreign banking systems—to encourage compliant institutions to issue stablecoins, creating a new model of "on-chain offshore structure" and "on-chain shadow currency", thereby amplifying the monetary multiplier effect of circulating dollars.

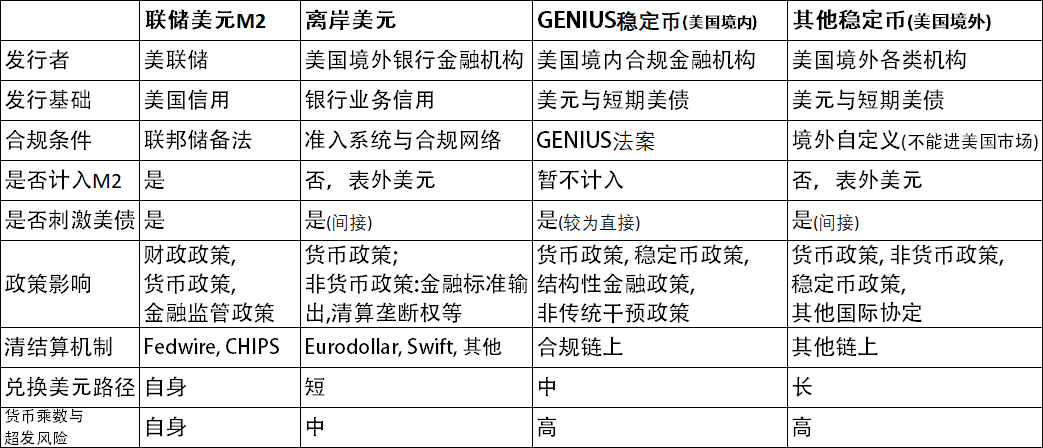

The table below compares characteristics across different tiers and types of dollar forms and various shadow dollar variants:

This decision and initiative under the GENIUS Act will significantly help the dollar “re-anchor” itself. It not only restores confidence among holders of U.S. Treasuries and dollar-denominated assets but also enables off-balance-sheet dollars to rapidly expand alongside the growth of the crypto market, achieving both risk mitigation and dual benefits simultaneously.

3. The Nominal Purpose vs. Actual Purpose of the GENIUS Act

The stated purpose and real intent of the GENIUS Act are clearly different. Simply put: internally framed as regulatory compliance, externally designed as a demonstration model. It aims to provide a policy blueprint for financial regulators worldwide and, using the U.S. market as an example, offer execution templates for financial institutions elsewhere—accelerating global adoption of dollar-pegged stablecoins in the crypto market.

In the short term domestically, the goal is straightforward regulatory oversight—to ensure stability during the transitional phase as the fast-growing crypto market disrupts traditional finance, which aligns with standard operations of the U.S. financial legal system. But in the long run internationally, the act achieves maximum demonstration and promotional impact. It fully leverages the dollar’s inherent advantage as a price anchor in traditional finance, while addressing the critical pain point that no alternative stablecoin price anchors exist in the crypto market besides the dollar. Through a semi-compliant, semi-open approach—the bill specifically restricts foreign issuers: foreign stablecoin issuers without approval from U.S. regulators cannot operate in the U.S. market, effectively signaling they may still operate outside the U.S.—it stimulates and confirms deeper global dependence on and usage of dollar-pegged stablecoins during the upgrade of crypto finance.

On May 21, Hong Kong’s Legislative Council passed the

4. Insights for Fiat Systems from DeFi Restaking and the Money Multiplier Effect of Shadow Currencies

A partner from an asset firm told me last week that the next phase of global finance will pose significant challenges, requiring dual expertise and cross-domain understanding of both traditional finance and crypto—or else players will be swiftly eliminated by the market. Indeed, over the past two cycles of DeFi development, the crypto market has independently evolved a sophisticated, protocolized economic science framework—from protocol logic, tokenomics, financial analysis methods and tools, to business model complexity—that now far surpasses traditional finance. While distinct from conventional finance, DeFi continues to require calibration against traditional financial experience as it grows. The two systems learn from each other, evolve rapidly, and become increasingly coupled, forming a new financial paradigm.

The proposal of the GENIUS Act closely resembles earlier DeFi practices such as staking, restaking, and LSD—it represents another extension of the same methodology into the fiat world.

In DeFi, consider this example: deposit ETH into Lido to receive rebase-earning stETH; stake stETH in AAVE to borrow up to 70% of its value in USDC; use that USDC to buy more ETH in the open market. Repeating this process ideally follows a geometric series with q=0.7, ultimately yielding a 3.3x monetary multiplier.

Soon, under the GENIUS Act, a similar cycle can occur based on fiat-backed stablecoins: suppose a Japanese financial institution outside the U.S., compliant with regulations, pledges U.S. Treasuries to issue USDJ; uses off-ramp channels to convert into JPY, then exchanges into USD, and reinvests in U.S. Treasuries to restart the loop. Several assumptions affect the multiplier: first, collateral ratio (could be full, discounted, or over-collateralized); second, friction from on/off-ramping and exchange costs; third, market leakage rate. After accounting for all factors, each cycle yields a geometric ratio q, resulting in a final multiplier of 1/(1−q). This number represents the ideal financial leverage—monetary multiplier—that the GENIUS Act and subsequent national stablecoin laws could enable regarding holdings of U.S. dollars and Treasuries.

And this doesn't even include excess issuance by non-regulated entities or secondary restaking of tokenized assets derived from deployed stablecoin reserves, generating additional shadow-like assets. The flexibility of stablecoins will vastly exceed that of traditional derivatives markets, and the phenomenon of “stablecoin nesting” will inevitably deliver unimaginable shocks to traditional finance.

5. Gold, the Dollar, and Crypto Stablecoins

In my previous article “Post-Trump Election Landscape Shifts,” I discussed the evolution of faith in financial anchors across three generations: gold, the dollar, and Bitcoin—at the macro level. At the micro level, each generation requires a practical unit for daily transactions: once a gold bar, then a dollar bill—what will it be in the future?

Earlier, I mentioned the key weakness in the crypto market: apart from the dollar (in stablecoin form), there is no native crypto currency or asset capable of serving as a stable price anchor. Pricing matters greatly. In real-world transactions involving goods or services, people need relatively stable numerical references. Imagine if yesterday a cup of Americano cost 0.000038 BTC and today 0.000032 BTC—this volatility undermines consumers’ and traders’ ability to assess value. Stability is paramount: stablecoins help users perceive and understand value through consistent pricing. Price fluctuations around a baseline serve as dynamic regulators balancing purchasing power and economic growth.

Why the Dollar (Stablecoin)?

First, the dollar has achieved relative universality in the fiat world. Second, establishing a better consensus is extremely difficult. I’ve discussed this with several friends: a hypothetical “world currency stablecoin.” Even if its issuance were based on a more rational mechanism—such as global historical GDP plus annual GDP growth—and offered superior economic efficiency compared to today’s dollar, gaining social consensus to replace dollar-pegged stablecoins would remain nearly impossible. This mirrors the invention of Esperanto 140 years ago: despite algorithmic optimization, it failed to overcome English’s entrenched global market dominance. Many countries with native languages later adopted English as official language—India, Singapore, the Philippines—not following British standards but developing their own norms. These “shadow Englishes” operate independently. The indirect influence and control expansion via decentralized issuance of dollar stablecoins under the GENIUS Act is strikingly similar.

The timing of the GENIUS Act perfectly captures this historical inflection point—exploiting the irreplaceable current advantage of the dollar as a global price anchor, transforming it via dollar stablecoins into a long-term value anchor for the futureCrypto Market, a clever innovation design that maximizes historical advantages to unlock future dominance. At its core, the idea of pledging dollars and Treasuries to issue dollar stablecoins represents a bold attempt to upgrade U.S. dollars and Treasuries into a kind of “second-order gold.”

6. Global Market Feedback and Financial Transaction & Asset Transformations Post-Legislation

The implementation of the GENIUS Act will take time, as will stablecoin legislation in other jurisdictions. Some markets have already begun showing preliminary emotional responses reflected in asset prices.

In the short term, the introduction of stablecoin legislation will trigger dramatic changes in institutional assets, RWA, and crypto assets. Opportunities arise amid restructuring, with disorder coexisting with developmental expectations. Uncertainty in traditional finance adjustments will increase further, making some asset price corrections normal. Yet renewed confidence in dollar and Treasury anchoring will inversely reinforce and support current markets. The openness of this policy move enables dollar assets to ride the second curve of crypto-fueled growth—an autonomous second growth trajectory unique to dollar-denominated assets. This forward-looking expectation will offset some short-term reorganization fears, creating a complex superimposed environment.

From the perspective of the Crypto Market, this undoubtedly opens an excellent window for further asset management and financial innovation. RWAFi will gain more deployment channels and asset forms, benefiting long-term institutional projects like CICADA Finance focused on Real Yield Asset Management, accelerating their transition and development across DeFi, PayFi, and RWAFi sectors.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News