The "Genius Act" and the New East India Company: How Dollar Stablecoins Will Challenge the Existing Fiat System and State Structures

TechFlow Selected TechFlow Selected

The "Genius Act" and the New East India Company: How Dollar Stablecoins Will Challenge the Existing Fiat System and State Structures

This is an extremely sophisticated asymmetric strategy. The U.S. is leveraging its opponent's weakest link—the fear of losing control—to build its own moat.

I. The Ghost of History: The Digital Return of the East India Company

History does not simply repeat itself, but it rhymes. When Trump happily signed the "GENIUS Act" into law, what came to mind was a historical memory—the commercial behemoths of the 17th and 18th centuries, the Dutch and British East India Companies, granted sovereign powers by their states.

This bill may appear to be merely a technical adjustment in financial regulation, but its deeper meaning lies in granting a charter for 21st-century “new East India companies.” A transformation reshaping the global power structure has already begun.

1a. Charters for New Power

Looking back four hundred years, the Dutch East India Company (VOC) and the British East India Company (EIC) were not ordinary trading firms. They were hybrids—merchants, soldiers, diplomats, and colonists—all empowered by state authority. The Dutch government granted VOC powers including raising armies, issuing currency, signing treaties with foreign monarchs, and even waging war. Similarly, Queen Elizabeth I’s royal charter gave EIC monopoly rights over trade in India, along with military and administrative functions. These were history’s first multinational corporations, controlling not just goods but the very lifeline of globalization at the time—maritime trade routes.

Today, the "GENIUS Act" legally legitimizes a new era of power giants—stablecoin issuers—through legislation. On the surface, the bill aims to regulate the market by setting reserve standards and requiring asset certification to prevent risks. But its real effect is creating an oligarchy of U.S.-recognized “legitimate” stablecoin issuers through screening and certification. These “crowned” companies—such as Circle (issuer of USDC), Tether (if it chooses compliance), and internet giants like Apple, Google, Meta, and X with billions of users—will no longer be unruly crypto rebels, but officially integrated “chartered companies” within America’s financial strategic framework. What they control will be the new global trade routes—borderless, 24/7 digital financial rails.

1b. From Trade Routes to Financial Rails

The power of the East India Companies stemmed from monopolizing physical trade routes. Using warships and fortresses, they secured exclusive rights over spices, tea, and opium trades, extracting enormous profits. The new “digital East India companies” will exercise power by controlling the financial rails of global value flows. When a dollar-pegged stablecoin regulated by the U.S. Treasury or specific agencies becomes the default settlement unit for global cross-border payments, DeFi (decentralized finance) lending, and RWA (real-world asset) transactions, its issuer gains the power to define the rules of the new financial system. They can decide who accesses this system, freeze assets on command, and set compliance standards for transactions—a form of power deeper and more invisible than control over physical routes.

1c. Ambiguous Symbiosis and Conflict Between State and Corporation

The history of the East India Companies is an epic tale of evolving relations with their home countries. Initially, they served as agents for national mercantilism and strategic competition against rivals like Portugal. However, driven by profit, these companies quickly grew into independent centers of power. To maximize gains, EIC waged wars (e.g., the Battle of Plassey), engaged in unethical trade (e.g., the opium trade), repeatedly dragging Britain into diplomatic and military quagmires it wished to avoid. Eventually, when poor management and overexpansion led the company toward bankruptcy, it had to seek state aid. This prompted the government to gradually tighten oversight through successive acts (like the Tea Act of 1773 and Pitt’s India Act of 1784), ultimately stripping EIC of its administrative powers after the Indian Rebellion of 1858 and bringing its territories under direct crown rule.

This history foreshadows the likely dynamic between future stablecoin issuers and the U.S. government. Currently, these firms are seen as strategic assets advancing dollar hegemony and countering China's digital yuan. Yet once they grow into “too big to fail” global financial infrastructure, their institutional interests and shareholder demands will become paramount. They may make decisions contrary to U.S. foreign policy for commercial gain.

This suggests that when privately issued dollar stablecoin systems become too large, inevitable conflicts with national sovereignty will arise, likely triggering further upgrades to stablecoin legislation based on interest-based bargaining.

The table below clearly compares these two trans-historical power entities, revealing striking historical parallels:

The ghost of history has returned. Through the "GENIUS Act," the U.S. is unleashing a new East India Company. Cloaked in technological innovation and wielding blockchain as its scepter, its core remains the ancient logic of commercial empires—an internationally chartered, globally operating private enterprise destined to eventually contest power with the state.

II. Global Monetary Tsunami: Dollarization, Great Deflation, and the End of Non-Dollar Central Banks

What the "GENIUS Act" spawns is not merely a new power entity, but a monetary tsunami sweeping across the globe. The energy behind this wave originates from the collapse of the Bretton Woods system in 1971. That historic “liberation” paved the way for today’s global conquest by dollar-pegged stablecoins. For nations whose sovereign credit is already fragile, the future choice will no longer be whether governments prefer local currencies or traditional dollars—but whether individuals choose between a collapsing domestic currency and an instantly accessible, frictionless digital dollar. This will trigger an unprecedented wave of hyper-dollarization, completely eroding many nations’ monetary sovereignty and delivering devastating deflationary shocks.

2a. The Ghost of the Bretton Woods System

To understand the power of stablecoins, we must return to the moment the Bretton Woods system collapsed. Under that system, the dollar was tied to gold, and other currencies were pegged to the dollar, forming a stable structure ultimately anchored to gold. However, this system contained a fatal contradiction—the “Triffin Dilemma”: as the world’s reserve currency, the dollar needed to flow continuously abroad via U.S. trade deficits to meet global demand; yet persistent deficits would undermine confidence in the dollar’s convertibility into gold, inevitably leading to collapse. In 1971, President Nixon closed the gold window, marking the end of the system.

Yet the death of the dollar marked the beginning of its rebirth. Under the subsequent “Jamaica System,” the dollar fully detached from gold, becoming pure fiat money. Freed from the “golden shackles,” the Federal Reserve could issue currency more freely to meet both domestic fiscal needs (e.g., Vietnam War spending) and global demand for dollar liquidity. This laid the foundation for half a century of dollar dominance—a floating hegemony sustained by global network effects and U.S. comprehensive national strength. Stablecoins, especially those recognized under U.S. law, represent the ultimate technological form of the post-Bretton Woods era. They elevate the dollar’s liquidity provision to a new dimension, enabling it to bypass layers of national regulations and the slow, costly traditional banking system, directly permeating every capillary of the global economy—and every individual’s smartphone.

2b. The Arrival of Hyper-Dollarization

In countries like Argentina and Turkey, long plagued by high inflation and political instability, people spontaneously exchange local currency for dollars to preserve wealth—this is “dollarization.” However, traditional dollarization faces numerous barriers: you need a bank account, face capital controls, and risk holding physical cash. Stablecoins dismantle all these barriers. Anyone with a smartphone can, within seconds and at minimal cost, convert depreciating local currency into dollar-pegged stablecoins.

In Vietnam, the Middle East, Hong Kong, Japan, and South Korea, u-stores are rapidly replacing traditional exchange shops. Dubai real estate offices now accept Bitcoin payments. Small shops in Yiwu allow cigarette purchases using “U” (referring to stablecoins).

This pervasive payment penetration will transform dollarization from a gradual process into an instantaneous tsunami. At the first sign of rising inflation expectations in a country, capital will no longer merely “flow out”—it will “evaporate,” instantly disappearing from the local currency system into the global crypto network. We can define this attribute as “enhanced substitutability for sovereign currencies.”

For governments whose credibility is already crumbling, this will be a fatal blow. The status of local currency will be fundamentally undermined, as people and businesses now have a superior, more efficient alternative.

2c. Great Deflation and the Evaporation of State Power

Once an economy is swept by hyper-dollarization, its sovereign state loses two core powers: the ability to print money to cover fiscal deficits (seigniorage), and the ability to manage the economy through interest rates and monetary supply (monetary policy independence).

The consequences are catastrophic.

First, as the local currency is widely abandoned, its exchange rate spirals downward into恶性 inflation. Yet, measured in dollars, economic activity undergoes severe deflation. Asset prices, wages, and commodity values, when denominated in dollars, plummet dramatically.

Second, the government’s tax base evaporates. Tax revenues collected in rapidly depreciating local currency become worthless, plunging public finances into collapse. This fiscal death spiral will utterly destroy the state’s governance capacity.

This process, starting from Trump’s signing of the GENIUS Act, will accelerate through RWA (real-world asset tokenization).

2d. White House vs. Fed: Power Struggle Within the U.S.

This monetary revolution doesn’t only strike America’s adversaries—it may also spark internal crisis.

Currently, the Federal Reserve, as an independent central bank, controls U.S. monetary policy. However, a privately issued digital dollar system regulated by the Treasury or a new agency under the White House would create a parallel monetary track. The executive branch could indirectly—or even directly—influence money supply and flow by shaping regulatory rules for stablecoin issuers, thereby bypassing the Fed. This could become a powerful tool for the U.S. executive to achieve political or strategic goals (e.g., stimulating the economy during election years or precisely sanctioning opponents), potentially triggering a profound crisis of confidence in the independence of U.S. monetary policy.

III. The 21st-Century Financial Battlefield: America’s “Free Financial System” Against China

If the stablecoin act represents an internal restructuring of power, externally it is a crucial move by the U.S. in its great-power game against China: legislatively supporting a private, public-blockchain-based, dollar-centric “free financial system.”

3a. A New Financial Iron Curtain

After WWII, the U.S.-led Bretton Woods system aimed not only to rebuild the postwar economic order, but also, within the Cold War context, to construct a Western economic bloc excluding the Soviet Union and its allies. Institutions like the IMF and World Bank became tools for promoting Western values and consolidating alliance systems. Today, the "GENIUS Act" seeks to build a digital-age version of this “Bretton Woods system.” It aims to establish a global financial network built on dollar-pegged stablecoins—one open, efficient, and ideologically opposed to China’s state-led model. It resembles America’s past arrangements to counter Soviet-style trade, but with far greater force.

3b. Open Siege vs. Closed: Permissioned vs. Permissionless

China and the U.S. have fundamentally different strategic paths in digital currency—a clash of ideologies between “open” and “closed.”

China’s digital yuan (e-CNY) is a classic “permissioned” system. It operates on a private ledger controlled by the central bank, where every transaction and account is under strict state surveillance. It is a digitized “walled garden,” offering advantages in centralized efficiency and social governance, but its closed nature makes it difficult to earn genuine trust from global users, especially individuals and institutions wary of surveillance.

In contrast, the stablecoins supported by the U.S. “GENIUS Act” are built on “permissionless” public blockchains like Ethereum and Solana. This means anyone, anywhere, can innovate on this network—developing new financial applications (DeFi), creating markets, conducting transactions—without approval from any centralized authority. The U.S. government’s role is not to operate the network, but to serve as the “credit guarantor” for its most critical asset—the dollar.

This is an extremely sophisticated asymmetric strategy. The U.S. leverages its opponent’s weakest point—the fear of losing control—to build its own moat. It attracts global innovators, developers, and ordinary users seeking financial freedom into an open ecosystem centered on the dollar. China is invited to play a game it cannot win structurally: how can a state-controlled intranet compete with a globally open, vibrant financial internet?

3c. Bypassing SWIFT: A Dimensional Strike Under the Foundation

In recent years, a core strategy adopted by countries like Russia and China to counter dollar dominance has been building alternative financial infrastructure—such as payment systems to replace SWIFT (Society for Worldwide Interbank Financial Telecommunication). However, the emergence of stablecoins renders such strategies clumsy and outdated. Stablecoin transactions on public blockchains fundamentally do not require SWIFT or any traditional banking intermediaries. Value transfer occurs through a globally distributed network of nodes via cryptography—a completely new, parallel track to the old system.

This means the U.S. no longer needs to struggle to defend its old financial castle (SWIFT), but instead opens an entirely new battlefield. On this new front, rules are defined by code and protocols, not international treaties. When most digital value begins flowing on this new track, efforts to build a “SWIFT alternative” become as meaningless as constructing a luxurious horse-drawn carriage road in the age of highways.

3d. Winning the Network Effects War

The core war of the digital age is the war for network effects. Once a platform attracts enough users and developers, it creates immense gravitational pull, making it nearly impossible for competitors to catch up. Through the “GENIUS Act,” the U.S. is merging the dollar—the world’s strongest monetary network—with the crypto world—the most innovative financial network on earth. The resulting network effects will be exponential.

Global developers will prioritize building apps on dollar-pegged stablecoins with the largest liquidity and user base. Global users, drawn by rich applications and diverse assets, will flood into this ecosystem. By comparison, while e-CNY may expand within specific regions like the Belt and Road Initiative, its closed, renminbi-centric nature makes it hard to compete globally with this open dollar ecosystem.

In summary, the “GENIUS Act” is far more than a simple domestic bill. It is a core strategic deployment by the U.S. in the 21st-century geopolitical arena. With a “light touch moving heavy weights” approach, it uses the ideals of “decentralization” and “openness” to consolidate its most fundamental power—dollar hegemony. It is not engaging in a symmetric arms race with China, but rather changing the terrain of the financial battlefield, shifting the contest into a new dimension where the U.S. holds absolute advantage, delivering a dimensional strike against its adversary’s financial system.

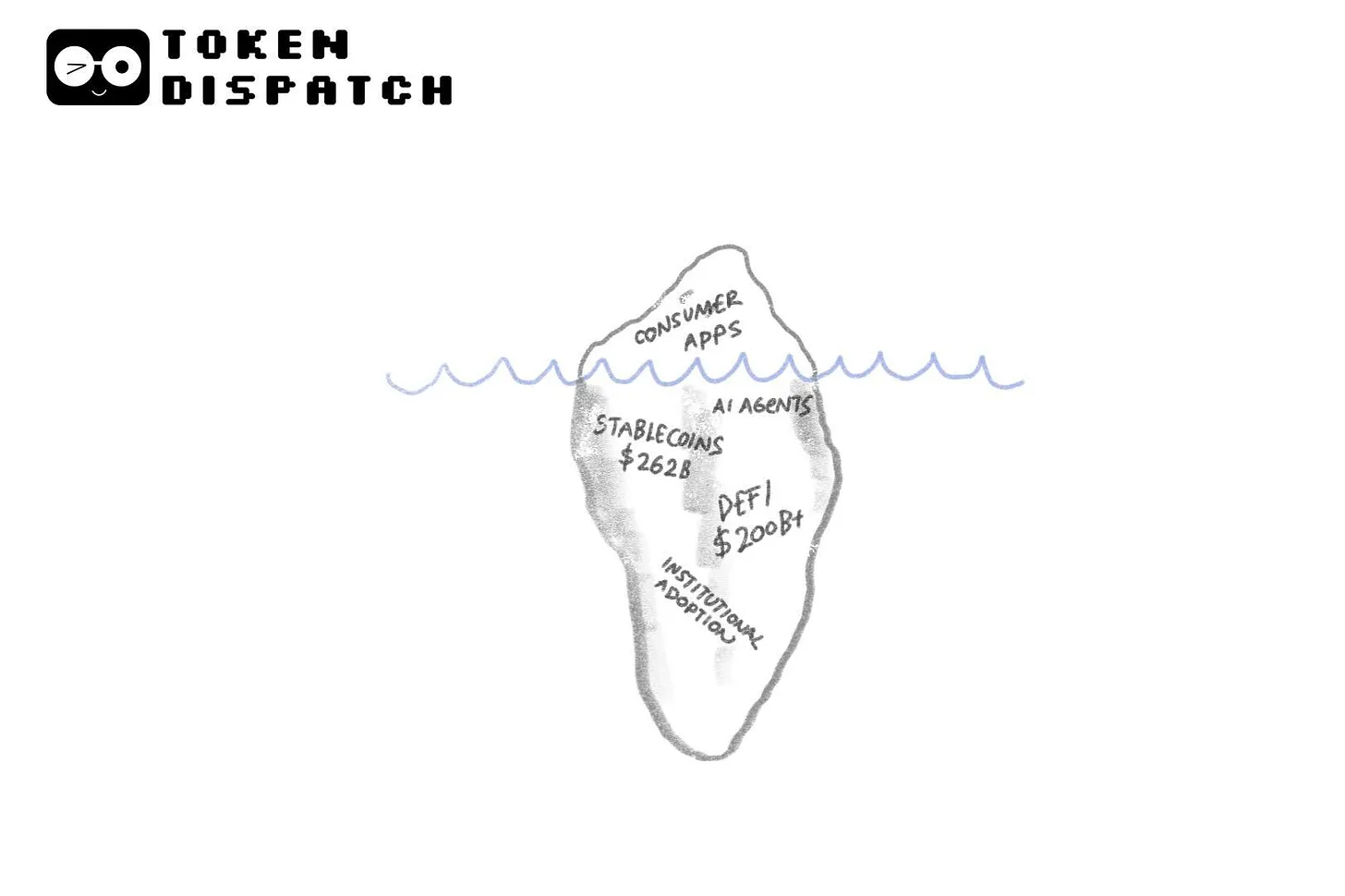

IV. The “Denationalization of Everything”: How RWA and DeFi Undermine State Control

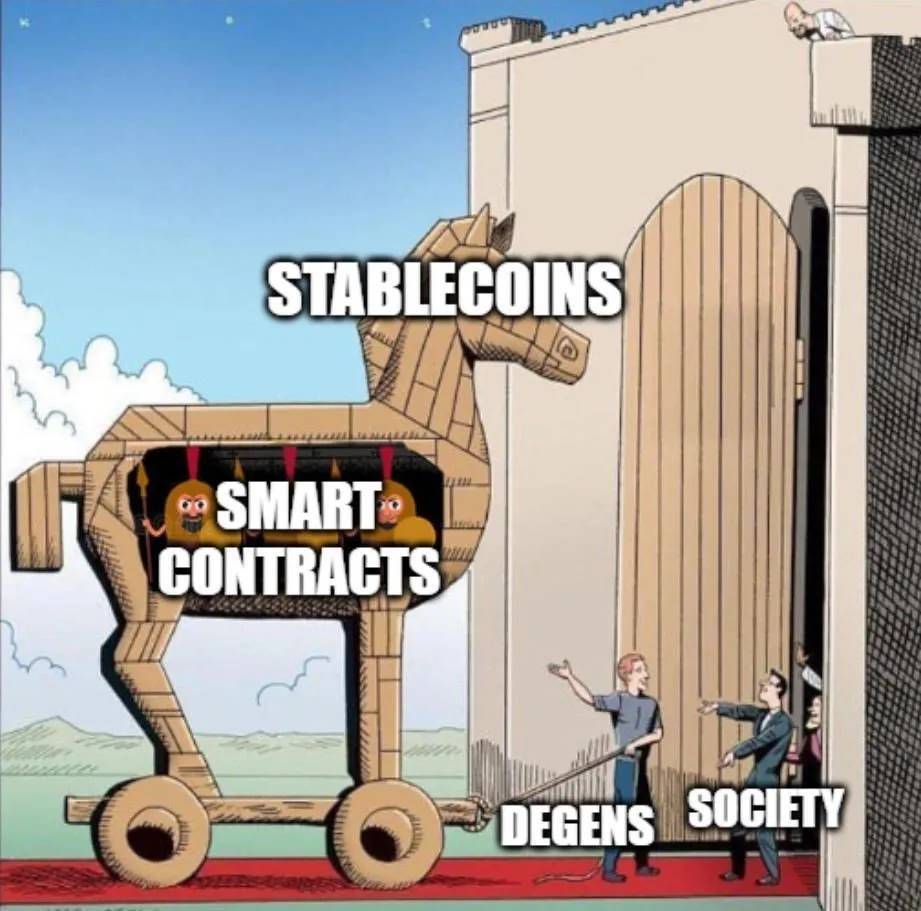

Stablecoins themselves are not the end of the revolution—they are more like the Trojan Horse breaching the city walls. Once global users become accustomed to holding and transferring value through them, a larger, deeper revolution follows. Its core is transforming all valuable assets—stocks, bonds, real estate, art—into digital tokens freely circulating on global public ledgers. This process—“tokenization of real-world assets” (RWA)—fundamentally severs the link between assets and specific national jurisdictions, achieving the “denationalization” of assets, and ultimately overturning the bank-centered traditional financial system.

4a. Stablecoins: The “Trojan Horse” to a New World

In ancient legend, the Greeks breached the mighty city of Troy by offering a giant wooden horse. Today, stablecoins play a similar role. To governments and regulators, regulated, asset-backed stablecoins appear to be the “horse” taming the wild beast of crypto—a relatively safe, controllable entry point.

Yet the irony of history is that the GENIUS Act, while aiming to strengthen state power by promoting “safe” stablecoins, inadvertently builds the largest user-acquisition channel ever for the “dangerous,” truly decentralized, non-state currencies.

The core function of stablecoins is serving as a gateway between the traditional fiat world and the crypto asset world. They are the “on-ramps” to crypto, the bridges crossing two realms. An ordinary user might initially adopt stablecoins for low-cost, high-efficiency cross-border remittances or daily payments, or merchant subsidies. But once they download a digital wallet and get used to on-chain transactions, the distance to truly decentralized assets like Bitcoin and Ethereum is just one click away.

Platforms offering stablecoin services, such as Coinbase or Kraken, are essentially all-inclusive crypto supermarkets. Users come for stablecoins, but soon find themselves attracted by the high yields offered by DeFi protocols or the narrative of Bitcoin as a store of value. Transitioning from holding USDC to staking ETH in liquidity mining is a natural progression for an experienced user.

This creates a profound paradox for the state. The short-term goal is strengthening dollar hegemony by promoting dollar-pegged stablecoins. To achieve this, the state must encourage and support user-friendly wallets, exchanges, and various applications. Yet these infrastructures are technologically neutral and protocol-agnostic. The same wallet can hold regulated USDC or anonymous Monero; the same exchange can trade compliant stablecoins or fully decentralized Bitcoin.

As users deepen their understanding of the crypto world, their demand for higher returns, stronger privacy protection, or true censorship resistance grows. At that point, they naturally shift from stablecoins—which offer stability but no upside potential—to assets fulfilling these higher-level needs.

4b. The RWA Revolution: Assets Breaking Free from National Borders

If DeFi is the superstructure of this revolution, then RWA is its solid economic foundation. The essence of RWA is converting assets existing in the physical world or traditional financial systems into blockchain tokens through legal and technical processes.

Consider this scenario:

-

An app developed by a Chinese team, with millions of global users on Apple’s App Store, has its ownership tokenized through legal and technical means into a digital certificate circulating on a blockchain.

-

This token is traded on a decentralized, permissionless DeFi protocol on-chain.

-

Within seconds of initiating the transaction, a user in Argentina receives this token in their digital wallet.

The entire process—tokenization, collateralization, minting and transfer of stablecoins—occurs entirely on-chain, bypassing the traditional banking systems of China, the U.S. (due to dollar pegging), and Argentina. This is not just a superior payment rail; it is a parallel financial universe, almost indifferent to the political and legal boundaries defined by the Westphalian system.

This is precisely how the “denationalization of money” drives the “denationalization of finance,” culminating in the “denationalization of capital.”

When capital becomes denationalized, capitalists, naturally, will also become denationalized.

4c. The End of the Traditional Financial System

This new financial ecosystem, driven by stablecoins and built on RWA, delivers a comprehensive shock to the traditional financial system. The core function of traditional finance is essentially acting as an intermediary of information and trust. Banks, brokers, exchanges, and payment companies solve trust issues between counterparties through massive capital, complex systems, and government licenses, charging high fees in return.

Blockchain technology, through its immutable, transparent nature and rules enforced by code (smart contracts), provides a new trust mechanism—“code is law.” Under this new paradigm, most functions of traditional intermediaries become redundant and inefficient:

-

Bank deposit and lending can be replaced by decentralized lending protocols.

-

Exchange trade matching can be replaced by automated market maker (AMM) algorithms.

-

Cross-border settlements by payment companies can be replaced by second-level global transfers via stablecoins.

-

Wall Street’s asset securitization can be replaced by more transparent and efficient RWA tokenization.

V. The Rise of the Sovereign Individual and the Twilight of the Nation-State

When capital flows borderlessly, when assets escape jurisdiction, when power shifts from nation-states to private giants and network communities, we arrive at the endpoint of this transformation—a new era dominated by the “sovereign individual,” marked by the end of the Westphalian system. This revolution, jointly driven by stablecoins and artificial intelligence (AI), will have far-reaching impacts surpassing even the French Revolution, because it brings not just regime change, but a transformation in the very nature of power.

(The book *The Sovereign Individual* is indeed a prophecy for our times)

5a. The Prophecy of *The Sovereign Individual* Comes True

In 1997, James Dale Davidson and Lord William Rees-Mogg, in their groundbreaking book *The Sovereign Individual*, predicted that the arrival of the information age would fundamentally alter the logic of violence and power. They argued that nation-states rose to prominence in the industrial age because they could effectively protect large-scale, fixed industrial assets and tax them. But in the information age, the most important capital—knowledge, skills, and financial assets—becomes highly mobile, even existing in intangible cyberspace. Then, the state becomes like a rancher trying to fence in “cattle with wings,” seeing its taxation and control capabilities drastically diminished.

The emergence of stablecoins, DeFi, and RWA is the real-world manifestation of the book’s concepts of “cybermoney” and “cybereconomy.” Together, they form a global, low-friction value network, giving capital literal wings. An elite individual can effortlessly allocate wealth across RWA tokens worldwide, instantaneously transferring funds between jurisdictions via stablecoins—all recorded on a public ledger beyond the reach of state machinery. The book’s predictions—that “individuals will escape government oppression” and “wealth holders will bypass the state’s monopoly on money”—are becoming reality.

5b. The End of the Westphalian System

Since the 1648 Peace of Westphalia, the basic unit of world politics has been the sovereign state. Core principles of this system include: supreme sovereignty within territorial borders, equality among states, and non-interference in internal affairs. The cornerstone of this system is the state’s absolute control over people and property within its territory.

The rise of the sovereign individual is fundamentally eroding this foundation. When the most creative and productive individuals conduct their economic activities and accumulate wealth in cyberspace—outside national jurisdiction—territorial borders lose meaning. States find themselves unable to effectively tax these globally mobile elites, inevitably weakening their fiscal foundations. Desperate to stop capital flight, some governments may resort to more radical, authoritarian measures—such as the “hostage-taking” taxation and suppression of technologies enabling personal autonomy, as predicted in the book. But this only accelerates the exodus of elites, creating a vicious cycle. Ultimately, nation-states may devolve into hollow shells, their functions limited to providing welfare and security for less mobile populations excluded from the global digital economy—a “nanny state” for the poor. Clearly, such a state has nothing to do with wealth creation.

5c. The Final Frontier: Privacy and the Ultimate Battle Over State Taxation

The next stage of this revolution will be privacy. Current public blockchains, while pseudonymous, still allow transaction tracing. However, as privacy technologies like zero-knowledge proofs mature (as used by Zcash and Monero), future financial transactions may achieve full anonymity and untraceability.

When a global, stablecoin-based financial system combines with robust privacy technology, it poses the ultimate challenge to state taxation. Tax authorities will face an impenetrable “black box,” unable to identify parties or taxable income. This will be the final form of “deregulation,” because when the state loses its ability to tax, it also loses the capacity to regulate effectively or provide public services.

The French Revolution replaced “monarchical sovereignty” with “national sovereignty,” shifting power from kings to nation-states, but leaving the territorial nature of power unchanged. The revolution ignited by stablecoins, however, replaces “territorial sovereignty of the nation-state” with “network sovereignty” and “individual sovereignty.” It is not a transfer of power, but the decentralization and denationalization of power. This is a more fundamental and thorough paradigm shift, whose impact is indeed no less than—and may even surpass—the French Revolution. We stand at the dawn of an old world disintegrating and a new order emerging. This new world will grant individuals unprecedented freedom and power, but also bring chaos and challenges beyond our current imagination.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News