Three Major Impacts of the Genius Bill on the Cryptocurrency Industry Over the Next Five Years

TechFlow Selected TechFlow Selected

Three Major Impacts of the Genius Bill on the Cryptocurrency Industry Over the Next Five Years

Genius bill could change stablecoin rules, impacting blockchain selection and market liquidity.

Author: Alex Carchidi

Translation: Baihua Blockchain

On June 17, the U.S. Senate passed the Generative and Secure Innovation for Payments Act (Genius Act), the first comprehensive federal stablecoin regulatory framework, clearing its biggest hurdle.

The bill has now moved to the House of Representatives, where the House Financial Services Committee is preparing its own version for a conference committee, with a possible vote later this summer. If all goes smoothly, the bill could be signed into law before autumn, significantly reshaping the cryptocurrency industry landscape.

The bill’s strict reserve requirements and national licensing regime will determine which blockchains are favored, which projects become significant, and which tokens are used—thereby influencing the direction of the next wave of liquidity. Let’s examine three major impacts this legislation could have on the industry if enacted.

1. Payment Altcoins Could Vanish Overnight

The Senate bill would create a new “licensed payment stablecoin issuer” license, requiring each token to be backed 1:1 by cash, U.S. Treasuries, or overnight repurchase agreements (repos)—with annual audits required for issuers with circulation exceeding $50 billion. This stands in stark contrast to today’s “Wild West” system, which has little in the way of substantive safeguards or reserve requirements.

This clarity comes at a time when stablecoins are becoming the primary medium of exchange on blockchains. In 2024, stablecoins accounted for about 60% of crypto transfer value, processing 1.5 million transactions daily, most under $10,000.

For everyday payments, a stablecoin token that reliably holds $1 value is clearly more practical than most traditional payment altcoins, whose prices might fluctuate 5% before lunch.

Once U.S.-licensed stablecoins can legally operate across state lines, merchants accepting volatile tokens will struggle to justify the added risk. In the coming years, the utility and investment value of these altcoins may decline sharply unless they successfully pivot.

Even if the Senate bill doesn’t pass in its current form, the trend is unmistakable. Long-term incentives will clearly favor dollar-pegged payment rails over payment altcoins.

2. New Compliance Rules Could Effectively Crown the Winners

The new regulations won’t just legitimize stablecoins—they’ll also effectively steer their flow toward blockchains capable of meeting audit and risk management requirements, should the bill become law.

Ethereum (ETH 1.15%) currently hosts around $130.3 billion in stablecoins, far surpassing any competitor. Its mature decentralized finance (DeFi) ecosystem allows issuers easy access to lending pools, collateral lockers, and analytics tools. Additionally, they can assemble a suite of compliance modules and best practices to meet regulatory demands.

In contrast, the XRP Ledger (XRPL) is positioning itself as a compliance-first platform for tokenized money, including stablecoins.

In the past month, fully-backed stablecoin tokens have launched on the XRP Ledger, each built with account freezing, blacklisting, and identity screening tools. These features align closely with the Senate bill’s requirement that issuers maintain strong redemption and anti-money laundering controls.

Ethereum’s compliance architecture might cause issuers to violate such requirements, though it remains unclear how strictly regulators will enforce them.

Nevertheless, if the bill becomes law as written, large issuers will need real-time verification and plug-and-play “Know Your Customer” (KYC) mechanisms to remain broadly compliant. Ethereum offers flexibility but complex implementation, while XRP provides a streamlined platform with top-down control.

Currently, both blockchains appear better positioned than privacy- or speed-focused chains, which may require costly modifications to meet the same standards.

3. Reserve Rules Could Unlock an Institutional Flood to Blockchains

Since every dollar of stablecoin must be backed by equivalent cash-like assets, the bill quietly ties crypto liquidity directly to U.S. short-term debt.

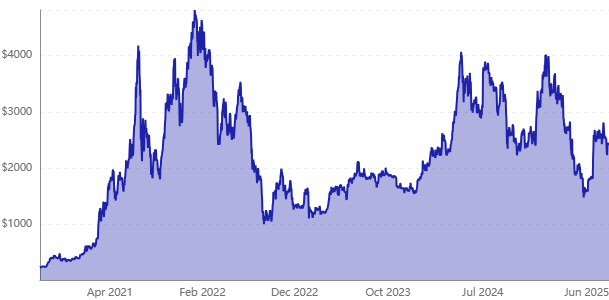

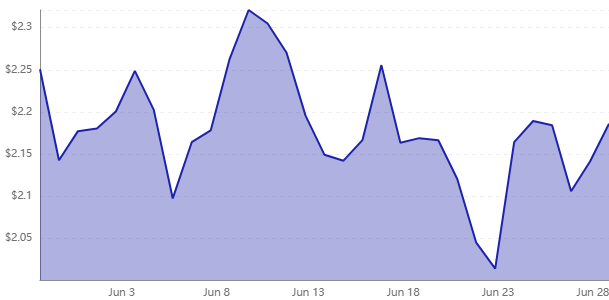

The stablecoin market has already surpassed $251 billion. If institutional adoption continues along its current trajectory, it could reach $500 billion by 2026. At that scale, stablecoin issuers would become among the largest buyers of U.S. short-term Treasuries, using the yield to support redemptions or customer rewards.

For blockchains, this linkage has two implications. First, growing reserve needs mean more corporate balance sheets will hold Treasuries alongside native tokens to pay network fees, boosting organic demand for tokens like Ethereum and XRP.

Second, interest income from stablecoins could fund aggressive user incentives. If issuers return part of the Treasury yield to holders, using stablecoins instead of credit cards could become a rational choice for some investors—accelerating on-chain payment volume and fee throughput.

Assuming the House retains the reserve provisions, investors should also expect increased sensitivity to monetary policy. If regulators adjust collateral eligibility or the Fed changes Treasury supply, stablecoin growth and crypto liquidity will move in tandem.

This is a notable risk—but also signals that digital assets are gradually integrating into mainstream capital markets rather than operating independently of them.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News