Never underestimate the significance of the U.S. stablecoin "Genius Act"

TechFlow Selected TechFlow Selected

Never underestimate the significance of the U.S. stablecoin "Genius Act"

In the future, concerns will soon be cleared, standards will be mastered, and the era of large inflows seems imminent.

Author: 0xTodd (@0x_Todd)

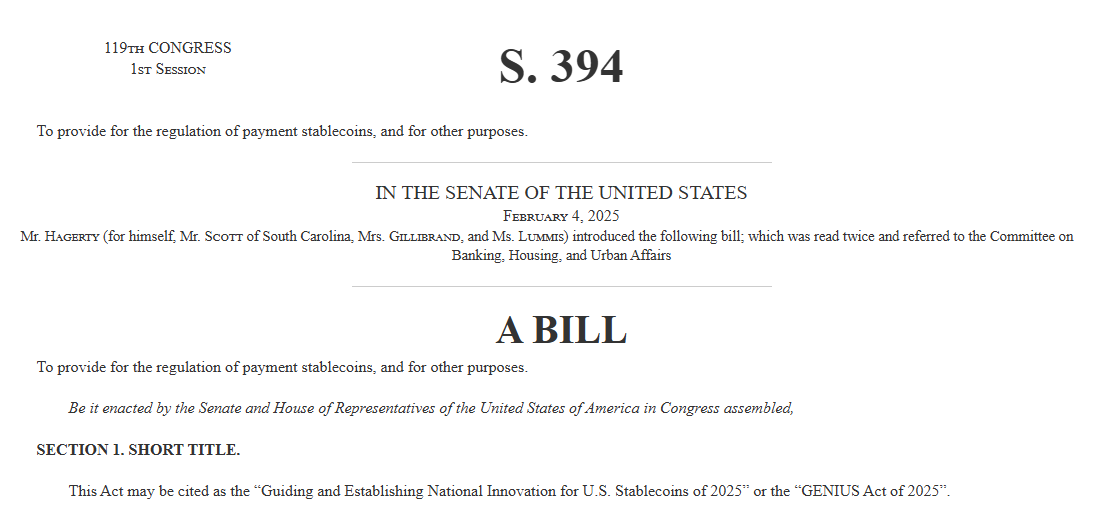

If the U.S. stablecoin bill, the GENIUS Act, passes smoothly, its significance will be tremendous—I even believe it could rank among the top five milestones in Crypto history.

Although abbreviated as the GENIUS Act—literally "Genius Act"—it actually stands for "Guiding and Establishing National Innovation for U.S. Stablecoins," meaning "Guiding and Establishing National Innovation for U.S. Stablecoins."

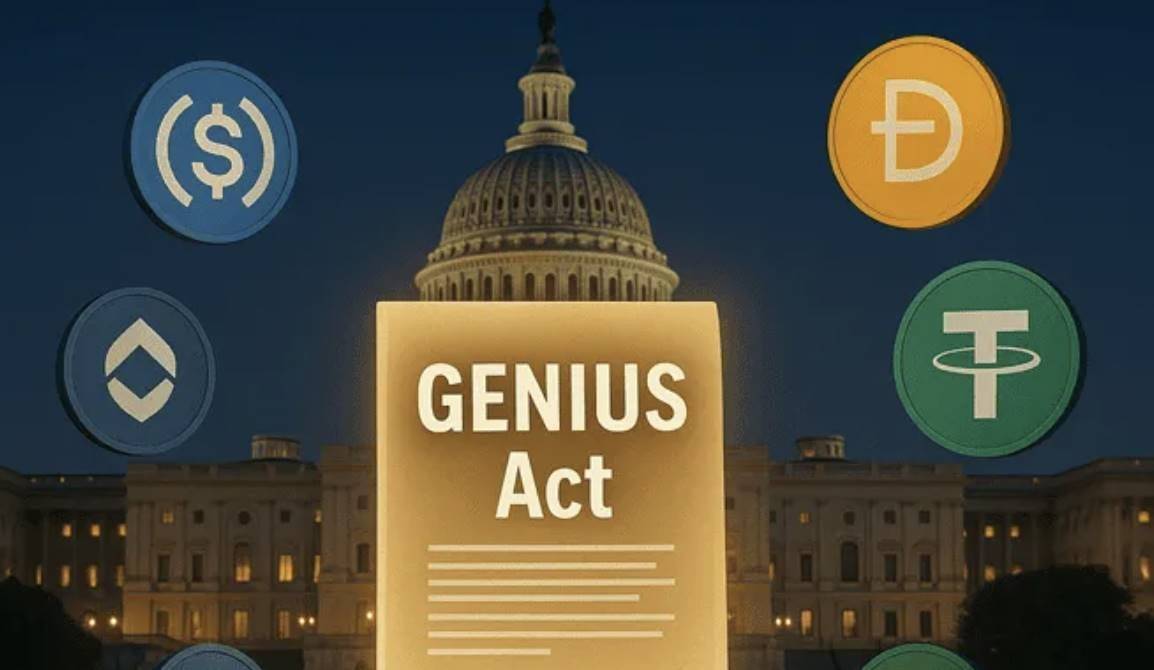

The proposal is lengthy, so here are the key highlights summarized:

1. Mandatory 1:1 full-reserve assets: including cash, demand deposits at banks, and short-term U.S. Treasury securities. Misappropriation and re-pledging are strictly prohibited.

2. Frequent disclosure requirements: reserves must be reported at least monthly, with external audits introduced.

3. Licensing requirement: if a stablecoin issuer's circulating market cap exceeds $10 billion, they must transition into the federal regulatory framework within a specified period, subject to banking-level oversight.

4. Custody requirements: custodians of stablecoins and their reserve assets must be regulated, qualified financial institutions.

5. Clear definition as a payment medium: the bill explicitly defines stablecoins as a new form of payment instrument, primarily governed by banking regulations rather than securities or commodities frameworks.

6. Onboarding existing stablecoins: a maximum 18-month grace period after enactment aims to urge current stablecoin issuers (e.g., USDT, USDC) to obtain licenses or achieve compliance.

---Divider---

Now that the main points are covered, let me share some thoughts on the significance of this development amid my excitement.

For years, whenever someone asked, what real application has your crypto industry built in 16 years?

From now on, you can confidently answer—stablecoins.

First, eliminating concerns is fundamental

Some previously held opposing views, as stablecoins were once seen as opaque black boxes. Every few months there would be FUD—either Tether’s assets being frozen or Circle having massive holes and deficits.

But think deeper: Tether alone earns billions annually just from interest on underlying Treasuries. Circle made $1.7 billion in profit last year.

This is money earned effortlessly—with no incentive whatsoever to act maliciously. In fact, these entities are among the most eager for regulation.

Now, this opaque black box will become a transparent white box.

Previously, people worried about Tether’s funds being seized by the U.S.; now, placing them under U.S.-regulated custodians with frequent disclosures makes it safe to trust.

【No need to worry about rug pulls】is an enormous advantage—I believe every crypto user understands this deeply.

Second, owning the standard matters

Stablecoins were once close to losing their achievements to CBDCs. No matter which country, if a central bank digital currency exists, it likely won’t be built on public blockchains but perhaps on some internal central bank consortium chain—which, frankly, is meaningless.

When CBDCs were hottest, stablecoins were at their most vulnerable.

If CBDCs had succeeded back then, today’s stablecoins would have been suppressed into obscurity, and blockchains could only play minimal roles.

The remaining half-dead stablecoins might even have had to adopt CBDC standards, completely losing control over standard-setting.

Now, stablecoins are winning (soon to be official).

Everyone else will instead follow the 【blockchain + token】standard.

Many blockchains today lack meaningful applications—only stablecoin transfers remain. For example, the only time I use Aptos is transferring between Binance and OKX.

Now, with stablecoins being codified into law, what does this mean?

Exactly—blockchain will become the sole standard.

In the future, every stablecoin user will first need to learn how to use a wallet.

A side note: I now believe Ethereum’s push for EIP-7702 shows real foresight. While other chains rush into memes, thank goodness Ethereum continues advancing account abstraction.

EIP-7702 enables account abstraction, supporting features such as:

Social account-based wallet registration

Paying gas fees with native tokens

And more

This solves the last-mile problem for mass adoption of stablecoins by new users.

Third, a new era of onboarding begins

Once stablecoins receive legislative backing, depositing and withdrawing funds will become much easier.

Imagine this scenario: previously hindered by stablecoins’ gray status, traditional brokers could not participate. But after the bill passes, many could directly support stablecoins. U.S. stock investors’ money could instantly convert into stablecoins and flow into Coinbase in one second—would you believe it?

Now imagine another scenario: if the Genius Act smoothly passes through the House, what comes next?

Given the immense profitability, both incumbent stablecoin leaders and new traditional giants will aggressively promote their stablecoin products.

An outsider, drawn in by these promotions, starts using stablecoins. Then one day realizes: since the wallet is already set up, how hard is it to explore Bitcoin inside?

Stablecoins are a giant Trojan horse. The moment you start using them, you've unknowingly stepped halfway into the Crypto world.

Fourth, finally

As a major reservoir absorbing U.S. debt, stablecoins may not directly reduce national debt, but they at least supply liquidity to the secondary Treasury market. These functions are critically important, and gradually, stablecoins become part of the U.S. Treasury ecosystem. Therefore, once the U.S. enacts this legislation and experiences its benefits, there will be no turning back.

We also firmly believe stablecoins are one of our industry’s greatest innovations. Once someone has used stablecoins, returning to the traditional cash-banking system becomes nearly impossible.

The legislation won't be reversed, nor will users go back. The future is clear: concerns will be eliminated, standards will be owned, and the great onboarding era appears imminent.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News