From the Nixon Shock to the GENIUS Act: The Digital Evolution of Dollar Hegemony

TechFlow Selected TechFlow Selected

From the Nixon Shock to the GENIUS Act: The Digital Evolution of Dollar Hegemony

Challenging Tether, boosting Circle, reshaping the stablecoin landscape.

Source: The GENIUS Stablecoin Play

Compiled & translated by: Lenaxin, ChainCatcher

On August 15, 1971, President Nixon announced a series of economic measures: severing the dollar’s link to gold, freezing wages and prices, and imposing a 10% import surcharge. "I have directed the Secretary of the Treasury to take the necessary actions to protect the dollar from speculative attacks," he declared. This speech, which reshaped the global monetary system and later became known as the "Nixon Shock," was met with more criticism than praise at the time.

This week, the U.S. Senate passed the GENIUS Stablecoin Act by an overwhelming 68-to-30 vote, marking a critical step toward establishing America’s first comprehensive regulatory framework for digital dollars. Unlike Nixon’s hasty emergency move to abandon the gold standard, this legislation builds a careful and deliberate monetary infrastructure for the digital age. According to Citigroup, the current $250 billion stablecoin market could surge to $3.7 trillion by 2030 under bullish conditions.

The bill now awaits a vote in the House of Representatives and presidential signature. This in-depth report analyzes:

-

How will this legislation reshape the financial system?

-

Why is Tether facing an existential crisis?

-

Has the U.S. truly reached a turning point in its monetary system?

Digital Dollar Blueprint

The GENIUS Act establishes clear boundaries in the digital currency space. Unlike previous fragmented crypto regulations, it sets forth precise standards:

At its core, the law mandates that stablecoin issuers must maintain 1:1 reserves in U.S. dollars, short-term Treasuries maturing within 93 days, or equivalent liquid assets, subject to mandatory monthly public audits. Interest-bearing stablecoins are explicitly prohibited.

Only three types of entities may issue payment stablecoins: subsidiaries of insured banks, non-bank federal issuers approved by the Office of the Comptroller of the Currency (OCC), or state-level issuers meeting federal standards. Foreign issuers are granted only a three-year transition period; those failing to comply after that will be fully excluded from the U.S. market.

By defining stablecoins as “digital currency” rather than a special form of crypto asset—and enforcing monthly reserve disclosures, criminal liability for false statements, and compliance with the Bank Secrecy Act—the bill transforms stablecoins from unregulated experiments into legitimate financial infrastructure. In affirming the legal status of digital dollars, it systematically phases out non-compliant participants.

Intensifying Competition

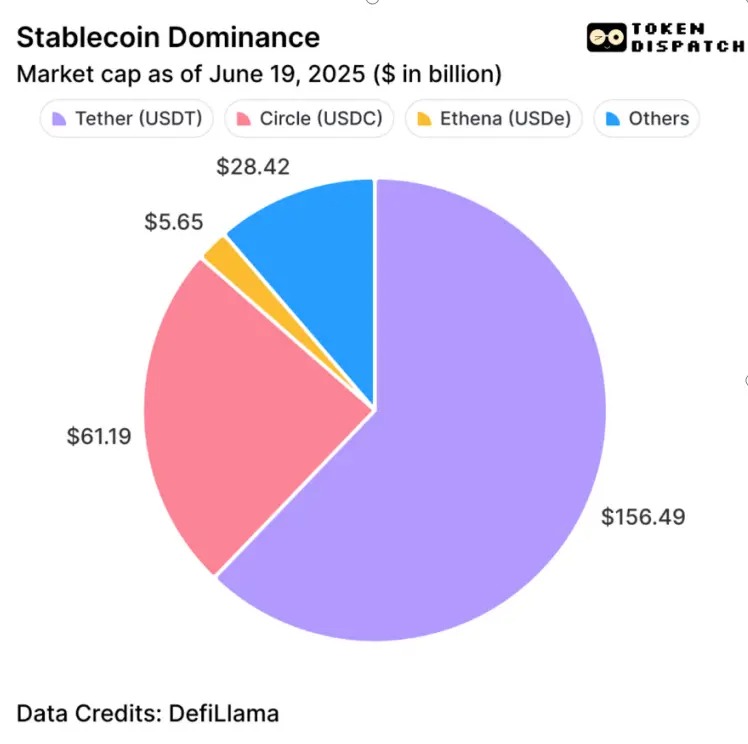

For Tether, the world’s largest stablecoin issuer, the GENIUS Act reads like a precisely worded three-year ultimatum. USDT, issued by a company holding 62% of the stablecoin market, may face its most severe challenge yet—proving once again the adage that "the bigger they are, the harder they fall."

Tether’s current reserve structure fails to meet the bill’s requirements. Its website shows that only 81.5% of USDT is backed by cash and short-term deposits, falling short of the 1:1 high-liquidity asset standard. Moreover, its Italian auditor, BDO, does not meet the qualifications required by the U.S. Public Company Accounting Oversight Board (PCAOB), necessitating a complete overhaul of its audit framework.

While its CEO has pledged to launch compliant products, Tether’s business model—relying on high-yield investments—directly contradicts the bill’s prohibitions. During the three-year transition, USDT is expected to lose institutional support from banks, payment providers, and corporate treasuries, leading to a continuous contraction in use cases.

In contrast, Circle, the issuer of USDC, saw its share price surge 35% following the Senate vote, reaching five times its initial valuation. Leveraging its U.S.-based operations, compliant reserves, and banking partnerships, Circle is capturing significant regulatory advantages. Its recent integration with Shopify for USDC payments further underscores its growing momentum.

Balancing Security and Innovation

The most controversial provision in the GENIUS Act is the outright ban on interest-bearing stablecoins—a reflection of Congress’s lessons learned from past crypto leverage collapses. The underlying principle is clear: payment instruments should not double as investment vehicles. When stablecoins generate yield, they begin to resemble bank deposits or securities. Traditional banking systems manage such systemic risks through mechanisms like deposit insurance and capital adequacy requirements.

This poses a direct threat to decentralized finance (DeFi) protocols reliant on yield-generating stablecoins. By explicitly excluding “securities issued by investment companies” and “deposits” from its scope, the bill channels yield-seeking users toward tokenized bank deposits or regulated investment products instead.

Yet controversy persists. While users bear the opportunity cost of holding non-interest-bearing assets, stablecoin issuers can still earn returns by investing in interest-bearing instruments. This trade-off, however, secures institutional confidence far exceeding the value lost in DeFi yields. Monthly reserve transparency, mandatory anti-money laundering compliance, and transaction monitoring are transforming stablecoins from fringe crypto experiments into mainstream financial infrastructure.

Today, major banks can treat compliant stablecoins as true cash equivalents, corporate treasuries can hold them with confidence, and payment providers can seamlessly integrate them based on their bank-like characteristics. This institutional recognition could fundamentally reshape the entire financial ecosystem.

Infrastructure for Scalable Adoption

The GENIUS Act establishes a regulatory foundation for stablecoin integration into mainstream finance through two pillars: custody protection and regulatory clarity.

The custody framework requires qualified custodians to segregate customer assets, prohibit commingling, and ensure priority in bankruptcy proceedings—extending traditional financial safeguards into the digital asset realm.

-

For retail users, the bill preserves self-custody rights while requiring service providers to meet bank-grade standards, ensuring that regulated stablecoin wallets receive protections equivalent to bank accounts.

-

For enterprises, cross-border settlements can be reduced to minutes, supply chain payments become programmable and transferable, and treasury management operates beyond holiday constraints. Individuals benefit from fast, low-cost international transfers without hefty fees.

The bill also mandates assessments of interoperability standards to ensure stablecoins can flow across platforms, preventing regulatory fragmentation from stifling innovation.

Implementation Challenges

Despite bipartisan support, the GENIUS Act faces multiple hurdles in implementation:

1. Compliance costs will reshape the market landscape. Monthly audits, complex reserve management, and ongoing regulatory reporting create a high barrier to entry. Large issuers can absorb these costs easily due to economies of scale, but smaller and mid-sized stablecoin firms may be forced out by rising operational burdens.

2. Cross-border friction could hinder global adoption. European companies using dollar-pegged stablecoins may face issues labeled as “currency conversion” and “foreign exchange risk.” As Heiko Nix, Siemens’ global head of cash management and payments, told Bloomberg, this is precisely why the German industrial giant opted for tokenized bank deposits instead.

3. The yield ban may drive innovation overseas. If other jurisdictions permit interest-bearing stablecoins, the U.S. may preserve financial stability but risk losing technological leadership. DeFi protocols dependent on yield-generating stablecoins could face a cliff-edge disruption if no compliant alternatives emerge.

4. Coordination between state and federal regulators introduces new uncertainty. The bill allows issuers with less than $10 billion in market cap to opt for state-level regulation—but only if they prove their standards are “substantially similar” to federal rules. State regulators must proactively submit compliance documentation, and the Treasury Secretary retains veto power over certifications, potentially forcing reluctant issuers into the federal framework.

Token Dispatch Observation

The Republican-controlled House (220–212) makes passage of the bill nearly certain. Yet execution will test America’s ability to balance innovation and regulation. This legislation could redefine monetary sovereignty in the digital age—just as the 1971 “Nixon Shock” controversially ended the gold standard, the GENIUS Act may now usher in a new era of digital dollars. Its core mechanism—requiring all compliant stablecoins to be backed by U.S. dollars or Treasuries—converts global demand for stablecoins directly into dependence on the U.S. dollar system.

The bill features a novel “substantially similar” reciprocity clause: those who comply gain access to the U.S. market; those who refuse face market isolation. Ironically, a technology originally designed to circumvent centralized control becomes a tool reinforcing dollar dominance. Crypto purists must now confront this institutional irony.

Traditional financial institutions see this as a turning point for digital assets entering the mainstream. Circle’s 35% stock surge reflects capital markets’ verdict: a clear regulatory framework is far more attractive than unregulated, chaotic growth. When technological idealism meets real-world regulation, the market has already cast its vote—with real money.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News