ICO valued at $4 billion, is Pump.fun worth it?

TechFlow Selected TechFlow Selected

ICO valued at $4 billion, is Pump.fun worth it?

If revenues continue to grow, there will be significant room for valuation expansion, making the $4 billion valuation appear reasonable or even undervalued.

Author: tomas

Translation: TechFlow

On Twitter, discussions about @pumpdotfun's planned ICO are filled with mixed emotions, but there is little concrete evidence supporting these views. Therefore, it’s worth diving into the fundamentals to assess two key questions: 1) Is a $4 billion ICO valuation reasonable? 2) What are the potential returns or risks of this investment?

This article isn't an exhaustive analysis but rather a series of critical observations I believe are necessary to form a complete judgment. Also, for full transparency, I have no affiliation with @pumpdotfun, and this analysis will also help me decide how to trade this ICO myself.

To answer my two questions, I believe we need to explore the following points further:

-

How does @pumpdotfun fare against competition in the memecoin space?

-

How has @pumpdotfun performed within the broader ecosystem?

-

Is @pumpdotfun's user appeal and momentum increasing or declining?

Let’s analyze each one by one.

@pumpdotfun vs. Competition in the Memecoin Space

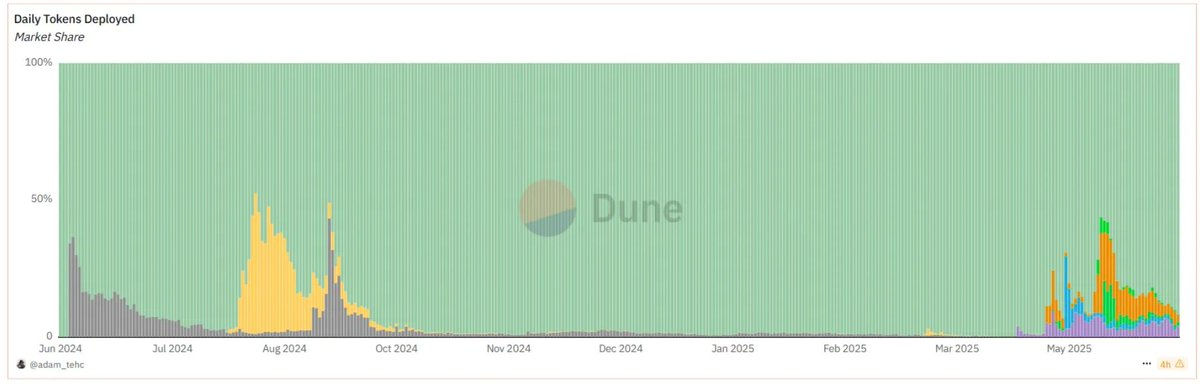

The chart above clearly shows that while competitors emerge and briefly capture market share, they quickly fade away. The most recent wave of competition came from @bonk_fun, @RaydiumProtocol's LaunchLab, and @believeapp, marking the second competitive cycle since Pump’s inception. However, as seen during the first wave (Justin’s pump[.]sun), these competitors were not sustainable, and users typically returned to @pumpdotfun within weeks.

How Does @pumpdotfun Perform Within the Broader Ecosystem?

Clearly, Pump performs exceptionally well in the memecoin space, but I also want to understand its significance relative to memecoins and the broader ecosystem.

https://dune.com/hashed_official/pumpdotfun

https://dune.com/ilemi/solana-dex-metrics

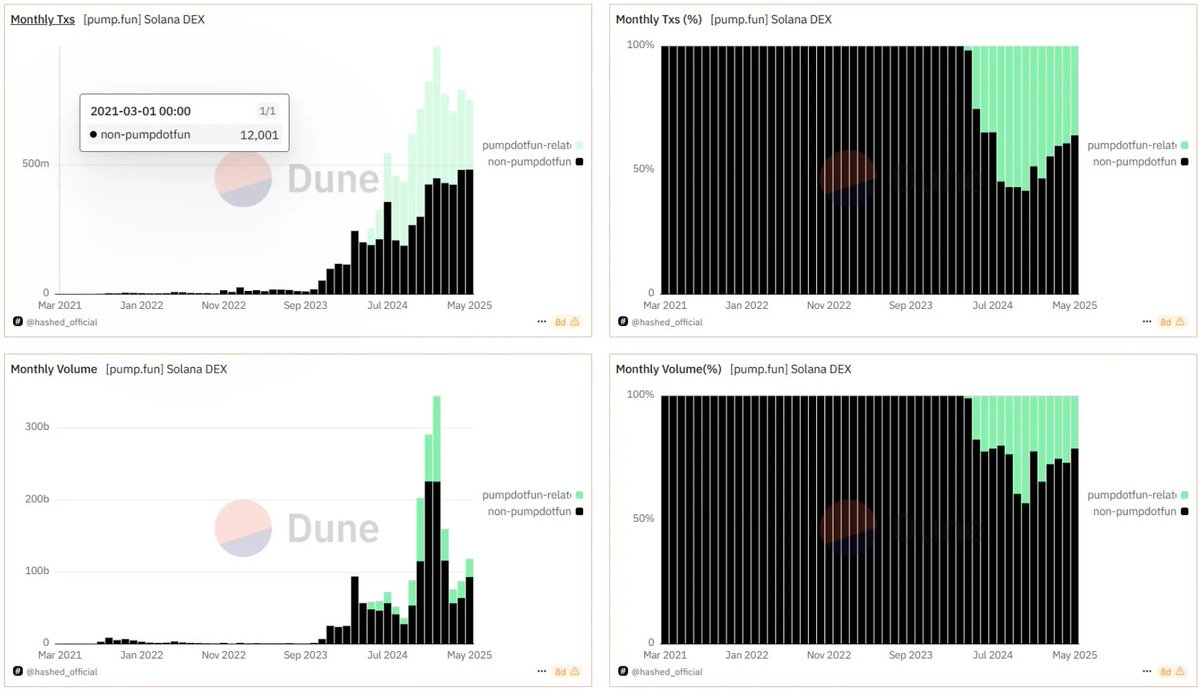

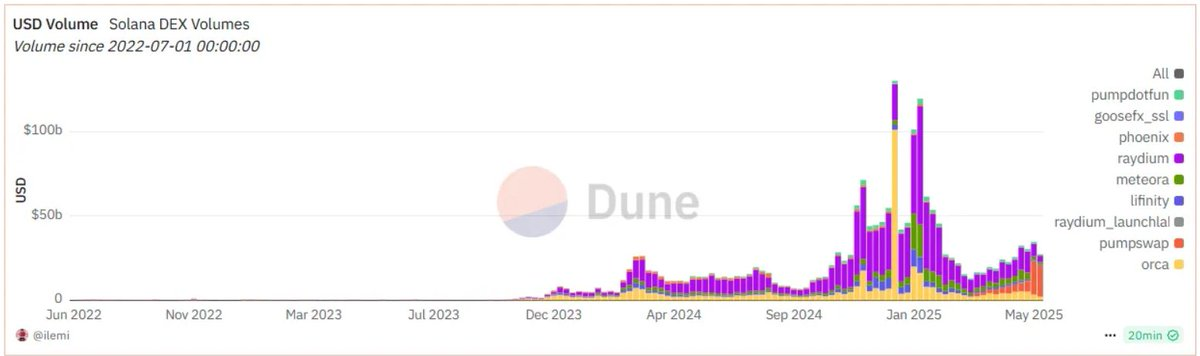

From the top chart, we can see that memecoins' market dominance is declining, dropping from 45% of total ecosystem volume at year-end to around 25% today. Meanwhile, the bottom chart shows that pump.swap has experienced significant growth compared to other @solana decentralized exchanges (DEXs).

It's important to note that the decline in memecoin trading volume share has reverted to levels seen before @virtuals_io and $TRUMP fueled the Q4 2024 bull run. Thus, this decline is natural and expected. I’m encouraged that memecoin trading may now be settling into a sustainable, normalized portion of overall activity.

Is @pumpdotfun’s User Appeal and Momentum Rising or Falling?

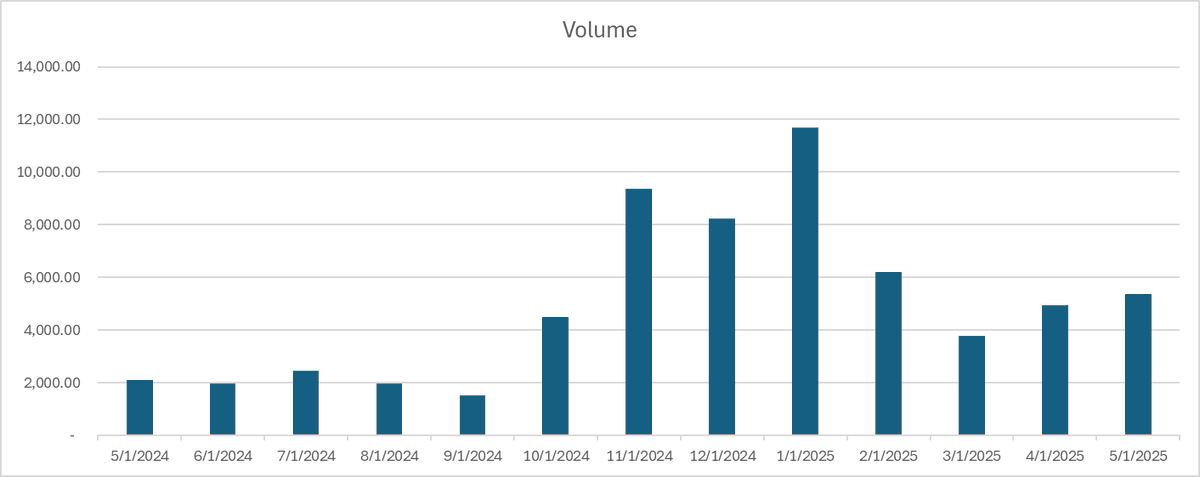

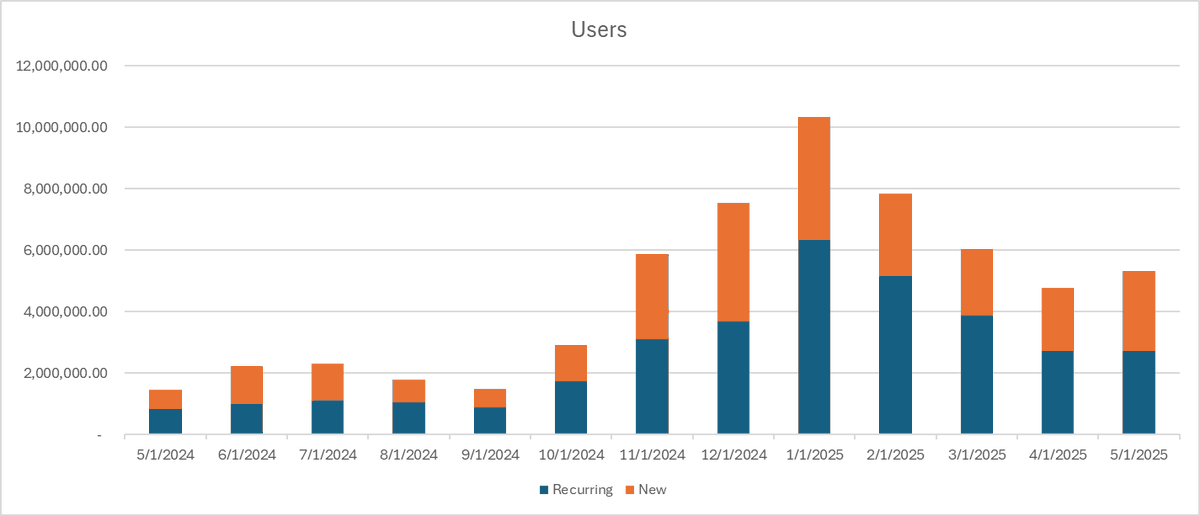

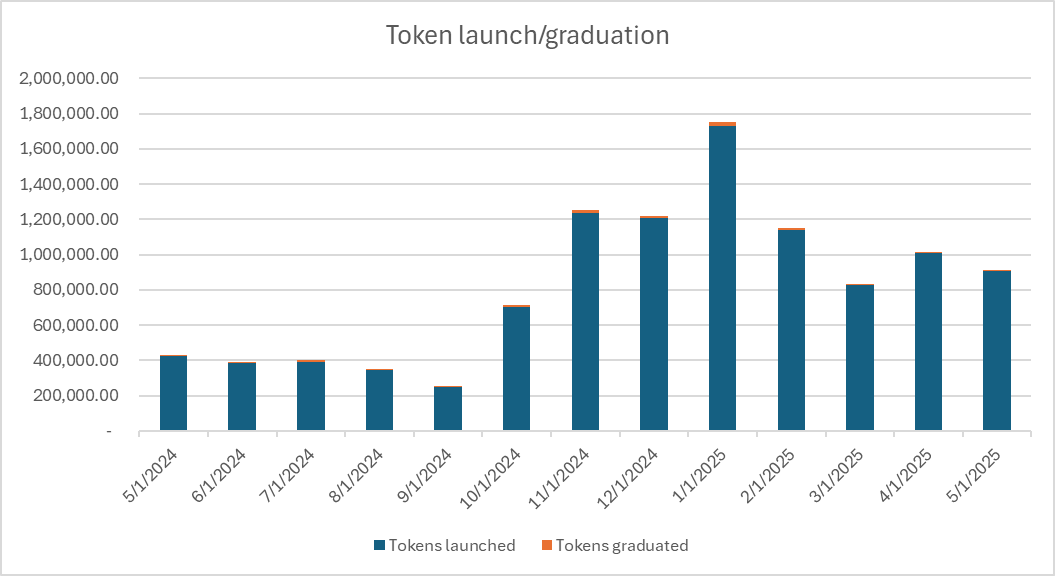

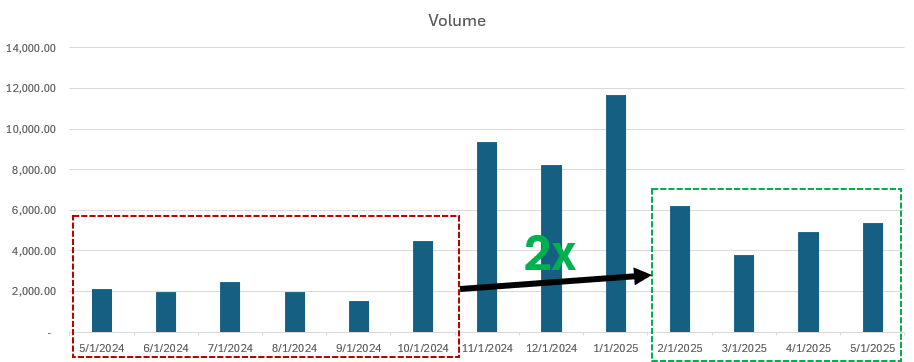

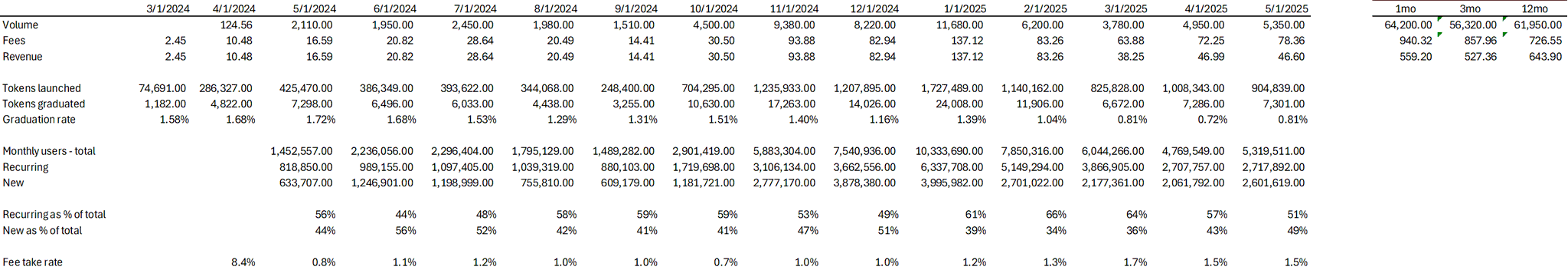

A picture is worth a thousand words, so below are three charts showing @pumpdotfun’s trading volume, user base, and token launch/graduation rates.

Overall, when viewed in context, these metrics appear positive to me. Excluding the "frenzy" bull period from November to January, all metrics have doubled, with high user retention (on average, 56% of monthly users are returning users), and while graduation rates remain relatively stable, they have slightly declined.

Valuation Analysis

In my view, @pumpdotfun continues to grow healthily, faces almost no sustainable competition, and broader market conditions suggest memecoins are far from over. Therefore, the notion that @pumpdotfun's ICO represents a "final extraction" doesn’t hold water.

Since Pump clearly has non-zero value (and doesn’t appear short-term doomed), we can proceed to estimate its fair valuation.

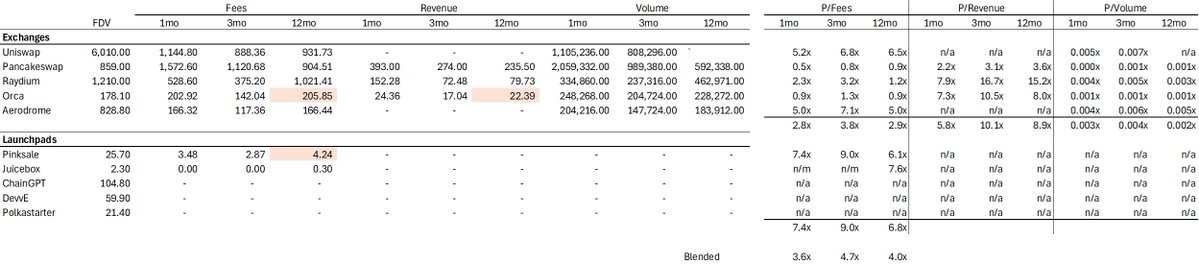

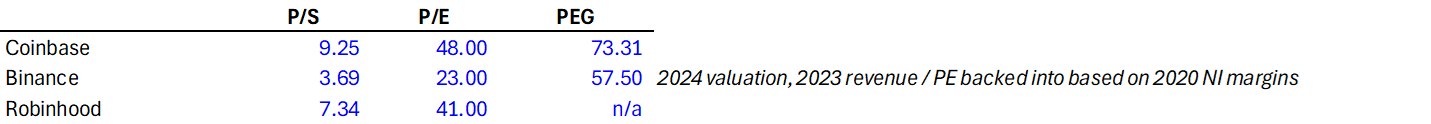

Rather than relying on subjective inputs for a discounted cash flow (DCF) analysis, I opted for a comparable analysis approach. I began by gathering two datasets:

Dataset A

Dataset B

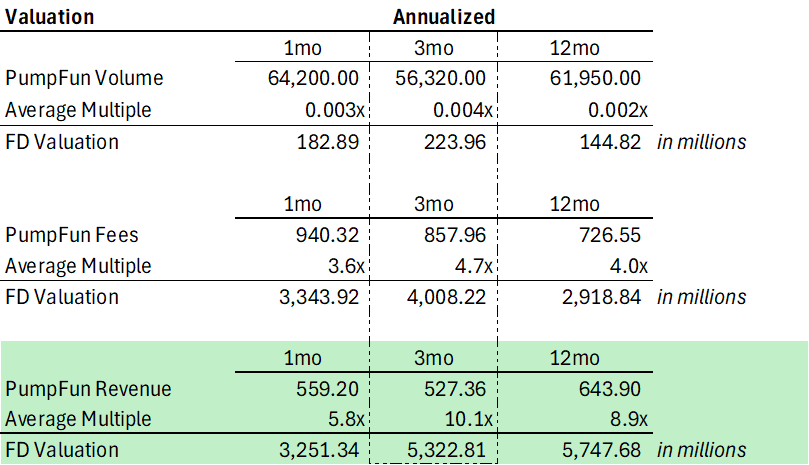

For @pumpdotfun, I used the following data in my analysis:

pump.fun data

Using different metrics from Dataset A, we see @pumpdotfun’s fully diluted valuation (FDV) ranging from $183 million to $5.7 billion. Clearly, such a wide range offers no definitive answer. However, as a fundamentals-focused investor, considering that Pump.fun’s business model differs significantly from traditional decentralized exchanges (DEXs) or launch platforms, I believe revenue is the most appropriate metric for evaluating the company.

DEX trading volume is a poor proxy for monetization, and fees do not accurately reflect capacity for token buybacks. In my view, buyback capacity will become the primary driver in analyzing any token going forward. Hence, revenue is clearly the best metric for valuing @pumpdotfun.

Another point to clarify: which annualized metric is more appropriate?

I believe a 3-month metric is optimal here. One month’s data is too volatile (e.g., @HyperliquidX’s annualized revenue fluctuates between $300M and $1B), while 12-month revenue fails to reflect recent changes in @pumpdotfun’s business model—such as introducing creator revenue sharing—which could overstate its current run-rate revenue.

Based on DEX multiples, Pump’s fully diluted valuation (FDV) is approximately $5.3 billion.

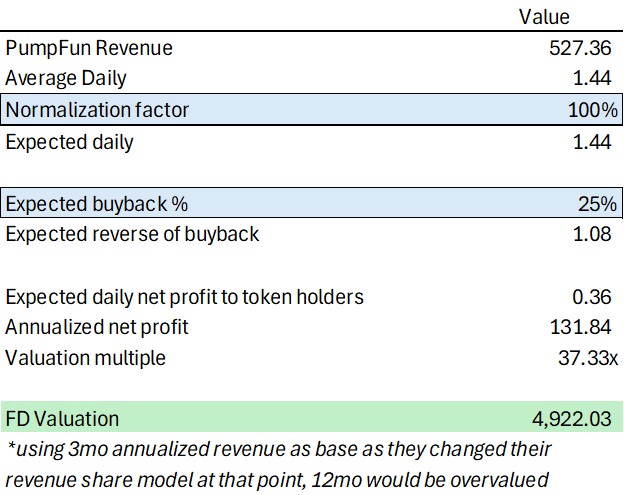

But can we do better? Current valuation methods assume 100% buyback rates, which is unrealistic. Moreover, they fail to account for the fact that Pump operates more like a company than a protocol, making DeFi multiples less suitable for valuation.

Therefore, we can instead use P/E ratios from key players in centralized finance (CeFi)—Coinbase, Binance, and Robinhood—as a representative dataset.

Valuation based on Dataset B

Interestingly, assuming a 25% buyback program, FDV is approximately $5 billion—very close to the DEX multiple-based estimate.

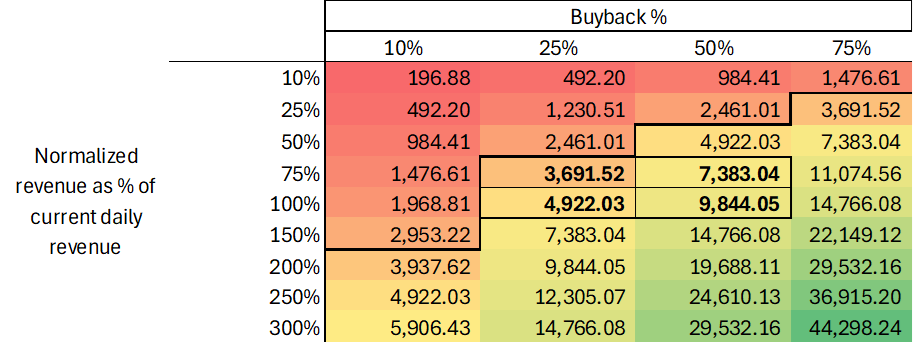

But here’s a catch! These scenarios assume specific buyback programs and sustained user engagement. What if we conduct a sensitivity analysis on these assumptions?

Sensitivity analysis based on “Valuation from Dataset B” yields the following:

My base assumption is that Pump.fun can sustain 75%-100% of current revenue ($1.5M daily) and allocate 25%-50% of revenue toward buybacks. This places its valuation between $3.7 billion and $9.8 billion. If revenues continue growing, there’s substantial upside, making a $4 billion valuation seem reasonable—or even conservative.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News