ARK Invest: Stablecoins Will Become the Most Resilient Financial Ally for the U.S. Government

TechFlow Selected TechFlow Selected

ARK Invest: Stablecoins Will Become the Most Resilient Financial Ally for the U.S. Government

Stablecoins will strengthen the U.S. dollar's global dominance.

Author: Lorenzo Valente

Translation: Luffy, Foresight News

In ARK's Big Ideas 2025 report, we offer investors deep insights into the cryptocurrency space, including stablecoins. Since January this year, the stablecoin supply has surged 20% to $247 billion—exceeding 1% of U.S. M2 money supply. Tether and Circle continue to dominate the market with scales of $150 billion and $61 billion respectively, collectively holding over 85% market share.

We believe stablecoins could become one of the U.S. government’s most important strategic assets in the next 5–10 years. Why? Over the past 15 years, foreign ownership of U.S. Treasuries has declined sharply, and given evolving geopolitical pressures, this trend may persist. Meanwhile, due to its ongoing quantitative tightening, the Federal Reserve is unlikely to increase its purchases of Treasury bonds.

We expect the stablecoin market to grow exponentially, with supply potentially increasing five- to tenfold over the next five years. This expansion could push demand for Treasuries back to levels once supported by sovereign nations. Moreover, stablecoins are reaching regions and populations underserved by traditional banking systems, counteracting current de-dollarization trends.

We present our argument and analysis on stablecoins in six parts:

-

Show that major historical holders of U.S. Treasuries have seen sustained declines in their holdings;

-

Demonstrate how macroeconomic dynamics—including geopolitical shifts—have reduced these countries’ interest in investing in U.S. debt;

-

Explain how persistent inflation lowers the likelihood of large-scale bond purchases by the Fed in the near term;

-

Show how stablecoins are filling the demand vacuum left by traditional major holders of U.S. Treasuries;

-

Illustrate how Treasury-backed stablecoins act as "Trojan horses," promoting trade and recycling dollars back into U.S. debt;

-

Argue that stablecoins have already significantly strengthened the global dominance of the U.S. dollar.

The U.S. Government Is Losing Its Largest Bond Buyers

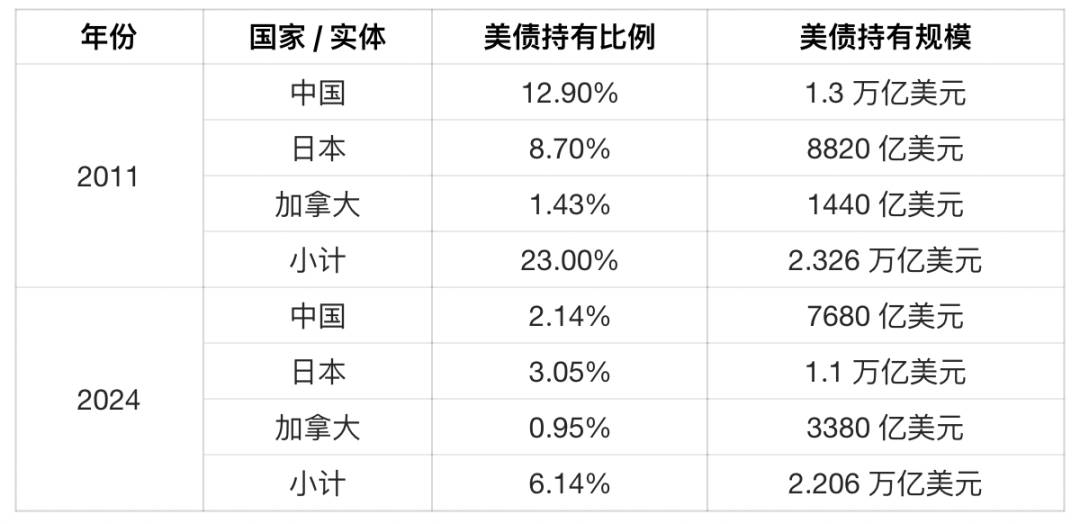

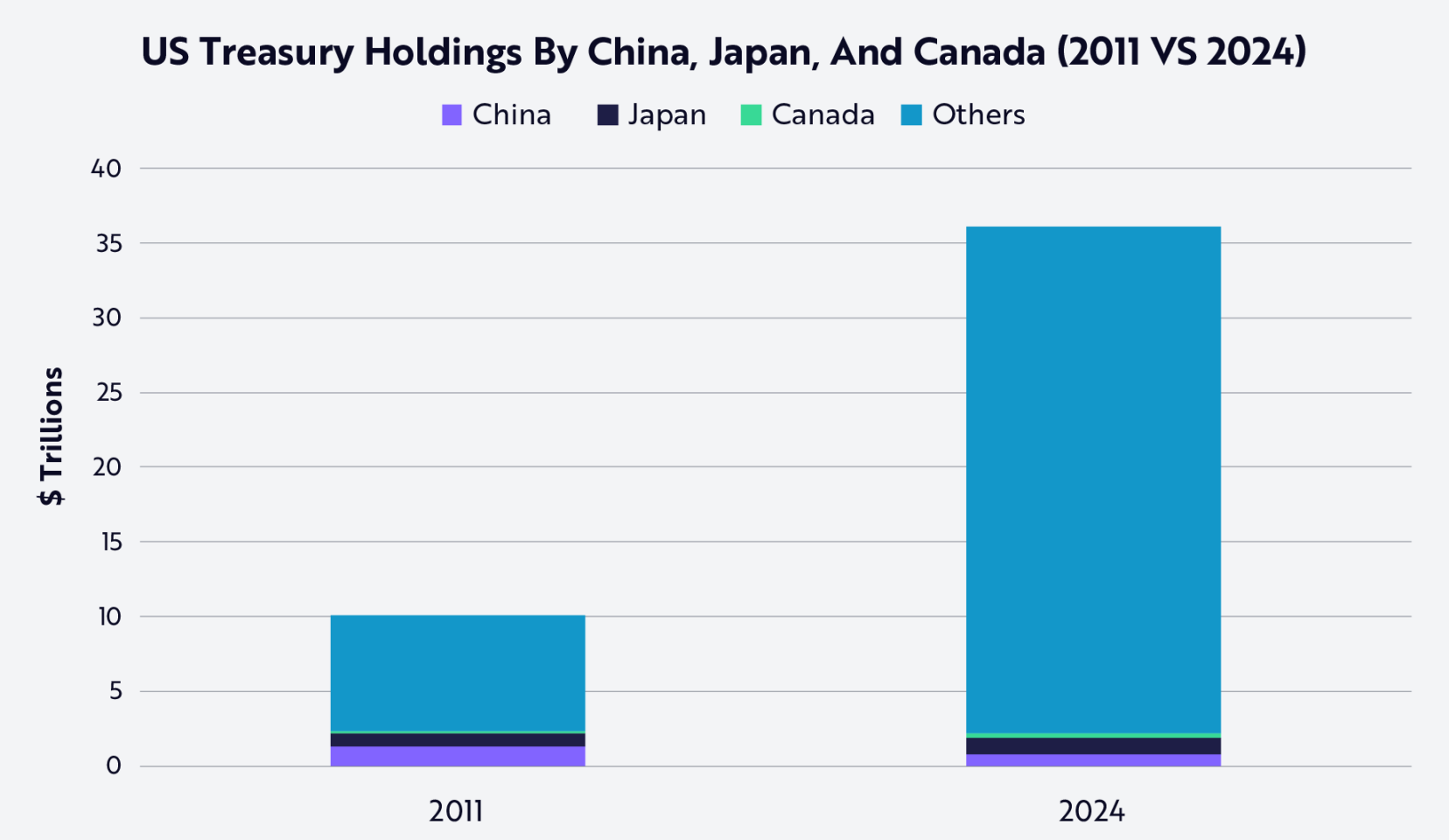

In 2011, China, Japan, and Canada held 12.9%, 8.7%, and 1.43% of the $10.1 trillion outstanding U.S. debt, totaling 23%. By November 2024, amid $36 trillion in outstanding debt, their shares had dropped to 2.14%, 3.05%, and 0.95% respectively—just around 6% combined—as shown in the table and chart below:

Source: ARK, as of May 15, 2025

To reiterate: within just about 13 years, the share held by the largest creditors of U.S. Treasuries has plummeted from 23% to 6%, detailed below:

Source: ARK, as of May 15, 2025

What Happened?

Historically, China accumulated dollars through massive trade surpluses and reinvested them into U.S. Treasuries—primarily to manage the yuan’s exchange rate against the dollar and maintain export competitiveness, which was vital for economic growth. However, over the past five years, China’s trade imbalances have narrowed, reducing its need for U.S. debt. U.S.-China trade data shows the deficit fell from $419.2 billion in 2018 to $295.4 billion in 2024—a reduction of more than 29% in just six years.

Geopolitical changes have accelerated this shift. Sanctions related to the war in Ukraine have pushed Russia to rely more heavily on alternative trading partners, especially China. Today, 92% of Russian-Chinese trade is settled in rubles and renminbi—an unmistakable sign of de-dollarization. As trade tensions escalate—including national security sanctions tied to the race for general artificial intelligence—Chinese policymakers face growing pressure to reduce reliance on U.S. financial services and securities.

On April 2, 2025, Donald Trump held a “Liberation Day” ceremony, announcing sweeping tariffs aimed at correcting trade imbalances and supporting domestic industries:

-

Global: 10% tariff on all U.S. imports;

-

China: Tariffs on Chinese goods raised to 145%, comprising a 125% “reciprocal” tariff plus a 20%附加 tax linked to fentanyl policy;

-

Canada and Mexico: 25% tariff on imports from both countries, with energy products like crude oil and natural gas taxed at a lower 10%.

Unless China devalues the yuan again—as it did during Trump’s first presidency—these tariffs will significantly raise prices on Chinese exports to the U.S., giving China another incentive to focus on other trading partners such as ASEAN, the Middle East, and BRICS nations. In these markets, China is increasingly settling trade in renminbi, local currencies, or commodities. For example, the Shanghai International Energy Exchange settles oil trades in renminbi, and China has become the top trading partner for fast-growing economies like Brazil, Argentina, Australia, and South Africa.

Japan also faces structural economic and demographic challenges, prompting the Bank of Japan (BOJ) to adopt a more hawkish stance in response to inflationary pressures and a tightening labor market. In January 2025, the BOJ raised short-term interest rates by 25 basis points to 0.50%—its highest level since 2007—and signaled further hikes if inflation approaches or exceeds its 2% target.

Over the past three decades, the wide interest rate differential between Japan and the U.S. fueled massive carry trades: investors borrowed in low-yielding yen to invest in higher-yielding dollar-denominated U.S. Treasuries. According to Charles Schwab, the scale of carry trades reached $1 trillion; Deutsche Bank estimated it at $20 trillion. While investors can hedge currency risk via FX swaps, rising hedging costs are eroding net returns.

In summer 2024, carry trades were suddenly and violently unwound, suggesting many participants may not have been fully hedged. If the BOJ continues raising rates, the appeal of carry trades will diminish further, while Japanese government bonds will become more attractive to domestic investors—accelerating capital outflows from U.S. Treasuries.

The Federal Reserve Is Unlikely to Buy U.S. Treasuries

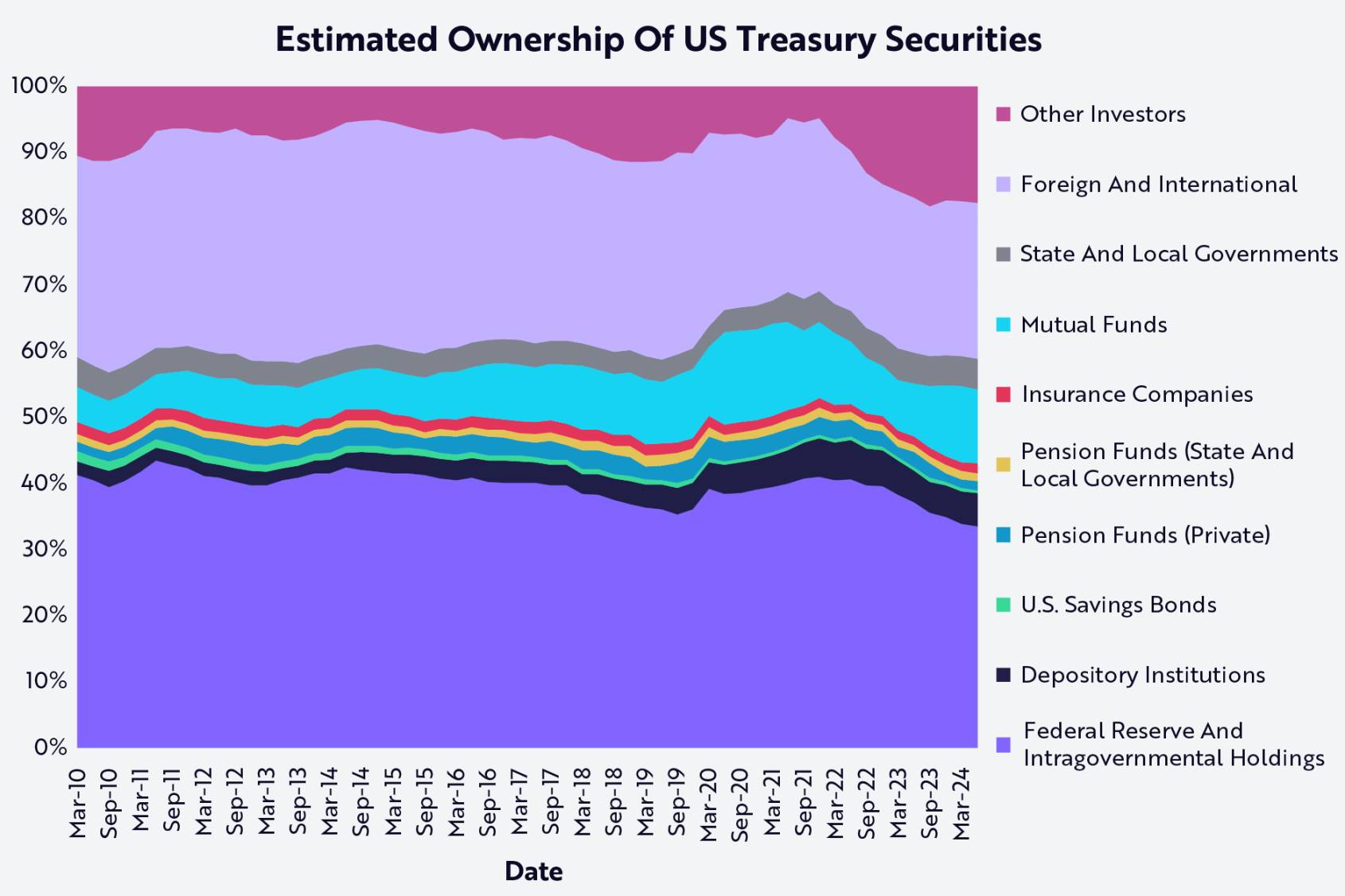

From February 2020 to April 2022, the Fed expanded its balance sheet from $4 trillion to $9 trillion, stabilizing around $7.3 trillion by June 2024. Now, quantitative tightening suggests the Fed is more likely to be a seller than a buyer of Treasuries.

Source: ARK, as of May 28, 2025

The Fed is shrinking its balance sheet through quantitative tightening, allowing maturing bonds to roll off without reinvestment. When the Fed sells Treasuries—or lets proceeds from matured bonds go un-reinvested—the open market must absorb that supply. All else equal, this tends to push bond prices down and yields up.

The Fed is unlikely to restart Treasury purchases in 2025. On February 12, Chair Powell reiterated, “We still have a long way to go in reducing the central bank’s bond holdings,” explaining there was no sign of liquidity deterioration severe enough to slow QT. By late February, the Fed was allowing approximately $25 billion in Treasuries and $35 billion in mortgage-backed securities to mature each month without reinvestment.

Meanwhile, the Congressional Budget Office projects a $1.9 trillion deficit in fiscal year 2025—about 6.4% of GDP. Over the next decade, cumulative deficits could reach $20 trillion, meaning the U.S. Treasury will need to issue at least $2 trillion annually in short-, medium-, and long-term bonds to finance government spending.

Although the Trump administration aims to keep long-term Treasury yields low, interest rates are more likely to rise unless inflation and real growth decline significantly or new sources of Treasury demand emerge. With demand from the largest holders of U.S. debt continuing to fall—and trade wars pushing partners to drastically reduce reliance on Treasuries—rising supply could overwhelm bond investors.

Can Tether and Circle Pick Up Where China and Japan Left Off to Boost Treasury Demand?

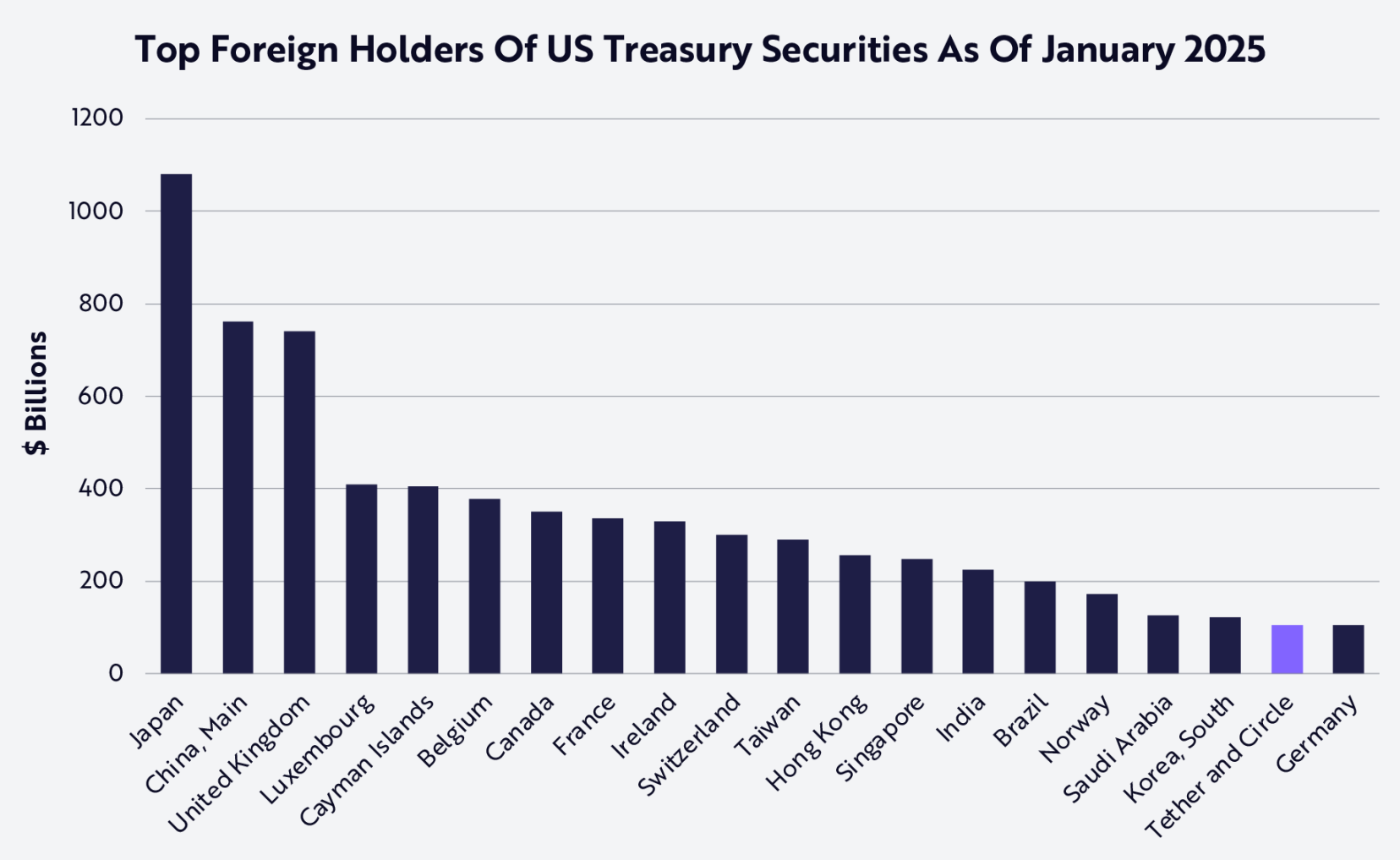

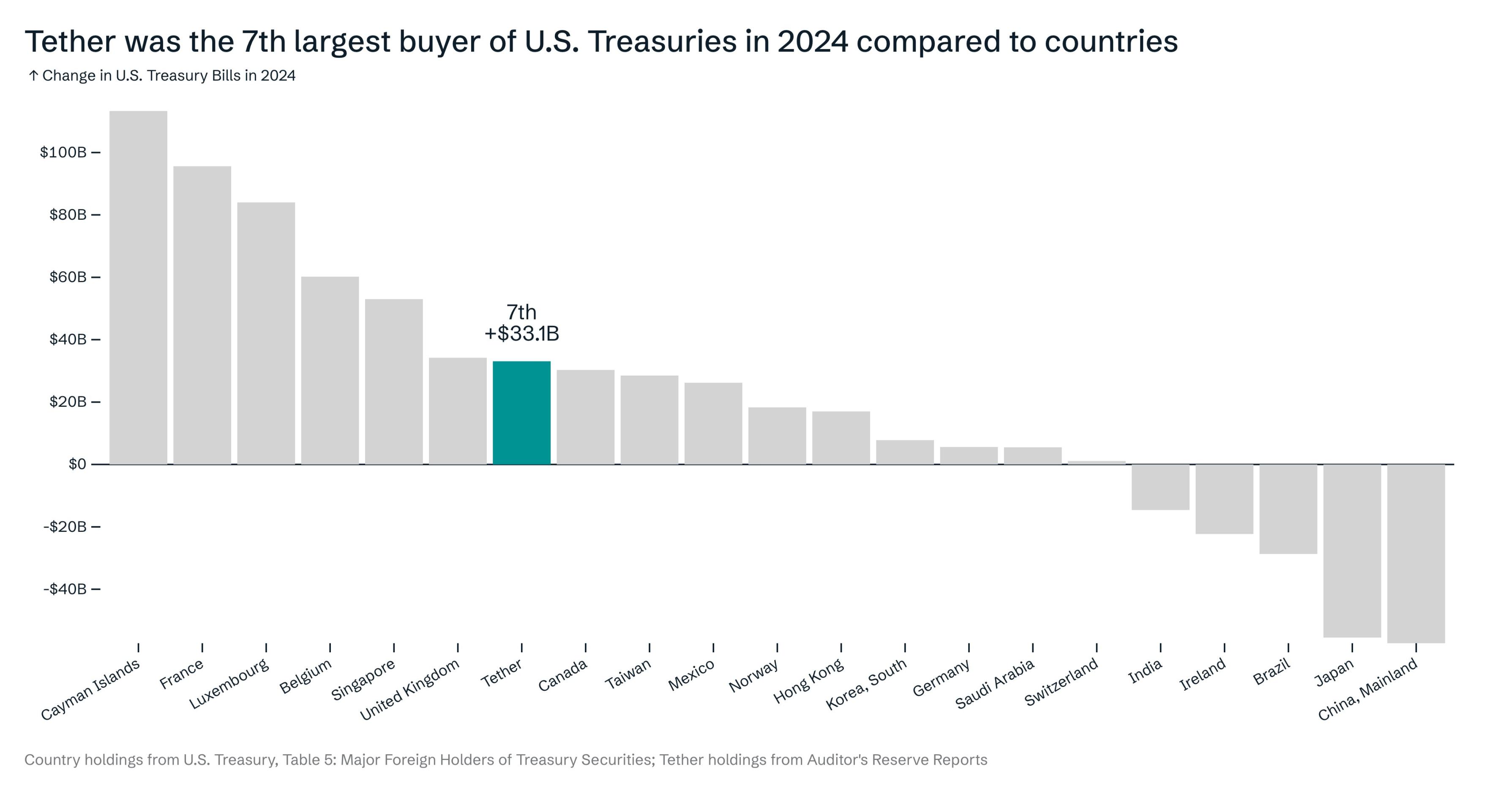

Despite the Biden administration’s negative stance toward digital assets, the stablecoin market has continued to surge over recent years. Amid extreme volatility in crypto markets, stablecoin issuers have quietly become among the world’s largest holders of U.S. Treasuries, as illustrated below:

Source: ARK, as of May 15, 2025

On January 31, 2025, Tether’s annual audit report revealed stunning 2024 financial results: $13.7 billion in annual profit, with $6 billion earned in Q4 alone. Additionally, the company issued $23 billion in USDT during the fourth quarter and $45 billion for the full year. According to its latest transparency report as of March 2025, Tether currently holds $98 billion in U.S. Treasuries.

Meanwhile, Circle, the second-largest stablecoin issuer, held over $22 billion in U.S. Treasuries as of late January. Combined, Tether and Circle rank as the 18th-largest holder of U.S. debt—behind only South Korea but ahead of Germany. Looking specifically at 2024, Tether was the seventh-largest buyer of U.S. Treasuries (after the UK and Singapore), while the biggest sellers were China and Japan.

Source: Ardoino 2025, as of May 15, 2025

At current issuance rates, we believe they could surpass four to five countries by year-end.

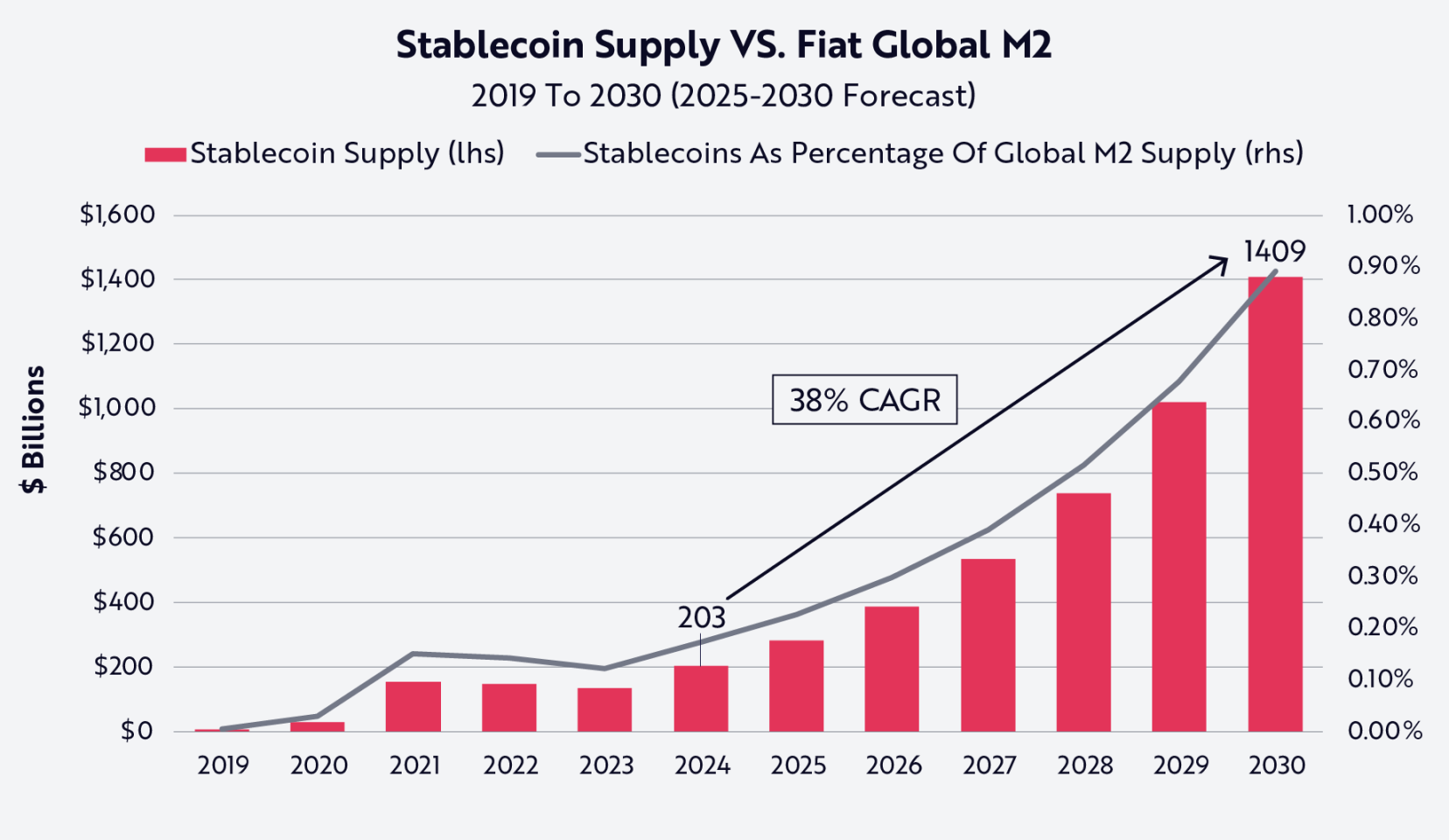

In ARK’s Big Ideas 2025 report, we estimate that total stablecoin supply could reach $1.4 trillion by 2030. If Tether and Circle maintain their current market share and Treasury allocation, they could collectively hold over $660 billion in U.S. Treasuries—approaching China’s current $772 billion holdings and trailing only China and Japan.

Source: ARK, data as of December 31, 2024

Clearly, Tether, Circle, and the broader stablecoin industry may create one of the largest sources of demand for U.S. Treasuries in the coming years—and could potentially surpass China and Japan as top holders by 2030. If so, the stablecoin sector could make a significant contribution to lowering long-term U.S. interest rates.

Stablecoins Can Counteract De-Dollarization

The de-dollarization movement has two main goals:

-

Remove the dollar’s status as the world’s reserve currency, particularly as an invoicing currency;

-

Stop surplus capital from flowing into U.S. Treasuries.

While efforts to replace the dollar in trade invoicing have made some progress in emerging markets, gains elsewhere remain limited. The war in Ukraine and sanctions on Russia accelerated Moscow’s push for BRICS nations (Brazil, Russia, India, China, South Africa) to bypass SWIFT using alternative currencies and payment systems.

The group’s expansion into BRICS+—adding Ethiopia, Iran, Saudi Arabia, and the UAE—was clearly intended to strengthen the alliance and promote a new financial order.

In 2024, Putin unveiled the proposed “BRICS Bridge” international payment framework aimed at boosting non-dollar transactions, but the initiative received lukewarm responses from other members and faced skepticism regarding feasibility and implementation.

Meanwhile, bilateral trade agreements in local currencies are becoming increasingly common among BRICS and other emerging economies—for example, recent deals between India, China, Brazil, and Malaysia. About 50 years ago, the petrodollar agreement cemented the dollar as the primary invoicing currency for global oil sales. Russia’s response to war-related sanctions marks the effective end of that era. According to Oilprice.com, by the end of 2023, 20% of global oil transactions were settled in non-dollar currencies—though those proceeds often get converted back into dollars.

While many de-dollarization attempts have yielded limited results, one stark reality cannot be ignored: in terms of GDP, the U.S. is no longer the world’s largest economy. With the addition of Saudi Arabia, the UAE, Egypt, Iran, and Ethiopia, the BRICS+ bloc reached a combined GDP of $29.8 trillion in 2024—slightly surpassing the U.S. at $29.2 trillion.

Over the past two decades, the trend has been clear: BRICS+ economies have grown significantly faster than G7 nations, and all signs suggest this divergence may continue.

Stablecoins occupy a unique position in the evolving global financial landscape. They serve as the most liquid, efficient, and user-friendly “wrapper” for short-term U.S. Treasuries, effectively overcoming two key obstacles of de-dollarization: preserving the dollar’s dominance in global transactions while ensuring sustained demand for U.S. debt.

In other words, whenever a citizen of Argentina, Turkey, or Nigeria buys a stablecoin like USDT or USDC, they reinforce the dollar’s role as the preferred invoicing currency and simultaneously generate demand for short-term Treasuries. Thus, stablecoins have become “Trojan horses” for U.S. debt, ensuring continuous—and even growing—global demand for Treasuries.

Although the petrodollar agreement formally ended last year, a similar tacit understanding appears to be forming—one that could prove equally critical over the coming decades. Anyone wanting to buy Bitcoin, Ethereum, or other digital assets outside the U.S. still needs dollars on the world’s most liquid exchanges. This financial moat has existed for over five years: dollar-backed stablecoins—especially USDT—have served as the primary trading pairs on major Asian exchanges such as Binance, OKX, Upbit, Bybit, and Bithumb.

Take Binance, the world’s largest crypto exchange: its proof-of-reserves shows that among $166 billion in token balances, customers hold over $34 billion in USDT and $6 billion in USDC. Dollar-denominated trading of cryptocurrencies like BTC, ETH, and SOL creates massive overseas demand for USDC and USDT.

The Rise of Stablecoins as Internet-Native Dollar Infrastructure

As of October 2024, Tether reported over 330 million on-chain wallets and accounts holding USDT, with 86 million held on centralized exchanges like Binance and OKX. In total, roughly 416 million wallets have interacted with USDT in some form.

Tether currently commands about 70% of the stablecoin market. Given its reported ~400 million addresses, it’s reasonable to estimate that the number of global addresses interacting with stablecoins is close to 570 million.

However, individuals and businesses often use multiple wallets, and many addresses belong to exchanges or institutions that pool funds from numerous users into single addresses. According to Chainalysis’ 2024 report, approximately 30%-40% of addresses represent individual users, implying that the number of people globally holding stablecoins ranges between 170 million and 230 million—a figure consistent with other available data. For instance, we know that around 40 million wallets are active monthly, and an estimated 600 million people worldwide hold cryptocurrency.

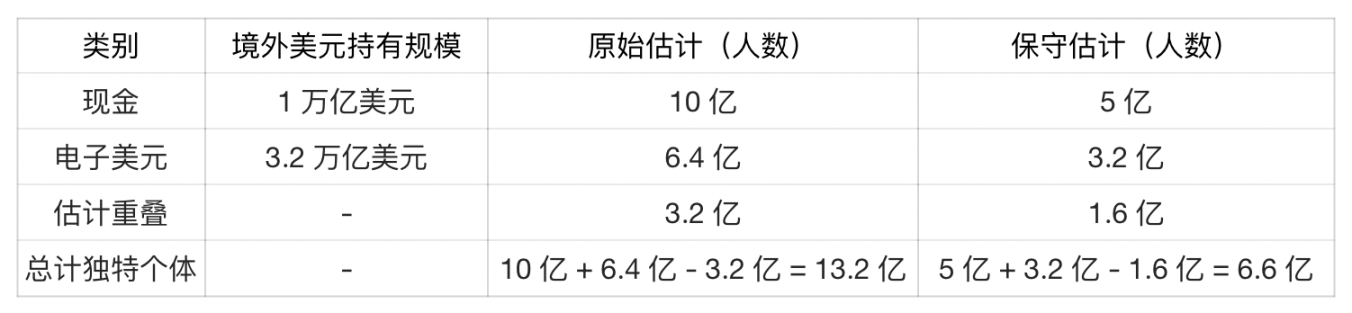

In this context, an interesting comparison emerges when contrasting stablecoin holders with traditional dollar holders—those holding physical cash or dollar-denominated bank accounts:

-

Physical dollars: As of 2022, about $2.3 trillion in U.S. currency was in circulation, with an estimated 50% held abroad. Assuming $1,000 per person, approximately 1 billion people globally hold physical U.S. cash.

-

Digital dollars: The Bank for International Settlements (BIS) reports $12 trillion in cross-border dollar liabilities, including interbank transactions. Assuming one-quarter is held by households—that is, $3.2 trillion in personal dollar deposits—and an average balance of $5,000, roughly 640 million people hold dollar-denominated bank accounts.

Assuming half of those holding digital dollars also hold physical dollars, there is an overlap of about 320 million people.

Source: ARK, as of December 31, 2024

In just over five years, stablecoins have reached approximately 200 million users globally—representing 15–20% of all non-U.S. residents who hold dollars. Considering the dollar has circulated for centuries, this is a remarkable achievement.

Given USDT’s strong influence in emerging markets and its position as the largest stablecoin by supply, we can assume that USDT holders constitute a large proportion of *new* dollar holders—with relatively low overlap with holders of physical cash or traditional dollar accounts.

Despite past misunderstandings and criticism, stablecoins have undergone a dramatic transformation following the collapses of FTX and LUNA. Indeed, the Trump administration, the newly appointed cryptocurrency “czar,” and many legislators now praise stablecoins as strategic assets that strengthen the dollar’s global dominance by generating sustained demand for U.S. Treasuries. Therefore, Tether, Circle, and the entire stablecoin industry may evolve into one of the most reliable and resilient financial allies of the U.S. government—bolstering the dollar’s role in global trade while ensuring long-term support for U.S. debt.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News