MEME Handbook 01 | When You Can't Beat Them, Follow Them: OKX Wallet's "Track" Feature Helps You Lock onto High-Quality Addresses and Improve Hit Rate

TechFlow Selected TechFlow Selected

MEME Handbook 01 | When You Can't Beat Them, Follow Them: OKX Wallet's "Track" Feature Helps You Lock onto High-Quality Addresses and Improve Hit Rate

Many high-win-rate P generals have taken off by chasing addresses!

The narrative around crypto trading has split into two extremes: on one side, BTC continues to dominate; on the other, a wave of MEME coins is sweeping across the market. On high-performance public chains like Solana, Base, and BSC, thousands of new MEME tokens keep emerging, drawing more and more on-chain players into the battlefield—everyone wants to evolve from a rookie "P soldier" to an elite "P general" and catch the next “golden dog”.

But how many of these P soldiers are actually making money in the MEME arena? Let’s cut to the chase: only about 10%–20%. The rest mostly fall into liquidity traps. Over 80% of MEME tokens have a lifespan shorter than 24 hours—you might think you’ve caught the “first wave,” but in reality, you're just carrying earlier entrants on your back. Research into those rare P generals who successfully ride golden-dog rallies reveals several common traits: they’re tied to KOLs (key opinion leaders) to maintain visibility; they run self-organized projects with clear rhythms—first pumping to attract attention, then washing out short-term traders, finally dumping after a final surge; their operations are highly tool-driven, using bots for chain scanning and deployment; and they operate in coordinated groups with precise roles, functioning like professional market manipulators.

So here comes the question: Is there a better way to participate? Yes: If you can't beat them, join them. Tracking addresses belonging to elite P generals is one of the best ways to enter the game. Their on-chain behavior serves as the most reliable compass for MEME investing. In this first edition of the MEME Handbook, we’ll cover how to track valuable addresses and build your own address intelligence system. In future issues, we'll dive deeper into advanced professional strategies—identifying and copying smart money, mastering chain-scanning and patience, understanding differences between insider and open markets, cross-verifying uncertain information, and managing expectations and capital allocation. Stay tuned to avoid pitfalls and level up together.

Multi-chain Address Tracking – Convenient on Both Desktop and Mobile

OKX Wallet's "Track" feature is a core tool for building and monitoring an on-chain address database. One of its biggest advantages is seamless consistency between mobile and browser extension experiences—truly smooth, always online. This is crucial for MEME traders because opportunities never wait. For demonstration purposes, the following walkthrough uses OKX Wallet Web: log in to the OKX Wallet website → connect your wallet → go to the "Market" page → open the "Tracking Panel".

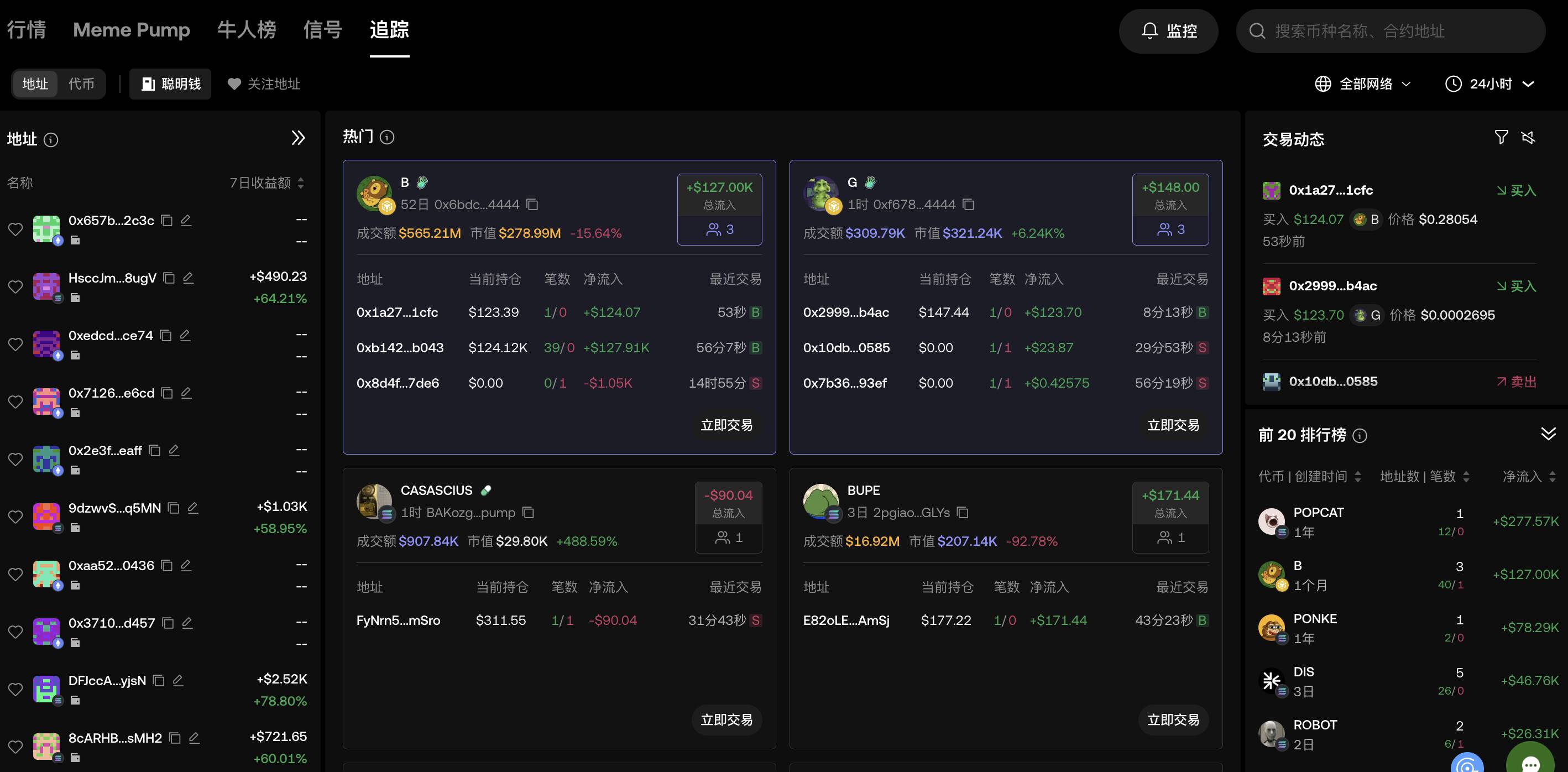

Once opened, you'll realize the Tracking Panel isn’t just a simple wallet utility—it’s an all-in-one on-chain intelligence hub and trading system. The Smart Money section not only includes hundreds of the most active trading addresses, but also supports real-time tracking across multiple chains including ETH, BSC, Base, and Solana. All data comes directly from on-chain interactions, with latency kept at millisecond levels, ensuring you’re among the first to detect when smart money is accumulating, buying aggressively, or exiting—giving you critical early signals before any price movement begins.

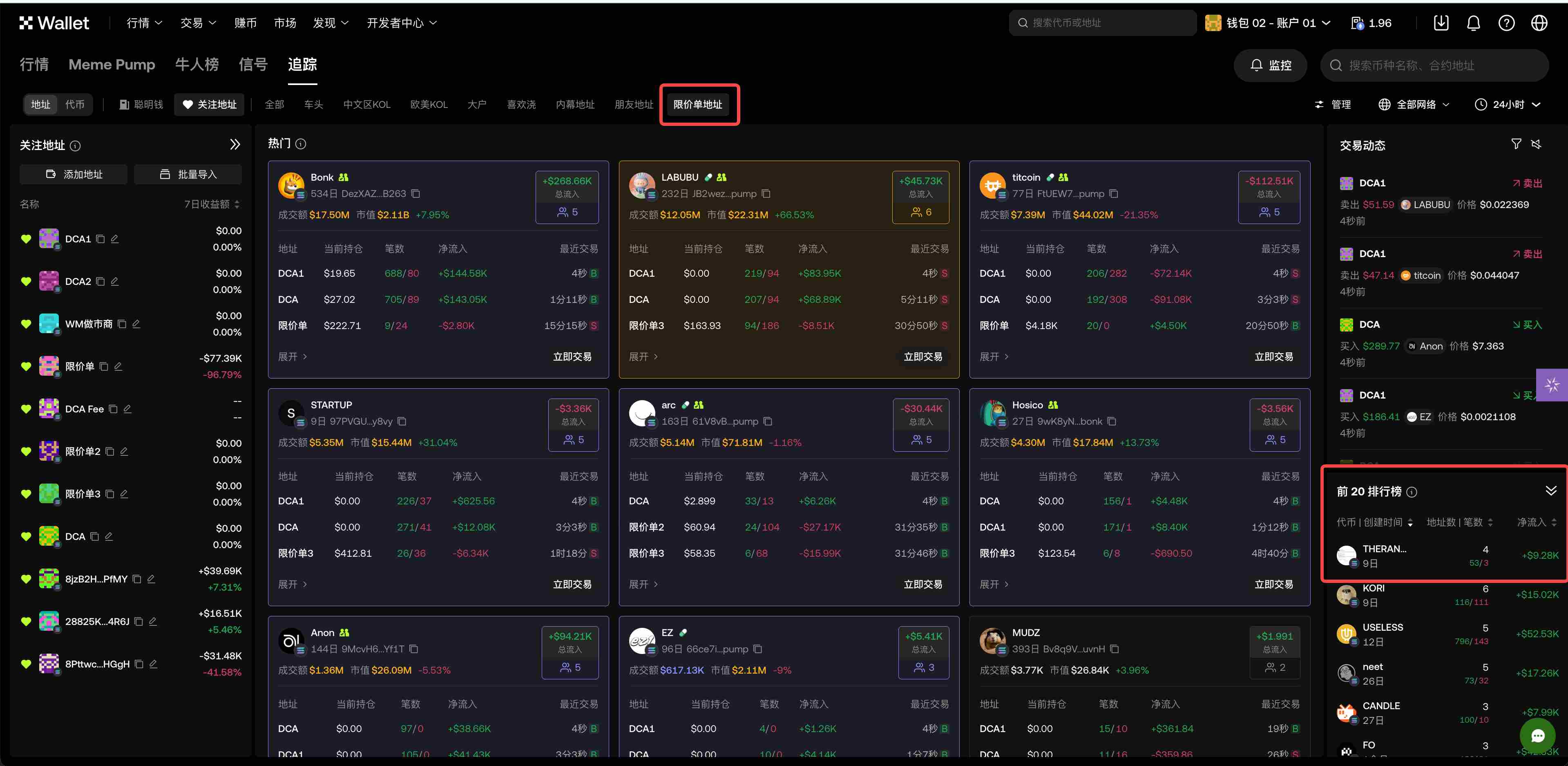

Illustration of the “Tracking Panel”

On the left are addresses within the Solana ecosystem (EVM support is still being enhanced). You can filter promising targets by ROI ranking, recent transaction time, and other dimensions, then set up monitoring alerts based on purchase activity and amount thresholds to receive instant notifications via app or web.

Moving toward the center lies the core of the Tracking Panel: aggregated trading data from popular addresses. Recently traded tokens automatically appear as updates on the screen and allow one-click navigation to the trading interface. Different stages of a MEME token call for different trading parameters—for example, higher slippage and smaller buy sizes during early-stage insider trading; lower slippage and larger volumes once market cap grows. When copying smart money, users often need high slippage and gas settings. To accommodate various scenarios, OKX DEX offers default mode, MEME mode, and customizable Preset modes, allowing users to adjust slippage, fees, MEV protection, and more. Additionally, tiered templates simplify buy/sell actions—for instance, preset amounts like 0.5 SOL, 1 SOL, or 2 SOL.

On the right is your personalized MEME activity dashboard—above shows the latest transactions from wallets you follow; below is a Top 20 trending tokens list generated from these tracked behaviors. Sort by net inflow or trade frequency to pinpoint which tokens are currently being accumulated by “professional players.”

All these capabilities are fully available on the mobile app too—address grouping, real-time sync, and push alerts included—turning your phone into a tactical command center so you can scan the market even while on the move.

How to Build Your Own On-Chain Address Database?

Selecting high-value addresses matters far more than blindly scanning. Tens of thousands of new addresses appear daily, yet only a tiny fraction generate profitable signals. Have you studied which DEV addresses tend to launch successful tokens? Or noticed which KOL/sniper addresses frequently act in coordinated clusters? These insights require creating a structured tagging system for on-chain addresses—an essential foundation for your personal intelligence network. While analyzing tokens, you can instantly add addresses to your watchlist from transaction histories, profit leaderboards, or holder lists. Alternatively, discover top performers through the “Top Traders” leaderboard. If you already have an existing address list, use the “batch import” function—the system will recognize and organize them automatically.

The “Tracking Panel” allows users to monitor up to 600 addresses, presented with intuitive visual design. For most active traders, this limit is sufficient—but what truly counts is how you manage, label, group, and tag them! New users are advised to start with basic categorization, such as:

- Insider market, second-phase trader

- Long-term holder, swing trader

- Chinese-speaking KOL, Western KOL

- DEV address, whale/big player address, insider trading address

- High-win-rate address, high-return address

- Lead car address, “Jiao Gei” address, etc.

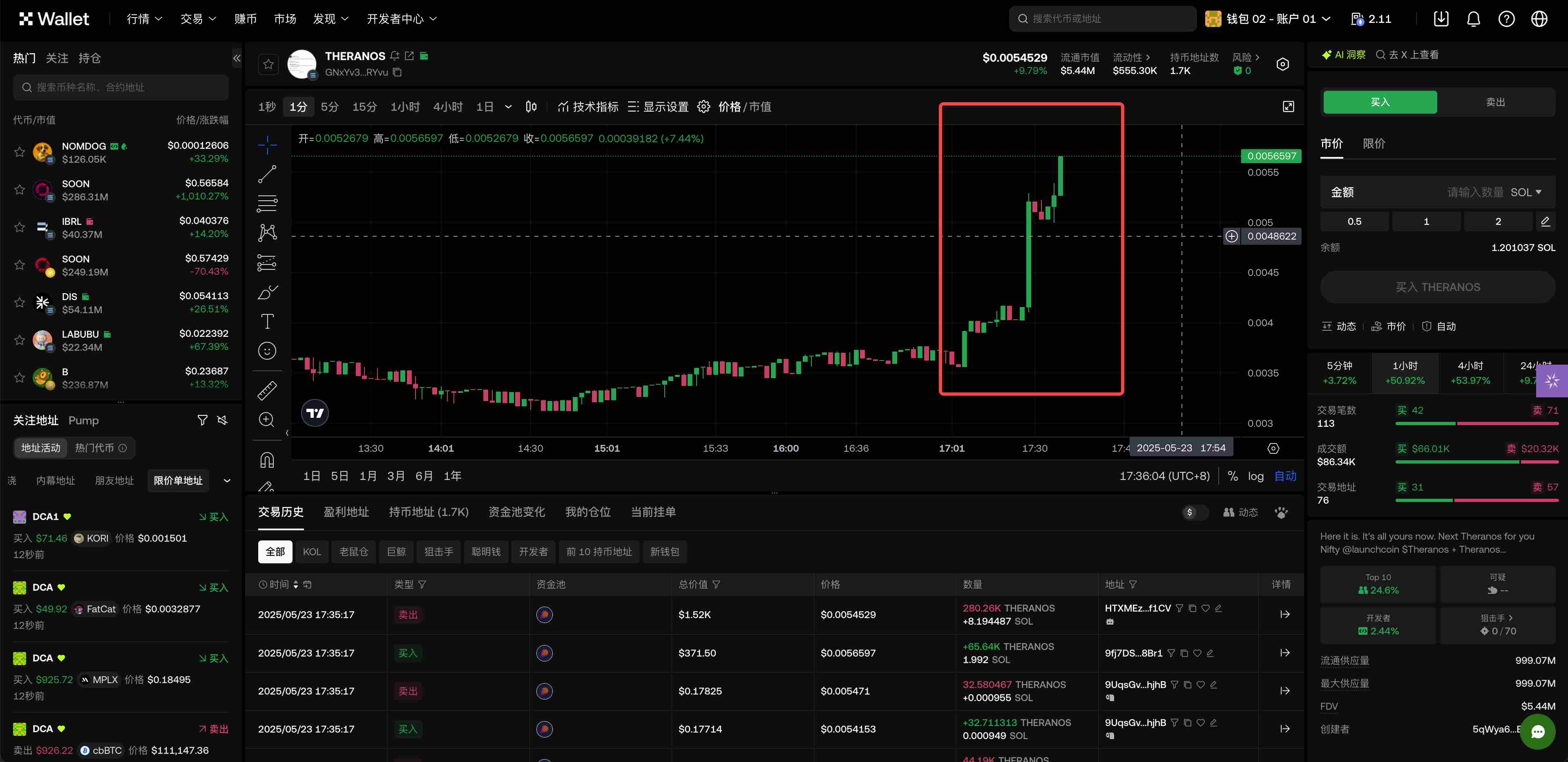

Currently, OKX Wallet supports multi-category tagging—for example, one address can be both an insider trader and a KOL. Good organizational habits help you better observe patterns and extract meaningful signals from overwhelming data. For instance, a user recently used the Tracking Panel’s leaderboard to spot an address on Solana quietly accumulating Theranos via limit orders. This low-key accumulation often indicates that whales may be stealthily buying—a signal followed by the user who then rode the subsequent price surge, achieving their own “Aha Moment.”

Illustration: Monetizing your address database

Moreover, OKX Wallet is one of the rare wallet tools to offer address tracking and real-time alerts on mobile from day one. Once alert settings are configured and app notifications enabled, you’ll immediately receive alerts whenever a watched address opens positions, adds to holdings, or makes aggressive purchases—meaning you don’t need to sit glued to your computer, and won’t miss key moments even while stepping out for dinner.

Opportunity or Reverse “Scalping Trap”? Practical Tips Shared

A well-curated address database is your strategic battlefield map and early-warning radar. Here’s a real “sweet spot” scenario shared by seasoned MEME trader B using OKX Wallet’s tracking feature. By leveraging the “batch import” function, Player B collected Jupiter’s DCA (dollar-cost averaging) addresses and grouped them together. Using the net inflow ranking, he identified where capital was flowing on-chain—and caught some solid opportunities. A quick note: behind Jupiter’s DCA addresses may lie professional teams with large funds and strong risk management, consistently investing over time to benefit from long-term appreciation.

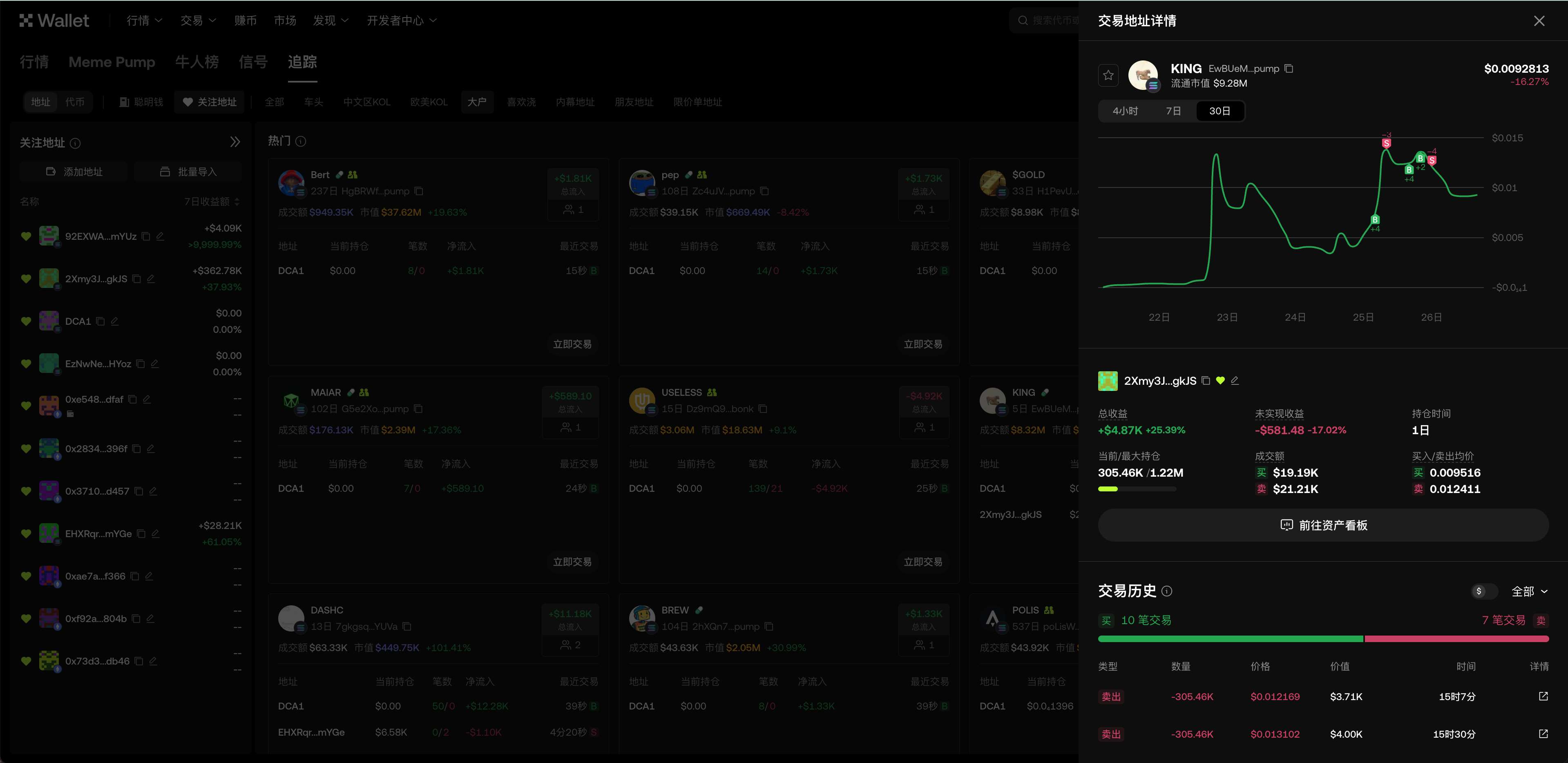

Beyond such clever tactics, users can also conduct independent research using the detailed on-chain data provided by OKX Wallet’s “Track” feature—including address detail pages and token detail pages. For example, analyze an address’s profitability, win rate, token preferences, and transaction history to assign tags, validate performance over time, and decide whether to include it in your personal database.

Illustration: Address detail page

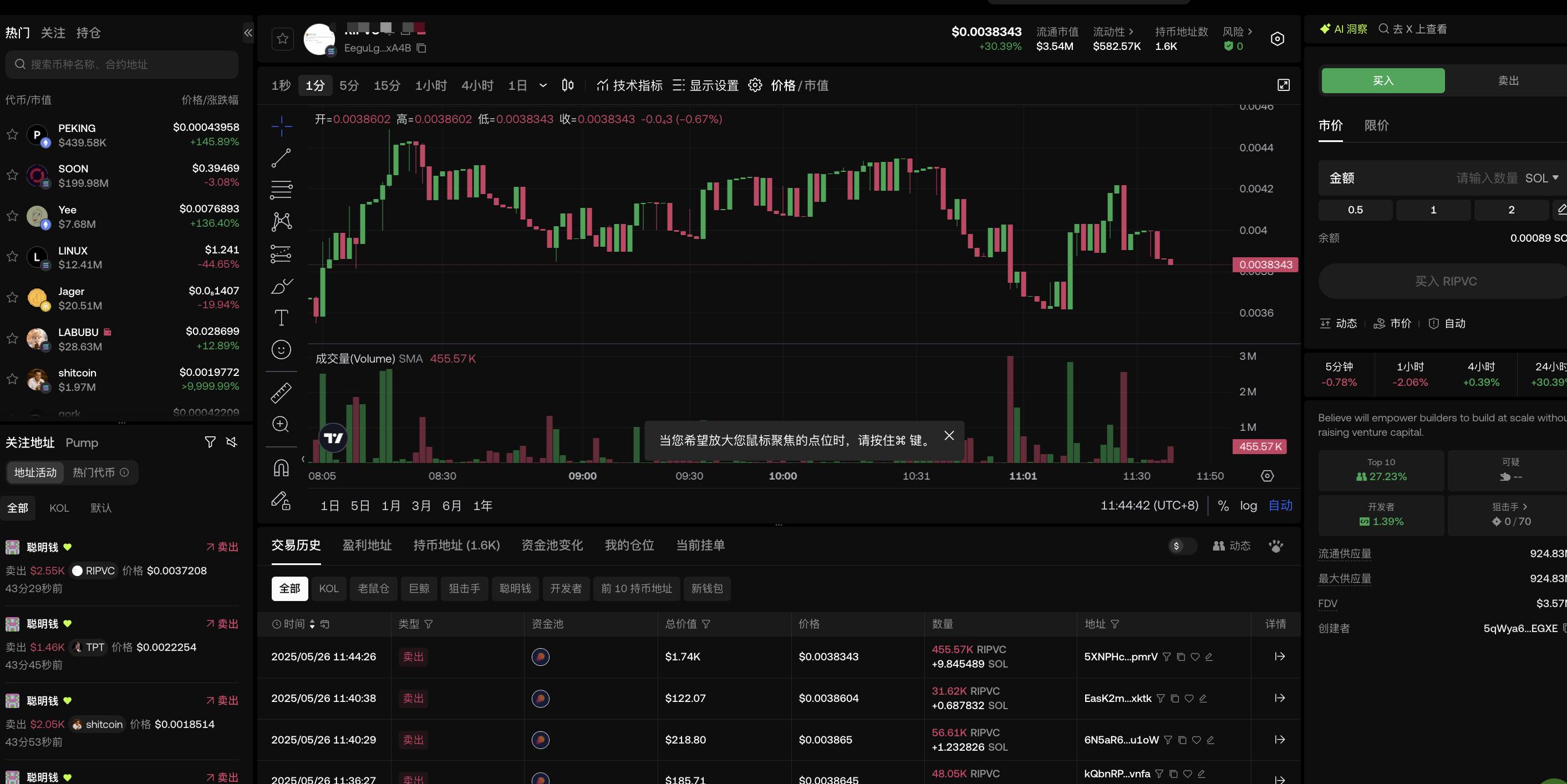

You can also assess risk and opportunity through the token detail page, using multiple data points for cross-validation:

- If trading volume rises, AI mentions spike, and KOLs, whales, and smart money are simultaneously buying a token, it likely enjoys strong liquidity and potential marketing backing—indicating breakout potential;

- If a project is newly created, has low market cap, and sees many new wallets buying heavily within a short window, it could be undergoing cold-start seeding or early hype buildup—an early warning sign worth watching;

- If a developer recently deployed multiple token contracts, but previous launches quickly went live and then crashed to zero, this address may belong to a scammer or exploitative operator—best avoided;

- If sniper addresses jump in seconds after initial liquidity is added, and these same addresses were active in past successful MEMEs, it suggests organized manipulation is underway—worth close monitoring or participation;

- If a token keeps rising, but evidence shows insider wallets accumulated large stakes beforehand, and the top 10 addresses control over 50% of supply, followed by sudden social media buzz or sharp price spikes, the project is likely tightly controlled. Price movements depend entirely on a few actors—high risk outweighs reward.

In short, evolving from a P soldier to a true P general hinges on building your own on-chain SOP (standard operating procedure). Monitor real-time pop-up alerts from OKX Wallet’s “Track” feature; use net inflow/outflow rankings alongside holdings structure and market cap changes to make timely decisions on trending tokens. Sharpen your on-chain instincts, do your own research, stop waiting for handouts—DYOR (Do Your Own Research) is the real path to mastery.

Looking ahead, as OKX Wallet rolls out its on-chain copy-trading functionality, those who’ve already built robust address databases and mastered timing will gain even greater edge, enabling high-quality, high-precision trades. With the right tools in hand, value shines right at your fingertips.

Disclaimer

This article is for informational purposes only and does not constitute (i) investment advice or recommendation, (ii) an offer, solicitation, or inducement to buy, sell, or hold digital assets, or (iii) financial, accounting, legal, or tax advice. Digital assets (including stablecoins and NFTs) are subject to market volatility, involve high risks, and may lose value. Please consult your legal/tax/investment professionals regarding the suitability of trading or holding digital assets for your circumstances. OKX Wallet is a self-custody wallet software service that enables discovery and interaction with third-party platforms. OKX Wallet does not control or assume responsibility for such third-party services. Not all products are available in all regions. You are solely responsible for understanding and complying with applicable local laws and regulations. OKX Wallet and its related services are not provided by OKX Exchange and are governed by the OKX Web3 Ecosystem Terms of Service.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News