Circle and Tether may not be competing in the same species—so says the stablecoin value realization tier model

TechFlow Selected TechFlow Selected

Circle and Tether may not be competing in the same species—so says the stablecoin value realization tier model

Circle wins on "tool utility," Tether wins on "survival necessity."

Author: Nathan

Translation: Dingdang, Odaily Planet Daily

Editor's Note: Since Circle announced its public listing, an invisible line has formally emerged in the stablecoin market: USDC and USDT have begun to diverge onto two distinct development paths. USDC, emphasizing compliance and transparency, is gradually integrating into the U.S. financial system, becoming a "permissioned dollar" for institutional users and fintech applications. In contrast, USDT continues to play a critical role in global trading, payments, and asset hedging, leveraging its extensive on-chain circulation and deep market penetration.

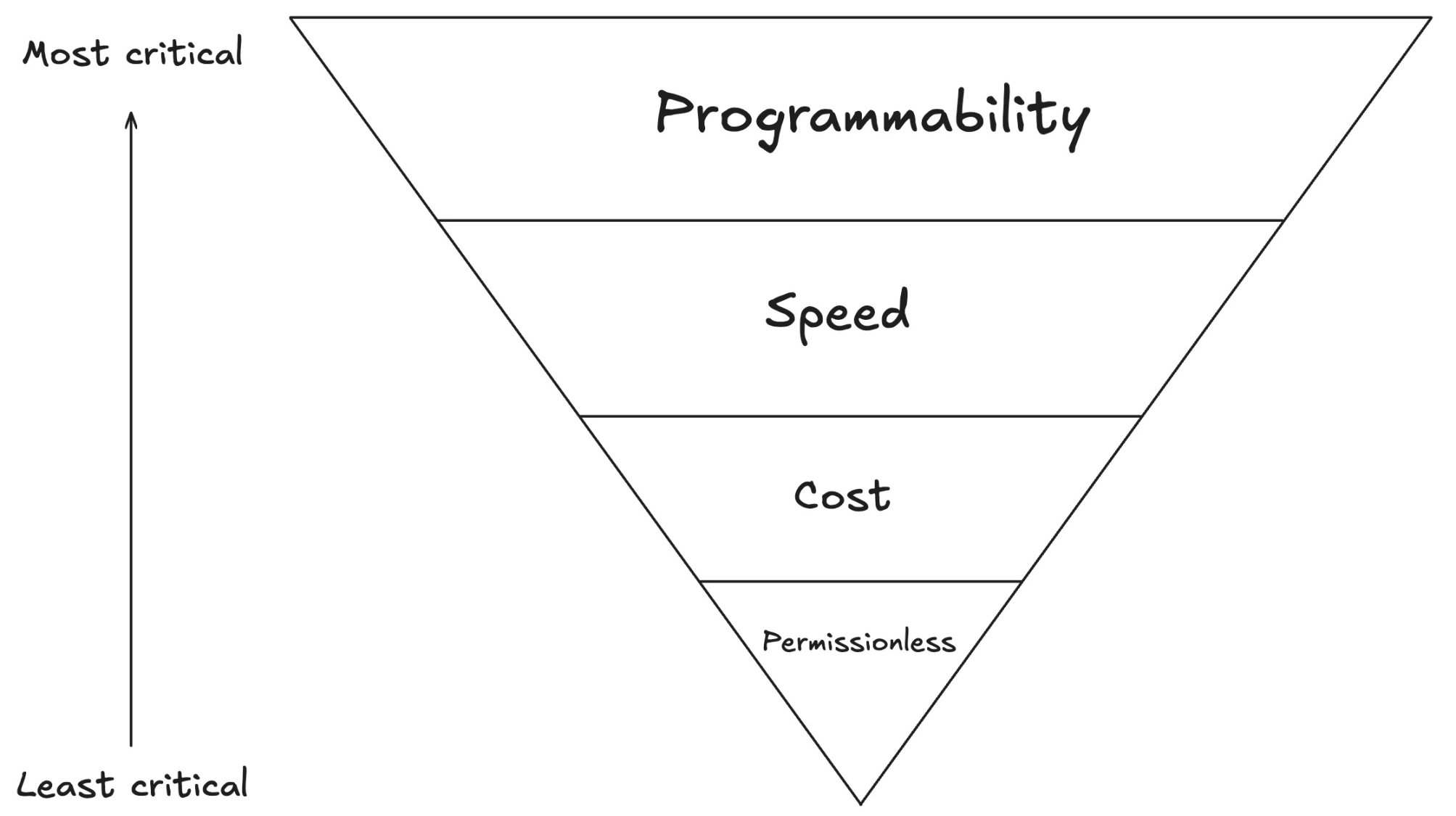

This divergence essentially reflects differing priorities in how stablecoins realize value across markets. For some users, regulatory compliance and programmability are paramount; for others, liquidity, accessibility, and permissionless usability take precedence. Therefore, we need a new cognitive framework to understand how different user types derive value from stablecoins—this is precisely what the "Hierarchy of Stablecoin Value Realization" aims to explore.

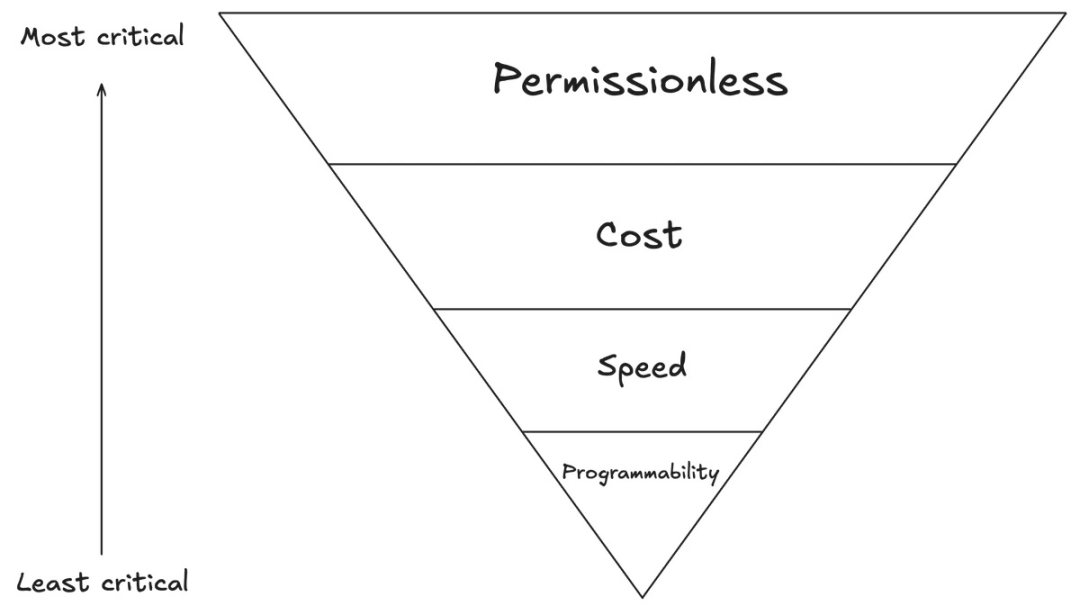

Although individuals benefit from stablecoins in various ways, these benefits ultimately stem from four core value propositions: low cost, high speed, permissionless access, and programmability.

In another article titled *The What and Why of Programmable Money*, original author Nathan explains: programmable money is currency that can have behavioral logic coded into it like software. It’s both stablecoin and fuel for smart contracts. It enables rules about when, why, and how funds are transferred—all without reliance on banks or trust, only on code itself.

These four value propositions correspond respectively to four primary use cases: store of value, payments, transfers, and yield generation.

The "Hierarchy of Value Realisation" is a new conceptual model designed to explain which values different user types prioritize most in stablecoins.

This article focuses on two main user groups: those who truly *need* stablecoins versus those for whom stablecoins are less essential—namely, users in emerging markets and Western markets.

Two Major Stablecoin User Groups

In short, in emerging markets, stablecoins are building entirely new financial infrastructure; in Western markets, they serve more as supplements integrated into existing fintech and traditional finance (TradFi) systems.

This pattern holds true across both new entrants and established players in the stablecoin space.

Based on this, we can outline distinct "value realization hierarchies" for each group.

1. Value Realization Hierarchy for Western Market Users

The Western market primarily refers to “Global North” countries—politically stable, with advanced financial systems where most people have bank accounts and even earn interest on savings.

In these markets, **programmability** is the key driver behind stablecoin innovation. This mirrors the explosive growth seen with the internet, iPhone, or smart contracts: programmability enables new financial innovations, and financial innovation is precisely where the West excels.

Next comes **speed**. Settlement latency in cross-border or domestic payments has long been a major challenge in fintech. Delays consume liquidity and create opportunity costs, making speed the second-highest priority in Western markets.

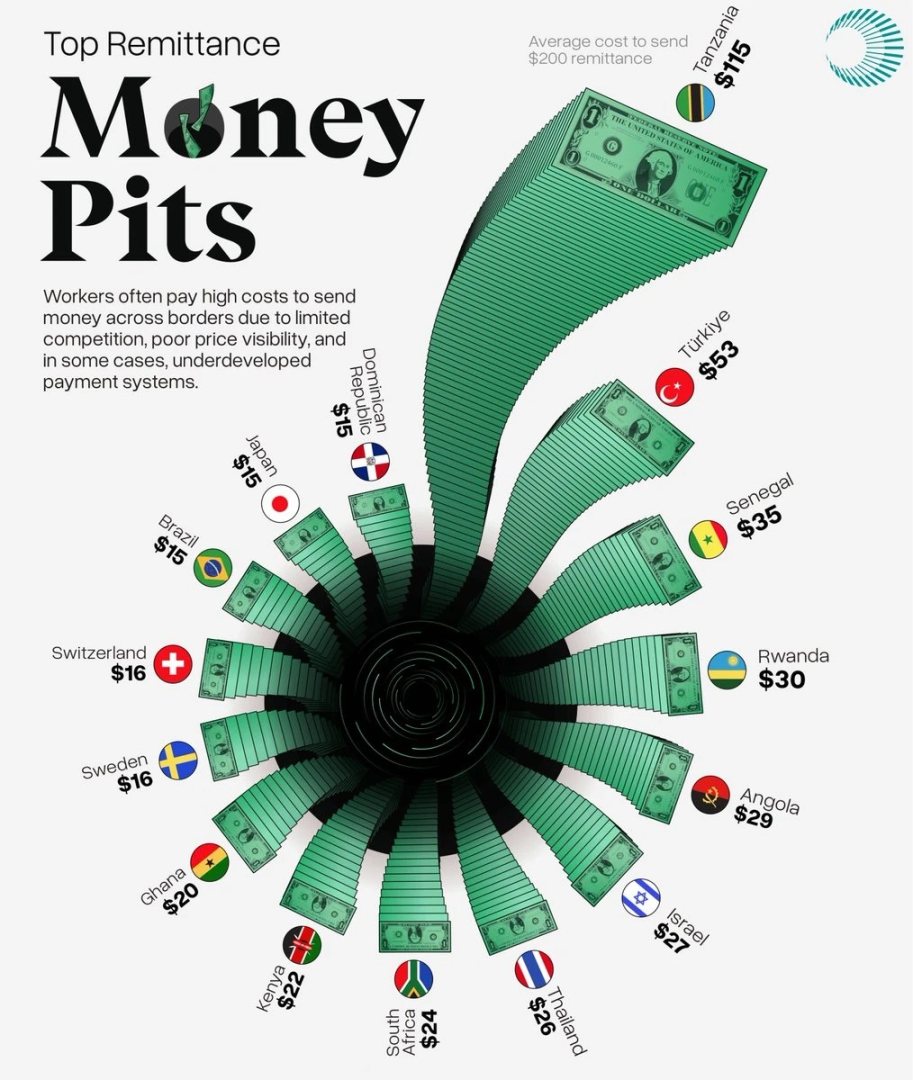

**Cost** ranks third. While reducing transaction fees is one of stablecoins’ standout features, transaction costs in Western markets are already relatively low—nowhere near the absurd levels seen in emerging markets, such as $115 fees on $200 remittances.

**Permissionless access** is least important in the West. Most people already have bank accounts and can easily use cash or digital transfers, so there’s little need to rely on stablecoins for basic financial services.

Hence, Circle and USDC hold stronger positions in Western markets. As a company fundamentally oriented toward fintech, Circle emphasizes programmability, low cost, and efficiency—all closely aligned with Western user preferences. Today, more and more Western enterprises building stablecoin solutions choose to develop on top of USDC.

Additionally, **yield** is becoming an increasingly notable consideration for Western users. Accustomed to earning interest on bank deposits, they often question why holding stablecoins shouldn’t offer similar returns.

This mindset contrasts sharply with that of users in emerging markets, who prioritize monetary stability and access to the U.S. dollar over yield.

According to the author, yield has never been the decisive factor for stablecoin adoption in these regions. As industry analysis shows, USDT became the world’s most liquid stablecoin precisely because it didn’t need to distribute Treasury yields to maintain dominance—its unparalleled accessibility and deep liquidity base were sufficient. For many users facing high inflation or capital controls, protecting assets from local currency depreciation is far more meaningful than earning 3% annualized interest. Their real concerns are: Can I securely convert my assets into dollars? Can I transfer them out instantly? Can I spend them locally?

Therefore, in regions with genuine product-market fit, a stablecoin’s liquidity vastly outweighs its yield-generating capability. Liquidity tends to concentrate, creating network effects that favor dominant players. That’s why stablecoins like USDT achieve widespread global adoption despite lacking native yield mechanisms.

2. Value Realization Hierarchy for Emerging Market Users

Compared to the West, emerging markets (i.e., the “Global South”) have weaker financial infrastructure, suffer from severe local currency inflation, and exhibit low banking penetration.

The emergence of stablecoins allows users in these regions—for the first time—to freely access, transfer, and use stable currencies like the U.S. dollar, something previously unimaginable.

For these users, **permissionless access** is the most fundamental and transformative value proposition. Regardless of whether they have a bank account, individuals can directly plug into the dollar-based financial system, unlocking financial freedom.

Second is **low cost**. Cross-border remittance fees remain prohibitively high in emerging markets. For example, a father sending money home may lose a significant portion to fees. Stablecoins dramatically reduce these costs.

Third is **speed**. Current cross-border payment systems are inefficient, with funds often taking days or even weeks to settle. Stablecoins enable near-instantaneous transfers, alleviating urgent economic and personal hardships caused by delays.

Last is **programmability**. While this feature holds long-term potential in emerging markets—such as enabling insurance, lending, or automated contract payments—its immediate perceived value remains lower compared to the top three.

Overall, Tether’s USDT shines in emerging markets. By offering a freely usable, widely accepted, and highly liquid stablecoin, USDT delivers essential financial services to millions of unbanked individuals. Its success stems directly from delivering on these foundational value propositions.

Conclusion and Reflection

Circle aligns well with Western markets, meeting the needs of fintech companies;

Tether serves a broader user base, especially those who genuinely depend on stablecoins.

In other words, Circle wins on **tool-like utility**, while Tether wins on **survival-level necessity**.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News