The Founder of the "First Stablecoin Stock": How I Went All in on Stablecoins Seven Years Ago

TechFlow Selected TechFlow Selected

The Founder of the "First Stablecoin Stock": How I Went All in on Stablecoins Seven Years Ago

Stablecoins are a peer-to-peer electronic cash system; Bitcoin is not.

Author: BlockBeats

Circle, the world's second-largest stablecoin giant, has gone public and started trading on the New York Stock Exchange (NYSE). This marks the emergence of crypto industry’s second native U.S. publicly listed company since Coinbase—the largest U.S. cryptocurrency exchange—went public in 2021. Four years ago, Coinbase’s IPO coincided with Bitcoin’s peak moment; four years later, right at the end of a full bull-bear market cycle, Circle’s listing highlights a new narrative for cryptocurrencies: stablecoins.

In simple terms, stablecoins are tokenized U.S. dollars, pegged in value to the dollar—one token equals one dollar.

The concept of stablecoins—and by extension, RWA (real-world assets being brought on-chain)—has stood out significantly this year compared to previous years. Favorable regulatory developments around stablecoins in both the United States and Hong Kong, combined with growing attention from Wall Street titans like BlackRock toward RWA projects, along with increasing adoption of stablecoins by traditional financial institutions, have rapidly propelled RWA and stablecoins into mainstream awareness. Previously overlooked, Circle saw its IPO valuation surge repeatedly—from an initial $5.4 billion to around $7 billion today—thanks to strong demand from investors including BlackRock and Cathie Wood competing fiercely for IPO shares.

Bitcoin’s white paper defines it as “a peer-to-peer electronic cash system.” But today, Bitcoin has become a financial commodity—nobody uses Bitcoin for payments anymore. The only thing that now truly fulfills the role of a peer-to-peer electronic cash system is stablecoins. That’s where the real potential lies.

And Jeremy Allaire, founder of Circle, saw all of this seven years ago.

Below is BlockBeats’ edited version of Jeremy’s personal account.

The "Pickaxe Seller" of Web 1.0

In 1990, I first encountered the internet. What truly fascinated me was experiencing firsthand the power of open networks, distributed systems, decentralized architectures, open protocols, and open-source software. I often refer to these as the "DNA of the internet."

At the time, I was also closely following the collapse of the Soviet Union, deeply struck by such structural transformation, while diving deeper into technology and becoming increasingly convinced that the internet would change the world.

By 1994, the first graphical web browser emerged. At once, I realized we finally had a software tool capable of displaying content, applications, and other things directly within web pages—giving rise to the idea of “the Web as an application platform.”

So, together with my brother and some partners, I co-founded Allaire Corporation and launched ColdFusion—the first commercially available web programming language.

While Perl existed and some developers wrote dynamic page logic in C on web servers, ColdFusion made web application development genuinely accessible—anyone with an idea and about a thousand dollars could build interactive web apps viewable through browsers.

In 1995, this was already a major breakthrough. Riding the wave of rising websites, e-commerce, and online content, we thrived. Allaire developed a full suite of tools used by millions of developers worldwide.

As the market matured, we successfully took the company public in early 1999.

This was somewhat unconventional—we were profitable at IPO, which was rare during the dot-com bubble when most companies went public while still losing money. We were more like the "pickaxe sellers" of Web 1.0, providing foundational tools for the entire industry.

After going public, we merged with Macromedia, another major player building internet and content development tools. Following the merger, I became CTO of the new company and began driving the adoption of Flash, a powerful software enabling rich multimedia experiences and interactivity on the web.

The "Couch-Based Political Economist" Falls Down the Crypto Rabbit Hole

Going back to what initially drew me to the internet—I originally studied international political economy, focusing on comparative economic systems and political institutions, deeply interested in macro-level topics like the global monetary system. Then I got excited by the internet itself, captivated by how open networks transformed information sharing and software distribution.

At Macromedia, as early as March 2002 (yes, 2002—not 2022), we integrated seamless video playback into Flash Player, making video ubiquitous across the internet.

For the first time, anyone could easily embed videos into browsers. YouTube’s explosive growth was built upon this very technology—it originally ran entirely on Flash Player.

Later, I founded another company called Brightcove. Its core philosophy remained rooted in the fundamental DNA of the internet: open networks, open protocols, and distributed systems.

My vision then was: Could every company or media organization publish video and TV content directly onto the internet? Keep in mind, this was 2004—broadband and Wi-Fi were just emerging, smartphones didn’t exist yet—but people were already talking about the future of connected devices.

It was clear to me that countless connected devices with Wi-Fi and mobile broadband would emerge, liberating video distribution completely.

So we built an online video delivery system—an “online television platform,” you might say.

This extended the capabilities of the internet, fulfilling more fully what Web 1.0 pioneers had imagined, now realized in the Web 2.0 era. Brightcove became highly successful and eventually went public in early 2012.

Why Did I Start Circle?

The 2008 financial crisis reignited my earlier academic interests. I turned into a “couch-based political economist,” voraciously reading about the nature of money, central banks, the international monetary system, fractional reserve banking. As I asked myself, “What exactly is going on here?” I also began wondering: Is there a better monetary system? A better way to design the global financial architecture?

Of course, this wasn't something you wake up one day and say, “I’m going to build a company to disrupt the global monetary system.” Back in 2009–2010, there was no practical path forward—just deep exploration.

But by 2012, shortly after Brightcove’s IPO, I discovered cryptocurrency and plunged headfirst down the rabbit hole.

Jeremy Allaire during his Brightcove days

I come from a tech and product background. Approaching this space technically, I witnessed something astonishing: a genuine technological breakthrough.

Some long-standing computer science problems had been solved—and their solutions were incredibly powerful. For the first time, I synced the Bitcoin blockchain on my laptop and completed a peer-to-peer transaction over the internet—entirely relying on open protocols. To me, that moment felt just like seeing the Mosaic browser load a webpage for the first time—I thought, “My God, this is the missing piece of internet infrastructure!”

From there, my co-founders and I dug deeper, especially engaging with the technical community, where many were asking:

Beyond Bitcoin, can we issue other types of digital assets on these networks? Today we call them “tokens” or “digital assets.” Given my past work on virtual machines and programming languages, I naturally joined discussions around:

How do we make these digital assets programmable?

How do we create programmable money?

How do we implement smart contracts?

Back then, these ideas were still scribbled on napkins, with whitepapers just beginning to appear. But we were certain they would materialize—it was only a matter of time.

We combined these thoughts with another question: How can we build a safer, more open financial system? These converging insights consumed my mind entirely. I became obsessed, and ultimately decided to launch Circle.

Our original idea was: Can we create an HTTP-like protocol for money? Can we design an open internet protocol for the U.S. dollar—one that’s open, programmable, etc.?

This was our vision ten years ago. Today, it has become reality and evolved into crypto’s true “killer app.” Though it took years to build, the ecosystem now has significant scale—even if still in its infancy.

The Rise of USDC

In spring 2018, the crypto market suffered a sharp correction, plunging the entire industry into a severe winter—almost every sector saw dramatic declines. Our revenue-generating products either broke even or started losing money, causing us to burn cash at an alarming rate.

By 2019, at the deepest point of that winter, fundraising became extremely difficult. Operational costs spiraled out of control, and our cash reserves were nearly depleted—if we didn’t act fast, bankruptcy loomed.

It was precisely at this moment that we officially launched USDC in October 2018.

A High-Stakes Bet

In 2019, DeFi protocols began widely integrating USDC, and we started seeing early signs of product-market fit (PMF). Despite ongoing market volatility, Ethereum had matured enough at the technical level to support real-world use cases. Tools like MetaMask and others allowed developers to actually start using the ecosystem.

Transaction volumes were still small, but developer acceptance of USDC was remarkably high. We recognized this aligned perfectly with our founding vision—this was our core mission. So, in a short span, we swiftly sold off three businesses: Poloniex exchange, Circle Trade OTC desk, and Circle Invest (our retail investment product), while shutting down and winding up our payment app.

These asset sales provided emergency funding and enabled a complete corporate restructuring. Some employees moved to the spun-off units, and the company underwent sweeping changes.

By autumn 2019, we were again teetering on the edge of collapse. Yet simultaneously, USDC began showing early signs of vitality. That’s when we made a pivotal decision—to go all-in on USDC. We committed all resources to building a comprehensive platform around it and accelerating its adoption.

This was effectively a “bet-the-company” move. At the time, USDC generated zero revenue, and the company overall had almost none. But I firmly believed the era of stablecoins had arrived—they would become central components of the global monetary system, representing the ideal monetary architecture for the internet age.

We had the right product. If we stayed the course, we’d find the right path and deliver meaningful impact. So we pushed forward with everything we had.

This marked the first true existential challenge in USDC’s development. We’d faced difficulties before, but this moment determined the company’s survival. Although USDC showed early momentum, it wasn’t yet sufficient to sustain a large-scale business.

We redirected every resource toward USDC, betting the entire company on it. I remember clearly: In January 2020, we officially announced this strategy. Circle’s homepage was completely redesigned into a massive billboard declaring, “Stablecoins are the future of the international financial system.” The only button on the page? “Get USDC.” Everything else was removed.

Then on March 10, 2020, we released a major platform upgrade—overhauling USDC’s account system and launching a full suite of new APIs. These enabled seamless integration between bank accounts, debit cards, and USDC on/off ramps. The entire platform was rebuilt around USDC.

Just three days later, on March 13, the world entered lockdown due to the pandemic. Interestingly, USDC had already begun growing in February 2020—before our official launch. I believe Asian users, recognizing the severity of the outbreak earlier, started reacting ahead of time.

During this period, a complex convergence occurred: Many people, distrustful of their domestic financial systems, began moving funds into digital dollars. Meanwhile, governments rolled out massive emergency stimulus programs to inject liquidity and prevent a “Great Depression.”

As a result, highly coordinated ultra-loose monetary policies emerged globally, flooding markets with capital. People sat at home holding government stimulus checks, asking themselves, “What should I do with this money?”

Simultaneously, society underwent a profound shift—the digitization of everything accelerated overnight.

The metaverse concept gained popularity at this exact moment. Suddenly, everyone went fully online. Digital products exploded in growth. From Zoom (which became emblematic of that era) and Peloton (home fitness) to e-commerce, online retail, digital payments, and digital marketplaces—virtually every digital sector experienced five years’ worth of acceleration in a single phase.

Meanwhile, blockchain adoption and the digital asset market also entered an explosive phase.

Summer 2020 became known as “DeFi Summer.” USDC’s circulating supply surged from $400 million at the start of 2020 to $40 billion by year-end—a violent, explosive growth.

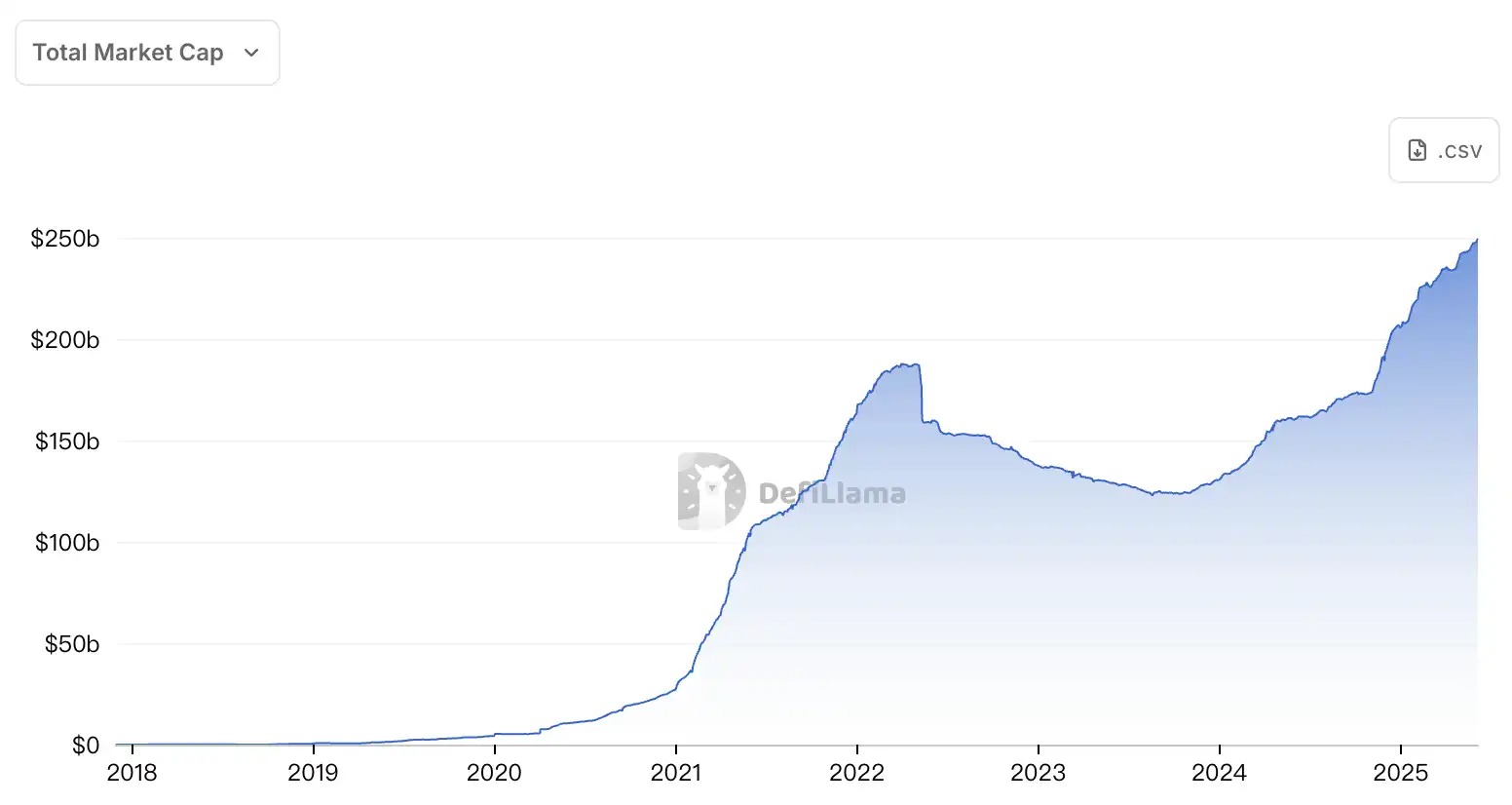

Stablecoin Market Cap Growth Curve

Prerequisites for Stablecoin Adoption

Over the years—and even just one or two years ago—people often asked: “How can this achieve true mass adoption?” My consistent answer has always been: We need to solve three key challenges. And by “we,” I mean not just Circle, but the entire industry working collectively.

The first challenge is infrastructure—the blockchain network itself.

I think of blockchain networks as “operating systems for the internet.” We need higher-performance, higher-throughput operating systems. In recent years, we’ve made great progress. We’re now entering the “third generation” of blockchain networks—high-performance Layer 1 blockchains and Layer 2 scaling solutions.

This enables much higher transaction throughput and extremely low per-transaction costs—possibly less than one cent, even fractions of a cent.

Coinbase CEO Brian Armstrong once said “sub-one-second transactions, sub-one-cent fees”—and we’ve now largely achieved that state. These advances in high-performance networks are fueling broader ecosystem growth. Lower unit and marginal costs, plus faster transactions, resemble the leap from dial-up to broadband, or from Web 1.0 to Web 2.0.

The second challenge is network effects. Stablecoins like USDC are networked platform products—developers build applications on top of them. The more apps integrate it, the more useful the network becomes. The more users hold stablecoins, the greater the utility grows—creating a positive feedback loop.

Eventually, developers realize that if their product doesn’t support USDC, they’re already behind competitively. So once infrastructure improves, these network effects between users and developers begin to take hold.

Third is usability improvements, closely tied to infrastructure upgrades. Recall just two or three years ago: To use stablecoins, you had to buy them on a platform, install a browser wallet extension, acquire Ether first to pay high gas fees, transfer ETH to your self-custody wallet—taking seven or eight minutes, extremely cumbersome and illogical.

If someone back then said, “Who would want to use this?” it was completely understandable.

Now, you can access a wallet via a web interface or mobile app—experience similar to signing up for WhatsApp—requiring just a phone number, facial recognition, or biometric authentication. No need to remember seed phrases or configure complex settings.

All these changes together are creating a favorable environment, making stablecoins easier to adopt and use.

The final hurdle is government regulation.

The most exciting development is that globally—from Japan, Hong Kong, Singapore, across Europe, the UK, UAE, to the U.S.—nearly every major jurisdiction is rolling out laws explicitly recognizing stablecoins as legal electronic money and integrating them into formal financial systems.

Once implemented, stablecoin usage will expand beyond early crypto natives to the general public. We believe that by the end of 2025, stablecoins may become a widely accepted and legally integrated part of the global financial system.

Still, we must remain clear-eyed: We’re in a very early stage. Using Geoffrey Moore’s “Crossing the Chasm” framework, we’re mid-leap across the chasm—not yet landed, and still at risk of falling. But I believe we’ll make it.

We’re seeing more institutions I call “FinTech-friendly banks” or “neobanks” natively supporting stablecoins—like Nubank in Latin America, Revolut in Europe, or brokerage apps like Robinhood.

Also included are major crypto firms like Coinbase and Binance, which together serve over 400 million users. In many ways, they’ve become “financial super apps”: You can store balances, receive salaries, link cards, spend, and obtain or use USDC seamlessly.

We’re witnessing a trend: People increasingly treat “dollars” as a store of value, but the underlying form is actually USDC.

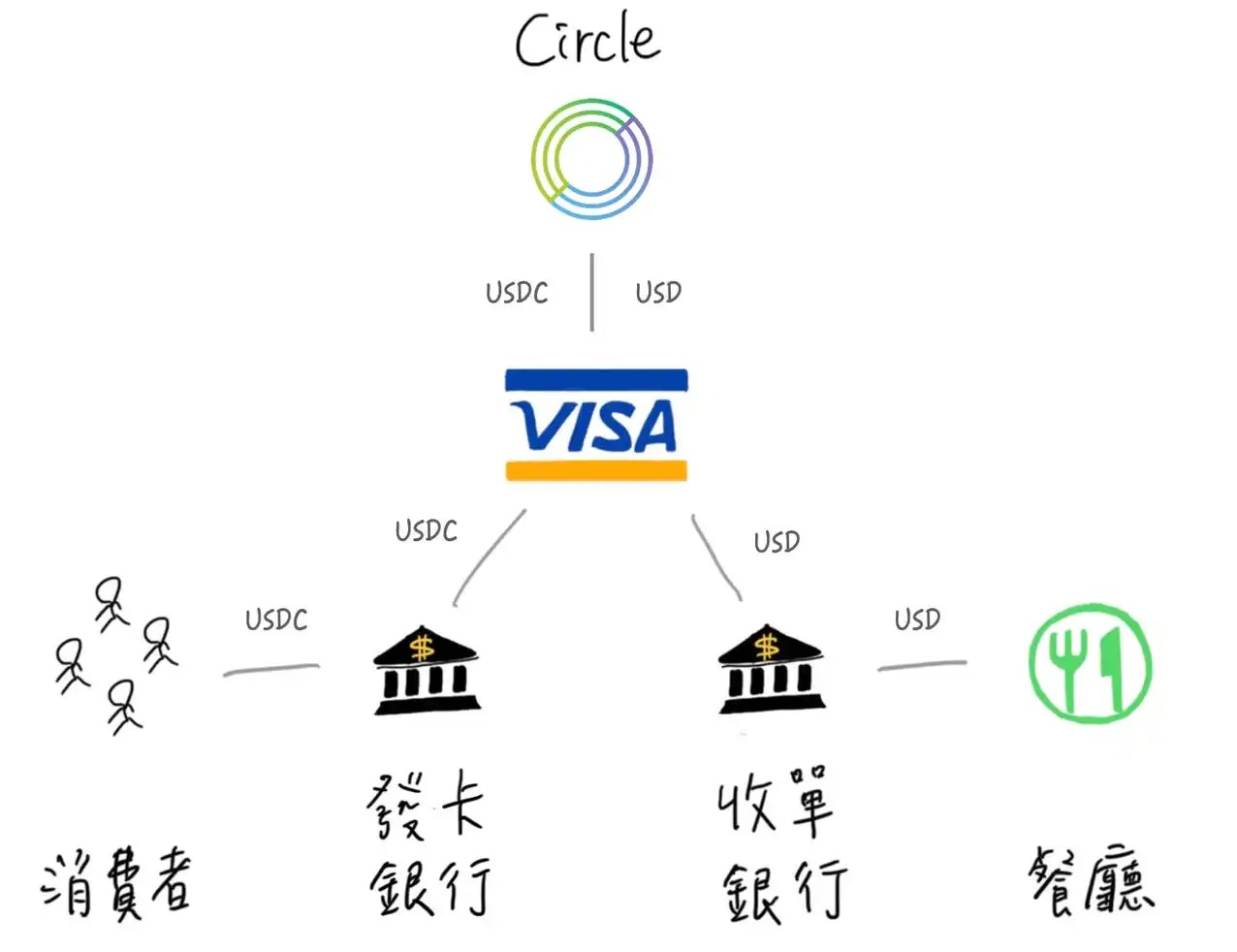

We’re now collaborating with Visa and MasterCard, both of which have initiatives allowing card issuers to offer cards branded as Visa or MasterCard—but spending powered by stablecoins like USDC.

This model is already widespread in emerging markets. Users get physical or virtual cards via neobank-style digital wallet apps, linked to their stablecoin balance. Many wish to hold dollars, and these cards let them spend within traditional card networks—only the backend settlement now happens via USDC.

Even for card issuers, the settlement funds sent to Visa or MasterCard can now be transferred directly via USDC. In effect, USDC is already serving as a settlement rail between financial institutions and card networks—an intriguing development.

On the merchant side, acquirers like Worldpay, Checkout.com, Nuvei, and Stripe are also joining in, offering merchants the option to settle in USDC.

Earlier this year, we saw a striking example: Stripe co-founder John Collison unveiled a “keynote announcement” at their annual event, saying something close to: “Crypto is back—but this time, it’s not Bitcoin, it’s USDC, it’s stablecoins.”

He demonstrated a new feature in Stripe Checkout—a product allowing merchants to embed Stripe’s payment gateway into their website or app. During the demo, USDC appeared alongside credit cards as a payment method, and merchants could choose to accept USDC.

Collison excitedly showcased the flow on stage, exclaiming, “This is what payments should look like.” They used the Solana network in the demo—settlement was instant, with negligible fees.

As stablecoins gain clearer legal status, more financial institutions will begin treating them as a base settlement layer.

A merchant might say: “I’ll accept USDC because I get paid instantly and save on fees—it’s simply a better option.”

On the user side, more end-user products are emerging—whether traditional banks, neobanks, or crypto super apps—all aiming to provide seamless experiences where users can pay with a simple QR code scan.

Another major development I mentioned on Twitter earlier this year: iOS has begun opening NFC access to third-party wallets. This means Web3 wallets could soon support “tap-to-pay,” letting users spend USDC directly from their phones at physical merchant terminals.

Of course, this requires coordination—payment processors and acquirers must support on-chain transactions, wallet developers must integrate NFC functionality, and Apple approval is needed.

But these efforts are underway, with broader rollout expected by 2025. It’s a promising evolution.

Favorable Regulatory Environment

From day one, Circle’s philosophy has been to stand at the intersection between traditional finance and the new blockchain world. To do so, we relied on clarity from the U.S. government dating back to March 2013:

If your company connects the banking system with the virtual currency world, you are classified as a “money transmitter.” You must register federally, maintain robust anti-money laundering procedures, and obtain licenses in every state requiring them.

We were the first crypto company to secure full compliance from day one. We were the first crypto firm in Europe to obtain an Electronic Money Institution (EMI) license, and the first to receive New York’s “BitLicense”—the first regulatory license specifically created for the crypto industry. For nearly a year after its creation, we were the only holder of this license.

We’ve always prioritized regulation, choosing the “front door” approach, ensuring solid, sound compliance frameworks. Incidentally, this compliance foundation enabled another critical goal: liquidity.

What is liquidity? It means being able to mint and redeem stablecoins reliably, linking to real bank accounts, buying and redeeming stablecoins with fiat. If you’re a questionable offshore entity, no bank will give you an account—you literally won’t know where your money is held.

We were the first to establish high-quality banking partnerships and brought on strategic allies like Coinbase to distribute USDC at retail scale, enabling any ordinary user with a bank account to easily buy and redeem USDC. We also offer institutional-grade services. In short, we’ve delivered on transparency, compliance, regulatory alignment, and actual liquidity.

Technologically, we continue exploring what the protocol itself can enable. We see USDC as a stablecoin network protocol and constantly collaborate with developers to drive integration and adoption. These principles are why we’ve succeeded so far—and we continue building beyond the U.S. market.

Significant progress has been made on the policy front in the U.S., particularly with the “Payment Stablecoin Act,” which I consider quite mature. It enjoys bipartisan support in the House and active engagement from Senate leadership. There’s also strong governmental interest—from the White House, Treasury, and Federal Reserve. This issue has been a top priority for years.

(Translator’s note: On May 19, the U.S. Senate passed a procedural vote on the GENIUS Act (Guiding Emerging National Innovation Using Stablecoins Act of 2025) by 66–32, aiming to establish federal oversight for dollar-backed stablecoins.)

Key questions—such as how to support private innovation while ensuring financial safety and stability, how the Federal Reserve should play a central role (setting standards for dollar-backed stablecoins), and how to provide pathways for state issuers and regulators akin to the current “dual banking system” (state-chartered vs. federally chartered banks)—are all advancing.

Financial systems are highly regulated—so are energy, transportation, aerospace, and pharmaceuticals. Most critical technologies or infrastructures operate under intense regulation.

Software may have been an exception over the past 30 years, largely unregulated. But now, if you’re doing something big and groundbreaking—like AI, autonomous hardware, or building a global digital currency system—these domains intersect with heavily regulated sectors and carry immense societal implications. Regulation in such cases is appropriate.

I don’t believe “innovation should never be regulated.” If something becomes critically important to society, it needs corresponding accountability and social responsibility frameworks—this is how institutions function. Regulation varies in intensity—global systemically important banks (G-SIBs) face far more scrutiny than local community banks.

So if our work someday becomes systemically important, our relationship with the U.S. government—and other governments—will evolve accordingly. But these are distant considerations for now.

Our immediate focus is realizing our vision for an internet-native financial system—making “open, programmable, composable money” a reality. We want this innovation to thrive, not be stifled. Achieving this also requires policymakers and governments to grant more room for innovation—just as the internet once enjoyed in other fields.

Circle’s Business Model

I believe Circle is among the most transparent financial institutions ever. If you observe banks, insurers, or other financial entities, they rarely disclose operational details in real-time or publish daily updates of core balance sheet data. Yet this is exactly what we do consistently.

How Do We Ensure Reserve Safety?

When we receive U.S. dollars, before minting USDC, those dollars are deposited into segregated reserve accounts established for customer benefit, as required by law. Regulations mandate that these funds be isolated, and electronic money instruments can only be issued after segregation. Legal ownership remains with customers. Thus, from legal, regulatory, and operational perspectives, we strictly comply.

What comprises these reserves? Currently, about 90% sits in an account called the Circle Reserve Fund. This is crucial. We want anyone interested in USDC to clearly see the reserve composition within a regulated structure. Therefore, we partnered with BlackRock, the world’s largest asset manager, to establish the Circle Reserve Fund.

This fund is essentially a government bond fund—or a government money market fund—solely dedicated to holding USDC reserve assets. It issues securities, is regulated by the U.S. Securities and Exchange Commission (SEC), and features independent audits and an independent board.

All assets are fully transparent and updated daily. Search “USDC” online, visit BlackRock’s website, and you’ll see each Treasury bond’s face value, purchase date, and maturity date. All Treasuries mature within 90 days—highly liquid, price-stable dollar assets.

Additionals assets exist via “overnight Treasury repo agreements,” collateralized by the world’s largest systemically important banks (G-SIBs), effectively equivalent to holding Treasuries.

Thus, every component of the reserve structure is visible and transparent. Any market participant familiar with liquidity and financial assets knows we could liquidate all assets within 24 hours if needed.

The remaining ~10% of reserves are held in cash at several global systemically important banks—the so-called “too big to fail” institutions. Globally, about 50 such banks exist, including JPMorgan. We’ve publicly disclosed some partner banks. Due to their size and credibility, they effectively enjoy implicit government backing.

We’ve also built global infrastructure enabling institutional clients to mint and redeem USDC. Our ability to operate stems from being a regulated entity. Banks and regulators worldwide allow us to function locally.

We’re licensed in Singapore and Europe, and actively establishing compliant distribution channels in Japan and elsewhere. This means institutions—and individuals—with accounts in Singapore, Hong Kong, Brazil, the U.S., or European banking systems can mint or redeem USDC, with funds flowing directly into the reserve structure described above.

Thus, from a local banking perspective, users have on/off-ramp liquidity; from a reserve standpoint, they’re backed by the world’s most liquid and stable assets; and supported by a publicly registered, daily-disclosed fund structure under global regulatory supervision.

Circle’s Future Plans

Recall that before the iPhone, there were roughly 17 different mobile operating systems: Symbian, Windows Phone, Palm, BlackBerry, NTT Docomo systems—each company vying for developers, pushing their own platforms and distribution.

To be honest, those systems offered terrible user experiences. Go to a Mobile World Congress and see people demoing Symbian-based apps—most of it was garbage.

So my point is: While some systems may seem architecturally advanced, their actual usability remains poor.

They’re like operating systems competing for ecosystems, developers, and ease of use. But let me be clear: We haven’t yet had the blockchain equivalent of the “iPhone moment.”

We need blockchain networks that do more than just financial transactions.

They should support social interactions, gaming, content, intellectual property, AI data provenance, AI agent transaction flows, retail-scale applications, mass-market digital tokens—and currently, we can’t do any of that. Throughput is insufficient, systems can’t scale, infrastructure lacks scalability.

Long-term, we need networks capable of processing millions of transactions per second. This is achievable. Developer experience and user experience are still in early stages.

Reflecting on my experience in platform software, developer tools, and UX, I feel we’re not fully ready. Still, I agree: We’re very close.

Even if we achieve a “click-to-use” blockchain platform, I expect new layers and additional networks to keep stacking on top.

Imagine a scenario: A major Asian internet company with 500 million users wants to introduce digital tokens, stablecoins, and smart contracts to its user base. Once opened, today’s infrastructure would collapse instantly—unable to handle the traffic.

But envision a future evolution similar to AWS’s Virtual Private Cloud (VPC): the emergence of “dedicated blockchains” forming interconnected networks to enable massive scalability. This will lead to more fragmentation but also drive further infrastructure development.

At Circle, our goal is to ensure stablecoin network protocols—USDC, EURC, CCTP (Cross-Chain Transfer Protocol), gas fee abstraction—can be easily leveraged across these environments, abstracting complexity from users and developers alike.

Whether we support 15 chains or 50 chains, I can’t predict the exact number. But one thing is certain: We will continue expanding, deploying, and releasing stablecoin infrastructure across more blockchain networks.

When the true “iPhone moment” arrives—or when we reach diminishing returns—I cannot say.

Regarding currencies, we’ve already launched USDC and EURC. I won’t claim we’ll definitely issue more currencies, but it’s clear that globally—both in emerging and developed markets—stablecoin regulations are rolling out, and more high-quality stablecoin projects are launching.

I expect to see increasing issuance of stablecoins pegged to Mexican pesos, yen, Australian dollars, British pounds, and others by 2025. Circle doesn’t need to issue all these ourselves. What matters is having compliant, high-quality local teams using our infrastructure to issue these stablecoins, ensuring strong cross-currency interoperability so applications can seamlessly integrate and use multiple currencies.

Issuing each currency is complex—legal and regulatory hurdles, central bank preferences, market readiness—all must be considered.

We also assess market size—how large is the potential market for each currency? This ties back to our earlier priorities.

We strongly believe that in this “internet financial system era,” the U.S. dollar’s importance will grow, and dollar-backed stablecoins (USDC) will remain central. Our primary focus will stay here.

That said, we aim to establish entry and exit points globally, fostering connectivity across markets. We’ll continue pushing this forward and welcome the growth of other projects.

From a business and ecosystem perspective, we don’t believe we must personally launch every non-dollar stablecoin.

From a monetary theory standpoint—whether from central banks or commercial banks—there’s a concept called the “neutral interest rate.” It’s neither stimulative nor restrictive.

After the 2008 crisis, we entered a prolonged era of the “zero lower bound,” with monetary financing of government debt used to counteract recession. Later, soaring inflation prompted aggressive tightening. Interest rate policy follows cyclical patterns.

Both “nominal rates” and “neutral rates” fluctuate within target ranges. Some economists now estimate the neutral rate at around 2.75% to 3%—a level that neither suppresses nor overheats the economy.

High interest rates aren’t inherently “good,” whether for central banks or commercial banks. Yes, institutions like ours may benefit slightly from higher interest income on reserve assets, but overall, tight monetary conditions reduce economic activity, slow money velocity, dampen capital investment, and lower risk appetite.

When rates fall, yes, interest income on our reserves declines—that’s factual. But at the same time, capital becomes cheaper, liquidity increases, investment rises, and the economy accelerates—benefiting venture capital, real economy activity, and entrepreneurship. All of this, in turn, drives stablecoin usage and growth.

We’ve lived through loose cycles and tight cycles. The next may be more moderate—we can’t predict. But we firmly believe:

On one hand, macroeconomic forces—beyond our control—like global economic trends and central bank decisions, play a role.

On the other, we’ve built a platform network with user growth flywheels and developer ecosystem flywheels. We’re creating a highly usable form of digital currency and a powerful development platform—an ecosystem with intrinsic growth dynamics.

Today, the global market for “legally recognized electronic money” exceeds $100 trillion. I believe a subset of that—stablecoins like USD-pegged and EUR-pegged variants—will keep expanding, regardless of interest rate levels.

Right now, total stablecoin market cap is only about $160 billion (now over $200 billion), just 0.16% of that $100 trillion. Clearly, we’re still in the earliest stages.

If you recognize how “internet-scale utility” reshaped media, communication, transportation, and software distribution, you’ll likely believe internet-native money could bring similar transformative power.

If all goes well, perhaps in 10 to 20 years, 10% of global money could take stablecoin-like forms. That may not sound extreme—after all, it takes decades for internet products to reach 10% penetration—but it will indeed change the world.

We hope Circle can be a key participant in this transformation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News