Is Circle, the 'First Stock' in Stablecoins, Worth Buying?

TechFlow Selected TechFlow Selected

Is Circle, the 'First Stock' in Stablecoins, Worth Buying?

Theoretical significance is a subjective construct; the market's attitude is what truly matters. Whether something has real value or is merely a capital cash-out will be revealed by Circle's trajectory on its first day of trading.

Author: Tuoluo Finance

The U.S. is aggressively advancing stablecoins, drawing strong participation from all sides—but the first mover remains the veteran player, Circle.

On June 5 Eastern Time, following Coinbase, the most anticipated IPO in the market has arrived. Circle will officially become the first stablecoin company listed on the New York Stock Exchange (NYSE), marking a perfect end to its seven-year journey toward going public.

According to the latest data, Circle completed its IPO on the NYSE at $31 per share, exceeding the originally expected pricing range of $24–$26, raising $1.1 billion with the stock ticker "CRCL." Due to surging demand, the number of shares offered expanded from the initially planned 24 million to over 34 million.

Capital market enthusiasm is evident. For the industry, however, Circle’s listing means far more than just selling shares.

While Circle is well-known within crypto circles, it may still feel distant to those outside. Founded in 2013 and headquartered in Boston, Circle originally operated as a U.S. consumer fintech startup, primarily offering Bitcoin storage and fiat currency exchange services. As the market evolved, its business repeatedly shifted—from crypto wallets to exchanges—until ultimately consolidating around one core product: USD Coin (USDC). As a native U.S. dollar-pegged stablecoin, USDC faces relatively stricter compliance requirements but is favored by domestic users compared to the more globally dominant USDT. In the stablecoin sector, USDC has consistently ranked second, with a current circulating supply of approximately $61 billion, capturing 27% of the market share—second only to USDT.

Judging solely by its development path, Circle can be considered a golden-spoon-born favorite of capital. From its early days in 2013, it attracted General Catalyst's attention, securing a $9 million Series A round—the highest record for a cryptocurrency startup at the time. It later drew investments from major players such as Goldman Sachs, IDG, DCG, and even Chinese investors including Baidu Ventures, Everbright Holdings, CICC Jiazi, and Yixin. However, due to well-known regulatory changes, Circle’s Chinese entity, Tianjin Shike Technology Co., Ltd., was deregistered in 2020. Interestingly, after news of Circle’s IPO broke, Everbright Holdings’ stock price rose 44% within five days—an emotional legacy of Circle’s presence in China.

Despite elite backing, Circle’s road to going public has been anything but smooth. After reaching a $3 billion valuation in its Series E round in 2018, Circle began considering an IPO, aiming to stand out through “compliance + listing + transparency.” But less than a year later, the unexpected 2019 market crash slashed its valuation from $3 billion to $750 million, shattering its IPO dream for the first time.

In 2021, Circle revived its listing plans. To avoid regulatory scrutiny, it opted to go public via SPAC (Special Purpose Acquisition Company) Concord Acquisition Corp, targeting a $4.5 billion valuation. However, the SEC stepped in, launching an investigation into whether USDC qualifies as a security, forcing Circle to abandon the plan once again.

Three years passed. In January 2024, having learned from past experiences, Circle quietly and discreetly filed for an IPO to minimize inquiries from regulators and media. Then on April 2, 2024, Circle submitted its S-1 form to the SEC, officially kicking off its initial public offering process, planning to list on the NYSE. Interestingly, in early May, Bloomberg reported that Ripple had made an acquisition offer to Circle, which was rejected due to a low bid. Shortly afterward, The Block reported that Circle was actively seeking buyers among Coinbase and Ripple, seeking a valuation of at least $5 billion. Amid these consecutive sale rumors, speculation arose that Circle was pursuing dual paths—IPO and potential sale—with the goal of choosing whichever option yielded a higher price.

On May 27, Circle denied the sale rumors. On the same day, it formally submitted its listing application to the NYSE. According to the disclosed prospectus, Circle planned to issue 24 million Class A shares—9.6 million newly issued by the company and 14.4 million sold by existing shareholders—with an estimated price range of $24–$26 per share. Morgan Stanley and Citigroup were named lead underwriters.

On June 5, Circle officially debuted on the NYSE. Latest disclosures revealed a 25x oversubscription rate, prompting an increase in shares offered from 32 million to 34 million. The final price was set at $31 per share—above the anticipated $27–$28 range and significantly higher than the initial $24–$26 guidance. At this price, Circle’s total valuation reached $6.2 billion. Including potential dilution factors such as employee stock options, restricted stock units (RSUs), and warrants, the fully diluted valuation stands at approximately $7.2 billion. While still below the $9 billion target it aimed for in 2022, in today’s relatively tight liquidity environment within the crypto space—where valuations often reach tens of billions—Circle’s valuation appears healthy and realistic.

The prospectus data supports this view. As previously noted, Circle’s USDC issuance stands at about $60 billion, lagging behind USDT’s $150 billion but clearly ahead of the third-place contender, whose scale falls short of $10 billion. With the U.S. Stablecoin Act progressing steadily, the sector still holds significant long-term growth potential.

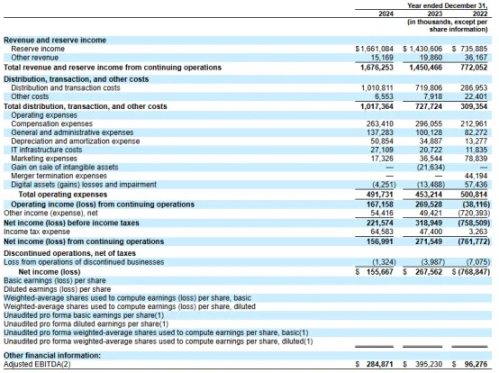

However, Circle’s business model reveals clear vulnerabilities. Revenue-wise, Circle generated $1.676 billion in total revenue in 2024, up about 16% year-on-year. Of this, approximately 99.1%—or $1.661 billion—came from interest income on USDC reserve assets, while other revenues amounted to $15.169 million. Clearly, risk-free interest arbitrage forms the core of Circle’s income. Yet this relies heavily on the current high-interest-rate macroeconomic environment. Should a rate-cutting cycle begin, its revenue would face pressure. In other words, Circle is highly correlated with systemic economic cycles and thus exposed to systemic risks.

On the other hand, despite generating $1.6 billion in revenue, Circle reported a net income of only $156 million. The missing $1.45 billion lies precisely in what seems negligible—issuance costs. Many assume that minting large volumes of tokens on-chain approaches zero cost. While token creation itself is nearly free, in today’s ecosystem, distribution is a technical challenge requiring heavy reliance on the network effects of major exchanges. Breaking down its issuance expenses, Coinbase is Circle’s largest partner, alone capturing $900 million of Circle’s profits—accounting for 54.18% of Circle’s annual revenue. Additionally, Circle partnered with Binance to allow USDC in Binance Launchpool, paying a one-time fee of $60.25 million and committing to monthly incentives based on Binance’s USDC custody balance, provided Binance holds no less than $1.5 billion in USDC over the next two years. This highlights Circle’s weak pricing power and how its margins are squeezed by exchange partners.

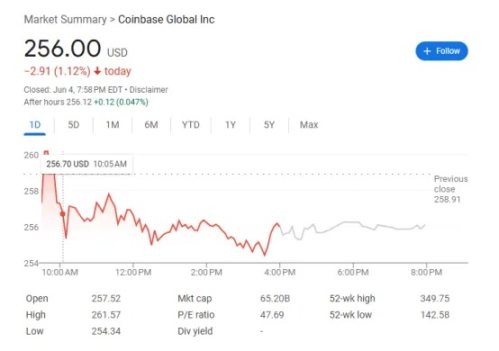

Yet valuation is subjective. Some argue that since USDC-related revenue accounts for 14.6% of Coinbase’s total income, and given Coinbase’s current market cap of around $65 billion, Circle’s valuation should be at least $10 billion. Indeed, Circle seemed to think similarly—in leaked reports, its negotiation targets with Coinbase and Ripple ranged between $9 billion and $11 billion—but both parties reportedly declined.

Overall, Circle’s valuation appears reasonable, and institutional interest has surged accordingly. According to a U.S. Securities and Exchange Commission filing, Cathie Wood’s ARK Investment Management expressed interest in purchasing up to $150 million worth of shares. Meanwhile, asset management giant BlackRock plans to acquire around 10% of the IPO shares. Notably, the two firms had already partnered in March: Circle entrusted BlackRock with managing at least 90% of its dollar-denominated custodial reserves (excluding bank deposits), while BlackRock committed not to launch its own stablecoin. This strategic move proved wise—securing strong support from traditional institutions facilitates future sales channels while skillfully avoiding direct competition with established asset managers.

Meanwhile, skepticism persists that Circle’s relentless pursuit of listing is merely a vehicle for large investors to cash out—benefiting Wall Street rather than retail holders. So far, this argument lacks solid ground. First, Circle’s valuation had already reached $3 billion back in 2018; the subsequent $440 million funding round in 2021 was priced at $4.5 billion. Most investors entered at relatively high valuations, so even at a $7.2 billion fully diluted valuation, returns for long-term early backers are not extraordinary. Second, unlike Coinbase’s direct listing, Circle chose a traditional IPO route, meaning early investors and insiders cannot sell their shares within the first 180 days—ensuring retail investors won’t immediately absorb exit liquidity. Ahead of the listing, amid strong oversubscription, most industry observers expect Circle to perform well.

Regardless of performance, this event marks another milestone—for Circle and the industry alike. For Circle, going public alleviates funding pressures and grants entry into the mainstream capital arena, creating a key driver for future operations and expansion. It strengthens its global footprint and secures a leading position in the foreseeable U.S. stablecoin landscape, gaining early cyclical advantages.

For the industry, the implications run deeper. On the surface, it’s the listing of a stablecoin issuer; in reality, it reflects the U.S.’s strategic prioritization. Among all stablecoin issuers, Circle stands out for its compliance rigor—evidenced by its acquisition of a BitLicense from New York State. Going forward, post-listing, USDC is poised to become the first stablecoin compliant with the proposed U.S. Stablecoin Act, setting a benchmark for legal tender-stablecoin conversion and establishing a compliant circulation mechanism. Under this framework, regulated stablecoins will integrate directly into banking and Wall Street systems, positioning dollar-backed stablecoins as the central bridge connecting global crypto markets—a core objective of the U.S. stablecoin legislation. The U.S. dollar, acting as an anchor, will reinforce its dominance across both traditional and digital finance worldwide. Long term, as stablecoins evolve, cross-border payments could bypass traditional bank accounts altogether, settling instead via stablecoins—potentially reshaping the global clearing infrastructure.

Additionally, some analysts believe Circle’s listing could stimulate the DeFi market. As Circle’s valuation rises, projects and services closely tied to stablecoins may also benefit. In this sense, Circle could emerge as a valuation anchor in the DeFi space.

Theoretical significance is subjective—market response is definitive. Whether this reflects real value or mere capital exit will ultimately be revealed by Circle’s stock performance on its first trading day.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News