Artemis Research Report: Frontline Data from Stablecoin Payment Adoption

TechFlow Selected TechFlow Selected

Artemis Research Report: Frontline Data from Stablecoin Payment Adoption

An overview of stablecoin adoption in global payment scenarios, including regional distribution and transaction categories.

Author: Artemis

Compiled by: Web3 Lawyer

It is widely known that stablecoins have evolved from merely facilitating crypto transactions (without relying on banking tools) into broader tools used in consumer and business payments. Recently, major payment companies such as Visa, Mastercard, and Stripe have begun integrating stablecoins into their payment systems.

Against this backdrop, stablecoins—built on blockchain—have emerged as a key network for payments and settlements. The total supply of stablecoins is now approximately $239 billion, up from less than $10 billion five years ago. Around 10 million blockchain addresses conduct stablecoin transactions daily, and over 150 million blockchain addresses hold non-zero stablecoin balances.

While transaction volumes are difficult to measure precisely, sectors like decentralized finance (DeFi, $7.8 trillion), centralized exchanges ($4.3 trillion), and miner extractable value (MEV, $1.9 trillion) all report annualized transaction volumes exceeding $1 trillion, supporting diverse use cases. The Bank for International Settlements (BIS) estimates that around $400 billion in cross-border transactions annually are settled via USDC and USDT.

Over 99% of stablecoins are pegged to the U.S. dollar and backed by dollar-denominated assets. If considered as a country, the stablecoin ecosystem would rank as the 14th-largest holder of U.S. Treasury securities. U.S. Treasury Secretary Scott Bessent stated: “We want to maintain America’s position as the issuer of the world’s dominant reserve currency, and we will use stablecoins to achieve that goal.” The Treasury Borrowing Advisory Committee projects that stablecoin supply could grow to $2 trillion by 2028.

However, specific data on stablecoin payments has historically been scarce, often estimated through top-down methods—analyzing all on-chain stablecoin transactions and attempting to filter out noise—but these approaches remain incomplete. Last year, Artemis, Castle Island, and Visa jointly released a survey across five emerging markets to understand how average users incorporate stablecoins into their economic lives. Yet, there was still no concrete data on the actual volume of known stablecoin payments.

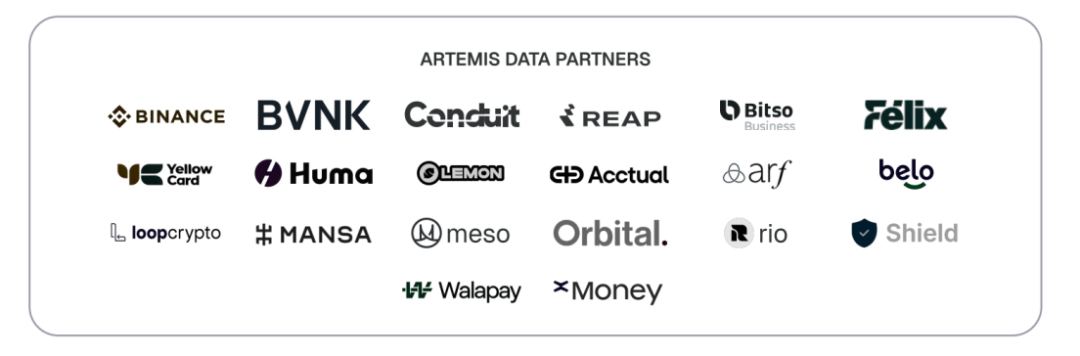

To address this, Artemis partnered with Castle Island and Dragonfly in this study to present a new dataset provided by 31 stablecoin-based payment companies. This includes direct surveys of 20 such companies and supplementary estimates from 11 others, covering various domains including B2B, P2P, B2C, card-linked payments, and prefunding. This is the most comprehensive report to date and likely captures a significant portion of transaction volume within the emerging stablecoin payments landscape.

Through our research, we derive the following findings:

-

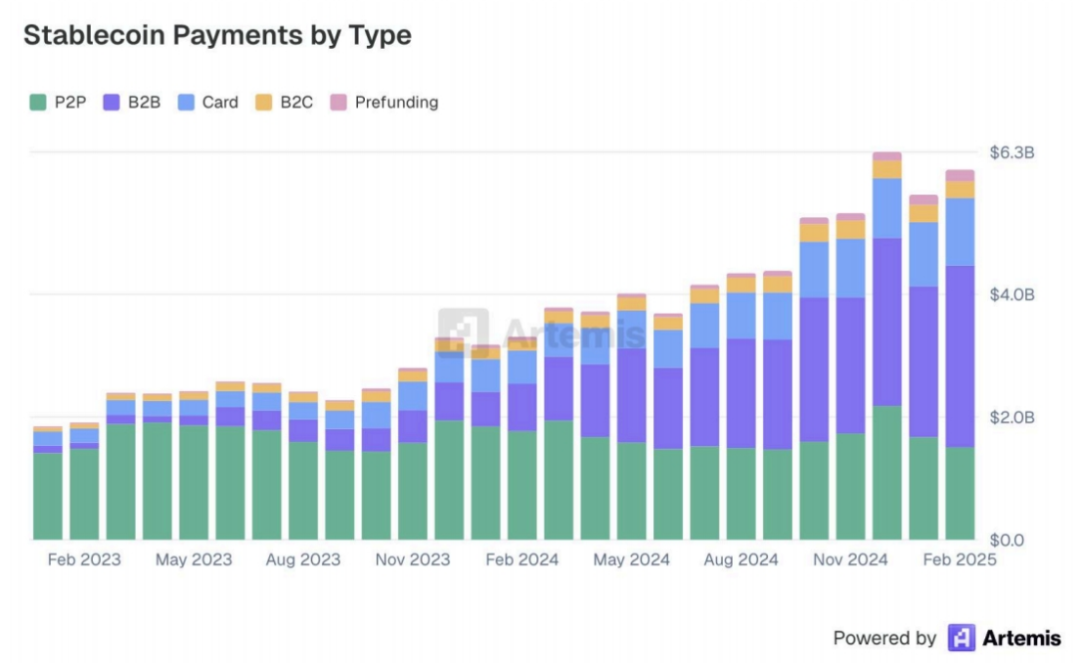

From January 2023 to February 2025, the amount clearly attributable to stablecoin payments reached $94.2 billion. As of February 2025, the sampled stablecoin payments were running at an annualized rate of $72.3 billion.

-

B2B payments (annualized at $36 billion) were the most active, followed by P2P ($18 billion), card-linked payments ($13.2 billion), B2C ($3.3 billion), and prefunding ($2.5 billion). All categories except P2P showed rapid growth.

-

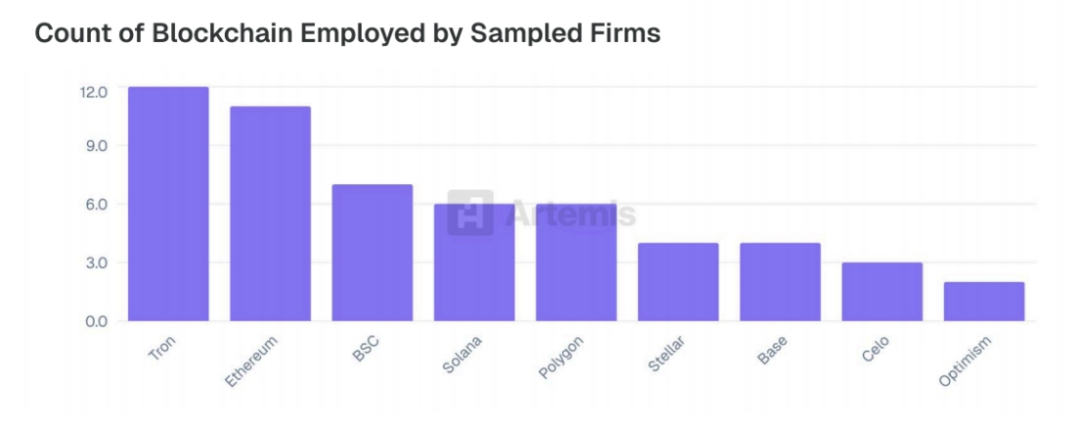

Among sample companies, Tether’s USDT was the most widely used stablecoin, accounting for about 90% of transaction volume, followed by Circle’s USDC. Tron was the most popular blockchain by transaction volume, followed by Ethereum, Binance Smart Chain, and Polygon.

Although the sample does not represent the full global picture of stablecoin payments, it provides first-hand insights into the adoption of stablecoins in global payment scenarios, including regional distribution and transaction types.

Hence, this article compiles Artemis' latest research report: *Stablecoin Payments from the Ground Up*, aiming to guide us through the era of crypto navigation.

Original report:

1. Core Stablecoin Metrics

Based on data contributed by participating companies and additional on-chain estimates, we describe $94.2 billion in stablecoin settlements across various payment types between January 2023 and February 2025, with the majority settled directly on blockchains. By February 2025, the annualized processing rate reached approximately $72.3 billion.

B2B payments accounted for the largest share, followed by P2P transfers, card-linked payments (typically debit or prepaid cards linked to stablecoin wallets), and B2C payments.

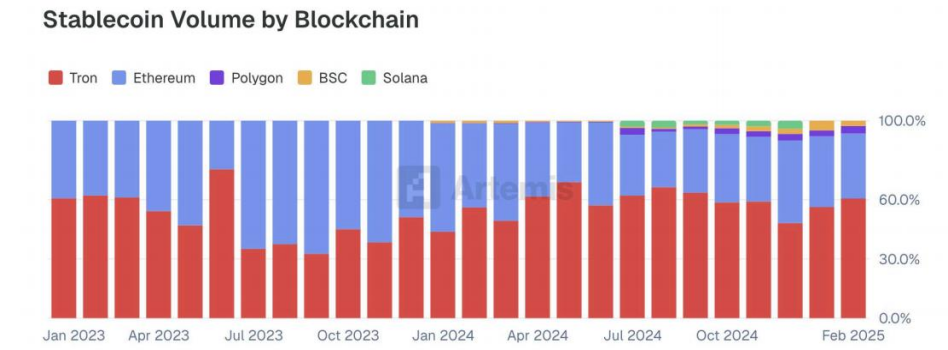

In terms of value sent, Tron is the most popular blockchain for settling customer cash flows, followed by Ethereum, Polygon, and Binance Smart Chain. This echoes findings from our 2024 report, which found users prioritizing these top five blockchains, although Ethereum was previously the most popular network.

The data underlying the chart below represents a representative subset (57%) of the full dataset provided by contributing companies, as not all participants reported fund flows by blockchain. These data were also validated against Artemis’ own estimates derived from direct monitoring of blockchain nodes.

The majority of contributing companies use multiple blockchains for stablecoin settlement. Among the companies in this study, Tron, Ethereum, and Binance Smart Chain are the most popular networks, though a longer tail of supported blockchains also exists.

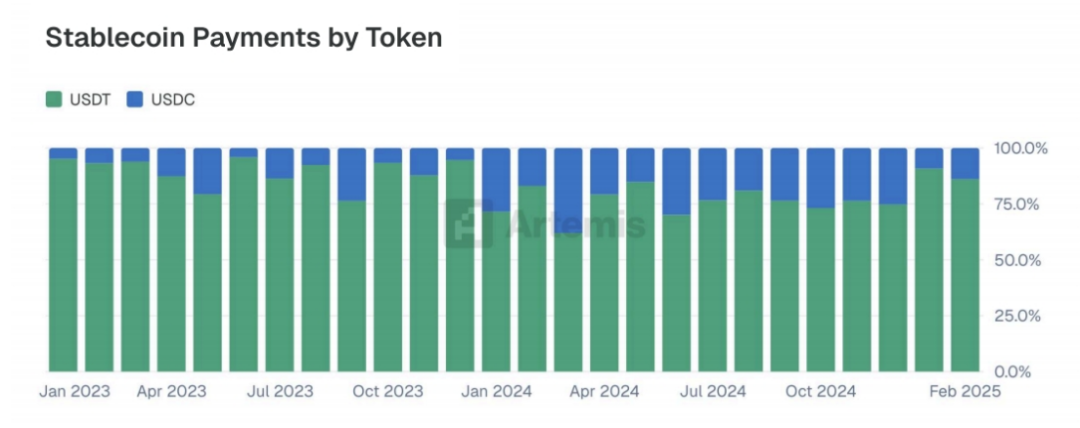

Within the surveyed company sample, Tether’s USDT is by far the most widely used stablecoin for settling fund flows. We will explore the comparative usage of USDT versus Circle’s USDC across countries later in the report.

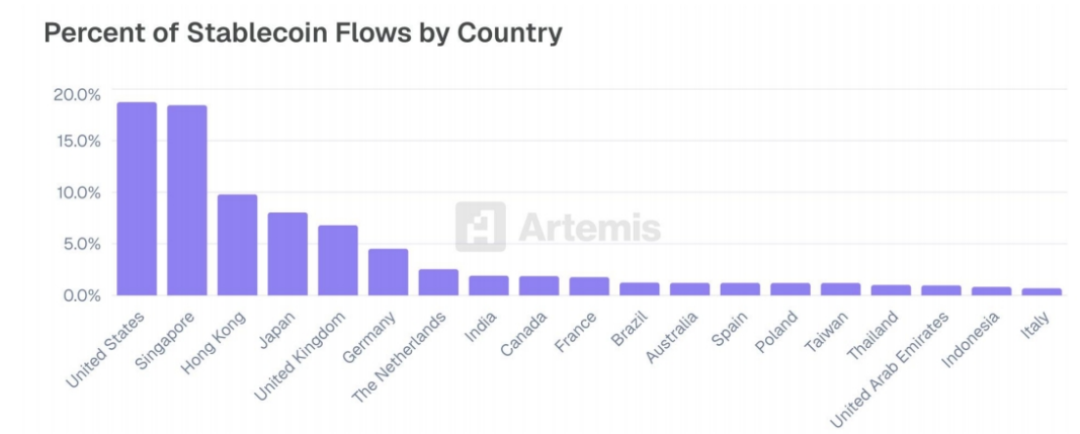

Using geographic data provided by participating companies, combined with geolocation estimates derived from IP addresses and time zones of on-chain entities when transactions reach blockchain nodes, we identified countries generating the majority of stablecoin transactions. The United States, Singapore, Hong Kong China, Japan, and the United Kingdom lead as top stablecoin-sending nations.

Within the companies included in this study, the Singapore–China corridor emerged as the most active stablecoin flow channel. Seven of the next eight largest corridors involve the United States, underscoring its central role in global stablecoin usage. Singapore and Hong Kong China appear frequently, reflecting their importance as regional financial hubs deeply integrated into cross-border stablecoin activity.

One application in cross-border payments is remittance substitution, which remains expensive globally, especially outside mainstream channels. Stablecoin-based remittances can move directly between exchanges, reducing cost and latency. In highly crypto-adopted countries like India, Nigeria, and Mexico, blockchain-settled remittances have already replaced traditional ones routed through correspondent banks or fintech firms like Wise or Remitly.

Case A – Binance Pay Consumer Payment Tool

Binance Pay is a contactless, borderless, and secure global cryptocurrency payment solution embedded within the Binance exchange. Binance, the world’s largest centralized exchange, has over 270 million registered users. Binance Pay enables users and merchants to make cryptocurrency payments globally without paying any gas fees. It brings the power of cryptocurrency into everyday transactions. Currently, Binance Pay supports:

-

300+ cryptocurrencies for peer-to-peer payments (Binance users can instantly send and receive crypto from other Binance users).

-

100+ cryptocurrencies for business-to-consumer (B2C) payments (using crypto at online and offline merchants worldwide via Binance Pay).

-

A global ecosystem with 40+ million active payment users and 32,000+ merchants.

Binance Pay aims to make cryptocurrency practical, accessible, and useful in daily life—from P2P transfers to seamless payments at thousands of online and physical stores. It offers zero-gas instant transactions, multi-currency support, and seamless checkout via QR codes, in-app flows, or payment links. Binance Pay has integrated with Pix, Brazil’s central bank-developed instant payment system with over 174 million users and 15 million businesses, enabling real-time crypto-to-Brazilian reais payments.

For merchants, Binance Pay offers several advantages:

-

Real-time settlement: Transactions are processed and settled instantly in cryptocurrency.

-

Cross-border payment support: Send and receive crypto payments globally, free from banking restrictions.

-

QR codes, in-app payments, or payment links: Seamlessly accept crypto payments for online and brick-and-mortar merchants.

-

Direct debit and pre-authorization: Enable recurring or automatic payments with one-time customer authorization—ideal for subscriptions, travel, or transportation.

-

Invoicing: Create and send cryptocurrency invoices with QR codes for easy collection.

-

Payouts: Instantly distribute large volumes of cryptocurrency—for global payroll, supplier payments, loyalty rewards, tax refunds, etc.

Case B – BVNK Enterprise Stablecoin Payment Infrastructure

BVNK provides stablecoin payment infrastructure that integrates banks and blockchains onto a single platform to accelerate global money movement. While stablecoins offer compelling benefits like instant global settlement, enterprises often struggle to integrate them at scale. BVNK solves this by:

-

BVNK’s auto-conversion feature means businesses don’t need to interact with stablecoins directly—they can hold funds in USD, GBP, or EUR.

-

Proprietary infrastructure and modular APIs ensure consistency between fiat and crypto, enabling fast integration and flexibility.

Through its stablecoin infrastructure, BVNK partners with fintechs and enterprises with global payment use cases:

-

Worldpay, one of the world’s largest merchant acquirers, uses BVNK’s embedded wallet to offer instant global stablecoin payments to its clients—paying partners, customers, contractors, creators, sellers, etc., across 180+ markets. Payments originate from fiat balances, so neither Worldpay nor its clients handle or hold cryptocurrency.

-

Deel, an employer-of-record platform, uses BVNK to pay over 10,000 freelancers in more than 100 countries via stablecoins. Workers can choose to receive wages in stablecoins for faster payouts and as a hedge against local currency inflation.

-

Bitwave, a digital asset financial platform, has partnered with BVNK to integrate stablecoin payment capabilities into its invoicing software, allowing commercial clients to receive stablecoin payments from customers and automatically convert them to fiat—or vice versa.

BVNK connects major stablecoins with traditional banking functions and operates under regulatory licenses across multiple jurisdictions. The company recently launched Layer1, a self-custodial infrastructure product enabling financial institutions to integrate stablecoin functionality and efficiently coordinate cross-border payments between stablecoin and traditional rails.

BVNK’s approach to unifying traditional finance and blockchain finance positions it as a key enabler of the next phase of digital payment innovation.

2. Regional Adoption Overview

This section summarizes key regional findings based on available country-specific data. Among the companies included in the broader study, 52% provided geographically segmented reporting, enabling analysis of stablecoin usage patterns across regions and countries.

These insights reveal how stablecoin-driven companies—including fintechs, exchanges, payment platforms, and on/off-ramp providers—operate across markets. By examining regional behavior, we can identify where companies settle transactions, their preferred blockchains and stablecoins, and how local infrastructure influences product design and user engagement.

2.1 Latin America

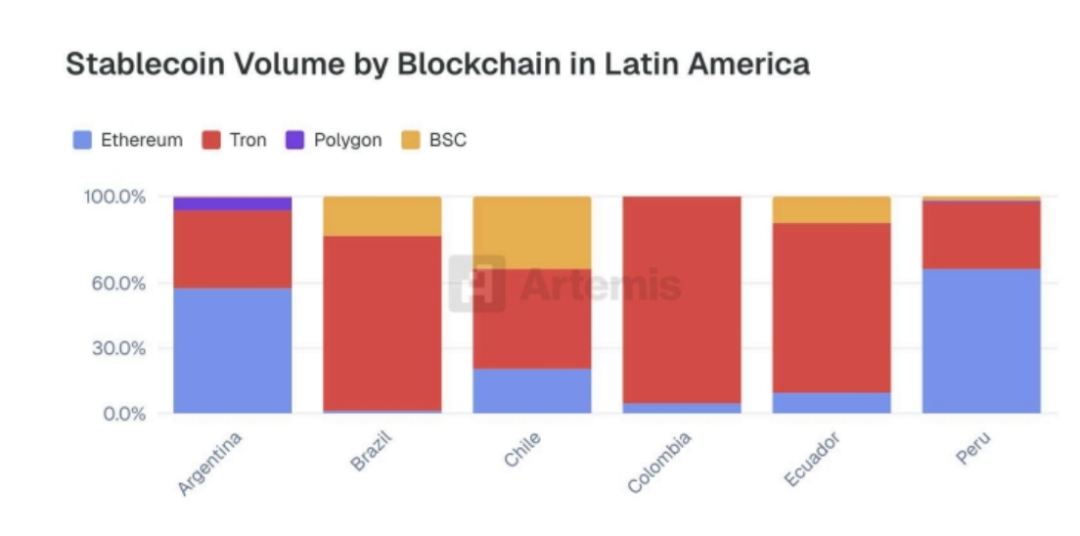

Across Latin America, Tron dominates as the primary blockchain for stablecoin settlement, particularly in Colombia, Ecuador, and Brazil, where it accounts for the majority of observed activity. In contrast, Ethereum remains the leading blockchain in Argentina and Peru, surpassing Tron in these markets. Polygon sees moderate usage in Argentina and Peru, while BSC gains notable traction in Chile, Brazil, and Ecuador.

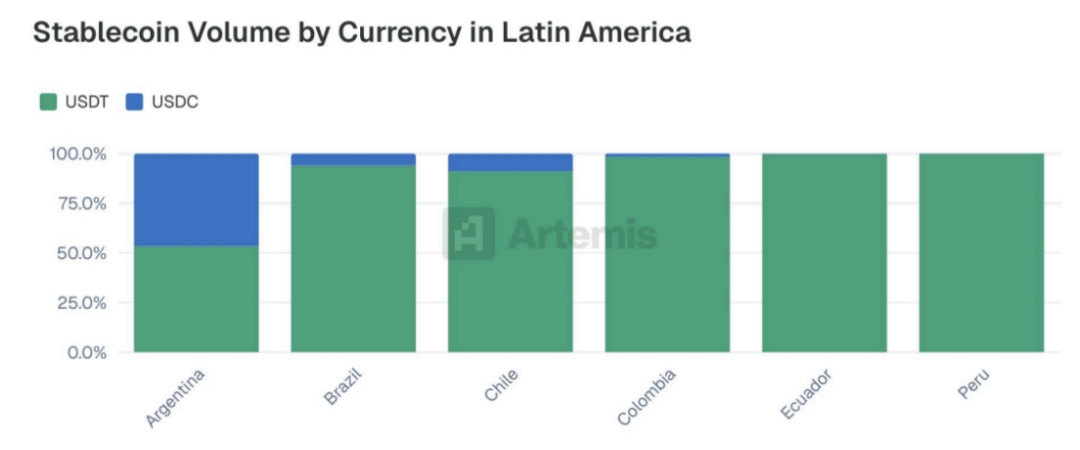

In Latin America, USDT leads as the dominant stablecoin by transfer volume. Notably, Argentina is the only country in the region where USDC reaches significant market share, accounting for nearly half of stablecoin transaction volume. In Brazil, Chile, and Colombia, USDC adoption shows only modest growth, while in Ecuador and Peru, its presence is negligible. Other stablecoins like PYUSD and DAI show almost no activity in analyzed countries. The relatively high USDC adoption in Argentina may reflect ongoing monetary instability driving the formation of more venture-backed startups. In contrast, neighboring countries continue to rely primarily on long-established USDT-based systems.

Case C – Bitso Focuses on Latin American Cross-Border Business Payments

Bitso Business offers a suite of stablecoin-powered financial services for enterprises in Latin America (Argentina, Brazil, Colombia, Mexico), the U.S., and Europe, focusing on transforming cross-border payments.

-

Bitso Business provides solutions leveraging stablecoins and other digital assets, enabling businesses of all sizes to achieve faster, more transparent, and cost-effective cross-border payments.

-

Enterprises can streamline international transactions, manage multi-currency operations, and reduce complexities and fees associated with traditional banking systems, resulting in shorter settlement times and improved cash flow management.

-

With robust APIs and enterprise-grade infrastructure, Bitso Business enables companies to integrate crypto-powered payments into existing workflows, offering greater flexibility and control over international inflows and outflows.

-

Innovations within Bitso Business, such as developing MXNB—a fiat-backed stablecoin fully reserved in Mexican pesos—demonstrate its commitment to delivering tailored solutions for regional needs.

-

By providing a regulated and secure platform, Bitso Business is becoming a key partner for Latin American enterprises and global companies operating in the region seeking to optimize their cross-border payment processes.

Case D – Conduit Bridges Cross-Border and Local Payments via Stablecoins

At Conduit, we enable businesses to seamlessly transact between stablecoins and local fiat currencies across a wide range of domestic payment rails. By integrating with our API, payment platforms, fintechs, and neobanks can offer their customers stablecoin-enabled cross-border payment services—enabling fast, low-cost payments in USD and over 10 other currencies.

Why Stablecoin-Powered Payments Matter for Business:

-

Near-instant settlement drastically reduces payment-in-transit time, freeing up capital for working capital and credit needs.

-

Brazilian enterprises using Conduit settle euro payments over 500x faster, saving thousands of hours in transaction settlement time annually.

-

In markets with volatile local currencies, stablecoins allow businesses to keep treasuries denominated in USD while still making fast domestic payments.

-

In 2024, Colombian companies holding treasuries in USD-pegged stablecoins reduced their effective inflation rate from 6.6% to 2.96%.

-

Blockchain transparency and faster settlement eliminate the black box of cross-border payments, removing the need for MT103 and other traditional transaction verification methods.

-

Stablecoin payments are instant and immutable, reducing reconciliation time and lowering operational costs.

2.2 Africa

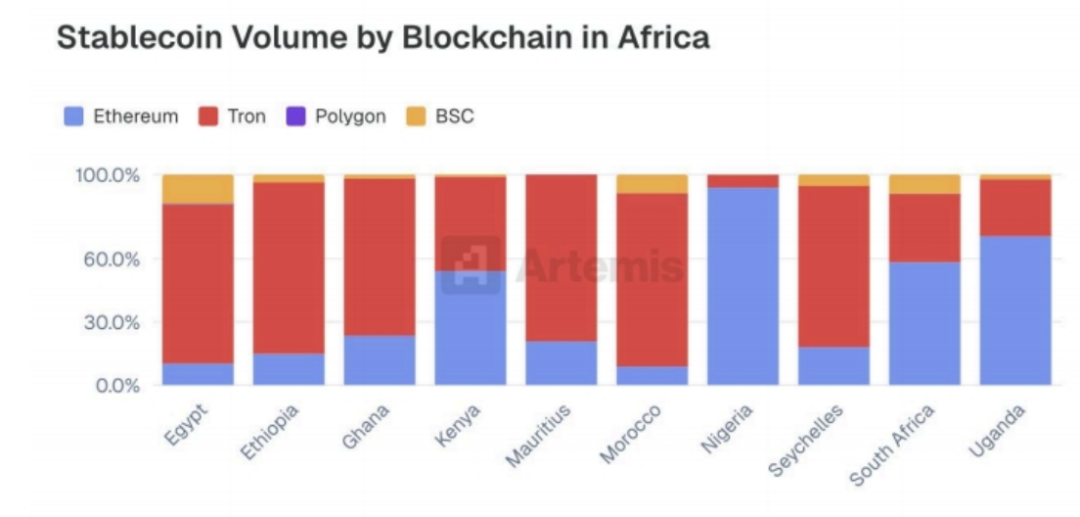

In African markets, Tron and Ethereum are the main blockchains for stablecoin settlement. Among the ten African countries analyzed, Tron leads in six—Egypt, Ethiopia, Ghana, Mauritius, Morocco, and Seychelles—while Ethereum is the most used blockchain in Kenya, Nigeria, South Africa, and Uganda. BSC plays a secondary role, contributing steady but modest transaction volume in countries like Egypt, Morocco, and South Africa.

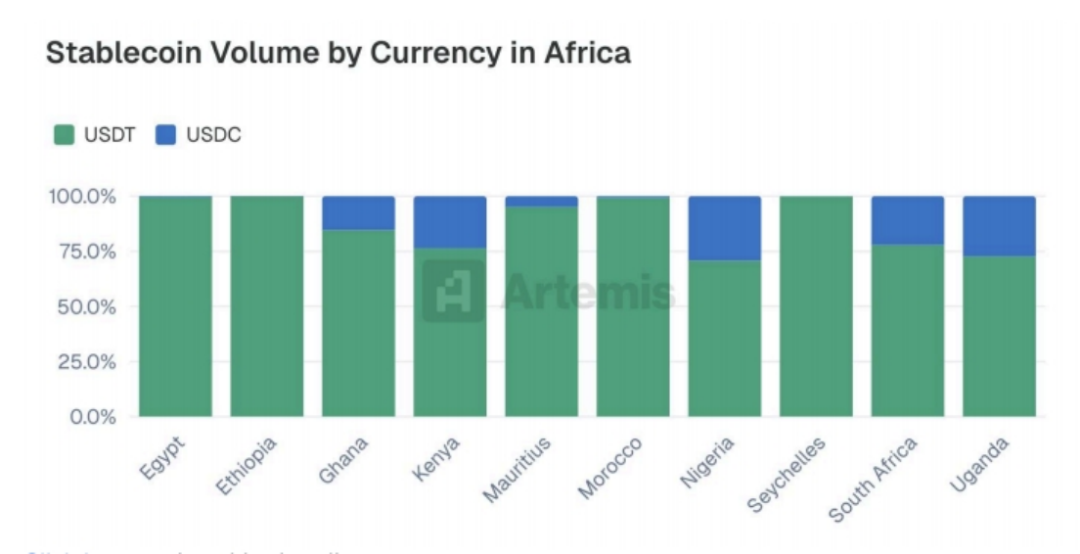

USDT dominates across all analyzed African markets, consistently capturing the vast majority of transfer volume. However, USDC shows significant adoption in certain countries—particularly Nigeria, Uganda, South Africa, and Kenya—where it holds a notable minority share. In contrast, USDC usage remains minimal in markets like Egypt, Ethiopia, and Morocco.

Case E – Yellow Card Pioneer of Stablecoin Adoption in Africa

Yellow Card is Africa’s largest and first licensed stablecoin company, operating in 20 countries. We enable individuals and businesses of all sizes to easily make international payments, protect financial assets, manage treasury functions, and access hard currency liquidity. Our 25,000+ customers are primarily businesses using stablecoins for B2B payments.

Stablecoins solve critical issues with African currencies and banking systems. Over 70% of African countries face foreign exchange shortages. In many markets, local bank debit cards cannot be used internationally, banks cannot process cross-border payments, and access to USD is severely restricted.

Stablecoins do not replace local currency transactions—they replace previous SWIFT-dependent payments, which are expensive, slow, and inefficient. Stablecoins offer a faster, cheaper, and simpler alternative. Yellow Card has facilitated over $5 billion in transactions.

In economies like Nigeria, stablecoins have become essential tools for USD-denominated payments without requiring physical hard currency to leave the country. Africa is at the forefront of real-world applications of stablecoins, cryptocurrencies, and blockchain technology.

2.3 North America and the Caribbean

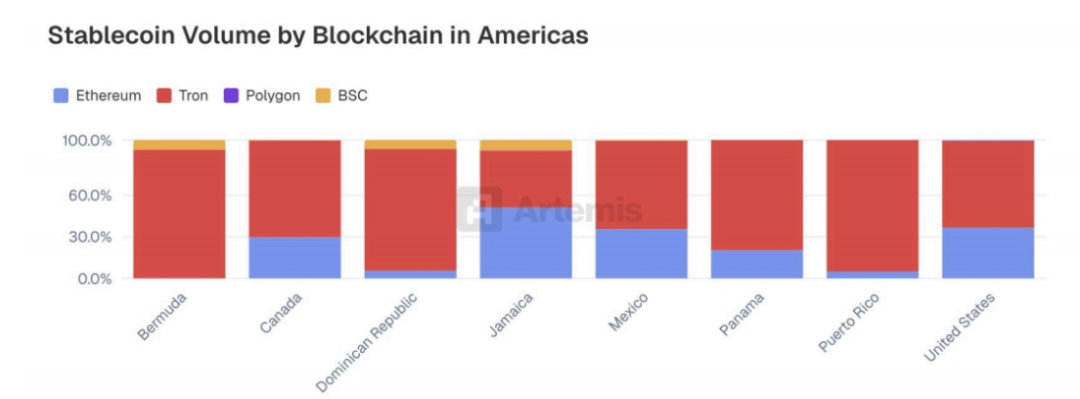

Stablecoin settlement in North America and the Caribbean follows global trends, with Tron and Ethereum dominating as primary networks across all surveyed markets. Tron consistently accounts for the majority of transaction volume, surpassing Ethereum in every country except Jamaica, where both blockchains see roughly equal usage. BSC shows modest but visible activity in several markets, including Bermuda, the Dominican Republic, and Jamaica. Other networks like Polygon, XRP, and Solana see minimal or no adoption in the region. Ethereum maintains strong influence in the U.S., unlike most other countries.

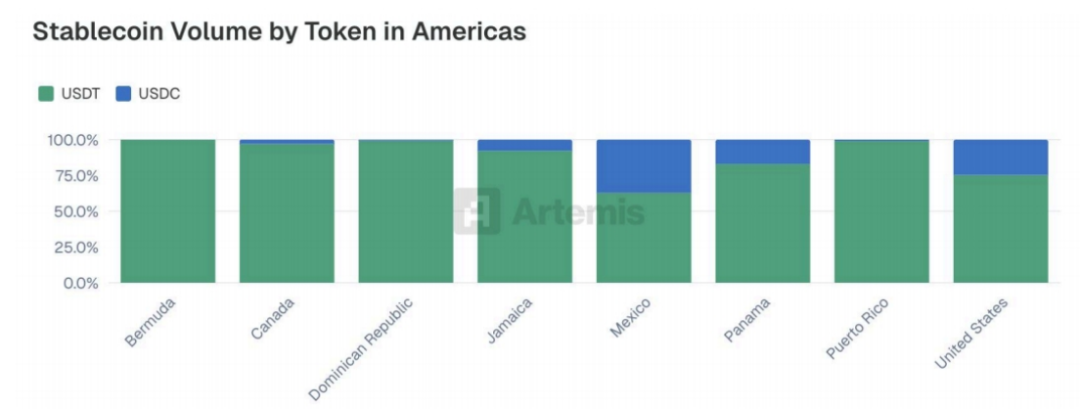

In North America and the Caribbean, stablecoin activity is heavily concentrated in USDT, which consistently dominates transaction volume across all markets. USDC, while secondary, sees measurable adoption in some countries, particularly the U.S., where it accounts for nearly a quarter of stablecoin transaction volume. Other markets like Mexico, Panama, and Jamaica also show modest but visible USDC usage, while Bermuda, Canada, the Dominican Republic, and Puerto Rico show very low USDC presence. Likewise, PYUSD and DAI are virtually absent across all studied markets.

2.4 Europe

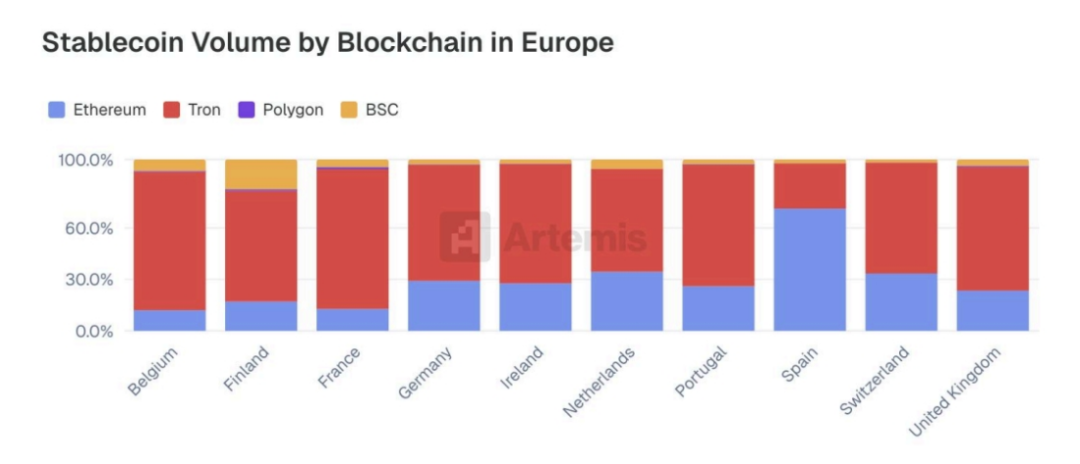

In nearly all European markets covered in this study, Tron leads in stablecoin settlement volume, continuing its trend as the most widely used global network. Spain is the sole exception, where Ethereum accounts for a larger share of stablecoin activity. Ethereum maintains a consistent secondary role across the region, with notable adoption in countries like the Netherlands, Portugal, and Switzerland. BSC contributes modest transaction volume in specific markets, particularly Finland and Belgium, while Polygon appears only marginally.

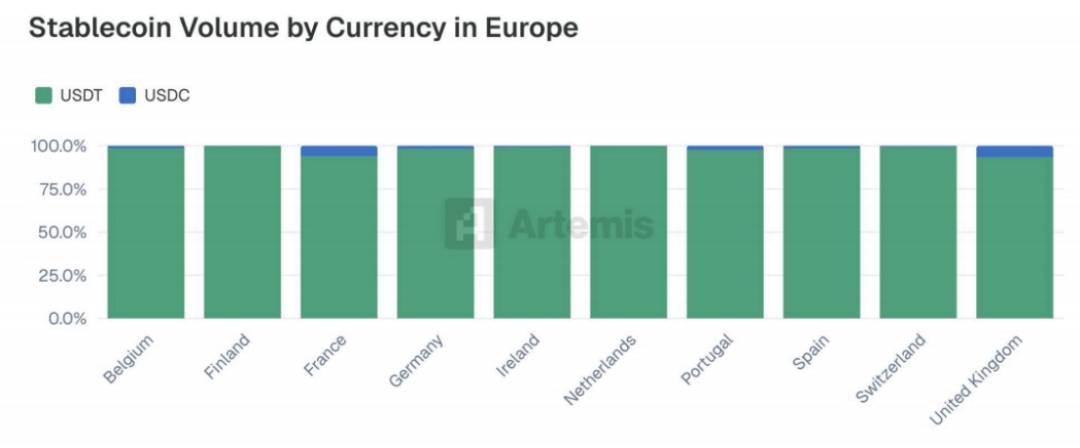

Across all analyzed European countries, USDT dominates stablecoin usage, consistently capturing over 90% of transfer volume. USDC activity is limited, with market share remaining below 10% in each country. Other stablecoins, including PYUSD and DAI, are virtually absent from the dataset.

2.5 Asia

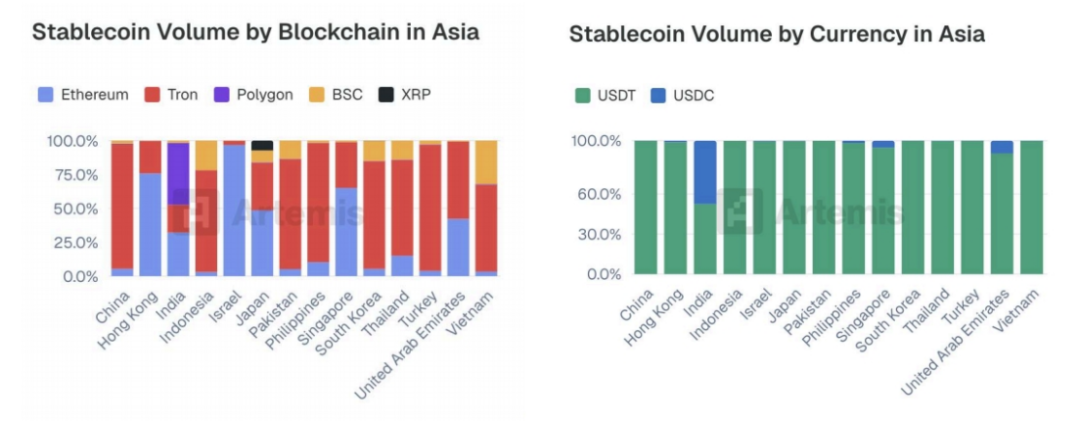

Asia exhibits the most diverse network distribution among all analyzed regions. While Tron leads in most markets, Ethereum and BSC also gain considerable adoption in several countries. Notably, India is the only country where Polygon holds a significant market share—unsurprising given that Polygon was founded there. This relatively fragmented landscape suggests a more diverse mix of local infrastructure, exchange integrations, and user behaviors in Asia.

Among the Asian markets covered in this study, USDT is the dominant stablecoin by a wide margin. The sole exception is India, where USDC holds a substantial share—nearly half of all observed stablecoin transaction volume. In other countries, USDC usage exists but is limited, while alternative stablecoins like PYUSD and DAI show little to no adoption.

2.6 Overall Observations

Across all analyzed regions, USDT dominates as the leading stablecoin, with USDC firmly in second place but clearly established. Together, these two stablecoins account for the vast majority of observed transaction volume, far surpassing all alternatives.

A similar pattern emerges in blockchain infrastructure: Tron leads in overall usage, followed by Ethereum, with these two networks far ahead of others in stablecoin settlement activity. While this hierarchy remains consistent across most regions, Asian markets show relatively greater diversity in blockchain usage.

Currently, global stablecoin activity is largely concentrated on USDT and USDC transactions conducted on Tron and Ethereum.

3. Adoption Across Transaction Types

3.1 Business-to-Business (B2B)

Although stablecoins are often associated with retail use and remittances, a growing share of transaction volume is driven by B2B activity. This section explores how companies use stablecoins for cross-border payments, vendor settlements, treasury operations, and other enterprise use cases.

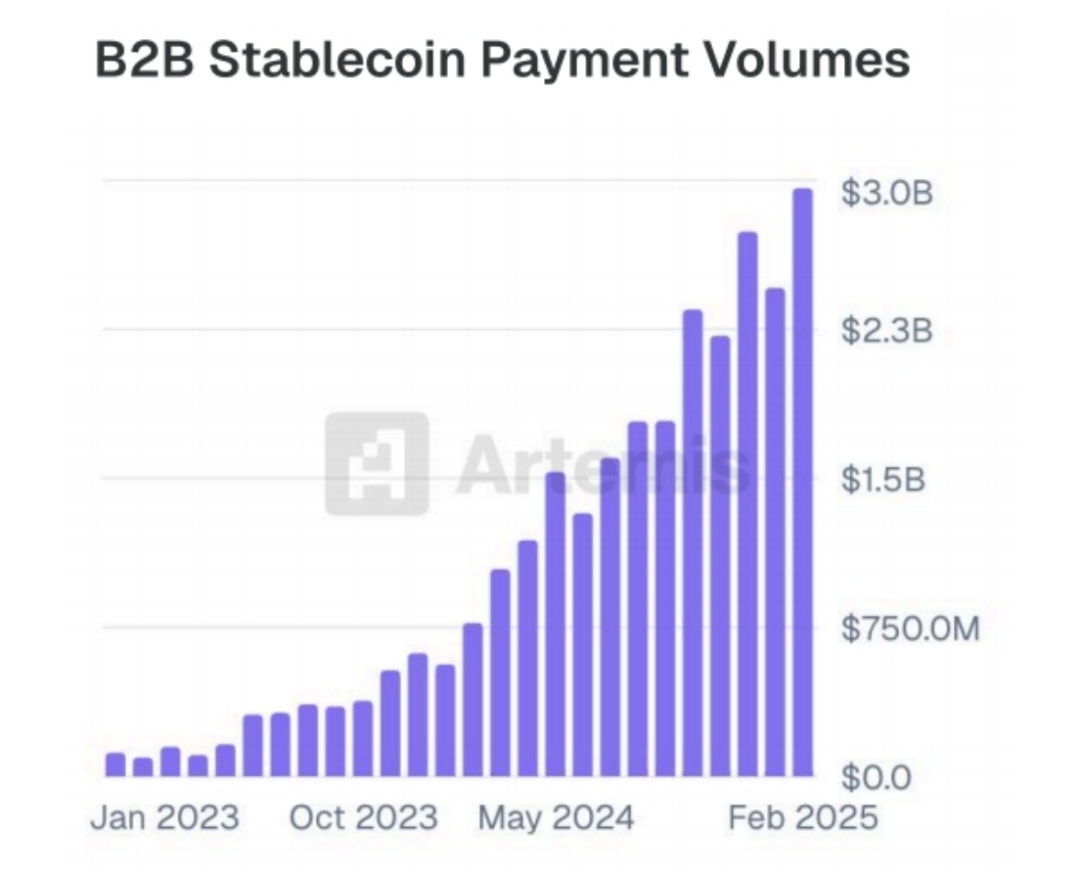

Among the companies in this study, total stablecoin B2B transaction volume has grown significantly—from less than $100 million per month in early 2023 to over $300 million per month by early 2025. This steady rise reflects increasing enterprise adoption of stablecoins for use cases like supplier payments, invoicing, and collateral transfers. The sharp acceleration in late 2024 indicates that for many enterprises, stablecoins have moved beyond experimentation into core financial operations.

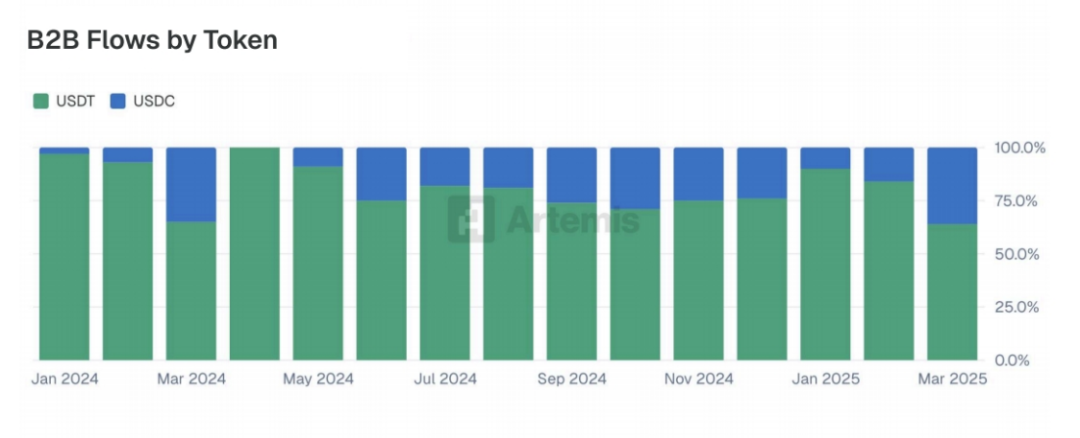

Among the companies studied, USDT remains the primary stablecoin for B2B transfers, although USDC maintains a significant share, averaging around 30% of monthly transaction volume.

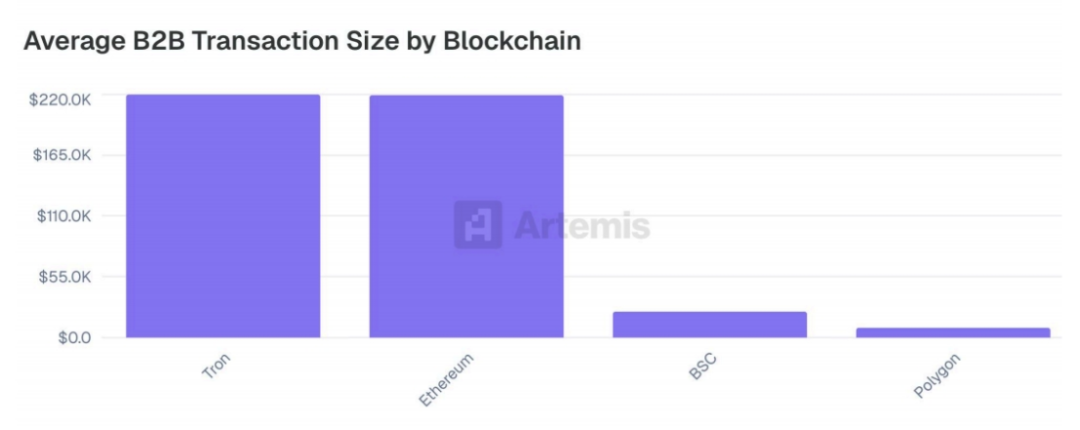

There are significant differences in average B2B transaction size across blockchains. Notably, Tron and Ethereum record nearly identical average transaction sizes (both over $219,000 per transaction), suggesting they are the preferred channels for high-value enterprise transfers among the companies in this study. In contrast, BSC and Polygon have significantly lower average transaction sizes, indicating their use in smaller-scale or higher-frequency commercial activities.

3.2 Card Payments

As stablecoin infrastructure matures, one of the fastest-growing applications is card-based spending. Supported by fintech issuers and crypto-native platforms, card-linked stablecoins allow global users to spend digital dollars in real-world scenarios. This section examines how businesses and consumers use stablecoins to fund card transactions, offering insights into adoption trends, transaction behavior, and network-level distribution.

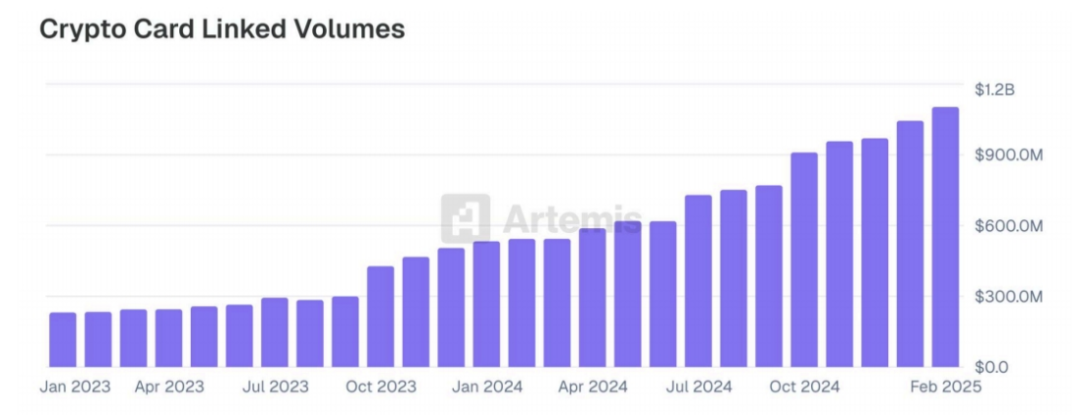

Among participating companies, transaction volume for card-linked stablecoin payments has shown steady and significant growth—from around $250 million per month in early 2023 to over $1 billion per month by end of 2024. Growth during this period remained relatively consistent.

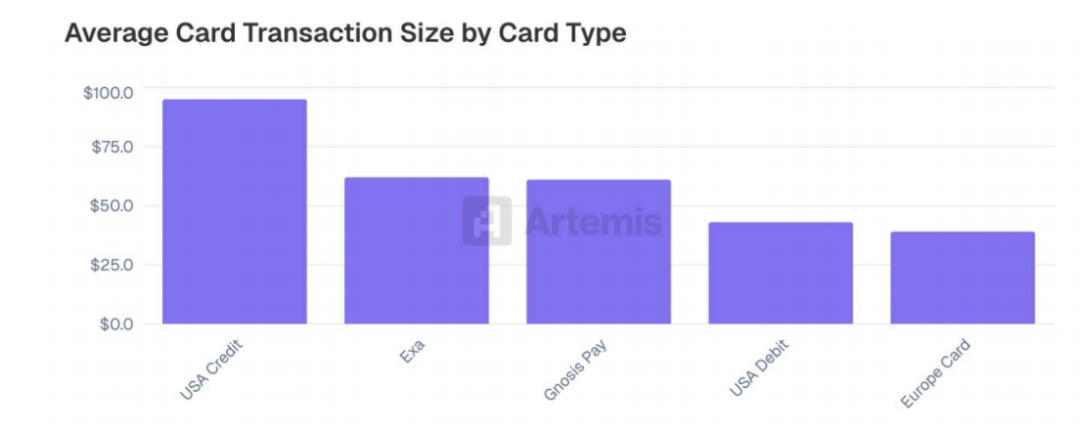

Usage patterns for stablecoin-linked cards closely resemble those of traditional cards, suggesting they are likely used for everyday purchases and recurring payments. Platforms like Exa and Gnosis Pay report average transaction sizes comparable to those of traditional credit and debit card products, further reinforcing the idea that users increasingly view stablecoin cards as functional equivalents to existing payment tools.

Case F – Reap Offers Stablecoin Solutions from Corporate Visa Cards to Cross-Border Payments

Reap is a fintech company providing stablecoin-powered infrastructure for modern enterprises to achieve borderless global finance. As Asia’s leading stablecoin debit card issuer, Reap processes billions in stablecoin payments monthly.

Reap offers stablecoin-powered financial services for businesses of all sizes. For Web3- and digital-asset-savvy enterprises, Reap Direct provides a comprehensive business account including corporate cards, payments, and expense management. Businesses can manage their digital asset treasury, fiat expenses, and financial operations within a single integrated account.

Through our API-driven embedded finance solutions, enterprises can directly integrate Reap’s stablecoin services—from Visa card issuance to cross-border payments—into their systems and build new solutions.

Our clients include the world’s largest cryptocurrency exchanges and fast-growing neobanks like KAST. Headquartered in Hong Kong, Reap adheres to the highest regulatory and compliance standards of one of the world’s top financial centers, enabling access to major financial institutions and global currencies for efficient and cost-effective capital flows.

3.3 Peer-to-Peer (P2P) Payments

P2P payments were one of the earliest stablecoin use cases, offering a faster, cheaper, and more accessible alternative to traditional remittances and fund transfers. This use case gained early traction in regions facing currency instability, limited banking access, or high cross-border fees.

An early catalyst for scaling this behavior was Binance Pay C2C, which enabled Binance Pay users worldwide to send stablecoins directly and instantly to other Binance Pay users. Since then, we’ve seen widespread emergence of stablecoin P2P applications globally. Today, stablecoin P2P usage spans individuals, informal businesses, and online communities, solidifying its role in the global stablecoin ecosystem.

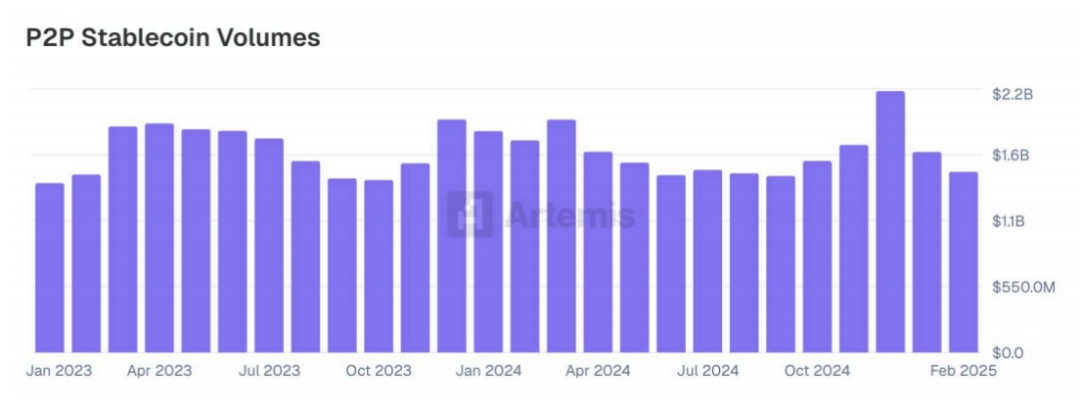

Unlike other categories, P2P payments among sample companies remained flat throughout the observation period, ending at an annualized run rate of $18 billion by February 2025. In early 2023, P2P transfers constituted the vast majority of all stablecoin-based payments, but have since declined sharply, falling well behind recent B2B payment volumes.

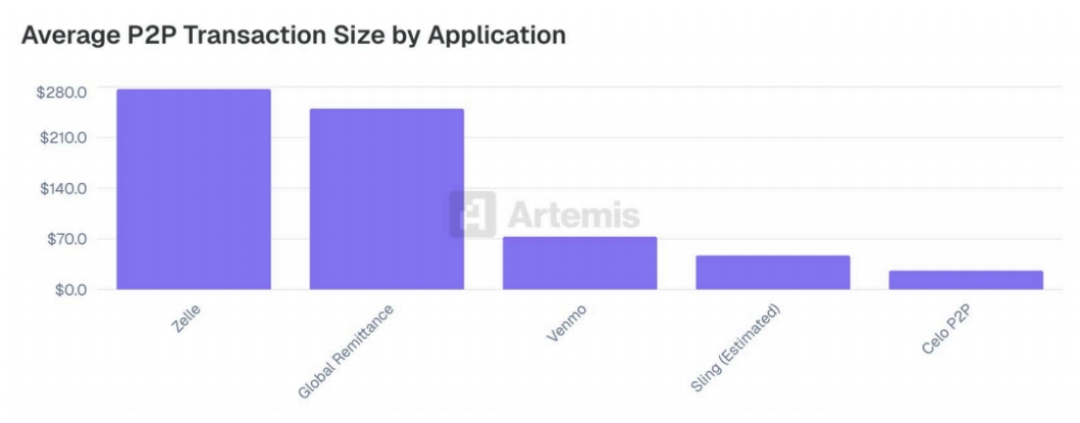

The low-cost nature of stablecoin transfers unlocks broader use cases, especially for small-value transactions. Platforms like Sling and Celo P2P report average transaction sizes significantly lower than traditional alternatives such as Zelle ($277) and global remittance services ($250), which typically charge higher fees. This cost efficiency enables stablecoins to be used not just for high-value remittances but also for lightweight, frequent P2P payments.

3.4 Business-to-Consumer (B2C) Payments

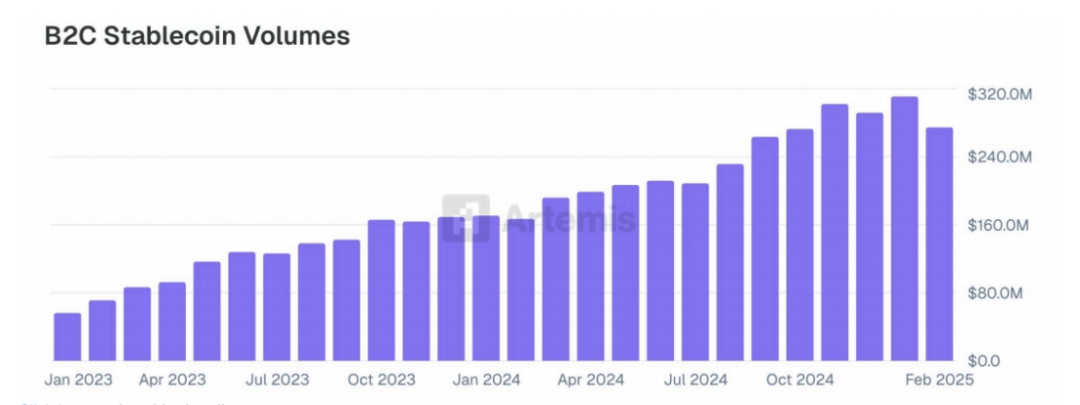

B2C payments represent another rapidly growing area of stablecoin adoption, particularly in use cases where individuals receive payments (e.g., payroll) or use digital dollars for regular purchases. This study’s B2C analysis focuses on two key players: Binance Pay and Orbital, both supporting stablecoin-based consumer payments across various industries. Transaction volume among these participants increased significantly—from around $50 million per month in early 2023 to over $300 million per month by early 2025. This growth highlights the expanding role of stablecoins in everyday digital commerce and service platforms.

3.5 Prefunding

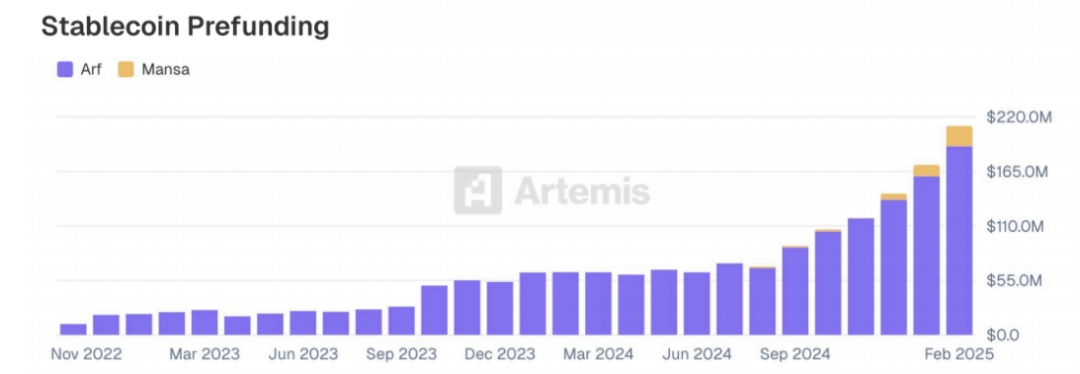

Prefunding refers to businesses sending funds in advance before a transaction settles, usually in fiat, to ensure smooth completion. In stablecoin-based transfers, this often means delivering local currency to the recipient’s destination before the underlying stablecoin settles or converts back to fiat. This creates a short-term funding gap, with the sender bearing the risk and responsibility of covering the advance. Companies like Arf and Mansa help solve this issue by providing short-term funding to stablecoin businesses, enabling them to offer prefunded cross-border payments, supplier payouts, and working capital without tying up their own cash. Loan volumes from these providers have grown steadily, especially in 2024 and early 2025, highlighting rising global demand for flexible on-chain liquidity solutions.

Case G – Huma Finance Meets Cross-Border Advance Funding Needs via On-Chain PayFi Innovation

Huma Finance provides on-demand stablecoin liquidity through its PayFi network, enabling licensed financial institutions to complete cross-border transactions and settle stablecoin-backed card payments without traditional prefunding. This innovative approach addresses the $4 trillion currently held in global bank accounts for payment settlement.

Key prefunding use cases:

-

Cross-border payment financing: Partnering with global payment providers via regulated entity Arf Financial

-

Stablecoin-backed card solutions: Enabling settlement with Visa/Mastercard networks

-

Marketplace payment acceleration: Piloting with Amazon’s payment partner to reduce supplier payout times for Asian vendors from days to under 3 hours. Amazon processes ~$1 trillion in payments annually, typically collecting from U.S. buyers and paying Asian suppliers

-

Instant merchant settlement: Eliminating multi-day waits in card payment processing

Huma minimizes risk by using protected incoming funds to finance transactions already in the system. Growth is primarily driven by expanding stablecoin liquidity, especially following its launch on Solana. Additionally, the recent launch of Huma 2.0 represents significant protocol innovation, extending PayFi access from institutions to everyday retail investors. Finally, through Arf, Huma serves global licensed financial institutions and plans to scale as global stablecoin regulatory frameworks become clearer.

4. Conclusion

This survey shows that stablecoins are evolving from niche tools into meaningful alternative mechanisms in global payments. Our analysis of data from 31 stablecoin payment companies reveals over $94.2 billion in payments settled between January 2023 and February 2025. These payments represent genuine transactions rather than trading or speculative economic activity.

Business-to-business (B2B) transactions are the largest use case, with a significant annual run rate of $36 billion, highlighting stablecoin adoption in cross-border payments, treasury management, and vendor settlements. Card-linked stablecoin payments have also grown substantially, exceeding $13.2 billion in annual transaction volume.

Consistent with prior findings, our survey participants report that payments are dominated by USDT, followed by USDC, primarily settled on Tron and Ethereum blockchains.

Overall, stablecoins have established themselves as a growing and important component of global payment infrastructure, with expanding use across transaction types and regions, demonstrating their rising significance within the international economic system.

For this study, we collected transaction data from 20 payment service providers and other companies facilitating stablecoin payments, supplemented by estimated data from 11 additional companies, covering a total of 31 stablecoin payment firms. Except for Binance Pay—which settles transactions directly between exchange account users—all data involves on-chain stablecoin settlements.

Generally, these payments are made on behalf of end users (consumers or enterprises), including card transactions, business-to-consumer (B2C), business-to-business (B2B), or peer-to-peer (P2P) payments. The exception is prefunding, which refers to loans in stablecoin form provided to other stablecoin payment processors. Other forms of lending (even if related transactions are settled in stablecoins) were excluded, as they are not payment-related.

Some companies listed in the dataset are service providers to others; thus, some transaction volume overlap may exist, though we minimized duplication where flow data was available. For certain providers, we used only partial data—for example, excluding internal transfers in Binance Pay (which we consider more likely to be non-economic transactions). Generally, we adopted conservative estimates wherever possible.

In this study, our goal was to limit data collection to specific payment transactions reflecting genuine payment activity (excluding investment-related fund flows). Annually, trillions of dollars in stablecoin transactions occur on-chain, but we focused only on bottom-up analysis of companies settling payments for known individuals and enterprises.

As of the publication date, Artemis estimates $26 trillion in annual on-chain stablecoin settlements (adjusted to remove known noise sources), but much of this volume relates to trading (on exchanges and DeFi), MEV, and other non-payment transactions. In our study, we were able to aggregate about 1% of all stablecoin settlement activity. While this number seems small, based on our most recent month’s data (February 2025), it equates to $72.3 billion in known stablecoin-based payments.

The represented companies are a subset of all stablecoin-based payment providers and do not offer a complete picture of the field, but we believe we have captured a significant portion of transaction volume. We expect to expand coverage in future versions of this study.

Data is broken down monthly by user type (B2B, B2C, P2P, etc.), blockchain, sending and receiving countries (where applicable), and specific stablecoins used. In some cases, charts are based on partial company data (as not all participating companies provided detailed breakdowns). Data was collected in May 2025 and traces back to 2023. Naturally, some companies began operations only recently, so growth in some charts reflects both increasing per-company payment volumes and the emergence of more companies in the space. Data is aggregated by transaction type and anonymized at the company level.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News