Achieve Over 20% Annualized Returns in Real-world Testing: Unlock the Wealth Code for TRX "Multiple Ways to Profit"

TechFlow Selected TechFlow Selected

Achieve Over 20% Annualized Returns in Real-world Testing: Unlock the Wealth Code for TRX "Multiple Ways to Profit"

"Golden Shovel" TRX continues to see positive developments.

Recently, TRX has been making waves in the crypto space! According to the latest data from TRONSCAN, the TRON protocol generated over $343 million in revenue in May, setting a new all-time high, with an average daily income reaching $11 million. Yesterday (June 4), the TRON Foundation announced that the "TRX supply reduction" proposal will officially open for voting on June 10. If approved, the on-chain supply of TRX will be directly reduced.

Over the past three months, the price of TRX has surged from $0.21 to a high of $0.28, easily surpassing a 30% gain. In May, the U.S. SEC formally accepted the application for a Staked TRX ETF. If this application is ultimately approved, TRX’s price could experience a significant rally, sparking much speculation about its future trajectory.

Now, more and more users in the crypto community are keenly sensing this potential opportunity and have begun actively buying and firmly holding TRX tokens, patiently waiting for the ETF approval to capture substantial gains—hoping to secure their share in this wealth-building feast.

However, merely buying and holding TRX seems to many investors like “sitting on a gold mine without knowing how to mine it,” failing to fully unlock its latent value. How can holders maximize returns on their TRX? Finding reliable yield channels and actively participating in stable income-generating strategies has become the top priority for TRX holders.

On JustLend DAO, a native DeFi application within the TRON ecosystem, there exists a powerful TRX “yield-generating tool”—the “sTRX + USDD” dual-mining vault. Real-world testing confirms that staking TRX through this combination delivers annualized yields exceeding 20%, offering TRX holders an exceptionally attractive path to wealth growth. Moreover, the process is extremely simple—just a few steps allow investors to activate a “set-and-forget” earning mode on JustLend DAO, enabling TRX to achieve “multi-layered yield harvesting” and truly realize steady wealth accumulation.

JustLend DAO Gold Mine “sTRX+USDD”: Unlocking TRX’s “Multi-Layer Yield” Wealth Code

In the world of cryptocurrency, pursuing high yields remains an unrelenting goal for investors. The “sTRX + USDD” gold mine combination on the JustLend DAO platform offers TRX holders an optimal path to steady wealth appreciation, enabling TRX to deliver “multi-layered yield harvesting” and generate multiple streams of income.

Staking TRX on-chain can yield nearly 20% annualized returns—an attractive return made possible through two pools on the JustLend DAO platform: “sTRX” and “USDD.”

Before diving into the operational details, let's first understand the core functionalities of three key components—JustLend DAO, sTRX, and USDD—and how they interconnect.

- JustLend DAO, originally a decentralized lending protocol built on the TRON network, has evolved into a central DeFi ecosystem hub within the TRON ecosystem. Its offerings are diverse, including collateralized lending, staking TRX (i.e., Staked TRX to receive sTRX receipt tokens), energy rental, and support for users exploring various DeFi applications. According to DefiLlama data, as of June 5, the platform’s total value locked (TVL) reached $3.4 billion, solidifying its position as the highest-TVV DeFi protocol on the TRON network—a testament to its strength and influence.

- sTRX (Staked TRX) is JustLend DAO’s liquid staking product for TRX. By staking TRX, users receive sTRX receipt tokens. As an interest-bearing asset, sTRX automatically captures node validator rewards and energy rental income from the TRON network. This feature has made sTRX highly popular and sought-after. As of June 5, approximately 8.1 billion TRX (worth about $2.19 billion) were staked on JustLend DAO across 4,360 addresses—clear evidence of its widespread adoption.

- USDD 2.0 is a decentralized stablecoin operating on the TRON network, pegged 1:1 to the U.S. dollar. Users can mint USDD by over-collateralizing high-quality crypto assets such as TRX, sTRX, and USDT. As of June 5, the circulating supply of USDD exceeded $420 million, demonstrating its growing significance.

So, how exactly does the “sTRX + USDD” gold mine combination work on JustLend DAO?

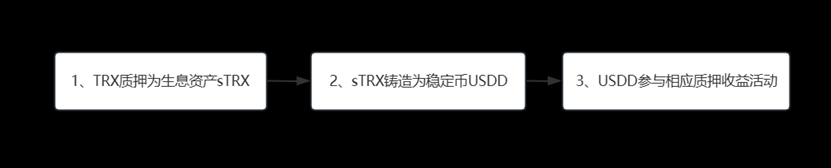

Specifically, users stake TRX on the JustLend DAO platform to convert it into the yield-bearing asset sTRX; then use sTRX as collateral to mint the stablecoin USDD; after completing this minting process, the obtained USDD can be deposited or staked on JustLend DAO to earn additional yield, thereby enjoying dual returns: yield from sTRX staking and interest from USDD deposits.

The entire process can be summarized simply as: Stake TRX → Receive sTRX → Mint USDD with sTRX → Deposit USDD on JustLend DAO to earn interest.

Through this method, TRX achieves “multi-layered yield harvesting,” with returns consisting of two main parts: one part comes from the underlying yield of sTRX staking, including validator voting rewards and energy rental income; the other part arises from activities involving USDD minted via sTRX, encompassing deposit yields and returns from participating in various DeFi opportunities.

At a time when the crypto market remains volatile, the “sTRX + USDD” gold mine combination on JustLend DAO provides TRX holders with a stable and efficient path for yield growth, allowing investors to effortlessly grow and preserve their assets even amid complex market conditions.

TRX Staking Deep Dive: Only 3 Simple Steps to Effortlessly Earn Over 20% APY

Finding high-yield yet user-friendly on-chain investment strategies remains a core demand among crypto users. The “sTRX + USDD” vault strategy on the JustLend DAO platform requires only three simple steps to enable TRX to achieve “multi-layered yield harvesting” and generate multiple streams of substantial returns.

Step 1: Stake TRX to Obtain sTRX and Begin Earning Base Yield

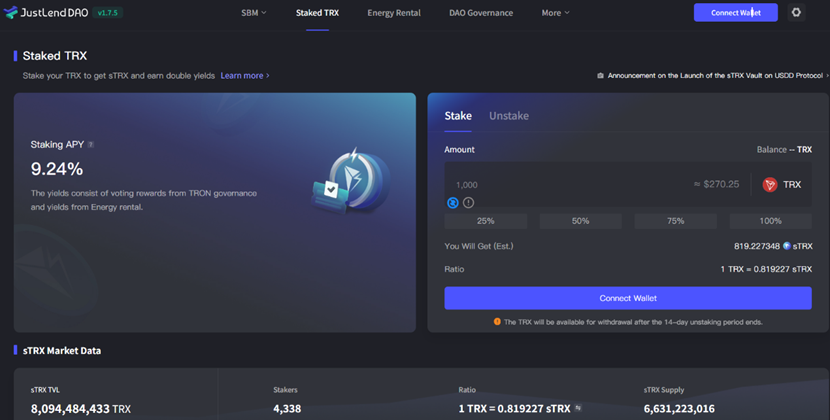

On the Staked TRX section of the JustLend DAO platform, users simply stake their TRX to easily receive the liquid staking receipt token—sTRX. Think of sTRX as a “money-making magic token” that automatically earns staking rewards from the TRON network, including voting incentives and energy rental income. However, sTRX yields are not fixed—they fluctuate dynamically based on the total amount of TRX staked across the network. Over the past seven days, the sTRX staking yield was approximately 9.24%.

Website link (https://app.justlend.org/strx?lang=en-US)

Here’s a helpful tip: Regarding transaction fees on the TRON chain, if you conduct frequent transactions, consider leasing energy from the Energy Rental Center on JustLend DAO. This can reduce your per-transaction fee from several dollars down to just a few cents, significantly cutting costs.

Step 2: Use sTRX to Mint Stablecoin USDD and Expand Yield Opportunities

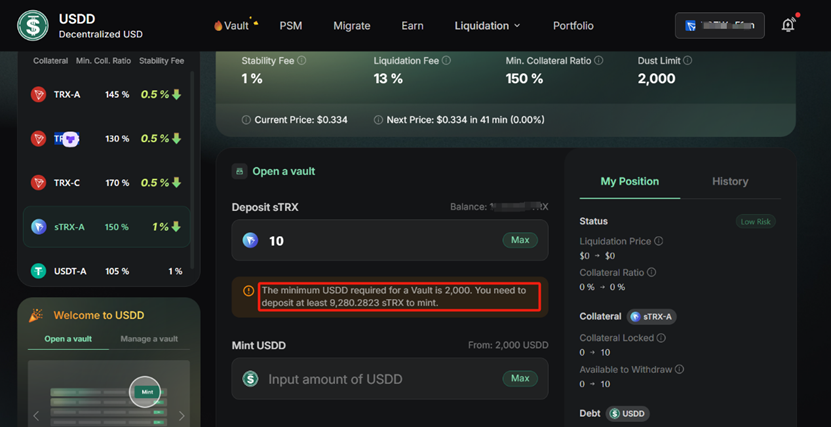

After obtaining sTRX, you can proceed to the USDD platform to over-collateralize and mint USDD using the sTRX vault.

(Website link: https://app.usdd.io/vault?token=STRX-A)

However, several key points must be noted: The minimum minting amount for USDD is 2,000 USDD per transaction, and it operates under an over-collateralization model with a current collateral ratio of around 150%. On June 5, minting 2,000 USDD required at least 9,280 sTRX in collateral. To avoid being unable to mint USDD due to insufficient sTRX holdings, it's advisable to stake a sufficient amount upfront. Given the current exchange rate of 1 TRX = 0.81 sTRX, staking around 12,000 TRX at once would be a safe approach.

Step 3: Stake USDD to Earn High Yields and Grow Wealth

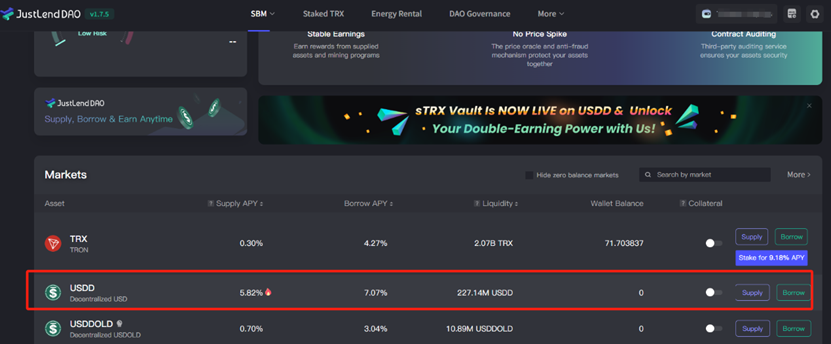

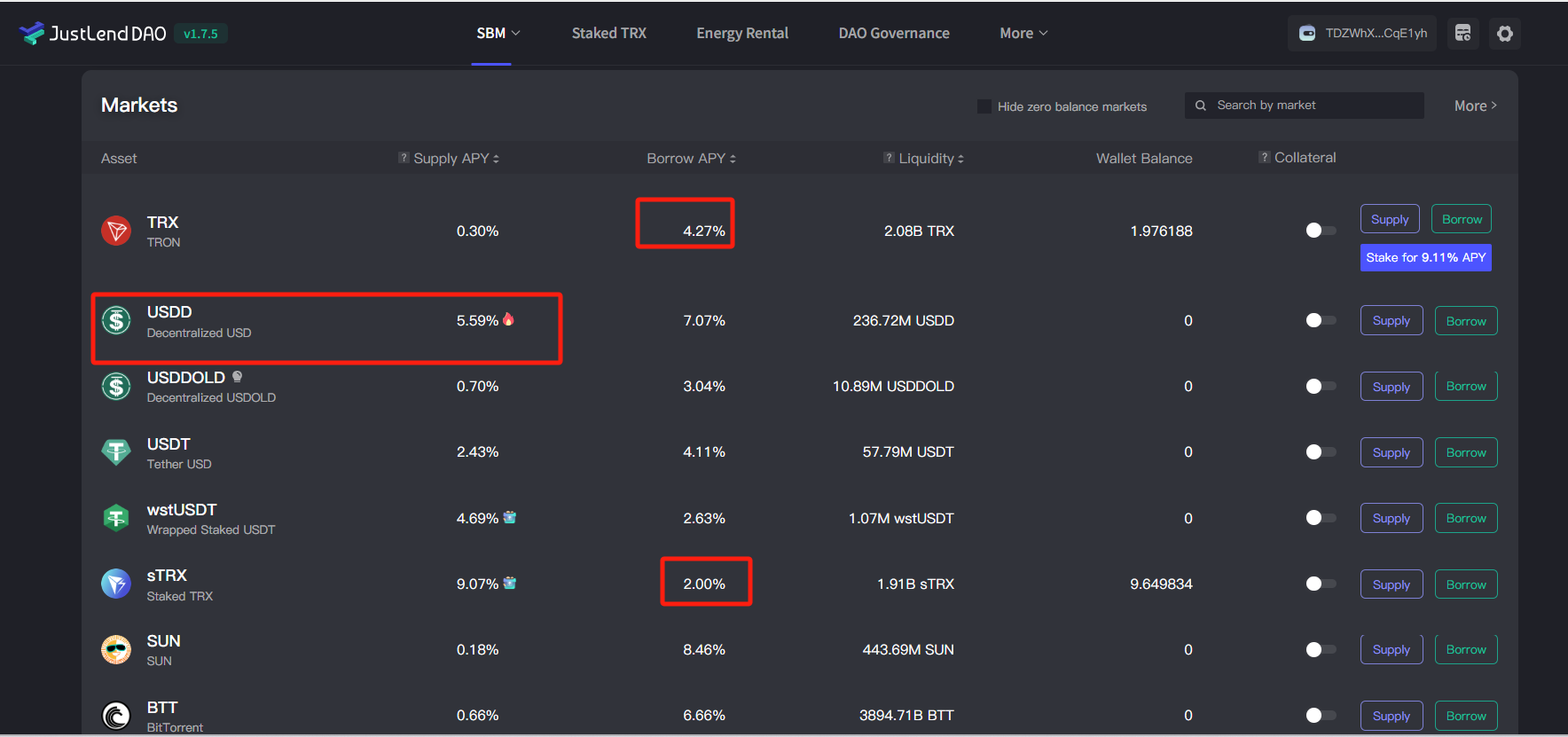

Once USDD is successfully minted, it can be directly deposited into the high-yield earning program for USDD on JustLend DAO. Currently, the annualized yield for depositing USDD on JustLend DAO stands at 5.8%, a highly competitive rate within the stablecoin investment landscape.

(Website link: https://app.justlend.org/homeNew)

With these three simple steps, TRX holders can easily earn multiple layers of yield:

- Yield 1: Stake TRX on JustLend DAO to obtain sTRX and earn base staking rewards. The 7-day annualized yield was approximately 9.24%, laying a solid foundation for asset appreciation.

- Yield 2: Holders can over-collateralize sTRX on the official USDD platform to mint USDD, then deposit the acquired USDD into JustLend DAO’s staking program. On June 5, depositing USDD on JustLend DAO offered an annualized yield of 5.82%, further broadening the income stream.

“TRX staking yield (Yield 1) + USDD deposit yield (Yield 2)” are generated simultaneously and independently, without interference.

Real-time data from June 5 shows that the combined annualized yield in TRX terms easily surpassed 15% (9.24% from TRX staking + 5.82% from USDD deposits). Moreover, both the sTRX staking rate and the USDD pool interest rate are variable, adjusting dynamically based on the volume of staked or deposited assets. During periods of high market activity, sTRX staking yields can reach as high as 30%. Consequently, the overall annualized yield fluctuates accordingly, often far exceeding 20%, presenting investors with highly attractive wealth growth opportunities.

Advanced Player Guide: Leverage Recursive Borrowing to Capture “sTRX+USDD” Supercharged Returns

Using the “sTRX+USDD” gold mine combo on JustLend DAO, beginner players can already earn dual returns—sTRX staking yield and USDD deposit interest—using only their underlying TRX assets. However, for experienced, advanced on-chain users, the profit potential goes far beyond this basic strategy, offering even greater opportunities for amplified gains.

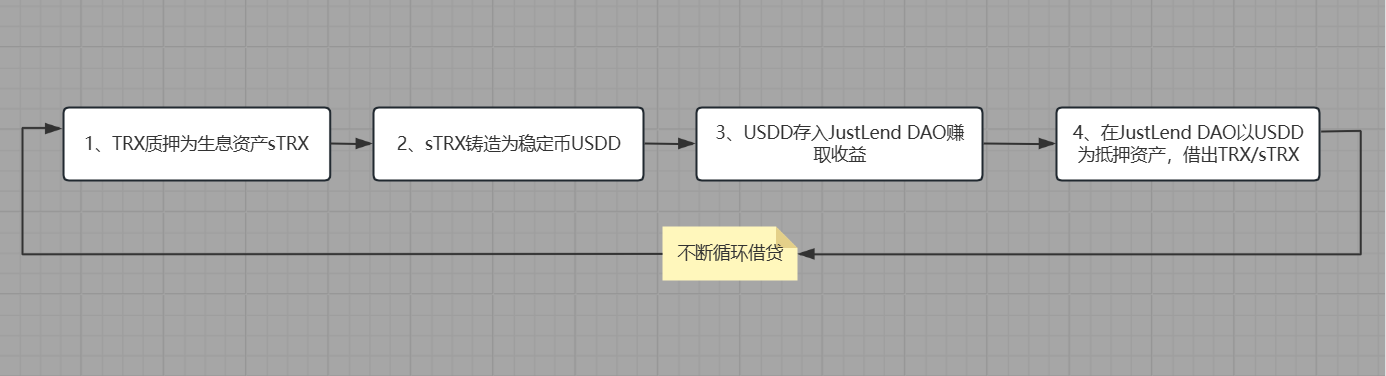

Advanced players can skillfully leverage the lending pool feature on JustLend DAO—deposit USDD to borrow TRX or sTRX—unlocking the golden key to recursive yield farming. By depositing USDD on JustLend DAO as collateral, users can directly borrow TRX or sTRX, then use them to mint more USDD. This step may seem simple but holds immense profit potential.

After borrowing TRX, users quickly stake it to obtain sTRX receipt tokens. Then, they use the newly acquired sTRX as collateral to mint additional USDD. The freshly minted USDD is redeposited into a yield-generating platform to accumulate interest. Once sufficient funds are accumulated, the cycle repeats—borrow more TRX/sTRX—and the loop continues, compounding returns with each iteration.

This recursive borrowing mechanism functions like a rolling snowball—each cycle amplifies earnings. Compared to the basic “sTRX staking yield + USDD deposit interest” model, the total return grows exponentially, easily surpassing conventional annualized yields of 20%.

"Golden Shovel" TRX Keeps Delivering Bullish Catalysts

The “sTRX + USDD” gold mine strategy on the JustLend DAO platform functions like a precision-engineered automated money-making machine, opening a new value-creation pathway for TRX—from staking, to stablecoin minting, to earning yield on stablecoins—and establishing a clear revenue chain: TRX → sTRX → USDD → back to TRX/sTRX,truly realizing a “money makes money, which then makes more money” wealth-building model, cementing TRX’s status as the ultimate “golden shovel” asset.

For TRX holders, this strategy not only allows them to benefit from potential upside in the TRX price but also enables them to capture substantial on-chain yields through the “sTRX + USDD” combo.

For long-term TRX holders (“HODLers”), this model offers unique advantages. Without sacrificing liquidity, users can maximize returns and asset appreciation. Neither sTRX nor USDD has lock-up periods—users can redeem sTRX or USDD at any time or instantly swap them for other assets on DEX platforms, providing exceptional convenience and flexibility in fund management. Furthermore, the sTRX+USDD yield model is transparent and sustainable: sTRX staking rewards come from governance voting incentives and energy rental income, while USDD yields are supported by system subsidies.

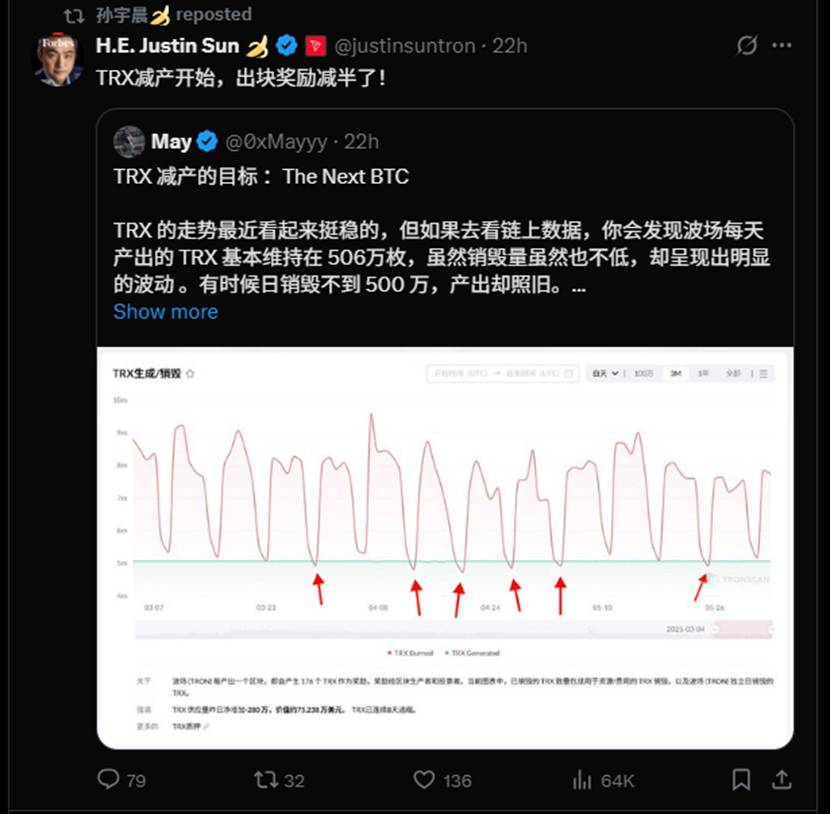

Additionally, the underlying asset TRX itself keeps receiving bullish catalysts. First, in May, the TRX ETF application was accepted by the U.S. SEC; then, TRON protocol revenue hit a record $343 million in May; and just yesterday (June 4), the TRON Foundation announced that the TRX supply reduction proposal (TIP-738) is set to begin voting on June 10, 2025, Singapore time—sparking widespread attention and discussion across the crypto community.

The “TRX supply reduction proposal” aims to cut block rewards for TRX. Specifically, it proposes halving the block reward from 16 TRX to 8 TRX, and reducing voting rewards from 160 TRX to 128 TRX. If passed, this reduction means significantly fewer new TRX tokens will be issued daily, directly constraining on-chain supply growth and slowing inflation. This increased scarcity could boost TRX’s long-term price outlook.

Considering all factors—the potential narrative around a TRX ETF, continuously breaking revenue records, and the upcoming supply-reduction proposal—it appears TRX may emerge as one of the most promising digital assets in the crypto space. Meanwhile, leveraging JustLend DAO’s “sTRX + USDD” multi-yield strategy allows TRX to act as a “golden shovel,” enabling holders not only to benefit from future price appreciation but also to seamlessly embark on a journey of wealth accumulation, achieving steady asset growth and long-term prosperity.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News