Artemis: Where Did the 240 Billion in Stablecoin Supply Go?

TechFlow Selected TechFlow Selected

Artemis: Where Did the 240 Billion in Stablecoin Supply Go?

While people are still debating the market share between USDC and USDT, the real transformation is quietly taking place at the distribution level.

Author: Artemis

Translation: Will Awang

Whether stablecoins can reshape the global financial landscape is no longer a yes-or-no question, but a question of *how*.

In the early days, stablecoin growth was measured by total supply. The key challenge lay in trust: which issuers were trustworthy, compliant, and capable of scaling. With the proposed U.S. GENIUS Act on the horizon, this issue may soon be resolved.

As issuance becomes standardized, the stablecoin market is entering its next phase—shifting from minting to distribution (from Mint to Distribution).

The days of issuers reaping outsized profits are numbered—distributors are now recognizing their leverage and capturing their fair share of value. Circle’s IPO filing already makes this clear.

Given this shift, it's increasingly important to understand which applications, protocols, and platforms are driving real growth—especially within the relatively mature on-chain stablecoin use cases in crypto markets.

Last week, we translated "Artemis: On-the-Ground Data from Stablecoin Payment Adoption," exploring stablecoins’ potential and pathways in linking traditional finance through off-chain payment scenarios.

Today, we continue with insights from *Artemis, The Future of Stablecoins, Usage, Revenue, and the Shift from Issuers to Distribution*, focusing on on-chain stablecoin use cases. Each has its unique context and practical application, offering visibility into trends of value capture amid dynamic on-chain market movements.

Key Takeaways

Despite a $240 billion market cap and $3.1 trillion in annual transaction volume, widespread misconceptions persist about stablecoin adoption. On one hand, issuers spend heavily to expand reach—Circle paid Coinbase and other distributors $900 million in 2023 alone, over half its revenue, to incentivize USDC usage.

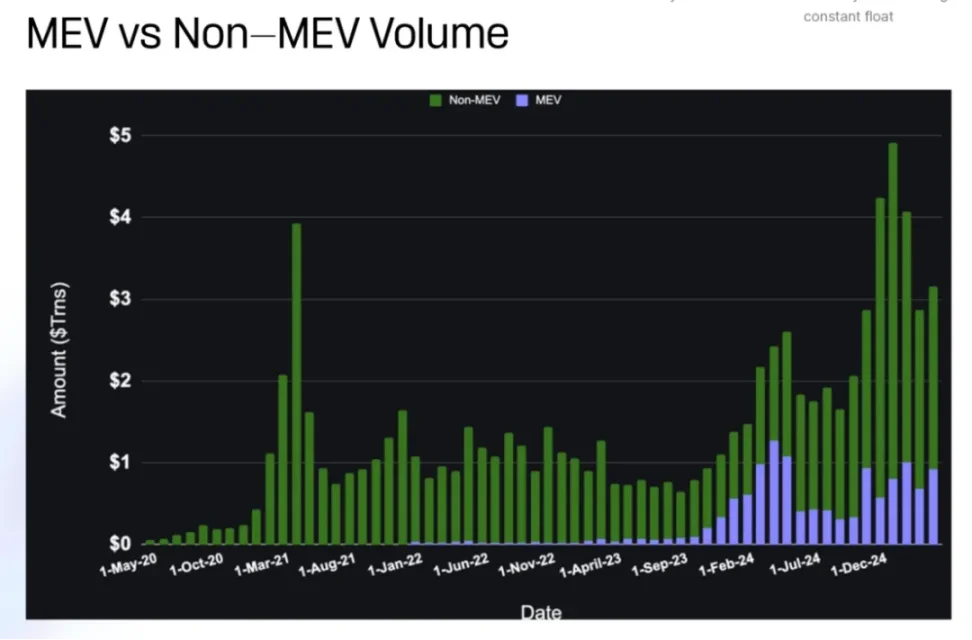

On the other hand, the headline $3.1 trillion annual volume is highly misleading: 31% comes from MEV bots cycling the same funds thousands of times daily. Real human-driven activity is far smaller than the surface numbers suggest.

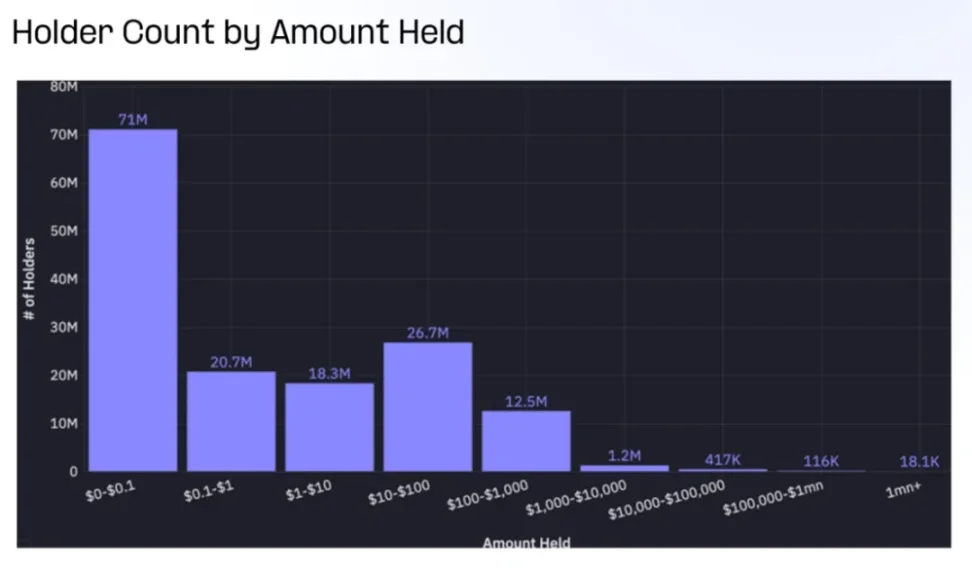

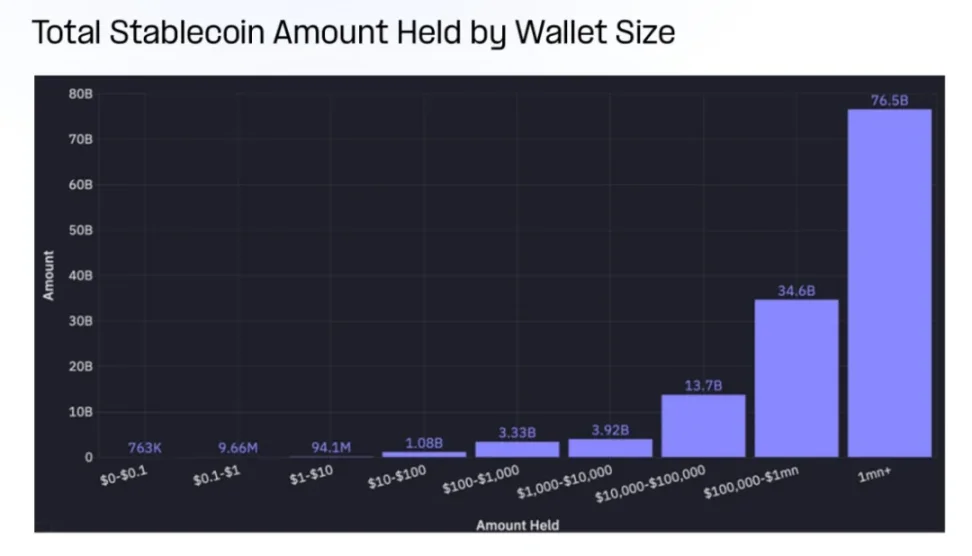

Moreover, stablecoins exhibit extreme wealth concentration that remains largely unknown. While there are 150 million stablecoin wallets, 99% hold less than $10,000. Just 20,000 mysterious wallets control $76 billion—32% of total supply. These are neither exchanges nor DeFi protocols, labeled “gray zone” wallets whose nature remains unclear.

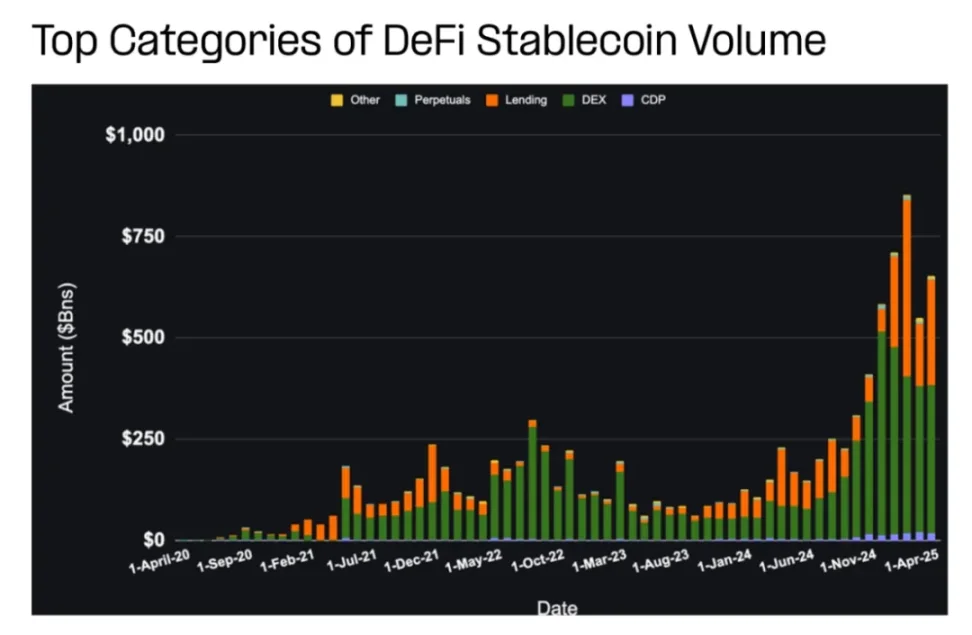

Notably, stablecoins have seen explosive growth in the past six months. Since summer, DeFi stablecoin volume surged from $100 billion to $600 billion. Meme coin trading alone generated $500 billion in stablecoin flow—12% of annual volume.

Yet our metrics for measuring stablecoin success are backwards. Declining TVL may not signal reduced usage but rather technological progress and efficiency gains. Rising volume might simply reflect increased bot activity. All current adoption-tracking metrics suffer from fundamental flaws.

While debates rage over USDC vs. USDT market share, true transformation is quietly unfolding at the distribution layer—potentially reshaping the entire stablecoin value chain.

1. The Next Phase of Stablecoins

In just a few years, stablecoins have evolved from experimental products into indispensable financial tools, with undeniable product-market fit. But we’ve now entered a new era where supply and liquidity alone are insufficient for sustained growth. The next stage will involve new factors: sharing economic benefits with partners, ease of on- and off-chain integration, and depth of programmability. — Jelena Djuric, Co-founder & CEO, Noble

1.1 Behind the $240 Billion Supply

Stablecoins are among the most widely used products in crypto, with over $240 billion in supply and more than $7 trillion in annual on-chain transaction volume—rivaling traditional payment networks. Yet many figures warrant scrutiny.

Supply reflects how much exists, not how it’s used, moved, or applied. Transaction volume captures a mix of human and bot activity on-chain, missing off-chain flows entirely.

1.2 Usage as a New Signal

Not all stablecoins circulate efficiently. Some lie dormant as node collateral or staking assets; others drive real-world economic activity across platforms, users, and regions.

As highlighted in *The State of Stablecoins 2025*, usage patterns vary significantly across ecosystems. Ethereum-based stablecoins often serve as DeFi collateral and trading liquidity, while Tron-based ones are frequently used for remittances and payments in emerging markets. USDC dominates institutional capital flows, while USDT thrives due to reach and accessibility.

These usage patterns don’t just reveal capital flows—they offer builders opportunities to target underserved or high-growth niches.

Understanding stablecoin use cases and functional utility provides the clearest signal today: where stablecoins are truly being adopted, and where the next wave of innovation will emerge.

2. From Institutional Issuance to Market Distribution

Stablecoins will grow further as regulatory clarity opens doors for institutional investors. The next phase isn’t just about who has scale, but about business models across the stablecoin supply chain—issuers, distributors, and holders. In the next 12–24 months, we’ll see shifts and challenges in value chains and value capture. — Martin Carrica, Head of Stablecoins, Anchorage Digital

2.1 Historical Value of Issuers

In the early days, value capture centered on issuers. Maintaining a 1:1 peg at scale was difficult, and few issuers could manage it effectively.

Tether and Circle dominate not only as first movers but as rare entities capable of consistently managing large-scale issuance/redemption, reserves, bank partnerships, and market stress.

Monetization via reserve yields (mainly short-term U.S. Treasuries and cash equivalents) turns even modest interest rates into massive revenue. Early success compounds: exchanges, wallets, and DeFi protocols built around USDT and USDC reinforce network effects in issuance and liquidity.

2.2 Distribution as a Key Value Layer

Custody, liquidity, and redemption are no longer differentiators—they’re expected. As more issuers with similar capabilities enter, the issuer’s role diminishes.

What matters is what users can *do* with stablecoins. Thus, control is shifting from issuers to distributors.

Distributors—wallets, exchanges, and apps integrating stablecoins into real use cases—now wield influence and leverage. They own user relationships, shape experiences, and increasingly decide which stablecoins gain visibility.

And they’re monetizing this position. Circle’s recent IPO filing reveals it paid nearly $900 million to partners like Coinbase to integrate and promote USDC—over half its 2023 revenue.

Crucially, issuers now pay distributors—not the reverse.

(Circle S-1 Form)

Many distributors are upgrading their infrastructure: PayPal launched PYUSD; Telegram partnered with Ethena; Meta is revisiting stablecoin options; fintech platforms like Stripe, Robinhood, and Revolut are embedding stablecoins directly into payments, savings, and trading.

Issuers aren’t idle: Tether is building wallets and payment rails; Circle is going full-stack via payment APIs, developer tools, and infrastructure acquisitions—including launching the Circle Payment Network to create network effects.

But the trend is clear: distribution is now the strategic high ground.

We’re in a structural shift—a change in perspective: stablecoins are no longer seen as “crypto,” but as “global infrastructure”; a shift in utility, as institutions actively reshape products using these new rails; and an evolving competitive landscape.

— Ran Goldi, Senior Vice President, Payments & Networks, Fireblocks

2.3 Building Programmability and Precision

With stablecoin adoption rising, new infrastructure is emerging—focused on programmability, compliance, and shared value. Issuance alone is no longer enough. To stay competitive, stablecoins must adapt to the needs of platforms driving adoption.

The next generation includes programmable features like audit trails, compliance rules, and conditional transfers. These enable stablecoins to act as application-aware assets, automatically routing value to merchants, developers, LPs, or affiliates without off-chain agreements.

Each use case has unique demands: remittances prioritize speed and conversion; DeFi requires composability and collateral flexibility; fintech integration demands compliance and auditability. Emerging infrastructure stacks aim to meet these diverse needs, allowing the stablecoin layer to dynamically adapt—not offer one-size-fits-all solutions.

Critically, this infrastructure shift enables more precise value capture. Programmable flows mean value can be shared across the stack—not hoarded by issuers. Stablecoins are becoming dynamic financial primitives shaped by the incentive structures and architectures of their ecosystems.

3. On-Chain Stablecoin Use Cases

As value capture shifts downstream, distributors define actual usage.

Wallets, exchanges, fintech apps, payment platforms, and DeFi protocols determine which stablecoins users see, how they interact with them, and where utility is created. These platforms shape user experience and control demand-side economics.

Analyzing real-world usage in payments, savings, trading, DeFi, and remittances reveals who creates value, where friction exists, and which distribution channels work. This report focuses on on-chain stablecoin use cases, tracking flows across wallets and platforms to uncover the infrastructure and incentives shaping adoption.

Among known ("labeled") participants, stablecoin usage concentrates in three main environments:

-

Centralized Exchanges (CEX)

-

DeFi Protocols

-

MEV

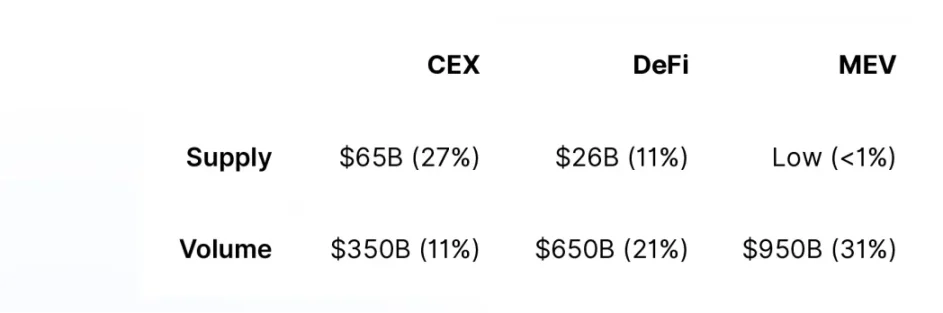

The table below shows supply and volume share by category in April 2025:

These three address types account for 38% of total stablecoin supply and 63% of total transaction volume.

Unlabeled addresses make up most of the remaining supply and volume. These wallets aren’t directly linked to known institutions, exchanges, or smart contracts. We explore unlabeled address trends later in this report.

3.1 Overall Stablecoin Market Overview

-

Total stablecoin supply: $240 billion

-

Total transaction volume (past 30 days): $3.1 trillion

-

Reserve income: $10 billion

A. Supply

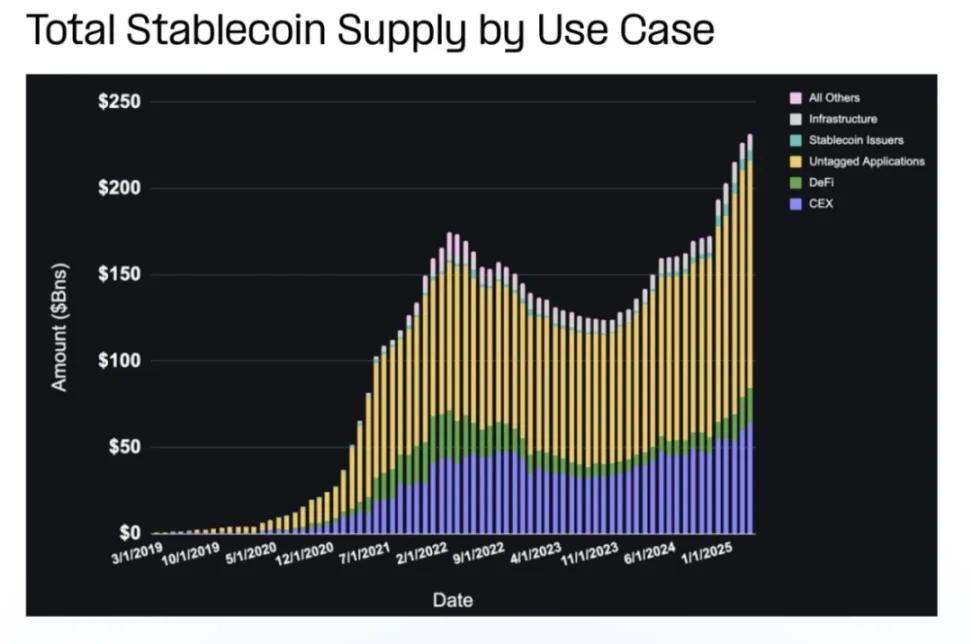

Supply distribution reveals which platforms and use cases attract and retain circulating volume. Since summer 2023, total stablecoin supply has steadily climbed to record highs, with strong growth in CEX, DeFi, and unlabeled wallets.

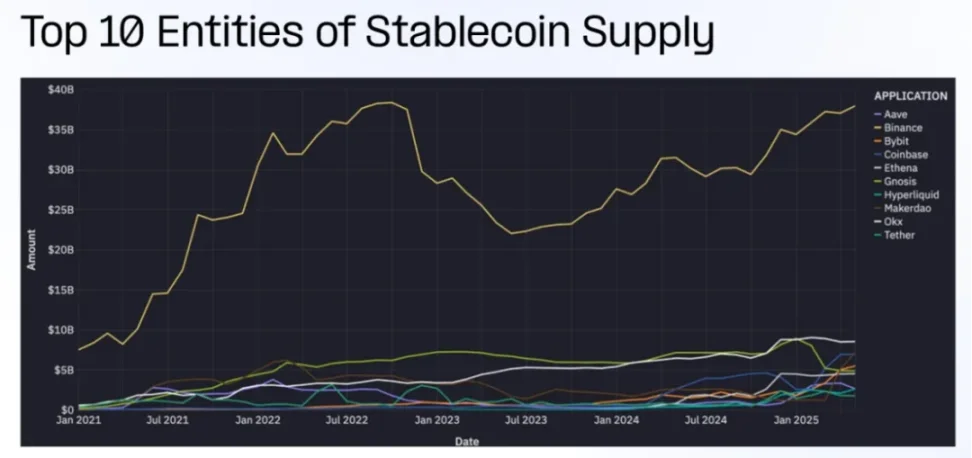

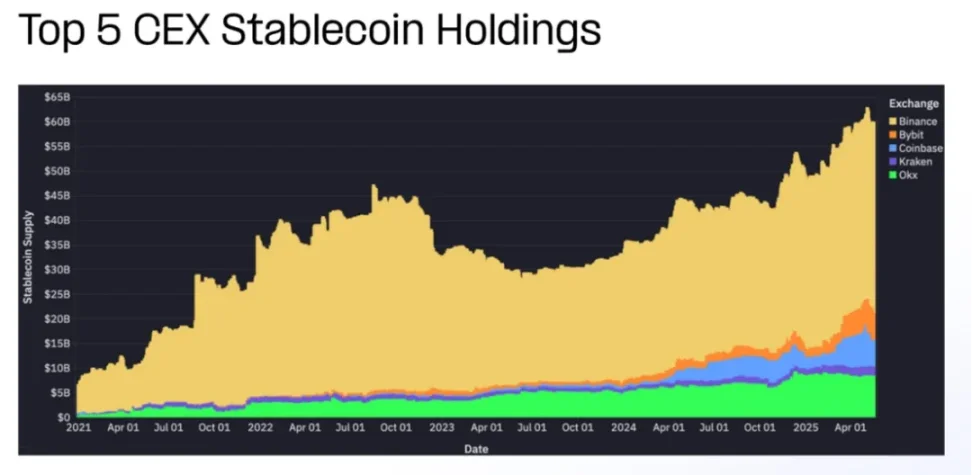

Most stablecoin supply is concentrated in centralized exchanges, led significantly by Binance. DeFi protocols and issuers also hold substantial shares.

B. Volume

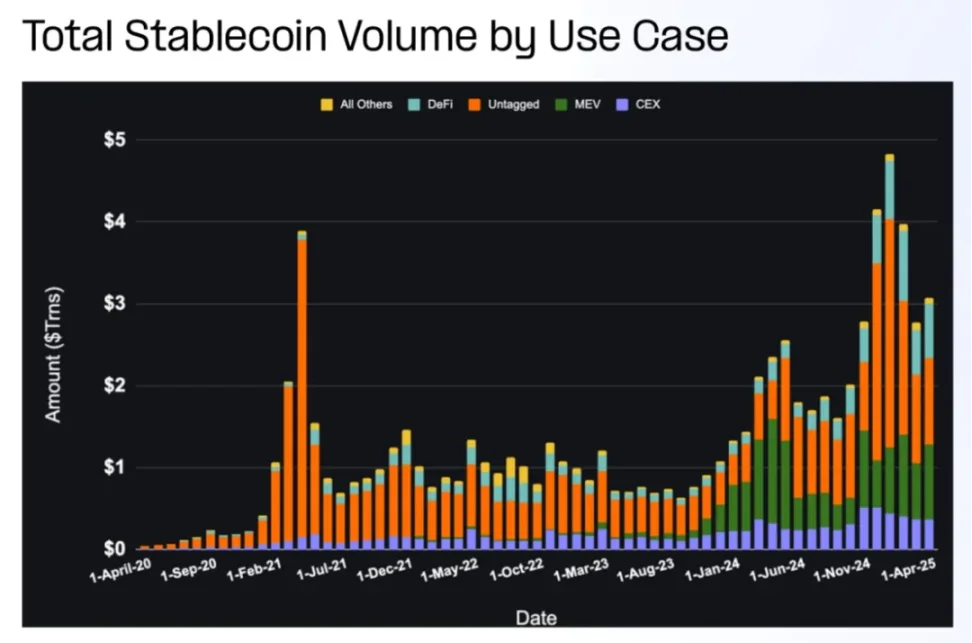

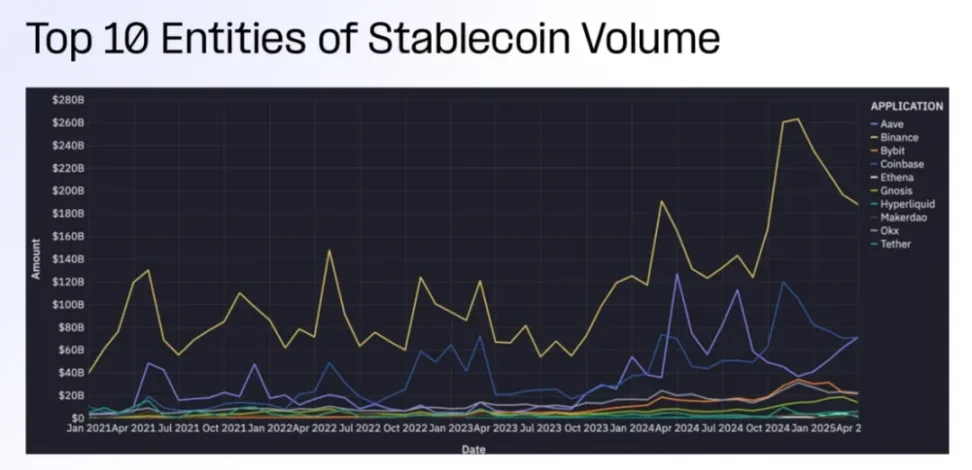

Since summer 2023, stablecoin transaction volume has risen steadily, spiking during periods of high market activity. DeFi saw the highest volume growth, while MEV and unlabeled wallets show higher but more volatile volumes.

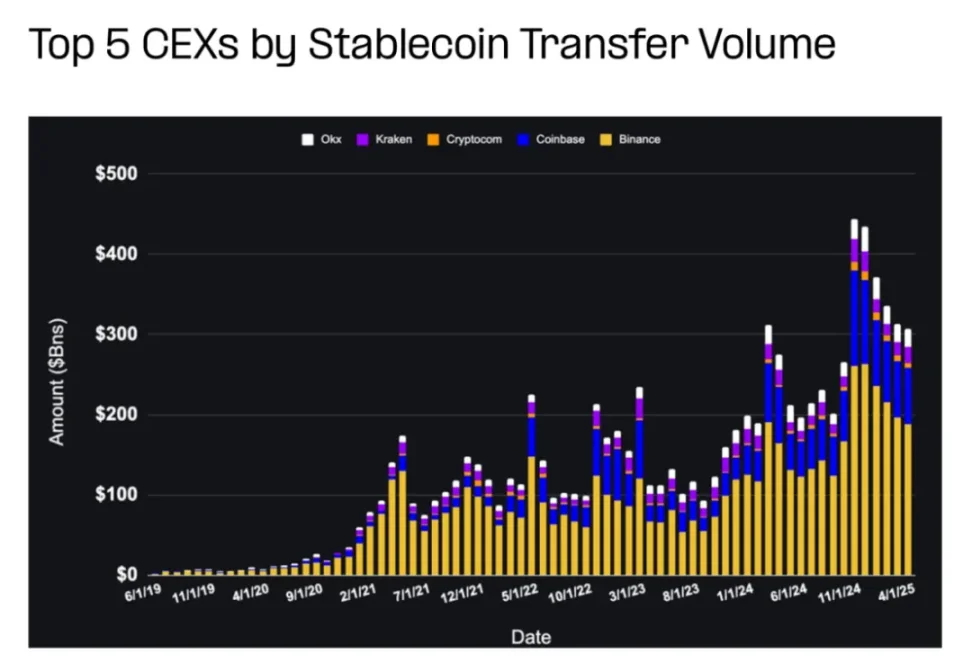

Entities with the highest stablecoin transaction volumes are typically centralized exchanges, followed by DeFi and issuers. CEX volume doesn’t reflect on-platform trading (most occurs off-chain), but rather deposits, withdrawals, inter-exchange transfers, and internal operations.

3.2 Centralized Exchanges (CEX)

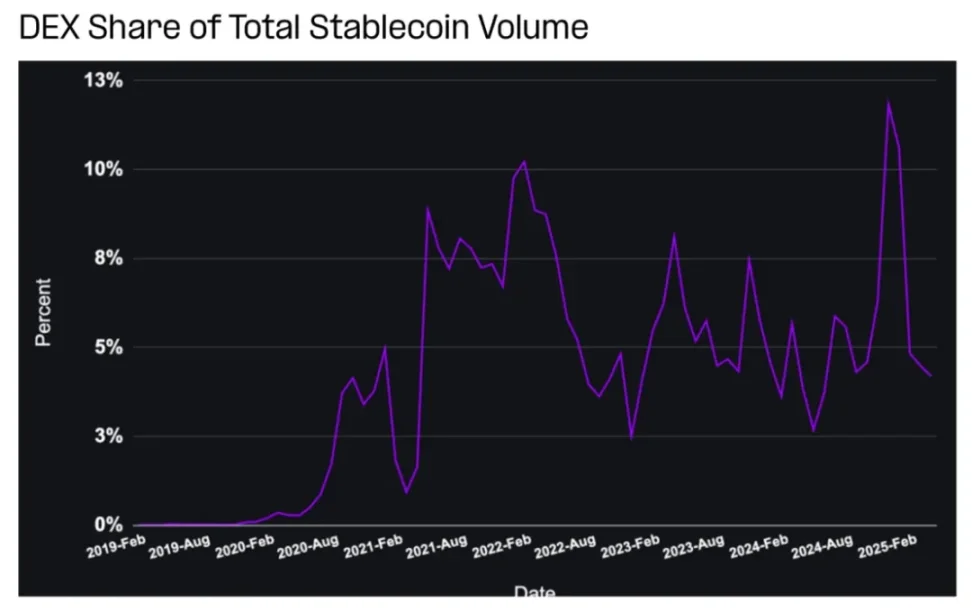

Stablecoins held on centralized exchanges represent a large portion of circulating supply. In terms of transaction volume, DeFi protocols and MEV-driven actors are currently most active, highlighting the growing role of on-chain applications and composable infrastructure.

-

Share of total stablecoin supply: 27%

-

Past 30 days, share of total stablecoin volume: 11%

-

Reserve income: $3 billion

Top centralized exchange (CEX) supply has nearly doubled since mid-2023 lows. Coinbase, Binance, and Bybit fluctuate with market cycles, while Kraken and OKX show steadier growth.

Because most activity occurs off-chain (on centralized ledgers), specific data on how CEXs use stablecoins is hard to obtain. Funds are often pooled, with little disclosure of usage. This opacity makes comprehensive assessment of stablecoin use within CEXs extremely difficult.

CEX-associated stablecoin transaction volume reflects on-chain activity related to deposits, withdrawals, inter-exchange transfers, and liquidity operations—not internal trades, margin collateral, or fee settlements. It’s best viewed as a proxy for user-exchange interaction, not total trading activity.

3.3 Decentralized Finance (DeFi)

-

Share of total stablecoin supply: 11%

-

Past 30 days, share of total stablecoin volume: 21%

-

Reserve income: $1.1 billion

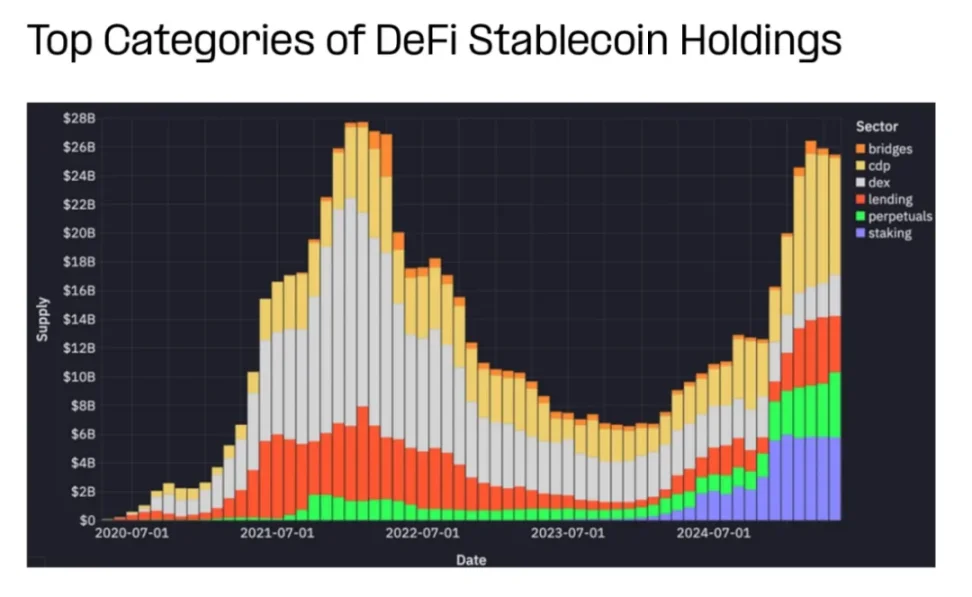

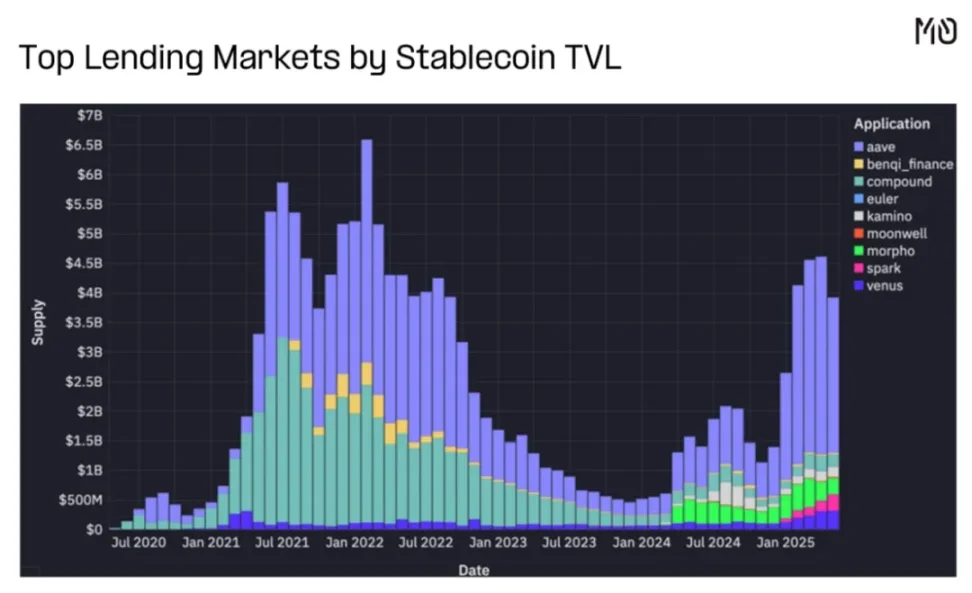

DeFi stablecoin supply comes from collateral, liquidity provider (LP) assets, and settlement layers in lending markets, DEXs, and derivatives protocols. Over the past six months, supply in CDPs, lending, perpetuals, and staking has nearly doubled.

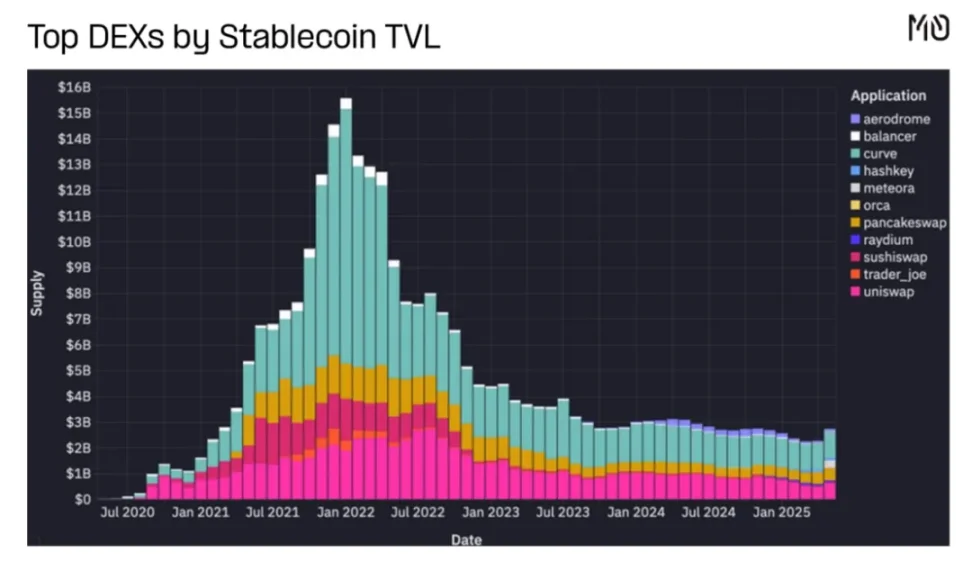

DEX supply share has dropped sharply—not due to declining usage, but because of higher capital efficiency. With Hyperliquid’s surge in popularity, supply locked in perpetual contracts has recently grown substantially.

Over the past six months, monthly DeFi stablecoin volume has risen from ~$100 billion to over $600 billion, driven by strong growth in DEXs, lending markets, and CDPs.

In DeFi, stablecoins are used across several key areas:

-

DEX Pools

-

Lending Markets

-

Collateralized Debt Positions

-

Others (including perps, cross-chain, staking)

Each area uses stablecoins differently—as liquidity, collateral, or payment—which affects user behavior and protocol-level economics.

A. DEX

Concentrated liquidity, stablecoin-centric DEXs, and cross-protocol composability reduce the need for high floating stablecoin balances.

Most DeFi stablecoin volume comes from DEXs. Their share of total volume fluctuates with market sentiment and trading trends. Recently, memecoin trading volume spiked above $500 billion—12% of total volume.

B. Lending Markets

Though lending has cooled from peak levels, Aave shows strong recovery, while new protocols like Morpho, Spark, and Euler are gaining traction.

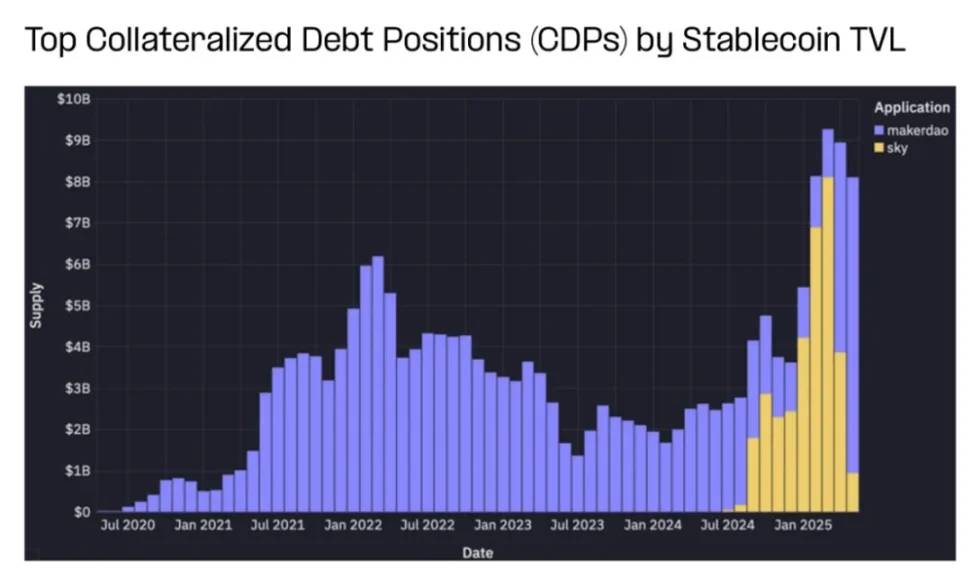

C. Collateralized Debt Positions

MakerDAO continues to manage one of DeFi’s largest stablecoin pools. Driven by high savings rates, DAI adoption keeps rising. Holding billions in stablecoins, it plays a crucial role in maintaining DAI’s dollar peg.

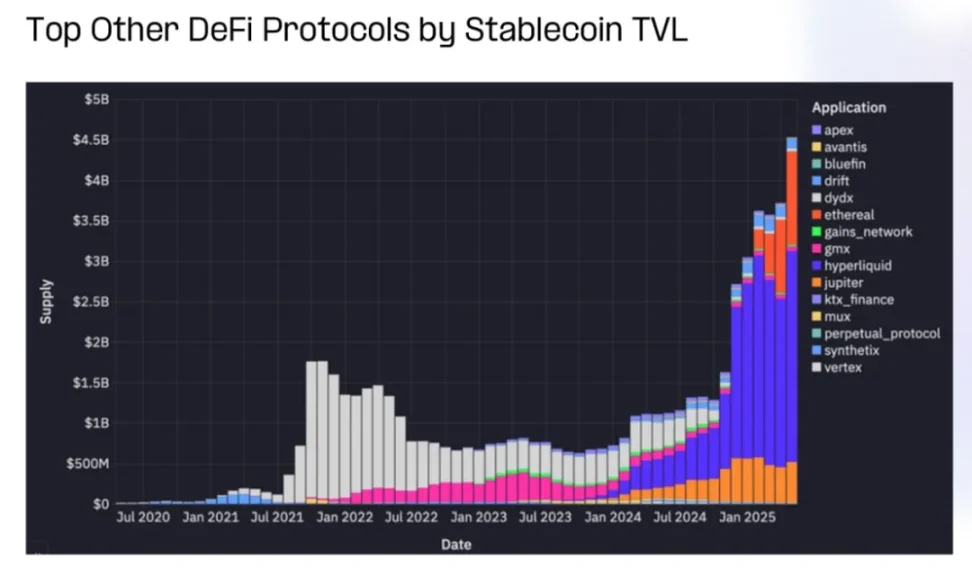

D. Others

Stablecoins are vital in supporting DeFi derivatives, synthetic assets, perpetual contracts, and trading protocols.

Supply rotates across perpetual contract protocols over time, currently concentrated in Hyperliquid, Jupiter, and Ethereal.

3.4 MEV Miners / Validators

-

Share of total stablecoin supply: < 1%

-

Past 30 days, share of total stablecoin volume: 31%

-

Reserve income: /

MEV bots extract value by reordering transactions. Their high-frequency behavior inflates on-chain volume, often recycling the same funds repeatedly.

The chart above separates MEV-driven activity to distinguish bot volume from human-driven volume. MEV volume spikes during high-activity periods and fluctuates as blockchains and apps evolve anti-MEV strategies.

Revenue forecasting for high-volume, low-floating use cases like MEV is less straightforward than for high-supply cases. Reserve yield models don’t apply well here, but such use cases can adopt various monetization strategies—transaction fees, spread capture, embedded financial services, or app-specific revenue models.

3.5 Unattributed Wallets

-

Share of total stablecoin supply: 54%

-

Past 30 days, share of total stablecoin volume: 35%

-

Reserve income: $5.6 billion

Activity in unattributed wallets is harder to interpret, as intent must be inferred or verified through private data. Still, these wallets hold the majority of stablecoin supply and often dominate transaction volume.

Unattributed wallets include:

-

Retail users

-

Undisclosed institutions

-

Startups and SMEs

-

Dormant or passive holders

-

Uncategorized smart contracts

While attribution models are imperfect, these "gray zone" wallets play an increasing role in real-world payments, savings, and operations—many falling outside traditional DeFi or exchange frameworks.

Some promising use cases emerging include:

-

P2P remittances

-

Startup treasury management

-

Dollar savings for individuals in inflationary economies

-

Cross-border B2B payments

-

E-commerce and merchant settlements

-

In-game economies

As regulatory clarity improves and payment-focused infrastructure attracts more capital, these use cases are expected to expand rapidly—especially in regions underserved by traditional banking.

See also: Artemis: On-the-Ground Data from Stablecoin Payment Adoption

Currently, we focus on the following high-level trends:

Though unattributed wallets number over 150 million, most hold negligible balances. Over 60% hold less than $1 in stablecoins, while fewer than 20,000 hold over $1 million.

When we shift focus to wallet balances, the picture flips entirely.

Fewer than 20,000 unattributed wallets with over $1 million in balance collectively hold over $76 billion—32% of total stablecoin supply.

Meanwhile, wallets with under $10,000 (over 99% of unattributed wallets) hold $9 billion total—less than 4% of supply.

Most wallets are small, but most unattributed stablecoins are held by a few high-value actors. This reflects the dual nature of stablecoin usage: broad grassroots adoption alongside deep concentration among institutions or whales.

4. Conclusion

The stablecoin ecosystem has entered a new phase—value is increasingly flowing to those building applications and infrastructure.

This marks a critical maturation: focus is shifting from the currency itself to the programmable systems that make it useful. With clearer regulation and a surge in user-friendly apps, stablecoins are poised for exponential growth. By combining fiat stability with blockchain programmability, they are becoming foundational to future global finance.

The future of stablecoins belongs to builders who create applications, infrastructure, and experiences that unlock their full potential. As this shift accelerates, we can expect greater innovation in how value is created, distributed, and captured across the ecosystem.

The financial world of tomorrow won’t be defined solely by stablecoins—but by the ecosystems built around them.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News