Behind the Rising Tide of Global Stablecoins, Cryptocurrency Is No Longer What It Once Was

TechFlow Selected TechFlow Selected

Behind the Rising Tide of Global Stablecoins, Cryptocurrency Is No Longer What It Once Was

Cryptocurrency has evolved from a speculative tool on the fringes of the mainstream financial system into an indispensable component of the global financial ecosystem.

Author: Zhong Yi, China Finance 40 Forum

Recently, global legislative progress on stablecoins has accelerated. On May 20, the U.S. Senate passed a procedural vote on the "Guiding and Establishing National Innovation with Stablecoins Act" (GENIUS Act). Just one day later, Hong Kong's Draft Stablecoin Ordinance was formally passed by the SAR Legislative Council and took effect on May 30, establishing a licensing regime for legal tender-backed stablecoin issuers in Hong Kong. Suddenly, the concept of stablecoins gained significant market attention.

In fact, CF40 research pointed out at the beginning of this year that "cryptocurrencies are no longer what they used to be." Cryptocurrencies have evolved from being fringe tools outside the mainstream financial system—once labeled as "money laundering instruments" or "speculative vehicles"—into emerging asset classes increasingly embraced by institutional investors, becoming an undeniable component of the global financial ecosystem. As the cryptocurrency market develops, regulation by major economies worldwide has gradually shifted from early focus on speculation and illicit activities toward more comprehensive and systematic multi-layered regulatory frameworks.

Stablecoins, as a key intersection between traditional finance and the crypto ecosystem, represent one of the most important directions in global cryptocurrency regulation in recent years. Recent legislative developments globally signal that their strategic importance and market scale will continue to rise. Yet stablecoins are just one category within the broader cryptocurrency landscape—an ever-evolving field where concepts and applications keep expanding.

By revisiting this article, we hope to help readers understand the development trajectory and potential trends of cryptocurrencies, deepening awareness and research in this domain. This article highlights that the mainstreaming of cryptocurrencies is driven by multiple factors including technological innovation, institutional participation, regulatory evolution, and shifts in social perception. Given the multidimensional complexity of cryptocurrencies and the fast-moving market with constant emergence of new concepts, there is an urgent need for our country to clarify fundamental concepts and operational mechanisms of cryptocurrencies, build a systematic research framework, and lay the foundation for effective regulation.

* The author is Zhong Yi from the China Finance 40 Forum Research Institute. The original article titled "Cryptocurrencies Are No Longer What They Used To Be" was first published on January 5, 2025, on the "CF40 Research" mini-program. Logging into the "CF40 Research" mini-program also allows further access to "Main Trends in Global Cryptocurrency Regulatory Policies." This article is copyrighted by the China Finance 40 Forum Research Institute. Unauthorized reproduction, copying, or citation in any form is strictly prohibited without prior written permission. Due to space constraints, references are omitted.

In 2009, Bitcoin (BTC), created by Satoshi Nakamoto, ushered in the era of decentralized digital currencies. Although this blockchain-based innovation sparked controversy due to its anonymity and early associations with speculation and illegal activities, it also demonstrated transformative potential for the financial system.

After 2014, Ethereum introduced smart contracts, expanding the boundaries of blockchain applications. The rise of specialized exchanges improved market infrastructure, while the Initial Coin Offering (ICO) boom helped shape regulatory frameworks. The emergence of stablecoins such as Tether (USDT) brought stability to the market.

In 2020, loose monetary policies globally prompted institutional investors to reassess and enter the cryptocurrency market. In January 2024, the approval of spot Bitcoin ETFs broadened mainstream investment channels into crypto assets. Notably, after Donald Trump won the U.S. presidential election, his campaign proposals to "make America the cryptocurrency capital of the world" and establish a Bitcoin reserve triggered strong market reactions, driving Bitcoin’s price above $100,000 and drawing widespread global attention and discussion about cryptocurrencies.

Today, cryptocurrencies like Bitcoin are gradually shedding earlier labels such as “money laundering tool” or “speculative instrument.” Their identity as a new asset class is now gaining recognition in mainstream markets, with Federal Reserve Chair Jerome Powell likening Bitcoin to “digital gold.”

These transformations prompt deeper reflection: How exactly has cryptocurrency evolved over the past decade?

Overview of Cryptocurrencies

(1) Three Distinct Types of Cryptocurrencies Have Emerged

Cryptocurrency refers to purely digital forms of money secured through cryptographic techniques. Typically operating on decentralized networks using blockchain technology as a public ledger, cryptocurrencies can be categorized into central bank digital currencies (CBDCs) and private cryptocurrencies based on the issuer.

CBDCs are issued and managed by central banks and serve as digital versions of national fiat currencies—for example, China’s Digital RMB (DCEP) issued by the People's Bank of China. Private cryptocurrencies, issued by non-governmental entities and not controlled by any central authority, are the focus of this article.

Since Bitcoin’s creation in 2009, thousands of cryptocurrencies have emerged, with new ones appearing daily. While all rely on decentralized consensus mechanisms and distributed ledger technologies, they differ significantly in design. Based on functionality and mechanism, private cryptocurrencies can be broadly classified into three categories: store-of-value cryptocurrencies, utility tokens, and stablecoins.

It should be noted that as an evolving field of innovation, the definitions and applications of cryptocurrencies continue to expand, making these classifications fluid. For instance, USDT functions both as a dollar-pegged stablecoin and, as an ERC-20 token on Ethereum, possesses characteristics of a utility token.

Type I: Store-of-Value Cryptocurrencies – exemplified by Bitcoin (BTC) and Litecoin (LTC). Originally designed for peer-to-peer electronic payments, these cryptocurrencies have largely transitioned into digital stores of value. They feature decentralization, trustlessness (transactions verified by the network rather than institutions), global transferability, and varying degrees of anonymity.

These cryptocurrencies typically operate on dedicated blockchains that do not support smart contracts or decentralized applications (DApps). They often enforce fixed supply caps to maintain scarcity—for example, Bitcoin’s cap of approximately 21 million coins and Litecoin’s limit of 84 million. Their prices are determined entirely by market supply and demand, unlinked to other assets.

Type II: Utility Tokens – represented by Ether (ETH), Solana (SOL), etc. Ethereum was the first blockchain platform to support smart contracts, enabling developers to create and deploy decentralized applications (DApps) and digital assets. This programmability vastly expanded blockchain use cases and gave birth to innovative fields such as decentralized finance (DeFi).

Tokens refer to any crypto assets running on existing blockchains such as Ethereum. Instead of building and maintaining their own networks, tokens exist “parasitically” on main chains like Ethereum, requiring ETH to pay transaction fees (gas fees) when issued or transferred.

Utility tokens can be further divided into three subcategories based on function:

First, Infrastructure Tokens. These are native tokens of smart contract-enabled blockchains, primarily used to sustain network operations and compensate for computational resources.

Ether is the most prominent example. Its use cases include paying network transaction fees, powering DApp environments, and participating in network validation via staking to ensure security.

Second, Service Tokens. A special type of utility token granting holders access to specific services or actions within a network. For example, Basic Attention Token (BAT), built on Ethereum’s ERC-20 standard, operates within the Brave browser ecosystem to reward users for viewing ads, pay ad costs, and tip content creators.

Third, Financial Tokens. These tokens facilitate various financial activities such as decentralized lending, trading, and crowdfunding. Holders often gain governance rights or share in platform revenues. Issuers may impose supply limits, vesting periods, and multi-signature controls. Binance Coin (BNB) is a typical case—holders receive discounts on trading fees.

Type III: Stablecoins – best represented by USDT and USDC. Designed to maintain price stability relative to specific assets or baskets, stablecoins differ from Bitcoin in that they must be pegged to external assets, with issuance and redemption managed by issuers according to market demand. There are four main types:

First, fiat-collateralized stablecoins—the most popular type—backed 1:1 by reserves of fiat currencies (e.g., USD, EUR), similar to a currency board arrangement. Examples include USDT and USDC, which are pegged to the U.S. dollar.

Second, commodity-backed stablecoins, tied to physical assets such as gold or silver. For example, PAX Gold represents one troy ounce of gold stored in secure vaults.

Third, crypto-collateralized stablecoins such as DAI and LUSD, which use over-collateralization to mitigate volatility of underlying crypto assets. For instance, DAI requires users to lock up $150 worth of ETH to mint $100 of DAI (a 150% collateral ratio).

Fourth, algorithmic stablecoins, which theoretically maintain price stability via smart contracts adjusting supply and demand without relying on collateral. However, real-world implementations have largely failed. Eichengreen (2018) identified inherent instabilities in so-called “algorithmic central banks,” a theory validated during the 2022 collapse of Terra/LUNA.

Beyond these three categories, blockchain has seen expansive applications. One notable example is non-fungible tokens (NFTs), representing unique digital certificates of ownership on the blockchain, each with distinct identifiers, indivisible and non-interchangeable.

NFTs are currently used in digital art (e.g., digital paintings, music, videos), virtual real estate (e.g., plots in metaverses), gaming items (e.g., rare equipment or characters), and digital collectibles (e.g., sports memorabilia).

For example, in March 2021, digital artist Beeple's work Everydays: The First 5000 Days sold for $69.3 million (approximately RMB 450 million) at Christie’s auction, marking a landmark moment for the NFT market.

In addition, there are crypto-based derivative assets, such as Bitcoin futures, Bitcoin futures ETFs, and Bitcoin spot ETFs.

(2) The Cryptocurrency Market Has Built a Unique Financial Innovation Ecosystem

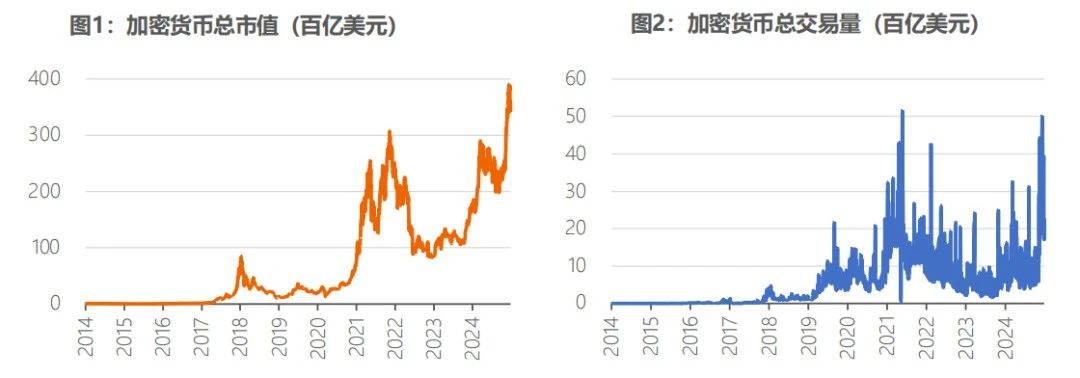

First, the market capitalization and trading volume of cryptocurrencies have grown significantly over the past decade.

As of December 28, 2024, CoinGecko tracked 16,022 cryptocurrencies across 1,200 exchanges globally, with total market capitalization reaching approximately $3.43 trillion and 24-hour trading volume around $165.3 billion.

In relative terms, this market cap equals about 5% of the total U.S. stock market value and 35% of China’s. In early 2014, the total global cryptocurrency market cap was only $10.6 billion—representing over a 300-fold increase in ten years.

Source: CoinGecko, as of December 28, 2024

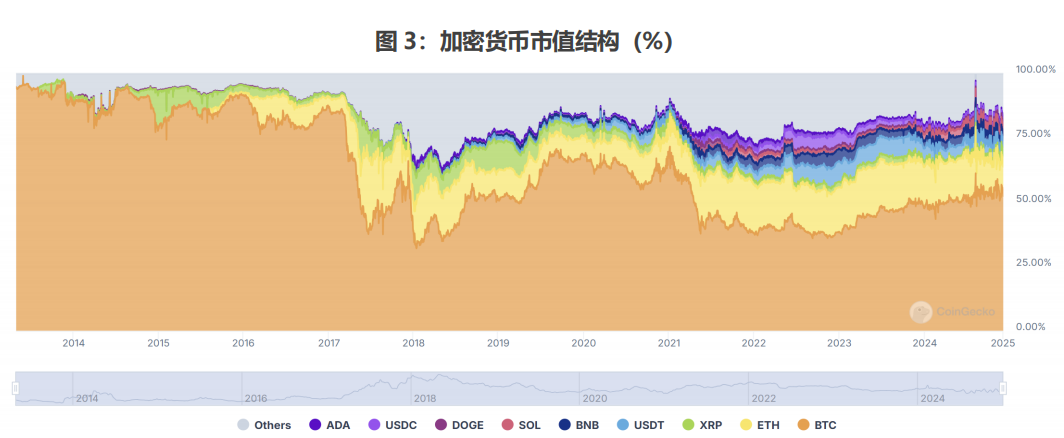

Second, while diversified, Bitcoin still dominates the market. As of December 28, 2024, the top three cryptocurrencies by market cap were Bitcoin ($1.87 trillion), Ether ($403.3 billion), and USDT ($138.6 billion), accounting for approximately 54%, 12%, and 4% of total crypto market cap respectively.

Over the past decade, the market has evolved from Bitcoin-dominated to increasingly diverse. Before 2017, Bitcoin held absolute dominance, exceeding 75% of total market cap. Between 2017–2018, Ethereum’s rise pushed ETH’s share to a peak of ~31%, while Bitcoin dropped to a historic low of ~33%.

Bitcoin later rebounded, rising back to ~70% in 2020 and stabilizing above 50% today, maintaining its dominant position. Meanwhile, stablecoins (USDT and USDC) grew from zero to 5%-7% market share, while newer cryptos like BNB and SOL also captured meaningful shares.

Source: CoinGecko, as of December 28, 2024

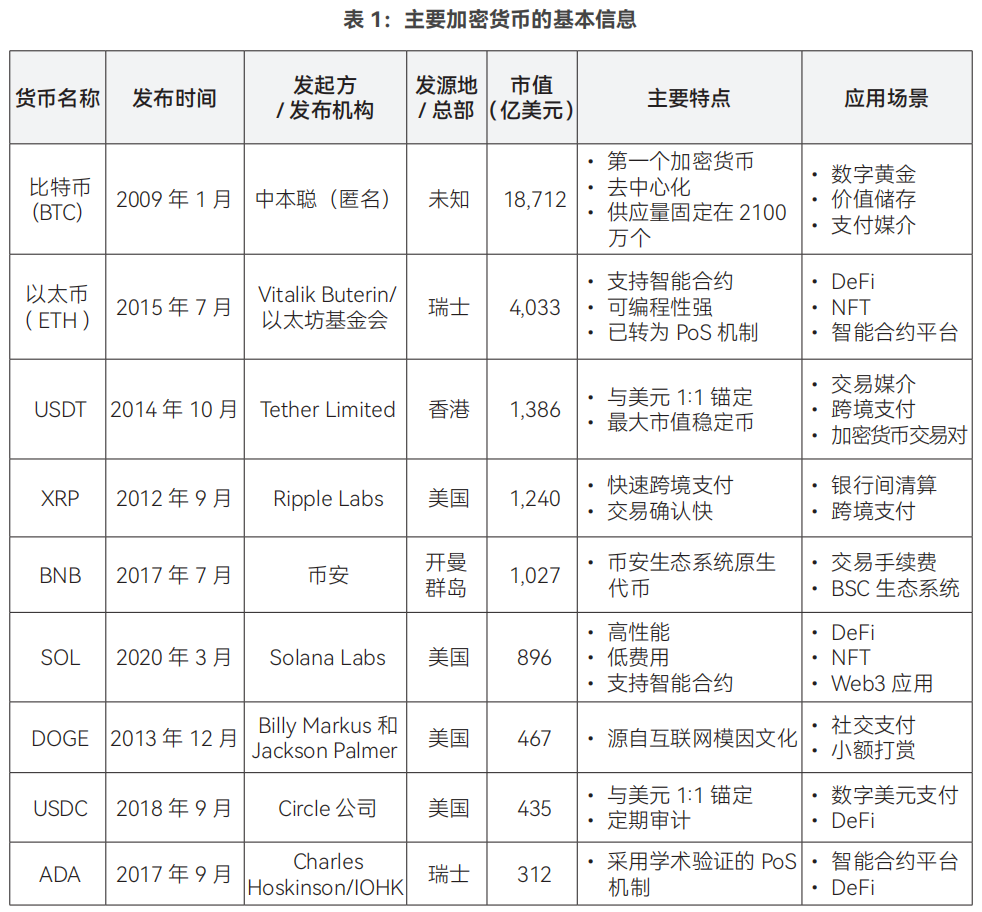

Sources: CoinGecko, as of December 28, 2024; compiled by author

Third, since 2022, stablecoins have begun to dominate trading volumes.

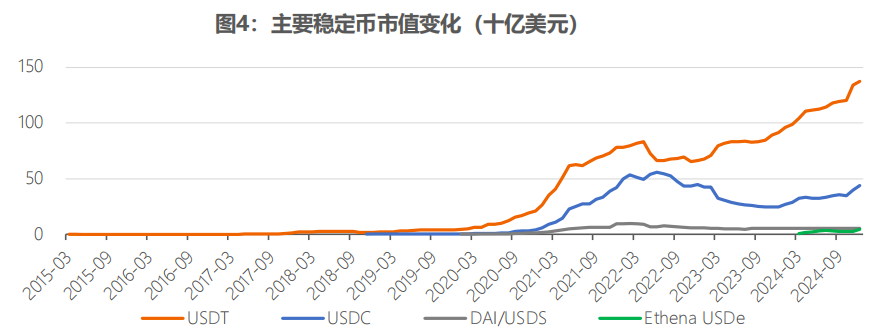

One, stablecoin market cap has steadily increased. Growth was slow before 2019 but exploded post-2020. By December 2024, total stablecoin market cap reached $211 billion, representing 6.12% of total crypto market cap.

USDT led with $138.6 billion (69% share), followed by USDC at $42.5 billion (22%). Together, they control over 90% of the market, indicating high concentration (Figure 4).

Source: CoinMarketCap, as of December 31, 2024

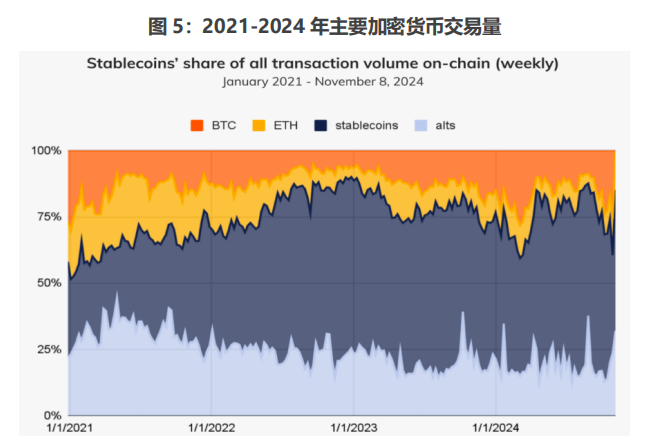

Two, stablecoin use cases are expanding. Despite comprising only 5%-7% of total market cap, stablecoins accounted for roughly two-thirds of all crypto trading volume recently (Figure 5). It is worth noting that these trades likely reflect asset exchange activity rather than everyday consumer payments.

Source: Chainalysis

Fourth, Decentralized Finance (DeFi) shows volatile upward momentum (Figure 6). DeFi offers financial services similar to traditional systems while achieving disintermediation (Table 2). As of December 28, 2024, the DeFi market cap reached $122.7 billion, about 3.6% of total crypto market cap.

Source: CoinGecko, as of December 28, 2024

In the early stage (2017–2019), DeFi applications were relatively simple, focusing on lending protocols and stablecoins. In 2020, projects like Uniswap surged under the “yield farming” trend. Around 2021, some migrated to high-performance, low-cost blockchains like Solana due to Ethereum congestion. In 2022, the collapse of Terra/LUNA caused a sharp decline in DeFi market cap, leading to industry consolidation. The market began stabilizing and recovering from 2023 onward.

Source: IMF, updated examples from original

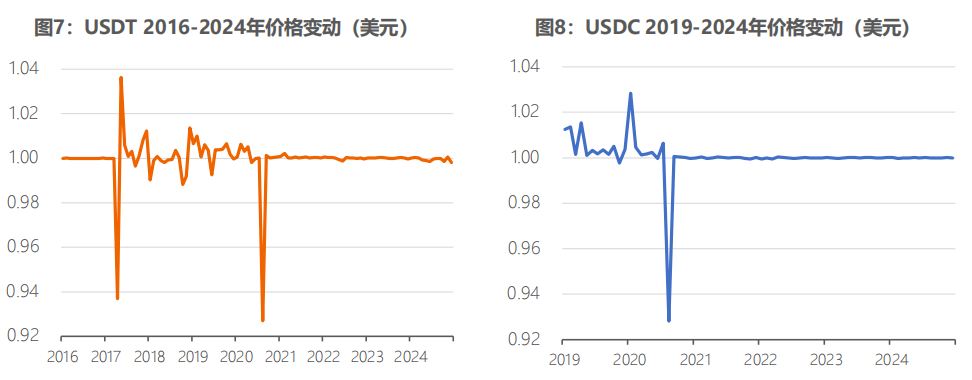

Fifth, cryptocurrency prices exhibit distinct trends. One, stablecoins USDT and USDC have largely maintained their $1 peg since 2021 (Figures 7 and 8).

Source: CoinMarketCap

Both experienced multiple deviations before 2021: Starting in 2017, concerns arose over Tether’s dollar reserves amid banking disputes involving its affiliate Bitfinex, triggering regulatory scrutiny. In 2020, pandemic-induced panic selling led to temporary de-pegging. Since 2021, enhanced reserve transparency and improved market mechanisms have stabilized their prices near $1.

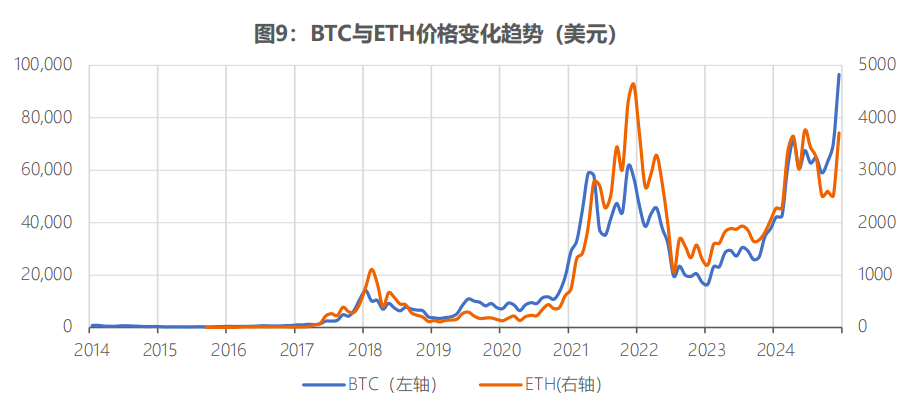

Two, cryptocurrency prices show strong internal correlation (Figure 9). Bitcoin and Ether move closely together, influencing broader market trends. Both are affected by macroeconomic factors such as global monetary policy, regulatory changes, and major events like the 2022 FTX exchange collapse, inflation expectations, etc.

Source: CoinGecko

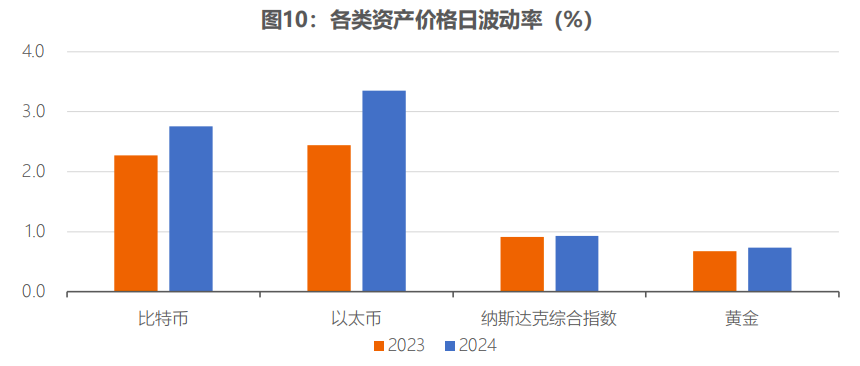

Three, cryptocurrencies are far more volatile than traditional financial assets (Figure 10). Comparing daily volatility: In 2023, Bitcoin’s daily volatility was 2.27%, 3.4 times that of gold (0.68%) and 2.5 times that of the Nasdaq Composite Index (0.91%). In 2024, volatility rose across all assets, with Bitcoin increasing to 2.76%—3.7 times gold (0.74%) and 3.0 times the Nasdaq (0.93%).

Sources: CoinGecko, WIND; calculations by author

Development Trajectory of the Cryptocurrency Market

The evolution of the cryptocurrency market has been shaped by institutional participation, regulatory developments, societal perceptions, and technological innovations.

(1) Early Development Phase (2009–2016): Technology in its infancy, traditional financial institutions skeptical, regulators focused on illicit activities

In 2009, Bitcoin was officially launched, initially spreading among tech enthusiasts and cryptography hobbyists who saw it merely as a technical experiment.

In May 2010, American programmer Laszlo Hanyecz famously paid 10,000 Bitcoins for two pizzas (worth $25, or about $0.0025 per BTC), marking Bitcoin’s first real-world transaction.

From 2010 to 2013, cryptocurrencies gradually moved from niche experiments into public view. First, market size expanded rapidly. Bitcoin hit $1 for the first time in February 2011, continued rising after its first halving in November 2012, reached $100 in April 2013, and surpassed $1,000 in November that year.

Second, technological innovation flourished. In 2012, Peercoin (PPC) pioneered the Proof-of-Stake (PoS) consensus mechanism, drastically reducing energy consumption—a model later adopted and refined by Ethereum and others. The Ethereum whitepaper introducing smart contracts was also published during this period.

Third, tentative commercial payment applications emerged. WordPress began accepting Bitcoin payments in November 2012 but discontinued them three years later, citing low adoption and noting that cryptocurrencies were more philosophical than practical. In October 2013, Canada installed the world’s first Bitcoin ATM, allowing CAD-BTC exchanges.

Fourth, foundational infrastructure like exchanges began forming. For much of Bitcoin’s early life, no formal exchanges existed; people traded mainly on forums like Bitcoin Talk. In October 2009, New Liberty Standard started publishing Bitcoin prices based on electricity cost, quoting 1,309.03 BTC per USD. In July 2010, Mt.Gox—the earliest mainstream exchange—launched and eventually handled about 70% of global volume. Later, platforms like OKCoin, Huobi, and Coinbase emerged.

From 2014 to 2016, the market entered a brief adjustment phase. First, security issues drew serious attention. In February 2014, Mt.Gox—the then-largest Bitcoin exchange—declared bankruptcy after a hacker attack, losing over 850,000 BTC. Bitcoin prices fell from over $1,000 in December 2013 to below $200 by January 2015.

Second, technological progress continued. In August 2015, Ethereum’s mainnet launch marked the beginning of the smart contract era. Smart contracts enabled automated execution of agreements, going beyond simple transfers and laying the groundwork for future DeFi development. In July 2016, Bitcoin underwent its second halving, sparking intense debate over how to scale the network to handle more transactions.

During this early phase, traditional financial institutions embraced blockchain technology but remained skeptical or negative toward cryptocurrencies. Institutions tended to separate blockchain from crypto assets, reflecting openness to technology but caution regarding the assets themselves.

Jamie Dimon, CEO of JPMorgan Chase, called Bitcoin a "terrible investment," while BlackRock CEO Larry Fink labeled it a "money laundering tool" in 2017—views representative of mainstream U.S. financial opinion at the time.

However, starting in 2015, traditional institutions began exploring blockchain applications. In 2015, NASDAQ launched Linq, a blockchain-based private equity trading platform. The R3 blockchain consortium attracted around 50 major global financial institutions, including Morgan Stanley and Goldman Sachs. Numerous blockchain-based innovation projects emerged.

Lael Brainard, Federal Reserve Board member, stated in 2016 at an IIF event that the Fed had a 300-person team actively researching blockchain and tracking market developments.

Between 2013 and 2016, countries focused on risks related to speculation, anti-money laundering (AML), counter-terrorism financing (CTF), and transaction security, establishing preliminary regulatory frameworks.

The U.S. prioritized speculation and consumer protection. FinCEN issued cryptocurrency guidance in 2013, defining it as a "payment medium" and requiring exchanges to conduct KYC checks and register as Money Services Businesses (MSBs). The IRS declared in 2014 that cryptocurrencies are property, not currency, subject to capital gains tax. The CFTC classified cryptocurrencies as commodities, regulating market manipulation under the Commodity Exchange Act (CEA). New York introduced the BitLicense framework in 2015, mandating licenses for firms operating in-state. Japan recognized cryptocurrencies as legal payment methods.

The Japanese Financial Services Agency (FSA) added a chapter on "virtual currency" to the Payment Services Act in May 2016, legally recognizing it as a valid payment method and offering legal protection to exchanges. Supporting regulations, including the Enforcement Order of the Fund Settlement Law, were released on March 24, 2017, detailing rules for fund transfers and clearing.

In Europe, the European Banking Authority (EBA) warned in 2013 about risks such as exchange failures, hacking, and price volatility. In 2016, the EU Commission proposed including cryptocurrencies and exchanges under its AMLD4 directive. After two years of discussion, the EU formally adopted the Fifth Anti-Money Laundering Directive (AMLD5) in June 2018, bringing crypto into the regulatory fold for the first time.

(2) ICO Bubble Period (2017–2018): ICO frenzy drives growth, fundraising booms alongside fraud and scams, prompting tighter regulation

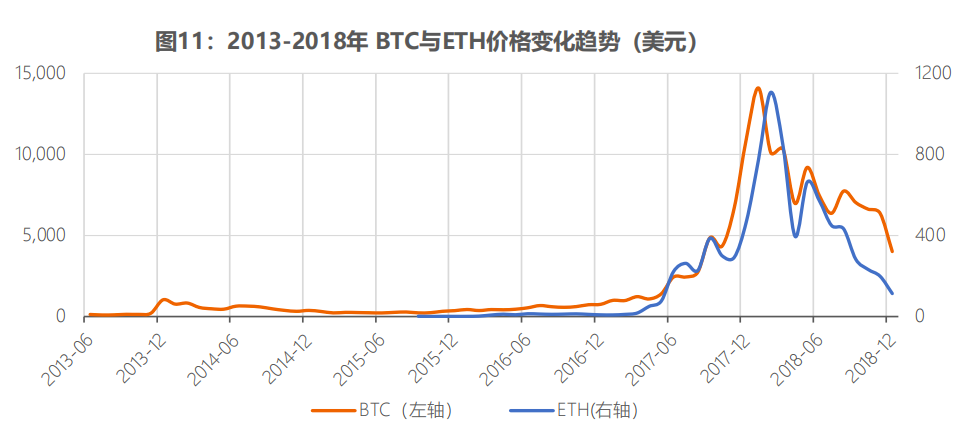

The cryptocurrency market experienced a short bull run in 2017–2018 (Figure 11), briefly peaking in market cap—mainly fueled by the ICO craze.

Source: CoinGecko

An Initial Coin Offering (ICO) is an innovative fundraising mechanism in the crypto space, where project teams issue new cryptocurrencies on a blockchain to raise established cryptos like Bitcoin or Ether.

Mastercoin made the first ICO attempt in 2013. Ethereum’s successful 2014 ICO raised $18 million and garnered wide attention. As Ethereum became the primary ICO platform, its price rose, attracting media spotlight and retail investors, turning “blockchain” into a buzzword.

But due to lack of regulation, rampant speculation, and technical flaws, the ICO bubble burst in 2018. In May 2016, The DAO, an Ethereum-based project, raised about $152.3 million via ICO but suffered a hack a month later due to a smart contract vulnerability, losing ~3.6 million ETH. Many low-quality projects failed or turned out fraudulent, causing ICOs to become synonymous with “Ponzi schemes.”

According to cybersecurity firm CipherTrace, losses from ICO-related exit scams, fake trades, hacks, and Ponzi schemes totaled $750 million in 2018. The Russian Association of Cryptocurrency and Blockchain (RACIB) reported that Russia raised $300 million via ICOs in 2017, half of which were Ponzi schemes.

Governments reevaluated cryptocurrencies and tightened ICO oversight. In April 2017, seven Chinese regulators jointly announced a ban on all token offerings and required unwinding of existing ones. In July 2017, the U.S. SEC issued a statement using The DAO as a case study, emphasizing the need for compliance. The SEC clarified that some ICOs qualify as securities and must follow relevant laws, warning of fraud, market manipulation, and false promises of high returns with low risk. It particularly cautioned against unregistered or unlicensed operations. The SEC also suspended problematic ICOs like CIAO and First Bitcoin Capital. Under combined pressure from declining project quality and regulatory crackdowns, the rally ended with speculative capital exiting and a sharp market correction.

At this stage, cryptocurrencies saw limited usage as payment tools and were associated with illicit activities. Athey et al. (2016) found that active Bitcoin usage did not grow quickly by mid-2015—few users actually used Bitcoin for daily payments, with most holding it as an investment.

Foley et al. (2019) showed that between January 2009 and April 2017, illegal activities constituted a large portion of Bitcoin usage: about 26% of users and 46% of transactions linked to illicit purposes. In transaction value terms, ~23% of total volume and ~49% of Bitcoin holdings were tied to illegal activity.

Based on their estimates, by April 2017, around 27 million Bitcoin participants used it primarily for illegal purposes, collectively holding $7 billion in Bitcoin and conducting ~37 million annual transactions valued at ~$76 billion.

As an asset, cryptocurrencies showed little correlation with traditional financial assets, driven instead by internal and market-specific uncertainties. Bianchi (2020) analyzed data from 14 major cryptocurrencies between April 2016 and September 2017, finding no clear link between crypto returns and equities or bonds. Crypto trading volumes were mainly driven by historical price movements and market uncertainty.

In late 2017, the Chicago Board Options Exchange (CBOE) and the Chicago Mercantile Exchange Group (CME) launched cash-settled Bitcoin futures, enhancing trading activity and price discovery.

(3) Institutional Investment Era (2019–2021): Amid abundant global liquidity, institutional investors began adding cryptocurrencies to portfolios

Indeed, institutional attitudes had already begun shifting subtly around 2018.

Fidelity established Fidelity Digital Assets in 2018, preparing to offer custody and trading services for institutional clients. In 2019, JPMorgan launched JPM Coin, a digital currency for instant settlement between clients (though CEO Jamie Dimon continued criticizing Bitcoin as late as 2024).

A fundamental shift in institutional sentiment began in 2020, with more traditional financial firms offering positive assessments and strategic positioning.

First, pandemic-driven quantitative easing heightened inflation fears, pushing institutions to seek new hedges. Bitcoin rebounded from its March 2020 “Black Thursday” low of $3,800 and broke $20,000 by year-end. During this phase, institutional-grade infrastructure—including custody, trading, and settlement—matured, improving industry compliance and security, paving the way for institutional entry.

Second, institutions shifted from outright rejection to cautious engagement, deepening participation over time. In May 2020, renowned investor Paul Tudor Jones announced he was using Bitcoin as an inflation hedge. Investment giants like BlackRock entered the crypto space—CEO Larry Fink evolved from calling Bitcoin a “money laundering tool” in 2017 to describing it as a “global asset.” In March 2021, Morgan Stanley became the first major U.S. bank to offer Bitcoin fund access to wealthy clients (managing $4 trillion in client assets); Goldman Sachs soon followed.

Payment giants integrated into the crypto ecosystem: PayPal enabled users to buy, hold, and sell crypto in October 2020, extending service to Venmo users in early 2021. Digital payments company Square supported crypto on Cash App and purchased $50 million in Bitcoin as treasury reserves. In March 2021, Visa allowed crypto settlements on its network.

Public companies like MicroStrategy began allocating to Bitcoin, purchasing $250 million worth in August 2020 and repeatedly increasing holdings, funding purchases via convertible bonds and stock offerings. As of December 15, 2024, it held ~439,000 BTC. Tesla also bought $1.5 billion in Bitcoin in early 2021.

Third, clearer regulatory frameworks accelerated crypto mainstreaming. In 2020, the U.S. Office of the Comptroller of the Currency (OCC) allowed federally chartered banks to provide crypto custody services, lowering technical barriers and risks for individual users while opening new business lines for traditional institutions. BNY Mellon, State Street, JPMorgan, and Citigroup—the global Big Four—are expected to begin offering crypto custody by 2025, collectively managing over $12 trillion in assets.

The CFTC treats crypto as commodities, overseeing new derivatives approvals. The SEC maintains strict oversight, targeting ICOs deemed unregistered securities—e.g., Telegram’s TON project was shut down and paid an $18.5 million settlement.

The EU proposed the Markets in Crypto-Assets (MiCA) regulation in September 2020, aiming to establish a unified regulatory framework across member states.

(4) Structural Transformation (2022): Major risk events triggered deep market corrections

First, the market plunged after hitting record highs. Driven by institutional and retail demand, Bitcoin climbed from $30,000 at the start of 2021 to nearly $68,000 in November, while Ether surpassed $4,800. But in 2022, Fed rate hikes, the Terra/LUNA crash, and FTX’s collapse sent Bitcoin down to $16,000.

Second, the crisis forced the industry to reevaluate systemic risk management. In May 2022, the Terra LUNA ecosystem collapsed. Within days, LUNA plummeted from $119 in April to near zero, while its algorithmic stablecoin UST severely de-pegged, wiping out over $40 billion in market value. This exposed fundamental flaws in algorithmic stablecoins: overreliance on market confidence and insufficient external backing.

The crash significantly impacted the market, dragging down Bitcoin, Ether, and others, triggering cascading effects. Prominent crypto hedge fund Three Arrows Capital (3AC), heavily leveraged in LUNA and other cryptos, went bankrupt, defaulting on billions owed to Voyager Digital and Genesis Trading. Centralized lender Celsius froze withdrawals and filed for bankruptcy in June 2022, revealing a $1.2 billion shortfall. Voyager Digital also sought bankruptcy protection after 3AC defaulted.

The crisis peaked in November 2022 when FTX, the world’s second-largest crypto exchange, and its affiliate Alameda Research were revealed to have severe financial problems, including misappropriating customer funds and using FTT tokens as primary loan collateral. Market panic ensued, collapsing FTX from a $32 billion valuation to bankruptcy within a week.

These incidents revealed deficiencies in centralized institutions’ risk management, fund segregation, and corporate governance—especially excessive leverage, maturity mismatches, and weak internal controls.

Third, market turmoil caused divergence in institutional crypto involvement. Some scaled back: Tesla sold 75% of its Bitcoin holdings (~$936 million) in Q2 2022, citing liquidity needs. Several banks paused or reduced crypto services after FTX’s fall.

Conversely, institutions viewing crypto as a long-term strategic play doubled down. MicroStrategy kept accumulating Bitcoin during the downturn. Fidelity Digital Assets officially launched Ether trading, custody, and transfer services for institutions in October 2022.

Fourth, core technology continued advancing as planned. In September 2022, Ethereum completed “The Merge,” transitioning its consensus from Proof-of-Work (PoW) to Proof-of-Stake (PoS). This cut Ethereum’s energy consumption by over 99.9%, shifting block production from energy-intensive mining to stake-based validation. Post-upgrade, validator numbers and staking demand rose, signaling community confidence in PoS.

Ethereum’s Layer 2 scaling solutions advanced notably, with Arbitrum and Optimism processing transactions off-chain to reduce user costs and improve performance. Cross-chain bridge security, decentralized identity (DID) standards, and zero-knowledge proof privacy technologies also matured, strengthening Web3 infrastructure.

Fifth, industry shocks accelerated regulatory legislation. Japan began discussing stablecoin regulation in 2019. After the May 2022 Terra/LUNA collapse, it sped up efforts and passed amendments to the Fund Settlement Law in June 2022, comprehensively regulating stablecoin issuance, circulation, and redemption. The EU formally adopted MiCA in 2022—the world’s first comprehensive crypto regulatory framework, covering issuance standards, service provider rules, and market conduct.

(5) Stable Development Phase (2023–2024): Market stabilization, mature regulatory frameworks, and approval of spot Bitcoin ETFs broaden access

First, the market gradually recovered after major crises. Negative impacts from FTX’s 2022 collapse faded. Bitcoin rebounded from $16,000 at end-2022, surpassing $70,000 in March 2024, a new high. Market structure improved: Centralized Exchanges (CEXs) enhanced transparency. To rebuild trust and meet regulatory demands, many (e.g., Binance, Coinbase) implemented Proof of Reserves to verify proper asset custody. Meanwhile, Decentralized Exchanges (e.g., Uniswap, SushiSwap) offered more diverse trading options.

Second, crypto applications and infrastructure kept evolving, accelerating innovation. Ethereum’s Layer 2 ecosystem (Polygon, Arbitrum, Optimism) expanded. NFTs innovated continuously in branding, gaming, and art. Blockchain infrastructure began integrating AI capabilities for automated smart contracts and risk monitoring. Bitcoin explored transformation from a static chain to a multifunctional ecosystem. New application forms like Decentralized Social (DeSoc) emerged. Decentralized Physical Infrastructure Networks (DePIN) saw explosive growth in 2024, with total market cap exceeding $40 billion (+132% YoY), showing promise in telecom, mobility, and energy sectors.

Third, crypto regulation matured further, and Bitcoin officially entered the mainstream investment arena. The U.S. SEC shifted from restrictive to increasingly accommodating—from strict ICO enforcement in 2017, repeated denials of Bitcoin ETF applications in 2019, approval of Bitcoin futures ETFs in 2021, to finally approving spot Bitcoin ETFs in January 2024 for 11 firms including BlackRock and Fidelity—opening compliant pathways for institutional investors. The EU began implementing MiCA in 2023. Hong Kong introduced a new Virtual Asset Service Provider (VASP) licensing regime and allowed retail investors to trade ETF products.

Fourth, traditional financial institutions entered en masse, accelerating convergence between crypto and traditional finance. One, traditional investors expanded crypto access. In June 2023, BlackRock filed with the SEC for a spot Bitcoin ETF, followed by others, approved in January 2024. According to Messari, crypto lobbying spending surged in 2024, totaling $200 million—ranking among the top five industries in lobbying expenditure.

Two, institutional investment achieved tangible breakthroughs. Post-launch, Bitcoin ETFs performed strongly with sustained inflows. By 2024, the spot Bitcoin ETF market reached ~$100 billion. BlackRock’s IBIT set records, surpassing $3 billion in AUM in its first month and reaching $40 billion within 200 days.

Three, traditional institutions began engaging in tokenization of real-world assets, stablecoins, and other areas. Sky (formerly MakerDAO) and BlackRock launched on-chain money market funds. Ondo Finance’s USDY (tokenized Treasury fund) reached $440 million in AUM. Institutions explored blockchain’s potential to reduce costs, enhance transparency, and improve payment efficiency. PayPal issued its PYUSD stablecoin on the Solana network.

Four, institutional investors generally expressed optimism. According to Fidelity’s 2023 survey of institutional investors, 51% had already invested in digital assets. Their rationale: If digital assets become mainstream stores of value, the market opportunity could vastly exceed current levels. Gold’s market cap exceeds $18.5 trillion, and Bitcoin’s market cap as a percentage of gold’s has risen from 1.6% in 2020 to nearly 10% by November 2024.

With more traditional investment vehicles like ETFs available, investing in digital assets will become easier, potentially accelerating Bitcoin’s growth. According to PwC’s 2024 survey of hedge fund digital asset investments, hedge funds are increasing allocations, driven by improved regulatory clarity, new investment tools (especially ETFs), growing investor interest, and mainstream institutional adoption.

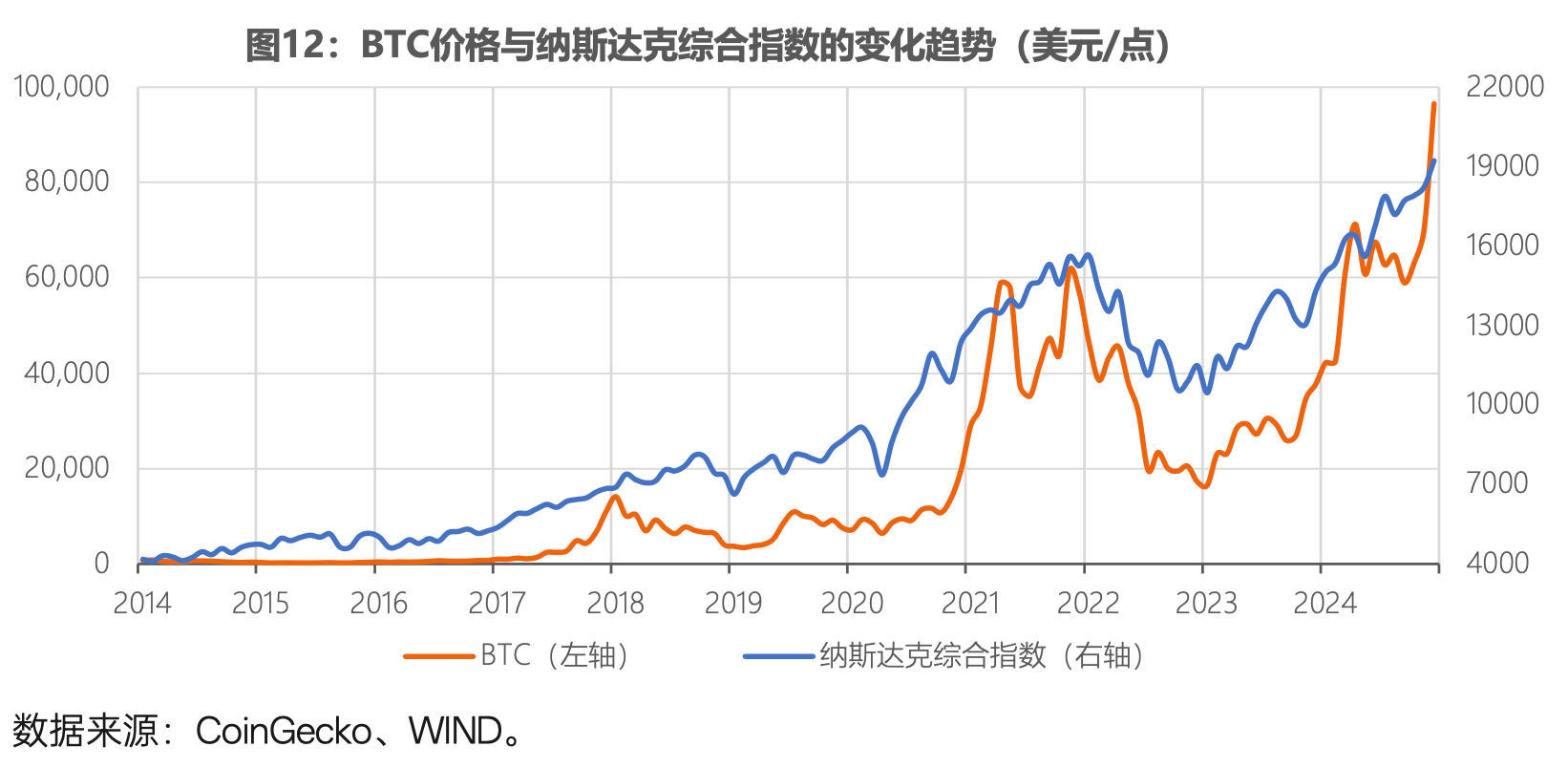

Five, Bitcoin demonstrated gold-like safe-haven properties under certain conditions (Figures 12 and 13). After 2020, the relationship among Bitcoin, gold, and the Nasdaq Index changed markedly. During the early pandemic (March–April 2020), all three dipped briefly then rebounded—but at different paces: Nasdaq surged first on tech strength, gold rose steadily on safe-haven demand, and Bitcoin fluctuated most sharply. During the global liquidity expansion (late 2020 to early 2021), Bitcoin and Nasdaq showed strong positive correlation, highlighting Bitcoin’s risk-asset nature, while gold diverged after peaking in August–September 2020, entering a pullback. In 2021’s inflation surge, the divergence intensified: Nasdaq hit new highs, Bitcoin had two strong rallies, while gold lagged.

When the Fed began hiking rates in 2022, both Nasdaq and Bitcoin fell sharply, especially after the FTX collapse worsened Bitcoin’s decline, while gold showed greater resilience due to safe-haven demand. During the March 2023 U.S. regional banking crisis (Silicon Valley Bank failure), Bitcoin and gold showed strong positive correlation, both rising on safe-haven flows, while Nasdaq resumed its uptrend after short-term swings. This evolution suggests that Bitcoin, once highly correlated with Nasdaq as a risk asset, is now beginning to exhibit gold-like safe-haven behavior in certain market environments.

Prior studies have suggested Bitcoin has hedging capabilities similar to gold (Dyhrberg, 2016) and can act as an inflation hedge (Blau et al., 2021; Choi and Shin, 2022).

This view is echoed by institutional players. BlackRock expressed similar views in October 2023 and September 2024, arguing that Bitcoin’s long-term return drivers fundamentally differ from—and sometimes oppose—those of traditional asset classes. With global investors facing rising geopolitical tensions, worsening U.S. debt crises, and political instability, Bitcoin may be seen as a unique hedge against fiscal, monetary, and geopolitical risks. Federal Reserve Chair Powell publicly stated in December 2024 that Bitcoin “is like gold, except it’s virtual and digital.”

Conclusion and Reflection

The cryptocurrency market is undergoing profound transformation. Reviewing its trajectory, it has evolved from a speculative tool outside the mainstream financial system into an indispensable part of the global financial ecosystem.

This transformation—both profound and rapid—is driven by technological innovation, institutional participation, regulatory evolution, and changing social perceptions. Today’s cryptocurrency market presents a fundamentally new picture across multiple dimensions.

First, cryptocurrencies have transformed from pure technological experiments into a sizable asset class. Today, total crypto market cap exceeds $3 trillion—about one-third of China’s A-share market value. Just a decade ago, it stood at barely over $10 billion. Fifteen years ago, Bitcoin itself had not yet been introduced. Bitcoin has evolved from a niche product for tech enthusiasts into the world’s seventh-largest asset, surpassing silver and energy giant Saudi Aramco in market value.

Second, the market has evolved from Bitcoin-dominated to a diverse crypto ecosystem—and continues to evolve. One, the number of cryptocurrencies is vast: CoinGecko tracks over 16,000, with 1,200 exchanges. Two, the crypto ecosystem has developed infrastructure mirroring traditional finance (Table 2), enabling trading, lending, and investment—core functions of conventional finance.

Three, cryptocurrency functions have diversified. Early Bitcoin focused on value storage and payments. With Ethereum and smart contracts emerging in 2014–2015, applications expanded dramatically, spawning DeFi, NFTs, DeSoc, DePIN, PayFi, and other novel use cases. Stablecoins aim to solve excessive price volatility and improve payment efficiency and cost. According to Visa and Castle Island Ventures, stablecoin circulating supply exceeded $160 billion by 2024—up from mere billions four years earlier.

Third, crypto finance and traditional finance are increasingly intersecting and converging. Initially, Bitcoin and other cryptos aimed to be decentralized alternatives to central banks and banking systems. Now, the boundary between crypto and traditional financial services is blurring.

This convergence manifests in various ways: Fiat-collateralized stablecoins resemble currency board arrangements, backed by actual USD or EUR reserves. JPMorgan launched JPM Coin in 2019 for client settlements. Starting in 2020, payment giants like PayPal and Visa began supporting crypto payments. Since 2020, U.S. banks have been allowed to offer crypto custody. Institutions like BlackRock launched on-chain money market funds. The crypto financial system appears to be shifting from a full alternative to traditional finance (“competitor”) to a collaborative partner (“collaborator”).

Fourth, the crypto market is transforming from a retail-driven speculative arena into an emerging asset class embraced by institutional investors and moving toward mainstream acceptance. Initially, major financial institutions viewed cryptos negatively—as “money laundering tools” or “speculative instruments.” But as Bitcoin and Ether prices rose and global QE heightened inflation fears, institutions began seeking new hedges. Starting in late 2020, giants like BlackRock and Fidelity entered the space. Traditional firms like MicroStrategy began allocating to Bitcoin.

Larry Fink’s dramatic reversal on crypto reflects a broader shift among large institutions. These players then actively pushed for mainstream adoption. After years of applications and rejections, the U.S. SEC finally approved spot Bitcoin ETFs in January 2024 for 11 firms including BlackRock, creating compliant avenues for investor participation. Stable long-term capital helps reduce market volatility, guiding the crypto market toward maturity.

Fifth, regulation has evolved from focusing on speculation and illegal acts to building multi-layered frameworks. Early regulation targeted speculation and illicit behavior, but has since developed into more comprehensive and systematic regimes covering stablecoin payments, AML/CTF, cross-border transactions, and more. Throughout this process, regulatory attitudes and asset classifications have continuously adapted to market developments.

The U.S., as a global financial center, exemplifies this shift. From 2013 to 2016, FinCEN, IRS, and CFTC introduced rules targeting speculative and criminal risks. The 2017 ICO boom led the SEC to bring cryptos under securities regulation, initiating a prolonged regulatory clash. The journey of Bitcoin spot ETF approvals reflects the SEC’s gradual shift from strict scrutiny and repeated denials to increasing openness and acceptance.

Key implications emerge:

First, a more systematic understanding and research framework for cryptocurrencies is needed. Cryptocurrencies span finance, cryptography, blockchain technology, and intersect with core modern financial functions like payments, trading, and investing. Their multidimensional complexity, coupled with rapid market evolution and constant emergence of new concepts, makes it difficult to develop a coherent cognitive framework. Clarifying basic concepts and mechanisms and building a systematic research foundation is essential for effective regulation.

Second, cryptocurrencies must be considered a potential factor affecting financial stability. As their market size grows and integration with traditional finance accelerates, policymakers must assess their potential impact on financial stability just as they do for traditional markets. Particularly for stablecoins, former Fed Chair Ben Bernanke described them as bank-like money backed by financial assets and warned that inadequate regulation could lead to insufficient asset backing—similar to a bank run, potentially triggering financial crises.

Third, an increasing number of countries are inclined to establish rules and legislation for crypto regulation. According to PwC’s 2023 survey of 35 major jurisdictions, about 90% have begun establishing crypto regulatory systems, covering frameworks, AML/CTF, travel rules, and stablecoin usage. Most have at least established AML/CTF frameworks—the current priority in crypto regulation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News