Analyze Four Changes in the Global Cryptocurrency Market Following the South Korean Presidential Election

TechFlow Selected TechFlow Selected

Analyze Four Changes in the Global Cryptocurrency Market Following the South Korean Presidential Election

South Korea will hold its presidential election on June 3.

Author: Ryan Yoon, Tiger Research

Key Takeaways

-

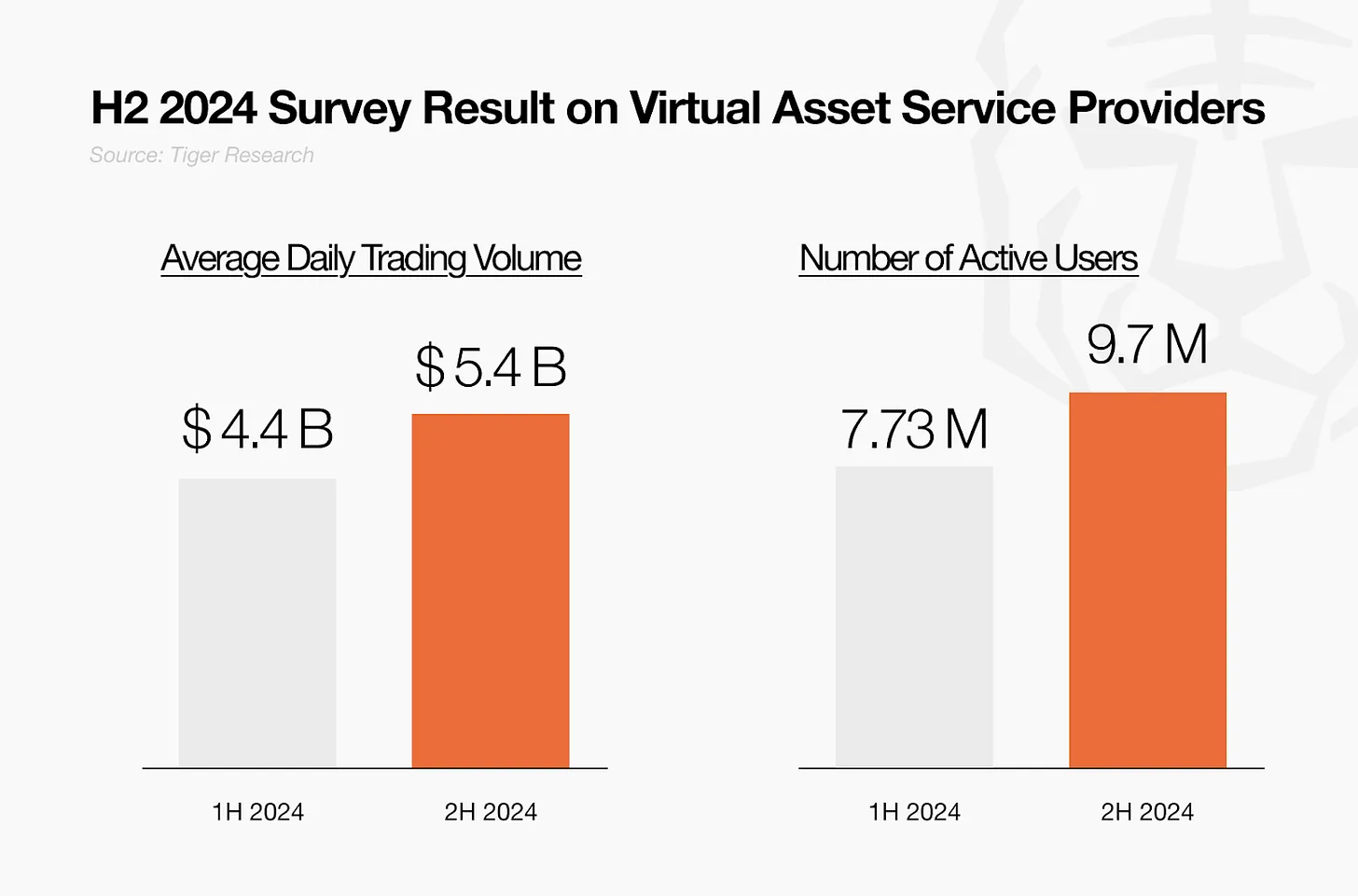

Korea as a Core Web3 Hub: With $5.4 billion in daily trading volume and 9.7 million active users, South Korea ranks as the world’s third-largest cryptocurrency market after the U.S. and China. It serves as a critical benchmark for global projects entering Asia.

-

Taxation Could Trigger Trading Volume Decline: Although crypto taxation is currently postponed until 2027, a new administration may accelerate its implementation. Drawing from international precedents, trading volumes could drop by over 20%.

-

High Likelihood of ETF Approval; Other Reforms May Be Delayed: All major candidates support spot Bitcoin ETFs, increasing their chances of early adoption. In contrast, regulatory reforms around KRW-pegged stablecoins and the “one exchange, one bank” policy are expected to be longer-term agenda items.

1. Is Korea’s June Presidential Election Only About Local Matters?

South Korea will hold its presidential election on June 3. While this appears to be a domestic political event, its implications extend beyond national borders due to the country's influence on the global cryptocurrency market.

Source: Tiger Research

South Korea is widely recognized as the third key market for global Web3 projects, following the U.S. and China. This status is not merely the result of marketing strategy. According to a 2024 report by the Financial Services Commission (FSC), Korea’s daily crypto trading volume reached 7.3 trillion KRW, with over 20 million registered accounts and 9.7 million active users.

Investor behavior further solidifies this position. Korean users consistently show strong interest in altcoins beyond Bitcoin and Ethereum. On-chain activity is also highly active, making Korea a valuable indicator of how new projects gain traction in broader global markets.

For many global projects, establishing operations in Korea has become a strategic entry point into the wider Asian market. This gives the upcoming election special significance, as key campaign issues now include crypto taxation, regulation of KRW-pegged stablecoins, and approval of crypto ETFs.

These developments are not confined to domestic stakeholders. Global investors and project operators must also monitor the election outcome. Both regulatory tightening and liberalization are possible, and projects with substantial Korean user bases may be particularly sensitive to the policy direction set by the next administration.

2. What Changes Will Follow Korea’s Presidential Election?

Source: Tiger Research

2.1. End of the Crypto Tax Deferral Policy

According to the Financial Services Commission’s roadmap on corporate participation in crypto asset markets, corporate entities are being gradually granted access to the crypto market. This phased opening inevitably requires a comprehensive overhaul of the tax framework.

Currently, virtual asset taxation in Korea is deferred until 2027. The original plan was to impose a 20% tax starting January 2025 on annual gains exceeding approximately $1,850. However, implementation was delayed by two years.

An increasingly contentious issue is that both individuals and corporations currently generating income from crypto trading benefit from the tax deferral. Under the FSC’s roadmap, listed companies and registered professional investment firms will be allowed to invest in virtual assets through corporate accounts starting in the second half of 2025.

Given this shift, it is unlikely that the deferral policy for individuals and corporations will be extended again. The government may seek legislative revisions to abolish the current deferral and advance the tax implementation.

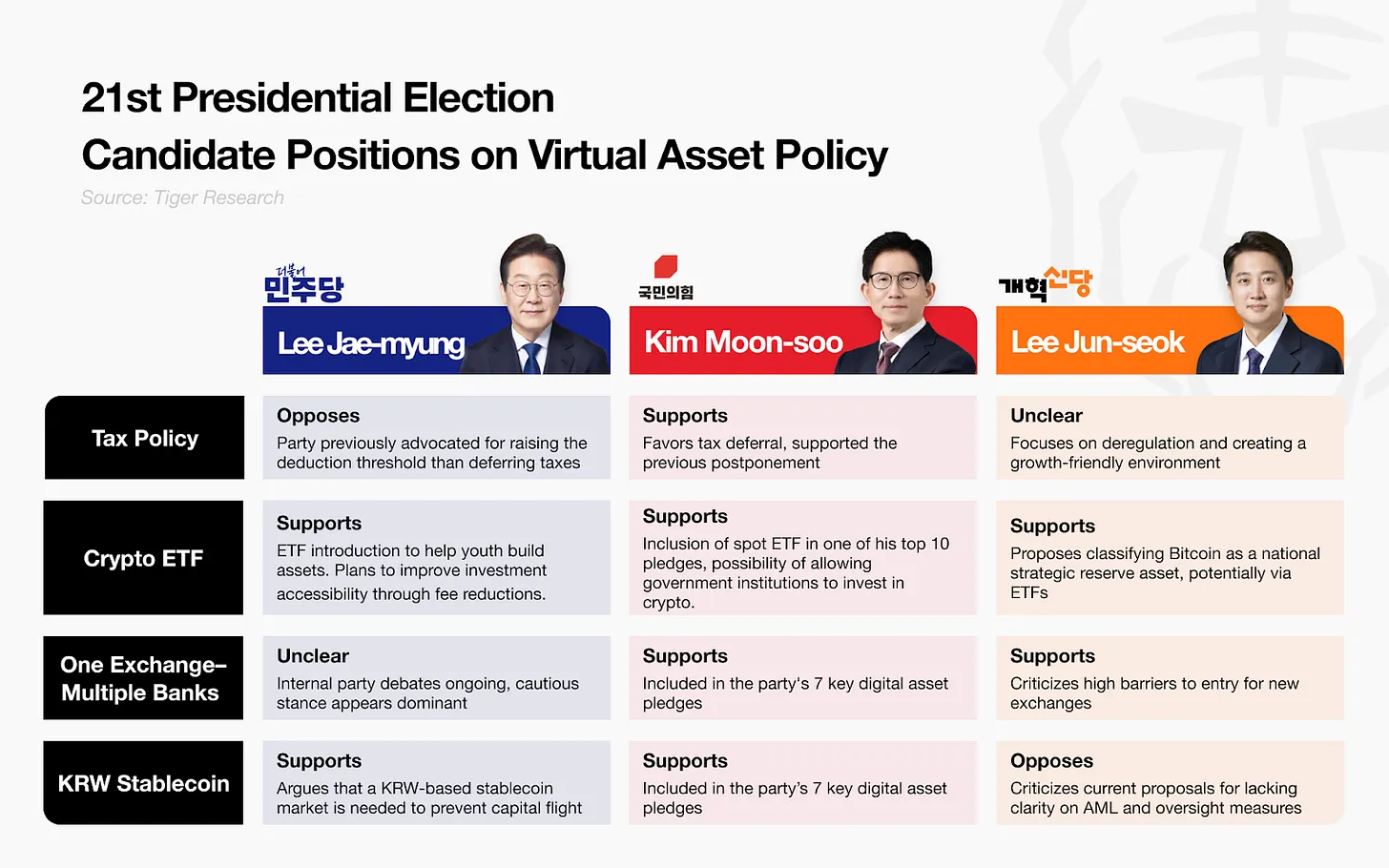

Political stances on tax deferral have historically differed between parties. The Democratic Party initially advocated raising the tax-free threshold rather than delaying taxation, though it ultimately supported the deferral. Depending on the election results, policy may shift toward increasing deduction limits instead of maintaining the deferral.

If taxation is implemented, domestic exchanges are likely to see a significant decline in trading volume—consistent with international precedents. In 2022, India introduced a 30% tax on crypto gains and a 1% withholding tax on all trades, leading to trading volume drops of 10% to 70% on major platforms like WazirX and CoinDCX. Similarly, after introducing high rates in 2023, Indonesia saw trading volume fall about 60% year-on-year.

While the proposed rate in Korea is less aggressive, these examples suggest local exchange volumes could still decline by more than 20%, with capital potentially shifting to offshore platforms.

2.2. Introduction of Crypto ETFs

Source: Tiger Research

-

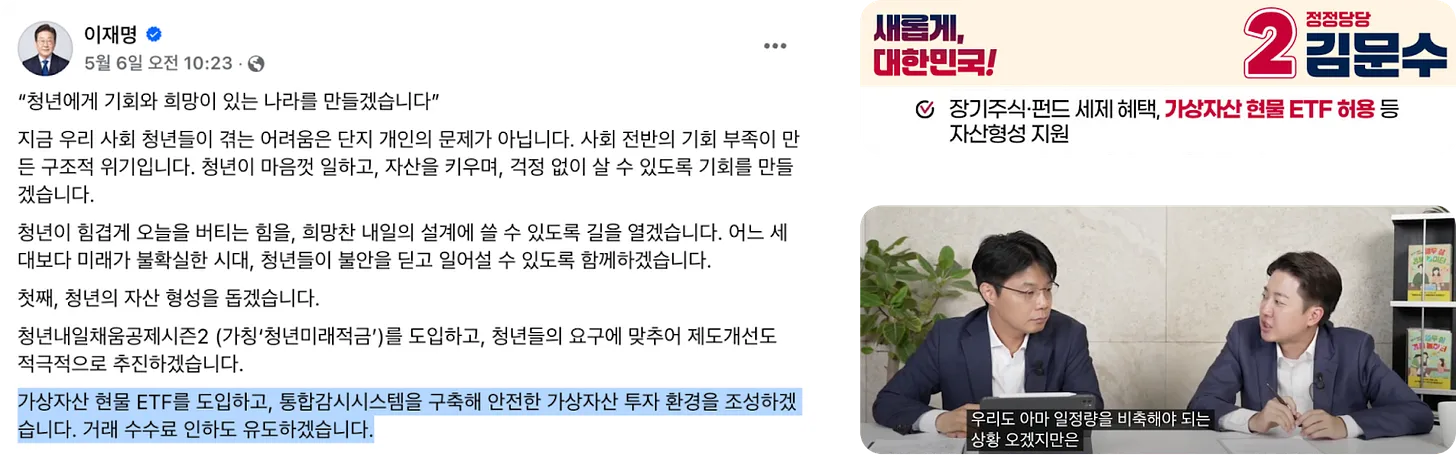

Lee Jae-myung (Democratic Party): On May 6, Lee announced his support for spot crypto ETFs via Facebook as part of a broader initiative to support youth wealth creation. He also proposed lowering investment fees to improve accessibility.

-

Kim Moon-soo (People Power Party): On April 27, he expressed openness to allowing public institutions to invest in the crypto market. His ten core policy pledges include introducing spot crypto ETFs under the banner of “middle-class wealth expansion.”

-

Lee Jun-seok (Reform Party): On May 20, Lee suggested via his YouTube channel that the government should hold Bitcoin as a strategic reserve through instruments such as ETFs.

The introduction of spot crypto ETFs is the only policy proposal with cross-party consensus among leading candidates, making it one of the most likely near-term outcomes. Policy discussions are expected to begin in earnest shortly after the election.

If spot ETFs are introduced, they will naturally compete on fees with existing exchanges facilitating spot Bitcoin trading. This would promote healthier market dynamics and improve overall service quality. For investors, especially those with smaller portfolios, lower fees can reduce barriers to entry and increase accessibility.

In the long term, the launch of spot ETFs could serve as a catalyst for further financial innovation. It might pave the way for new products integrating crypto with traditional finance, such as derivatives, index funds, and other hybrid investment vehicles.

2.3. Revisiting the “One Exchange, One Bank” Model

To manage anti-money laundering (AML) risks in the crypto sector, South Korea has maintained an implicit “one exchange, one bank” principle. Under this model, each licensed crypto exchange is only permitted to partner with one commercial bank to issue real-name verified deposit accounts. For example, Upbit partners exclusively with K-Bank, while Bithumb is linked to KB Kookmin Bank.

This framework contrasts with jurisdictions like the U.S., where platforms such as Coinbase offer integration with multiple financial services, including Apple Pay, Google Pay, and various banking institutions.

The debate over abolishing the “one exchange, one bank” rule gained momentum after Jeong Jin-wan, CEO of Woori Bank, raised the issue during a policy discussion hosted by People Power Party lawmakers. He argued that the current structure poses systemic risks, limits consumer choice, and imposes unnecessary constraints on institutional clients. Jeong called for a transition to a “one exchange, multiple banks” model.

As the presidential campaign progressed, parties began clarifying their positions. On April 28, the People Power Party included the abolition of the “one exchange, one bank” rule in its “Seven Digital Asset Promises.” The Democratic Party appears to be reviewing the matter internally, but cautious sentiment has emerged within the party, and it remains unclear whether this issue will appear in official campaign pledges. Financial regulators remain similarly cautious, indicating any changes may require prolonged deliberation.

While regulatory prudence is necessary, maintaining the current model based on concerns over market concentration and AML risks may need reevaluation. The argument that the rule prevents market monopolies is increasingly unconvincing, given that Upbit and Bithumb already control about 97% of the domestic market. Allowing multiple bank partnerships could strengthen competition by enabling exchanges to serve broader user segments. This could lead to lower fees and more innovative services for both retail and institutional users.

Concerns about AML risks also require more nuanced assessment. In practice, greater risk occurs during outflows to overseas exchanges. Since the implementation of the Travel Rule and improvements in compliance infrastructure, Korea now operates under stricter international monitoring standards. In this context, the systemic risks associated with multiple banking relationships appear overstated.

2.4. KRW-Pegged Stablecoin

Historically, Korea has prioritized central bank digital currency (CBDC) development over stablecoins. The Bank of Korea is currently running a pilot program called “Project Han-Gang” to test CBDC-based payment and settlement systems. However, as global trends shift toward stablecoins, domestic demand for a KRW-pegged stablecoin is growing.

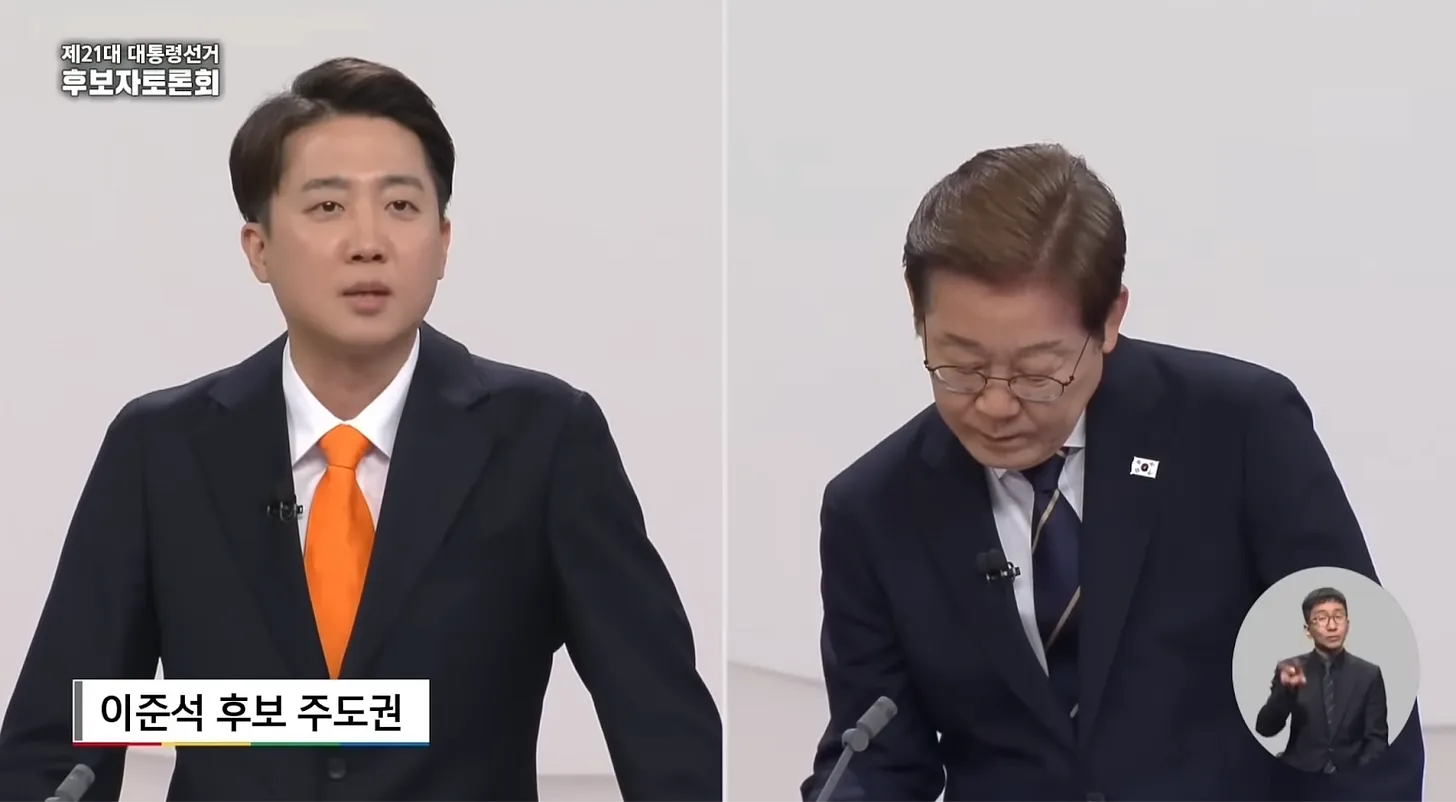

Source: 21st Presidential Debate: First Presidential Debate

-

Lee Jae-myung (Democratic Party):

-

May 8: During an economic YouTube interview, stated that KRW-pegged stablecoins could prevent capital flight by creating a domestic alternative.

-

May 18: During a televised debate, emphasized that the KRW stablecoin would be backed by collateral reserves to ensure stability.

-

-

Lee Jun-seok (Reform Party):

-

May 18: Questioned the feasibility of Lee Jae-myung’s proposal, citing lack of clarity on AML measures in stablecoin issuance.

-

-

Kim Moon-soo (People Power Party):

-

April 28: Included a regulatory framework for stablecoins in his “Seven Digital Asset Promises.”

-

The first presidential debate on May 18 brought stablecoins into mainstream political discourse through the exchange between Lee Jae-myung and Lee Jun-seok. While the discussion showed directional support, it also highlighted the absence of detailed policy frameworks—particularly regarding risk mitigation and compliance.

At this stage, proposals around a KRW-pegged stablecoin remain visionary rather than actionable. Immediate implementation post-election is unlikely. However, given regional trends—especially in Singapore and Hong Kong, where authorities are actively developing local currency-pegged stablecoins—Korea may face growing pressure to follow suit to maintain its competitiveness as a financial hub.

Any meaningful progress will require a foundational legal and regulatory framework. Key issues include identifying qualified issuers, ensuring collateral transparency, establishing AML protocols, and defining the relationship between stablecoins and the CBDC program. Given the complexity of these issues, policy development is expected to proceed in a phased, medium-to-long-term manner rather than rapid change after the election.

3. Gradual But Inevitable: The Changes Ahead

While the policy shifts discussed are significant for the industry, they are unlikely to materialize in the short term. Among the main presidential candidates, only Kim Moon-soo has included Web3-related measures in his top ten campaign pledges. This suggests that while relevant to the sector, Web3 issues are not currently prioritized on the broader policy agenda.

Therefore, regulatory changes are expected to unfold gradually, with discussions proceeding alongside more urgent policy matters. Nevertheless, the trajectory is clear: transformation is inevitable.

As previously noted, the eventual implementation of crypto taxation is unavoidable. Additionally, legislative discussions around security token offerings (STOs) are expected to resume. Investors and market participants should not underestimate these shifts. Stakeholders must begin preparing for a policy environment that will become increasingly standardized and compliance-driven.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News