Pioneering copy trading with impressive returns—why is Bitget becoming the gateway to wealth for Web3 newcomers?

TechFlow Selected TechFlow Selected

Pioneering copy trading with impressive returns—why is Bitget becoming the gateway to wealth for Web3 newcomers?

Bitget has built an easier pathway to crypto wealth.

Author: OneshotBug

Traditional investment logic is quietly failing.

From stocks and real estate to financial products and savings accounts, once-reliable methods of asset appreciation are losing their original appeal. Against a backdrop of declining interest rates and economic slowdown, many individual investors are rethinking: what wealth opportunities remain worth exploring?

Crypto assets have become an option for more and more people. But it's not easy. High volatility, complex information, and technical barriers often deter newcomers. Even those interested in the crypto market may find it difficult to participate, let alone benefit from it.

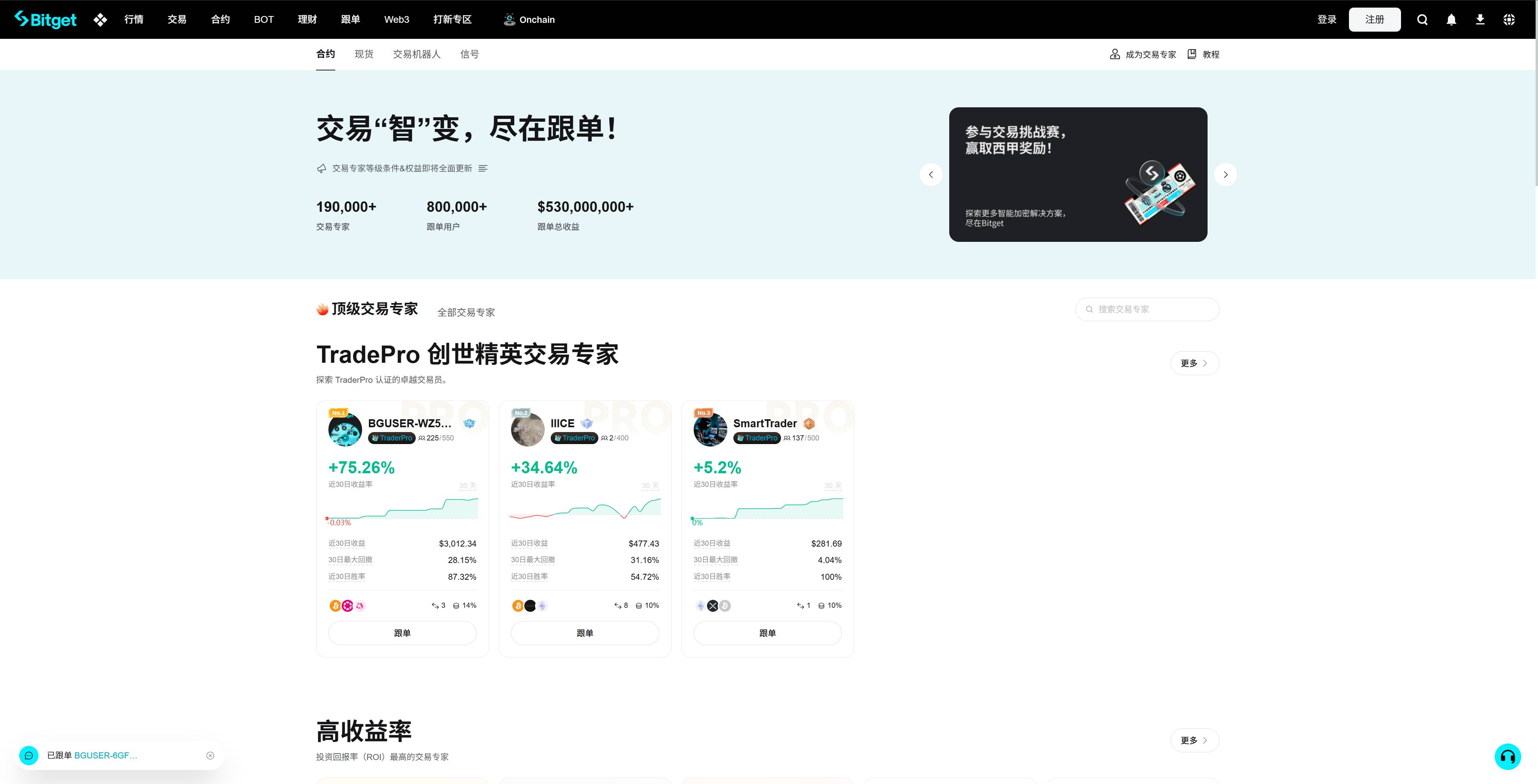

As one of the fastest-growing centralized cryptocurrency exchanges in recent years, Bitget offers a relatively accessible entry point that allows crypto beginners to easily engage in trading—the copy trading system. Through this system, new users can directly replicate the strategies and actions of experienced traders, gaining exposure to the market with low barriers. This "productized trading capability" is one of the few designs in the crypto world that genuinely lowers the barrier for beginners.

At the same time, around copy trading, Bitget has built a comprehensive matrix of features and an ecosystem incentive system, including its platform token BGB, airdrop distributions, and financial returns, providing users with limited risk tolerance and time another pathway to "participate in Web3."

Is this system truly effective? Are users actually earning returns? Is Bitget’s model sustainable? This article will offer a user-centric perspective by examining product design, strategy, security, and wealth effects.

Established for six years, with over 100 million users—how did Bitget rise into the top tier?

In the past two years, competition among crypto exchanges has moved beyond simple metrics like "who lists more tokens or runs bigger promotions." As user growth slows and trading demands become more rational, distinctions between platforms are being redrawn. Bitget has advanced precisely during this period of restructuring.

According to its official transparency report released in April 2025, Bitget now has over 120 million registered users, with daily average trading volume stably exceeding 20 billion USD. Its key performance indicators rank it among the leading global exchanges. This achievement wasn't driven by a single product or short-term surge, but rather by the steady evolution of its multi-dimensional framework combining "product + marketing + operations."

(Data screenshot: CoinGecko, May 29, 2025)

Bitget's user base is also highly representative. Unlike traditional exchanges that primarily cater to "high-frequency traders and long-time users," a significant portion of Bitget’s users come from emerging markets and include novice investors. While seeking returns, they want to participate in the Web3 market within an environment they can understand and keep up with.

This entire foundation rests on Bitget’s relatively unique development path:

-

Started with futures trading, initially focusing on high-activity users;

-

Launched the first copy trading system in 2020, opening up the new user market;

-

Expanded its product suite starting in 2021, covering spot trading, initial offerings, staking, and other core services;

-

Merged with BitKeep in 2023 to build an on-chain asset gateway (Bitget Wallet);

-

Saw BGB, its platform token, take off in 2024, establishing an ecosystem-wide incentive system.

Bitget isn’t the exchange with the most aggressive moves, but its performance in user expansion, ecosystem development, and strategic pacing shows strong goal orientation. Instead of attracting new users through hype, it focuses on helping them stay by centering the trading experience. Because of this, it has gradually cultivated a distinct identity in the industry—a blend of “financial gateway” and “crypto toolkit.”

Next, we’ll dive deeper into how Bitget found growth through differentiation, especially how it uses copy trading, platform tokens, security mechanisms, and ecosystem planning to create a clear and visible on-ramp to Web3 for new users.

Copy trading, strategy content, and low-barrier design: How does Bitget truly enable participation for those who don’t know how?

For most people, “investing” is a complex and uncertain endeavor. Especially in the crypto market, where prices swing wildly and trading logic evolves rapidly, ordinary users typically require long-term learning to get started. Yet Bitget’s approach is this: if most people can’t become expert traders, can a product allow them to “indirectly possess trading ability”?

This is exactly the context behind Bitget’s launch of its copy trading feature.

One-click replication: Turning trading into a product

Bitget pioneered the copy trading system in 2020, becoming the first major exchange to introduce such a function. The core idea is simple and intuitive: professional traders on the platform share their live trades in real time, allowing regular users to subscribe and automatically mirror these trades—just like following a social media influencer.

For users without technical backgrounds or knowledge of K-line charts, this “productized trading” design eliminates nearly all entry barriers. Copy traders don’t need to analyze the market themselves; they simply choose a trader they trust and start investing.

To enhance transparency and choice, Bitget has implemented numerous supporting optimizations in its product structure:

-

All traders must pass real-name verification and platform review;

-

Clear metrics such as trading history, return curves, and maximum drawdown are provided;

-

Customizable take-profit and stop-loss ratios allow users to control risk;

-

Leaderboards and strategy tagging systems help users quickly filter options.

Currently, Bitget hosts over 200,000 traders available for copying, with active copy traders numbering in the millions, making it one of the largest crypto copy trading platforms globally. This ecosystem creates a two-way “content + trading” structure: traders are incentivized to maintain consistent performance, while followers enjoy a more accessible market experience.

More than just copy trading—a full “beginner-friendly” journey

Bitget’s “new-user friendliness” extends beyond just the copy trading product. To help users unfamiliar with crypto adapt faster, the platform has made multiple refinements in both product design and content:

-

User interface follows app-like, simplified design principles to reduce learning curve;

-

Guided prompts, risk warnings, and video tutorials are embedded throughout workflows;

-

A content hub consistently produces guides on copy trading techniques, beginner investment courses, and strategy breakdowns;

-

Community sections provide interactive spaces to build trust networks.

These features aren’t flashy, but they’re practical. For many first-time crypto users, Bitget doesn’t feel like a “high-barrier professional platform,” but rather like a hybrid “semi-investment, semi-tool” gateway application.

In other words, Bitget doesn’t expect users to become experts overnight. Instead, through a suite of low-barrier designs, it enables them to “start using it right away.” Building confidence through controllable risk and visible pathways is precisely the core experience the platform aims to deliver.

Participatory and redeemable wealth effects: Platform token BGB and diversified income channels

In the crypto world, the “get-rich-quick effect” is one of the most compelling aspects. But for most users, markets change rapidly, and blindly following trends often leads to losses. Rather than chasing short-term excitement, Bitget approaches “achievable wealth incentives” by building a mild, controllable, and gradually realized value capture mechanism through its platform token BGB.

BGB: From platform utility to engine of user returns

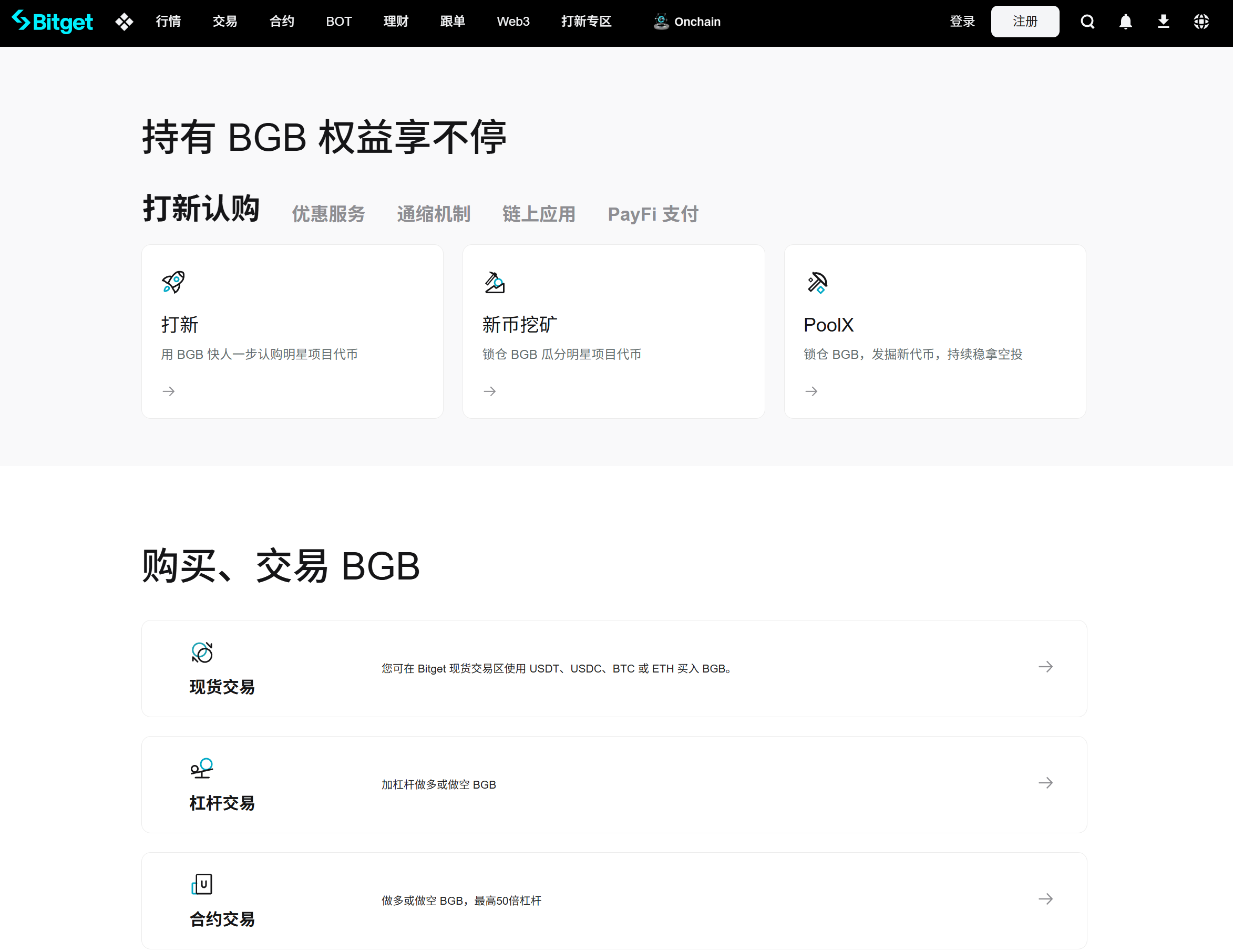

BGB is Bitget’s native platform token, initially designed for internal benefits such as fee discounts and membership tier rewards. As the platform expanded, BGB was integrated into more practical use cases: participating in Launchpad offerings, staking, earning airdrops, unlocking VIP perks, fee reductions, and engaging in wealth management and staking activities.

More importantly, since recently, Bitget has begun allocating a portion of its revenue back to BGB through buyback and burn mechanisms, creating a value feedback loop similar to “platform revenue sharing.”

According to CoinGecko data, BGB reached a high of $8.45 in 2024, with annual gains briefly surpassing 1,000%, significantly outperforming most other major platform tokens during the same period. Even after short-term corrections, BGB’s 365-day return exceeded 300% as of the end of May 2025.

While such price movements cannot be generalized, they have indeed allowed many users to grow their assets through “holding rather than trading” in the crypto market.

Diverse, stable, non-speculative “Web3 earning models”

Beyond BGB’s applications and returns, unlike some platforms that hype their tokens through speculation, pump-and-dump schemes, or empty airdrops, Bitget favors a “participation equals reward” model, including:

-

New users receive BGB airdrops upon registration and referral linking;

-

Users earn BGB incentives by trading, staking, or joining events;

-

BGB is used as entry tickets or participation requirements in special campaigns.

This transforms BGB from a speculative tool into an integral part of everyday user activity—you don’t need to specifically “invest in BGB”; you naturally gain its benefits by using Bitget.

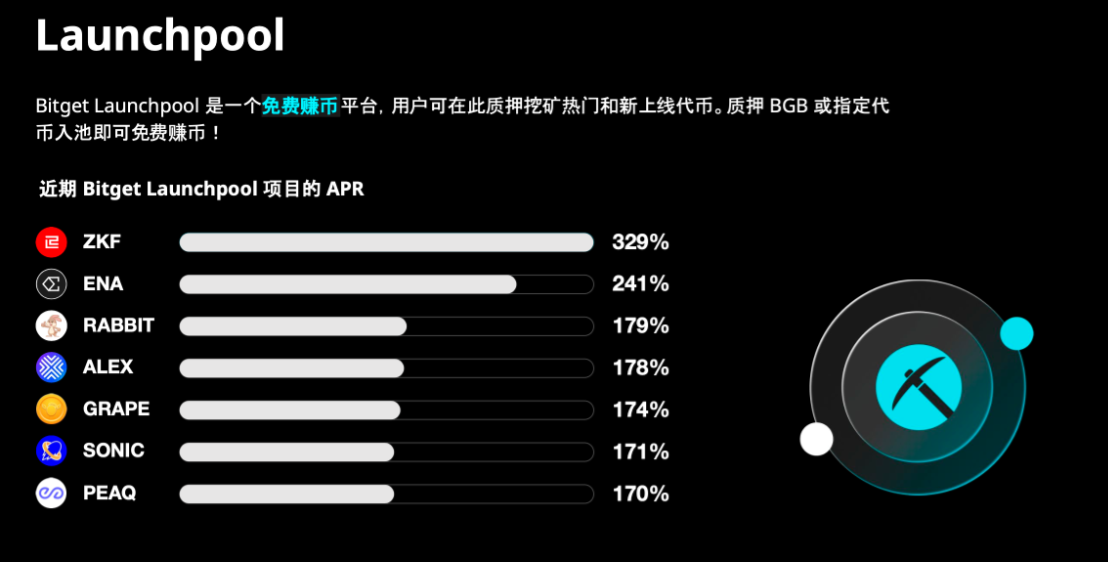

(Image: Recent APR returns from Bitget Launchpool projects)

In “wealth-focused” products such as Launchpool, PoolX, Wealth Management, and Shark Fin, BGB plays a role in “risk mitigation and yield locking,” forming a relatively “stable” asset return logic.

For users from traditional finance backgrounds—those with lower risk tolerance yet dissatisfied with low-interest environments—this provides a “participatory, perceptible, and predictable” way to enter Web3.

Innovative automated investment tools open new paths for beginner crypto investing

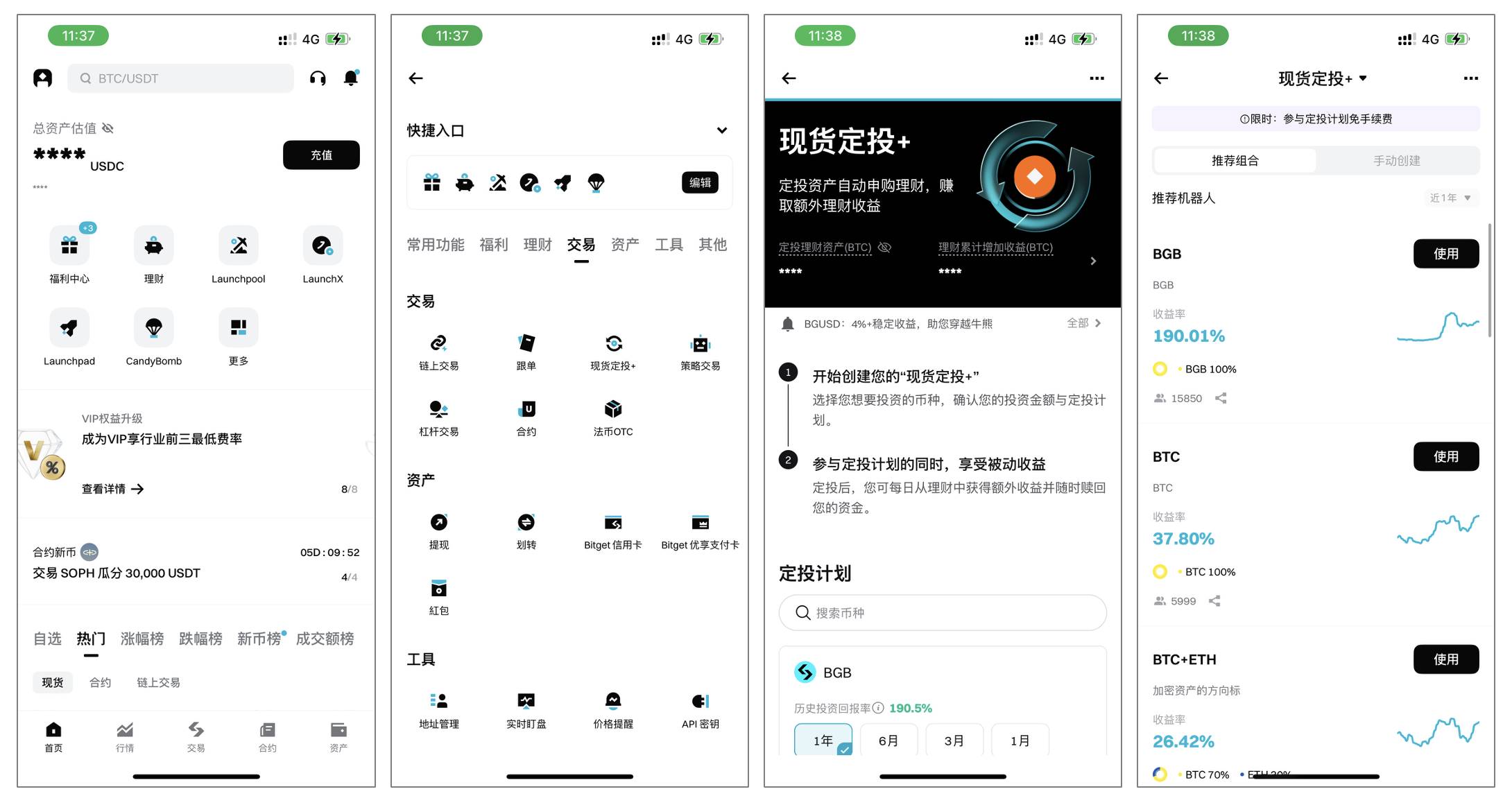

Take Bitget’s “Spot DCA+” feature as another example—an automated investment tool designed to help beginners invest and earn returns. This feature can be found under the “Trade – Spot DCA+” section in the Bitget App. By setting up a dollar-cost averaging (DCA) strategy with fixed intervals and amounts, a bot automatically purchases selected cryptocurrencies at regular intervals. This automated investment strategy helps users avoid constant market monitoring and achieve steady asset growth through low-risk, incremental buying.

Safety nets and compliance efforts: How does Bitget build a “trustworthy platform”?

No matter how the crypto industry evolves, security remains the most fundamental concern for users. After numerous incidents of exchange collapses, frozen assets, and hacker attacks, questions like “where are funds held?” and “can the platform be trusted?” have become decisive factors in user retention.

Bitget doesn’t sidestep these issues. Instead, it implements a structured,常态化 risk management system to cultivate a sense of “trustworthiness.”

PoR and protection fund: Not just concepts, but implemented measures

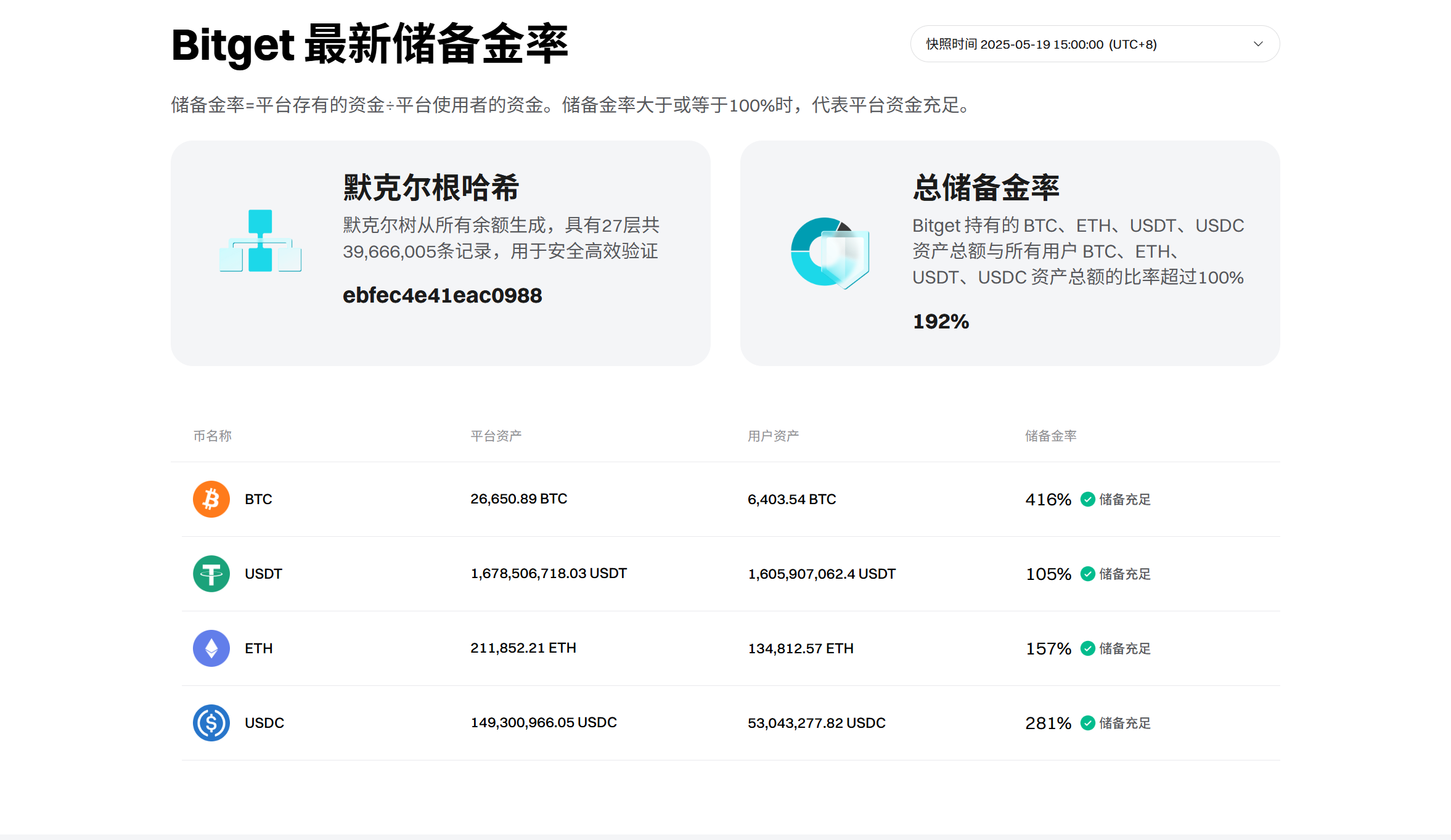

Shortly after the FTX collapse, Bitget promptly launched its Proof of Reserves (PoR) system, using Merkle Tree technology to allow users to verify whether platform reserves fully cover user assets. This proof is updated monthly and publicly accessible at any time. (https://www.bitget.com/zh-TC/proof-of-reserves).

According to the latest data from April 2025, Bitget’s reserve ratio stands at 213%, far above the industry standard baseline of 100%. In other words, even under extreme mass withdrawal scenarios, the platform holds sufficient assets to meet all obligations. These figures can be viewed in real time on Bitget’s reserves page, and users can manually cross-check blockchain addresses against their account balances to confirm fund consistency.

To guard against potential black swan events, Bitget established a “User Protection Fund” totaling over 600 million USD, pledging to prioritize compensation from this fund in case of platform-attributable security incidents. Composed of mainstream assets like BTC, USDT, and USDC, the fund is stored in publicly transparent addresses, ensuring clarity in funding sources and disbursements.

These mechanisms are not temporary PR moves but are embedded into the platform’s daily operations, forming the core of its “trust infrastructure.”

Compliance pace: Not aggressive, but clearly mapped

On regulation, Bitget avoids the aggressive “license race” strategy, opting instead for “regional rollout + gradual integration.” It has obtained relevant licenses in El Salvador, Australia, Italy, Poland, and Lithuania, and launched compliant services in the UK.

This approach may result in narrower regulatory coverage compared to legacy crypto firms like Coinbase or Kraken, but it grants greater flexibility in regions with unclear policies, avoiding regulatory conflicts from overly rapid expansion.

For users, compliance actions mean the platform won’t “vanish overnight.” Bitget’s philosophy is to fully embrace and implement compliance without sacrificing operational efficiency.

While this “compliance + security” dual system can’t eliminate all user anxiety, in the volatile crypto landscape, it already represents a relatively rare foundational safeguard.

Conclusion: Bitget has built a more accessible path to crypto wealth

In an industry marked by complexity, countless projects, and persistently high technical barriers, Bitget’s strategy stands out: create a “clear, usable, and keep-up-with” pathway for individuals lacking expertise but eager for asset growth opportunities.

It doesn’t rely on technological showmanship or sheer number of listed tokens. Instead, through the product mechanism of “copy trading,” it transforms trading capability into a productized, packaged service—something far more appealing to first-time crypto users than any whitepaper.

Building around this core, Bitget has developed a cohesive ecosystem of token incentives, airdrop access, financial products, and asset management tools that lower entry barriers while increasing user retention. Throughout this process, BGB has evolved into a key token linking user behavior with platform value, solidifying its functional role within the ecosystem.

Overall, Bitget may be the platform that best understands “how ordinary people enter the crypto world.” For those who want to participate but wish to avoid extremely high risks, it offers a more friendly, scalable, and sustainable wealth pathway.

For users seeking their next investment gateway—and hoping for a relatively low-barrier entry into Web3—Bitget is the “perfect starting point.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News