Dialogue with Dr. Feng Xiao (Part 2): Chinese people will inevitably become the leading force in RWA innovation

TechFlow Selected TechFlow Selected

Dialogue with Dr. Feng Xiao (Part 2): Chinese people will inevitably become the leading force in RWA innovation

But we cannot wear new shoes to walk the old path.

Author: Meng Yan

[Introduction] With the U.S. Senate passing a motion to vote on the dollar stablecoin bill, and Hong Kong’s Legislative Council approving the draft ordinance for Hong Kong dollar stablecoins, stablecoins have rapidly become one of the hottest industry topics, attracting broader attention. It is widely expected that the implementation of the dollar stablecoin legislation will usher in an exciting boom for blockchain-based digital economies. Around dollar stablecoins and real-world assets (RWA), a new window of entrepreneurial opportunity will emerge. Dr. Xiao Feng is a leading figure among Chinese practitioners and researchers in blockchain, with deep insights into blockchain, stablecoins, and RWA. To fully understand this era of opportunity, I had the privilege of conducting an in-depth exchange with Dr. Xiao Feng through video meetings and written correspondence, which I have compiled and published here for discussion with peers. Due to the length of the original text, it is published in two parts. The first part has already been released, focusing on interpreting the significance of dollar stablecoins. This article is the second half, concentrating on the opportunities that stablecoin economics and RWA bring to Chinese entrepreneurs. The views expressed are solely those of the author, and readers are welcome to engage in dialogue.

4. Stablecoin Economy Is the Initial Stage of RWA and Will Drive Blockchain Applications Across the Chasm

Meng Yan: Regardless, with the legislation of dollar stablecoins and Hong Kong stablecoins, the era of stablecoins is clearly arriving. What does this mean for entrepreneurs?

Xiao Feng: In the next few years, stablecoins will drive a massive explosion in blockchain and RWA applications. On the demand side, hundreds of millions of users will come online to open crypto accounts and hold stablecoins, causing user scale to grow several times within a short period. At the same time, on the supply side, millions of platforms, enterprises, internet merchants,自媒体, and creators will begin accepting stablecoin payments, and large amounts of assets will be tokenized and brought on-chain as RWAs. “How to earn stablecoins” will become one of the most critical topics for all businesses in the coming years.

Demand for various applications around stablecoins and RWA will surge rapidly. Truly capable entrepreneurs will abandon hesitation and rush in. Stablecoins and blockchain will become the most attractive sector in the coming years, nurturing the greatest number of success stories.

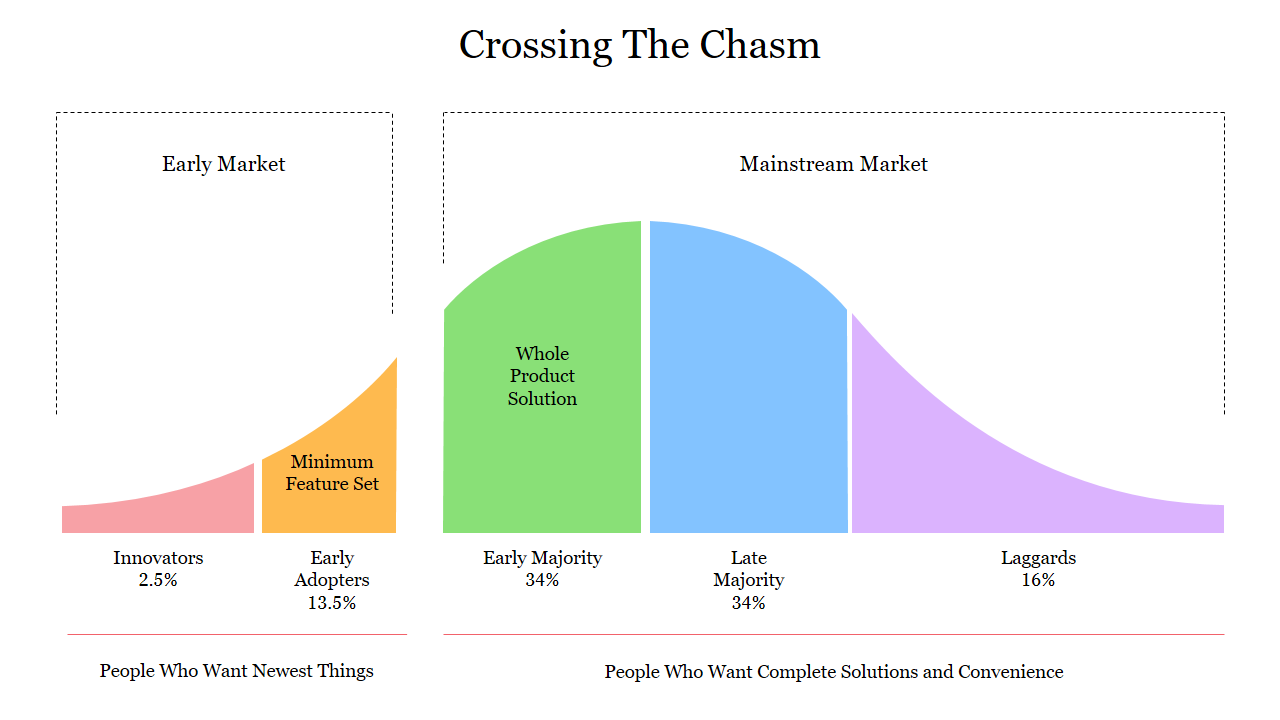

I’d like to use a model from a classic business book to explain this phenomenon: Geoffrey Moore’s “Technology Adoption Life Cycle” from his book *Crossing the Chasm*. He divides users into five categories: Innovators, Early Adopters, Early Majority (Pragmatists), Late Majority (Conservatives), and Laggards. Most high-tech products die in the “chasm” between “Early Adopters” and the “Early Majority.” Technology must transition from vision to reality—solving concrete problems and delivering real value—to cross this chasm; otherwise, it fades away.

I believe stablecoins are becoming the bridge enabling the blockchain industry to cross this “chasm.” Previously, when we talked about crypto or Web3, discussions were always confined to small circles of “believers” and “tech enthusiasts.” Many认同the concepts, but when it came to large-scale adoption, issues such as “lack of practical use cases,” “user confusion,” and “high compliance risks” emerged. Now, stablecoins are becoming the first blockchain product truly adopted at scale by “pragmatists.” Cross-border e-commerce, freelancers, platform settlements, global payments—everyone is starting to use them. For the first time, blockchain is not just a narrative but is integrating into the real economy as infrastructure.

When users adopt stablecoins, they need to open digital currency accounts and learn how to use wallets. Therefore, stablecoins are not merely a product—they are the passcode for the entire blockchain industry to cross the market chasm. Once across, lies a vast blue ocean market—the mainstream user base composed of the “early majority” and “late majority.” Once this threshold is crossed, “mass adoption” is no longer a dream but a natural outcome.

Recently, I’ve frequently quoted Nobel Economics laureate John Hicks: “Behind every industrial revolution, there is a financial revolution.” Now we’re entering the next phase—every financial revolution needs a universal-level product to break through user boundaries. Stablecoins are becoming exactly that product.

I must emphasize: such explosive growth happens only once per industry—and then it's gone. Entrepreneurs can no longer hesitate. Those who have experienced the internet and mobile internet revolutions know that missing this window dramatically increases future difficulty.

5. RWA Innovation Must Not Follow Old Paths in New Shoes

Meng Yan: You just mentioned RWA, which has become a very hot topic after stablecoins. It’s said that in China’s first-tier cities, many entrepreneurs are actively discussing how to seize RWA opportunities. Yet I have doubts. So-called RWA means tokenizing real-world assets and putting them on-chain. Many people fantasize that illiquid assets in their hands will instantly become hot commodities once turned into RWA. I find this illogical. Given your deeper exposure, I believe you share this view. What do you think?

Xiao Feng: I meet with entrepreneurs almost daily pitching RWA ideas—I’ve seen all these asset types you mentioned. But in 90% of cases, I advise them to abandon the idea. While technically simple to put such assets on-chain as RWA, the key question is: would you buy them? Personally, I wouldn’t.

RWA is an inevitable trend and will grow massively. A recent Boston Consulting Group report predicts that by 2033, on-chain RWA assets could reach $18.9 trillion—implying a 53% annual growth rate over the next eight years. No entrepreneur wants to miss boarding this rocket.

But slapping an RWA label on anything doesn’t guarantee success. From over a decade of crypto industry development, we’ve learned that progress must follow objective laws and be value-driven. Admittedly, bubbles are unavoidable—but when too large, they burst and drag down the whole industry.

I often say this: there’s a serious cognitive mismatch today regarding RWA. RWA isn't about adding a blockchain tag or coating an asset with a layer of technological “gold leaf” to magically transform it. It cannot change the fundamental nature of an asset. If your assets suffer from poor liquidity, opaque pricing, and high transaction costs, going on-chain won’t make them soar. RWA is no magician—it can’t turn crows into phoenixes.

RWA is a digital representation of real assets—the key is what you’re representing. If the underlying asset lacks clear ownership, standardization, or inherent quality, no amount of packaging will help. It’s not financial alchemy, nor a panacea for blockchains.

Therefore, I believe RWA development must follow an objective progression: start with high-grade, standardized, and top-tier assets, then gradually expand to long-tail and non-standard assets. What are high-grade assets? Sovereign bonds, blue-chip stocks of major corporations—assets already highly standardized, globally accepted, and transparently priced. Next come corporate bonds from leading firms, quality bills, receivables, even mortgage loans from high-growth regions. These are the assets truly suitable for tokenization—because they have solid value foundations and symmetric price understanding between buyers and sellers, allowing genuine liquidity amplification rather than illusion creation.

You're right—many now approach RWA with speculative intent, hoping to find a shell on-chain to "monetize" worthless off-chain assets, even resorting to quasi-Pyramid schemes. I’m skeptical of this path of “wearing new shoes but walking old roads.” RWA is not an escape from regulation, nor a dumpster for bad assets. Without solving trust, circulation, and pricing issues, going on-chain is meaningless.

We must be realistic. Currently, high-quality assets are concentrated primarily in the U.S. The real opportunity for Chinese entrepreneurs isn’t rushing to tokenize any random asset, but first establishing a foothold in the “stablecoin economy” stage. What does this mean? Go overseas, sell products and services online and on-chain, earn stablecoins—that’s our current advantage. In short: start RWA by earning stablecoins.

Why? Because we possess the world’s strongest supply chains, engineering and manufacturing capabilities, and internet operations expertise. Cross-border e-commerce is already scaled; e-commerce entrepreneurs are already adept at traffic and efficiency. Once stablecoins are adopted, transaction costs drop immediately and settlement speeds increase dramatically. This is the true starting point for integration with blockchain—the Chinese solution in the stablecoin economy phase.

This isn’t speculation—it’s already happening. Small-to-medium e-commerce and foreign trade companies that went overseas in recent years, including export merchants from Yiwu, are rapidly adopting stablecoins. Some have achieved considerable scale—their ability to earn stablecoins surpasses many blockchain projects. And this is just the beginning. I’m certain that once the GENIUS Act passes, platforms like Amazon will quickly support stablecoin payments, and tens of thousands of e-commerce merchants will soon become central players in the stablecoin economy.

So I believe it’s now the moment for Chinese internet elites to embrace blockchain and the stablecoin economy. Once you establish your position—gathering users, merchants, and cash flow—you’ll naturally incubate high-quality RWAs. For example, cross-border order receivables, supply chain debt based on real logistics—these are natural on-chain assets. At that point, you won’t need to tell stories; investors will come to trade your RWA.

Thus, my advice is to solidify the first step. The stablecoin economy is the initial phase of RWA—the bridgehead for blockchain to enter industries and cash flows. Whoever secures this stage will naturally dominate the next phase of RWA.

Meng Yan: Some also feel that since RWA is trending, it’s time to launch another ICO. Can launching an RWA project and issuing a token work again?

Xiao Feng: This requires a two-sided perspective.

On one hand, the era of telling a blockchain story, building a protocol, and getting rich by issuing a token is over—the window has closed. Over the past decade, we experienced blockchain’s first growth curve: infrastructure development and token-based fundraising. That phase was indeed “narrative-driven capital,” where launching a token could fuel an entire funding round.

But today, the marginal returns of token fundraising are rapidly declining. Crypto investors are increasingly rational, and markets more competitive. Users have seen countless flashy whitepapers; the key now is whether you have real use cases, users, and cash flow. Thus, the energy of the first growth curve is fading. What we need now is the second growth curve—a breakout phase centered on real applications.

On the other hand, the U.S. hasn’t taken a blanket ban on token fundraising. Instead, it’s building a new legal framework through two paths: the FIT21 Act and the “Token Safe Harbor” regulatory exemption mechanism. Together, they form the prototype of a new compliant token fundraising system.

If you understand U.S. securities law history, you’ll recognize FIT21’s significance akin to the 1933 Investment Company Act. It’s structural legislation for an economic entity, standing alongside the 1933 Securities Act and 1934 Exchange Act, forming the legal foundation for a century of U.S. capital market prosperity. We now see SEC and CFTC continuously releasing guidance defining whether tokens are securities, commodities, or virtual commodities, while clarifying regulatory responsibilities. This reflects the gradual clarification of the entire framework.

I believe if these efforts continue and converge, U.S. legislation today could set a precedent for global token fundraising and market regulation. If successful, it may lay the foundation for a new century of digital financial prosperity. We used to talk about stocks and bonds; now we discuss RWA and tokens. The forms change, but the core logic of finance remains—risk pricing, information transparency, and rule of law.

I repeat: don’t rush to issue tokens. First, build your business in the stablecoin economy, develop real applications, and strengthen your foundation. Once your model is market-validated and cash flow proven, raising funds via token issuance under new U.S. rules will be efficient. Why worry about fundraising or successful listings? Build great products and applications first—the legal pathways are being cleared, and capital bridges will naturally connect to you.

In the future, Nasdaq and NYSE may list tokens, while exchanges like HashKey could list stocks. Recently, U.S. crypto exchange Kraken announced support for trading certain tokenized U.S. stocks. As SEC Chair Gensler recently stated, we’ll soon see “super apps” enabling trading of all asset types—stocks, bonds, tokens, stablecoins, RWA—on a single platform. That day is not far off.

6. Chinese Entrepreneurs Will Be Central to RWA Innovation

Meng Yan: But when I speak with Chinese blockchain entrepreneurs, I sense overall lack of confidence. The main concern is that this wave of stablecoins and RWA is centered in the U.S., and due to current strategic competition between China and the U.S., with rising rhetoric about “decoupling” and heightened nationalism on both sides, will Chinese entrepreneurs face discrimination or unequal opportunities?

Xiao Feng: If I said this issue didn’t exist, I’d be unrealistic. Geopolitical rivalry between China and the U.S. does affect the entrepreneurial environment, especially in highly sensitive areas like technology and finance. However, history never progresses linearly, and reality is often more complex and nuanced than public discourse suggests. Despite tensions, I remain confident that Chinese entrepreneurs not only have opportunities in this wave of stablecoin economy and RWA, but also possess unique advantages.

The first reason is massive existing strength. Even during the toughest periods in recent years, China remains one of the world’s largest hubs for blockchain developers, innovation, engineering excellence, and community activity. Don’t be misled by surface appearances—behind many global leading projects lie Chinese engineers’ code, algorithms, and infrastructure. In one interview, I frankly told the Ethereum Foundation: “Ethereum has declined because you lost China.” From 2014 to 2016, China was Ethereum’s most solid base of developers and users. Later, due to various reasons, Ethereum withdrew from China—an important factor in its loss of momentum. The same applies to any global blockchain project: whoever wins Chinese developers and communities wins the world.

The second reason is aligned interests. The stablecoin economy and RWA represent a new globalization channel in the digital economy era. What does this mean for China? It means we can bypass traditional dollar settlement systems and centralized platforms, exporting Chinese goods, services, and content in new ways. This not only creates jobs, drives growth, and stimulates innovation but also allows us to build competitiveness in the Web3 world. In other words, this is a new form of “digital globalization.”

The third reason is the inherent diversity of the new system. The future stablecoin economy won’t be monolithic, but a multi-layered, multi-regional, spectrum-like global network. We’ll see onshore and offshore dollar stablecoin economies—similar to today’s Eurodollar system—with broad space across Asia, Africa, and Latin America. These regions offer vast innovation potential and flexible regulations. With the ambition and vigor of Chinese overseas entrepreneurs, these markets can become our home turf.

The fourth reason is irreversible momentum. Once the U.S. breaks through, other major economies will inevitably follow. Look at Hong Kong—it’s already ahead, having passed its Stablecoin Ordinance. I believe it’s only a matter of time before we debate developing offshore RMB stablecoins. I consider this a serious strategic topic worth thorough discussion. If realized, Chinese entrepreneurs would gain greater dominance and voice in non-dollar stablecoin ecosystems.

The fifth reason is my long-standing conviction: China will eventually embrace the broad trend of blockchain and digital assets. We are a pragmatic nation—if this movement drives development, serves the real economy, and generates benefits, it will ultimately be accepted. Once opened, given China’s market size, density of entrepreneurship, and the diligence and pragmatism of its people, blockchain in China will explode into one of the world’s most vibrant innovation hubs.

Therefore, Chinese entrepreneurs must not let partial obstacles blind them to the entire era. What you see today in stablecoins and RWA is a once-in-a-decade wave. If you don’t step onto it, you voluntarily relinquish your voice. But if you dare to join—even amidst strong waves and fierce winds—you can secure a place in this new world. I believe Chinese entrepreneurs can do it. In five or eight years, when the stablecoin economy reaches $20–30 trillion, I’m confident a significant proportion of the industry’s leading entrepreneurs will be Chinese.

7. The Most Important Innovation Is the Innovation of Order

Meng Yan: There’s little doubt now about Chinese entrepreneurs’ ability to create high-quality products. The market skepticism centers on integrity. As a blockchain entrepreneur myself, I’m deeply dissatisfied with the current state of order in this industry. When I decided to join, I was inspired by Satoshi Nakamoto’s spirit—the idea that blockchain, as an open and transparent infrastructure, could enable large-scale collaboration mechanisms beyond corporations—more inclusive and fairer. But after ten years, the order this industry has built might fairly be described as “sowing dragons and reaping fleas.” Our original ideal was to oppose excessive centralized regulation, yet today’s crypto market order is worse than the one we aimed to replace—rife with fraud,失信, bullying, backroom dealings, and bottomless mutual harm. Frankly, ten years ago, if the U.S. proposed regulating stablecoins and crypto projects, I might have opposed it. But now, since the industry cannot self-generate healthy order, external intervention may be the only way.

Xiao Feng: Order is also a product—and the most important one.

You said “sowing dragons and reaping fleas”—I won’t dispute that. After ten years, we’ve all felt the gap between ideals and reality. Starting from technological idealism, we hoped blockchain could spontaneously form an open, transparent, and fair economic order without relying on traditional regulation. But reality proves that markets without basic rules struggle to function stably—just like the U.S. stock market in the 19th century. Human nature hasn’t changed; outcomes won’t either.

But the problem isn’t entirely ours. For the past decade, financial regulators in major jurisdictions have mostly responded to blockchain’s rapid development with blanket bans, failing to provide clear compliance pathways. This led to adverse selection—many honest innovators with real project capabilities, seeing no clarity or hope, exited. Those remaining were often more radical and speculative.

Now, proposals like the U.S. FIT21 Act and Token Safe Harbor are the positive signals we’ve waited for. They don’t aim to ban tokens outright, but to “establish rules and leave room for survival.” For example, under Token Safe Harbor, project teams register with the SEC, use tokens for fundraising, and after three years, regulators assess their decentralization level: if met, they continue operating without being treated as securities; if not, they fall under securities regulation. This is dynamic balance between regulation and innovation. It acknowledges token fundraising’s efficiency while setting regulatory baselines and exit mechanisms. To me, this is the process of creating new order—not cutting off tokens, but institutionalizing them into sustainable development.

More importantly, establishing such order benefits more than just the crypto industry. Future entrepreneurs in AI, robotics, biotech, new energy, carbon assets—could all potentially use tokens for fundraising and governance. This isn’t just about Web3—it’s about new foundational infrastructure for the entire innovation ecosystem.

So I’m optimistic. When the right people are willing to enter and play by the rules, with clear order established, success will follow. Markets don’t fear regulation—they fear the absence of rules. Once order is established, innovation will naturally follow.

Meng Yan: Do you have advice for Chinese entrepreneurs brave enough to participate in this wave of stablecoins and RWA?

Xiao Feng: I’ve been asked this frequently lately. I’d say today’s entrepreneurs need greater courage than in previous years. But precisely because barriers are higher, it shows the industry is entering a true construction phase. My suggestions are humble—five points for reference.

First, go overseas. This wave is global—you must go out and enter the eye of the storm. Go to the U.S., to Hong Kong, to Singapore, to Dubai—these places are becoming global frontiers for stablecoin and RWA innovation. To participate, you can’t hesitate—you must fight in the waves and stake your claim where rules are being shaped.

Second, align your intentions. The industry’s rules have changed. The path of getting rich by launching a token is gone. This is now an era of competing on real user value and application capability. For every product you build, every model you design, ask: Does it genuinely solve user problems? Does it create new efficiency? Only projects creating real value will survive this era.

Third, learn continuously. Learn not just technology and compliance, but new ideas and institutional frameworks. You can’t apply Web2 thinking to Web3, nor speculate in the stablecoin and RWA era with the mindset of “launching tokens to scalp韭菜.” This demands a whole new paradigm—continuous learning and constant self-disruption.

Fourth, collaborate. In this new phase, Chinese entrepreneurs must unite—not just for self-protection, but for resource integration, mutual learning, and even mutual oversight. This is the beginning of building a new industry order. We’ve suffered from “crypto chaos” before—those lessons must not repeat. Now is the starting point to rebuild order, requiring collective effort to shape a healthy ecosystem.

Fifth, stay open. Blockchain’s essence is an open, transparent, and fair collaborative network—this is its soul. Participate in the stablecoin economy and RWA, and innovate in blockchain, with this very spirit.

These aren’t grand theories—just some thoughts I hope may inspire entrepreneurs still considering whether to dive into this industry.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News