After Ethereum's Pectra upgrade: With the underlying architecture solidified and PeerDAS ready to launch, where should developers go?

TechFlow Selected TechFlow Selected

After Ethereum's Pectra upgrade: With the underlying architecture solidified and PeerDAS ready to launch, where should developers go?

EIP-7691 doubles the blob target capacity to 6 and raises the hard cap to 9, reducing L1 data availability gas fees to under approximately 1 Gwei.

Author: OKX Ventures

Key Takeaways

• Pectra (Prague + Electra) is the largest hard fork bundle upgrade since The Merge, encompassing 11 Ethereum Improvement Proposals (EIPs) aimed at synchronously reducing data costs, simplifying smart account operations, and optimizing validator operations.

• EIP-7691 doubles the blob target capacity to 6 and raises the hard cap to 9. This brings Layer 1 (L1) data availability (DA) gas fees below ~1 Gwei, with swap fees on major Layer 2s briefly dropping under $0.02.

• Now, every externally owned account (EOA) can be converted into a smart account via a single transaction (EIP-7702), enabling gas sponsorship, stablecoin fee payments, and batched user experiences without requiring contract migrations.

• The validator balance cap has been raised to 2,048 ETH (EIP-7251), significantly cutting DevOps costs for large operators without materially affecting decentralization.

• PeerDAS will be the next step in the Fusaka upgrade and is far more consequential for roll-ups than any single EIP in Pectra.

OKX Ventures' View: Pectra itself is not a "modular data availability (DA) inflection point"; it’s the final critical piece enabling L2s to attract mass-market users while Ethereum retains its settlement dominance. Future winners will be those who (a) externalize all UX friction through 7702-style accounts, (b) leverage the blob benefits to drive new data-intensive verticals (on-chain AI, orderbook DEXs, content storage), and (c) double down on proof compression technologies ahead of PeerDAS.

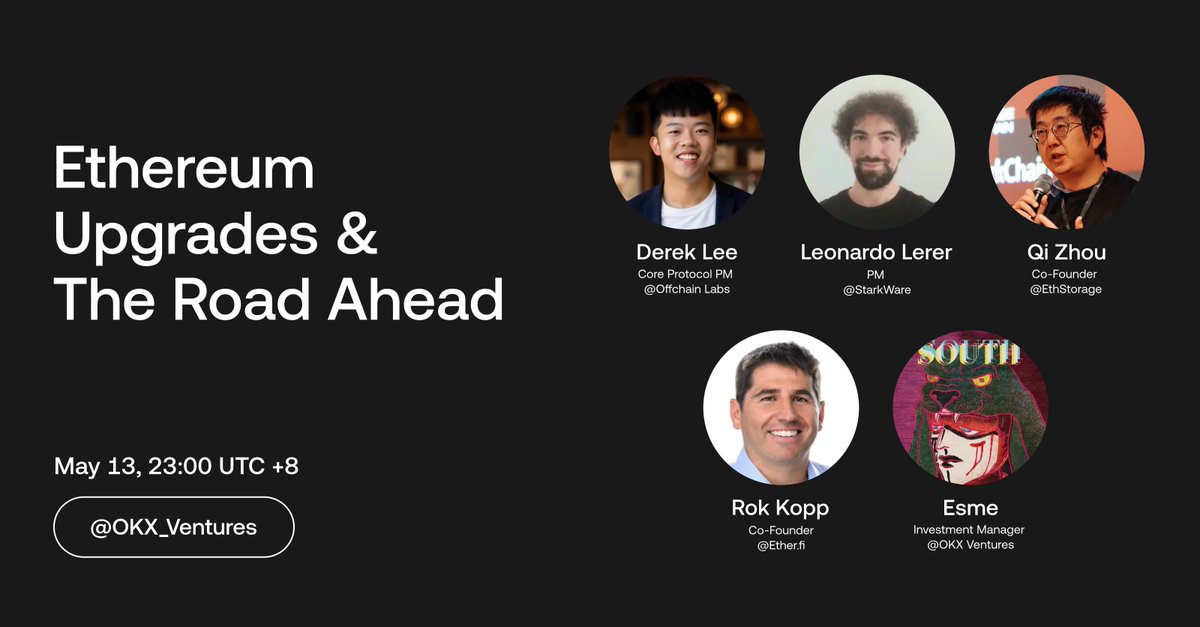

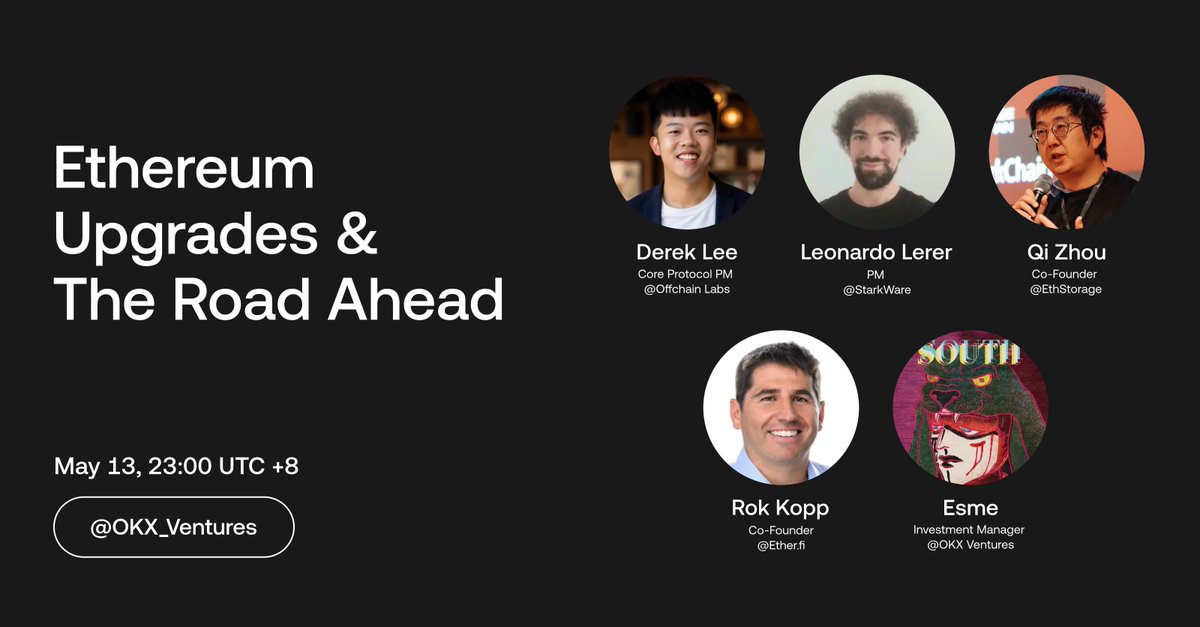

On May 13, OKX Ventures hosted a Twitter Space featuring guests directly involved in post-fork code development or infrastructure operations, diving deep into these changes.

During the event, OKX Ventures examined these changes closely with individuals responsible for delivering code or running hardware after the fork:

• Derek Lee – Core Protocol Product Manager, Offchain Labs

• Leonardo Lerer – Core Product Manager, StarkWare

• Qi Zhou – Co-founder, EthStorage

• Pok Kopp – Co-founder, Ether.fi

• Esme Zheng – Investment Manager, OKX Ventures

1. In the First Week, Who Changed Course and Who Felt the Ripple?

Arbitrum – Derek

No need to rewrite any code, but each Arbitrum instance had to upgrade its embedded Geth client. His primary focus was EIP-7691: doubling the blob target capacity means more low-cost space for DEX and gaming users.

Post-Pectra progress:

• BoLD permissionless fraud proofs entered testnet in April and are planned for mainnet launch “before Q4.”

• Stylus compiles hundreds of Rust/C contracts daily—examples shown by Derek include llama.cpp inference and real-time chess engines.

• TimeBoost has replaced the “first-price auction” mechanism in Arbitrum’s sequencer mempool, improving fairness in transaction inclusion.

Starknet – Leo

Pectra mainly adjusted Starknet’s blob cost model; Cairo 1.x’s fee schedule remains unchanged. A larger shift lies in StarkWare’s own roadmap: lower L1 DA costs reduce urgency around Volition (selective off-chain data), redirecting focus toward stateless client research.

Decentralization milestones:

• Staking v2 (proof-of-block rewards) launching this quarter.

• Sequencer-as-a-service (v0.14)—a 3f+1 Byzantine fault-tolerant (BFT) cluster—coming in 2025; cheaper blobs may allow shorter proof generation cycles without increasing fees.

EthStorage – Qi Zhou

Higher blob activity is a blessing—his storage layer now plans to offer persistent incentives when Ethereum discards data after two weeks. Pectra also forced a full fleet Geth upgrade; one group of operators using v1.13.8 froze mid-epoch.

Ripple effects:

• Node Operators: Within 48 hours, 732 validators increased their stake above 32 ETH.

• Roll-up Users: As blob gas fees dropped back to ~1 Gwei, swap fees on major L2s fell below two cents despite mempool volatility.

• Infrastructure Developers: Rapid point releases from Go-Ethereum kept all archive node operators on high alert.

OKX Ventures View: Cheap blobs, one-click accounts, and larger validators aren’t headline features—they’re foundational “plumbing” that enables the next headline feature to land smoothly. PeerDAS will soon test this claim.

2. EIP Deep Dive

Scaling Smart Accounts (EIP-7702)

EIP-7702 allows any externally owned account (EOA) to act as a smart account within a single transaction, inheriting batch calls, gas sponsorship, and stablecoin fee payments without contract migration.

Starknet has lived in an AA (account abstraction) world since genesis. Leo illustrated: productivity app FocusTree silently deploys an account for each mobile user and begins minting achievement NFTs funded by sponsored fees. Users don’t even realize they’re operating on-chain.

EthStorage will use paymasters to fund users’ first ten transactions—e.g., deploying a personal website via blob in one click.

Arbitrum already has GMX, Camelot, and Plays integrating 7702 flows via third-party AA providers. Derek expects the first direct metric uplift to be in transaction success rates and failed swap refunds, followed by a second wave of Web2-native user onboarding channels.

OKX Ventures View: 7702 removes the final self-custody UX barrier. Investable areas include paymasters performing gas arbitrage across tokens and chains, and security middleware enforcing spending limits and fraud rules at the AA layer.

Cheaper Data (EIP-7691)

Arbitrum: Every roll-up competes for the same blob pool; doubling capacity merely “buys breathing room before congestion pricing kicks in.”

Starknet only posts state diffs; cheaper blobs don’t unlock new functionality but reduce per-transaction cost and help avoid shifting toward Volition (selective off-chain data).

EthStorage estimates the new capacity (~3 TB every 12 days) finally makes it feasible to store static websites under 100 MB—including vitalik.ca—entirely in blobs. Note: Gas fees for on-chain transactions are now the bottleneck, often exceeding long-term storage costs. Qi is pushing for block-level access lists and higher gas limits to alleviate this constraint.

OKX Ventures View: The data gravity is shifting back on-chain; near-term TAM includes non-financial blob-native content (AI inference weights, game assets, social graphs) that can tolerate blob expiry if retrieval incentives exist. Long-tail retrieval and proof markets will become critical infrastructure.

Validator Cap at 2,048 ETH (EIP-7251)

Data point: So far, only 732 / 1,000,000 validators have increased stake—no centralization panic.

Arbitrum & Starknet: Purely an operational win—lower DevOps costs, negligible impact on users. Theoretically, slashing risk per validator increases slightly, but Leo considers this an “interesting academic question,” not a practical hurdle.

EthStorage: Enables running hot/cold validator replicas without increasing infrastructure spend; makes large-scale blob proofs more reliable. Qi emphasizes staking service advantages: fewer devices, same yield, and running hot standby validators without doubling hardware budgets.

OKX Ventures Insight: Hardware cost savings will flow into restaking and shared security markets, not directly to end users; watch EigenLayer-style protocols absorb released liquidity. More idle ETH → more security capacity.

3. Post-Pectra Roadmap Signals

PeerDAS (Fusaka Hard Fork, EIP-7623)

Every speaker used the same adjective: existential. Derek called it “critical and non-negotiable”—Offchain Labs already has Prism engineers in spec discussions because Arbitrum’s fraud proof throughput is ultimately limited by DA bandwidth. Leo sees PeerDAS as “the foundation of the entire L2 roadmap”; once sampling launches, he can increase Starknet’s proof frequency without worrying about blob fees. Qi has already written the economic foundations for that world—EthStorage will incentivize peers to keep sampled blobs available even after the protocol forgets them.

Verkle Trees and State Expiry

Qi sees these paths as complementary. Verkle trees shrink witness sizes and enable stateless clients; state expiry reduces full-node disk usage by half by discarding old blocks. He estimates ~50% storage savings, but only if a retrieval market exists—Portal + EthStorage paying someone to preserve cold data. Leo cares less about savings and more about what Verkle unlocks: a phone capable of verifying Ethereum without syncing state. He wants to observe how Beacon clients handle stateless mode before porting the idea to Starknet.

SSZ Object Transactions (EIP-6404 series)

Qi is leading the first public testnet. The promise: smaller witness data, faster decoding, and perfect alignment with Verkle tree object hashing. Derek is format-agnostic (“roll-ups can absorb either”), while Starknet is merely monitoring—Cairo already serializes with its own field element layout.

Contract Size 128 KB (EIP-7907)

If you’ve ever split a monolithic app into 24 KB shards, you know the pain. Qi and Curve’s dev team are spearheading this patch, but the blocker isn’t consensus—it’s a DDoS-resistant gas meter needed for very large deployment transactions.

Block-Level Access Lists

Qi’s benchmarks show parallel preloading of state cuts Geth’s IO wait time by ~70%. This justifies raising gas limits, which directly lowers blob publishing costs. He’s collecting mainnet trace data to validate this trade-off.

OKX Ventures Insight: Pectra is a “comfort” release; the next twelve months will focus on data availability, stateless validation, and ultimately giving developers space to deploy large, complex contracts without workarounds.

4. Big Picture – How Does This Expand the Moat?

The key metric to watch is settled value. Leo expects L2 throughput’s compound growth curve to outpace all other KPIs, stating: “Each roll-up brings its own exponential growth.” If true, then the settlement layer anchoring all these L2s—Ethereum—captures the entire flywheel effect.

Developer retention finally looks healthy. Qi’s litmus test is Web2 teams experimenting with AA wallets and subsidized blobs—both of which lacked credible forms six months ago.

Security budgets are about to be repriced. Derek notes validator consolidation combined with EigenLayer-like restaking mechanisms will shift yields from idle staking to active validation services. Ether sitting idle in personal 32 ETH hot wallets will transform into remote attestation revenue for oracles, bridges, and DSPs.

Is Pectra a “pivot”? That’s overstated. The panel agrees: even with blob utilization at only 40%, large roll-ups won’t migrate to Celestia or EigenDA. Ethereum’s **data availability (DA)** remains the most cost-effective trust premium in crypto. Keep expanding the base layer, and the market will sort out the rest.

Derek’s core point: “Not a pivot, but a double down—focused on making Ethereum faster and roll-ups more comfortable.”

Qi adds: Killer UX upgrades will still be prototyped first on L1—7702 did this, and PeerDAS sampling will follow—then cascade down to L2s.

OKX Ventures View: The synergy between highly modular roll-up stacks and continuously expanding L1 capacity curves creates a flywheel no monolithic chain can match. Pectra didn’t “save Ethereum”; it simply cleared the last UX gap before PeerDAS multiplies DA by 25x.

5. Hot Topic: Is Pectra ‘Enough’?

Roll-up DA Choices: Consensus is no—Arbitrum, Starknet, and EthStorage all plan to stay on Ethereum DA, even if blob utilization remains below 60%.

Non-technical Leverage: Derek believes continued focus should be on L1 scaling and roll-up support; no need for issuance games. Qi adds: L1 scaling experiments (block-level access lists, higher gas limits) will originate from Ethereum and flow backward to L2s.

6. OKX Ventures Future Investment Strategy

Smart Account Infrastructure will become the default consumer entry. EIP-7702 combined with third-party paymaster mechanisms will compress the two-year gap between crypto-native contract design and mass user onboarding. OKX Ventures prioritizes investment in modular paymaster liquidity networks, intent relays, and AA risk scoring engines so any Web2 app can offer “stablecoin gas payment” and “one-click signup” from day one.

Blob-native Content is the next frontier. A storage incentive layer guaranteeing blob retrieval after protocol expiry is highly promising. Cheap blobs plus storage incentives will create a medium where games, AI models, and social media can fully reside on Ethereum’s security.

Restaking will absorb funds saved by validators. EIP-7251 frees up hardware budgets and activates idle ether. Protocols turning this collateral into measurable security—such as oracle attestations, bridge verification, shared sequencer sets—will earn outsized yields. OKX Ventures expects “investment-grade” restaking targets to become scarce and is actively funding teams with the clearest risk-adjusted accounting.

PeerDAS is the real inflection point. When sampled DA lands, roll-ups can dilute marginal DA costs by 10x without sacrificing Ethereum’s trust. Teams currently building data sampling clients, proof compression circuits, or DA markets will control the core tooling layer post-Fusaka activation. OKX Ventures is actively seeking tools, proof compression, and data availability market projects that can front-run Fusaka.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News