U.S. Stablecoin Strategy: Reshaping Dollar Hegemony and the Treasury Market Landscape

TechFlow Selected TechFlow Selected

U.S. Stablecoin Strategy: Reshaping Dollar Hegemony and the Treasury Market Landscape

From certain policy perspectives, "Tether's interests suddenly align with U.S. interests."

By: Cobo Researcher

Stablecoin legislation has been held up as a model of successful U.S. crypto regulation. But within a broader narrative, it marks the opening move of a dollar expansion strategy.

With the GENIUS Act passing a procedural vote in the Senate on May 19 by an overwhelming margin, the U.S. stablecoin regulatory framework is accelerating toward implementation. This is not merely a regulatory update, but a strategic national deployment by the United States in the realm of digital finance. In recent years, the U.S. government has quietly advanced a far-reaching financial strategy aimed at reshaping the global financial landscape and reinforcing the dollar’s international dominance by regulating and guiding the stablecoin market.

According to Bloomberg, this strategic calculus may be deeper than commonly perceived. As early as during the Trump administration, there were signs that the development of dollar-based stablecoins had been placed on the national strategic agenda through executive action, seen as a tool to sustain dollar hegemony. The advancement of legislative frameworks such as the GENIUS Act reflects the continuation of this thinking under the current administration. Treasury Secretary Scott Bessent recently told Congress that digital assets are expected to generate up to $2 trillion in new demand for U.S. Treasury securities over the coming years. This not only introduces a new structural buyer base for U.S. debt but also digitally extends the dollar’s global reach through stablecoin pegging mechanisms.

Stablecoin Legislation: A Strategically Dual-Pronged Policy Design

The core provisions of the GENIUS Act—such as requiring stablecoin issuers to back tokens with 100% cash in U.S. dollars or short-term U.S. Treasuries and other highly liquid assets, along with monthly transparency reports—go beyond simple risk control. These rules will directly create structural demand for U.S. dollars and Treasury securities. In theory, each dollar of compliant stablecoins issued locks an equivalent value of U.S. dollar assets into reserves. Given that nearly 99% of global stablecoins are currently pegged to the dollar, the scale effect of this mechanism is significant.

On one hand, this brings a new and growing buyer group to the ever-expanding U.S. Treasury market—particularly valuable as traditional foreign sovereign buyers (like China and Japan) have been steadily reducing their holdings in recent years. On the other hand, by supporting a compliant dollar-based stablecoin ecosystem, the U.S. can maintain its monetary influence in the digital currency era without directly expanding the Federal Reserve’s balance sheet.

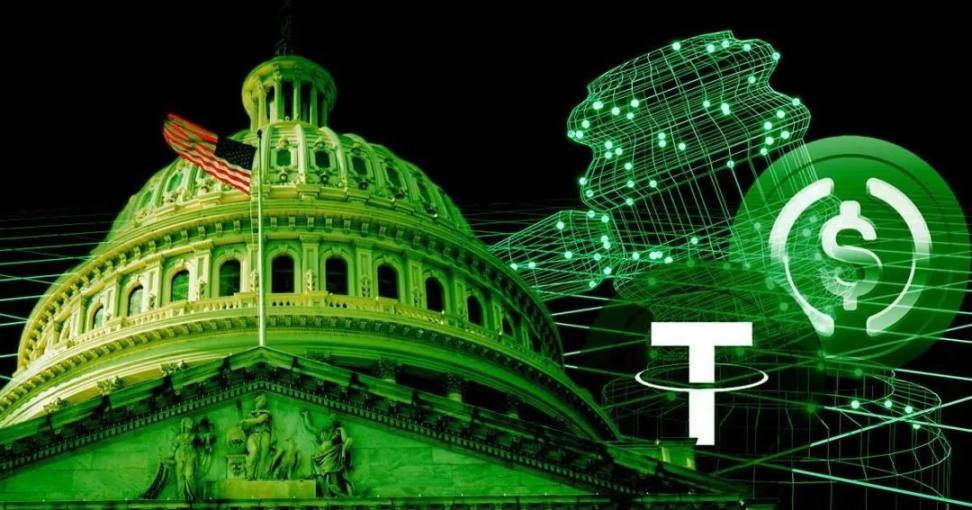

The strategic importance of this emerging capital flow to the U.S. Treasury market is further confirmed by recent forecasts from major financial institutions. For example, Standard Chartered estimates that by the end of 2028, the market capitalization of dollar-pegged stablecoins could surge eightfold to $2 trillion. Citigroup’s analysis paints a similar growth trajectory, projecting a “base case” market size of $1.6 trillion by 2030, and a “bull case” scenario reaching as high as $3.7 trillion.

Source: U.S. Treasury, Tagus Capital, Citi Academy

Critically, both international banks explicitly state that because stablecoin issuers must purchase low-risk assets like U.S. Treasuries to back their tokens, they are likely to surpass many sovereign nations in Treasury holdings within the coming years. This trend is particularly noteworthy against a backdrop where traditional large holders like China have been consistently reducing their positions, while policies such as those on trade tariffs during the Trump era once prompted scrutiny and doubt about the traditional safe-haven status of U.S. Treasuries. In this context, compliant stablecoin issuers are evolving from niche crypto participants into potential, and possibly primary, sources of structural demand for U.S. debt.

Tether's Role: From Market Giant to Strategic Hub

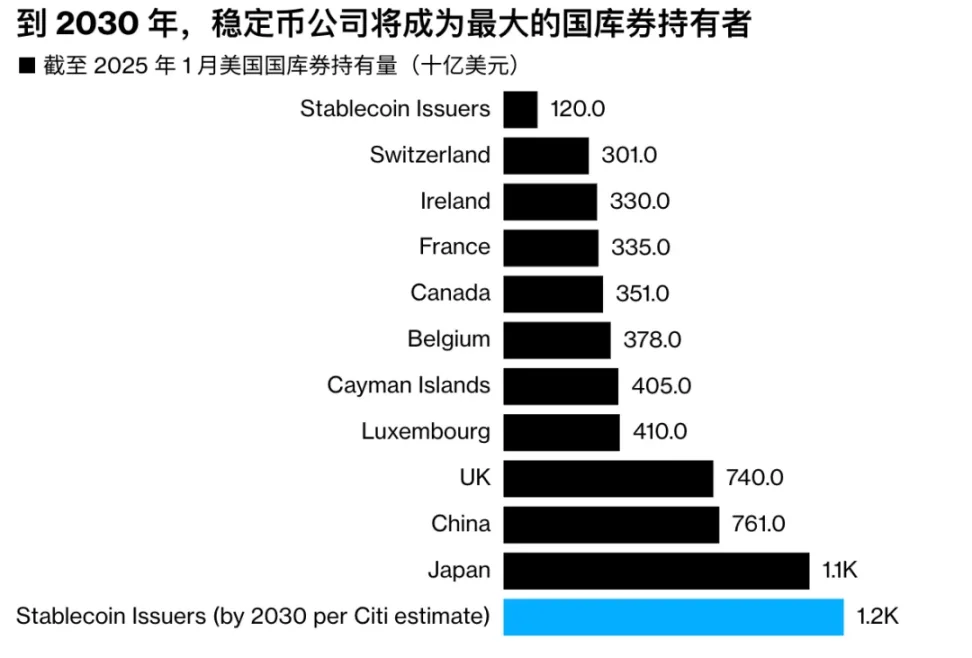

Within this strategic landscape, Tether—the issuer of the world’s largest stablecoin, USDT—is playing an increasingly prominent role. Data shows that Tether’s holdings of U.S. Treasuries are now comparable to those of major industrialized nations like Germany. This makes Tether not only a critical piece of crypto market infrastructure but also a significant holder of U.S. debt.

Tether's U.S. Treasury holdings are approaching those of Germany

Tether’s uniqueness lies not just in the scale of its assets, but also in its deep collaboration with Cantor Fitzgerald, a long-established U.S. financial institution and primary dealer with direct access to the Federal Reserve. This relationship grants Tether unparalleled liquidity support during extreme market conditions. Through Cantor Fitzgerald, Tether can swiftly sell its U.S. Treasury holdings to obtain cash when users redeem USDT en masse. For instance, during the severe crypto market turmoil in 2022, USDT briefly lost its dollar peg. Yet, using this mechanism, Tether successfully met $7 billion in redemption requests within 48 hours—about 10% of its supply at the time. Such a bank run would typically push most traditional financial institutions into crisis, yet Tether weathered it smoothly, underscoring the robustness of its reserve system and the uniqueness of its liquidity arrangements.

In a way, this institutional design aligns perfectly with the U.S.’s long-term goals of promoting financial innovation and consolidating dollar dominance—by strengthening American financial advantages through non-traditional means. The result is a powerful, deeply dollar-integrated stablecoin issuer that objectively enhances the global penetration of the dollar system.

Global Expansion and the Soft Power Projection of Digital Dollars

Tether’s ambitions extend well beyond existing markets. The company is actively expanding its USDT operations into emerging regions such as Africa and Latin America. Through diverse initiatives—including acquiring local infrastructure entities, developing the Hadron asset tokenization platform, launching an open-source self-custody wallet, and investing in brain-computer interfaces and peer-to-peer communication apps like Keet (based on the Holepunch protocol)—it aims to build what it calls an “AI Agent-driven peer-to-peer network.” Its newly launched QVAC platform natively supports USDT and Bitcoin payments and integrates decentralized communication tools, aiming to create a digital ecosystem emphasizing user autonomy, censorship resistance, and trustlessness.

Tether CEO Paolo Ardoino has commented on China’s efforts to expand influence in developing countries through infrastructure projects and potential non-dollar payment systems (such as gold-backed digital currencies). Against this backdrop, Tether’s moves in these regions can be seen as market-driven commercial activities designed to promote the use cases of dollar-pegged stablecoins. Objectively, this also competes with alternative digital currency systems and expands the dollar’s footprint in the digital domain—a development that aligns, to some extent, with America’s macro-level strategy of preserving global monetary leadership.

Despite its dominant market position and unique liquidity mechanisms, Tether’s operations are not without controversy. According to a report by The Wall Street Journal last October, federal prosecutors in Manhattan investigated whether Tether violated sanctions and anti-money laundering regulations (Tether stated it was unaware of the probe or is cooperating with authorities). In 2021, Tether paid $41 million to settle with U.S. regulators over allegations of misrepresenting its reserves. These past incidents and ongoing scrutiny highlight the compliance and transparency challenges faced by major stablecoin issuers. CEO Ardoino himself did not visit the U.S. until March this year, joking that he might have been arrested if he had come earlier—reflecting the delicate nature of Tether’s relationship with U.S. authorities. Nevertheless, Bloomberg has noted that from certain policy perspectives, “Tether’s interests have suddenly aligned with those of the United States.”

A New Pathway for Dollar Hegemony in the Digital Age

The U.S. strategy of using legislative tools like the GENIUS Act to regulate and guide the stablecoin market, combined with the rise and global expansion of market players like Tether, is opening a new pathway to reinforce the dollar’s international standing. This not only generates crucial new demand for U.S. Treasuries—Standard Chartered analysts even suggest that over the next four years, industry purchases of Treasuries “could roughly cover all potentially issued additional U.S. debt,” alleviating pressure from declining traditional buyers—but also maintains and extends the dollar’s global influence in a relatively low-cost, high-penetration manner amid the global digital transformation. As Treasury Secretary Bessent acknowledged, digital assets could bring $2 trillion in new demand for Treasuries in the coming years. Yet stablecoin growth also brings risks: any sudden spike in redemptions could force operators to rapidly liquidate their Treasury holdings, potentially disrupting markets. Moreover, as traditional financial giants like PayPal and new entrants such as World Liberty Financial—linked to the Trump family—enter the space, the competitive landscape continues to evolve. Nonetheless, the long-term effectiveness of this “open strategy” will ultimately be tested across multiple fronts: global regulatory coordination, technological security, geopolitical competition, and market dynamics.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News