From Hype to Value: How Meme Coins Are Embracing Real-World Assets?

TechFlow Selected TechFlow Selected

From Hype to Value: How Meme Coins Are Embracing Real-World Assets?

Meme Coins embrace real-world assets, ushering in a new era of stability and yield.

Author: Ave AI

Translation: Baihua Blockchain

Meme Coins started as jokes—fun, viral, community-driven tokens that often surged in value due to internet culture, celebrity tweets, and perfect timing. Yet despite their meme magic, they've always lacked one critical element: intrinsic value.

That's changing.

In 2024 and extending into 2025, we're seeing a powerful new trend emerge: real-world assets (RWAs) being integrated into the Meme Coin ecosystem. This is a surprising and compelling fusion—the marriage of cultural momentum with tangible value—that could reshape how Meme Coins are created, traded, and perceived.

What Are RWAs? And Why Do They Matter?

Real-world assets (RWAs) are physical or intangible assets with measurable value, including:

-

Real estate (residential, commercial properties)

-

Commodities (such as gold or oil)

-

Intellectual property (music copyrights, patents)

-

Financial contracts or invoices

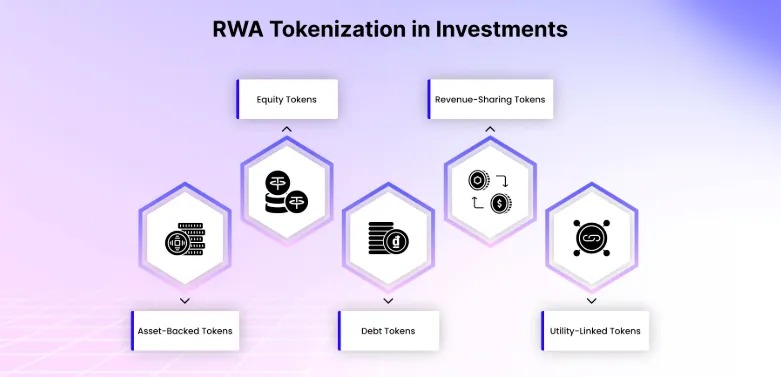

Through tokenization, these assets are digitally represented on blockchains—essentially converting ownership into tradable tokens.

RWAs have gained traction in institutional finance and decentralized finance (DeFi). Now, Meme Coins—long seen as the "Wild West" of crypto—are beginning to inject real value into themselves by incorporating RWAs into their ecosystems.

How Do RWA-Supported Meme Coins Work?

So, how do Meme Coins become tied to real-world value?

In most cases, Meme Coin projects partner with RWA protocols or directly tokenize an asset—such as a piece of land, artwork, or revenue stream. Then:

The Meme Coin is partially or fully backed by that asset.

Holders may receive real-world dividends, usage rights, or passive income from the underlying asset.

The Meme Coin trades publicly, but now with asset backing that provides credibility and a potential floor for value.

This model creates a new kind of meme token: still riding speculative waves, yet rooted in tangible assets.

Why Does This Matter?

The Meme Coin market is exciting—but highly volatile. Token prices can surge 100x or crash to zero within days. The introduction of asset backing changes this dynamic in several ways:

Increased Credibility

Investors are more likely to trust a Meme Coin project anchored in real-world assets—whether property, intellectual property, or other income-generating assets.

Reduced Risk

Asset backing can provide a minimum value floor, helping holders mitigate losses during market downturns.

Broadened Appeal

By combining internet culture with tokenized RWAs, Meme Coins become more attractive to traditional investors skeptical of purely speculative crypto assets.

Emerging Real-World Use Cases

Here are some ways we’re already seeing RWAs intersect with Meme Coins:

Real estate fractional memes: Meme Coins partially backed by ownership of real-world properties. The more the token grows, the larger its exposure to real-world assets becomes.

Music royalties: Tokens linked to meme-themed music or short audio clips, where holders share streaming revenue.

Revenue-sharing NFTs: Meme Coins bundled with NFTs representing shares of future ad revenue, merchandise sales, or content licensing.

This isn’t just theoretical—some projects are already experimenting with these models on chains like Solana and Base, where meme culture and rapid innovation thrive.

How This Changes the Meme Coin Game

Let’s be clear: Meme Coins will always be part speculation, part culture, part chaos. But with the addition of RWA backing, the rules shift:

Founders gain a new way to anchor narratives in reality.

Communities have reasons to hold beyond short-term hype.

The Meme Coin category matures—without losing its identity.

This isn’t about making Meme Coins boring—it’s about giving them more dimensions and potentially longer staying power.

Conclusion: Forces Driving the Shift

What’s next?

As the lines between traditional finance and on-chain culture continue to blur, Meme Coins may become one of the most unexpected beneficiaries of RWA tokenization. We’re entering a new era where Meme Coins will:

-

Be supported by real-world revenue streams.

-

Embed smart contracts representing ownership or profit-sharing.

-

Be enhanced through utility, governance, or real economic impact.

If last cycle’s Meme Coins were “attention assets,” the next generation could be a hybrid of “attention + assets”—driven by memes, but grounded in value.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News