Stablecoin Data Insights: Total Market Cap Surpasses $232 Billion, Infrastructure Such as Wallets Continues to Improve

TechFlow Selected TechFlow Selected

Stablecoin Data Insights: Total Market Cap Surpasses $232 Billion, Infrastructure Such as Wallets Continues to Improve

USDT and USDC still dominate, collectively holding 89% of the market share.

Author: OurNetwork

Translation: TechFlow

Editor's Note:

In this article, we will focus on another stablecoin giant with a market cap exceeding $10 billion—USDC—and provide updates on Ethena’s dual stablecoin products, USDe and USDtb. Additionally, analysts from OurNetwork will bring you insights into the current state of stablecoins on Solana, infrastructure developments (account abstraction is coming), and coverage of USR—an emerging dollar-pegged asset with a market cap surpassing $250 million that employs a delta-neutral backing mechanism.

If there were any doubts before, it's now clear: stablecoins have become a critical component of the financial landscape. Tether generated over $1 billion in operating profit in Q1 2025. Circle, the issuer of USDC, has filed for an IPO. Even the World Economic Forum estimates that stablecoin transaction volume reached $27.6 trillion in 2024—surpassing the combined volumes of Visa and Mastercard.

Now, let’s dive deeper.

Second Installment of the Stablecoin Series

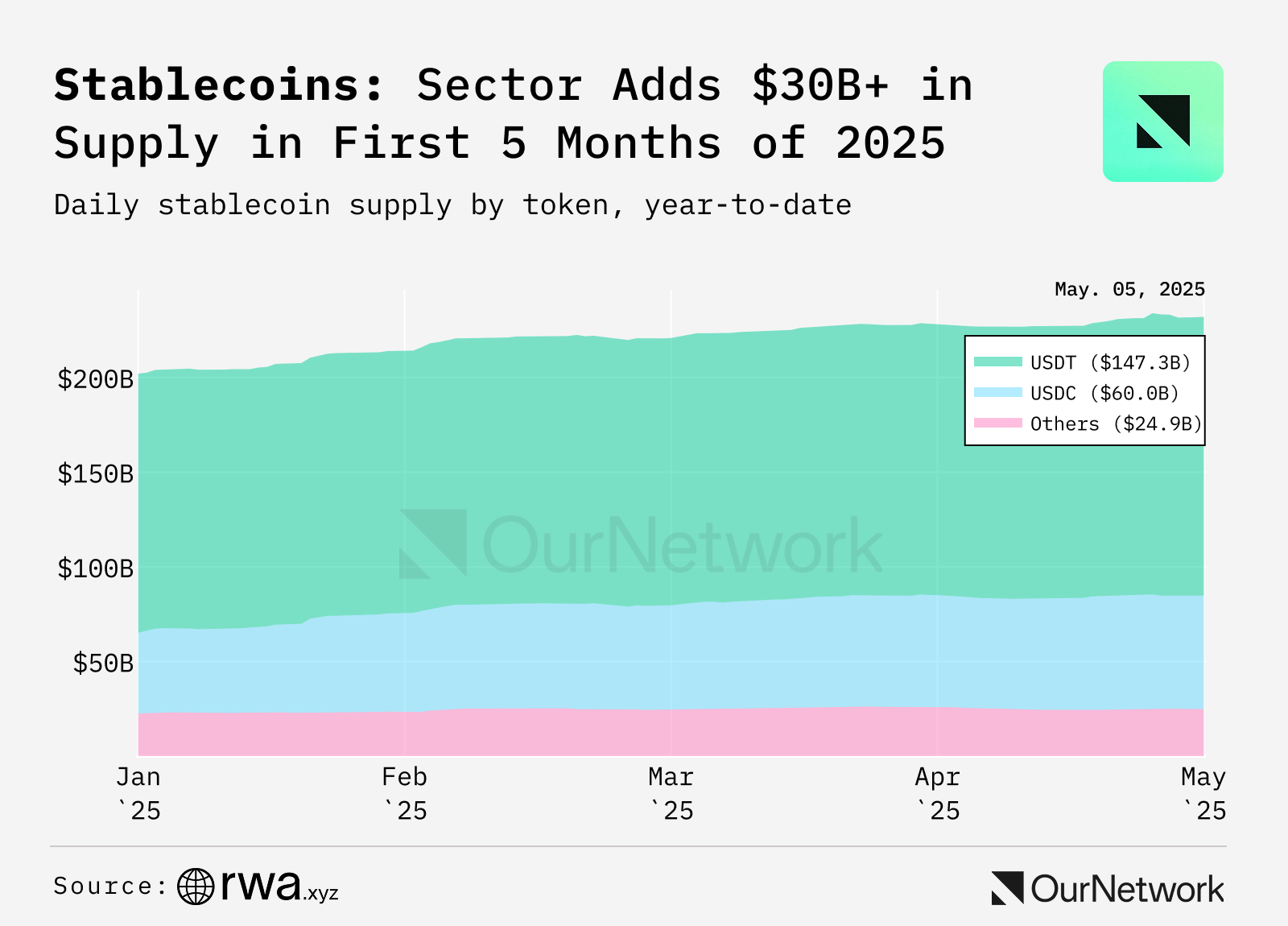

Stablecoin market cap surpasses $232 billion in 2025, up 15% year-to-date

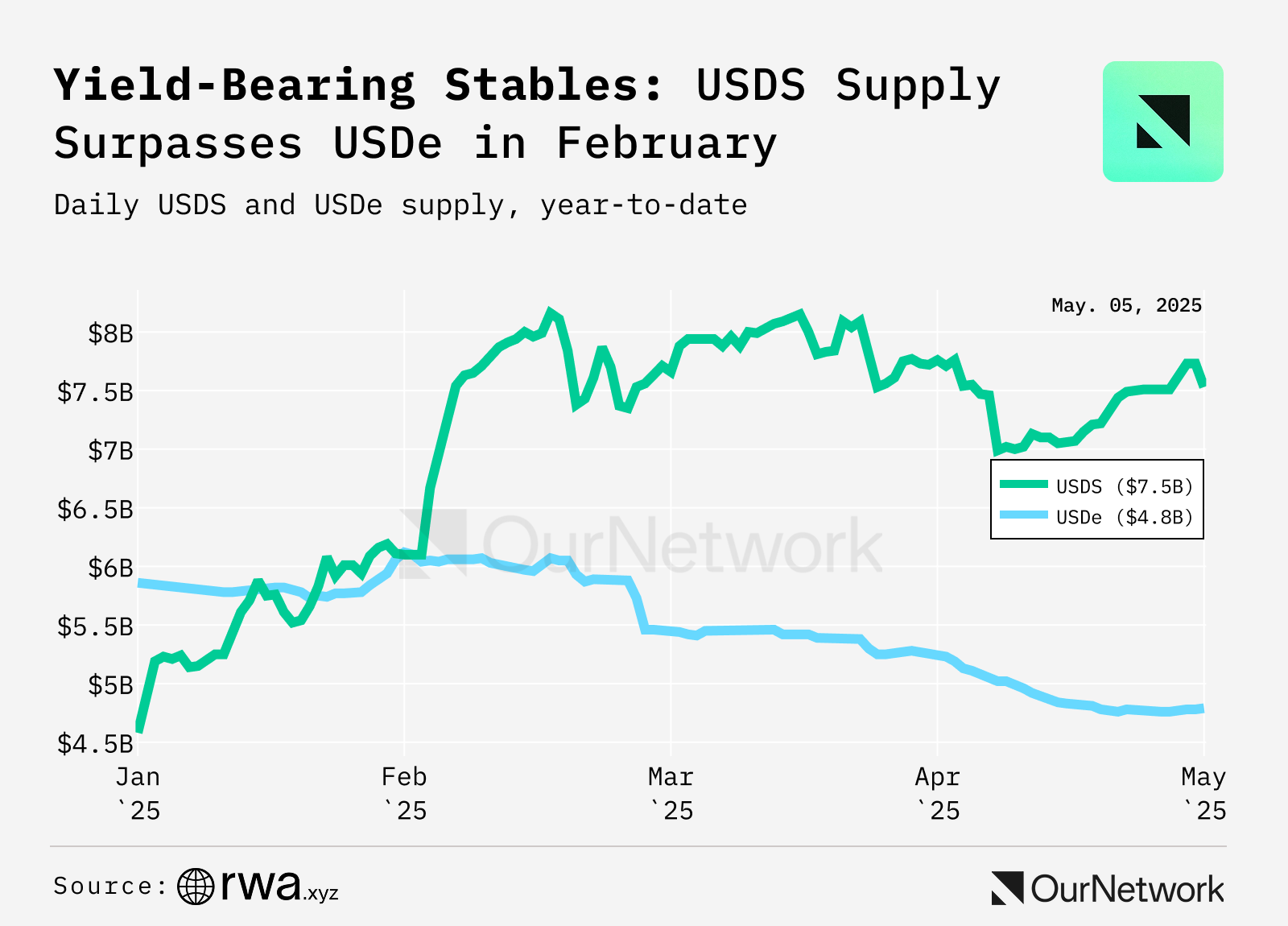

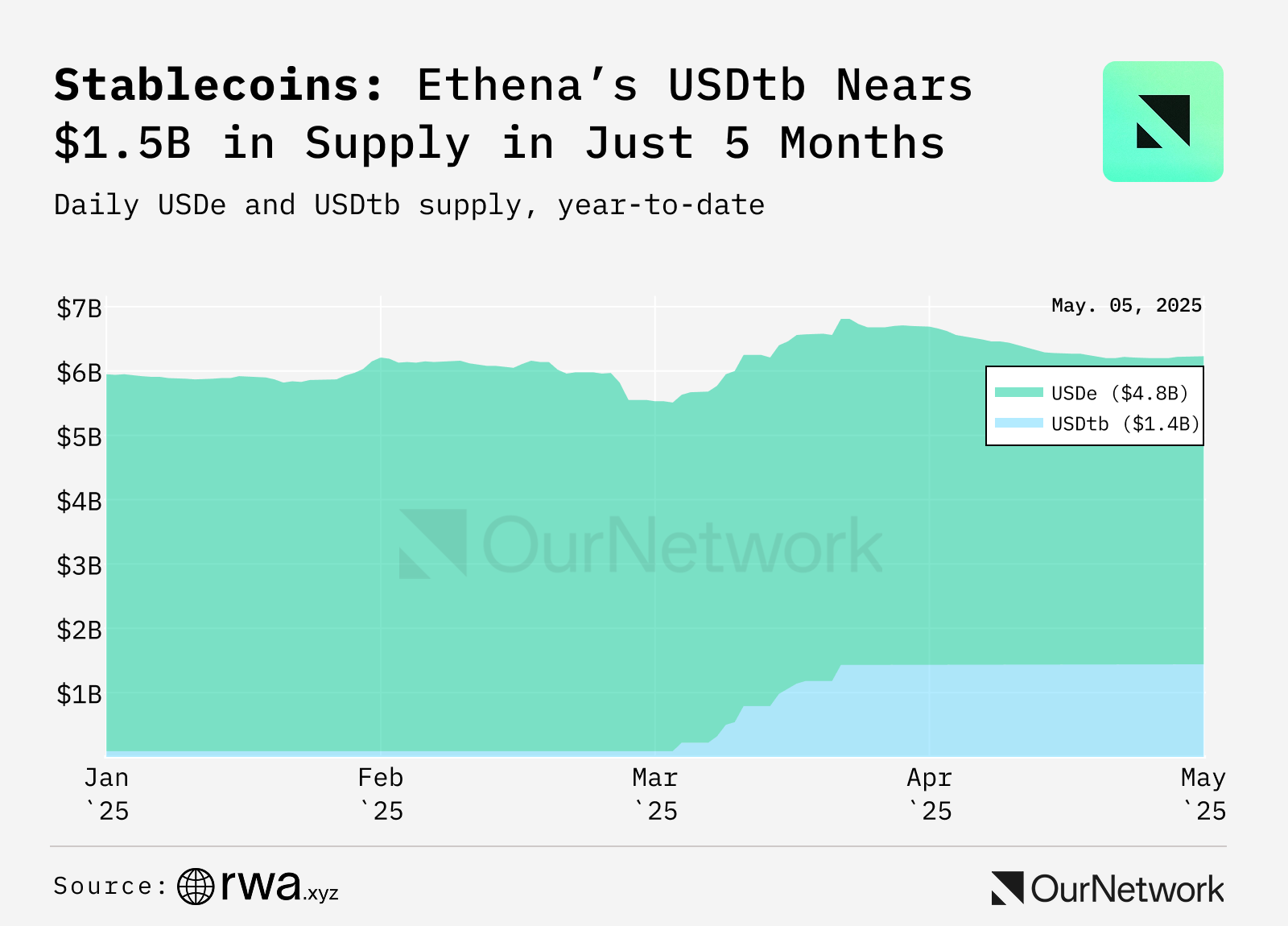

In 2025, the stablecoin market grew by $30 billion, reaching a total market cap of $232 billion. USDT and USDC remain dominant, collectively holding 89% market share. However, due to delistings related to MiCA (Markets in Crypto-Assets Regulation), USDT's share dropped from 68% to 62%, while USDC rose to 26%. Sky’s USDS and USDtb, issued by Ethena and backed by U.S. Treasuries (primarily BlackRock’s BUIDL fund), stood out among yield-generating stablecoins, growing by over $4 billion. USDtb’s market cap surged from $89 million to $1.4 billion, reflecting its role as a safer option within the Ethena ecosystem during market volatility.

Sky’s USDS surpassed Ethena’s USDe in supply volume in February. As market conditions worsened and staking yields for USDe declined from double-digit highs to single digits, USDe’s supply dropped by over $1 billion. Meanwhile, USDS supply increased by nearly $3 billion, driven by its more stable and predictable returns.

Although both assets are issued by Ethena, USDtb is backed by BlackRock’s BUIDL fund and serves as a safer alternative to USDe. When perpetual futures funding rates turned negative, Ethena closed its delta-neutral positions and shifted assets into USDtb. USDe’s supply fell by 18%, while USDtb surged by 1510%.

Solana Stablecoins

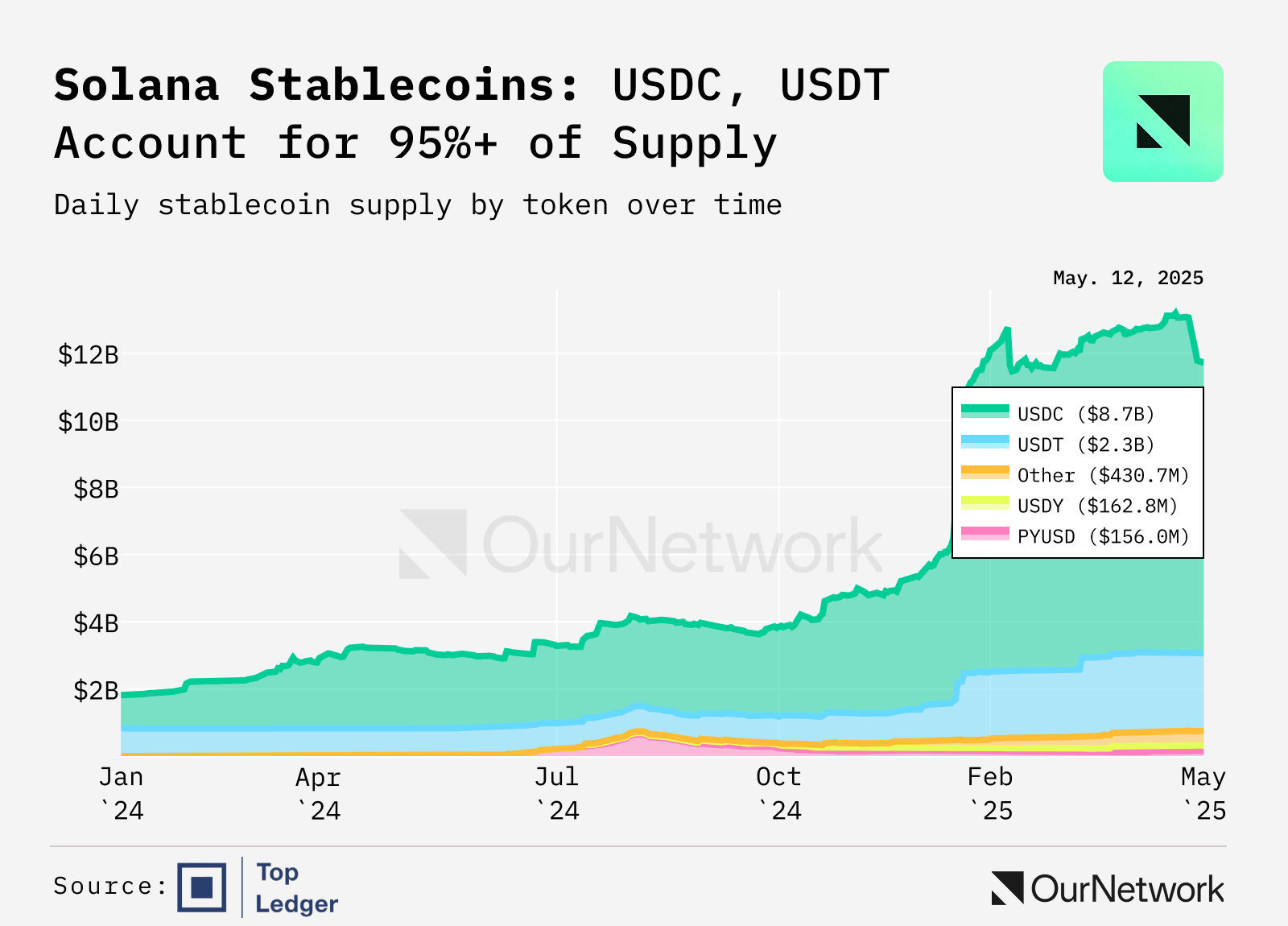

Solana stablecoin supply has slightly declined since peaking in January, but peer-to-peer transaction volume remains active, reflecting faster capital velocity and a healthy DeFi ecosystem

Circle’s USDC dominates the Solana stablecoin market, capturing nearly 80% market share.

USDC, USDT, PYUSD, USDY, USDS, FDUSD, and AUSD are the most popular dollar-pegged stablecoins on Solana. As of March 14, the total value of dollar-pegged stablecoins on Solana exceeded $11.7 billion.

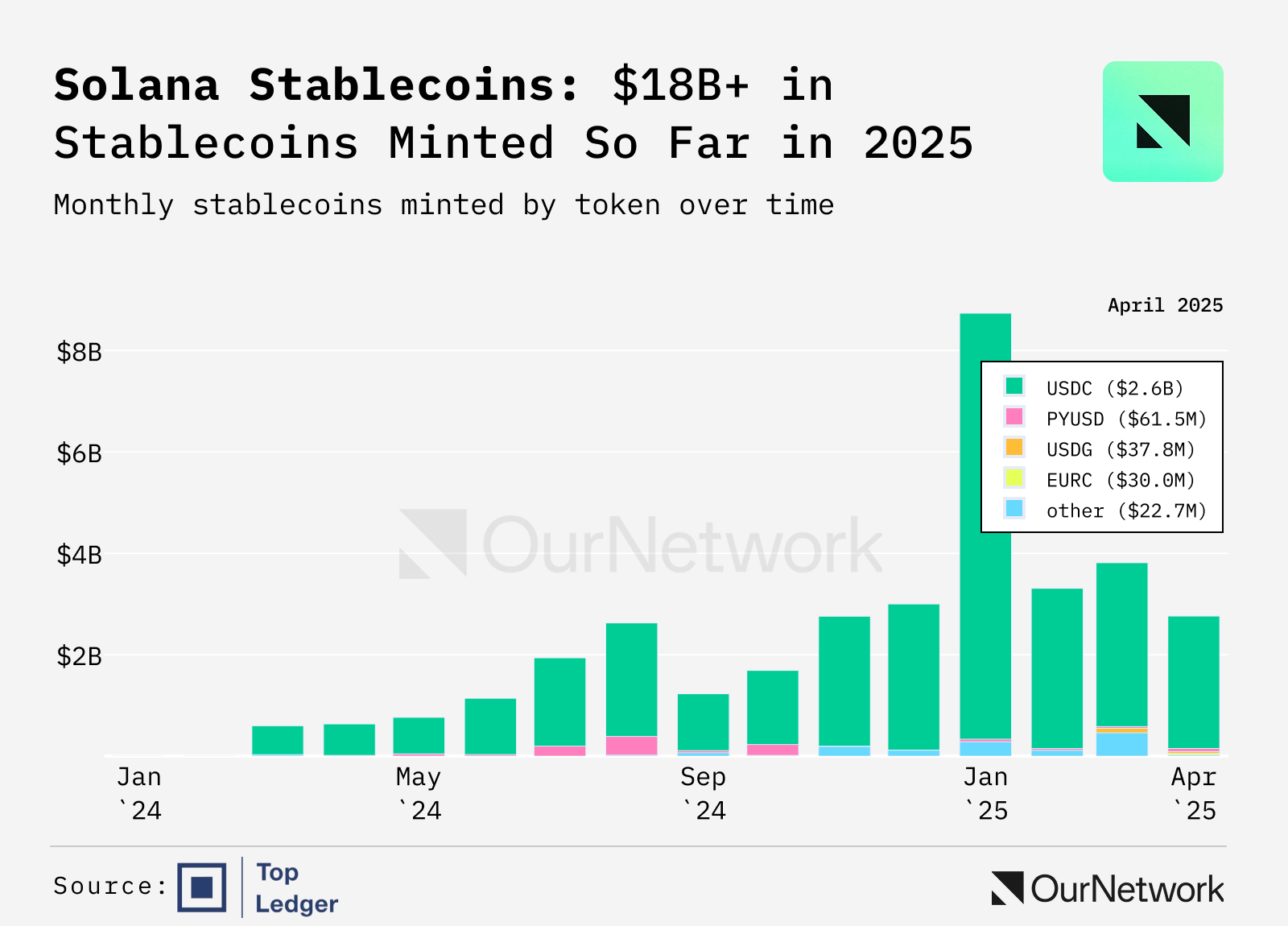

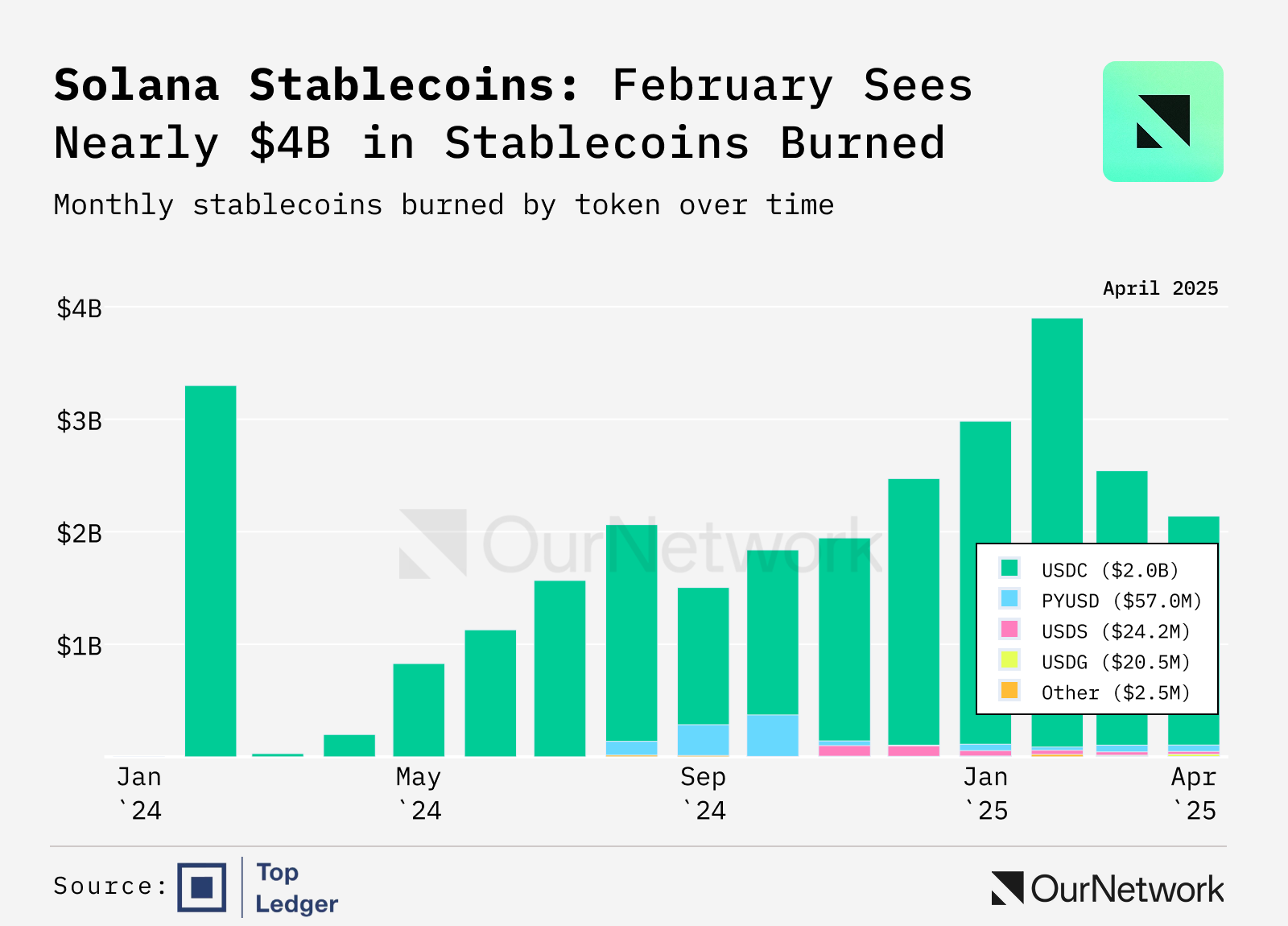

The following chart shows monthly redemption and minting activity for stablecoins. Notably, January 2025 was a breakout month, with minting volume twice that of redemptions.

Stablecoin Infrastructure

Robust payment infrastructure drives broader stablecoin use cases

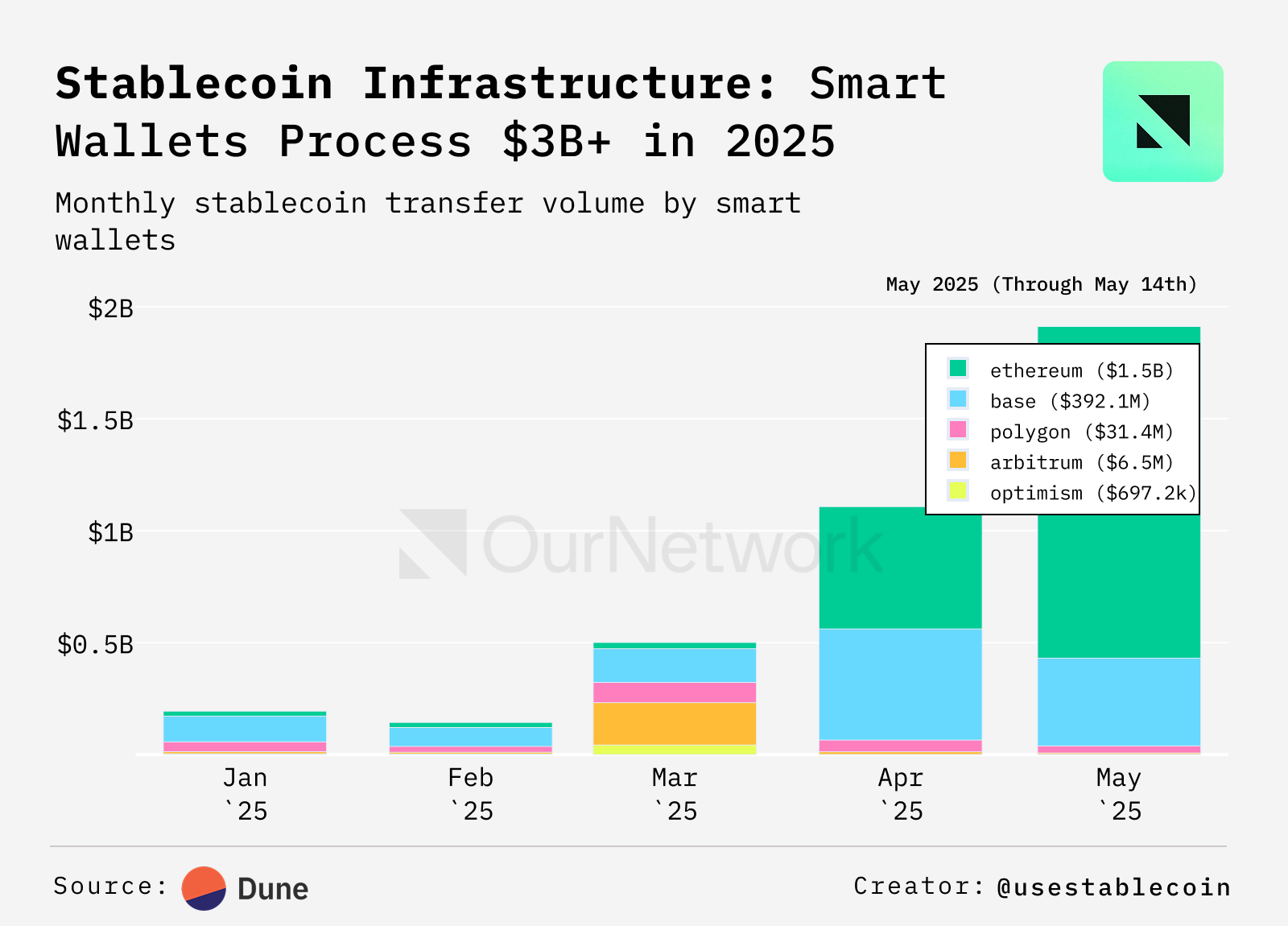

Since 2025, wallets supporting account abstraction have processed over $2.4 billion in stablecoin transactions across 4.46 million transactions. These smart wallets enhance user experience through gasless transactions, key management, and recovery modules. Base leads with over $1 billion in transaction volume and the highest number of active wallets, while Polygon records the highest transaction count (193,000), indicating strong performance in microtransactions or app-driven activity.

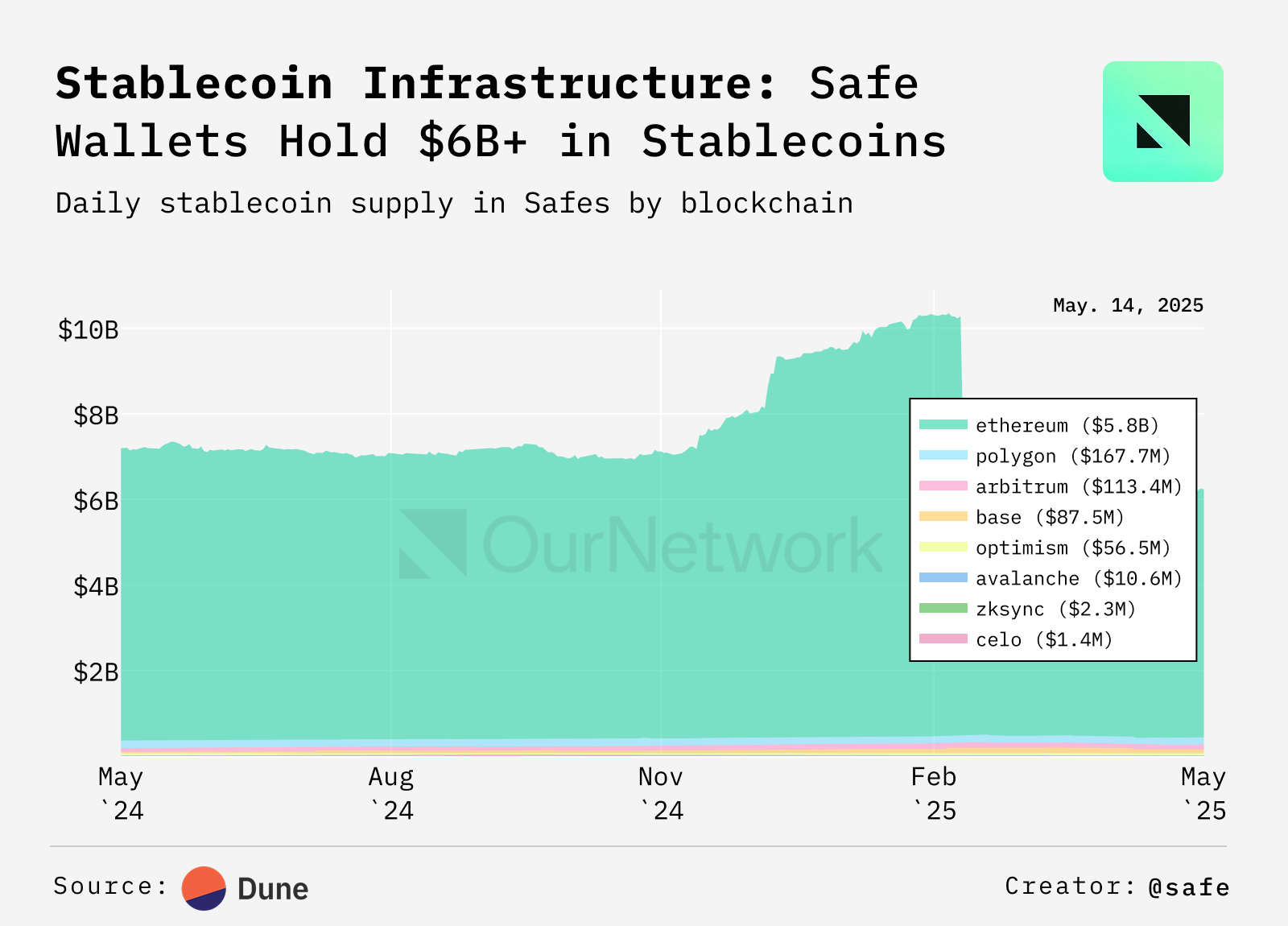

Within the Ethereum ecosystem, Safes are the most widely adopted smart accounts. To date, they hold approximately $6.2 billion in stablecoins and have processed over $303 billion in stablecoin transactions across 17 blockchains since 2024.

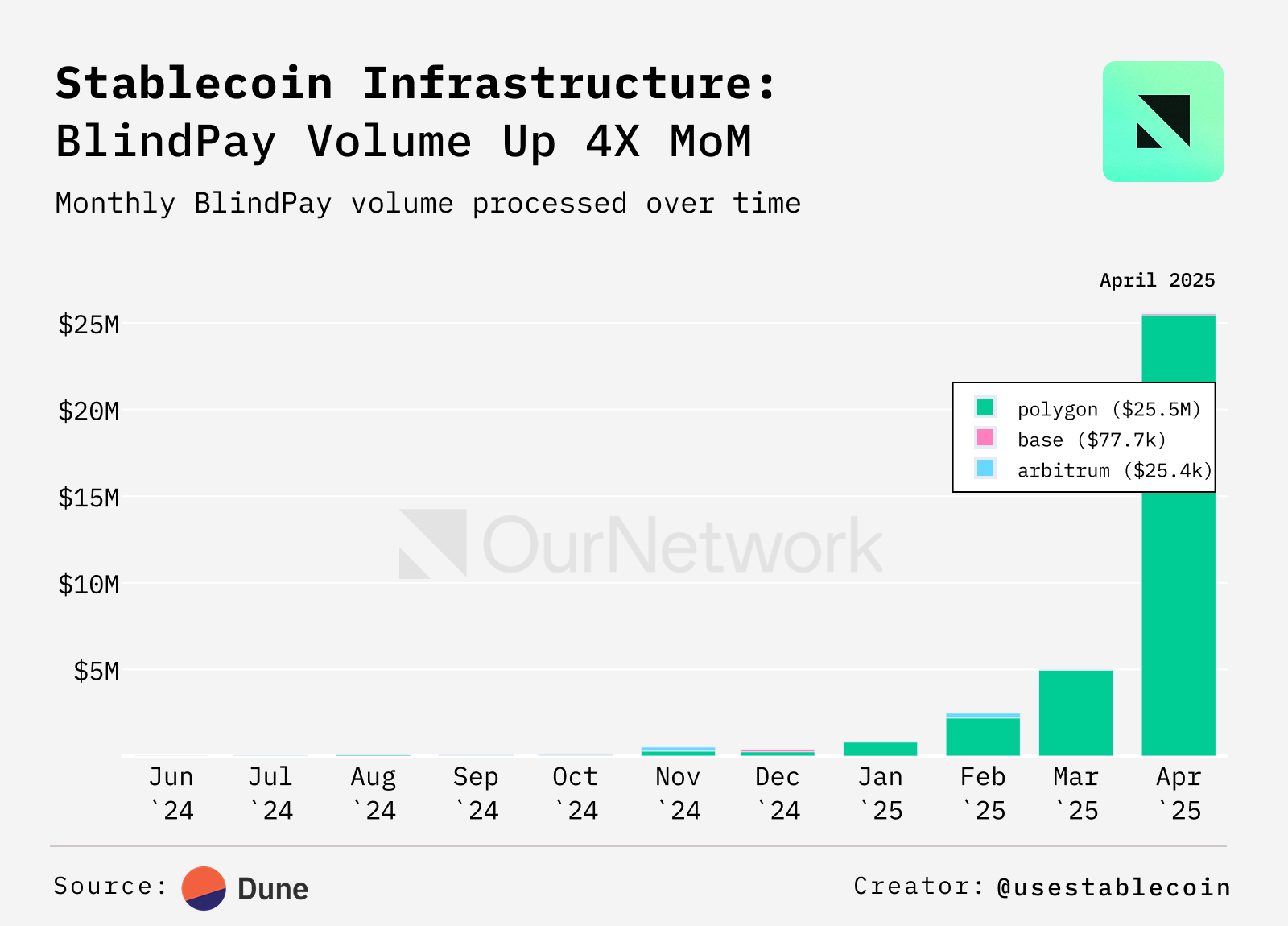

YC-backed startup Blindpay offers a unified multi-rail payment API. It has processed $39 million in USDC and USDT, with 95% of transactions occurring on Polygon. The company saw rapid growth in 2024, with April transaction volume 30 times higher than in January.

USDC

Circle supply up 80% year-on-year

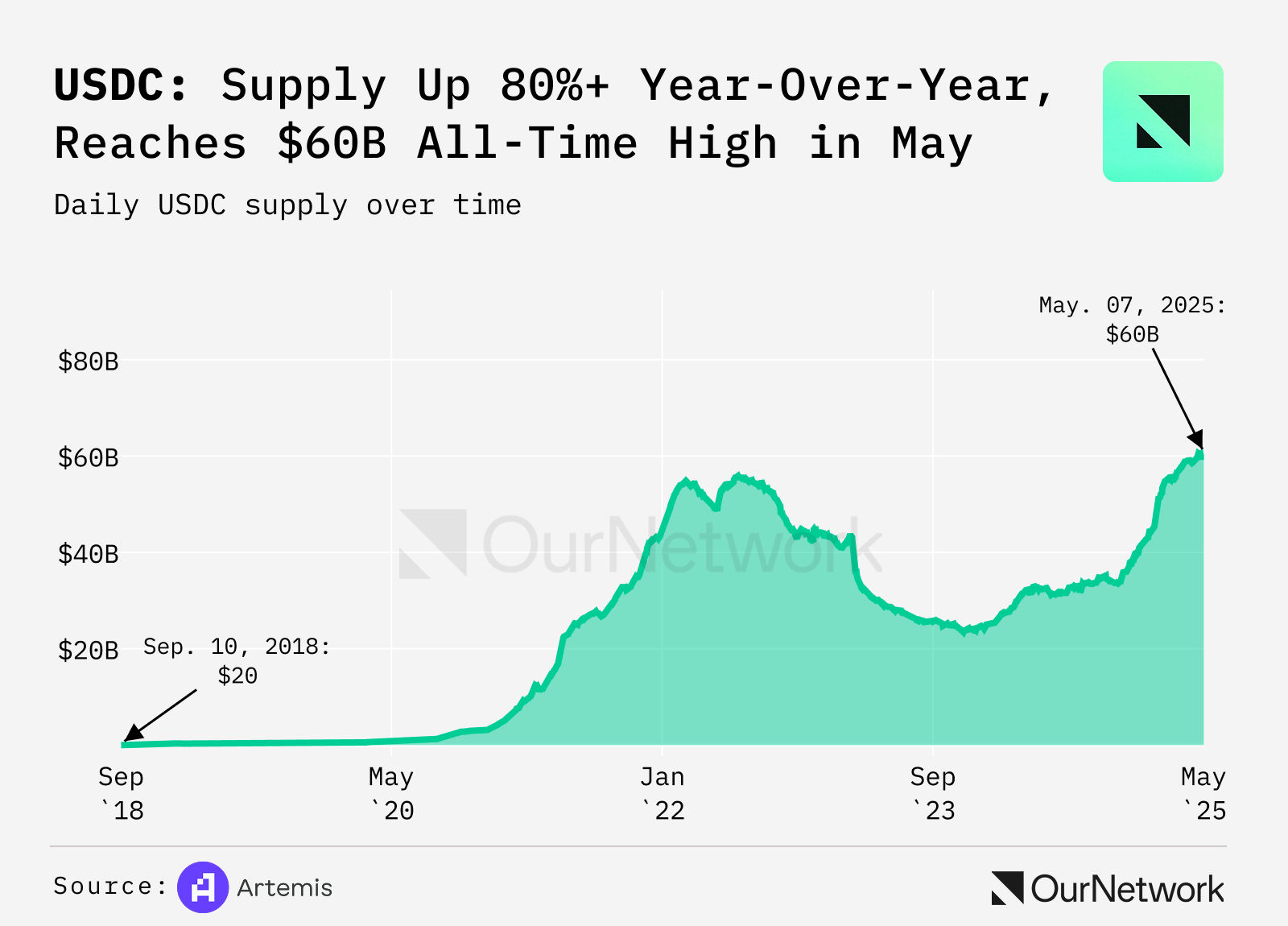

With rising adoption and expanding use cases, Circle’s USDC has accelerated growth, surpassing $60 billion in supply—a year-on-year increase of 80%. USDC’s market share continues to grow, rising from 20% in April 2024 to 25% in April 2025. This growth is fueled by significant expansion in ecosystems like Base (a Layer 2) and exchanges such as Binance.

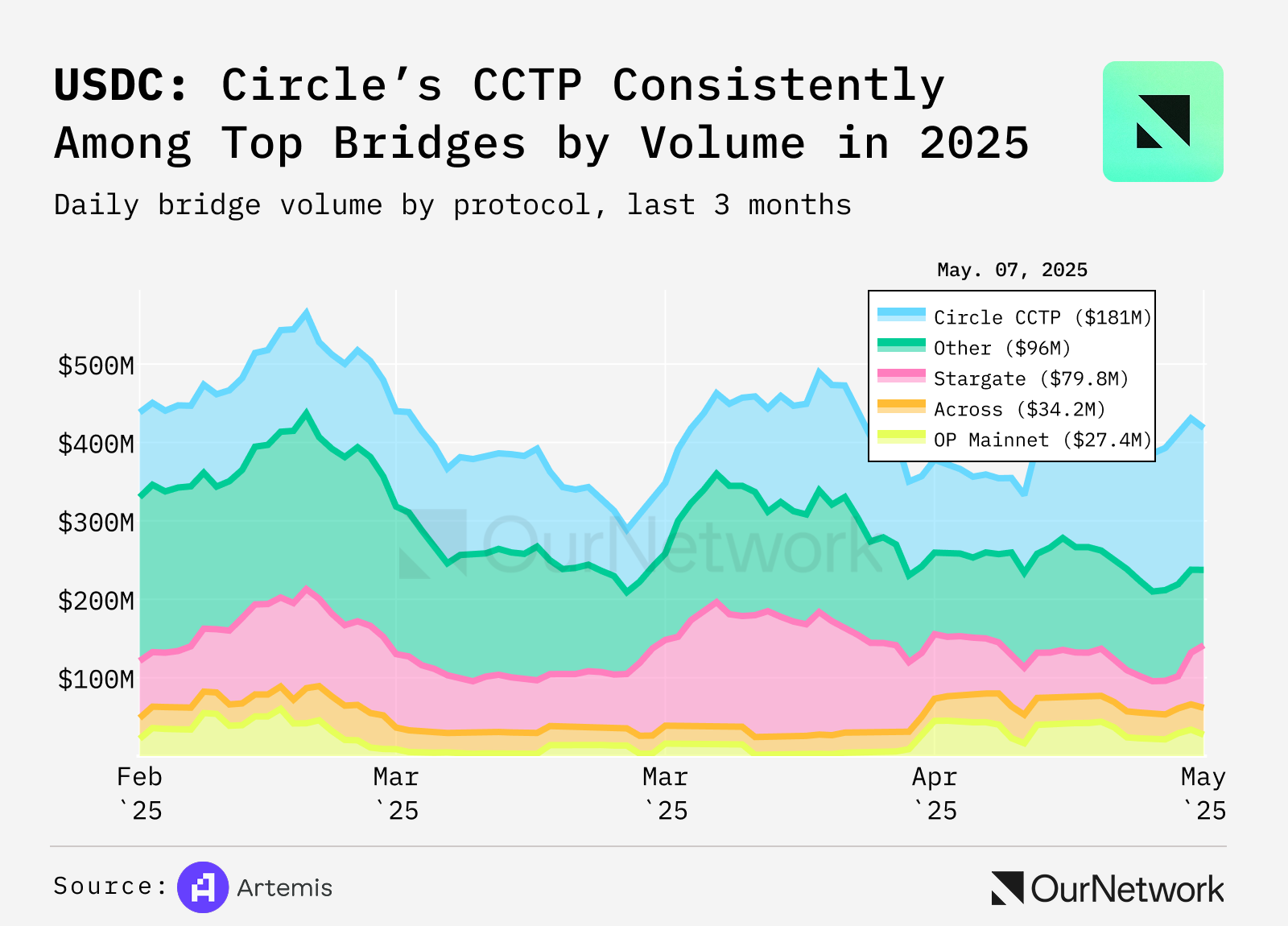

Circle’s CCTP (Cross-Chain Transfer Protocol) is one of the key drivers behind USDC’s growth. According to Artemis data, it consistently ranks as the top cross-chain bridge by volume. CCTP enables users to transfer USDC across chains and has recently hit a three-month high in weekly volume, exceeding $200 million.

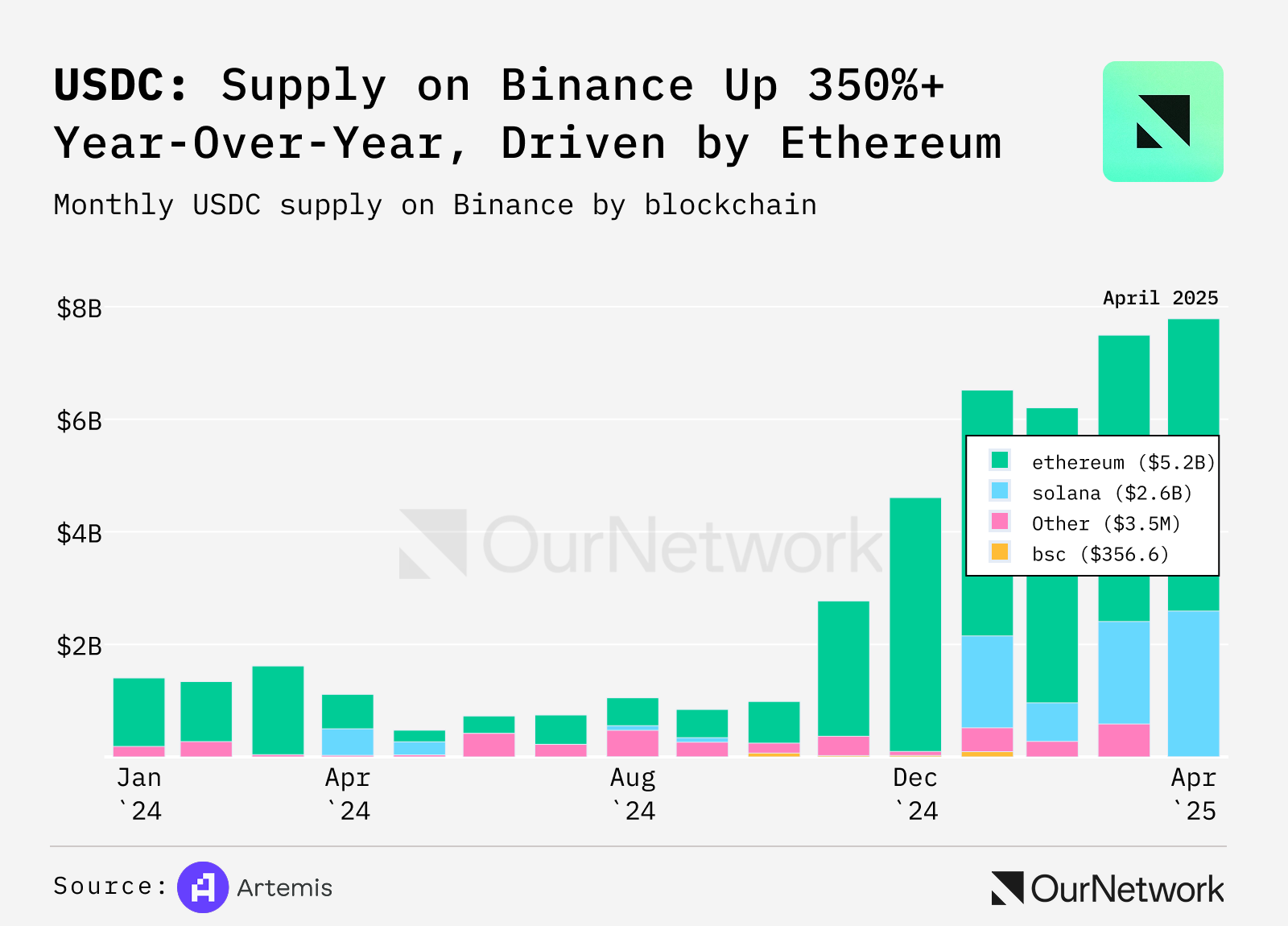

Since Circle and Binance announced their partnership last year, USDC supply on Binance has quadrupled. Solana and Ethereum have emerged as the primary networks driving usage on Binance. Additionally, USDC trading pairs have secured a stable position among Binance’s top 10 trading pairs for the first time.

USR

Resolv’s success proves the viability of fully on-chain, delta-neutral stablecoin architecture

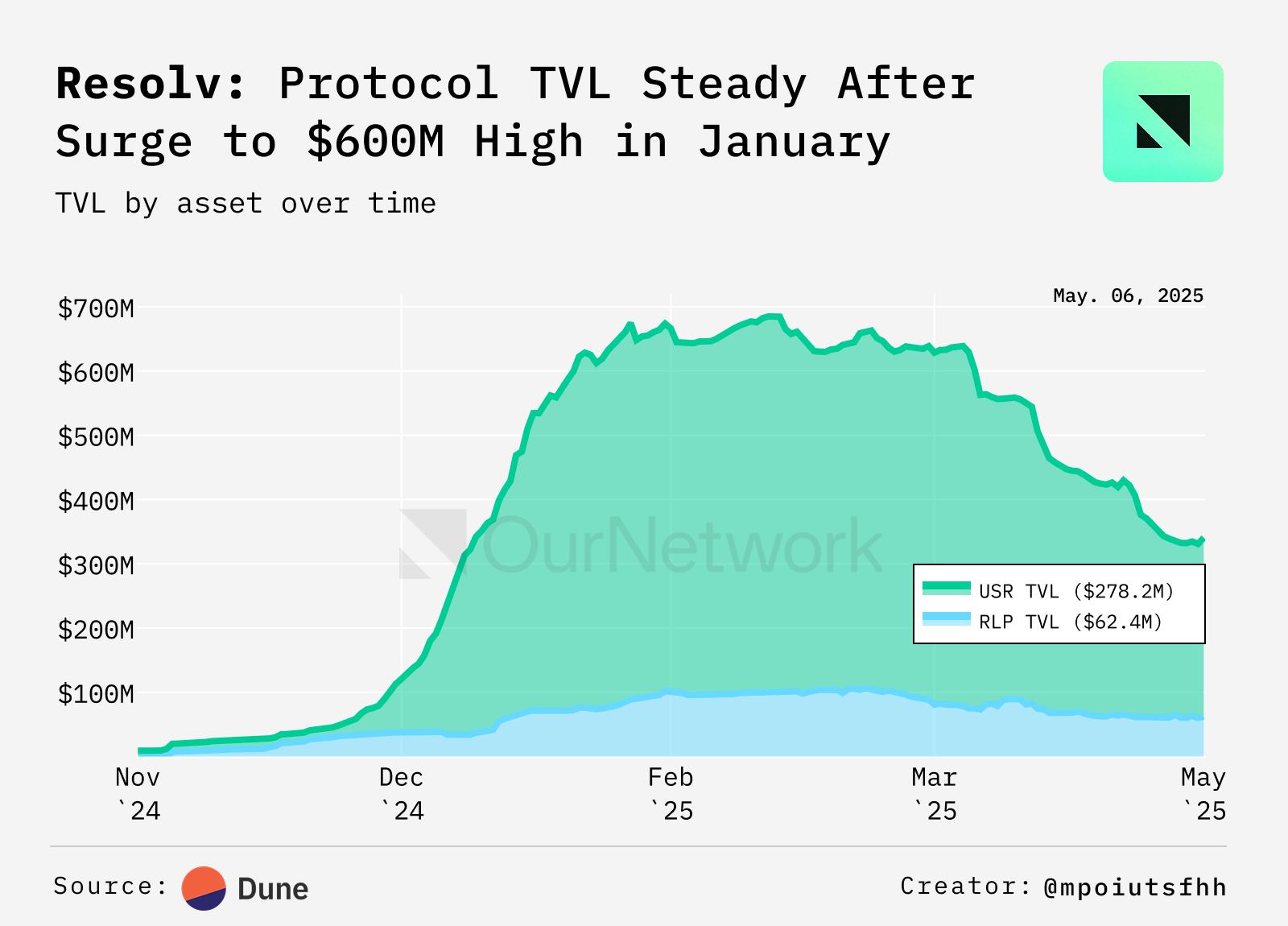

Resolv is a crypto-native stablecoin protocol issuing USR, a dollar-pegged token backed by crypto assets and hedged via short perpetual contracts to maintain a delta-neutral position. Market and hedging risks are absorbed by a high-yield token called RLP, preserving USR’s stability and capital efficiency. This structure drove rapid growth—Resolv’s total value locked (TVL) surged from $10 million at the end of 2024 to over $600 million at the start of 2025, though it later declined to below $400 million by mid-year. This peak reflected strong market confidence in delta-neutral stablecoin design.

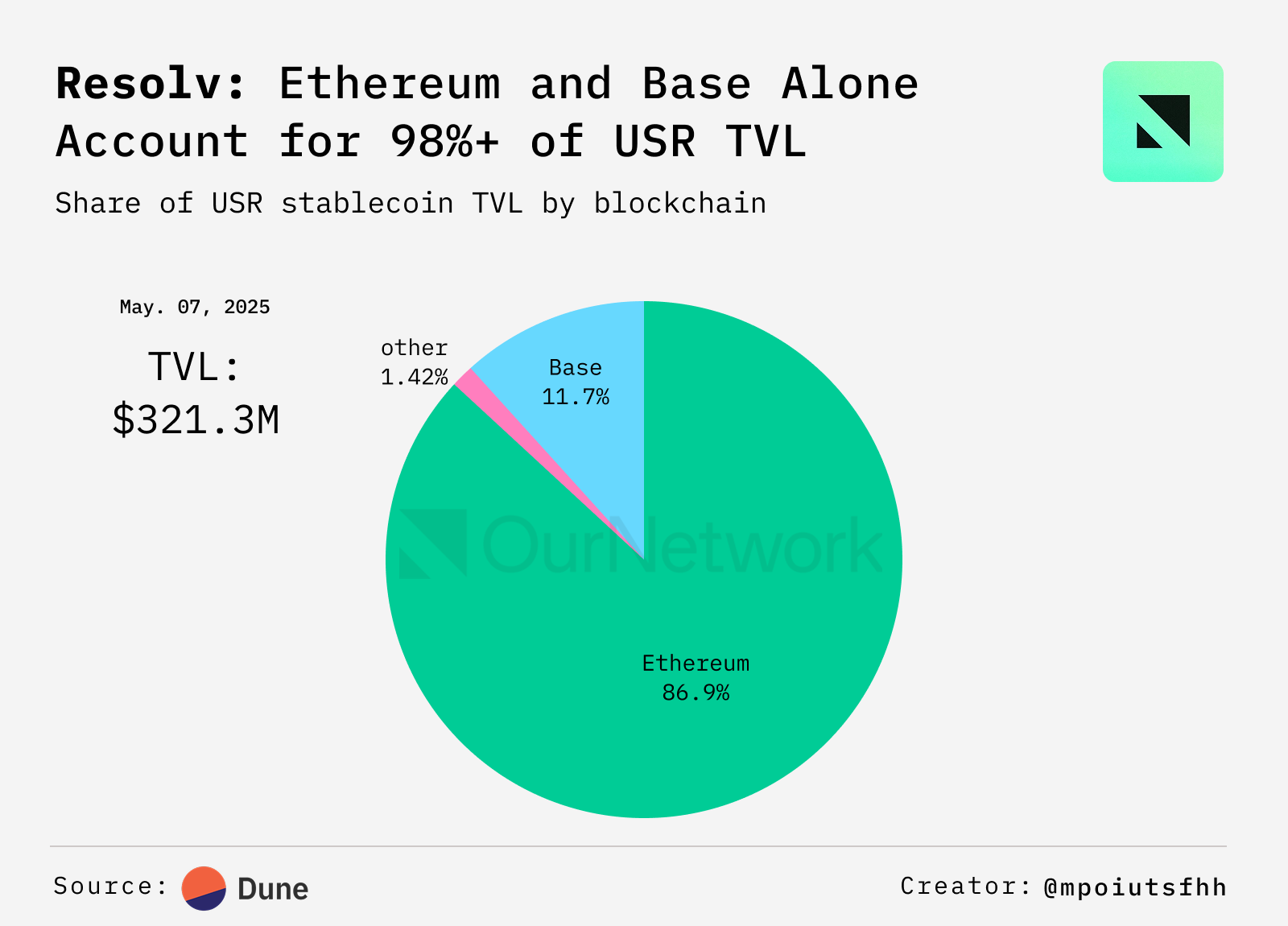

The majority of Resolv’s USR supply remains concentrated on Ethereum, indicating strong demand and deep integration within DeFi infrastructure. At the same time, Resolv is expanding to Base, Arbitrum, BNB Chain, and Berachain, demonstrating strategic efforts to enhance cross-chain interoperability.

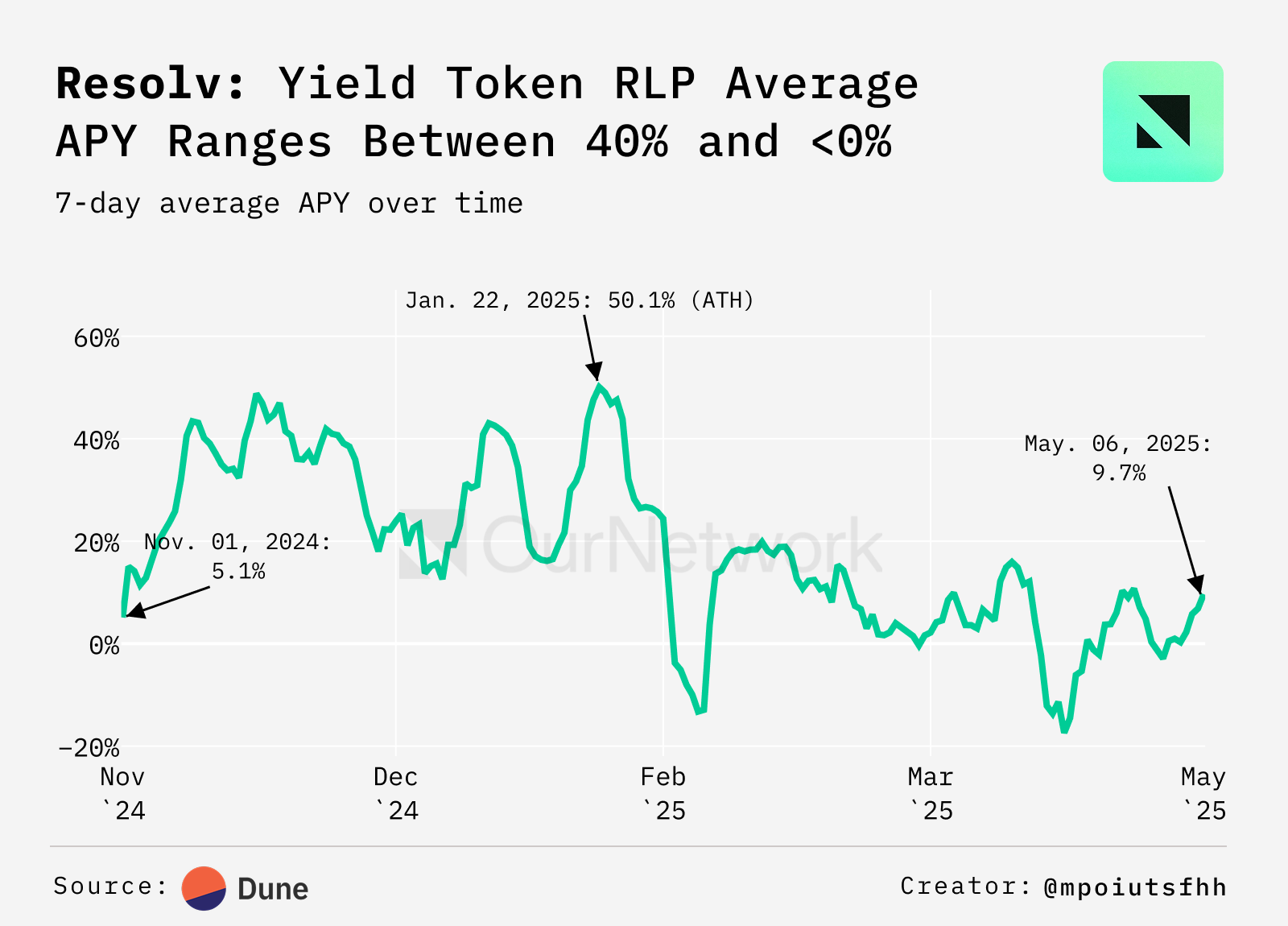

RLP’s annual percentage rate (APR) exceeded 40% at the end of 2024 but fell below 0% by April 2025. This volatility reflects RLP’s risk-return role in absorbing systemic shocks and generating yield. Negative yields indicate failures in the delta-neutral strategy due to market shifts and negative funding rates.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News