Ondo: Analysis of Product Line, Competitors, and Token Valuation of the RWA Leader

TechFlow Selected TechFlow Selected

Ondo: Analysis of Product Line, Competitors, and Token Valuation of the RWA Leader

If Ondo Chain develops smoothly, Ondo could enjoy the valuation level of a public blockchain, making a market cap of several billion dollars and an FDV over 10 billion USD seem less exaggerated.

Author: Alex, Mint Ventures

Introduction: Why Focus on the RWA Sector Now?

In this cycle of lackluster innovation in crypto, we haven’t seen new sectors emerge like DeFi, NFTs, or even GameFi in the previous cycle. Meme speculation has become the primary market trading focus. However, as projects are mass-produced, liquidity extraction accelerates, and themes become exhausted, the meme market has also entered its inevitable downturn. Meanwhile, despite numerous AI projects emerging as the latest trend in this cycle, they have yet to find a proper product-market fit between Crypto and AI. The sector’s business logic remains fragile, making it difficult to attract long-term industrial investment or sustained capital inflows.

The overall failure of Web3 commercialization efforts and the absence of solid, industry-backed investment narratives are the main reasons why most crypto assets—aside from BTC—have prematurely entered a “bear market.” The downturn in application-layer activity has directly led to declining valuations for public chains hosting these applications, causing ETH and other chain-based assets to depreciate continuously against BTC.

At the same time, BTC has benefited from multidimensional improvements in fundamentals (opening of compliant investment channels, government reserves, inclusion on corporate and sovereign fund balance sheets, regulatory shifts toward friendliness…). After several months of mid-term correction, it is now approaching new highs again, accumulating substantial unrealized profits.

This portion of capital may realize some profits and still seeks opportunities to deploy into higher-beta alt assets.

The question is: what to buy?

When comparing across crypto sectors, RWA may be one of the more noteworthy categories to watch.

In my article “Tokenizing U.S. Stocks and STO: A Narrative Waiting to Unfold”, I elaborated on the underlying rationale: from a business logic perspective, the value proposition of tokenizing U.S. stocks and other RWAs is clear, with well-defined supply and demand. Additionally, improved regulatory environments—especially in the U.S.—provide an opportunity for this sector to take off, prompting strong interest from influential traditional financial institutions.

Based on this, I recently conducted research on numerous RWA projects, among which Ondo stands out as a representative project worthy of in-depth analysis.

In this report, I will analyze Ondo from the perspectives of its current business status, team background, competitive landscape, challenges, and risks, and compare its current valuation level with other projects in the same sector.

PS: This article represents my interim thoughts as of publication and may change in the future. The views expressed are highly subjective and may contain factual, data, or logical reasoning errors. All opinions herein are not investment advice. Feedback and further discussion from peers and readers are welcome.

1. Business Overview

1.1 Product Matrix

Ondo Finance is an institutional-grade platform focused on tokenizing traditional financial assets (Real-World Assets, RWA) and bringing them onto blockchains. It is currently the most prominent RWA project with issued tokens, boasting the highest brand recognition and the most comprehensive product line.

Ondo’s product suite covers tokenized funds, yield-bearing stablecoins, lending platforms, tokenized asset issuance protocols, tokenized asset trading platforms, and its own compliant blockchain—covering the full lifecycle of RWA from issuance and custody to trading and circulation.

We can categorize its products into asset, protocol, and infrastructure types.

Next, let’s examine Ondo’s key products.

1.1.1 Asset Products

OUSG (Ondo Short-Term US Government Bond Fund)

A token backed by U.S. Treasury bonds, issued exclusively to Qualified Purchasers with strict KYC/qualified investor verification. Purchasing OUSG is equivalent to holding shares in a professionally managed short-term U.S. Treasury portfolio. The intrinsic value of OUSG increases with the net asset value of the fund, effectively rolling interest gains into the token daily. Underlying assets include bond shares from BlackRock’s BUIDL fund, Franklin Templeton (FOBXX), Wellington, WisdomTree, Fidelity, and others.

OUSG Revenue Model

OUSG charges institutional clients a 0.15% management fee (currently waived, set to begin July 1, 2025) and a 0.15% fund expense fee (currently collected). Actual returns are derived from U.S. Treasury interest minus these fees.

USDY (US Dollar Yield)

A yield-generating dollar stablecoin. USDY is issued to non-U.S. individual and institutional users, generating yield from short-term U.S. Treasuries and bank deposits. USDY has a base price of $1, but interest is settled daily and automatically accrued into the token value, allowing holders to earn passive income without staking or locking. USDY yields are typically calculated as the risk-free rate (SOFR) minus a 0.5% fee.

USDY Revenue Model

Ondo sets a monthly annualized yield for USDY (e.g., 4.25% in a given month), distributing most of the base yield to holders while retaining approximately 0.5 percentage points as a management fee.

Additionally, both OUSG and USDY can be converted into rebase-enabled stable-value tokens—rOUSG and rUSDY—whose values remain constant while their token quantities increase with accrued earnings, similar to Lido’s stETH mechanism.

Differentiation Between OUSG and USDY

At first glance, OUSG and USDY appear very similar, both investing in high-quality cash equivalents like short-term U.S. Treasuries. In reality, however, they differ significantly in several aspects:

-

Asset Composition: OUSG indirectly invests in U.S. Treasuries by holding shares in regulated government bond funds (e.g., BlackRock’s Buidl fund, WisdomTree’s WTGXX), forming a diversified portfolio composed entirely of government-related securities. In contrast, USDY adopts a direct holding strategy, primarily consisting of bank deposits and short-term Treasuries. USDY does not invest in any fund products, with a significantly higher proportion allocated to demand bank deposits.

-

Yield and Risk: Both offer yields closely tracking the risk-free rate (~4–5% annually), with minimal difference. However, due to its partial allocation to bank deposits, USDY exhibits slightly higher yield stability, with net value almost unaffected by interest rate fluctuations, and includes a 3% over-collateralization buffer to enhance risk resilience. Correspondingly, USDY introduces limited bank credit risk (though mitigated), whereas OUSG is essentially backed solely by U.S. government credit (purer credit quality). Thus, USDY achieves yield stability and risk isolation through structural design, while OUSG directly reflects Treasury market rate movements, with all risk stemming from Treasury rate volatility.

-

Liquidity and Redemption Mechanism: OUSG targets qualified investors, offering instant subscription/redemption with on-chain settlement, but secondary market transfers are restricted and must occur within controlled environments—only KYC-verified institutional addresses may hold it. USDY becomes freely tradable after an initial lock-up period (40 days), functioning as an interest-bearing stablecoin that circulates freely on-chain, enhancing its liquidity and accessibility. However, due to the 40-day waiting period, USDY’s initial liquidity lags behind OUSG’s immediacy. Regarding redemption, OUSG allows direct conversion back to USDC, while official USDY redemptions require fiat withdrawal with minimum thresholds, so most holders typically liquidate via secondary markets.

-

Face Value: OUSG has a base face value of $100, while USDY’s base face value is $1.

In simple terms: USDY emphasizes open circulation and caters more to retail demand, positioning itself as a stablecoin; OUSG prioritizes immediate liquidity within closed environments, targeting institutional demand, and functions more like a fund share.

1.1.2 Protocol Products

Flux Lending Platform

Flux Finance is a decentralized lending protocol built on the Compound V2 pool model. It enables users to collateralize high-quality RWA assets (currently only OUSG) to borrow stablecoins, or lend idle stablecoins to earn interest. Flux currently supports depositing and borrowing USDC, DAI, USDT, FRAX, and other stablecoins. It implements permission controls for restricted assets like OUSG (whitelist-only addresses can serve as collateral) to maintain compliance. Flux is governed by the Ondo DAO, meaning ONDO token holders control parameters and asset listings. Flux enables OUSG holders to unlock liquidity via collateralization.

With only OUSG supported as collateral, Flux remains relatively insignificant, with tens of millions in total deposits and loans. However, as more RWA assets enter the ecosystem, Flux is expected to become a key component of the Ondo ecosystem, providing lending liquidity for RWA assets.

Ondo Global Markets (GM)

At the inaugural Ondo Summit held in New York in February 2025, Ondo officially unveiled the GM platform—a planned tokenization platform for traditional assets aimed at bringing thousands of publicly traded securities (stocks, bonds, ETFs, etc.) on-chain. Ondo refers to GM’s vision as “Wall Street 2.0.” GM is expected to target non-U.S. investors, with every issued GM token fully backed 1:1 by real securities, freely transferable like stablecoins and usable in DeFi, while incorporating compliance controls at issuance and redemption levels. Ondo highlights existing inefficiencies in traditional investing—high fees, limited access, fragmented liquidity—and aims to leverage blockchain for lower costs, 24/7/365 trading, and instant settlement. For example, investors could easily acquire tokenized versions of Apple, Tesla, or S&P 500 ETFs just like buying stablecoins, then freely trade them in non-U.S. markets or use them in on-chain financial services. GM will also allow token holders to participate in securities lending to earn additional yield.

However, Ondo Global Markets has not yet launched. Its website vaguely states it is “expected to launch later this year.” The product is likely still under development across product and compliance dimensions. Clear regulatory guidance from U.S. authorities on asset tokenization and relevant legislative clarity will be critical prerequisites for its successful operation. Additionally, Ondo Global Markets will run on Ondo Chain, detailed below.

Nexus Asset Issuance Protocol

Ondo Nexus, introduced in February 2025, is a new technical solution designed to provide immediate liquidity for third-party-issued U.S. Treasury tokens. Simply put, Nexus leverages OUSG’s instant mint-and-burn capability to act as a shared liquidity layer between different issuers. Ondo expanded OUSG’s eligible collateral to include U.S. Treasury tokens from Franklin Templeton, WisdomTree, Wellington, and others. These partner-issued instruments (e.g., Franklin’s FOBXX fund tokens) can be accepted and exchanged for OUSG, enabling shared liquidity between products and stablecoins. Through Nexus, an investor holding a third-party Treasury token can sell it to Ondo anytime (24/7) for USDC or other stablecoins, while Ondo adds the token to its asset pool and mints an equivalent amount of OUSG. This provides the market with an “instant redemption” mechanism, overcoming traditional funds’ limitations of redemption only during limited weekday windows. Nexus strengthens Ondo’s collaboration with major asset managers like BlackRock and Franklin Templeton.

1.1.3 Infrastructure Products

Ondo Chain: A Compliance-Focused Permissioned L1

In February 2025, Ondo announced the launch of its semi-permissioned blockchain, Ondo Chain, specifically designed for institutional-grade RWA issuance and trading. Ondo Chain uses Proof-of-Stake (PoS) consensus, but validators can stake not only crypto assets but also highly liquid real-world assets, reducing the impact of crypto market volatility on network security. Validator nodes will be operated by licensed, well-known financial institutions (advisory participants include Franklin Templeton, Wellington, WisdomTree, Google Cloud, ABN AMRO, Aon, McKinsey, and other major traditional firms).

The chain uniquely combines public blockchain transparency with permissioned chain compliance and security: open access and development on-chain, but controlled validator layer to prevent MEV attacks and meet regulatory requirements. Additionally, Ondo Chain natively supports key financial features (e.g., dividend distribution, stock splits), provides on-chain proof of reserves, and requires validators to conduct regular audits ensuring each token is fully backed by physical assets. Ondo Chain will also feature a cross-chain bridge powered by a decentralized validation network. The term “open” means anyone can issue tokens, develop apps, or access the network as a user or investor. At the same time, user identity and permissions are core functionalities, allowing asset issuers and app developers to implement access controls and transfer restrictions at the contract level—meaning while users can freely access the network, developers can define which users may interact with their deployed protocols and assets.

The chain aims to serve as the foundational architecture for the future “Wall Street 2.0,” enabling institutions to perform operations such as prime brokerage and cross-collateralized lending on-chain, achieving seamless integration between traditional finance and DeFi. Ondo Chain is expected to go live in test mode in 2025. It is reportedly collaborating with PayPal, Morgan Stanley, and BlackRock to design network details.

In summary, Ondo Finance has preliminarily established a comprehensive matrix covering asset issuance, liquidity management, and infrastructure. Its product lines—from underlying assets (Treasuries, bank deposits, public securities) to on-chain protocols and infrastructure (lending, cross-chain bridges, dedicated chains)—are mutually reinforcing and synergistic.

1.2 Business Data

Despite Ondo Finance’s broad product layout, few products are currently live. The asset products are OUSG and USDY, and the protocol product is the lending platform Flux.

OUSG Business Data

Data source: Ondo official website

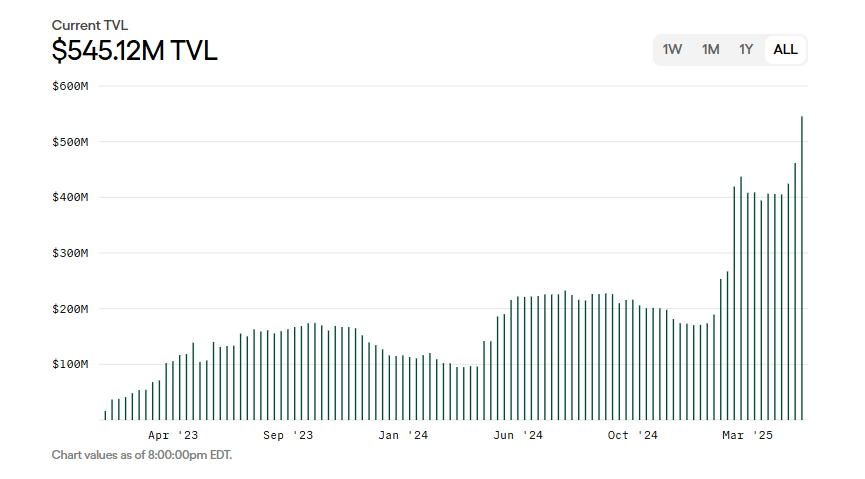

OUSG currently manages $545 million in assets. Since its launch in 2023, it has experienced three rapid growth phases, the fastest being from February 2025 to present, growing from under $200 million to over $500 million.

OUSG is available on three blockchains: Ethereum, Polygon, and Solana. However, the vast majority are issued on Ethereum, with negligible scale on the other two chains.

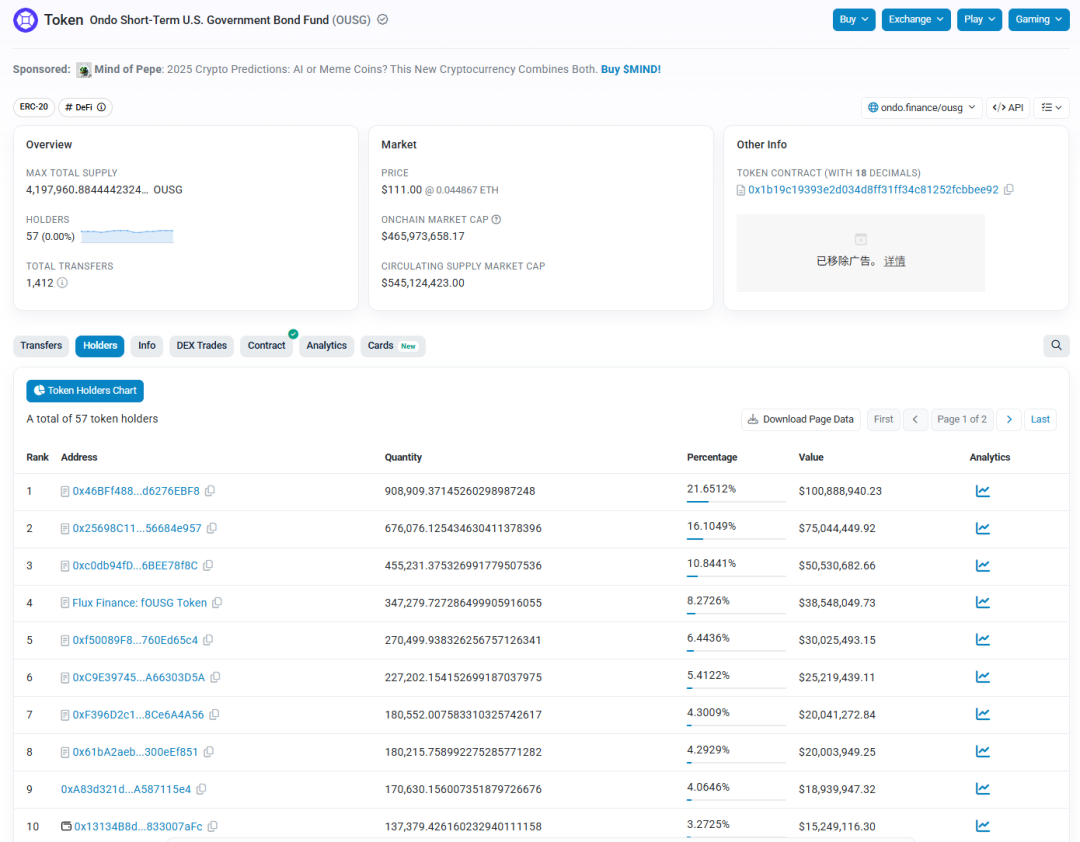

Examining Ethereum address data, OUSG has only 57 holder addresses, with the top 10 addresses holding over 90% of the total supply—consistent with OUSG’s exclusive availability to compliant institutions.

Data source: Etherscan

USDY Business Data

Data source: Ondo official website

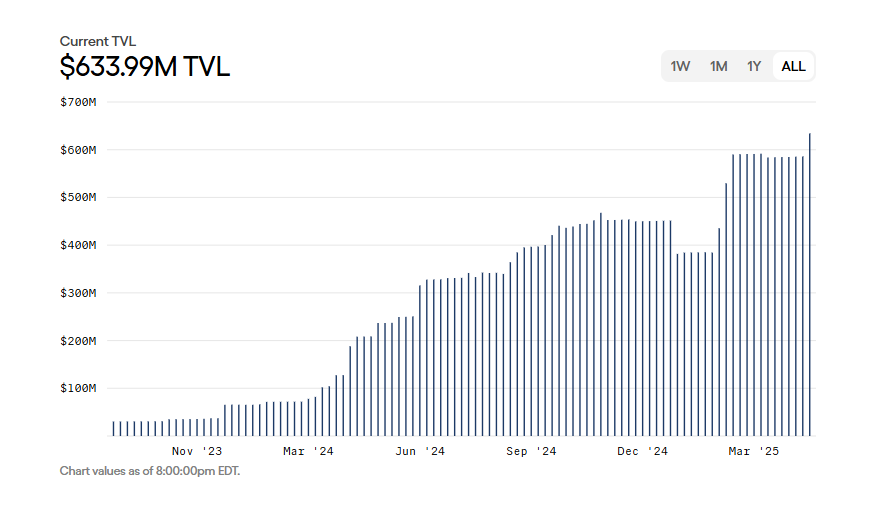

USDY currently manages $634 million in assets and supports eight blockchains: Ethereum, Mantle, Solana, Sui, Aptos, Noble, Arbitrum, and Plume.

Ethereum remains the primary issuance chain for USDY, hosting over half of its supply, valued at approximately $330 million, with only 316 holder addresses. Solana follows closely with a market value of about $177 million but has 6,329 holders, indicating higher retail adoption.

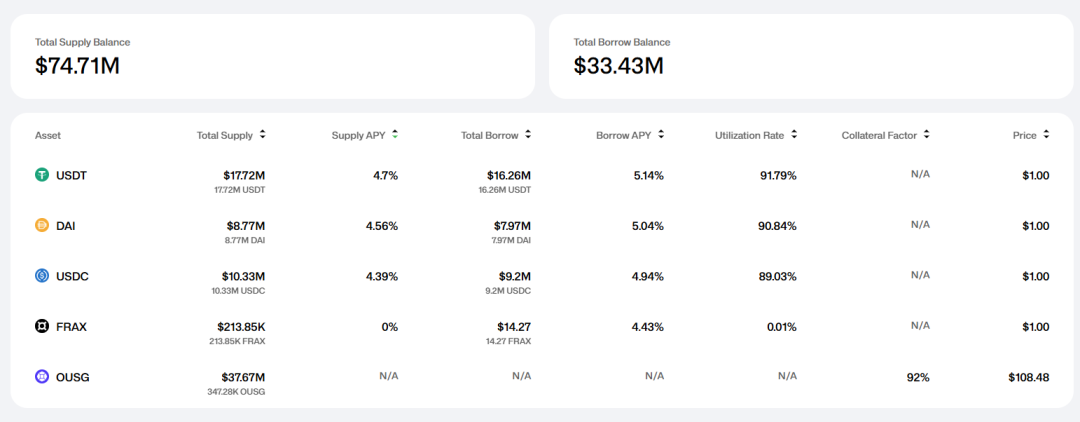

Flux Business Data

Data source: Flux official website

Since Flux currently only accepts OUSG as collateral, its business scale remains modest, with $74 million in total deposits and $33.43 million in loans. Flux’s future growth depends on Ondo’s ability to bring more RWA assets into the ecosystem.

1.3 Team Background

RWA is a sector requiring strong compliance, blending DeFi and traditional finance. Whether a project has abundant connections with traditional financial institutions, effective communication channels with regulators, and deep expertise in financial compliance are key factors in assessing its potential for success.

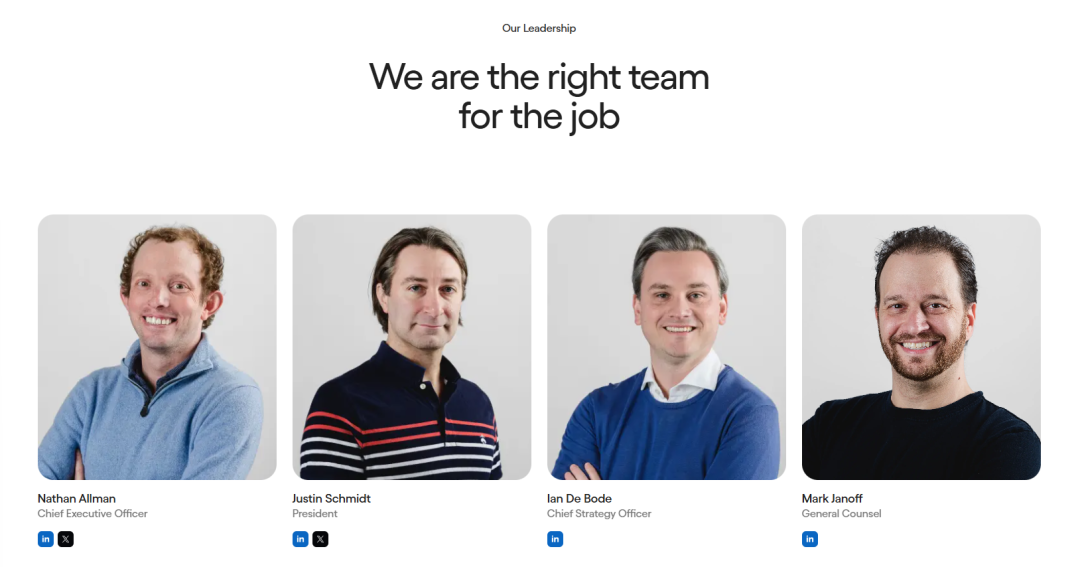

Key Team Members' Professional Backgrounds

Source: Ondo official website

Ondo Finance’s founding and executive team mainly come from major Wall Street financial institutions and renowned consulting firms, with many from Goldman Sachs’ digital assets division. Core team members are fully doxxed.

Co-founder Nathan Allman previously worked in Goldman Sachs’ digital assets division. President and COO Justin Schmidt formerly led Goldman Sachs’ digital assets markets team and was one of the founding members of Goldman’s digital assets group. Chief Strategy Officer Ian De Bode was a partner at McKinsey, advising on digital assets, with nearly ten years of experience providing strategic counsel to financial institution executives. General Counsel Mark Janoff holds a law degree from Stanford and has prior experience in legal affairs for tech companies. The team’s credentials are impressive and highly aligned with the demands of the RWA sector.

Government Relations: Active Engagement in Policy and Industry Initiatives

In April 2025, the Ondo team met with the SEC’s Crypto Asset Working Group alongside its legal counsel, submitting a proposal on a compliant framework for tokenized securities. According to meeting notes, Ondo presented a plan for issuing and selling on-chain tokenized U.S. securities under existing financial laws, discussing key topics including structural models for tokenized securities, registration and broker-dealer regulatory requirements, market structure regulations, anti-financial crime compliance, and state corporate law. Ondo even suggested regulators consider “regulatory sandboxes” or temporary exemptions to allow innovation before formal regulations are enacted, promoting progress while safeguarding investors.

Ondo Finance’s engagement with officials extends beyond private meetings into public forums. In February, Ondo hosted the inaugural Ondo Summit in New York, inviting key figures from traditional finance and blockchain. Notably, attendees included former and current U.S. congressional and regulatory officials: Patrick McHenry, former Chair of the House Financial Services Committee, attended and spoke on the future of digital asset regulation; CFTC Commissioner and Acting Chair Caroline Pham participated in a fireside chat, sharing regulatory updates. During discussions, McHenry urged the crypto industry to actively engage with Washington policymakers, emphasizing the lengthy and complex legislative process. Pham outlined recent enforcement progress by regulators.

Furthermore, in early 2025, Ondo announced Patrick McHenry would join the company as an advisor, serving as Vice Chair of the Ondo Finance Advisory Committee. McHenry, a long-serving congressman involved in shaping financial regulations, joining Ondo is seen as a significant step in strengthening its government relations.

Relationship with the Trump Family

In early February 2025, at the “Ondo Summit” in New York, Donald Trump Jr., the U.S. President’s eldest son, made a surprise appearance and delivered a speech. Subsequently, in February 2025, Ondo Finance officially announced a strategic partnership with World Liberty Financial (WLFI), a crypto platform supported by the Trump family, aiming to jointly promote RWA adoption and bring traditional financial assets onto blockchain. According to the announcement, WLFI plans to integrate Ondo’s tokenized assets (OUSG, USDY) into its network as reserve assets. Later, an Ethereum address linked to WLFI exchanged $470,000 worth of USDC for approximately 342,000 ONDO tokens. Two months earlier, the same address had already purchased $245,000 worth of ONDO and deposited the tokens into Coinbase Prime custody.

Of course, many crypto projects have formed verbal partnerships with WLFI and received purchases from its addresses. Such collaborations and transactions are heavily promotional, resembling commercial arrangements more than deep strategic alliances.

1.4 Business Summary

Summarizing the above, I believe Ondo’s business can be described in a few sentences:

-

From asset issuance to trading, Ondo has a comprehensive product matrix around RWA, offering a high ceiling for its business narrative

-

The core team has strong credentials, with excellent positioning in both traditional finance and government relations, capable of engaging directly with regulators

-

Core products (Global Markets and Ondo Chain) have not yet launched, still awaiting regulatory green lights; current business development remains highly “early-stage”

Overall, facing the largely untapped crypto blue ocean of RWA, Ondo is currently one of the best-prepared crypto firms, possessing strong resources and favorable conditions, merely awaiting the signal from regulators and legislators.

2. Competitive Landscape

As RWA gains traction, Ondo faces competition across multiple fronts from projects such as Securitize (no token), Centrifuge, and Polymesh (listed on Binance).

Below is a comparison of Ondo versus key competitors across market share, product differentiation, compliance progress, and ecosystem partnerships:

2.1 Market Position and Scale

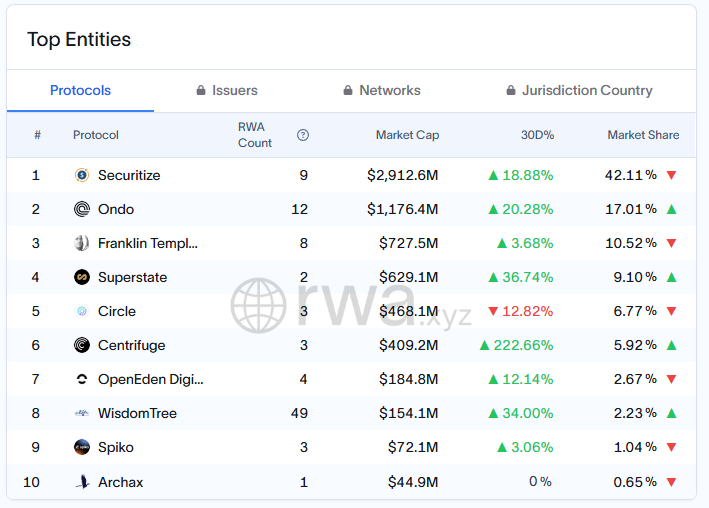

Data source: https://app.rwa.xyz/treasuries

According to RWA data platform RWA.xyz, as of May 2025, Ondo ranks second in the U.S. Treasury RWA market by locked assets, with ~17.01% market share and ~$1.17 billion in assets. First place is Securitize, backed by BlackRock, with ~$2.912 billion in assets and 42.11% market share. Third is Franklin Templeton’s Benji platform ($727 million, 10.52%).

In the niche market of Treasury yield tokens, Securitize and Ondo lead, with Securitize having larger scale and Ondo showing faster growth (20.3% over the past 30 days). Centrifuge focuses on private credit RWA like SME loans, with ~$409 million in locked assets (5.96%), and a staggering 222.66% monthly growth rate.

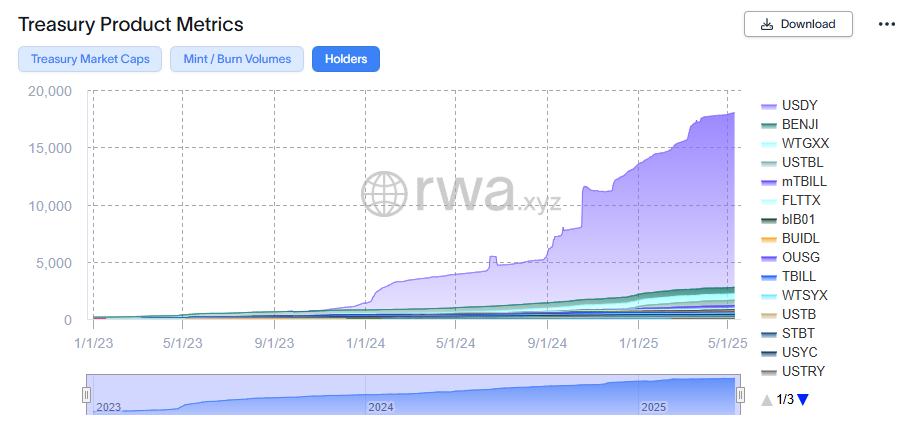

Holder counts of various Treasury tokenized assets, data source: https://app.rwa.xyz/treasuries

Notably, Ondo leads far ahead in holder count—its Treasury token holders account for over 90% of the entire market (due to USDY’s availability to non-U.S. retail investors), while Securitize and others cater primarily to institutional investors, with holdings concentrated among a few large clients.

2.2 Product Positioning and Mechanism Differences

Ondo focuses on high-liquidity, stable-yield dollar assets (short-term Treasuries, money market funds) and integrates them into DeFi applications. USDY is positioned as a “yield-generating stablecoin” suitable for payments and collateral. In contrast, Securitize, as a digital securities issuance platform, offers broader services, including tokenization of private equity and fund shares. In the Treasury yield space, Securitize partnered with BlackRock to issue the BUIDL fund token (custodied by Coinbase), targeting institutions and wealthy clients. BUIDL, like OUSG, is an accrual-type fund token, but differs in liquidity: BUIDL allows subscriptions/redemptions only during specific U.S. business hours on weekdays, while Ondo’s OUSG offers 24/7 instant minting and burning. In DeFi integration, Ondo clearly leads—USDY and OUSG are usable in 80+ multi-chain applications and support on-chain collateralized lending (via Flux). Securitize, by contrast, relies on its own permissioned trading system (ATS license) for matchmaking, with limited integration into public DeFi protocols, though its products serve as key underlying yield assets for projects like Ondo and Ethena.

Centrifuge’s offerings are fundamentally different: its core is the Tinlake loan pool, packaging real-world receivables and mortgage loans into coupon-bearing instruments for investors seeking higher yields (often 5–10%+ annually) at greater risk. These assets have longer durations and poor liquidity, relying on large institutions like MakerDAO for exit liquidity (since 2021, MakerDAO has accepted senior tranches of Tinlake pools as RWA collateral, allowing asset originators to lock claims and borrow DAI at agreed rates). Accordingly, Centrifuge’s governance token CFG is used for staking and security, not retail or payment use cases, representing a more specialized RWA niche.

Polymesh positions itself as a dedicated securities chain, using built-in identity and permission controls to enable institutions to issue compliant tokens (stocks, bonds, fund shares, etc.). Evolved from the original Polymath project, POLYX tokens are used for transaction fees and governance. However, actual asset issuance activity on Polymesh remains limited, far below RWA activity on major chains like Ethereum. Yet, heavyweight traditional institutions like WisdomTree are choosing to partner with Ondo (issuing assets via Nexus and serving as Ondo Chain design advisors) rather than building their own chains, suggesting Ondo has stronger long-term execution potential.

2.3 Compliance and Regulatory Progress

Platforms adopt different compliance strategies.

Ondo follows a “registration exemption + overseas issuance” model by partnering with regulated financial entities. Registration exemption means securities issued by institutions meet specific criteria (e.g., not offered to all U.S. public), thus exempt from SEC public registration, lowering compliance costs and improving issuance efficiency. OUSG is offered in the U.S. only to qualified investors as a private placement, while USDY is issued overseas via offshore entities. Ondo’s compliance team is experienced, with its Chief Compliance Officer and several executives from Wall Street firms like Goldman Sachs, giving them deep familiarity with regulatory rules.

Securitize holds multiple U.S. financial licenses directly, including Broker-Dealer and SEC-registered Transfer Agent, granting it more direct compliance authority when issuing digital securities. This enables it to legally serve large asset management programs, such as tokenizing KKR fund shares. Securitize also collaborates with major banks on blockchain initiatives. In contrast, Ondo does not hold an SEC license itself but operates legally through partner structures (e.g., collaborating with Clear Street as broker-dealer, Coinbase for custody). Globally, Ondo leverages regulatory arbitrage (not offering USDY to Americans) to expand markets, while Polymesh embeds compliance at the protocol level (requiring identity binding for each address). Centrifuge uses offshore special purpose vehicles (SPVs) to hold underlying assets and obtains legal opinions ensuring its tokenized debt does not violate securities laws.

Regulatory policy risk remains a common challenge for all RWA platforms. If the U.S. eventually requires such tokens to be classified as public securities, both Ondo and Securitize would need broader licenses or revised issuance methods.

Currently, however, Ondo maintains good communication with regulators. For example, Ondo established a regulated U.S. subsidiary (Ondo I LP, etc.) and operates under existing rules. Products like USDY emphasize daily transparency reports from independent third parties, reducing enforcement risk. In contrast, some decentralized RWA attempts (e.g., unregistered sales of RWA tokens to U.S. users) are more likely to attract regulatory scrutiny.

2.4 Ondo’s Current Advantages

Ondo’s current leadership stems from strong brand recognition driven by broad support from traditional finance ecosystems. Through various product collaborations and PR campaigns, Ondo has “strategically” gained indirect endorsements from financial giants like BlackRock, Morgan Stanley, and Fidelity. For instance, BlackRock’s Buidl fund is one of OUSG’s underlying assets. Though no direct partnership exists, heavy marketing has led the market to widely view Ondo as a primary “BlackRock-themed token.” Top-tier asset managers like Franklin and Wellington directly participate in Ondo’s Nexus program, contributing their Treasury products to Ondo’s ecosystem. Even payment giant PayPal and card network Mastercard have partnered with Ondo—PayPal’s PYUSD stablecoin will be used for OUSG redemptions, and Mastercard invited Ondo into its Multi-Token Network (MTN) pilot, linking bank payment interfaces to on-chain settlement.

While these partnerships aren’t deeply integrated, compared to other RWA projects, they provide Ondo with strong marketing appeal, brand accumulation, and valuable case studies for future commercial expansion.

Overall, Ondo leverages a “dual-connectivity” strategy: linking upstream to traditional asset managers for assets and brand credibility, and downstream to the crypto market for users and liquidity, aiming to gain a first-mover advantage over competitors.

3. Key Challenges and Risks

Despite Ondo’s progress, its business faces multiple challenges and risks:

3.1 Intensifying Competition

Ondo’s current advantages are relative to other Web3 projects. Against truly platform-backed institutional ventures (e.g., Securitize, backed by BlackRock), Ondo’s edge is less pronounced. Currently, due to unclear regulations, most major financial institutions have not fully entered the arena. Traditional finance giants still dominate the sourcing of RWA assets. Given the size of this financial opportunity, these incumbents have strong incentives to build their own ecosystems rather than ceding everything to emerging Web3 players like Ondo.

3.2 Product Delivery and Execution Capability

Ondo’s core protocols—Global Markets and Ondo Chain—have not yet launched. Its current offerings are mostly asset-based, while its lending protocol is a fork of Compound V2, relatively simple. After delivering these core products, it remains uncertain whether Ondo can withstand challenges across product, operational, and compliance dimensions.

3.3 Regulatory and Compliance Uncertainty

Although the current U.S. administration is the most crypto-friendly to date, no formal crypto regulation has passed into law (the recent rejection of the GENIUS Act stablecoin bill exemplifies this). With midterm elections in 2026, it remains unclear whether Republicans will retain their congressional majority. If asset tokenization legislation fails to pass before midterms, future progress will be much harder, greatly increasing uncertainty.

3.4 Token Risks

1. ONDO token circulation is only ~34%, facing a potential 64% inflation rate over the next year, implying significant downward pressure; 2. Token value capture is unclear—ONDO currently grants only governance rights, with no defined fee-sharing, buyback, or burn mechanisms.

4. Valuation Reference

ONDO has a total supply of 10 billion tokens, with ~3.16 billion currently circulating (~31.6%).

Based on today’s price (May 25, 2025), Ondo’s circulating market cap is ~$3.27 billion, with a fully diluted valuation (FDV) of ~$10.3 billion.

Among similar asset tokens, ONDO surpasses others in both circulating market cap and FDV.

From a relative valuation perspective, the ONDO/CFG market cap ratio is ~40x, while the Ondo TVL/CFG TVL ratio is ~2.7x, indicating ONDO’s price has already fully priced in optimistic growth expectations, significantly discounting future upside and making the valuation vulnerable to various risk factors.

From a fundamental standpoint, ONDO’s current valuation remains clearly high.

Based on Ondo’s static reality: assuming annual revenue (~$3–5 million) comes from USDY and OUSG management and spread fees (based on $1B assets, 5% average yield, 0.3–0.5% fee ratio), plus minor income from Flux, total annual revenue likely falls below $10 million.

This results in a static P/E ratio for circulating market cap far exceeding 300x, with FDV over 1,000x—extremely expensive by traditional standards, especially given ONDO’s lack of clear token value capture.

ONDO’s high valuation reflects the market’s extremely optimistic growth premium for its future: if Ondo can scale to $10B+ TVL within 2–3 years (as per its “Next Stop: $10B” goal) and successfully expand into equities and other areas, revenue could grow tenfold, partially justifying the current valuation.

Ondo’s high valuation also stems from its grand “on-chain Wall Street 2.0” narrative. If Ondo Chain succeeds, Ondo could command valuations typical of Layer 1 blockchains, making a $10B+ FDV seem less exaggerated.

Of course, considering the numerous challenges outlined earlier, reaching this point will require immense effort, luck, and favorable market conditions—carrying significant uncertainty.

Future Events to Watch

The following events and data will directly impact market expectations and token price, warranting close attention:

1. Project milestones:

-

Deployment and launch of Ondo Chain mainnet and testnet

-

Testing and launch of Ondo Global Markets

-

Introduction and issuance of new categories of RWA assets

-

Onboarding more institutional partners and deepening current shallow relationships with major financial institutions

-

Sustained growth in asset scale

2. External environment shifts:

-

Legislative progress on U.S. asset tokenization bills

-

SEC’s stance on asset tokenization—will they clarify “sandbox-style regulation,” allowing pre-legislation business exploration?

-

Will traditional TradFi giants enter directly to build their own products and platforms, turning the blue ocean red?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News